Viking

-

Posts

4,689 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

On 8/4/2023 at 6:07 PM, Viking said:

Updated January 13, 2024: For members who enjoy reading my posts on Fairfax I have attached at the bottom of this post two documents:

1.) Fairfax - Hiding in Plain Sight: PDF file contains about 70 of my best posts on Fairfax, organized into 16 chapters (now +300 pages long).

2.) Excel workbook: companion document to the PDF file, contains 11 worksheets (see below for details).

Both documents have seen a fair number of updates/changes from my last update (Dec 23). Of interest, the PDF file had 477 downloads over the past 3 weeks.

Sanjeev, thanks for everything you do running this board. For all the members on this investing forum, ‘thank you’ for breaking bread on a daily basis and sharing your thoughts on investing and life. Over the years, it has been a life changing experience for me and my family. What is contained in this document is the collective wisdom of this group. Let’s hope i have captured it reasonably well.

I always appreciate getting some feedback… maybe one or two things you like and one or two things you don’t. What is missing? Thank you.

A message from the legal department: Both documents are incomplete and contain errors. What is contained in the attached documents is not intended to be investing/financial advice. Its purpose is to educate and entertain.

Have a great 2024! Viking

-----------

The Excel file contains 11 worksheets:

1.) FFH-23: lists and tracks many of Fairfax's equity holdings in real time

2.) Size: ranking of Fairfax's equity holdings by size

3.) Moves: detailed compilation of many on Fairfax's transitions going back to 2010 - organized by year4.) 23 Earn Est: detailed 2023 earnings estimate

5.) Premiums: the build for 'underwriting profit'

6.) Interest: the build for 'interest and dividend income'7.) Associates: the build for 'share of profit of associates'

8.) Investments: the build for return on the total investment portfolio

9.) Shares: reviews 'effective shares outstanding'

10.) Float: the build for float

11.) 13yr View: A 13 year view of many key metrics for Fairfax

12.) Effects of discounting and risk adjustment - IFRS 17: quarterly summary of build

Fairfax Jan 10 2024.pdf 14.48 MB · 0 downloads Fairfax Jan 10 2024.xlsx 212.38 kB · 0 downloads

For board members who are interested I have just posted an updated version of 'Fairfax - Hiding in Plain Sight' and the companion Excel workbook. It includes lots of updates from the past 3 weeks: Chapter 1 has been updated. Updates to Fairfax India, BIAL, Hellenic Bank/Eurobank as well as estimated Q4 equity gains and YE equity rankings. I have also added Chapter 16: Education/Information on P/C insurance - just a few items today; moving forward, as i find good material i will add to it.

The document is now contains over 300 pages of information on Fairfax.

Let me know if you have any suggestions for improvement. Missing material? Errors?

Have a great 2024!

PS: FYI, I will always keep the most recent version of both documents (PDF file and Excel workbook) in the first post of this thread.

-

4 hours ago, Hamburg Investor said:

@Viking Thanks again! It‘s Great, that you share all this detailed information and your thoughts. That’s really really valuable.

I don’t have anything to add.

If we take a step back from the company itself and don’t focus on Management, but to external factors (your analysis ist just much more important and valuable, but still) two points come to my mind:

1. Inflation und Interest rates. Falling interest rates would give book value an extra push short term as the (big) bond portfolio would be valued higher. But it would be bad mid and long-term. I am not sure, if falling interest rates after all might help the stock price in this regard. The good trend of the last year would get even more visible on the surface on the one hand, even though it would be bad news for Fairfax outlook, the value stocks it holds etc., the value creation imho on the other hand. Would be interesting to watch, how Mr. Market would react.

- if rates just stay around where they are the good trend in value creation would just get more visible within this year. I guess this scenario would support rising stock price

- rising interest rates would be a good thing for Fairfax value creation, but one wouldn’t see it on the surface. Again would be interesting to watch.2. The election of the new president.

If I remember correctly, then when Trump became president Prem became very active... What would he do this time?

Of course, there are a lot of other external factors and my best guess is, that there will happen a lot that we don’t anticipate today. It’s just, that those topics popped up in my mind, when I tried unsuccessfully to finding about a maybe number 11 to your list.

The interest rate topic imho of course is important for all insurance companies; still, I think there are 3 reasons, why it’s more important to Fairfax than for any other insurer. First Prem Invests more into old style value stocks then another insurance float guy I am aware of, e.g. in comparison to Markel or Berkshire. Second the bond portfolio is just so big in comparison to book value, so the effect to book value is just reay hugh. And third Fairfax comes from being a hated and ignored and forgotten stock to maybe getting a loved one. The ones ignoring Fairfax until today maybe won’t find their way to Fairfax if interest moves into the wrong direction and they don’t find the stock in the typical lists of strong growers, etc.

Do you have any opinion to these two topics?

@Hamburg Investor I am going to push back on what you are trying to ask: I don’t think you can separate Fairfax management from external factors/events - the two are symbiotic. Is this what Soros called ‘reflexivity’?Let’s look at interest rates. If interest rates stay where they are, Fairfax will likely sit on current holdings/positions and collect interest. If interest rates fall 100 basis points on the long end, Fairfax will perhaps shorten duration and harvest some gains. If interest rates increase 100 basis points on the long end, Fairfax will likely extend duration and lock in high yields.

My point is Fairfax will thoughtfully adjust to high volatility events.

Look what happened last April. We had a mini-banking crisis. If we had discussed it before it happened, we probably would have guessed it would probably be bad for Fairfax (for any number of reasons). It ended up being good for Fairfax because they were able to pick up $1.8 billion in real estate loans that they will earn a return on of about 10%. Partner Kennedy Wilson picked up PacWest’s real estate team - greatly expanding their capabilities; my guess is this over time will prove be a great move.

There will also be second order effects over time.

Back to interest rates… Over time, where interest rates go will also impact parts of the insurance market (underwriting margins), although i am sceptical the linkage is as strong as some on this board think is the case. So if long rates decline 100 basis points then perhaps the hard market continues in parts of the insurance market. The opposite id long rates increase 100 basis points.

If the hard market persists Fairfax will continue to allocate capital to insurance subs. If the hard market turns soft, Fairfax will shift and allocate capital to investments / dividends / stock buybacks.

My point is Fairfax will thoughtfully adjust to events.

A Trump victory in the fall? We need to see what the platform is for each candidate. My guess is Trump will run on a pro-business (less government) type of platform. He also will likely be a big spender (the government will continue to run big deficits) - he is a real estate guy after all. I think you would want to have your portfolio positioned for higher economic growth and higher inflation - but that is my early guess. (It would not surprise me to see Trump fire Powell and appoint Fed members who will support his views/policies.)

How will this impact Fairfax? No idea. But i am confident we will get volatility in financial markets and Fairfax will be ready to pounce (again).

In terms of investors reaction and stock price… well, anything can happen in the short run. Fairfax’s stock price is being set day-to-day by Mr Market (a manic depressive).

With Fairfax I am focussed on earnings. And capital allocation. Macro, especially high volatility, is opportunity for Fairfax. At least that is how things have played out the past 5 years.

Active management appears to matter again.

Did i answer your question?

—————

Perhaps you are trying to look at Fairfax through the lens of an economist… let’s assume Fairfax management does nothing… how would a change in interest rates affect Fairfax? This is perhaps a ‘theory’ based way of looking at things.

I prefer (try?) to focus on a ‘reality’ based way of looking at Fairfax. What do i think will actually happen in the real world.

Toggling between the two is perhaps the best approach (understand the theory but also how things are likely to play out in the real world).

-

36 minutes ago, glider3834 said:

They now have significant control of Swan Topco - shareholding % not available - which in turn owns 100% of Meadow Foods which is the main subsidiary

Below excerpts from Mar-23 consolidated financials publicly available here for Swan Topco https://find-and-update.company-information.service.gov.uk/company/11436426/filing-history

It looks to be generating positive & growing net operating cash flows YoY which are being used to repay interest and repay debt (but not sure what capital structure will be post Fairfax acquisition). Swan Topco appears to have a non-cash acquisition related, goodwill amortisation exp of GBP26M , which is depressing operating profit, but gets added back to operating cash flows.

@glider3834 thanks! I’ll take a closer look tomorrow. -

2 hours ago, SafetyinNumbers said:

Terrific post as usual Viking!

It made me think about what could be on the 2024 list.

We already had the 50% dividend increase.

I think there is a decent chance Fairfax gets added into the S&P/TSX 60 in 2024. It's already 29th biggest in the S&P//TSX composite so when the next spot opens up, it has to be near the top or on the top of the list. That would generate ~750k-1m of buying in a very short period of time. I would expect a lot of managers benchmarked to both of those indices will have to take another look at Fairfax and increases the chances they decide to go to market weight from no position. Chances also are PMs will have to revisit being overweight IFC, if FFH becomes a bigger weight. IFC is currently 22nd biggest in the Composite at ~121bp and FFH is 96bp.

The anticipated Eurobank dividend might have a very big impact on valuation as Viking pointed out.

IPOs of Digit and BIAL would be huge.

It was easy to come up with 5 potential Top 10 items for 2024.

What else would you throw on the list or is there anything on my list have less than a 50% chance of happening?

Top 10 (mostly predictions) List 2024 (in no particular order)

1. Dividend increase

2. Addition to S&P/TSX 60

3. Eurobank dividend

4. Digit IPO

5. BIAL IPO

6. ?

@SafetyinNumbers i think your list is a good start. Here are some thoughts:

1.) equity position with most upside in 2024? Eurobank. I was surprised to see the stock value of Fairfax’s position up +$700 million in 2023. That values Eurobank at Euro 1.61/share. I think analyst price targets are currently in the Euro 2.25/share range. Eurobank could easily be up 30% in 2024 = $600 million gain for Fairfax. Re-starting the dividend at Eurobank will be very good. But Hellenic Bank could really drive earnings later in the year. The Eurobank management team is very good - my guess is they are not done growing.2.) FFH-TRS: it would not shock me to see Fairfax’s share price increase $300 in 2024 = another $600 million gain. Not a prediction. We will see. If you prediction of Fairfax getting added to the TSX60 comes true - that would just be another tailwind, and probably a significant one.

3.) India has been a very quiet region for Fairfax for a couple of years now. I suspect that will change in 2024. You highlight two big potential catalysts:

- Digit IPO: could we see a +$500 million increase in the value of Fairfax’s stake? There are also the ‘compulsory convertible preferred shares’ that Fairfax owns… when they get valued properly that will increase Fairfax’s ownership stake in Digit (74%?) and result in a big gain ($300 million?).

- Anchorage IPO (BIAL): i think BIAL is the real deal. The more i read/research the more i like that asset.

And there are reports Fairfax is bidding for part of IDBI Bank. if successful, that would be a big investment (even for a 10% stake).

- https://www.livemint.com/companies/news/carlyle-fairfax-dbs-bank-may-bid-for-idbi-bank-11670349260107.html

The problem with India is it is impossible to predict the timing of these events. I would probably be 50% for Digit IPO and 40% for Anchorage IPO - but those are wild guesses (more than my usual guesses).4.) Is 2024 the year investors start to notice Fairfax’s group of consolidated holdings? Do we see $200 million in annual earnings from this group? Perhaps $250 million? Does Fairfax continue to grow the number of holdings in this group?

Is the plan at Fairfax to morph into more of a Berkshire type structure? And make a concerted effort to grow another large income stream (that would complement the insurance businesses)? I am not sure. But they kind of appear to be moving in that direction a little.

5.) Poseidon. This is a massive holding for Fairfax. And it has been in a holding pattern for the past 2 years. More of the same in 2024? Or do we see earnings (finally) start to grow as the company modelled a couple of short years ago. They certainly messed up with the structure of their debt in a rising rate environment (surprising given Fairfax’s positioning two years ago). But i do think Sokol will get the train back on the rails… just not sure if it happens in 2024 or 2025. Probably 2025 - but we will see.

6.) Commodity holdings: Stelco, Foran Mining, EXCO, OXY, Altius Minerals

- i think some of these holdings are going to rip higher in the next up-cycle in commodities (late 2024 or 2025?). Just not sure if that is 2024 or 2025. I love Stelco - it is a coiled spring. Foran is a lottery ticket. I wonder if EXCO gets sold (nat gas). Buffett sees something with OXY.

7.) Insurance

- I am looking forward to seeing what GIG does to Fairfax’s balance sheet at year end when it gets consolidated. Total investments/float should get a nice pop.

- Does the hard market continue into 2024? If Fairfax can get another year of 5 or 6% growth in net premiums written that would be great. With GIG that would put them +10% for the year, which would be very good.

- Can we get another year with CR of around 95% or 96%? Lots of investors think it has to go to 100% - and quickly. I am not convinced.8.) Kennedy Wilson debt platform. This went from $2 to over $4 billion in 2023. Do we go over $6 billion (or higher) in 2024? What is average interest rate earned? Is 8% a crazy high number? $6 billion at 8% = $480 million.

9.) Rabbit: For the past couple of years, Fairfax has pulled a rabbit out of their hat - something that no one is expecting that is good for shareholders. I think we get another one in 2024 - and, of course, i have no idea what it is.

10.) Like each of the past 5 or 6 years, capital allocation is going to be huge again in 2024. Why? Earnings at Fairfax are so high. The team is going to have billions to allocate, especially if they sell/monetize one or two largish holdings. What new income streams are they going to seed/create? In what bucket? Insurance or investments? Public or private?

Anyways, there are some random/rambling thoughts about 2024… Would love to hear what others are thinking.

-

2023 Top 10 List: Fairfax Achieves ‘Escape Velocity’

At the end of each year I put together list of what I think are the 10 most important events that have happened at Fairfax during the year (usually in terms of driving shareholder value). This is the fifth year of me doing this list. Reading each of the summaries in succession provides an interesting 5-year view of what has been going on at Fairfax. Years 2019-2022 can be found in Chapter 14 of ‘Hiding in Plain Sight,’ a collection of my old posts on Fairfax (click the link below to access the PDF file).

Am I missing anything? Let me know your thoughts as, yes, the list below is quite subjective.

————

'Escape velocity' Fairfax edition, featuring David Bowie - Space Oddity

Prem to Fairfax investors: “Take your protein pills and put your helmet on.”

Prem needs to show up at the AGM this year dressed like David Bowie... especially the hair and platform shoes!

—————

Fairfax’s business and financial results have been steadily improving each of the past three years. 2023 was the year overall company performance achieved ‘escape velocity’ - finally breaking free from the gravitational pull/orbit of its recent past (2010-2020). The company - its business results/earnings and reputation - is now charting new territory.

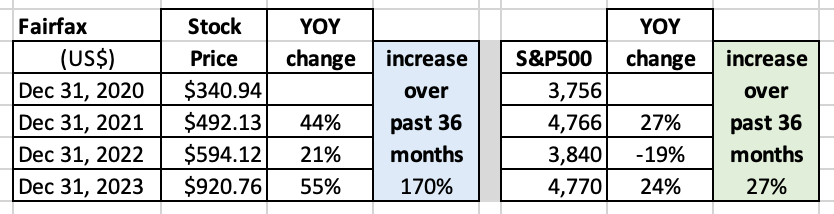

Investors have noticed. Fairfax’s stock increased 55% in 2023. Over the past 3 years, Fairfax’s stock is up 170% and it has outperformed the S&P500 by a staggering 143%.

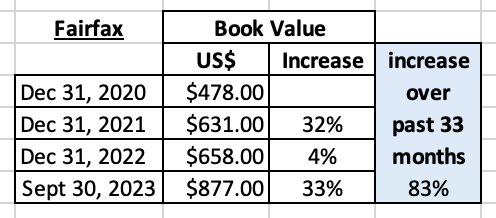

Book value per share increased at Fairfax by 33% in the 9 months to Sept 30, 2023, and 83% over the past 33 months. My guess is BV will be up nicely in Q4. This is best-in-class performance compared to other P/C insurance peers. The performance of a few that I follow - Chubb, WR Berkley and Markel (all good P/C insurers) - has not come close to the performance of Fairfax over the past three years (in terms of growth of BV/share).

A dividend of US$10/share was paid Jan 2023. Fairfax recently announced the dividend to be paid in January 2024 will increase to $15/share, which is an increase of 50%.

—————

Top 10 'events’ driving shareholder value in 2023

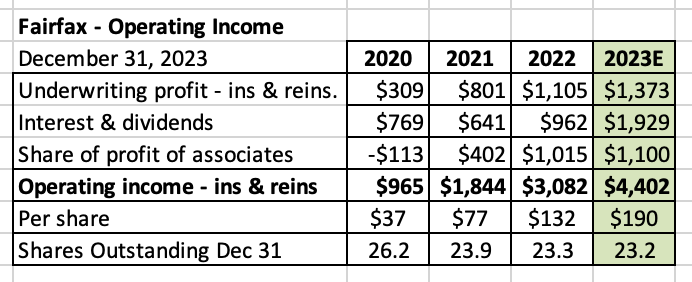

1.) Exceptional overall company performance. This might sound like a cop-out. But i don’t think so. ALL three of Fairfax’s economic engines performed at a very high level in 2023:

- Insurance

- Investments - fixed income

- Investments - equities/derivatives

As a result, Fairfax is poised to deliver - for the second year in a row - record results in each of underwriting profit, interest and dividend income and share of profit of associates. In 2023, operating income per share is poised to increase 43% (to $190/share) over 2022. Over the past three years, operating income per share is up a staggering 415% - this very important measure of company results has indeed achieved ‘escape velocity.’

My latest estimate has Fairfax delivering an ROE of about 20% in 2023. That is exceptional performance. But more important than the results delivered in 2023, Fairfax’s insurance and investment holdings continue to grow in size and improve in quality. This sets the table nicely for continued earnings growth (and high ROE’s) in the coming years.

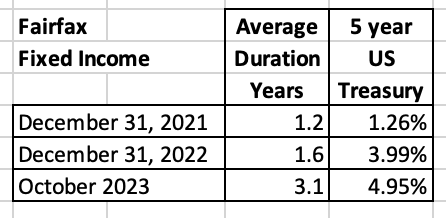

2.) Extending the average duration of the fixed income portfolio from 1.6 years at Dec 31, 2022 to 3.1 years in October 2023.

Prem Watsa - Fairfax Q3, 2023 Conference Call: “Recently, in October, during the spike in treasury yields, we have extended our duration to 3.1 years with an average maturity of approximately 4 years, and yield of 4.9%.”

Over the past three years, the fixed income team at Fairfax has superbly navigated the company (and Fairfax shareholders) through the greatest fixed income bubble top and subsequent bear market in history. They protected the balance sheet from booking billions in losses. And, by meaningfully extending the average duration, they have locked in high interest income for years in the future.

3.) Insurance subsidiary Allied World is delivering great results again in 2023 (after having a stellar 2022)

- To Sept 30, CR = 90.6%, UW profit = $318.5 million and net premiums written were +10.2% to $3.88 billion.

- To be fair, most of Fairfax’s insurance subsidiaries are having a very good year. There is a good chance Fairfax could deliver a company-wide CR under 94% for 2023.

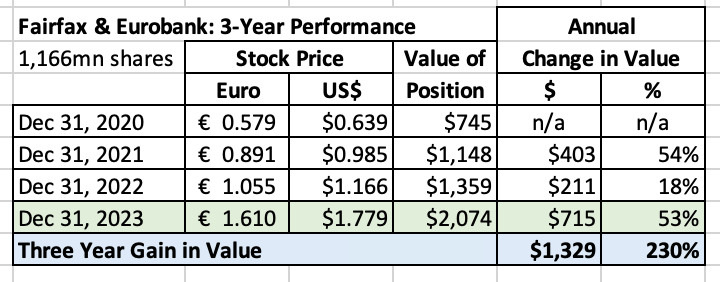

4.) Using the stock price, the value of Fairfax’s position in Eurobank increased about $715 million in 2023.

- Over the past three years, the position is up $1.33 billion.

- Eurobank earnings spiked higher in 2022 and again in 2023.

- The company has solid growth prospects; the pending acquisition of Hellenic Bank will be a catalyst in 2024.

- Dividend will likely be re-instated in early 2024 and this should be supportive of the stock price.

- Fairfax’s decision to merge Grivalia Holdings into Eurobank in 2019 is looking especially brilliant. With hindsight, the move allowed Fairfax to sell high (Grivalia) and buy low (Eurobank). At the time, the transaction was good for both parties.

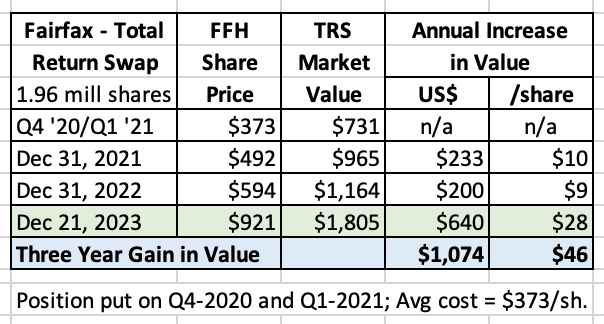

5.) The value of Fairfax’s position in FFH-Total Return Swaps increased $640 million in 2023 (giving it exposure to 1.96 million Fairfax shares).

- Since inception (basically three years), the position is up $1.07 billion.

- Fairfax shares continue to look very cheap, which suggests this position could continue to perform well for Fairfax.

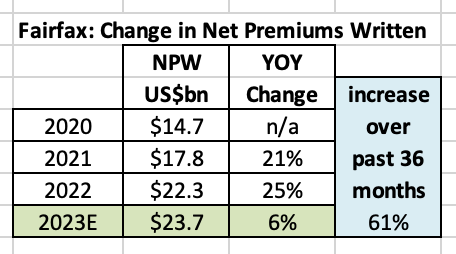

6.) Estimated increase in net premiums written in 2023 of $1.4 billion or 6% to $23.7 billion.

- The hard market in P/C insurance that started in late 2019 continued in 2023.

- Over the last three years, net premiums written have increased $9 billion or 61%.

- For some perspective, Warren Buffett purchased P/C insurer Alleghany in 2022 for $11.2 billion. In 2022, Alleghany had gross premiums written of $8.5 billion.

- The growth Fairfax has experienced the past three years in net premiums written has increased the intrinsic value of the company considerably.

7.) Purchase of KIPCO’s 44.3% interest in Gulf Insurance Group, increasing Fairfax’s stake from 43.7% to 90%.

- Cost? Aggregate fair valuation consideration of approximately $740 million (upfront payment of around $177 million and then 4 equal annual payments of $165 million).

- Prem on Fairfax Q1, 2023 Conference Call: “We structured it (the deal) in a way that perhaps a lot of it (annual payments) will come from the company itself, dividends from the company.”

- Size of GIG (2022): Net premiums written of $1.7 billion and investments of $2.4 billion.

- Deal closed in December. In Q4, Fairfax will book a pre-tax gain of around $290 million.

- Fairfax goes from being a minority shareholder in GIG to the controlling shareholder.

- Strategically, this secures Fairfax’s position as one of the leading P&C insurance providers in the Middle East North Africa (MENA) region.

- Fairfax is using its substantial cash flow to grow its insurance operations. It is also buying more of something it already owns (and knows well), a capital allocation strategy endorsed by both Peter Lynch and Warren Buffett.

8.) Purchase of $1.8 billion of PacWest real estate loans with expected annual return of 10%.

- This was one of Fairfax’s big capital allocation decision of 2023; very contrarian, very opportunistic and deep value.

- Expansion of real estate/debt platform partnership with Kennedy Wilson (to over $4 billion in total).

- Fairfax also invested $200 million directly in KW in debentures (6%) with 7-year warrants (12.3 million shares with strike price of $16.21).

- In December, it appears Fairfax increased their commitment to the KW debt platform by $2 billion from $8 billion to $10 billion. This will be something to monitor in 2024.

9.) The market value of Fairfax’s position in Thomas Cook India (TCIL) increased about $305 million in 2023.

- The excess of market value to carrying value (at Sept 30) increased by about $379 million. A significant portion of the value of TCIL is not captured in Fairfax’s book value (about $338 million at YE).

- On December 1, Fairfax sold 40 million shares for proceeds of $67 million.

- Covid hit TCIL especially hard. TCIL (and Sterling Resorts) aggressively cut costs. With its travel businesses rebounding strongly in 2023, the much lower cost base is now spiking profits.

10.) Monetized another asset and booked a $275 million pre-tax investment gain (closed in Q2, 2023).

- Sale of Ambridge Group (MGU operations of Brit) to Amynta Group for $379 million (and an additional $100 million subject to 2023 performance targets).

- Fairfax also entered into multi-year strategic partnership with Amynta

Asset sales are important part of capital allocation framework at Fairfax, and this is something that differentiates it from BRK and Markel.

Why sell an asset? Someone values it much more and/or for strategic reasons (the asset is a better fit elsewhere).

Account Change: Implementation of IFRS 17 accounting standard Jan 1, 2023, increase book value per share by $104.60.

- On January 1, 2023, Fairfax (and all Canadian insurers) were required to implement IFRS 17 accounting standard. The cumulative effect of implementing IFRS 17 resulted in an increase in common shareholders’ equity at Fairfax of $2.4 billion at December 31, 2022.

- Pre-IFRS 17, at December 31, 2022, BV/share was US$658.

- Post-IFRS 17, at December 31, 2022, BV/share was US$762.

- Below is what Fairfax has to say about IFRS 17 when they released Q1, 2023 results:

Honourable mention:

- Digit - growth of the business during the year was solid.

- BIAL - back in growth mode. Fairfax India purchased another 10% for $250 million.

- Increase in value of Mytilineos share price.

- Turnaround at Brit? After a couple of years of underperformance (from an underwriting perspective) it looks like Brit might have turned the corner in 2023.

- Reduction in size of Blackberry debenture to $150 million (to Feb 14, 2024), down from $365 million (was $500 million in 2020). Capital is being re-allocated from under-performers to better opportunities.

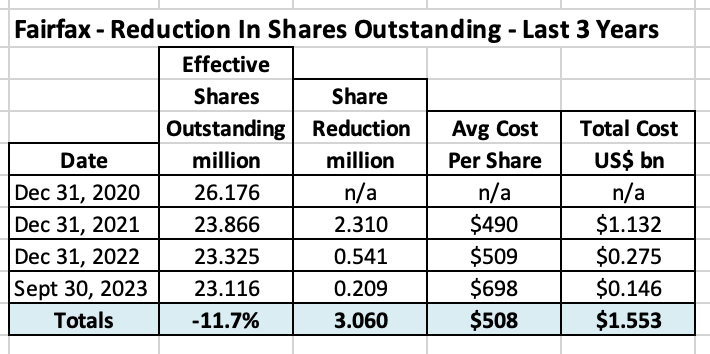

- I estimate Fairfax will reduce shares outstanding by about 1% in 2023. This is at a slower pace than the past couple of years. Over the past three years, the share count has been reduced by 3.06 million shares or 11.7%, at an average cost of US$508. My guess is Fairfax’s BV will finish 2023 north of US$900. This is yet another example of excellent capital allocation by Fairfax.

Incomplete:

- Meadow Foods (UK): how much did Fairfax spend to purchase a majority position in August? What are prospects of the company? (Company had £550 million in sales…)

Negatives:

- Continued decline in prospects of Blackberry/share price (market value of Fairfax’s position is down to $165 million at Dec 31, 2023).

- End of Farmers Edge: Fairfax is trying to take company private (to harvest significant tax losses?).

- Adverse reserve development in runoff of $80 million in 1H. Something to monitor moving forward.

- Digit IPO: in 2023, company appeared to continued to fumble the ball with regulators in India.

- Digit - still waiting for clarity on compulsory convertible preferred shares (expected to take Fairfax’s ownership position from 49% to 74%); appears to be another issue with regulators in India.

Personnel announcements:

- January 2023 Fairfax news release: “Brian Young, CEO of Odyssey Group, will begin to share oversight responsibilities with Andy Barnard, President of Fairfax Insurance Group, over all of Fairfax’s insurance and reinsurance operations. Brian Young will continue as CEO of Odyssey Group.”

-

5 hours ago, Dinar said:

@Viking, take a look at this article, claims that reinsurance rates are up 50%. I am trying to find out if that is true, have people heard anything?

https://nypost.com/2024/01/06/real-estate/america-is-running-out-of-home-owners-insurance/

I spoke with a friend who buys catastrophe bonds, and he informed me that premiums are unchanged from the high levels achieved last year. This is despite last year being a very profitable year.

@Dinar the article you link to might be discussing what happened last year. For information on what is happening now or what might happen moving forward, below are some links you might find helpful:

AM Best - 2024 Guide To Understanding the Insurance Industry

Gallagher Re - What A Difference A Year Makes - Jan 2024 (I haven't read this but it looks interesting)

Other:

-

4 hours ago, Thrifty3000 said:

Thanks @Viking . It looks to me like the top 5 holdings alone could generate look-through earnings in the ballpark of $1 billion. Since the top 5 holdings represent about half the equity portfolio, it seems like your $1.8 billion earnings estimate for the equity portfolio is perfectly reasonable.

Once again, thanks to your work, I’ll have to upwardly adjust my financial model. I have been underestimating the earning power of the equity portfolio.

@thrifty For fun, here are some rough numbers for 2024:- Poseidon = $200 to $250

- Eurobank = $400 to $450

- FFH-TRS = $400 to $500

- Fairfax India = $125

- Recipe = $75

Top 5 could deliver $1.2 billion in ‘value creation’ on their own. The FFH-TRS position is already up $120 million one week into the new year. If Eurobank announces the initiation of a dividend when they report YE results that likely will pop their share price.

Of interest, much of the TRS notional position is not captured in BV (just the gains are captured in BV). So gains in that position really helps the ROE math.

-

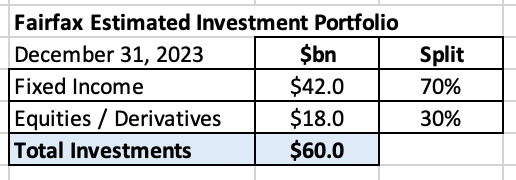

As of December 31, 2023, my guess is Fairfax has an investment portfolio that totals about $60 billion, with the split being roughly as follows:

In this post we review the holdings in the equities ‘bucket.’ To value a holding we normally used current ‘market value,’ which is the stock price at Dec 31, 2023, multiplied by the number of shares Fairfax owns. For private holdings we use Fairfax’s latest reported market value (sometimes carrying value). Derivative holdings, like the FFH-TRS, are included at their notional value. Where we have done something ‘funky’ we provide an explanation (see ‘additional notes’ below). We have attempted to capture a value for each holding that we feel roughly reflects its ‘intrinsic’ or actual economic value to Fairfax.

For Fairfax India and Recipe, some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. We used share counts that reflect what we think Fairfax actually owns/controls. (I think some Poseidon shares are also included in this note but I am not sure so I did not make an adjustment for this - so the Poseidon position below might be understated by about 9%).

Additional notes:

- Atlas: $2,100 = 2,046 FV at Q3 + $50 Q4 earnings (likely low)

- Fairfax India: $1,220 = $20.89 BV at FIH.U x 58.4 million shares

- Recipe: $900 = ($17.25 CV at Dec 31, 2022 x 49.4 million shares) + $50 million (2023 earnings est)

- AGT Food Ingredients: $350 million. A guess; probably low. EBITDA was C$150 million in 2022.

- Mytilineos: includes exchangeable bonds

- John Keells: includes convertible debentures

Ok, let’s get to the fun part of this post.

What are some key take-aways?

Below are mine. What are yours?

1.) Fairfax has a pretty concentrated portfolio

- The top 5 holdings make up 45% of the total

- The top 15 holdings make up close to 70% of the total

2.) Steady improvement in quality of the top 15 holdings over the past 6 years: What happened?

- New money has been invested at Fairfax very well (FFH-TRS, buying more of existing holdings)

- Some high quality businesses have continued to execute well (Fairfax India, Stelco)

- Some businesses, after years of effort, have turned around (Eurobank).

- Some businesses that were severely affected by Covid have emerged stronger (Thomas Cook India, BIAL, Recipe?)

- Some businesses were restructured/taken private (EXCO, AGT) and are now performing much better.

- Some low quality business were sold/merged/wound down (Resolute Forest Products, APR, Fairfax Africa).

- Some low quality businesses have shrunk in size due to poor results (BlackBerry, Farmers Edge, Boat Rocker).

The important point is the quality of Fairfax’s largest holdings have steadily been increasing. And this should result in higher overall returns from the equity portfolio in the coming years.

3.) What rate of return should this collection of equity holdings be able to deliver in 2024?

- 12% return x $18 billion = $2.16 billion (made up of share of profit of associates + dividends + ‘other’ consolidated non-insurance co’s + investment gains)

- This looks like a reasonable target for 2024, looking at the solid prospects/earnings profiles of the top 15 holdings (with a 70% weighting).

4.) A slow shift away from mark-to-market holdings. Today, less than 50% of the total portfolio is held in the mark-to-market bucket. Back in 2019, my guess is closer to 80% of the total portfolio was held in the mark-to-market bucket.

- This shift should have the effect of smoothing Fairfax’s reported results moving forward, especially during bear markets. As a reminder, in Q1, 2020, Fairfax had $1.1 billion in unrealized losses (when the equity portfolio was much smaller). As more holdings shift to the ‘Associates’ and ‘Consolidated’ buckets, it is the trend in underlying earnings at the individual holdings that will matter to Fairfax’s reported results and not a stock price - earnings are much more consistent than a stock price. Lower volatility in reported earnings should help Fairfax’s valuation (as volatility is considered bad by Mr. Market).

- This shift will also start to create a Berkshire Hathaway problem for Fairfax: over time book value will become an increasingly poor tool to use to value Fairfax. Why? The value of the ’Associates’ and ‘Consolidated’ companies captured in book value each year will fall short of the increase in their true economic value. Fairfax India is a good example of this today. Eurobank is a holding to watch moving forward.

Bottom line, Fairfax looks very well positioned today. But the story gets better: like the past 6 years, I expect the quality of Fairfax's equity holdings to continue to improve in 2024. That will improve future returns. And, like a virtuous circle, the growing cash flows will be re-invested growing the companies even more.

Thoughts? Am I missing something? What number below is most wrong? Why?

-

5 hours ago, OCLMTL said:

Beyond the debate of the incremental benefits which the $115M per year would bring if it was focused on buybacks, dividends, investments, etc, I think the $115M could create billions in value by restoring confidence in management and the new, higher earnings power of the company. If that “social capital”, that reputation of the mgmt gets enhanced enough in 2024 because of a big bump in dividends, then the “ROE” of that $115M could be a 0.2-0.3x BV impact. THAT is money well spent …

+1 Fairfax needs to re-build investor confidence. That is extremely important. Increasing the dividend is a no-brainer way to do that (yes, just one of many things that need to happen). And a material - 50% - increase in the dividend is even better (as long as it is sustainable… which it is in this case).

Three things drive a share price:

1.) earnings

2.) multiple

3.) share count

The spike higher in Fairfax’s shares the past three years has been driven by a spike in earnings and a rapid decrease in the share count. Multiple expansion HAS NOT HAPPENED. Yet. I think it will. But to get multiple expansion the management team will need to keep doing what they are doing - delivering solid results and communicating well.

Multiple expansion is rocket fuel to a share price.

-

53 minutes ago, nwoodman said:

If there was a single narrative that could get Fairfax trading at 1.5x’s book it would have to be India

@nwoodman i agree. There are a number of catalysts that might come to fruition in 2024 for Fairfax in India:1.) Digit IPO - surface value in Digit

2.) Anchorage IPO - surface value in BIAL

3.) NSE and Seven Island Shipping IPO’s - surface value in Fairfax India

There were also the rumours of Fairfax making a bid for IDBI Bank.

-

Fairfax India was launched in 2015. It has grown into a wonderful business for Fairfax.

- Solid collection of assets.

- Very well managed.

- Very good track record.

- Well positioned for the future.

In this post we are going to get into the weeds of how Fairfax India is valued by its parent, Fairfax.

Let me know if you think i have messed up with my math/logic/assumptions… that is how we all learn.

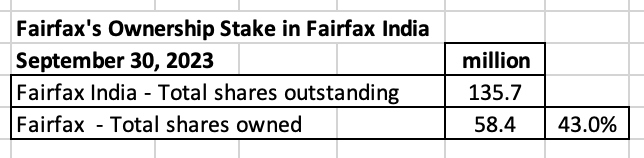

How much of Fairfax India does Fairfax own?

When Fairfax India was launched in 2015, Fairfax owned 28.1%. My math says Fairfax now owns 43.0% of Fairfax India, which is an increase of more than 50% over the past 8 years. Fairfax India is also now a much larger company - common shareholders equity has increased from $1 billion at inception in 2015, to $2.8 billion at Sept 30, 2023, which is an increase of 180%. So today, Fairfax owns 50% more of a company that has increased in size by 180%.

That sounds great. But what does the math look like?

How many shares of Fairfax India does Fairfax actually own?

It can be a little confusing to understand exactly how many shares of Fairfax India that Fairfax actually owns. This is because some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago.

On Feb 16, 2022, when they added to their position, Fairfax confirmed they ‘beneficially owned, and/or exercised control or direction over’ a total of 58.4 million shares of Fairfax India. I am assuming that is the number of shares they ‘own’ today.

A short history of the growth of Fairfax’s ownership of Fairfax India (total shares and %) can be found at the bottom of this post.

Market value and carrying value

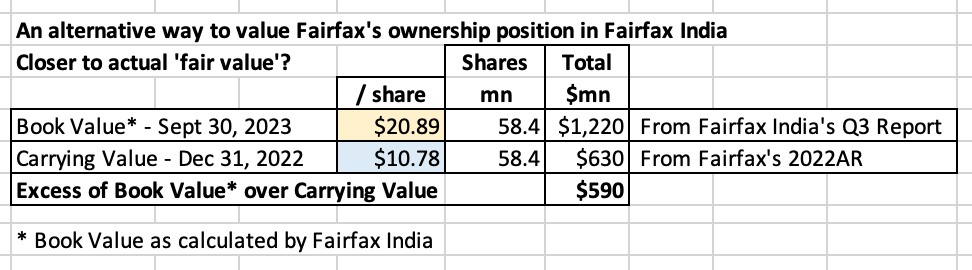

What is the market value that Fairfax uses to value its stake in Fairfax India?

To determine market value, Fairfax uses Fairfax India’s stock price, which at Dec 31, 2023, was $15.20/share. This gives a total market value to Fairfax’s position of $888 million.

What is the carrying value that Fairfax uses to value its stake in Fairfax India?

Carrying value is important. This is the value that finds its way into book value. And, as we know, book value is the ‘holy grail’ use by investors to value P/C insurance companies.

In the 2022AR, Fairfax said the carrying value for their investment in Fairfax India was $10.78/share, or $630 million (using my share count of 58.4 million).

What is the excess of market value over carrying value?

It appears Fairfax’s book value is understating the market value of its stake in Fairfax India by about $250 million. (Yes, i know my dates are messed up… directionally, it appears Fairfax India’s carrying value at Fairfax is low).

OK. Are we done? No. There is a wrinkle.

Fairfax India’s stock price is a terrible measure to use to value Fairfax’s stake in Fairfax India. And that is because Fairfax India’s stock price trades at a severe discount to the fair value of the collection of companies that it owns.

My guess is accounting standards require Fairfax to report carrying value and market/fair value the way they do.

What should we do? Fairfax India has very good disclosures. We should simply use Fairfax India’s book value - that is the best measure of what the collection of assets they own are actually worth.

What is the value of Fairfax’s stake if we use Fairfax India’s book value?

Fairfax India has a book value of $20.89/share (at Sept 30, 2023), which puts the value of Fairfax’s stake at $1.22 billion (using my share count of 58.4 million). It appears Fairfax’s book value is understating the value of its stake in Fairfax India by about $590 million. That is much larger than our previous estimate of $250 million.

If we use a fair value of $1.22 billion, this suggests Fairfax India is Fairfax’s 4th largest holding, along with Eurobank, Poseidon and FFH-TRS. These 4 holdings represent about 40% of Fairfax’s total equity exposure.

What does Prem think about Fairfax India’s reported book value?

Prem thinks that Fairfax India’s intrinsic value is ‘much higher’ than its reported book value. If Prem is right, then the value of Fairfax’s stake in Fairfax India is worth even more than $1.22 billion.

Below are Prem’s comment from Fairfax’s 2022AR:

Growth prospects

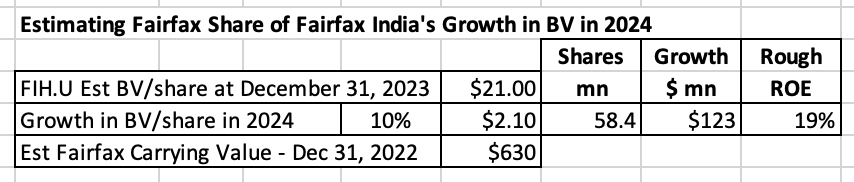

Fairfax India reported a book value of $20.89/share at Sept 30, 2023. My guess is it will be well over $21 at Dec 30, 2023. Let’s assume Fairfax India grows BV/share at 10% in 2024, which would be $2.10/share.

This would put Fairfax’s share of growth in BV at $123 million ($2.10/share x 58.4 million shares). This would also deliver a (very rough) high teens ROE.

Is 10% growth in BV/share an aggressive assumption? No, I actually think it will prove to be conservative. Why?

- BIAL is now 47% of total investments at Fairfax India. Its value has gone sideways for the past 3 years - as a result of Covid. However, the airport is beginning its next significant growth phase (as second runway and recently completed Terminal 2 ramp up). An Anchorage IPO in 2024 could unlock significant value that has been building at BIAL.

- Two other private holdings in Fairfax India also might see IPO’s in 2024: NSE and SIS, which would likely unlock more value for Fairfax India.

- The remaining holdings of Fairfax India are well run companies and should continue to increase in value.

If my rough math is accurate, Fairfax’s stake in Fairfax India is poised to grow in value by about $123 million in 2024. Some of this value will show up in the ‘share of profit of associates’ bucket. However, like the past 8 years, a large part of the value will likely not show up in Fairfax’s reported results. As a result, the gap between fair value and carrying value will continue to widen.

Conclusion

Since being launched in 2015, Fairfax India has quietly been growing like a weed. It is a great example of exceptional long term value creation by the team at Fairfax/Fairfax India/Fairbridge. However, the value creation has largely not been reflected/captured in Fairfax’s accounting results - especially book value.

Fairfax India is a great example of how book value at Fairfax is understated. There are likely more examples.

—————-

Warren Buffett on book value

Warren Buffett in 2018 decided to no longer publish the book value for Berkshire Hathaway as he felt it was no longer a useful tool for investors to use to value Berkshire Hathaway’s share price. I wonder how much longer book value will serve as a useful tool for investors to value Fairfax’s share price.

“Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mis-mark that has grown in recent years.”

—————-

Fairfax India: Summary of ‘total existing Indian investments’

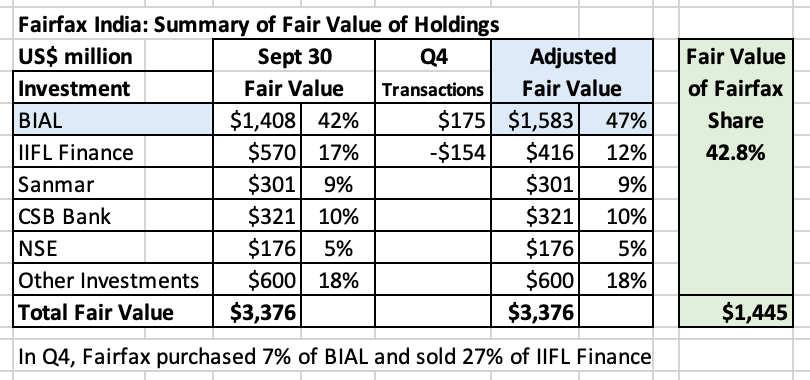

At Sept 30, 2023, Fairfax India held total investments with a fair value of $3.376 billion. If we adjust for Q4 transactions (increase in BIAL and decrease in IIFL Finance):

- BIAL (manages BLR Airport) = 47%

- All other holdings = 53%

Fairfax India

- Shareholders equity = $2.833 billion

- Debt = $500 million

—————-

A short history of Fairfax’s investment in Fairfax India

Fairfax India was launched in 2015. At inception, Fairfax invested a total of $300 million ($10/share) for a 28.1% ownership position. Fairfax India did a second capital raise in January 2017 (at $11.75/share) and Fairfax participated to keep its ownership position of similar size (it was 30.2% at the end of 2017. Fairfax has also received two performance fees in shares of Fairfax India (2018 and 2021). Today Fairfax owns 58.4 million shares of Fairfax India. My rough math says they paid a total of $539 million or an average of $9.23/share.

Share count at Fairfax India peaked at 152.9 million at December 31, 2018. Since that time, the share count has come down 11.2% to 135.7 million. With the stock trading well below book value, Fairfax India has been taking out shares on the cheap. Smart.

With Fairfax’s share count going up and Fairfax India’s share count coming down, Fairfax has increased its ownership interest in Fairfax India from 28.1% in late 2015 to 43.0 at Sept 30, 2023. That is an increase of more than 50% over the past 8 years. That is a meaningful increase.

—————

Summary of Fairfax India’s exceptional track record (at Sept 30, 2023)

- CAGR of ‘Total existing Indian Investments’ = 13.0%

- CAGR of ‘Total monetized Indian Investments’ = 17.5%

From Fairfax India's Q3 Interim Report - Page 32

- https://www.fairfaxindia.ca/wp-content/uploads/FIH-2023-Q3-Interim-Report-Final.pdf

—————

Summary of key metrics for Fairfax India (from 2022AR)

-

1

1

-

5 hours ago, petec said:

Viking - thanks for working this through. I have been meaning to do it for ages!

This is one thing I wish FFH would change in their reporting - the reported difference between carrying and fair value for equities would be more useful if it included FIH on a look-through basis. By my rough maths this adds $20-25/share to FFH's "BV at fair value".

@petec as i was working through my BIAL post it became clear to me that i needed to do a valuation post on Fairfax India. It should be out this weekend.

Another layer of complexity with Fairfax India (and Recipe) is some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. Fairfax reports they ‘beneficially owned, and/or exercised control or direction over’ these shares so they should be included as shares Fairfax ‘owns’ today. I think the shares being held in the ‘asset value note’ are slowly shrinking - hopefully this continues in Q4 (yes, Fairfax will need to spend some $ to buy the shares).

The ‘asset value note’ looks to me like another example of Fairfax using leverage to boost returns. The FFH-TRS is another example.

When i do my next size ranking of Fairfax’s equity holdings i am going to try and include the positions held in the ‘asset value note’ and Fairfax India at fair value (i will use Fairfax India’s reported book value). I might also take a stab at some private holdings like AGT and Bauer. This will increase the size of the equity bucket. And likely boost estimates of the returns from the equity bucket.

-

I love the 50% increase in the dividend to $15 (it had been at US$10 forever). Fairfax has paid a dividend for many years - and it is not going to stop (now that would be an idiotic thing to do). The fact Fairfax modestly increased the dividend should also not come a surprise to anyone. As was mentioned upthread, the payout ratio remains very low at 9% ($15 / $170 earnings in 2023). Yes, the increase of 50% looks dramatic - but let’s be honest, the amount is small potatoes in the big scheme of things ($5 for a company that is likely earning $170).

Total shareholder return at Fairfax (buybacks + dividends) has been very high at Fairfax for the past 5 years. Fairfax HAS delivered on the share buyback front - especially if you include the FFH-TRS position. Capital allocation, in general, has been excellent.

I can understand that some investors might not like dividends. There is an easy answer - stick to stocks that don’t pay a dividend.

But the simple truth is lots of well run companies also pay a modest dividend. Lots of P/C insurers pay a dividend. Are they all idiots? I don’t think so.

Fairfax is still trying to repair its image. This effort is going to take years. They are going to need to execute very well in the coming years. They are going to need to be rational. Increasing the dividend from $10 to $15 signals Fairfax is very bullish about its future - and that will be cheered my most investors. Well done Fairfax!

-

@This2ShallPass, I have a question. Can you explain what you mean by “wrong” when you say: “What could go wrong w Fairfax?”

I look at risks as kind of being across three dimensions:

1.) time - short term (next two years) and longer term (3 and more years)

2.) internal - under Fairfax’s control

3.) external - not under Fairfax’s control

Some events could be short term negative for the company’s stock price and be good for the company longer term (looking out a few years). For example, the dramatic fall in Fairfax’s stock price in 2020/2021 (outside of managements control?) ended up being a gift for long term shareholders (it allowed management to put on the FFH-TRS position - 1.96 million shares at $373/share - and buy back 2 million shares at $500/share).

—————The biggest near term risk to the stock price that i see is skittishness of Fairfax investors. The wounds inflicted by the past have not yet healed. It will take more time. As a result, at the first sign of trouble (real or not), we could see investors panic and Fairfax shares could get hit hard. Just another buying opportunity? Probably. But it will depend on what the trigger is.

IFRS 17 accounting is a near term risk for me (for reported earnings). It is new and i do not understand how it impacts Fairfax’s quarterly results (i don’t yet have a feel for its overall impact to results). Interest rates in Q4 have moved dramatically further out on the curve. What will the IFRS 17 impact be? I am not sure, other than i expect it to be a headwind to earnings.

Do losses from runoff accelerate? Losses have been running around $200 million for a few years now. Do they accelerate (inflation)? Or not? This is becoming a smaller part of Fairfax (helps when your insurance business grows like stink over a decade).

Reserving in general is a watch out, not just for Fairfax, but for the industry.

Another risk: lower interest rates + end of hard market could result in investors aggressively selling off P/C insurance stocks and rotating into other sectors. I think this has been happening a little over the past month or so. This is more of a P/C insurance risk than a Fairfax specific risk.

Sorry, i am rambling…

-

1 hour ago, SafetyinNumbers said:

@SafetyinNumbers thanks for the input/help. I have edited my summary to include this.

-

Bangalore International Airport Limited (BIAL)

What is Fairfax’s 4th largest equity holding? At December 31, 2023, with a value of about $630 million, it looks to me like it is BIAL. BIAL is owned entirely within Fairfax India so it tends to get ignored as a core holding at the Fairfax (parent) level. But the fact it is ignored does not mean it does not exist.

For good reason, Prem calls BIAL the ‘crown jewel’ of Fairfax’s various equity holdings in India. BIAL is a very high quality asset - it is a trophy asset (very hard to secure a control position). It is well managed. And it looks exceptionally well positioned to benefit from the expected growth of the economy in India in the coming decades. So, in this post, let’s shine a light on this important holding to see what we can learn.

There are so many interesting layers to this story. What is missing? Is my logic faulty?

Who is BIAL?

The best place to go to get information on BIAL is Fairfax India’s web site (start with the Q3 Interim Report and the 2022 Annual Report):

Here is how Fairfax India described BIAL in their Q3, 2023 Interim Report:

- “Bangalore International Airport Limited ("BIAL") is a private company located in Bengaluru, India. BIAL, under a concession agreement with the Government of India until the year 2068, has the exclusive rights to carry out the development, design, financing, construction, commissioning, maintenance, operation and management of the Kempegowda International Airport Bengaluru ("KIAB") through a public-private partnership. KIAB is the first greenfield airport in India built through a public-private partnership.” Fairfax India - Q3 Interim Report

KIAB (also know as BLR Airport) is the third largest airport in India and the largest airport in south India. Bangalore, the centre of India’s high-tech industry, is known as the ‘Silicon Valley of India’. KIAB was recently voted best domestic airport in India (go to the bottom of this post for a link to the article).

The History And Rise Of Bangalore International Airport

A review of the fair value of the assets owned by Fairfax India

Fairfax India owns assets with a fair value at Sept 30, 2023 of $3.38 billion. In Q4, Fairfax India increased is ownership in BIAL by 7% (at a cost of $175 million) and sold down its position in IIFL Finance by 27%. Including these two recent transactions, BIAL represents about 47% of all assets in Fairfax India. BIAL is a massive holding for Fairfax India.

Fairfax owns 42.8% of Fairfax India. This puts the fair value of Fairfax’s stake in Fairfax India at about $1.45 billion.

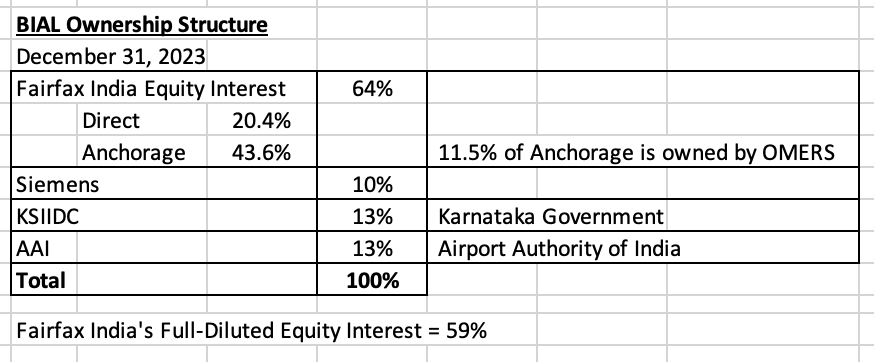

What is the math that gets BIAL to a $631 million valuation for Fairfax?

As we mentioned earlier, Fairfax does not own BIAL directly - its position is held entirely through Fairfax India.

Estimating the total value of BIAL: At September 30, 2023, Fairfax India held an equity interest in BIAL of 57% with an estimated fair value of $1.408 billion. This values 100% of BIAL at $2.6 billion. In Q4, Fairfax India purchased another 7% BIAL from Siemens for $175 million; this transaction values 100% of BIAL at $2.5 billion. Given this is the most recent transaction, this is the number we will use to value Fairfax’s stake.

Estimating the fair value of Fairfax’s stake in BIAL: As of December 31, 2023, Fairfax India owned 59% of BIAL (on a fully-diluted equity basis). Fairfax owns about 42.8% of Fairfax India. Therefore, Fairfax owns about 25.25% of BIAL (59% x 42.8%), with a value of $631 million ($2.5 billion x 25.25%). This makes BIAL the 4th largest equity holding of Fairfax (after Eurobank, Poseidon and FFH-TRS).

From Fairfax India’s Q3 interim report:

- “At September 30, 2023 the company held a 57.0% equity interest in BIAL (December 31, 2022 - 54.0%) and its internal valuation model indicated that the fair value of the company's investment in BIAL was $1,408,403 (December 31, 2022 - $1,233,747).”

- “At September 30, 2023 the company held 43.6% out of its 57.0% (December 31, 2022 - 43.6% out of its 54.0%) equity interest in BIAL through Anchorage. As a result, the company's fully-diluted equity interest in BIAL was 52.0% (December 31, 2022 - 49.0%). Refer to note 8 (Total Equity, under the heading Non-controlling interests) for further discussion on Anchorage.”

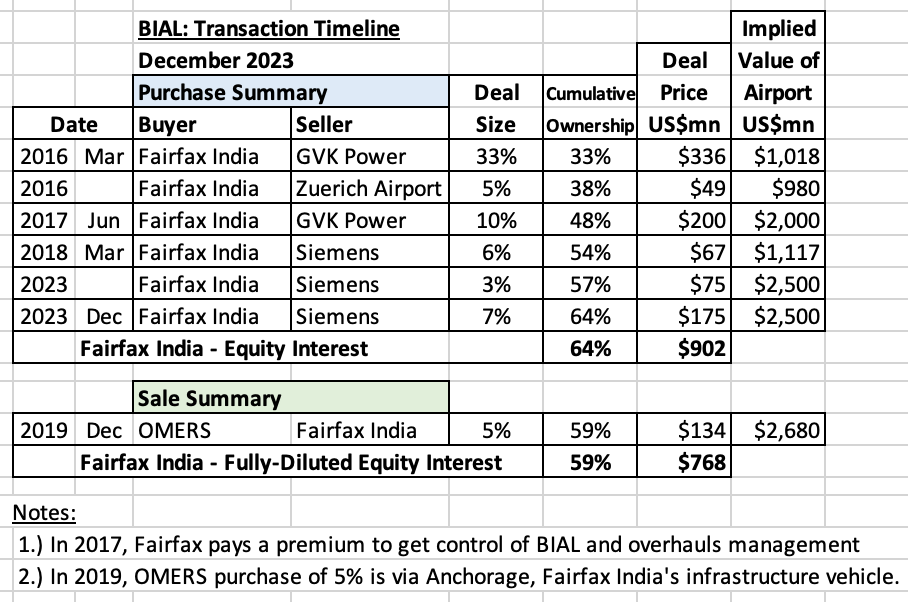

How much did it cost Fairfax India to secure a 59% interest in BIAL?

Fairfax India made their first purchase in BIAL in 2016. Since then they have made 5 more purchases. Over the past 8 years, Fairfax India has spent a total of $902 million for 64% of BIAL.

In 2019, Fairfax India also sold a 5% interest to OMERS for $134 million. The sale was made via Anchorage (a subsidiary of Fairfax India).

Fairfax India’s fully-diluted equity position in BIAL (of 59%) cost a total of $768 million.

What has been the return on the 8-year investment in BIAL?

The fair value of Fairfax India’s 59% stake in BIAL is about $1.475 billion. Its cost is $768 million. The simple return is about $707 million.

As reported by Fairfax India, the CAGR on this investment since inception has been 12.8% (to Sept 30, 2023).

What is the carrying value of Fairfax India at Fairfax?

This is where things get even more interesting.

At December 30, 2022, Fairfax had a carrying value for all of Fairfax India of $630 million (58.4 million shares x $10.78/share) - that is what is reflected in Fairfax’s book value. (Of interest, my math says the total cost to Fairfax since late 2015 of its various investments in Fairfax India has been about $535 million. So, carrying value for Fairfax India is slightly higher than Fairfax's cost basis? For an asset that has increased significantly in value of the past 8 years? That is something we will review in a future post.)

Carrying value significantly understates the value of Fairfax's stake in Fairfax India today.

BIAL represents about 47% of Fairfax India. This gives us a ball-park estimate for the carrying value of BIAL at Fairfax today of about $300 million ($630 million x 47%).

Summary: Fairfax’s 25.25% interest in BIAL has a fair value of about $630 million and a carrying value of about $300 million. That is a significant difference. And as the value of BIAL grows in the coming years, that difference will likely grow even larger.

The very low carrying value of Fairfax India (including BIAL), is one good example of how the book value of Fairfax today is significantly understated.

Management

In 2017, Fairfax India paid up to get a controlling position in BIAL. They quickly overhauled management and installed Hari Marar as Managing Director and CEO. BIAL is exceptionally well managed. BIAL is a great example of the strong management team at Fairfax India.

From Fairfax India’s 2017AR:

- “In July 2017 Fairfax India acquired the final 10% of BIAL owned by GVK for $200 million, the higher price being justified by this purchase enabling Fairfax India and the other remaining shareholders to reconstitute BIAL’s Board, to appoint the best qualified person as BIAL’s CEO, and generally to allow it to be managed according to Fairfax India’s standards of corporate governance and guiding principles.

- “Subsequently, three new directors with expertise in airport and airline management and finance were appointed to the Board of BIAL, and Hari Marar, the former COO of BIAL, was appointed as its new Managing Director and CEO.”

Since taking over in 2017, the management team at BIAL has done an exceptional job. See 'recent news' articles below for some current examples.

Conclusion

BIAL has been a solid investment for Fairfax India. Over the past 8 years, it has grown into the 4th largest equity holding of Fairfax. It has a carrying value that is less than half of its fair value.

BIAL is a very high quality asset. It is also exceptionally well managed. It is also perfectly positioned to benefit from India's growth in the coming years and decades. The runway for this investment is very long.

Most importantly, Fairfax (via Fairfax India) has a control position in this very rare asset. That is almost priceless - and likely the reason Prem calls BIAL a ‘crown jewel’ asset for Fairfax.

—————

Recent news:

Dec 2023: Bengaluru airport to roll out its master plan with renovation of T1, new place for T3 by 2030

Dec 2023: BLR Airport Secures ‘Best Domestic Airport’ Title

Dec2023: BLR Airport’s Terminal 2 earns UNESCO’s recognition as one of the 'World’s Most Beautiful Airports'

Dec 2023: Bengaluru airport most profitable in India in FY23

—————

Ownership structure of BIAL

Fairfax open to acquiring AAI’s 13% stake in Bangalore Airport: Hari Marar

—————

Prem’s Letter, Fairfax 2022AR:

- “While the book value per share of Fairfax India is $19.11 per share, we believe the underlying intrinsic value is much higher. Given the low market price for its shares, Fairfax India has taken the opportunity in the last four years to buy back 15.1 million shares for $194 million at an average price of $12.84 per share, including the three million shares it bought in 2022 for $36 million or an average price of $12 per share.”

—————

Fairfax India Q3, 2023 Interim Report: Details of BIAL and Anchorage Subsidiary

- “Non-controlling Interests: In 2019 the company formed Anchorage as a wholly-owned subsidiary of FIH Mauritius, intended to provide investment related services to support the company in investing in companies, businesses and opportunities in the airport and infrastructure sectors in India. On September 16, 2021 the company transferred a 43.6% equity interest in BIAL from FIH Mauritius to Anchorage and subsequently sold 11.5% (on a fully-diluted basis) of its interest in Anchorage to OMERS for gross proceeds of $129,221 (9.5 billion Indian rupees). Upon closing of the transaction, the company's ownership in BIAL was comprised of 10.4% held through FIH Mauritius and 43.6% held through Anchorage, representing effective ownership interest of 49.0% on a fully-diluted basis.

- “At September 30, 2023 the company continued to hold 43.6% out of its 57.0% (December 31, 2022 - 43.6% out of its 54.0%) equity interest in BIAL through Anchorage. As a result, the company's fully-diluted equity interest in BIAL was 52.0% (December 31, 2022 - 49.0%).”

—————

A history of financial transaction at BIAL

Timeline for BLR Airport

-

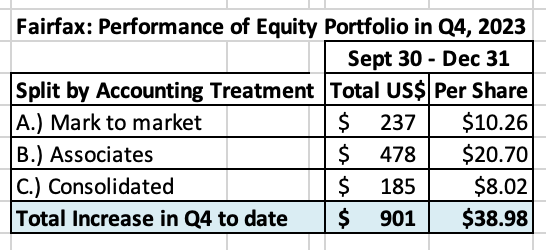

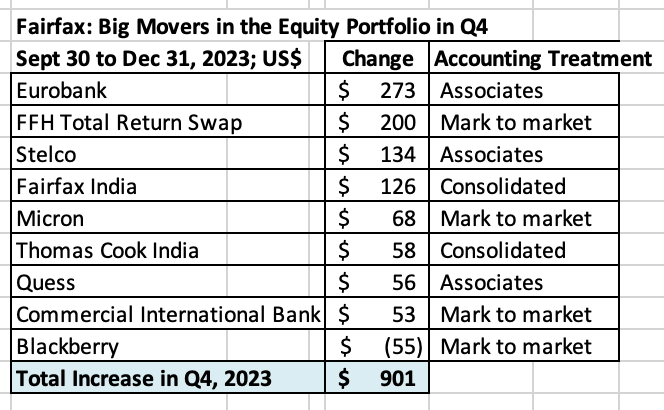

What was the change in the value of Fairfax’s equity portfolio in Q4, 2023?

Fairfax’s equity portfolio (that I track) has a total value of about $17.5 billion at December 31, 2023. This is an increase of about $901 million (pre-tax) or 5.4% from September 30. The increase in the quarter works out to about $39/share.

Currency, which has been a headwind for the past couple of years turned into a tailwind in Q4.

Please note, I include holdings like the FFH-TRS position in the mark to market bucket and at its notional value. I also include debentures and warrants in this bucket.

To state the obvious, my tracker portfolio is not an exact match to Fairfax’s actual holdings. It also does not capture changes in the value of private holdings – which are significant. It also does not capture changes Fairfax has made to its portfolio during the quarter that are not reported. As a result, my tracker portfolio is useful only as a tool to understand the likely directional movement in Fairfax’s equity portfolio (and not the precise change).

Split of total holdings by accounting treatment

About 49% of Fairfax’s equity holdings are mark to market - this includes 'A.) Mark to Market' and 'D.) Other Holdings' - and will fluctuate each quarter with changes in equity markets. The other 51% are Associate and Consolidated holdings.

Split of total gains by accounting treatment

The total change is an increase of $901 million = $39/share

The mark to market change is increase of $237 million = $10/share. Only changes in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter.

What were the big movers in the equity portfolio in Q4?

- Eurobank was up $273 million and is now Fairfax’s largest equity holding - a $2.1 billion position for Fairfax. The shares still look like they are dirt cheap, closing the year at €1.61. This holding looks primed to have another good year in 2024.

- The FFH-TRS was up $200 million. This position is up a total of $1.07 billion over the last 3 years, which is a gain of almost 150%. Simply an amazing investment.

- Stelco was a strong performer, up $134 million. It will be interesting to see if we get more consolidation in the North American steel industry in 2024.

- Fairfax India (finally) got some love from investors in Q4 and was up $126 million. This high quality holding continues to fly under the radar of most investors.

- International holdings - Thomas Cook India, Quess and Commercial Industrial Bank – all had strong gains in Q4

- Blackberry was the biggest under-performer, down $55 million. In Q4, Fairfax significantly reduced the size of its investment in Blackberry by reducing the debenture position from $365 to $150 million. The stock position is worth a total of $165 million.

Excess of fair value over carrying value (not captured in book value)

For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1.0 billion or $45/share (pre-tax). Book value at Fairfax is understated by about this amount (less the tax impact). What is the split?

- Associates: $668 million = $29/share

- Consolidated: $348 million = $15/share

Below is a copy of my Excel spreadsheet (next 2 pages) if you want a closer look.

Equity Tracker Spreadsheet explained:

The summary below attempts to track all equity holdings at Fairfax. Each quarter the spreadsheet is updated to capture any ‘new news:’ purchases and sales.

We have separated holdings by accounting treatment:

- Mark to market

- Associates – Equity accounted

- Consolidated

- Other Holdings (also mark to market) – derivatives (total return swaps), debentures and warrants

We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency.

Important: the list is not complete. Some information we only get once per year when Fairfax published their annual report. Fairfax also makes changes to their portfolio each quarter.

-

+35% for the year. The driver was Fairfax - simply an amazing year. I also had lots of single base hits - the volatility made trading around positions work really well (oil, US banks, retail etc). The run the last three years with Fairfax has been epic (at least that is how my kids would likely describe it). The crazy thing is i think Fairfax has lots left in the tank (it continues to be my largest holding by far).

I have also started to diversify my portfolio. I now hold 25% in index funds: XIC.TO, VOO and VO. About 1/3 in each. My total portfolio is now of a size that i want to put a big chunk of it on ‘set and forget’. My plan is to grow the index portions to +50% in the coming years. Part of that is wealth preservation - versus going for maximum return.

Historically, my strength has been avoiding bear markets. My weakness the past couple of bear markets is being too cautious coming out of them. Index funds are a nice solution: lock in the gains and stay invested.

Today, other than Fairfax, i don’t have any ‘strong conviction’, table pounding, ideas. A little surprising - to me at least. I see lots of cheapish things but not much that i think will materially outperform an index. So i am happy to increase my allocation to index funds because i am bullish on the economy and stocks in general in the coming years.

Of course, all of this could change. And that is what i love about investing.

-

25 minutes ago, Ross812 said:

I voted no.

From @Viking: For Fairfax, today only 20% of their various income streams comes from underwriting profit and 80% comes from other sources (40% from interest and dividends, 20% from share of profit of associates and 20% from mark to market equities and investment gains). Underwriting profit is a much more important income stream for traditional P/C insurers. So even if the CR at Fairfax declines slightly in the coming years (this is not a given), given its small relative size, it will likely have a small impact on Fairfax’s total earnings - the total $ decline will likely easily be absorbed by another income stream.

To get to $2000 I'll make the optimistic assumption that EPS are $200 in 2024-2027 and FFH rerates to 1.2x BV.

I assume that interest rates are headed back down a couple of percentage points which means over the next few years the ability to easily reinvest cash (both retained earnings and maturities) back into treasuries/bonds becomes less profitable. The 40% share of profit from interest and dividends comes from the float and I don't see the float increasing at 20%+ percent a year which means FFH has to rely on other sources - underwriting profit, profit from associates, 20% MTM investment gains. Declining interest payments is a big hole to fill and FFH hasn't done it in the past, even if you look at the profitability of the SOTP ex-hedges in the past. Remember there is a high probability (40-50%) underwriting disappoints in one of the next 4 years. Maybe that extends/renews a hard market and FFH ends up better for it over a full cycle, but that could be a significant whack to earnings in any one year. To get to $2000, a lot of things have to go right:

a) high interest rates continue -or- they knock investments out of the park (maybe 30% chance)

b) no super cats in the next 4 years (50% chance)

c) market rerates FFH to 1.2x BV (I'd say 80% chance)

So that is a 12% chance FFH ends up at $2000.

My estimation:

Starting BVPS - $890

2024 - $170 EPS

2025 - $175 EPS

2026 - $180 EPS

2027 - $170 EPS

Underwriting: super cat year knocks off $40 one year

Rerate to 1.2x BV

BVPS - $1545

Price - $1850

That's a CAGR of about 18% which is good enough for me, 15% of my NW is in FFH.

@Ross812 from my perspective the big unknown with Fairfax is asset sales/monetizations/revaluations. Will be get one big one - +$500 million - over the next 4 years? Two big ones? Or do we get a number of smaller ones - $250 million to $500 million - like the 2 we saw in 2023 (Ambridge and GIG).- Digit IPO and getting to 74% ownership

- Anchorage IPO - BIAL

- Stelco - does it get taken out?

- AGT Food Ingredients - delivered +$100 million in EBITDA in 2022 (if i remember correctly). Time to spin out?

- Foran Mining - will we need more copper in about 2 years?

I could go on. Fairfax has lots of levers to pull to surface significant value.

Bottom line, one or two big moves here (or a number of smaller moves) would really move the needle in terms of BV growth, which would likely pop the stock price. What i like about Fairfax today is most investors expect zero in their earnings estimates / valuation models for big gains. I don’t build them into my models (until they are announced) - hence why i think my estimates will likely prove to be conservative.

-

1 hour ago, bargainman said:

The reason I ask is because many years ago I decided I would invest with Buffett and his acolytes in value investing. I purchased Berkshire, Fairfax, Markel, Leucadia(now, Jeffries), fairholme, wintergreen even.

Other than Berkshire, they have all significantly underperformed.

@bargainman my strategy has been to invest in Fairfax only when i am in agreement/aligned with the general positioning of their investment portfolio. As i have stated before, I like what they have been doing since about 2018 (in aggregate). -

5 hours ago, bargainman said:

Sorry if this is a dumb question, but has FFH's stock portfolio over/underperformed indices over time?

@bargainman I have looked at Fairfax in lots of different ways over the years but i have never attempted that type of analysis - there are so many important moving/unknown parts i am not sure it can be done in a quality way. One of the challenges is we have incomplete information - Fairfax has lots of equity investments that are of significant size that we know nothing about. Fairfax is also very active - positions change. Part of the analysis would need to include dividends. And what do you include? Do you include the TRS-FFH? How do you value a company like AGT Food Ingredients? Or Bauer Hockey? Or the significant private equity holdings?

The other question: what benchmark should be used? S&P500, which is dominated by 7 or 8 companies?

At the end of the day, from my perspective, what really matters is total return on the total investment portfolio. And how does Fairfax’s performance compare to peers?

That we can take a stab at. My math says Fairfax is tracking to earn 8.1% in 2023. And my estimate is for Fairfax to earn around 7.2% in 2024 and 2025. My estimates for 2024 and 2025 assume zero from large asset sales / revaluations - which i think will be wrong. My guess is Fairfax will continue to monetize/revalue some assets in the coming years so 7.2% will likely be more like 7.5% or higher.

My guess is Fairfax is earning best-in-class total returns on its total investment portfolio when compared to other P/C insurance companies (most of whom are likely earnings in the 4 to 5% total return range). And I expect the large outperformance by Fairfax to persist in the current environment (where active management matters once again).

—————

Another approach would be to look at Fairfax’s largest equity investments. The big three are Eurobank, Poseidon and FFH-TRS. These three holdings represent about 33% of Fairfax’s equity holdings.

If you look at Fairfax’s top 12 holdings, that would get you to about 60% of their equity holdings. That might be a pretty good proxy for how the total equity portfolio was performing.

-

3 hours ago, Spekulatius said:

Yes all else being equal, higher interest rates should lead to higher CR because earnings from float should increase and that can compensate for higher CR’s.

Right now insurers have tailwind from both the hard market and higher investment income due to higher interest rates and I don’t think both will persist forever.

@Spekulatius i agree that we will see some tailwinds turn into headwinds in the coming years. At the same time we will see some headwinds turn into tailwinds. Insurers are in the capital management business - and the well run companies will make adjustments. Fairfax likely has more options than any other P/C insurer.

I think the relationship between CR and interest rates is way more complicated than people think. Why?

1.) there is no insurance market. There are many insurance markets. Workers comp is still in a soft market - its hard market is likely coming. Personal (auto) has been a terrible business in recent years - and it is a very large market. Reinsurance (property cat) looks to be in a hard market. This is just for the US. Each region of the world also has its own unique characteristics. All these lines and regions have their own unique insurance cycle. Sometimes they line up and other times (like now) they do not. WR Berkley talked about this on one of their conference calls this year.

2.) interest rates are not having a significant impact on investment portfolios today. The Swiss Re Institute released a comprehensive study recently and they are projecting portfolio returns to tick modestly higher in both 2023 and 2024. Most P/C insurers were not positioned like Fairfax was in 2021 - so they are not seeing a spike in interest income. If interest rates go lower in 2H 2024 most insurers will likely have missed the big move higher.

I also think the whole CR/interest rate discussion matters way less for Fairfax compared to traditional P/C insurers.3.) For Fairfax, today only 20% of their various income streams comes from underwriting profit and 80% comes from other sources (40% from interest and dividends, 20% from share of profit of associates and 20% from mark to market equities and investment gains). Underwriting profit is a much more important income stream for traditional P/C insurers. So even if the CR at Fairfax declines slightly in the coming years (this is not a given), given its small relative size, it will likely have a small impact on Fairfax’s total earnings - the total $ decline will likely easily be absorbed by another income stream.

4.) everyone is laser focussed on interest income today. Guess what rarely gets discussed? Equities/non-interest bearing investments. Even at Fairfax. Why? Equities have been in a bear market - pretty much everything ex the magnificent seven. This will reverse. And when it does Fairfax will likely see some big gains from its equity portfolio - likely +$2 billion in one year.And to really blow your mind (love the Matrix movie), try and forecast these individual buckets with precision looking out 3 or 4 years.

-

Ho Ho Ho! To everyone on the board: may your holiday season be filled with joy, laughter, and cherished moments with family and friends.

-

13 hours ago, petec said:

Viking:

In 2024, operating income at Fairfax could come in around $200/share. This number is sustainable.

Petec: For three years, or long term? If you mean long term, what interest rates and CR do you need to get there? Genuinely interested and you're much closer to the numbers and modelling than anyone else, so value your view.

@petec i build my forecasts from the bottom up. You can see all my assumptions for 2024 and 2025. After 2025? Looking out 3 years or more i do not have any hard numbers. But for operating income, $200/share looks to me like a reasonable baseline to use. There will be lots of important puts and takes:

- share count: will likely come down, perhaps meaningfully (i think 2% per year is meaningful if sustained over many years)

- minority interest: Fairfax will likely continue to take minority partners out

- leverage: Fairfax will likely continue to use leverage. The GIG acquisition includes a sizeable ‘promissory note’

All three of these things will meaningfully impact the $200/share number looking out 5 years (and how much accrues to Fairfax shareholders).

- net written premiums: my guess is this will continue to grow. Even if hard market ends? Yes. How? No idea, but GIG acquisition might provide a clue.

- size of fixed income portfolio: i expect this to continue to grow. $55 billion is not a crazy number looking out 5 years (it is $41 billion today).

- dividends: Eurobank could increase this by 50% in 2024. This bucket should grow nicely each year moving forward.