Viking

-

Posts

4,689 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

Capital Allocation - Is the Management Team at Fairfax Best-In-Class?

Of all the posts that I have done on Fairfax over the past year, this one on capital allocation is the most important. Below is an update with some new material. My view is over the past 6 years, the management team at Fairfax has delivered best-in-class results. Do you agree? Please share your thoughts.

—————

Capital allocation is the most important responsibility of a management team. Why? Capital allocation decisions are what drive the long-term performance of a company and important metrics like reported earnings, growth in book value and return on equity. These metrics in turn drive the multiple given to the stock by Mr Market - and finally the share price and investment returns for shareholders.

Capital allocation is especially important for P/C insurance companies. And that is because of something called float – which provides low cost (sometimes free) leverage (see Chapter 4 of my PDF called ‘Fairfax-Hiding in Plain Sight’ for more information on float).

When done well, capital allocation does two important things:

- Delivers a solid return.

- Improves the quality of the business.

Therefore, the fundamental task of an investor is to determine if management, over time, is making intelligent decisions regarding capital allocation.

What is capital allocation?

Capital allocation is the process of determining how capital is raised, managed and disbursed by a company. Capital allocation decisions often play out with a lag, sometimes years in length. Recognizing this, an investor needs to take a multi-year approach with their analysis.

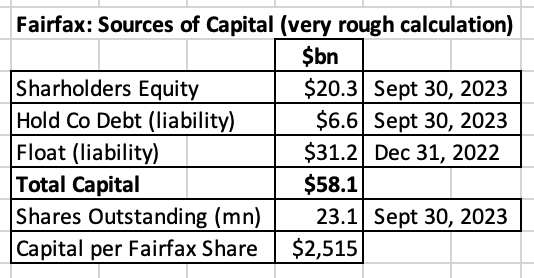

What are the sources of capital for Fairfax?

Fairfax has three sources of capital: equity, debt and float. The largest bucket is its $31 billion in float (as of Dec 31, 2022) which has a cost of less than zero - because they earn an underwriting profit (over the past 10 years they have averaged a CR of 95.6%). Fairfax also utilizes some debt, which has an average cost of about 5%.

All together Fairfax has total capital of about $58.1 billion working for shareholders, or about $2,500/share. This capital has been obtained at a very low average cost.

How does Fairfax do capital allocation?

Internal capabilities: Capital allocation at Fairfax is managed by the senior leadership team, led by CEO Prem Watsa.

- Insurance: Since 2011, the insurance business has been led by Andy Barnard. In early 2023, Brian Young was promoted and now shares oversight responsibilities with Andy Barnard over all of Fairfax’s insurance and reinsurance operations. Brian is also still CEO of Odyssey.

-

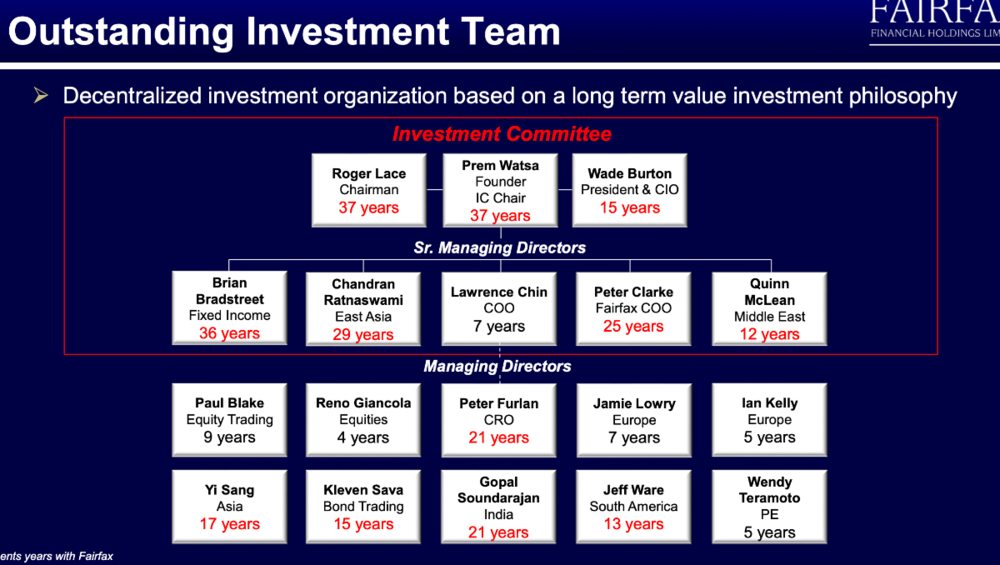

Investments: The investment business is managed by the large team at Hamblin Watsa.

- The fixed income team is led by Brian Bradstreet, who has been with Fairfax from the beginning.

- The equities team is led by Wade Burton, who joined Fairfax in 2009 from fund manager Cundill Investments, and Lawrence Chin, who also joined from Cundill in 2016.

- In India, Fairfax has Fairbridge, a boots-on-the-ground investment team.

Fairfax also leverages the knowledge of the many CEO’s who manage their vast collection of equity holdings across the globe.

“Since 1985, investments have been centrally managed for all of the Fairfax group companies by Hamblin Watsa Investment Counsel Ltd. (www.hwic.ca), a wholly-owned subsidiary of Fairfax. Hamblin Watsa emphasizes a conservative value investment philosophy, seeking to invest assets on a total return basis, which includes realized and unrealized gains over the long-term.” Fairfax web site

Fairfax has a large internal team with expertise across many different asset classes and geographies. They are a long-tenured group with experience managing through many different market cycles. They are also a battle tested team. They have established a strong long-term track record of success.

Below is a slide from the AGM (April 2023) that summarizes Fairfax’s internal investment team.

External capabilities: Fairfax has been actively cultivating relationships with a large network of individuals/companies in the investment world for decades. The company has established partnerships and expertise across many different asset classes (real estate, private equity, commodities) and geographies (India, Greece, Africa, the Middle East). These external partnerships have been an important source of ideas and diversification while also delivering solid returns to Fairfax over the years. This important external capability allows Fairfax to leverage the knowledge and skills of a much larger group of people and organizations.

Summary: Over decades, Fairfax has built out a large team and network of highly skilled internal and external capital allocators. In a world where active management is back, this has become a significant competitive advantage. Fairfax is well positioned at exactly the right time.

In general, what are the basic capital allocation options available to management?

- Reinvest in the business - grow organically: support the slow and steady growth of existing operations.

- Acquisitions/mergers - higher risk, but can be transformative.

- Asset sales - lower risk, opportunity to take advantage of Mr Market’s mood swings.

- Pay down debt: the most predictable option, as the cost of repaid debt is known.

- Pay dividends: although tax-inefficient, usually indicates a financially healthy, shareholder-friendly company.

- Share buybacks: impactful, if purchased below intrinsic value, by improving per-share financial metrics like earnings per share and book value per share.

What has Fairfax done?

The management team at Fairfax has been extremely active on the capital allocation front. Every year they typically make between five to ten meaningful decisions. So much has been happening on the capital allocation front in recent years it is hard for shareholders to keep up - especially understanding the impact on current and future business results. Below we are going to take a quick look at 16 of Fairfax’s bigger decisions made in recent years to see what we can learn.

Reinvest in the business:

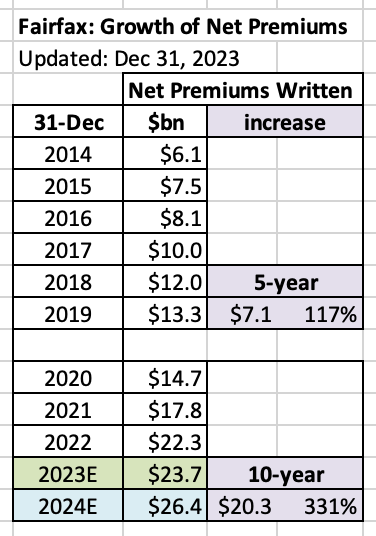

1.) 2019-2023, hard market in insurance. Net premiums written have increased 79% over the past four years from $13.3 million in 2019 to an estimated $23.7 million in 2023, a CAGR of 15.5% per year. Fairfax is poised to deliver an estimated record underwriting profit of $1.37 billion in 2023 (CR of 94%).

2.) In 2017, seeded start-up Go Digit in India at a cost of $154 million and a fair value today of $2.3 billion. This investment has turned into a home run, with a possible IPO coming in 2024 (bringing more potential gains).

Acquisitions/sales: insurance:

3.) In 2017, purchased Allied World, with the help of minority partners, for $4.9 billion (at 1.3 x book value). The price paid was not an overpay. Net written premiums have increased from $2.37 billion in 2018 to $4.46 billion in 2022, an increase of 88% in 4 years. With the onset of hard market in 2019, the timing of this purchase was perfect.

4.) In 2017/2019, sold ICICI Lombard for $1.7 billion: realized a $1 billion pre-tax investment gain. Due to regulations in India, Fairfax had to sell down its position in ICICI Lombard to be able to invest in Digit. This action was a brilliant strategic shift of Fairfax’s insurance business in India.

5.) In 2020/2021, sold Riverstone UK (runoff) for $1.3 billion (plus $236 million CVI). At a time when they needed the cash, Fairfax sold their UK run-off business at a much higher price than expected at the time. By shrinking the size of the runoff group, this sale also improved the overall quality of the remaining P/C insurance businesses.

6.) In 2022, sold the pet insurance business to JAB Holding Co. for $1.4 billion. This action resulted in a $1 billion after-tax gain. This sale was a home run for Fairfax as the business was sold for a much higher price than anyone thought possible (most people didn’t even know Fairfax owned this business).

7.) In 2023, purchased KIPCO’s 46% stake in Gulf Insurance Group for $740 million fair value consideration, as it is payable over 4 years. Fairfax paid a premium to get a control position in a quality business. This is a great strategic purchase that will solidify Fairfax’s presence in MENA region for insurance. This deal closed in late December 2023.

Acquisitions/sales: investments:

8.) In 2018, made initial investment in Poseidon/Atlas/Seaspan. Fairfax partnered with David Sokol (formerly Buffett’s heir apparent at Berkshire). Today Fairfax owns a 45.5% stake in this company valued at $2 billion. Poseidon will see significant growth in 2024 as it takes delivery of a large number of container ships and completes the final leg of its multi-year new-build strategy.

9.) In late 2018, purchased 13% of Stelco for $193 million. Fairfax partnered with Alan Kestenbaum. This investment has already delivered more than $300 million in in total gains (as of Dec 31, 2023). Today, Fairfax now owns 23.6% of Stelco (having invested no new money).

10.) In 2020/21, initiated a total return swap position giving them exposure to 1.96 million FFH shares at an average cost of $372/share. With Fairfax’s stock closing at $1,013/share (Jan 26, 2024), this investment has already delivered a cumulative gain of about $1.26 billion (before carrying costs). This action was very creative and opportunistic and has become in three short years one of Fairfax’s best investments ever.

11.) In Dec 2021, reduced the average duration of its $37 billion bond portfolio to 1.2 years (as interest rates bottomed). This action saved the company billions in bond losses, protected the company’s balance sheet and allowed the insurance subs to be aggressive in growing their business in the hard market.

12.) In Oct 2023, increased the average duration of its $41 billion bond portfolio to 3.1 years (as interest rates were peaking). This locks in record interest income, currently running at about $2 billion annually, for the next 3 or 4 years.

The string of decisions executed by the fixed income team over the past 24 months was brilliant and has delivered billions in value to Fairfax’s shareholders with much more to come.

13.) In 2020 and 2023, expanded partnership with Kennedy Wilson. Phase 1, in 2020, was the establishment of a $3 billion real estate debt platform. Phase 2, in 2023, was the purchase of $2 billion of PacWest loans yielding a fixed rate to maturity of 10%. Fairfax, through long term partner Kennedy Wilson, took advantage of a temporary market dislocation.

14.) In 2022, sold Resolute Forest Products for $626 million (plus $183 million CVR) at the top of the lumber cycle. Fairfax opportunistically sold at a premium price what had been one their large chronically underperforming equity holdings. This sale also improved the overall quality of the remaining basket of equity holdings.

15.) In 2023, sold Ambridge Partners for $379 million, delivering a $259 million pre-tax investment gain.

Dividend: In January 2024, Fairfax increased their annual dividend 50% to $15/share. It had been $10/share going all the way back to 2011.

Share buybacks: Effective shares outstanding have decreased an estimated 17.1% over the past six years from 27.8 million in 2017 to an estimated 23.0 million in 2023, an average decline of 2.9% per year.

16.) in 2021, re-purchased 2 million shares at $500/share. This was 7.6% of shares outstanding at the time. Fairfax’s share price recently closed at $1,013. Fairfax’s significant share purchase was done at an incredibly attractive price - which makes it very beneficial for the company and shareholders. This was another financial home run.

The list above captures only the largest capital allocation decisions made by Fairfax in recent years. We could easily add another 15 smaller examples of transactions that are also proving to be of a material benefit to Fairfax.

---------

For a comprehensive list of many of Fairfax’s capital allocation decisions going back to 2010 (sorted by year) go to the Appendix in my PDF called ‘Fairfax-Hiding in Plain Sight’.

----------

The importance of properly sizing your bet

A lesson from Stan Druckenmiller: position sizes really matter

“Sizing is 70% to 80% of the equation. Part of the equation is seeing the investment, part of the investment is seeing myself in a good trading rhythm. It’s not whether you’re right or wrong, it’s how much you make when you’re right and how much you lose when you’re wrong,” says Druckenmiller.

Position size matters. A lot. If you don’t believe Druckenmiller, just ask Buffett.

Now take a close look at the 16 examples I cited above. What jumps out? The size of gain from each of the decisions. My math says 9 delivered a $1 billion or more gain to Fairfax and its shareholders over time. In recent years, Fairfax has been not only making very good decisions - it has been sizing them exceptionally well. The benefits to the company and shareholders have been massive - with much more to come.

Fairfax’s market cap is only $25 billion. A $1 billion gain is a needle mover for the company. A bunch of them stacked one on top of the other? That is called ‘escape velocity’ for operating earnings. More on this point later in the post.

Asset sales

Asset sales is one part of capital allocation that separates Fairfax from its peers like Berkshire Hathaway and Markel. In selling an asset, Fairfax is essentially trading a stream of future cash flows for a lump sum today.

Why should a company sell an asset?

Sometimes another company - who is willing to pay up - values an asset at a much higher value than you do. The sale of the pet insurance business is a great example of this. There also can be important strategic reasons to sell an asset. For instance, if a sale allows the company to better focus on other parts of its business, selling an asset can lead to improved financial results. Selling APR to Atlas is perhaps a good example of this. Selling lower quality assets is also a good way to improve the overall quality of the remaining holdings. Selling Riverstone UK (runoff) and Resolute Forest Products are two good examples of this.

Put simply, asset sales have been a very important part of Fairfax’s capital allocation framework, realizing significant value for Fairfax and its shareholders over the years.

Improving the quality of the two businesses - insurance and investments

Over the past 6 years Fairfax has done a great job of improving the overall quality of both its insurance and equity holdings. Equities was where the heavy lifting needed to be done - and after years of effort Fairfax has made considerable progress with many underperforming holdings (sales, mergers, take-private). Other holdings, like Eurobank, always well managed, have been greatly assisted by external events (economic pivot in Greece).

Higher quality businesses are able to deliver higher and more stable earnings. And that is what we are starting to see. Analysts have been slow to recognize this change, which is one reason why their estimates were usually too low in 2023.

Is Fairfax’s capital allocation record perfect?

No, of course not (no company is perfect on this front). I see two notable misses:

- Taking until late 2020 to exit the last short position (and not exiting earlier).

- Not finding a way to unload Blackberry during the WallStreetBets mania that caused the share price to spike for a very short period of time in 2021. Fairfax says they were unable to act due to being in a blackout period at the time.

Looking at everything they have done over the past five or so years, it is clear that Fairfax has been executing exceptionally well.

"In this business if you're good, you're right six times out of ten. You're never going to be right nine times out of ten." Peter Lynch

Looking at Fairfax’s track record over the past five years, I would argue that the company has been right with their capital allocation decisions at a rate much higher than 6 out of 10.

In Druckenmiller parlance, Fairfax has been on a multi-year “hot streak”. Or in Buffett parlance, Fairfax has been hitting the ball like Ted Williams for the past couple of seasons.

Has Fairfax simply been lucky?

Did Prem give the team at Fairfax a sip of ‘liquid luck’ back in 2018? Some luck likely has been involved. But I like this definition of luck:

“Luck is what happens when preparation meets opportunity.” Roman philosopher Seneca

What have we learned?

Here are the words I would use to describe Fairfax’s approach to capital allocation:

- Flexible - use the full suite of options available.

- Opportunistic - take advantage of dislocations/opportunities as they arise.

- Countercyclical - act contrary to prevailing investment trends.

- Speed - act quickly when necessary.

- Conviction (position sizing) - go big when risk/reward is highly compelling/asymmetrical.

- Creative - be open minded during the process.

- Long term focus – goal is to generate above-market returns. Accepting of volatility.

- Strategic - make the company stronger - both insurance and investments.

- Rational - capital goes to the best (risk adjusted) opportunities.

- Equally capable in executing across both insurance and investment businesses.

What has been the financial impact of Fairfax’s capital allocation decisions?

Operating Income:

Let’s start by looking at operating income given it is viewed by analysts as the most important part of an insurance company’s total earnings. Operating income at Fairfax is the sum of three things: underwriting profit, interest and dividend income and share of profit of associates.

For the 5-year period from 2016-2020, operating income at Fairfax averaged $1 billion per year or $39/share. Compared to the 5-year averaged from 2016-2020:

- in 2021, operating income doubled to $1.8 billion or $77/share.

- in 2022, operating income tripled to $ 3.1 billion or $132/share.

- in 2023, operating income is on track to quadruple to $4.4 billion or $190/share.

- in 2024, operating income is estimated to quintuple to $4.6 billion or $202/share.

The run rate for operating income per share in 2023 ($190/share) is 4.9 times larger than the average from 2016-2020 ($39). What is the reason for the spike higher? The dramatic increase is due in large part to the exceptional capital allocation decisions made by the management team at Fairfax over the past 6 years. Importantly, the gains in operating income are durable as they have been driven by improving fundamentals (not one time items).

Investment Gains:

The other important part of earnings is investment gains. This lumpy part of earnings has historically been a strength for Fairfax - the pet insurance and Resolute sales in 2022, and the Ambridge Partners sale in 2023, being three recent examples. We should expect Fairfax to continue to deliver solid (but lumpy) investment gains moving forward.

My current estimate has Fairfax on track to deliver record earnings of around $170/share in 2023.

Return On Equity:

For the 5-year period from 2016-2020, ROE averaged about 6.0% per year. For the period 2021-2024, ROE is tracking to average 16.6%. That is a marked improvement.

Important: I have use 'average equity' to calculate ROE. Some P/C insurers (like WRB) use 'beginning year equity' in their calculation. If I used 'beginning year equity' my ROE for Fairfax would be higher.

Driven by strong capital allocation decisions, all important financial metrics at Fairfax have been materially improving in recent years. This strong performance looks set to continue in 2024.

How is the strategic positioning of Fairfax’s businesses?

Insurance:

- Significant expansion by acquisition 2015-2017 - build out of global platform is complete.

- Significant expansion by organic growth 2019-2023 - hard market

- Ongoing bolt-on acquisitions, like Singapore Re, has further strengthened the business.

- Ongoing buy-out of minority partners, like Eurolife in 2021 and Allied World in 2022, and majority partner KIPCO (GIG) in 2023, has further strengthened the business.

- The quality of the insurance businesses has rarely looked better.

- The business is delivering record net premiums written and record underwriting profit.

Investments - fixed income:

- 2021: shortened duration of portfolio to 1.2 years and shifted to primarily government bonds in late 2021, to protect the balance sheet.

- 2023: extended duration to 3.1 years in October 2023, to lock in much higher rates.

- 2023: capitalizing on dislocations in financial markets to lock in even higher rates - with KW, purchased $2 billion in PacWest real estate loans yielding a total return of 10%.

- The positioning of fixed income portfolio has rarely looked better.

- The portfolio is delivering record interest and dividend income.

Investments – equities:

- Total return swaps, giving exposure to 1.96 million Fairfax shares, looks well positioned.

- Eurobank - balance sheet is fixed, earnings are strong. Greece is expected to be a top performing economy in Europe in the coming years. Purchase of Hellenic Bank will be a catalyst in 2024.

- Poseidon / Atlas - is currently in rapid growth mode.

- Investments in India (Fairfax India/BIAL etc) look well positioned given India is expected to be a top performing global economy in the coming decade.

- The rest of the company’s portfolio looks well positioned.

- The quality of the portfolio of equities owned has rarely looked better.

- The portfolio is delivering record share of profit of associates and sold investment gains.

Summary: The strategic positioning of each of Fairfax’s three economic engines (insurance, fixed income and equities) has been steadily improving for the past five years.

Conclusion

Fairfax has a strong management team.

- They have been executing exceptionally well over the past 6 years.

- They are now delivering record financial results.

- Both businesses - insurance and investments - appear very well positioned.

Fairfax is delivering on the dual core objectives from capital allocation:

- Deliver good/great returns on capital deployed

- Improve the quality of each of the businesses (insurance and investments) over time

As a result, I think we can fairly conclude that the management team at Fairfax have demonstrable best-in-class capital allocation skills, and not just within their peer group in P/C insurance.

And with the company producing record operating earnings (and an estimate of around $4 billion in earnings) this best-in-class team is going to get the opportunity to deploy billions each year moving forward into new opportunities.

Record, sustainable and growing earnings + exceptional capital allocation + compounding + time = exponential growth

----------

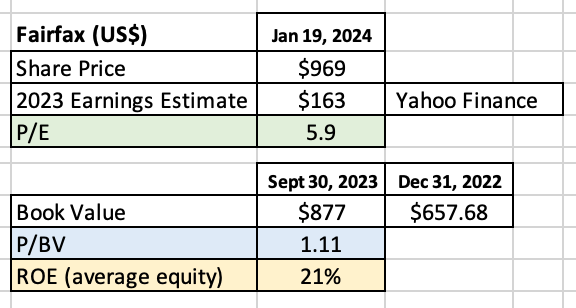

Fairfax is trading today at a P/BV of about 1.05 (using my estimated 2023YE BV). That is a very low valuation - it suggests Fairfax is a poorly run P/C insurer with poor prospects.

If Fairfax is best-in-class at capital allocation how can it also be poorly run with poor prospects? The answer is simple - it can’t be both at the same time.

If Fairfax is above average at capital allocation then future earnings growth should be solid. This will lead to an above average ROE.

As Mr Market comes to understand Fairfax better - and that the company is an above average P/C insurer, then we should see multiple expansion.

The trifecta for a stock: Growing earnings + growing multiple + lower share count = much higher share price.

'Time is the friend of the wonderful business.' Warren Buffett

-

21 minutes ago, Maverick47 said:

Viking — Thanks so much for sharing your thoughts in this latest post. And I think it dovetails well with musings of others regarding how large a position Fairfax should make of one’s portfolio. Temperament/patience are areas where small individual investors might well have an advantage over professional traders/portfolio managers.

Fifteen years ago when I had a much smaller non retirement portfolio, I made the mistake of treating my investments as if they were bets in a casino. When two of my small investments began to perform well I sold off half when they had doubled, telling myself I was now “playing” with house money.

I did keep the half stakes — one has turned into a 10 bagger after 15 years, while the other is a 14 bagger. But neither decision would have made a material difference to me now since the initial amounts were rather small.

I would only be concerned personally with Fairfax or other investments making up a large portion of my current portfolio if I believed there was a reasonable chance it might go to zero, like Enron. Part of Prem’s history makes me think that is unlikely. The struggles against short sellers when he faced a concerted attack betting that the company would go to zero or thereabouts in the early 2000’s had the benefit for me now, I believe, of making Prem more cautious about a financial situation that would ever put the company in such a position again. I think he and his investment folks really hit the ball out of the park with their credit default swaps at the time of the 2008 financial crisis. The profits on that allowed them to buy back the portions of their subsidiaries that they had to sell off to make it through the short selling attacks (was that both Odyssey Re and Northbridge?). I only got into the stock myself around the 2010 time frame. Then the lesson they learned from that macro bet was that they should make another one (the lost years thereafter betting on deflation, and hedging their equity investments). I think you have laid out very well that the latest lesson they have learned is not to make such huge macro bets in the future, and for roughly the last 4 or 5 years their actions have matched what they have said in that regard.

I think one sign that an insurance/investment platform company is taking the long view, allowing compounding to work its exponential magic, can be seen by examining whether they have a net deferred tax liability on their balance sheet or not. Those only get built up with years of unrealized capital gains, generally on equity investments. It takes a lot of patience and a long term view on the part of a CEO to do this. The power of compounding of this deferred tax liability only makes a material difference after about 25 or 30 years. Berkshire is a shining example of this — basically they are allowing an interest free loan of well over $10 billion from the government compound on behalf of their owners. Companies with net deferred tax assets are actually doing the reverse — making an interest free loan to the government. Fairfax has a net deferred tax liability of about $1 billion. Other US companies with net deferred tax liabilities are Markel and Cincinnati Financial, which is why I have some positions in those companies as well. I like companies that make decisions that pay off over the same long term that I have in mind for my retirement time frame of 30 years or so, and that’s what I see in all of these companies.

@Maverick47 i always appreciate your comments. You have areas of expertise that are different from mine. Thank you for sharing your thoughts on the tax liability. I will file that away.

I think there is merit to your comments about Fairfax going through adversity. And learning the right lesson on the other side. I agree with you - Fairfax has been making much better decisions in recent years - i put it at about 6 years (since about 2018).

It looks to me like Fairfax has been slowly improving the quality of their businesses over the years.

- insurance seems to have always been moving in that direction since Andy Barnard took over in 2011. I liked the sale of Riverstone UK (runoff) in 2020/21 although it appeared to be well run. More recently, Fairfax has talked about how they have reduced property cat exposure at Brit (who had been underperforming in recent years).

- equities is where you can really see the improvement in quality the last 5 years.Having higher quality insurance and equity holdings should also provide some buffer should adversity strike.

—————I continue to believe that something changed internally at Fairfax around late 2017 or early 2018 with how they were managing the equity bucket at Hamblin Watsa. It’s almost like someone very senior said ‘enough of this bullshit’. And from that day equity holdings were told:

1.) they had to stand on their own two feet financially. Fairfax hold co was no longer going to be piggy bank for poorly run operations

2.) they had to run themselves. Fairfax HO did not have the resources to be a turnaround shop.

Two other things were decided:

1.) New money would only go to the best opportunities.

2.) New equity purchases must have very strong CEO’s/management/leadership.

The amount of (good) change that has happened at Fairfax since 2018 has been breathtaking. The quality of the equity holdings (looked at as a group) has improved dramatically. And i don't think Fairfax is done.

-

How does an investor make the big money?

To state the obvious, outperforming the market averages is very difficult. Especially over a longer timeframe like 10 or 20 years. So why manage your own investments? Investors usually do it for the opportunity to make the big money - to materially outperform the market averages.

How can an investor do that? That is what we are going to explore in this post.

The post has been broken into the following sections:

1.) Learning from the master: how did Buffett do it?

2.) Time, compounding and exponential growth

3.) What do investors actually do?

4.) How to make the big money

5.) Berkshire Hathaway shareholders - a special breed?

6.) Fairfax Financial

—————

Warren Buffett - Berkshire Hathaway 2022AR

“In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so…

“Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years.

“The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.”

—————

Part 1: Learning from the master: How did Buffett do it?

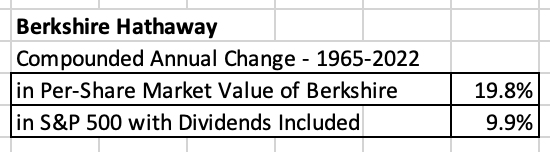

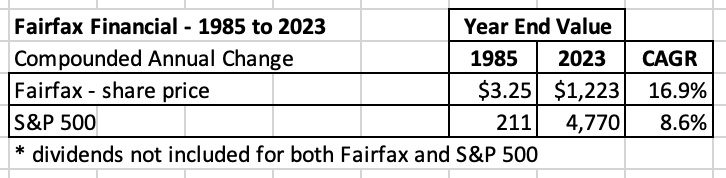

Warren Buffett has been able to significantly outperform the market averages since 1965. Over the past 58 years (to YE 2022), Berkshire Hathaway stock has had a CAGR of 19.8%, which is about 2 times the CAGR of the S&P 500 of 9.9% (including dividends). Yes, Buffett has earned ‘big money’ for Berkshire Hathaway shareholders.

But here is what is really interesting. Buffett readily admits most of his capital allocation decisions over this 58-year time period were ‘so-so.’

He goes on to explain that his significant outperformance was driven by a small number of ’truly good decisions’. Buffett puts the number at 12, or one about every 5 years.

This looks like it could be important. Let’s explore this further.

What is Warren Buffett’s greatest attribute?

Yes, this is kind of dumb thing to ask. Let’s do it anyway. What is it about Warren Buffett that has allowed him to consistently generate such outstanding results over the past 58 years?

- Intellect?

- Work ethic?

- Thirst for knowledge?

- Temperament?

- Character?

- Self awareness?

- Management skills?

Obviously, all of the above attributes are important and will help investors achieve success. But lots of investors have many of these attributes - and yet they still underperform the market averages over time (let alone outperform to the degree that Buffett did).

Is there something else, not listed above, that perhaps explains Buffett’s significant outperformance?

I think there is something else…

I think Buffett’s greatest strength might be his patience.

Before you throw your phone/tablet in disgust, let me explain. We need to peel the layers back.

Buffett’s holding period is not months. Or years. For his ‘truly good decisions,’ the investments that become needle movers for Berkshire Hathaway, his holding period can be measured in decades. And that is very different from almost any other investor out there. That is something Buffett does than pretty much no one else does. (Please name another successful investor who did it this way… i can’t think of another one.)

After patience, i think Buffett’s next greatest strength might be how he sizes his positions, especially his best ideas. And not just at the time of purchase - but also over time. How to size a position is exceptionally difficult to do and is a topic that requires its own post - so we will not explore it further here.

There are a couple of lessons here.

- Really, really good investment opportunities are exceptionally rare. Over his lifetime, Buffett points to 12 that worked out for him - or one about every 5 years.

- But finding a great investment is not enough on its own. Great patience is also required. It can take a decade or more for some investments to fully bloom.

Of the two skills (finding a great investment and having great patience with it) the second is the one that is incredibly rare today.

Part 2: Time, compounding and exponential growth

What is the greatest advantage of an investor?

It is time.

Why time?

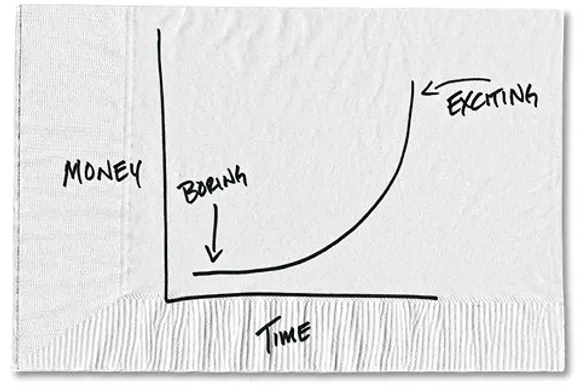

Time is what allows compounding to work its magic.

Compounding is simple to explain but wicked difficult for most people to actually understand. I like the description below. It is ‘boring’ for years and then very ‘exciting’.

Given enough time, compounding inevitably results in exponential growth. Or at least the is what one would think. More on this later.

The goal of all investors is to get their portfolio to the ‘exciting’ part of compounding curve (the hockey stick part) - because it is life changing when it happens.

Buffett’s genius?

It is understanding that patience and time are two sides of the same coin. Together, they allow an investor to fully maximize the benefits of compounding. This in turn, can lead to exponential growth.

Patience: this is how the big money is made.

Compound Interest (drawing by Carl Richards)

—————

Let’s take a quick trip into the archives

One of my favourite all time books on investing is Reminiscences of a Stock Operator. It was first published all the way back in 1923 (in serial form over two years in The Saturday Evening Post).

Of all the memorable quotes in this book the following might be my favourite:

“And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine - that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money…”

The lesson: Finding a great investment is hard. Holding the investment for years, perhaps decades - that is much more difficult. Should we be surprised that Buffett is in a league of his own?

—————

Part 3: What do investors actually do?

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” Peter Lynch.

Warren Buffett liked this quote so much he contacted Peter Lynch and asked him if he could use it.

What is the average holding period for retail investors?

I think it is around 5.5 months. And falling over time.

Retail investors are like Edward Scissorhands. The flowers in their garden don’t stand a chance.

Actually, we probably need to update Peter Lynch’s quote: these days, retail investors are so active buying and selling stocks in their portfolio - it’s like they completely raze their garden every year or two. What’s the chance the flowers are getting cut? Probably 100%. Should we be surprised that most retail investors achieve such poor results over time?

What about the professional/smart money?

The performance of professional/smart money is measured by investors quarterly… so they can’t be patient with their holdings. Sub-par results over a couple of quarters and retail investors start to pull the plug. The professional/smart money has to chase short-term performance if they want to stay in business (or get paid their bonus) - which usually means owning whatever are the most popular stocks at a given time (the list of which is always changing).

The bottom line, ‘patience’ is not a word that is part of retail and professional investors vocabulary or in their toolbox.

Patience is primarily the stomach part of investing. Not the brain part. This also probably tells us something…

Ben Carlson has a good article on the subject of holding period

Buy & Hold is Dead, Long Live Buy & Hold (Feb 2023)

(As an aside, ‘The Compound’ has become one of my favourite podcasts to listen to. Ben, Josh, Michael and guests are great. They have a bunch of different formats depending on what you are interested in.)

Taking profits

Why do retail investors turn their portfolio over so much? Lot’s of reasons. To buy something they think is better. To get rid of a mistake. To try and time the market. Macro call. Hot tip. I could list another +20 ‘good’ reasons.

Let’s be optimistic. We are told taking profits is a sensible thing to do. Yes?

But remember, in this post, we are trying to learn how to make the big money.

Here is another great quote from the book ‘Reminiscences of a Stock Operator’:

“They say you never grow poor taking profits. No. you don’t. But neither do you grow rich taking a four point profit in a bull market.”

When investors sell their best ideas they are cutting the flowers in their portfolio. And because the really good ideas (that actually work out) are exceptionally rare (Buffett found one about every 5 years), the proceeds are recycled back into inferior ideas - investors water their weeds.

This is like throwing sand in the gears of the compounding machine we discussed earlier. And hurts investment results. Investors get stuck in the ‘boring’ stage (from the napkin drawing above). As a result, many investors never get to the ‘exciting’ stage - the hockey stick part of compounding that becomes life changing.

What does the investment industry have to say on this topic? I find it is helpful to follow the money. Incentives matter. A lot. How does everyone in the industry get paid? Fees. And fees generally come from activity. Action. Churn. Chasing short term performance. The exact opposite of patience.

Part 4: How to make the big money

Buffett’s very simple model:

- Step 1: identify a ‘truly good’ investment and size the position appropriately.

- Step 2: exercise great patience and let it grow undisturbed for decades.

Truly great investments (the needle movers) are exceedingly rare. When you discover one, you need to size it appropriately. And then you hang on to it. For a long, long time.

Do we have any real-life examples of ‘patience’ actually working out for a retail investor?

Yes. A company named Berkshire Hathaway.

Part 5: Berkshire Hathaway shareholders - a special breed?

Investors have known for decades that Berkshire Hathaway was run by one of the best capital allocators of all time. All an investor had to do was buy shares and watch the Buffett flower continue to bloom year after year… bigger, brighter and more beautiful.

Importantly, investors had years to watch (learn) and get their position sized right.

How many investors followed Berkshire Hathaway over the decades? Lots.

How many investors never bought shares? Lots.

How many investors bought shares and then sold them after a small gain? Lots.

How many investors bought shares and then held them for a decade or longer? Very few. But the few who did so built great wealth over time. These investors exercised great patience - and were richly rewarded.

These investors had a ‘truly great idea’ - buy Berkshire Hathaway stock. But their real genius - what separated them (and their returns) from all other investors - was their patience. They held the stock for the long-term.

Why didn’t these investors sell out? That is a great question. I don’t know. Because I sold my Berkshire Hathaway every time i ever owned it (after what i thought was a nice gain). With hindsight, i was an idiot. I was happy making a small profit. And i completely missed the big move - when it was staring me right in the face.

So what does all of this have to do with Fairfax? Maybe nothing. Maybe everything.

Part 6: Fairfax Financial

Similar to Berkshire Hathaway, Fairfax has an outstanding long-term track record. Fairfax has significantly outperformed the S&P 500 over the past 38 years (since the company was founded in 1985).

However, unlike Berkshire Hathaway, Fairfax had a pretty big stumble from about 2010-2017. The investing side of the business messed up (the insurance side of the business continued to perform well). Business results suffered. However, from about 2016 to 2020 the company got to work correcting its past mistakes. By 2021, the turnaround was largely complete.

Operating income has increased from a run rate of $1 billion/year from 2016-2020, to $1.8 billion in 2021, to $3.1 billion in 2022, to an estimated $4.4 billion in 2023. And it is poised to increase again in 2024 (my current estimate is $4.6 billion).

Since around 2018, Fairfax’s capital allocation decisions have been very good - best-in-class among P/C insurers. I have written about this extensively in other posts so i am not going to rehash things here.

Bottom line, the set-up at Fairfax today - with both insurance and investment businesses - has never looked better.

Now i generally hate comparing Fairfax with Berkshire Hathaway because they are such different companies. But i am going to break my rule in this post.

Here is what i am wondering - and i would love to hear your thoughts.

Does Fairfax today look like a much younger Berkshire Hathaway?

Here are some of the similarities i see between Fairfax today and a Berkshire Hathaway from 30 years ago:

- Business model: built squarely on the P/C insurance / float model (Berkshire Hathaway has more of a conglomerate business model today)

- Capital allocation: master capital allocator (Fairfax has been hitting the ball out of the park in this regard since 2018 - that is a pretty good timeframe to use to evaluate the current management team)

- Significant, sustainable earnings: current estimates have Fairfax earning a record of more than $4 billion in 2023. And the future outlook is promising.

- Size: Fairfax is still small in size - good capital allocation decisions move the needle in terms of financial results (earnings and book value growth)

- All of the above + the power of compounding = opportunity for exponential growth over the next decade. ‘Time is the friend of the wonderful business’ to quote Warren Buffett.

- Valuation: Fairfax’s stock is trading today at a very low valuation - both compared to P/C insurance peers and the overall stock market.

The set up today for Fairfax looks - to me - an awful lot like a much younger Berkshire Hathaway. Fairfax is poised to become a compounding machine in the coming years. If that happens, Fairfax would become what Buffett would call a ‘truly good decision’ for investors.

Is Fairfax, once again, a buy and hold type of stock?

I am warming to this idea. I think 5 years is a good amount of time to evaluate a management team - and the team at Fairfax has done an exceptional job over the past 5 years. This topic is important - let’s give it the attention it deserves in a future post.

—————

Full quote by Warren Buffett from Berkshire Hathaway 2022AR

“At this point, a report card from me is appropriate: In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. In some cases, also, bad moves by me have been rescued by very large doses of luck. (Remember our escapes from near-disasters at USAir and Salomon? I certainly do.)

“Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years – and a sometimes-forgotten advantage that favors long-term investors such as Berkshire. Let’s take a peek behind the curtain.

The Secret Sauce

“In August 1994 – yes, 1994 – Berkshire completed its seven-year purchase of the 400 million shares of Coca-Cola we now own. The total cost was $1.3 billion – then a very meaningful sum at Berkshire.

“The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.

“American Express is much the same story. Berkshire’s purchases of Amex were essentially completed in 1995 and, coincidentally, also cost $1.3 billion. Annual dividends received from this investment have grown from $41 million to $302 million. Those checks, too, seem highly likely to increase.

“These dividend gains, though pleasing, are far from spectacular. But they bring with them important gains in stock prices. At yearend, our Coke investment was valued at $25 billion while Amex was recorded at $22 billion. Each holding now accounts for roughly 5% of Berkshire’s net worth, akin to its weighting long ago.

“Assume, for a moment, I had made a similarly-sized investment mistake in the 1990s, one that flat-lined and simply retained its $1.3 billion value in 2022. (An example would be a high-grade 30-year bond.) That disappointing investment would now represent an insignificant 0.3% of Berkshire’s net worth and would be delivering to us an unchanged $80 million or so of annual income.

“The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.”

-

Other than when i owned a home and had a mortgage, i have never used leverage. I don’t think that using leverage is a stupid idea. I probably read too much Buffett early on. However, i have always had a pretty concentrated portfolio - and that has definitely helped my returns over the years.

-

5 minutes ago, SafetyinNumbers said:

There is a committee (4 people from S&P & 3 from TMX) that decides. Generally the TSX 60 (XIU) tries to mimic the sector weights of the TSX Composite (XIC) while also trying to beat it. Historically, they have replaced components when they go under 20bp but I don’t think it’s a rule.

Financials are already overweight in XIU vs XIC so that might make the hurdle higher for FFH to get in. IFC took a long time to go in for that very reason. When IFC was announced in to XIU in March 2022, its weight at the end of Feb was 104bp and it was the 25th biggest company in the XIC. It was almost inevitable that IFC was going to get into XIU given its above average growth. Now its weight is ~124bp and it’s the 20th biggest weight in the XIU. They would have been better off putting it in sooner.

I would argue FFH is a good analog for what happened with IFC. Given the high certainty of near term earnings, FFH’s weight in XIC is only going to increase. Today, I estimate, it jumped from 29th to 27th biggest passing GIB and TRI. Its weight is probably close to 101bp. At the end of 2022, FFH was #41 and 65bp. It’s like a freight train and if the committee can see that, they may want to get it in soon so they don’t lose ground to XIC.

I estimate, AQN is only ~21bp in XIU after today’s trading so it’s flirting with the historical replacement precedent of 20bp. Please correct me if I’m wrong but I believe they will use Feb 29 as the measurement date. Presumably, it will be a live every quarter going forward or if a member of XIU is acquired. Recently ABX was rumoured to be interested in FM. If that transaction was consummated, it would open up a spot for FFH as well.

Of course, they could always skip FFH and go to TFII but it’s less than half the weight.

The biggest impact of Scotia and now NBF socializing the idea of FFH going in XIU is that shareholders who really want to take profits for risk management or because they are afraid of a drawdown might hold on instead. This is important, because most buying is institutional and it’s usually done on a % of volume. It’s a constraint placed by investors on asset managers to protect against them manipulating share prices.

The side effect of that is, sellers set the price. Knowing there is likely a significant amount of buying coming sometime in the next year at a time when the company is growing incredibly fast might decide to at least lift their offers. Some shareholders might even hold on and see if they can get a better price when there is an indiscriminate time constrained buyer and reported BV is likely somewhat higher.

The float in FFH is relatively tight and underowned by Canadian institutions who are benchmarked to XIC. If shareholders start believing what NBF is telling them, the multiple expansion could be significant. P/B could get out of hand.

It’s happened before from 95-98, a period when FFH put up 20%+ ROE for 4 years in a row. Maybe 2023 was year 1. P/B went over 3 back then before coming back to earth. It seems more likely to happen in this kind of market (meme stocks etc..) but it might take analysts starting to believe FFH can grow earnings consistently as some quants also set prices. Morningstar coming around would be a huge signal. I don’t expect that to happen but it’s possible.

@SafetyinNumbers that was very informative. Thank you for taking the time to lay it out in some detail. What if investors decide Fairfax is a buy and hold type of stock again? And not just a trade? When i read reports like National Bank (well done) i think we are getting to a sentiment inflection point. We will see. Fairfax’s AGM this year is setting up to be quite the event. -

2 hours ago, MMM20 said:

I think most of us agree, but we also know survivorship bias is real and context matters. Yes, the valuation on normalized earnings hasn’t really changed over the past 3-4 years even as the stock has 3-4x’d, and we know book value understates economic reality. But let’s say someone bought this back then at 0.5-0.6x book and has let it grow to nearly half their retirement portfolio or kids college fund or whatever and now the risk inherent in such concentration is keeping them up at night - let’s say the risk of The Big One, or of Prem keeling over tomorrow, or that Eurobank is a big fat fraud, or some true black swan. Would you blame them for cutting this in half this year if it keeps running up? Investing is never easy, right? Asking for a friend.

I would love to hear other board members thoughts: how do you handle position sizing? Especially when the winning/oversized position is likely just getting started?

@MMM20 that is a great question. I also have a friend who is looking for an answer.Position size has two components:

1.) when you buy

2.) what happens over time

Position sizing is exceptionally difficult. Probably because it is more art (gut) than science (brains). Unlike the ‘brain’ type, the ‘gut’ type of decisions can’t easily be explained.

My comments in earlier posts today were meant to be quite general in nature. As an example, i have owned Berkshire Hathaway stock many times over the years. I always sold it after a decent move higher. With hindsight, i should have simply held my position. And been adding to it on weakness.

Now there is another situation… and i think this is what you are getting at… i am going to make up some number. What if you backed up the truck with Fairfax a year ago and made it 33% of your total portfolio. Concentrated, but not a crazy number. Today, Fairfax might now be 50% of your total portfolio. At what point does it get too big?

I’m a big believer in the ‘sleep well at night’ rule of position sizing (that you reference). If your weighting is keeping you up at night, that is telling you something. I suspect there are a few people on this board in this boat. Yes, great problem to have.

Another way to look at it might on a risk / return adjusted basis:

- What do you think Fairfax is going to return over the next couple of years?

- What will the index averages return over the next couple of years?

- What is the chance something is going to happen to materially impact Fairfax’s valuation (a 30% or more permanent drawdown) over the next couple of years?

My view is you only want to be highly concentrated if the opportunity is materially better than putting the money in a broad based market index (you expect 1.5x or better outperformance). But you have to be wired the right way for this to work (to hold a very concentrated position).

My guess is quite a few Berkshire Hathaway shareholders have achieved generational wealth holding the stock for decades. What did these shareholders do when confronted with the same question? My guess is the ones who built the greatest fortunes didn’t sell a share.

-

36 minutes ago, Masterofnone said:

Just thinking that the created demand of 6 days worth of volume plus likely run-up in anticipation of this demand could possibly create that favorable valuation.

Here is what Prem said in the 2020AR after they put the position on: “We think this will be a great investment for Fairfax, perhaps our best yet!”

My view is the FFH-TRS is a ‘punch-card’ type of investment for Fairfax. A ‘truly good decision.’ Exceedingly rare. One that comes along perhaps once every 5 years or so. And Fairfax knows how to value this investment.

Why would you sell something that is likely going to compound at a high rate for the next 5 years? You would be a dummy to sell it even at fair value. And Fairfax is nowhere near fair value today.

Cutting your flowers and watering your weeds is never a smart thing to do. Inevitably, the proceeds go into an inferior idea. Most people sell because they think they can find something as good or better. That isn’t what happens when you sell the ‘truly good decisions’. I think it is mental flaw that lots of investors have. And it leads to sub-par returns.

i know this because i see a guy in the mirror every day who has repeatedly made this mistake over the years

-

46 minutes ago, Masterofnone said:

Should Fairfax get included in the index does anyone think they might use this as an opportunity to exit a portion of the TRS? There's a big wad of shares owned by the counter party.

Valuation will likely be the driver of what they do with the TRS position.

Of all the analyst reports I have read over the past 18 months National Bank has consistently been the best - and by the best I mean they get into the weeds and provide a very thorough and thoughtful build of all of their assumptions. Their estimate 12 months ago was the most accurate. I don't think it was luck.

Today? They have updated their models and have upped their price target to C$2,000. This is not a crazy number. It is based on Fairfax trading at a 1.3 multiple which is reasonable.

Fairfax is still cheap. And it would be easy to argue that it is crazy cheap. Why would they exit the TRS when the set-up is so favourable (not just valuation but also the near-term outlook)?

Buffett said 12 'truly good decisions' made over 60 years (one every 5 years) is what generated his significant outperformance versus the S&P 500. You make the big money by holding your best ideas for years - decades in Buffett's case. My guess is Fairfax is holding the TRS to make the big money.

“They say you never grow poor taking profits. No. you don’t. But neither do you grow rich taking a four point profit in a bull market.” Reminiscences of a Stock Operator

-

WR Berkley just released results. I like listening to their conference call to get an update on where the US P/C insurance market is at. WRB is a traditional insurer focussed on the US market.

Here are my key take-aways:

1.) the hard market continues with no signs of ending any time soon.

2.) P/C insurer returns - for some companies like WRB - are very good. ‘Record setting financial results.”

3.) The outlook is even better.

Sceptics continue to question how this can be possible. The simple answer is lots of insurers are not experiencing ‘record setting financial results’. Some lines, like auto, were beyond terrible for years.

Investments

- the current book yield on fixed maturity holdings is about 4.7%.

- new money yield is over 5%- average duration is 2.4 years, about the same as last quarter. WRB would like to extend duration

WRB missed out on extending duration when rates peaked out in October of 2023. It is exceptionally difficult to time the market.

This just further highlights the exceptional job the team at Fairfax has done with their fixed income portfolio over the past 2.5 years - extending the average duration from 1.6 years to 3.1 years in 2023 is a big, big deal. We will get clarity on all the puts and takes when Fairfax reports Q4 results (and more when they release the AR). It looks to me like WRB got caught ‘thumb sucking’ in Q4 when rates spiked.

Returning money to shareholdersWRB returned more than $1 billion to shareholders in 2023: dividends, special dividend and buybacks. Well done.

Importantly, this is capital that is leaving the P/C insurance industry.

Other

- Rate increase in Q4 = 8% and still exceeding loss cost trend. Q4 of 2022, rate increase was 6.9%. Yes, rate was up modestly YOY.

- Top-line growth of 12% in Q4: seeing nothing today to suggest growth rate is slowing in Q1.- Interest rate outlook: stay the same or maybe higher. See pressure on inflation in coming years driven by high government spending (supported by both Biden and Trump) and limited ability to raise taxes.

- ‘Alternative investments’ opportunities not compelling today given what is available in fixed income today (on a risk adjusted basis).

-

1

1

-

-

8 hours ago, petec said:

I was referring to Eurobank making great decisions for a decade!

What's the stumble at Poseidon? Just interest rates rising, or something more.

This was my big worry when I was a shareholder of Atlas - floating rates vs fixed revenues. I decided I preferred Brookfield's inflation-linked revenue asset classes.

@petec sorry, i missed that your comment was specific to Eurobank.From my perspective, the ‘stumble’ at Poseidon has been their inability to come close to hitting their financial targets set out in the recent past. Interest expense appears to be the culprit. The CFO resigned in July 2023.

2024 will be a big year for Atlas, given all the new-builds that are getting completed. The issues in the Red Sea - if they persist - might help at the margin (driving shipping rates higher). The fact interest rates have come down significantly over the past 3 months might also help a little.

I am not concerned about Poseidon/Atlas. I view it more as a missed opportunity (in the near term). I do expect the ship to right itself over time. Going private was the right move for Atlas.

-

1 hour ago, dartmonkey said:

For fun, here are some rough numbers for 2024:

- Poseidon = $200 to $250

- Eurobank = $400 to $450

- FFH-TRS = $400 to $500

- Fairfax India = $125

- Recipe = $75

Just a heads up that the Eurobank position if up over $200m year to date, i.e. over the last 3 weeks, and the FFH-TRS are up $118m. Good start to this year's scheduled $1.2b in equity gains. Come on, India, do your part now.

@dartmonkey yes, great start to the year for two of Fairfax’s largest equity holdings. And if the big boys are performing well, that usually means good things for the performance of the equity group as a whole. -

On 1/16/2024 at 8:00 AM, petec said:

I think they've been making great decisions for a decade - it's just taken until now for us to see it.

Question for me is whether rising interest rates has driven an unsustainable burst of earnings (if their assets reprice faster than their liabilities - I have not checked). But even if this is true they are in a much better place than a few years back, and the stock is not expensive.

@petec “I think they've been making great decisions for a decade”1.) On the insurance front, i agree.

2.) On the investments - fixed income front, i am neutral (looking at the decade as a whole).

3.) On the investments - equities front, the period 2014-2017 was a stinker (Eurobank 1st purchase, Fairfax Africa, APR, EXCO bankruptcy, AGT take private, Farmers Edge, Boat Rocker etc). Notwithstanding the recent stumble at Poseidon/Atlas, decisions made 2018 to present has been great (in aggregate).

4.) On the derivates front, the equity hedges/shorts were a catastrophe from 2010-2020 mostly (2010-2016). The FFH-TRS has been better than great.

The question i have is did all the equity hedge/short losses and the losses from the poor equity purchases from 2014-2017 significantly warp the book value we see today? I wonder if it is significantly understated.

The main reason i think it might be significantly understated is the fact the insurance business has increased in size by 350% from 2014-2024E. Book value has increased much less over this same timeframe.

That is probably why i prefer to use a bottom-up earnings estimate as my primary valuation tool for Fairfax as opposed to book value. I trust the informational value of one much more than the other.

-

1 hour ago, Haryana said:

Not undervalued enough, still, to double or touch US2000 in four years?

@Haryana If Fairfax's stock went up 20% each of the next 4 years then we would see a price of US$2,000.

Three things drive a stock price:

1.) earnings

2.) multiple

3.) shares outstanding

My view is much of the increase we have seen in Fairfax over the past three years is being driven by much higher earnings and much lower share count.

The P/BV multiple has not expanded much from its historical range - one could argue the multiple is actually below its historical average.

If we get multiple expansion in the coming years then I think investors will be very happy.

Solid earnings + lower share count + multiple expansion = very happy shareholders.

-

11 hours ago, LC said:

Viking- appreciate your ongoing analysis.

While implying FFH may be still cheap as the share price appreciation (+~100%) has not kept up with op. Income growth (+~330%), i think to really come to that conclusion you have to break out the components of op Inc. and assess the growth and durability of each.

For example performance on the fixed income portfolio are dependent on interest rates. It may be difficult to project that component.

Point is I do not think share price vs op income is a 1:1 relationship, although I personally tend to agree it should be closer than 3.3:1!

@LC great point. To come up with a ‘fair value’ for Fairfax shares, i think it is helpful to use a number of different methods. And of course, ‘fair value’ is going to be a range. My previous post was done kind of tongue in cheek and not meant to be rigorous. One of my big mistakes in the past was using price as my primary tool when exiting a position (that sucker went up a lot so it is time to sell). That (flawed) logic lead me to sell my big Apple stake in 2015/16 (after a big gain) Sometimes when i write my posts i am talking to myself…

As an investor I think it is very easy to get anchored in the past. I think many people are anchored in the past when they value Fairfax. Part of the problem is Fairfax is a turnaround… it was under-earning for almost a decade. So its past results are not a good input for investors to use today to value the company looking forward (although the past 2 years are much better). Getting anchored on faulty numbers is even worse.A question. I think with the following comment you were thinking interest rates might come down. Am i correct?

“For example performance on the fixed income portfolio are dependent on interest rates. It may be difficult to project that component.”

Do you see lower interest rates as a risk? Because they were lower in the past?

What about higher interest rates? Would that then be opportunity for Fairfax?

I find when investors look at Fairfax it is not done in a balanced way. Only one scenario is considered (usually anchored by past events) and it usually leads to lower earnings. The other scenario, which might be just as likely and would lead to higher earnings, is not considered. It is presented as being conservative but i don’t see it that way.

Both risk and opportunities need to be equally considered when valuing a company. Probabilities then need to be assigned to each. And then folded into a valuation framework.

- what is the probability rates move lower in the coming years?

- what is the probability rates move higher in the coming years?

Based on what i know today, my current assessment is the risks are probably petty balanced. At least close enough. (Yes, trying to predicting macro is pretty much impossible… but that is a topic for another day).Fairfax business results are in uncharted territory. They have been for the past three years. But investors keep expecting a return to the mean (lower historical numbers).

I am not oblivious to the risks. But i am also not ignoring the opportunities. I am trying to find the middle ground (i think).

What we are slowly learning is a great deal of intrinsic value had been building at Fairfax over the past 10 years. Until recently, it remained hidden (from earnings). But that is changing. It will likely take another couple of years for the true earnings power of the company to become clear to investors (including me).

-

11 hours ago, Dinar said:

@Viking, why do you think underwriting and reinsurance profits will be done in 2024 from 2023? Thank you.

@Dinar My estimate for underwriting profit for 2024 is a little lower than 2023 because of my assumptions with the combined ratio (CR). 2023 has been a low cat year (big ones) so i am forecasting a full-year CR of 94%. For 2024, i am using 95% as my CR estimate as i expect ‘big catastrophes’ to normalize (come in higher than this year). I think that is a reasonable assumption.

Of course, one of these years, we are going to get a really bad year for catastrophes.

There is also a chance we could learn that Fairfax is a better underwriter than previously thought. I think they have been slowly improving the quality of their insurance operations - most recently Brit and reducing its catastrophe exposure. If true, this suggests my CR assumption might prove to be too conservative.

We will see.

PS: if you go to the 'Premiums' tab in my Excel spreadsheet (attached) you can see the build. You can adjust the CR (or any estimate) as you like to make the estimate your own.

-

Fairfax: The Big Fish that Got Away?

“The stock market is there to serve you and not to instruct you.” Warren Buffett

Investors have lots of regrets. Missed opportunities. Not buying a stock that afterwards turns into a big winner. Or selling a winning position way too early. ‘The big fish that got away’ kind of story.

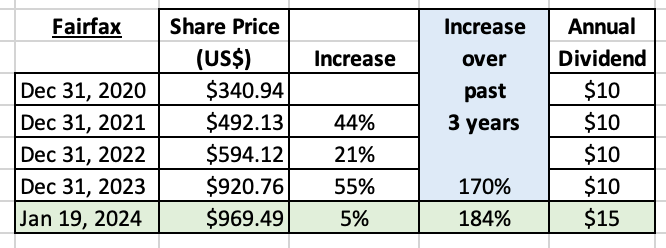

In 2021, Fairfax’s shares returned 44%. An investor looking at Fairfax in early 2022 might have concluded ‘dang, missed that one!’ and not invested.

In 2022, Fairfax’s shares returned 21%. Most stocks got crushed in the bear market of 2022, so Fairfax’s performance compared to the averages was exceptional. That same investor, looking at Fairfax in early 2023, might have come to the same conclusion: ‘dang, missed that one! For the second year in a row!’ and not invested again. The fish story just got bigger.

Well, here we are now in early 2024. How did Fairfax's stock do in 2023? It was up another 55%. Over the past three years shares are up 170%. Investors who did not buy shares (or sold their position too early) over the past three years are left asking themselves what happened? How did they miss out? And what should they do now? The fish story is turning into a whopper of a tale.

Three weeks into 2024 the stock is up another 5%. This puts the total increase at 184% since Dec 31, 2020, making it almost a two-bagger in Peter Lynch’s parlance. Fairfax, the ‘big fish,’ continues to taunt investors.

What is the lesson to be learned?

By itself, the increase in Fairfax’s share price of 184% since Dec 31, 2020, tells you little (nothing?) about Fairfax’s valuation today. This is because price (if used by itself) is a terrible valuation tool. Over the past three years, 'investors' who used price as their primary valuation tool for Fairfax have been led astray.

As Buffett teaches us, a stock price exists to serve investors, not instruct them.

Let’s take the discussion in a slightly different direction to see what we can learn.

What happens if we increase the timeframe?

Let’s humour ourselves and play the price game for a little longer. But this time with a couple of added twists. Let’s zoom out - instead of looking at Fairfax’s share price for the past three years, let’s look at the share price for the past 9 years. And let’s include operating earnings - let’s make our analysis a little more robust.

From 2015 to 2019 (right before Covid hit), Fairfax’s share price traded in a pretty tight band around US$500. About 50% of the time Fairfax’s share price was over $500 and the other 50% of the time it was under $500. So for 5 years straight investors felt Fairfax was worth about US$500/share.

Over this 5-year span, operating earnings at Fairfax averaged about $1.07 billion per year. So from 2015-2019, investors felt $1.07 billion in operating earnings warranted a Fairfax share price of about US$500.

Let’s now compare this historical period to today to see what we can learn.

Let’s start with the share price. Fairfax’s share price closed today at about US$970/share. The stock is up 94% from the average of about $500/share from 2015-2019.

Let’s now look at operating earnings. Operating earnings are forecasted to come in at about $4.4 billion for 2023. That is an increase of 305% from the average of $1.07 billion from 2015-2019. My current estimate is for operating earnings to increase in 2024 to about $4.6 billion. Because the share count has come down meaningfully in recent years, this would put operating earnings per share over $200/share in 2024. This is 359% more than the average from 2015-2019 (about $44/share). Importantly, the increase in operating earnings is durable (the average duration of the fixed income portfolio was increased to 3.1 years in October 2023, which locks in interest income for the next couple ofyears, the largest component of operating income).

Let’s put the two together.

Fairfax’s stock is up about 90% over the past 9 years. And operating earnings per share - the high quality stuff - is forecasted to be up 359% (over the trend from 2015-2019). High quality earnings have exploded and the stock price has increased modestly.

Valuation: Buffet teaches us that a stock is worth the present value of the cash flows (things like operating earnings) that are expected to be generated in the future.

Conclusion

Looking at Fairfax’s share price and using a 3-year time horizon it is easy to conclude the stock must be crazy expensive today. Looking at Fairfax’s share price and using a 9-year time horizon (and including operating earnings) it is easy to conclude the stock must be crazy cheap today. How can it be both crazy cheap and crazy expensive at the same time? The answer, of course, is that it can’t be both.

Let’s circle back to my original comment - using the share price, on its own, as your primary tool to value Fairfax is pretty dumb.

As we begin 2024, that big fish (called Fairfax) is once again staring investors right in the face. And guess what? It’s probably going to slip away from them yet again. And in another couple of years, they will think back to today and likely kick themselves. And the story of ‘the big fish that got away’ will get even bigger.

—————

How do the traditional valuation metrics look today?

Fairfax’s stock has a PE of 5.9 (to Yahoo Finance’s estimate of 2023 earnings). The ROE for 2023 is tracking to be a little over 20%, which is very good. Price to book value (P/BV) is 1.11, which is very low - and this could come down to around 1.05 when Fairfax reports Q4 results in a few weeks.

Expensive? Really?

—————

What happened in recent years to spike operating earnings so much at Fairfax?

Lots of things. Below is one of them. Fairfax is a P/C insurance company. Net premiums written have grown from $6.1 billion in 2014 to an estimated $26.4 billion in 2024 (my current estimate), an increase of 331% over 10 years.

Now over-lay this exceptional growth over 10-straight years with the much more modest increase seen in Fairfax’s stock price over the same time frame.

Things that make you go hymmm…

-

10 minutes ago, Parsad said:

I thought he was already in there! This is long overdue. Congratulations Prem! Cheers!

+1

-

4 hours ago, Crip1 said:

OK, so there has been some conversation on this board about how great the next three years ahead look and how great of a job management did to position the company as it is, and so on. All of that is valid and correct. There have been concerns around what happens after these 3 years (not sure whether the “3 years” is because Viking has been projecting that time period, or because of the stated run rate by the company). Specifically, concern over what happens when this “gravy train” ends and interest rates come back down to 1% or thereabouts. The more I ponder this, I’m increasingly less concerned about three years down the road for the following reasons:

- After peaking in October rates have come down, but they are still notably higher compared to Covid-times.

- Every day that the market moves sideways, and we’re a month plus into the sideways movement, that three years gets extended into 2026. (and I’m willing to bet that we don’t see 6 rate cuts by the fed in 2024, nor do I see that happening in 2024 and 2025 combined FWIW).

- The assumption (fear) that rates go back down to 1% is, in my opinion, overblown. Yes, if we do go into a recession, rates will drop, but we seem to be anchored into recent memory when rates were at historical lows and expect that to happen again. That fear is overblown.

- Assuming treasury yields do move lower, at some point the spread between treasuries and high-grade corporates is going to widen such that the risk-reward equation moves squarely in favor of moving some monies into corporates. It’s not always wrong to take prudent steps to “reach for yield” and with the size of the investment portfolio FFH is better able to benefit from this compared to the competition.

Of course, black swan events do occur, and there is no guarantee that Fairfax will avoid doing unwise things as has happened in the past, but risk-reward is squarely in “reward” at this juncture, and I think will be 2-3 years from now.

-Crip

@Crip1 i agree with your thinking: “I’m increasingly less concerned about three years down the road…”

At the start of 2023, many people were concerned that higher interest income was not sustainable. Fairfax’s fixed income portfolio had an average duration of 1.6 years and there were concerns a recession was likely later in 2023 (which would drive interest rates lower).

A year later… what actually happened?

1.) Fairfax earned a record amount of interest income in 2023 (est $1.8 billion). That baby has been delivered. What a surprise.2.) current run rate of interest income is likely over $500 million per quarter. It looks like 2024 will deliver another record year of interest income (third straight year). A second surprise.

3.) on the Q3 conf call, Prem stated average duration was extended to 3.1 years. High interest income is now locked in for 2024, 2025 and 2026. A third surprise.

Investors response? Yes… BUT…

My guess is lots of people still think interest income still has to come down… ‘soon’. My guess is this line of thinking is driven by recency bias.

From Charles Schwab: “Recency bias can lead investors to put too much emphasis on recent events, potentially leading to short-term decisions that may negatively affect their long-term financial plans.”With hindsight, it is now clear that Fairfax was grossly under-earning on its fixed income portfolio for many years. It was under-earning primarily for two reasons:

1.) central bank policy - zero interest rate

2.) Fairfax positioning - very short duration and high quality (government). This happened way back in late 2016 (Fairfax pivoted after Trumps’s election).