nwoodman

Member-

Posts

1,167 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

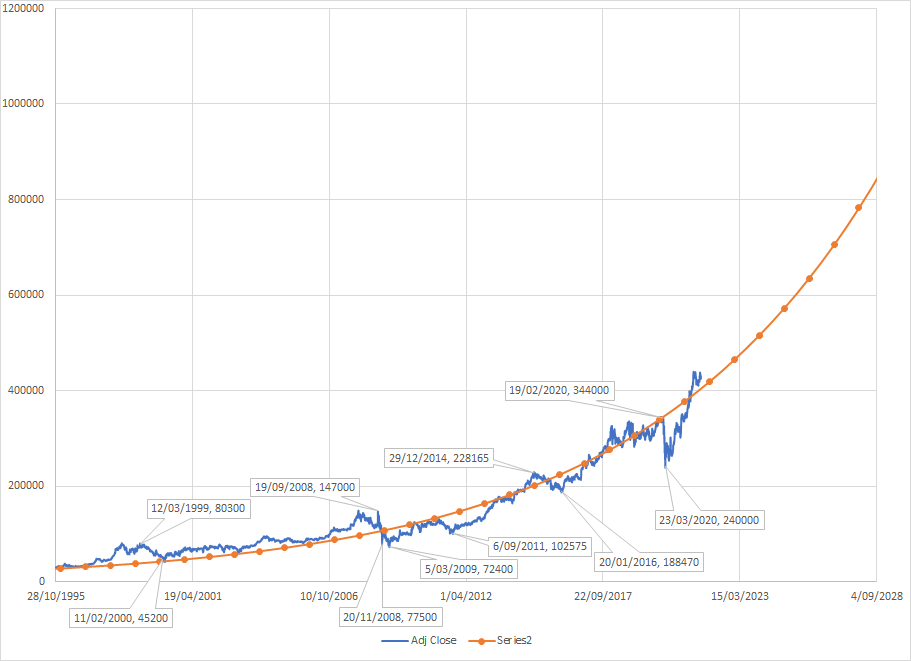

Viking, great post as always. As doodling is so much more fun than reviewing reports, I added in the regression to the mean curves for four years out on my 10,000ft view of Fairfax. Four years is quite arbitrary, but I agree that Fairfax over the last couple of years have made more good decisions than bad. This will be appreciated sooner or later. While the weighing machine is a bit broken at the moment, the current prices offers an opportunity for returns that will vary somewhere between acceptable and stellar. One thing that does standout out is how inconsequential some of those earlier dips look in retrospect, yet many thousands of words were written.

-

MS are out with a chart pack for the Indian Economy. A few caught my eye, Chart pack attached. We expect cyclical recovery in subsequent quarters: We expect economic activity to start to pick up from QE Sep, supported by pent-up demand, ramping up of the vaccination drive (daily vaccination tracking at 9mn on a 7 day avg basis), a favourable policy mix, and robust global growth. Indeed, we expect GDP to move into positive territory on a 2Y CAGR basis from QE Sept. The key risks to watch will be the pace of vaccination (any slowdown could increase risks) and trend in Covid-19 cases - potential re-acceleration, threat from new variants and restrictions on activity. INDIA_20210922_0000.pdf

-

Short article on the use of AI by Brit https://www.insurancejournal.com/news/international/2021/09/21/633025.htm Brit Ltd., the London-based specialty insurer and reinsurer, announced the creation and successful proof-of-concept launch of a proprietary machine-learning algorithm, designed to accelerate the identification of post-catastrophe property damage, based on the use of ultra-high-resolution imagery. This proof of concept is being used by the Brit claims team and its delegated claims adjusters in the wake of Hurricane Ida, to further improve claims service and expedite payments for customers. In this innovation, Brit’s Data Science team developed and overlaid a machine learning algorithm to access the ultra-high-resolution ariel images and data such that it pinpoints, color-codes, and displays properties by damage classification within days after a catastrophe event. This enables the Brit claims team to proactively identify, triage and assign response activity even before claims are reported. Since April 2019, Brit has worked with the Geospatial Insurance Consortium (GIC), a non-profit organization that captures best in class post-event ariel imagery for first responders and insurance companies. With the GIC images and the machine learning algorithm, the Brit claims team has a virtual claims adjusting platform that can expedite claims payments in locations that cannot be immediately serviced by local field adjusters in the initial days following catastrophe events. “A claim is the single most important interaction that an end client will have with their insurer and this will often be at a time of significant difficultly. We are therefore continually focused on improving the service we offer and how quickly we can provide resolution for our customers. Innovation and technology are critical to the equation,” commented Sheel Sawhney, group head of Claims and Operations. “This use of machine learning techniques and the best available imagery is further evidence of how our award-winning claims team is finding new ways to increase the speed and accuracy of claims payments,” added Sawhney. A subsidiary of Fairfax Financial Holdings, Brit underwrites a broad class of commercial specialty insurance with a strong focus on property, casualty and energy business. It has a major presence in Lloyd’s of London, the world’s specialist insurance market provider.

-

Given Trudeau’s win could we argue that the 3% tax surcharge doesn’t apply to Fairfax due to underperformance . Happy to pay it once the share price is back to BV

-

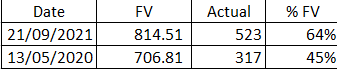

Good question. I agree that the visibility is better now than in March. In terms of the "mirage", personally I think that FFH, at times, guilds the lily a little with book value, but only time will tell. Visibility gets easier as they take their positions public. I think the bigger question is whether the compounding/capital allocation machine is broken? To this I answer a definitive no. Take the graph below with a pinch of salt, but if you think long run they can achieve low double digit CAGR then they look cheap today. Based on the 11% CAGR curve, the Fair Value (FV) today would be of order $CAD800 or ($USD650). P/B=650/540=1.2. This is my estimate of FV using a number of different measures, so quite unremarkable. We can then use this curve to back calculate the FV at the low in March. FWIW we get the following: So it was a 45c dollar at the bottom in May 2020 and is a 65c dollar now. Still cheap but not as cheap IMHO.

-

Thanks for this. The comparison between China and India is quite stark. Demography isn’t everything but it’s certainly not nothing.

-

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

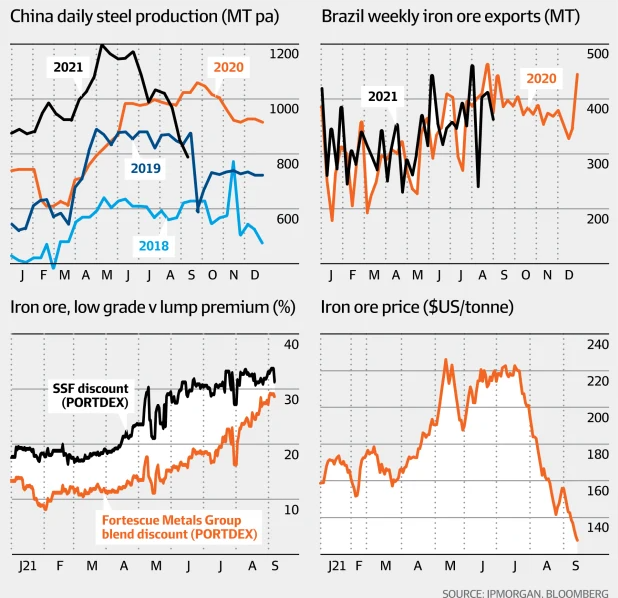

Greatly appreciated. The breakdown in Iron Ore prices is nothing short of spectacular. Under $100/tonne last night. The South Pacific Peso has held up quite well considering -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

I found this short talk by former Australian Prime Minister, Kevin Rudd quite illuminating. He frames the current changes going on in China under three driving forces: 1. Ideology 2. Demographics 3. Decoupling from the US https://youtu.be/cpLECUjTZwQ His feeling is that post Xi's election next year there might be some policy reappraisal but between now and then "fasten your seatbelts" -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

Yep it is a head scratcher. As Spek alluded to, many were bought as “investments’ where the prevailing sentiment was you don’t put tenants in them as they will depreciate. Kind of like collectibles are worth more if they are still in their original packaging. -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

They have been for years. If the credit spigot is open, then speculation takes hold and you end up in the bizarre situation of the last decade or so. The apartment is to build wealth not for living in. Ghost cities! This works wonders for GDP, jobs, wealth effect etc as long as you can keep credit growing then all good. I know, I know, the whole debt deflation thing is so 2010…. -

China's Real Estate Bubble Finally Cracking?

nwoodman replied to Parsad's topic in General Discussion

I heard an interesting theory on a podcast that the fallout from the Evergrande debacle was already manifesting itself in the various crackdowns on other sectors. eg tech, education etc. There is an inevitability that the CCP will need to bail this dog out. The crackdowns in other sectors are to mask the associated moral hazard. I am also somewhat surprised that commodity currencies are holding up as well as they are between developers going bust and crackdowns on steel production, it is looking like a perfect storm. I guess the market is implying that they have a public hanging or two and then its back to business as usual Iron ore price hits 10-month low as China accelerates steel cuts (afr.com) The broker subsequently cut its 2021 steel production growth forecast from 6.5 per cent to 4 per cent and lowered its demand growth estimate from 2.8 per cent to 0.8 per cent. “Current negative sentiment towards Chinese steel production and iron ore prices is likely to continue short-term given weakness in economic data,” Mr Fagan said. JPMorgan lowered its 2021 iron ore price forecast from $US181 a tonne to $US165 a tonne and its 2022 projection from $US150 a tonne to $US125 a tonne. “A fourth-quarter 2021 pick up in infrastructure activity should help arrest the decline in prices, particularly if tight steel conditions improve,” Mr Fagan said. -

Brilliant interview, thanks for posting. The commentary around inflation and then their hesitancy around providing reinsurance to “a lot of new entrants” was telling. Will have to listen again and take some proper notes.

-

+1 Happy to make a contribution to get rid of the ads. Thanks again Sanjeev

-

Agree the shares will already have been bought. The payer charges FFH, the receiver, a finance charge with downside protection if the price of the asset, in this case FFH shares drops. When the TRS is unwound, it is likely the IB would sell the shares back into the market. In a TRS contract, the party receiving the total return gets any income generated by the financial asset without actually owning it. The receiving party benefits from any price increases in the value of the assets during the lifetime of the contract. The receiver must then pay the asset owner the base interest rate during the life of the TRS. The asset owner forfeits the risk associated with the asset but absorbs the credit exposure risk that the asset is subjected to. For example, if the asset price falls during the lifetime of the TRS, the receiver will pay the asset owner a sum equal to the amount of the asset price decline. https://corporatefinanceinstitute.com/resources/knowledge/finance/total-return-swap-trs/

-

Perhaps. Maybe I am being too optimistic but it looks like classic horse trading to me. What they asked for (ambit claim) versus what they got doesn’t appear too far apart, especially when it is compared to the UDF they are currently charging. The public hand wringing also was a bit strange. Classic India?

-

A little background on the National Monetisation Pipeline Indian asset monetization plan boosts ABB Power Products and Systems (capital.com) India aims to raise INR6tn (US81bn) by monetising its assets. But the plan, the largest ever announced by any government since the country’s independence, includes caveats. The regime will grant firms the right to develop road projects, stadiums, airports, railway stations, power transmission lines and gas pipelines for a specified period, akin to a lease, according to guidelines published by government think tank.

-

Agree entirely on the confusing wording. I guess we will see how it gets reported in a quarter or two.

-

Based on the press release I figured it was a wash. Currently, Fairfax India, through its wholly-owned subsidiary, FIH Mauritius Investments Ltd, owns a 54.0% equity interest in Bangalore International Airport (“BIAL”). As previously disclosed by Fairfax India, as part of the transaction, Fairfax India will restructure approximately 43.6% of its equity interest in BIAL such that it shall be held through Anchorage, implying an equity valuation for 100% of BIAL of approximately INR 189.7 billion (approximately $2.6 billion at current exchange rates), which is the same valuation implied in Fairfax India’s June 30, 2021 consolidated financial statements. Upon closing of the transaction, Fairfax India’s effective ownership interest in BIAL will decrease to approximately 49.0% on a fully-diluted basis, while its actual ownership will remain unchanged. https://www.fairfaxindia.ca/news/press-releases/press-release-details/2021/Fairfax-India-Receives-All-Regulatory-Approvals-to-Complete-Sale-of-Minority-Position-of-Anchorage-Infrastructure/default.aspx

-

Same as it is today as far as I know, the key is “on a look through basis”. Happily proven wrong, but my take is that is a repackaging of their stake into Anchorage.

-

Over a 10 year horizon it probably doesn't matter for an individual's purchase today (10% or 11% CAGR). However, for Berkshire, I actually hope the reason that the price is correcting is because he has reduced repurchases. This an OK price but not worthy of 5%+ repurchases. Let the price fall and lose a few weak hands. Very simplistic I know, but for those with a longer term horizon, this is where we are currently at on a 11% CAGR journey. That CAGR increases by 1 or 2% if the old boy and subsequent management can do buybacks at the right price. The big one, is an option on capitalism actually having a role going forwards.

-

I recall something similar also, but the India IPO market is hot which must make it tempting. Perhaps the disclosure around financials of insurance companies is an Indian thing. If that is the case then it is pretty amazing as it provides quite a window into your soul for competitors. On the other hand it may also speak volumes about the value of a hunting license in the Indian insurance market. I think we all agree that Prem knows via Kamesh and team, he has captured lightning in a bottle. I am sure they will get the timing of an IPO roughly right.

-

Glider, that could well be right. In addition for me you have highlighted a couple of things. If many of the associates just move to break even then the numbers rise materially, highlighting the economics of the jewels in the crown. I have been elevator pitching Fairfax (to those that will listen) on the basis that I can see three investments, Atlas , Eurobank and Digit that in 7-10 years time could well be worth today's market cap. What your post has highlighted is that there is a fourth, BIA, that had kind of fallen off my valuation radar. The elevator pitch just got easier. Whether these investments ever get reflected in the share price is another matter but if you were an owner you would want to hoover up such mispricing at a clipping rate

-

Thanks Glider, the delta in CR is very promising considering their growth. As said many times if this company was listed on the NASDAQ as an insuretech then it would be valued much higher than even what Fairfax is claiming. Just reading through the article you posted I found it fascinating that Fairfax was not mentioned at all, I wonder if this was by design . Anyway keep up the great work, we certainly appreciate your posts. I wasn't even aware that Digit made their financials public. Following your post, I was able to find them with a google search but could not for the life me find them on their website until I scrolled all the way down and there in the fine print was "public disclosures". The way this is all laid out, plus a bunch of new micro investors, makes me think that an IPO is in the offing sooner rather than later.

-

It would be very unlike FFH to miss an opportunity to take a +ve mark

-

The latest 13/D shows Fairfax now owns 130,932,826 shares of ATCO common. A net change of 31.7m. So the warrants were converted and then some? Atlas Corp. Investor Relations - SEC Filings (atlascorporation.com) 25 August 2021 Thanks again Viking for all your work on this Cheers nwoodman