nwoodman

Member-

Posts

1,388 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

@Spekulatius Thanks for the vid, what a train wreck

-

Perhaps, while it is hardly an original thought, arming the these minorities has the potential for unintended consequences. Perhaps I am being overly optimistic but there is a chance for a levered outcome here. The underbelly is showing.

-

Fixed it for ya. I think this is the last roll of the dice for the nutjob. Watching the news tonight with the solitary voluntary conscript being interviewed as he departs….even my kids said “but that bus is so empty”

-

Where Does the Global Economy Go From Here?

nwoodman replied to Viking's topic in General Discussion

A rather irate Jeremy Siegal. “Calling it poor monetary policy is an understatement”. Sure is creating some interesting opportunities either way. Flushing of weak hands and crappy businesses is a pleasing outcome. Cathie Wood stepping down from a couple of her shittier ETFs should mark the beginning of the end -

Great read. The definition of insanity springs to mind. Watching the news this morning there appears to be a “run on Russia” with many young men fleeing across the border. Hopefully this plays out rapidly from here….in a good way

-

Yep, the regulator two-step goes on. I think you make an excellent point though….. there is a big difference between “No” and “No, but we will reconsider once you have done …..”. An impeccable record of corporate governance will be key…to misquote A Tropic Thunder “Very easy to shit the money bed” Will it be worth it? The market seems to have a view. We see an opportunity

-

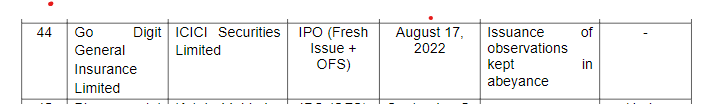

Looks like the IPO is on hold for now "While SEBI gave no reasons for its decision, a source familiar with the watchdog's thinking said concerns had been raised by the regulator that privately held Digit issued shares to more than 200 individuals in the past financial year, which is not allowed under Indian laws and regulations. Digit will need to review SEBI's concerns and resolve them at an appropriate forum, the source added." Digit Insurance IPO put on hold by Indian watchdog | Reuters SEBI | Processing Status : Issues

-

Fair chance they are raising cash for a crack at IDBI bank. 41m Cr => USD5.15Bn. This would give them short-term indigestion but perhaps side agreements with the other consortium members to buy them out over, say, five years. Certainly fits with the FFH spiel of investing roughly that amount in the foreseeable future. Govt taps TPG, Carlyle, Fairfax for IDBI Bank stake sale - The Economic Times Video | ET Now CSB Bank stock is a good buy for portfolio investors - The Sunday Guardian Live If this comes to pass, then they could make a "lotta money". Not without its risks, of course, but damn, there have been fortunes made picking up these types of government assets.

-

Interesting that the article claims a premium on the sale? Control premium? Current market cap 29.15 INR => USD365m @52.8% = USD192m. So if the premium applies this could net around USD250m ex tax. Not too shabby considering the entirety of Fairfax India is quoted at USD1.37B https://www.google.com/finance/quote/543252:BOM?sa=X&ved=2ahUKEwjG8der96H6AhW0_DgGHTnrC1kQ3ecFegQIIxAg&window=MAX

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

It’s a great show. In particular Marciano is one of my favourites. Pretty cool that you have had the opportunity to fish with him. Did you have any luck? -

Sold remaining ATCO and bought FFH and BRK.B with the proceeds. Still firmly believe they will raise the bid on ATCO but the price for FFH and BRK quite compelling here.

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Call out for Bad Sisters on Apple TV+. one of the best shows of the year if you are into slightly dark, Irish humour. Has a four weddings and a funeral vibe. Claes Bang, as Jean Paul is diabolical but a great performance . I think this will be up for multiple awards. Spoiler alert in the guardian review below , as the opening scene sets the tone and is worth watching without any preconceptions. Episode one is good enough to watch again, which I have https://www.theguardian.com/tv-and-radio/2022/aug/19/bad-sisters-review-sharon-horgan-pitch-black-comedy-is-murderously-good -

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Have tried to steer clear of the usual reviews for this one, to keep an open mind. So far we are really enjoying it. Great production values and almost justifies a decent OLED and sound system in my mind and the kids, if not the missus -

Swapped some more OXY for BRK

-

In terms of market discount I would not consider it huge within your usual margin of safety for a business like this. Further no major insights other than: 1. If you run a regression on results/share price/ book value you get an answer similar to 10-13% 2. Tom Gayner talking his book on a number of occasions alluded to this. I find it distasteful after following Berkshire for so many years but that is nothing to Fairfax coming out and stating a number of 15%! 3. Interesting that Tod or Ted see a similar valuation i.e Berkshire 4. Over a 5 year period there performance has been OK but not great. When I think I have found a true compounder and the share price has done nothing for X years, I get interested So in a nutshell the number was thrown out there on the basis that is a true compounder. Everyone’s mileage differs, I just need my investments going forwards to be of the kind that I can say to my wife “don’t flip that one” when I take my final bow . Edit: and for anyone playing at home for the first. Fairfax has paid out a roughly 2%. Important for side by side compariss.

-

What no Fairfax option? If both the companies and our good selves are there to see the winner then we will have all outperformed (speaking for me mostly). I voted MKL, but my portfolio argues differently, so a moment of cognitive dissonance. There will be some minor and major leadership changes for both companies over that period. The test for both on the capital allocation side is going to be “invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will”. So easier said than done. I was always intrigued by the dual CEO structure of MKL. Now that Gayner will be sole CEO shortly, it will be interesting to see any changes if any. FWIW my numbers are discount IV/Compounding rates/ Fair Value: BRK -7%/11% FV B Shares $300 MKL -23%/13.5%, FV $1550 FFH is the massive outlier at the moment I see it as an 11% return trading at a discount of 45% FV $USD 900. The certainty is in the order stated and varies from 20% to 40%.

-

@Viking above and beyond as always. Great work. I look forward to having a deeper look later tonight but first thoughts are what an amazing concentration of cash consuming 6’ hurdles. “The fish that John West reject”

-

Thanks, that answers the obvious of question of how he revalued the shares without any price discovery. Anyone have any thoughts on why they run this as such a black box?

-

Remaining TSLA position

-

KMX add on open

-

@glider3834 Thanks for the heads up. I hadn’t read through the prospectus in detail until now, from p.51. regarding the compulsorily convertible preference shares (CCPS) The promoter of FAL Corp is Fairfax Financial Holdings Limited, which is listed on the Toronto Stock Exchange, the majority designated partner of Oben (holding 99.99%) is Kamesh Goyal, and the promoters of GDISPL are Kamesh Goyal, Oben and FAL Corp, which respectively hold 14.96%, 39,79% and 45.25% of the equity share capital of GDISPL. For details of the shareholding pattern of GDISPL, see “Our Promoters and Promoter Group” on page 261. Additionally, FAL Corp holds 7,800,000 CCPS issued by GDISPL (aggregating to 100% of the preference share capital of GDISPL). The aforesaid CCPS has a fixed conversion ratio for conversion into equity shares of GDISPL being (i) 2.324 CCPS for each equity share, for 6,300,000 CCPS (”Ratio 1”) ; and (ii) 3.55 CCPS for each equity share for the remaining 1,500,000 CCPS (“Ratio 2”). Upon conversion of the CCPS, the parties have agreed that the shareholding of FAL Corp in GDISPL will represent maximum of up to 82.07% of the share capital of GDISPL. Further, consequent to conversion of the CCPS, the indirect shareholding of FAL Corp in our Company (on a fully diluted basis ) will be a maximum of up to 68.65%. While we believe that upon the CCPS conversion, none of our Promoters shall cease to act as promoters of our Company, we cannot assure you that the regulators will not take an adverse view, in which case such an event may have an adverse effect on our Company or its shareholders. On June 7, 2022, our Company applied to the IRDAI, seeking its approval for conversion of the 7,800,000 CCPS into equity shares of GDISPL. However, the IRDAI, by way of its letter dated July 26, 2022, communicated that this application cannot be considered by it, since the proposed conversion of the CCPS would result in GDISPL becoming a subsidiary of FAL Corp which is not allowed under the IRDAI (Registration of Indian Insurance Companies) Regulations, 2000, which defines an ‘Indian promoter’ to mean a company, as defined in the Companies Act, which is not a subsidiary, as defined in Section 2(87) of the Companies Act. For further details in relation to the above, see “Our Promoters and Promoter Group” on page 261. While upon the CCPS conversion, none of our Promoters shall cease to act as promoters of our Company, and our Company and our Promoters intend to continue to engage with the IRDAI in relation to such conversion of CCPS, as per the provisions of applicable law, we cannot assure you that the IRDAI will approve such conversion in the future. Consequently, we cannot assure you that the CCPS will be converted by FAL Corp in a timely manner, or at all. Further, each of FAL Corp and, subject to FAL Corp’s consent and right of first refusal, Kamesh Goyal and Oben has the ability, should they choose to do so, to sell their respective shareholding in GDISPL to a third party, which, if sufficient in size, could result in a change of control of our Company. The level of disclosure in the prospectus is refreshing. The scrutiny by the IRDAI is frustrating but also creates quite the moat.

-

A summary from the author. I haven’t see it reported elsewhere that IRDAI had knocked back the conversion of the Digit Prefs.

-

Yup, how do you increase the participation rate? This, but wait there’s more…