Viking

-

Posts

4,655 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

This is a long post. Fixed income is an under followed and under appreciated part of Fairfax. This post is broken into 3 parts:

- Part 1: an introduction to the fixed income portfolio of Fairfax

- Part 2: fixed income - some basics

- Part 3: what does all this mean for P/C insurers?

Part 1: An Introduction to the Fixed Income Portfolio of Fairfax

The team: how does Fairfax manage fixed income?

All investments at Fairfax are managed through Hamblin Watsa.

“Hamblin Watsa Investment Counsel, a wholly-owned subsidiary of Fairfax Financial Holdings Limited, provides global investment management services solely to the insurance and reinsurance subsidiaries of Fairfax.” Source: Hamblin Watsa website

Within Hamblin Watsa, the team that manages the fixed income portfolio is lead by Brian Bradstreet. Brian has been with Fairfax for 36 years - from the very beginning.

Is the team any good?

Under Brian’s leadership, the fixed income team at Fairfax has done an exceptional job over the decades of managing Fairfax’s fixed income portfolio. They have a very good long term track record. I think we can say the fixed income team is a competitive advantage for Fairfax compared to peers. This is important because fixed income is by far the largest piece of Fairfax’s total investment portfolio.

(As an aside, it was Brian Bradstreet who brought the CDS opportunity to Fairfax’s attention just as the housing bubble was getting going in the US. By 2009, that investment had made Fairfax $2 billion in profit. Not too shabby.)

How big is Fairfax’s fixed income portfolio?

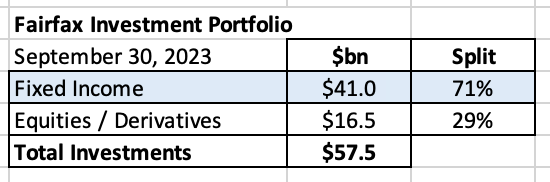

Fairfax has an investment portfolio of about $57.5 billion. Of this total, about $16.5 billion or 29%, is invested in equities. The vast majority, about $41 billion or 71%, is invested in fixed income securities.

When investors talk about Fairfax and investments, they usually focus exclusively on the equity holdings. The fixed income part of Fairfax is rarely discussed - even though it is the much larger part of the total investment portfolio.

Well, this is changing. Why? Follow the money…

Has the fixed income portfolio been growing in size?

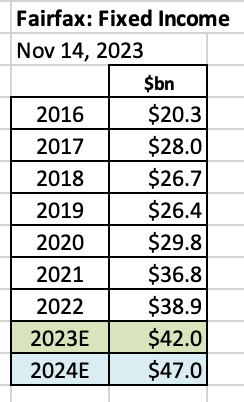

The fixed income portfolio at Fairfax has increased from $20.3 billion at Dec 31, 2016 to an estimated $42 billion at Dec 31, 2023. The increase is $21.7 billion, or 107%. The CAGR from 2016 to estimated 2023 is 11%. With the expected closing of the GIG acquisition in Q4 and the continuation of the hard market we should see similar growth in 2024.

How much does Fairfax earn on its fixed income portfolio?

The returns that Fairfax earns in its fixed income portfolio come primarily in two ways:

- Interest income

- Investment gains (losses) - realized and unrealized

Fairfax actively manages its fixed income portfolio and has generated meaningful realized investment gains over time. However, to keep our analysis simple (and this post to a reasonable length), we are going to focus here on the largest bucket, interest income.

The historical returns for interest income

Interest income averaged $647 million per year from 2016-2021. From this average, it increased to an estimated $1.8 billion in 2023 or +182%. It is forecasted to increase further in 2024 to about $2.1 billion (my latest estimate).

The average yield on the fixed income portfolio from 2016-2021 at Fairfax was about 2.4%. The yield has almost doubled to an estimated 4.3% in 2023 and 4.6% in 2024.

Summary

Fixed income investments are managed by a very capable team at Fairfax, lead by Brian Bradstreet. The fixed income portfolio has more than doubled in size from 2016 to 2023. At the same time the yield Fairfax is earning on its fixed income portfolio has almost doubled (from the average from 2016-2021). As a result of these two doubles (size and rate of return), interest income has spiked higher to about $2 billion per year (the current run rate).

Interest income is now the largest income stream at Fairfax. This is important because this source of income is considered to be very high quality by investors and analysts. It is considered to be high quality because it is relatively predicable and durable.

What happened to spike interest income so much? In short, over the past 2 years the fixed income team at Fairfax delivered a clinic in value investing and active management. But before we explore this further, let’s first cover off some bond basics.

Part 2: Fixed Income - Some Basics

Fixed income investing is very different from equity investing. Let’s spend a few minutes and review a few things that are relevant to our analysis.

The greatest bull market in history.

From 1981-2020, bonds experienced the greatest bull market in history. It began in September 1981, when the interest rate on the 10-year US treasury peaked at around 16%. It ended 40 years later, in June 2020, when the interest rate on the 10-year US treasury bottomed at 0.65%. Ever falling interest rates was an incredible 40-year tailwind for fixed income investors (actually, all investors - equity, real estate etc).

The bull market lasted so long some of the risks of owning bonds, like interest rate risk, receded into the shadows…. largely forgotten by fixed income investors.

But everything changed in early 2022. The scourge of double digit inflation escaped from its cage and was wreaking havoc on the global economy. The Federal reserve and other central banks began a historic tightening cycle and in the process unleashed hell on bond markets.

The greatest bond bear market in history

From 2021-2023, bonds experienced the greatest bear market in their history. The interest rate on the 10-year US treasury - that had bottomed at 0.65% in 2020 - hit a 15 year high of 4.98% in October 2023. The relentless move higher in interest rates over the past 2 years has caused the value of fixed income portfolios to crater.

Where are the losses hiding? The massive losses are sitting on the balance sheets of central banks, pension funds and financial institutions all over the world. And yes, P/C insurance companies.

—————

The Worst Bond Bear Market in History

October 13, 2023 by Ben Carlson

“One of the strange parts about living through the worst bond bear market in history is there doesn’t seem to be a sense of panic. If the stock market was down 50% you better believe investors would be losing their minds. Yes, some people are concerned about higher interest rates but it feels pretty orderly all things considered.

“So why aren’t people freaking out about bond losses more?

“It could be there are more institutional investors in long bonds than individuals. There are lots of pension funds and insurance companies that own these bonds.

“It’s going to take a very long time for investors to get made whole but you can hold these bonds to maturity to get paid back at par.”

—————

Active management matters again

As the bear market in bonds clawed its way though fixed income portfolios, a few P/C insurance companies were much better prepared than others. To understand who the relative winners and losers were/are it is helpful to first review the risks of investing in bonds.

A review of some of the risks of investing in bonds

- Interest rate risk - rising interest rates cause bond prices to fall. Duration matters a lot with this risk. Spiking interest rates impact long duration bond portfolios much more than short duration portfolios.

- Credit risk - the risk the issuer may default on one or more payments. Market dislocations / recessions matter a lot with this risk - events that cause credit spreads to blow out. Commercial real estate (in particular office) has taken a beating over the past year.

- Inflation risk (purchasing power risk) - the risk that inflation is higher than the total return received on the bond. Unexpected inflation is what matters with this risk. Especially if the inflation is high and persists for years.

- Reinvestment risk - the risk that at maturity, the proceeds will be reinvested at a lower rate than the bond was earning previously.

Part 3: What does all this mean for P/C insurers?

To state the obvious, how fixed income portfolios were structured in 2020 / 2021 - when interest rates bottomed - has determined how the bear market in bonds has impacted individual P/C insurers. The two key metrics were:

- duration

- credit quality

So far, the clear winners have been the P/C insurers that had fixed income portfolios in 2021/2022 that were low duration. (If we get an economic slowdown / recession then credit quality will likely also become an important factor.)

Interest rate risk

“Only when the tide goes out do you discover who's been swimming naked.” Warren Buffett

Most P/C insurers match the duration of their insurance liabilities with the duration of their fixed income portfolio. So, in 2020/2021, many P/C insurers had an average duration in their fixed income portfolios of about 4 to 4.5 years.

As a result of spiking interest rates in 2022, most P/C insurers saw the value of their fixed income portfolio plummet. This in turn caused book value to crater. This happened despite earning a strong underwriting profit in 2022.

Let’s look at one P/C insurer to better understand what happened

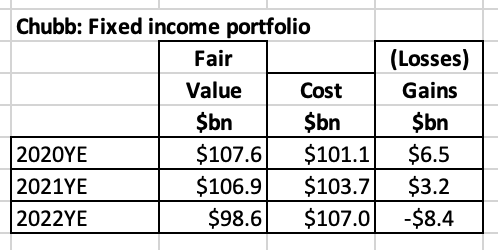

Chubb is viewed by many investors/analysts as being one of the better run P/C insurers. At the end of 2020, Chubb’s fixed income portfolio of $107.6 billion was sitting on an unrealized gain of $6.5 billion. Interest rates started to rise in 2021 and at year-end the fixed income portfolio was sitting on a smaller gain of $3.2 billion. In 2022, interest rates spiked higher. At the end of 2022, Chubb was suddenly sitting on a loss of $8.4 billion. Holy shit batman! The two year change in the fair value of Chubb's fixed income portfolio was a staggering swing in value of $14.9 billion (from a gain of $6.5 to a loss of $8.4 billion). As a result, despite earning a strong underwriting profit, book value at Chubb got crushed in 2022.

To put this in context, from 2020 to 2022, Chubb earned an average of $3.5 billion per year in interest income from its fixed income portfolio. So a $14.9 billion swing in value over 2 years is a big deal.

How did Fairfax manage to increase book value in 2022?

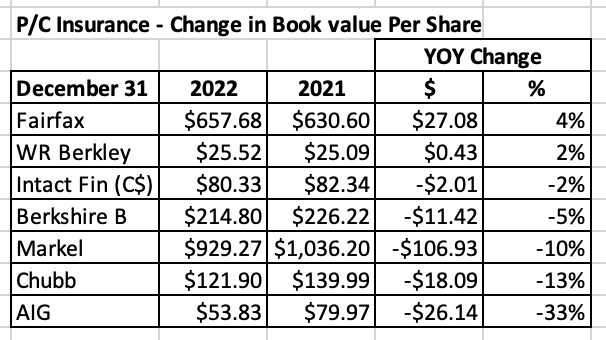

In terms of book value growth in 2022, Fairfax was a clear outlier. Why? In late 2021 Fairfax reduced the average duration of their fixed income portfolio to 1.2 years (more on this in my next post). As a result it was not impacted by spiking interest rates nearly as much as other P/C insurers.

Did any other P/C insurers have extremely low duration?

Yes. Berkshire Hathaway had very low average duration (my guess is their loss in book value in 2022 was due in part to mark-to-market losses on their equity portfolio). WR Berkley also deserves a shout-out as their average duration at December 31, 2021, was 2.4 years, which was much lower than the average. As a result, in addition to Fairfax, WR Berkley was one of the few P/C insurers who were able to deliver an increase in book value in 2022.

How should we think about these losses?

Yes, big unrealized losses sounds scary. But P/C insurers have said they will simply hold the bonds until they mature. Unless there is an unexpected liquidity need (perhaps like a 1-in-100 year catastrophe) it is unlikely we are going to see forced sales. So if the losses will not be realized are they really a problem?

Given the sizeable impact to book value there may be regulatory implications - insurance regulators and credit rating agencies are likely paying close attention.

Perhaps the more important question is how long are some P/C insurers going to have to sit on those (shit) low yielding bonds they are holding? The key is duration. P/C insurers with fixed income portfolios with an average duration of 4 or 5 years are likely going to need another couple of years to get the (shit) low yielding bonds off their books. Low yielding bonds - means low interest income - means lower earnings.

P/C insurers with a low duration portfolio have a big earnings advantage for the next couple of years over P/C insurers with longer duration fixed income portfolios. We will discuss this more below.

Inflation risk

Expected inflation is generally not a problem. Unexpected inflation, if it is high and persistent, can be a big problem for P/C insurance companies. And guess what we have had for the past 2 years? Unexpected high (double digit) inflation.

Why is unexpected inflation an issue? Because most P/C insurance companies are sitting on tens of billions in insurance liabilities.

P/C insurers get paid a fixed amount up front when they write an insurance policy. When they price the policy, they have to guess at its cost. After doing all this, they hope to make a profit.

Unexpected inflation is a big problem for P/C insurers. It means costs are likely going up more than expected. This is especially problematic for long tail lines of business. Because those higher than expected losses keep happening for years into the future.

And if you also have a long duration fixed income portfolio - and, at the same time, you are stuck with (shit) low yielding bonds - well, your problems are even worse.

High unexpected inflation and a long duration / low yield fixed income portfolio is not a good combination for the profitability of a P/C insurer - it has the potential to squeeze earnings for years.

Perhaps this partly explains why the hard market that started in late 2019 kept going strong in 2023 and looks set to continue strong into 2024 - despite repeated predictions of its imminent demise.

Reinvestment opportunity (not risk)

The increase in interest rates the past 18 months has been historic in amount and speed. P/C insurers are seeing interest rates today - across the curve - at 15 year highs.

P/C insurers with shorter duration fixed income portfolios have been able to capture the spike higher in interest rates much more quickly than P/C insurers with longer duration portfolios. We can see this by looking at the trend in interest income for the last 2 years.

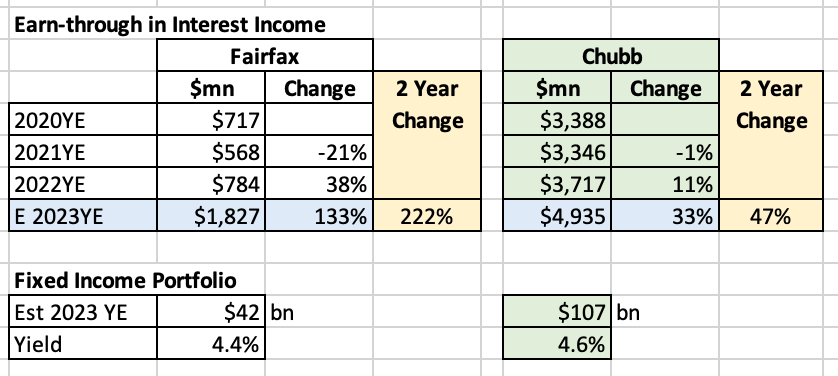

Fairfax is estimated to see interest income increase 133% in 2023 and 222% over the past 2 years. Chubb, on the other hand, is estimated to see interest income increase 33% in 2023 and 47% over the past two years.

The speed of the earn-through for Fairfax is more than 4 x that of Chubb.

It is also interesting to note that the yield on both Fairfax’s and Chubb’s fixed income portfolio now looks remarkably close. What is very different, however, is what they hold in their respective fixed income portfolios.

Credit Risk

The one risk I have not discussed is credit risk - the risk the issuer may default on one or more payments. Fairfax’s fixed income portfolio is stuffed mostly with government bonds. High quality. Chubb? Very different.

The yield on Fairfax’s and Chubb’s fixed income portfolio might be similar. However, the credit risk (made up of the holdings in each of the two portfolios) looks very different to me. Which portfolio is more risky? Which portfolio should perform better it we see an economic slow down? This post is long enough already… I’ll let you answer those two questions on your own.

Conclusion

The historic bear market in bonds has crushed the value of fixed income portfolios of many P/C insurance companies - in turn this has cratered book value. But a few odd ducks were prepared - Fairfax, Berkshire Hathaway and WR Berkely. On a relative basis, over the past 24 months, P/C insurers with low duration fixed income portfolios have been the clear winners over P/C insurers with long duration fixed income portfolios. Fairfax was exceptionally well prepared.

Short duration portfolios protected book value. And the earn-through from higher interest rates (in the form of spiking interest income) has been much quicker - which is boosting profitability - compared to long duration peers.

Having a short duration portfolio has also provided valuable optionality - it allows P/C insurance companies to be opportunistic should we see any dislocations in financial markets (like April of 2023, and the crisis that hit regional banks in the US).

In my next post (coming next week), I will take a closer look at what the team at Fairfax has done with their fixed income portfolio over the past 2 years. What can we learn about Fairfax and their fixed income team? Does value investing also apply to bonds? Does active management matter?

—————

Background Information:

How P/C insurance companies account for their bond holdings is important for investors to understand.

Most bonds at most P/C insurance companies are held in the ‘available-for-sale’ bucket. This means that unrealized losses do not show up in earnings (or ROE calculations). However, these unrealized losses are real - instead they show up in ‘other comprehensive income’ and book value.

How an Available-for-Sale Security Works

“Available-for-sale (AFS) is an accounting term used to describe and classify financial assets. It is a debt or equity security not classified as a held-for-trading or held-to-maturity security—the two other kinds of financial assets. AFS securities are nonstrategic and can usually have a ready market price available.

“The gains and losses derived from an AFS security are not reflected in net income (unlike those from trading investments) but show up in the other comprehensive income (OCI) classification until they are sold. Net income is reported on the income statement. Therefore, unrealized gains and losses on AFS securities are not reflected on the income statement.

“Net income is accumulated over multiple accounting periods into retained earnings on the balance sheet. In contrast, OCI, which includes unrealized gains and losses from AFS securities, is rolled into "accumulated other comprehensive income" on the balance sheet at the end of the accounting period. Accumulated other comprehensive income is reported just below retained earnings in the equity section of the balance sheet.”

-

1 hour ago, Hamburg Investor said:

As far as I remember, the deflation hedge from Prems point of view wasn't exactly a "bet", but more like an "black swan insurance", as he was cautious, when interest went to zero. So more a bit like: "I don't do it to get a great performance, but to get through a black swan event." Wasn't that what he wrote in the annual report back than? In hindsight it was wrong and the insurance was unnecessary; still than it wasn't made with some hubris, but with cautioness and that sheds a different light to Prem as a manager.

My gut feeling is, that Prem tries to avoid big macro bets, but he may fall back into the old pattern after all; reminds me a bit of Buffett trying to avoid Airplanes, but than investing into those again and again (he ones joked, he's an "airoholic" - from memory).My impression is, he and Fairfax have been focussing on insurance (improving cr and growth, widening global footprint - bought all this little insurers around the world and on nearly every continent), bond portfolio and investments in Greece and India. It works fine - so maybe, hopefully he stays on the path.

At least I just hope that, as the new Fairfax doesn't need that in my eyes. I'd be happy, if he just stays on that route of the last years. Improve quality, be a value investor. The way Markel has gone with Ventures and Buffett/ Gayner both have done with investing into more into quality has some logic, as you grow and investments have to get bigger and going in and out gets more difficult. On the other hand I sometimes ask myself if maybe low (or hidden) quality is just so much out of favor for such a long time, that Prems style might outperform. Everything comes back from time to time - look at inflation. So who's still doing "cigar butt investing"? And buying what nobody else wants in general is a very good concept. But I don't know, maybe quality investing is just better.

On the other hand regarding macro bets: Has someone here analyzed the outcome of ALL macro bets of Prem altogether? Maybe if we put the bad and the good decisions together, the macro bets have been a tailwind for returns?

My summary is somewhat that I hope it doesn't happen again, but also don't feel that a bad macro bet would ruin everything. Several things came together between 2010 and 2016: Growth outperformed value, Blackberry, zero interest rate. If it had just been the macro bet, book value growth would still have been bad, but not so underwhelming. Digit, Eurobank, Bangalore, TRS, better CR, growth of global insurance business, ... will work their magic.

@Hamburg Investor thanks for taking the time to write a thoughtful post.

- yes, calling what Fairfax does ‘macro bets’ is not entirely accurate. But i also think Fairfax’s explanations can also be messy - like their reasoning for exiting the equity hedges in late 2016.

- i do think Fairfax has moats - how else do you compound BV at such a high rate for 4 decades if you don’t have at least a few sustainable competitive advantages over most other P/C insurers? (Especially when you include the significant losses from the equity hedges.)

- what are the moats? Family control is likely one. The insurance business is likely another (today). Capital allocation might be the largest moat.- capital allocation: what Fairfax does today is unique in the P/C industry. In comparison, Markel plays checkers and Fairfax plays chess. This is not to say Markel is bad. Fairfax has spent decades building out their capabilities.

- i think capital allocation might be the thing most mis-understood part of Fairfax today. They use such a diverse array of strategies. And a chunk of the value being created is hidden from view (and book value). We find out when Fairfax surfaces the value - like when they sold pet insurance.

- i also think in a higher interest rate (high volatility) world active management matters again. Fairfax has been building a diverse team at Hamblin Watsa for this exact moment. Returns moving forward could surprise to the upside.- the power of compounding will also be something to watch in the coming years. Its possible we get some Berkshire type of magic.

I think about Berkshire and holding a stock long term (buy and forget about it possibly for decades). And then i think about Fairfax and i can’t square the circle.

What Fairfax does to be successful - with investments - just seems to take so much work year-in and year-out. Will fixed income continue to rock when Brian Bradstreet is gone? Will insurance continue to rock when Andy Barnard is gone?

My Christmas wish for Fairfax is that they continue to make the business model more self-sustaining. I think this is the direction they have been going for the last 5 years. I think we can see this with insurance. I think we are seeing that with the equity holdings - Fairfax has been moving up the quality ladder over the past 5 years. The fixed income portfolio looks locked and loaded for years (with average duration getting pushed out to 3.1 years).

So with insurance/investments we might have just arrived in 2023 at ‘new Fairfax’ - a more predictable self-sustaining P/C insurance company. Chug, chug, chug.

The big question for me is what are normalized earnings for ‘new Fairfax’. I keep throwing $150/share out there. But i think this could be way low moving forward. Capital allocation will be key. Active management will be another. I also wonder what hidden assets are sitting on Fairfax’s balance sheet that will be monetized moving forward. BIAL is a jewel. As is Digit. Fairfax India (and Fairfax’s capabilities there) are grossly undervalued. Fairfax has a bunch of things that are chugging away… I expect more large realized gains are coming - and these are not built into anyones models today (including my $150/share estimate).

Great time to be a Fairfax shareholder. I am doing my best to listen to @bearprowler6 - the big money is made by sitting on your hands and doing nothing. His posts remind me of this quote:

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.”

― Edwin Lefèvre - Reminiscences of a Stock Operator -

24 minutes ago, LC said:

Happy Thanksgiving everyone here, and thank you in particular to Sanjeev for maintaining this community for so many years.

+1 -

I think the discussion of ‘moat’ for Fairfax also needs to include the flip side: ‘what are the big risks of investing in Fairfax.’ I am talking about stuff that is largely in management’s control.

My number 1 risk is trust in the senior management team. Will they make another big macro bet that sets the company back 5 or more years?The phenomenal success Fairfax experienced with CDS/equity hedge bets from 2005-2009 likely set stage for the terrible equity hedge/short strategy from 2010-2016. Hubris set in and Fairfax was punished by the investing gods.

Given the success Fairfax has been having the past couple of years, do we see a repeat at Hamblin Watsa? Does hubris set in again?

This highlights what i think might be a fundamental flaw in Fairfax’s business model: too much macro thinking. When it works, it is a beautiful thing. When it doesn’t work, especially given the size of the company today, it will be ugly.

Given its massive size today, do we see Fairfax fine-tune its business model to rely less on big macro bets?

-

5 hours ago, ander said:

@Viking Appreciate your analyses. Any guesses what Fairfax (i.e., Prem) may view as fair value today? or what do you think is fair value today?

@ander What is fair value for Fairfax today? Great question. I am not sure what Fairfax’s answer would be. My guess is we will get an update from Fairfax in the 2023AR when it is released in early 2024.

What do i think? The key for me is earnings. I view Fairfax as a turnaround that grossly under earned for years. Those low earnings got anchored in investors psyche (messed them up) and this likely remains to this day.

We have been learning the past couple of years what the true earnings power of Fairfax and its collection of assets really is. What complicates things is:1.) we have seen crazy volatility in financial markets the past 5 years - with 3 different bear markets in stocks and an epic bear market in bonds.

2.) the management team at Fairfax has been executing exceptionally well. How much of this is one-time in nature and how much is sustainable moving forward?

3.) the spike in bond yields and Fairfax extending duration is a big deal.

As i have posted many times, i think ‘normalized’ earnings for Fairfax today is about $150/share. With the stock trading at $900 this gives a PE of 6. That tells me shares are exceptionally cheap.

EPS of $150 delivers an ROE in the high teens. P/BV is about 1. Yes, this is IFRS BV, which is higher than GAAP BV. But regardless the multiple is low. Looking at ROE and P/BV it looks to me like Fairfax is cheap. How cheap? Hard to say… because i think BV is messed up and likely understated…

Of the two ways to look at Fairfax, today i trust EPS the most. Given the size of earnings, capital allocation will be very important the next couple of years. The risk / reward today looks pretty compelling to me. But we all need to do our own analysis (to own it or not) and find the right fit (position size).

-

3 hours ago, SafetyinNumbers said:

If Fairfax added or reduced its TRS position this month what would you think?

If Fairfax reduced its TRS position (simple exit of the position with no explanation) at around current prices it would make me question how cheap the shares really are.

If Fairfax thought the shares were very cheap today would they exit the TRS position? No, i don’t think so.

I could see Fairfax exiting the TRS position when they feel shares are close to fair value (by close i mean within 10%).

—————

From a capital allocation standpoint my big surprise this year is the minimal buybacks we are seeing from Fairfax. At least compared to the past 5 years.

Clearly, Fairfax is seeing better opportunities doing other things. I am not complaining.

Fairfax shares are up significantly over the past 2 years.

————-If we saw Fairfax exit the TRS position and stop buying back stock it would likely tell me they no longer see their shares as being very cheap (perhaps just cheap).

————And if we saw Fairfax make a big acquisition by issuing new shares at current prices… Well, that would tell me Fairfax saw their shares as being fully valued, and perhaps even over valued.

-

4 hours ago, Hamburg Investor said:

I really, really appreciate Vikings in depth analysis with all the details.

On the other hand it may be an idea to just step back and try to understand the bigger picture.

We can look at the numbers and make an educated guess about the next 3 years or so and it’s eye-opening, what Viking and everybody is doing here, it’s incredible. But as a longterm investor I personally like to find the businesses that might compound at above average market rates over decades; and clearly there‘s no use of interpolating the detailed numbers of Viking over 10 or 20 years; there‘s just too much variables. Looking back we just find so many things happening all the time, that all were hard to anticipate 5 years before (some even days or weeks before) happening. E. g. Interest rates have been so low for so long and nobody anticipated that in - say - 2007. But if you wouldn’t have anticipated that back than, you were totally wrong with the numbers. The world has seen so many things within the last 15 years. One of the worst bear markets within the last 100 years, a worldwide lockdown for a virus, wars, fraud, political instabilities, financial crisis with nearly melting the financial system, new technologies changing whole sectors…

To me that seems just too much to get the numbers only even „approximately right“ with that concept (this is not saying Viking or anybody thought this would be possible; just saying). Trying to pinpoint the exact compounding rate until 2038 I personally would definetely end in being precisely wrong.

Okay, so how do we get it „approximately right“? I don‘t know of any other concept than looking for an endurable moat in any company. If you find that endurable moat it‘s hard to get a really bad outcome over 15 years. Even if you pay a bit too much.

Here and elsewhere have been some discussions, if Fairfax has a moat or not. „Is it again the old Fairfax?“ is a question that arises here again and again and my reading is, that this in larts refers to the moat wuestion too. Getting that answer wrong one looses a lot of money, either by investing too much or too less or by selling too early etc.

If Fairfax had an endurable moat

and looking at the valuation, than - from my perspective - this is one of the five or ten best investment opportunities in a lifetime.

So I thought it might be an idea to discuss that point here more broadly and to begin with here‘s a list of points why I think Fairfax has a moat. I‘d really appreciate others sharing why they (don‘t) feel there‘s a moat, as it helps increasing (at least my) learning curve:

- longterm outperformance - 19% per year over 37 years in book value growth. That‘s a bold indicator. The outperformance is just too big and lasts too long for being just luck.

- Prem is from Graham and Doddsville - Buffett laid out, that value investors outperform the market. Prem is clearly a value investor. He‘s more old style than others including Gayner and Buffett.

- Integrity of management. Prem has a lot of „skin in the game“. He‘s clearly not a phony. He has his own ideas and goes his way, even if nobody applauses him. As far as I know, he likes what he does more than living an easy life. I trust him.

- The business itself: Fairfax clearly is in the footsteps of Berkshire. Yes, Prem has a different style. But still Fairfax is build on the idea of compounding through float investing in combination with equity invested in businesses (stock market, wholly owned, …). This general concept as a basis to me seems totally reasonable to lead to outperformance. Buy an etf with your equity on the s&p500 and invest the float in bonds… Have a combined ratio below 100… and there you have the outperformance. Okay, Prem has been really different with combined ratios of 115 in the early years, and the macro bets… Okay, okay. Still: The general concept was being a value investor (in comparison to growth, momentum or other styles) and invest a bigger portion of the equity in equity and not into bonds. (And btw: What does it tell us about Prems future performance, when he just outperformed the market that much in the early years, even though the float was so expensive and has gotten so much better / higher quality since then?)

- Fairfax has changed to the better and has gotten even more Buffettesque:

- „No more shorts“

- Combined Ratio: in the first 20 years, Prem outperformed the market the most, allthewhile the CR was bad (and sometimes really bad!). Now Fairfaxs insurance businesses are profitable and most of the time really good and better than the sector, for over 15 years.

- The Fairfax insurance business has widened its footprint to other continents and will widen even more. US, Western and Eastern Europe, India, Asia, Africa, South America, … So even though the insurance abroad is really small, there’s a worldwide diversification of risk at the horizon. Even though really small, they are growing stronger than the North American and wordide insurers alltogether and he‘s buying more (like GIG)

Okay, let‘s play the advocati diavoli: „Prem has lost it. Look at the last 10+ years. No outperformance to speak of.“

The answer is easy: Interest rates were low. That hit Fairfax in two ways: First, no income to speak of from bonds. And indirect the low interest beared the hefty outperformance of growth versus value; that was clearly a bigger headwind for Prem as for Buffett or Gayner (both more on the GARP and/or quality investing site), as Prem is clearly more like a classic value investor (buying the ugly - in greece when everybody was fleeing, Blackberry… so low pb and pe ratios, not exactly cigar but investing, but „buying cheap“ is more important to Prem than to Warren or Tom m).

So some may find it being just an excuse, but in my analysis I think Prem has been in the worst environment ever for over a decade. You might say, talking about „the circumstances“ is a typical excuse of someone underperforming. „It‘s always the circumstances.“ I know I know.

Still to me it seems reasonable in this case. Look at insurance as a sector, look at Buffett or Gayner. They all left the S&P 500 in the dust in the (70ies), (half of) the 80ies, 90ies and to a lesser degree until 2007/2009. And since than, they are all about the same, a bit below the S&P500 or a bit above. But none of the three compounded with a cagr of - say - 5%, 10% or even more above the market over 10 years. Looking at the insurance business and it‘s logic what else should one expect within a timeframe of interest rates at 0%? I wasn‘t aware 0% would be coming and staying for so long. But in my eyes to everybody understanding the Berkshire concept it should be clear that higher interest rates are better than lower and well, cheap money helps growth investors, not value investors. What else?

Okay, let‘s put that alltogether. In my eyes Fairfax has a moat. I think, Prem will be able to beat the market with his equity investments (so no change to history). I find it reasonable, that the CR will be better than the average insurance company. Below 100 if interest will be way above 4% for longer… ? Maybe, maybe not. Still I’d bet Fairfaxs float being cheaper than risk free treasuries. I have no idea where interest rates are standing in three years or five, 10, …

Still I‘d say: Let‘s assume Prem just does as good as the S&P500 and compounds equity (stocks, dividends, wholly owned businesses) itself with a cagr of 10% over 10, 20, 30 years. That‘s below the historical average of 11.8% of the S&P500. And than let‘s say, he reaches a CR of 100 and earns 3% on bonds. Than Fairfax would compound at a rate of around 15%/year. To me that sounds like a reasonable, conservative base case.

If the S&P500 will be flat over the next 20 years, than Fairfax probably won‘t reach that 15%, but I guess would have a good chance of outperforming the market. Or if Growth again outperforms Value by such a margin over such a long or even longer time. Or if the CR goes way more up or if the new normal for interest rates is near zero. So if you believe, interest will be lower again for a decade, you clearly will come to other conclusions and worse outcome.

Still to me a base case should build on historical averagesand than you put in a margin of safety.

Anyway: If Fairfax should have an enduring moat and if it would compound equity with a cagr of 15%, than you could buy Fairfax at a PE ratio of 7 today. I wouldn‘t mind buying a business, that doubles its equity every 5 years, for a PE Ratio of 14 or even maybe 21. In fact the market is way higher (like PE of 24 for the S&P500) and the average company won‘t reach an roe of 15%. 20 years from now, equity 16-folds at a 15% cagr. If Fairfaxs price tag would go up by 150 per cent tomorrow and I should bet who compounds stronger over the next two decades, I won’t bet on the S&P500.

”Does Fairfax have an endurable moat?” This is a great question and one that i have not actually thought much about. I would love to hear what others think.

@Hamburg Investor Here is my question to you: Do you think Fairfax will continue to make big macro bets moving forward?

-

16 minutes ago, bearprowler6 said:

Just when you thought that a buyout of Farmer's Edge represents a new low; this gets reported:

https://finance.yahoo.com/news/prem-watsa-bolsters-stake-blackberry-200329382.html

Nothing has changed----same old Fairfax.....

Seriously, Farmers Edge and more Blackberry??

@bearprowler6 your comment surprised me. The size of the purchase was very small. The ‘report’ calls it a sizeable addition? It added 0.003% to Fairfax’s position. It was a $450,000 purchase - tiny in size.

Regardless, Blackberry is also in the process of being sold. Fairfax understands the company better than most. It probably IS good value at $3.52/share. Will Fairfax play around with their position size pre-sale? Perhaps.

Like Farmers Edge, IMHO we need more information before we rush to judgement.

—————

“On November 13, 2023, Prem Watsa (Trades, Portfolio), through Fairfax Financial Holdings, made a notable addition to its investment in BlackBerry Ltd (NYSE:BB). The transaction involved the acquisition of 129,000 shares at a price of $3.52 per share, increasing the total holdings to 46,853,700 shares. This move had a 0.03% impact on the portfolio, adjusting the position to 10.77% and marking a significant vote of confidence in the company's prospects.”

-

8 hours ago, glider3834 said:

I think there may also be a contingency, tax planning objective here, in the event the turnaround is not successful

I agree. And I do not understand all the anger with the posts on Farmers Edge. Can anyone explain to me what Fairfax is doing and more importantly why they are doing it? What are the financial impacts? Clearly more information is needed to properly assess this announcement. My initial read is this is a nothing burger. But i remain open minded.

Yes, Farmers Edge was a terrible investment. It has been clear for at least a year that the end of this investment is near. Sayonara.

-

What was the change in the value of Fairfax’s equity portfolio at the half-way mark in Q4 (to Nov 15)?

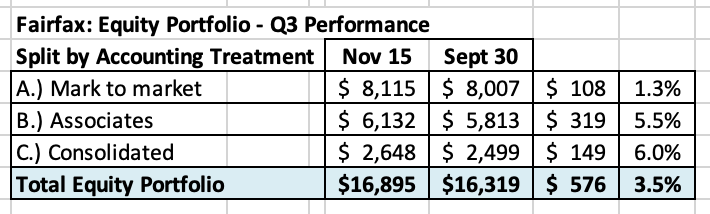

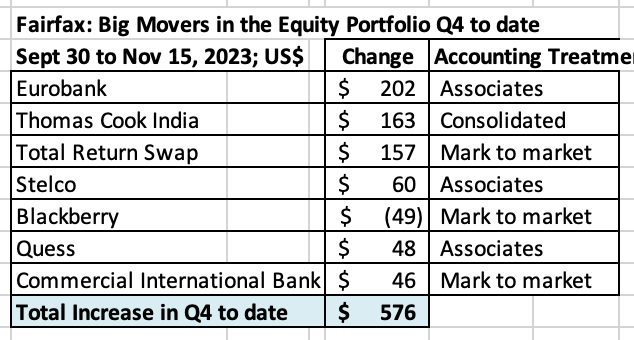

Fairfax’s equity portfolio (that I track) has a total value of about $16.9 billion at Nov 15, 2023 (midway through Q4). This is an increase of about $576 million (pre-tax) or 3.5% from September 30 to November 15, 2023. The increase in the quarter works out to about $25/share. My Excel tracking file is attached at the bottom of this post for those who are interested.

In the first 6 weeks of Q4, currency has been a bit of a tailwind.

Please note, I include holdings like the FFH-TRS position in the mark to market bucket and at its notional value (which was $1.765 billion at Nov 15). I also include debentures and warrants that are in the money in this bucket.

To state the obvious, my tracker portfolio is not an exact match to Fairfax’s actual holdings. It also does not capture changes Fairfax has made to its portfolio during the quarter. As a result, my tracker portfolio is useful only as a tool to understand the probable directional movement in Fairfax’s equity portfolio (and not the precise change).

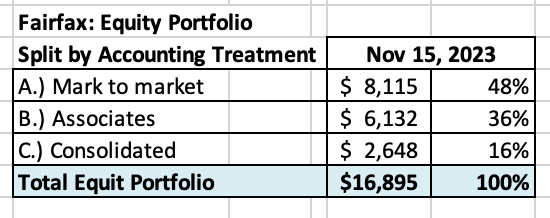

Split of total holdings by accounting treatment

About 48% of Fairfax’s equity holdings are mark to market and will fluctuate each quarter with changes in equity markets. The other 52% are Associate and Consolidated holdings.

Split of total gains (losses) by accounting treatment

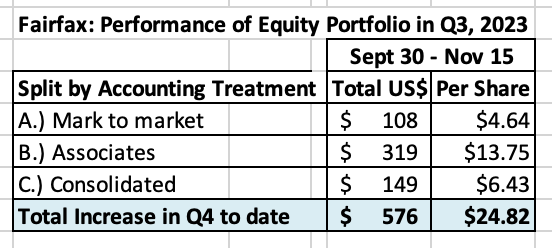

- The total change is increase of $576 million = $25/share

- The mark to market change is increase of $108 million = $5/share. Only changes in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter.

What were the big movers in the equity portfolio?

- Eurobank was up $202 million and it is now a $2 billion position for Fairfax.

- Thomas Cook India was the star performer in Q3 and continued its strong performance 6 weeks into Q4, up $163 million. With a market value of $645 million, TCI is now Fairfax’s 5th largest equity position.

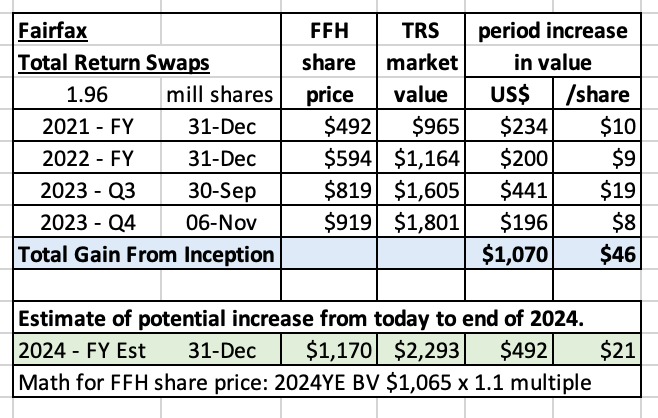

- The FFH total return swap position (giving exposure to 1.96 million Fairfax shares) continues to perform exceptionally well. This position is up another $157 million or more than $1 billion since it was initiated in late 2020.

Below is a copy of my Excel spreadsheet (next 2 pages) if you want a closer look.

For Associate and Consolidated holdings, the excess of fair value to carrying value is about $874 million or $38/share (pre-tax). Book value at Fairfax is understated by about this amount (less the tax impact). What is the split?

- Associates: $505 million = $22/share

- Consolidated: $369 million = $16/share

Equity Tracker Spreadsheet explained:

The summary below attempts to track all equity holdings at Fairfax. Each quarter we update the spreadsheet to capture any ‘new news:’ purchases and sales.

We have separated holdings by accounting treatment:

- Mark to market

- Associates – Equity accounted

- Consolidated

- Other Holdings – derivatives (total return swaps), debentures and warrants

We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$ so non-US holdings have their values adjusted for currency.

Important: the list is not complete. Some information we only get once per year when Fairfax published their annual report. Fairfax makes changes to their portfolio each quarter.

-

Not sure if this has been posted already… looks like Prem is elephant hunting. Am i reading this right that this is not Fairfax - but Prem on his own?

The partners on this proposed deal are interesting. Pierre Lasonde is a partner with Fairfax in Foran Mining. Kestenbaum is, of course, the CEO of Stelco. If you wanted to partner with stars, it would be difficult to find two better than Lassonde and Kestenbaum.

Here is a write up on Lassonde:

https://latinmines.com/pierre-lassonde/

—————

Pierre Lassonde ‘mystified’ by Teck choice of Glencore bid for coal unit

Veteran mining entrepreneur Pierre Lassonde said on Wednesday that he is “mystified” by Teck Resources’s decision to sell its coal unit to a Glencore-led consortium for $9-billion because his group bid the same price.

“We put together an offer that was very, very competitive, it was in the best interest of Teck shareholders, Canada … the employees,” Mr. Lassonde said in an interview.

“And it was a holistic solution with the same price tag.”

On Tuesday, Teck agreed to sell its steelmaking coal unit to the group led by Switzerland-based Glencore.

Mr. Lassonde said his consortium included Fairfax Financial Holdings founder Prem Watsa and Stelco Holding CEO Alan Kestenbaum, both in their individual capacities. Their offer was credible and comparable to what Teck’s board accepted from Glencore, he said.

-

31 minutes ago, glider3834 said:

I guess will allow Fairfax to free up around $200M to invest in higher return debt instruments

Great news: Fairfax is (finally) materially shrinking their exposure to Blackberry. $200 million that has been dead money for a decade is now going to be re-invested into something that should now earn an acceptable return.

Perhaps they extended some of the debenture to assist the company with the sales process? No idea.

Blackberry is one of the few legacy equity ‘problem children’ that Fairfax has left to fix. Fairfax just reduced its exposure to Blackberry by about 40%. A step in the right direction.

-

Initiated a starter position in Saputo (SAP.TO). Looks like we might be getting capitulation in the shares. A former high flyer that has crashed back down to earth. Shares are trading at 2014 levels. Another turnaround play. Family controlled business. Time to get back up to speed on the company.

Also bought a little Linamar (LNR.TO).

-

3 hours ago, vinod1 said:

If normalized earnings for Fairfax this year are $150 per share. Then these earnings must be growing at least at about 5% annually. That means, Fairfax should be able to easily earn $2000 per share in aggregate over the next 10 years. You cannot exclude any "one time" losses, this would be all in.

That would be the definition of what normalized earnings would mean.

Personally, I would be thrilled if this happens, but I think this is unlikely.

@vinod1 with earnings growth of 5% are you not essentially saying Fairfax’s capital allocation will be poor moving forward?

Part of the reason I am so optimistic on Fairfax today is:

1.) the cash flows are front loaded. We know with a fairly high confidence level that they are going to deliver record operating earnings 2023-2025. Buffett teaches us when valuing a company the TIMING of future cash flows is exceptionally important (the sooner the better - the higher the valuation a company should get).

2.) the opportunity set to deploy capital is very good today and i suspect is about to get even better: and Fairfax has +$3.5 billion that will be re-invested each year moving forward in a very good investment environment. Bond yields are at 15 year highs. Small cap stocks are trading at bear market lows. If we get a recession all equities will go on sale (and already cheap equities will get stupid cheap). When it comes to capital allocation today, Fairfax is like a major league hitter getting lobbed softballs.

As a result, I will be surprised if earnings growth is 5% per year moving forward.

You also bring up ‘one time’ losses. Fairfax’s results will be volatile. Especially if we get a recession (no idea if this happens). My view is volatility is a good thing for Fairfax - smoothing results out over a couple of years.

- The TRS-FFH purchase in late 2020/early 2021 is a great example. They masterfully took advantage of extreme volatility in Fairfax shares - extreme pessimism.

- Another great example was selling corporate bonds and shifting to government bonds and shortening duration to 1.2 years in late 2021. They sold at the top of the fixed income bubble.

- The extension of their fixed income portfolio to 3.1 years in October looks exceptionally well timed.

- Selling Resolute at the top of the lumber cycle? Brilliant.

- Selling pet insurance for $1.4 billion…. Nuts. Lots of these decisions are $1 billion decisions… they are ‘needle movers’ for Fairfax and its shareholders.

Fairfax investors fear volatility. I think they might have it backwards. Especially given how Fairfax is positioned today (strong balance sheet and record operating earnings). Investors in Fairfax should be praying for volatility. With both insurance and financial markets. Thriving in volatile markets - this looks to me like it is likely a significant competitive advantage for Fairfax today compared to peers.

-

1

1

-

55 minutes ago, StubbleJumper said:

@VikingThanks for the reply. I worry that you are misinterpreting cautious optimism and cautious enthusiasm with bearishness. There are four or five posters on this forum who have been wildly enthusiastic about FFH's last couple of years and have equal optimism about the next couple of years, but prefer not extrapolating that out too far!

1) and 2) It is always possible that we will see a 95 or 96 CR and treasuries yielding 4-5% over the next five years. But, if you return to the content of Prem's annual letter to shareholders and examine the history of CRs and sovereign debt rates, you will probably find that simultaneous profitable underwriting AND solid treasury yields is an exceptional circumstance. It's a circumstance that has made FFH a nice pile of money over the past year or so, and hopefully will continue to do so during 2024 and 2025. But that table depicting cost/benefit of float and bond rates reflects the competitive dynamics of the industry. The the financing differential (bond yield less the cost of float) widens out, capital has historically poured into the industry and profits tend to be competed away through lower underwriting standards. The current financing differential is roughly 11% (ie, benefit of float is ~6% in 2023 due to a 94 CR, and prevailing sovereign debt rates are ~5%), which is more than double the long-term average. Personally, I expect to see some reversion to the mean, but I am hoping that it doesn't happen too soon!

3) No, compounding isn't dead at all. The only reason why anyone would be a long-term FFH shareholder is the belief in compounding. I'm not sure that I'd assume that FFH will get a 10% return on the earnings that it reinvests, but there will definitely be some sort of return. Prem publishes a table in his annual letter that describes FFH's investment returns, and there have been a few periods with that kind of return, but it's exceptional which is consistent with the lumpy-returns mantra.

Nobody is assuming that FFH management will suddenly get stupid. But, equally, the assumption needs to be made that other companies' management teams don't become stupid either. FFH is making lots of money in a hard market and when the ROE eventually turns due to a softening it's not because they have become stupid. It's because everyone else has been competing furiously for premium.

SJ

@StubbleJumper we are not that far apart. I do appreciate the opportunity to discuss and debate. I sometimes will take a bit of an extreme view to create the opportunity for push back.

I wonder if we are going to learn that Fairfax was criminally under earning on its assets from 2010-2020. And that its earnings power is much higher than anyone imagined. Which just means the returns being generated today are not as abnormally high as they look. Just a theory… we will know more in a few years.

i also wonder what the value of active management is today (in terms of alpha - returns in excess of a benchmark). Howard Marks comments in his most recent memo that cost of capital matters again - it didn’t from 2008-2021. Another theory i have is the alpha being delivered by Fairfax’s management team is much higher than investors realize. They look ideally positioned to benefit from the current high interest rate / volatility environment - and much better than peers (including BRK). Again, we will know more in a few years.

I also wonder about the quality of the underwriting and the insurance business. It looks to me like Fairfax might be slowly moving up the quality scale (compared to peers). Not elite. But better than they were. Another crazy theory.All three ‘theories’ likely impact my view of Fairfax’s earnings potential over the next 5 years. We will see.

-

1 hour ago, StubbleJumper said:

Oh? You have some compelling explanation about how a 12% ROE might be obtained in 2026 without continued favourable CRs and continued favourable interest rates? Nobody is assuming that the earnings from 2023 or 2024 will be lit on fire, but you do need to get an ROE from them....

I find it instructive to periodically review the table depicting FFH's annualized growth in BV that Prem publishes every year in the annual letter.

SJ

@StubbleJumper why do you think1.) a 95-96CR is not sustainable over the next 5 years? What if Fairfax IS becoming a better underwriter?

2.) interest rates today are ‘favourable’? What if interest rates are simply back to normal?

3.) power of compounding is dead? it also appears you think Fairfax (and its equity holdings) will not invest record earnings well moving forward… $3.5 billion per year in earnings is a big number… it could deliver $350 million ($15/share) in incremental earnings to Fairfax each year if it is invested wisely. 2023 + 2024 + 2025 - year after year etc. You appear to be completely discounting the power of compounding looking forward…- Yes, the hard market will end at some point. Yes that will slow top line organic growth. But why does that mean CR has to immediately increase to 100 or higher?

- Yes, interest rates have increased from when they were zero. Why do we think they will be going back there?

People are anchored to the financial regime from 2008-2021. What if the next 10 years is different?

Maybe we ARE in a structurally higher inflation environment. Which suggests we are also in a higher interest rate environment. Cost of capital matters again. Active management matters again. Since 2018, Fairfax has excelled with active management. Why do we think they are all of a sudden going to get stupid?

Do i know how the future is going to unfold for Fairfax? No, of course not. I see a range of outcomes - some good and some bad. With a ‘baseline’ forecast i try and find the middle ground in the forecast. Some items will be too high; some will be too low.

I also try to work with facts as much as possible. Do i know how the insurance cycle is going to work out? Ot the economy? Or interest rates? Macro? I have no idea. So why would i assume it all turns against Fairfax? My guess is there will be both puts and takes.

What i see on the board is lots of pessimism. But no balance. No discussion of what might go better than expected. So i view people on the board as being too bearish in their outlook for Fairfax’s earnings moving forward.

i don’t equate bearish with being conservative. Conservative would include a more balanced discussion of positives and negatives.

I enjoyed listening to Howard Marks most recent memo: Further Thoughts on Sea Change

- https://www.oaktreecapital.com/insights/memo/further-thoughts-on-sea-change

—————PS: look at Eurobank. Look at the turnaround at this company the past 5 years. Look at what it is earning today (a record amount) and what it is doing with those earnings (purchase of Hellenic Bank). My guess is EPS will increase 20% in 2024. They likely will be instituting a dividend in 2024 and payments to Fairfax could be $80-$90 million. This will increase total dividends received by Fairfax by 50%. It is meaningful. Not built into my $150 ‘normalized’ number.

Digit? Do people think we are done with this investment? My guess is it is likely to deliver significant incremental value to Fairfax shareholders moving forward.

GIG is a great real time example. This purchase will increase top line. And float. And investments. Fairfax is done after the GIG acquisition? Because we don’t know with certainty what they are going to do we assume they are going to do nothing?

These are just three quick examples. Fairfax has so many levers to pull to drive value for shareholders moving forward with insurance and investments. My guess is they are going to continue to execute well. But i remain open minded.

-

1

1

-

16 hours ago, Jaygo said:

In the 20’s era the personal car and widespread electricity were just gaining serious traction In North America. That’s a tough comp for any era but it really did bring a sense of freedom and possibility.

kind of a far cry from today. Yea our standard of living is better today than 100 years ago but our improvement steps are getting incrementally smaller.

I think our main goal today should be to bring back some sense of pride in education, excellence and competition. We should squeeze out the rent seekers defined as everyone from welfare jobbers to uncompetitive monopolists.

When the war years ended everyone was already geared to striving to be the best or else risk loosing the war. Today we are bloated, lazy and frankly trivial in our ambitions.

When you look at the growth of Dubai or Shanghai and some other jurisdictions you can kind of see a boundlessness in it but that ain’t the west that’s for sure.

@Jaygo I look back 40 years ago to when i was a teenager. Quality of life for the average person in Canada today is much, much better in my opinion. Much has changed so there are big winners and losers. As i age out, the losers are much easier to see than the winners… so it is natural to feel that we collectively are worse off.

So what is better? Education is infinitely better and cheap. Health care is better. Women have much more opportunity. Net worth of anyone who owns real estate is through the roof (most Canadian families). These are just a few examples that quickly come to mind. I remember the recession in the early 1980’s (I was a teenager trying to find a job). GDP declined 3.2%. Inflation was +10% and the unemployment rate peaked out at 12%. All the hand wringing today about the current economy/situation cracks me up a little… it reminds me of the scene in Crocodile Dundee. Perspective is important.

My view is what doesn’t change over time is the opportunity for people to live a great life (here in Canada). Every generation, the model to live a successful life changes in important ways. And every generation 20% of young people figure it out and earn/live a great life; 20% crash and burn and 60% are going through the motions. My guess is it was the same 100 years ago. And the same 200 years ago. I tell my kids they should want to be in the 20% that lives a great life. The rub is the model of the past generation here in Canada (real estate) probably will not work for them - they need to figure out the new model. Your future reality is (usually) the sum of the choices you make.

Personally, i think a great current opportunity for young people is to take advantage of all the tax free accounts being offered by the government… tax free compounding (plus low fee self-directed accounts and low fee ETF’s) starting in your early 20’s is a lay-up in terms of achieving financial independence - in about 20-25 years if you work at it (knowledge/skill/desire).

-

4 hours ago, Spekulatius said:

Complexity is an issue that reduces valuations in general. A simple business will be valued higher than a complex business, all else being equal.

What @SafetyinNumbers call social numbers is what Aswath Damadoran call’s the story. I think the story is getting better with FFH but as an insurance holding stock, it is unlikely to even become a stock that has much of a story value.

@Spekulatius i think the fundamental problem for Fairfax is there is no consensus among analysts/investors of what the normalized earnings power is for Fairfax today. This in turn makes it impossible to come up with an intrinsic value.

I think normalized earnings for Fairfax is about $150/share. And this should grow nicely in the coming years.

Lots of people on this board think earnings this year at Fairfax are unsustainably high (and my $150 estimate is ‘peak earnings’). Lots of analysts agree - some are forecasting EPS to fall at Fairfax in 2024. Do they think Fairfax is going to destroy capital moving forward (mal-invest record earnings)?

I think the biggest issue with valuing Fairfax today is the historical numbers are grossly understated and full of noise. 2023 is the first year where we are getting an accurate picture of what the different income streams at Fairfax can generate moving forward. It makes sense investors will need to see 2 or perhaps 3 years of growing earnings to ‘believe’ they are real and sustainable.

Over time, as more investors come to understand the true earnings power of Fairfax the stock will get valued more appropriately. I suspect the narrative (story) will also continue to improve moving forward.

When Fairfax stock is trading at 1.1 x BV, my guess is the analyst at RBC will increase his target to 1.1 or perhaps even 1.2 x BV. And he will have a couple of really good reasons justifying the re-rating…

-

Fairfax has had an amazing run the past 3 years - the stock is up about 200% - so it is hard to argue that the stock is unloved or even under-followed today (maybe i need to update my view on this…). That is an amazing increase.

The response from the analyst at RBC highlights just how long it takes for the narrative around a company to change. It takes many years.

A good example is Apple. Apple’s stock bottomed in 2013. It took 7 years - right through until 2020 - for the old narrative to be fully exorcised and for the new narrative to become entrenched. And a lot of money was made by patient shareholders. The key for investors in Apple during this period of time was to simply hold their position - to sit on their hands.

That is probably the key lesson here: patience.

As long as the story / fundamentals remain intact, holding though the update in narrative phase (also called multiple expansion) can be extremely profitable for shareholders.

Growing earnings + increasing multiple + lower share count. This was Apple’s secret sauce and over a 9 year period it gave shareholders a 12 bagger.

-

1

1

-

-

On 11/6/2023 at 9:48 AM, Viking said:

RBC sent out their research report on Fairfax last night. It was pretty positive on the company - with earnings estimates increased. Price target was increased by US$40 to US$1,020. But there was one head scratcher for me... they feel Fairfax should be valued at 1 x BV. Really? After what we have seen Fairfax deliver over the past 3 years? And how they are poised moving forward? So late last night I decided to ask RBC (Scott) what he is seeing that I am missing. I'll let you know if/how he responds.

----------

RBC increased price target for Fairfax to US$1,020 (based on 1 x 2024YE book value). They forecast EPS of $151 in 2023 (up from $135), $140 in 2024 (up from $130) and $150 for 2025 (new).

From: VikingSubject: Fairfax QuestionDate: November 5, 2023 at 11:57:09 PM PSTTo: scott.heleniak@rbccm.comHello Scott. I am a long time RBC customer. I always enjoy reading your weekly research report on insurance and the companies in the P/C insurance space. It is a sector i have followed for about 20 years. I follow Chubb, WR Berkley and Fairfax pretty closely. Currently I only own shares in Fairfax.I have a question on Fairfax. Why do you have a price target of 1 x 2024YE book value? Clearly you are seeing something that I am missing. And I can’t pick it up reading your report (lots of good news and increases in estimates - similar to past quarters). My experience is P/C insurance companies that receive a 1 x BV multiple are ‘problem children:’ expected to deliver poor returns and are also poorly managed.My math says Fairfax will deliver an ROE of around 20% in 2023. Based on your earnings estimates for 2024 and 2025 (which are not aggressive) the company should deliver a mid-teens ROE. That would put them +15% average over 3 years. In 2022, Fairfax’s performance was best-in-class among P/C insurers (they actually grew BV). Weaving it all together, that type of performance (past and expected) is worth a multiple of 1 x 2024 BV?Fairfax is trading at a PE of 6 x earnings. With solid earnings expected in 2024 and 2025. That also looks very low (i.e. the stock looks very cheap at $900). Based on your earnings estimate, Fairfax will earn close to 50% of its market cap in three years (2023-2025). That type of actual and expected earnings is ‘worth’ a multiple of 1 x 2024BV?Is the issue poor operating earnings?- From 2016-2020 the average for operating earnings was $1 billion per year.

- In 2021 it doubled to $1.8 billion.

- In 2022 it tripled to 3.1 billion.

- In 2023 it is tracking to quadruple to $4.3 billion.

- In 2024 it will likely increase further (driven by interest income) to +$4.5 billion.

My guess is the increase in operating earnings we are seeing with Fairfax is best-in-class among P/C insurers.Operating income = underwriting profit + interest and dividend income + share of profit of associatesIs the issue capital allocation?- In late 2020 and early 2021 they initiated the total return swap position giving exposure to 1.96 million Fairfax shares. Their average cost was $372/share. This investment has made Fairfax shareholders over $1 billion in less than 3 years.

- In late 2021, Fairfax bought back 2 million shares at US$500/share. With shares trading today at $900 that is looking like a spectacular move for shareholders. (Total share count has come down more than 16% over the past 5 years.)

- In 2022, Fairfax sold their pet insurance business for $1.4 billion. This delivered shareholders a $992 million after tax gain. another big win for shareholders.

- In 2022, they sold their position in Resolute Forest Products for $626 million (plus $183 million CVR). They sold Resolute at the top of the lumber cycle; great decision for shareholders.

- In 2023, Fairfax announced they will be buying out partner Kipco to take their ownership in GIG to 90%. Smart strategic acquisition. When this transaction closes later this year it will significantly boost Fairfax’s insurance premiums and the investment portfolio. Another significant and solid move.

Fairfax also owns one of the fastest growing insurers in India - Digit. They seeded this company as a start-up in 2017 and their investment of $154 million is now worth over $2 billion. This positions Fairfax very well in what is expected to be the fastest growing economy in the world over the next decade (India).I could list many more examples… but I think you get my point. But wait, here is one more example…The best ‘capital allocation’ decision they have made in recent years is how they have navigated the bear market in bonds.They moved their $37 billion fixed income portfolio to 1.2 years average duration in late 2021 (sold their corporate bonds at a 1% yield and shifted to short term treasuries). In October of this year they have moved their $41 billion fixed income portfolio to 3.1 years average duration. These two moves were brilliant. They protected the company’s balance sheet (unlike other insurers, book value per share has grown meaningfully at Fairfax the last 2 years). And they now allow Fairfax to spike interest income - which doubled in Q3, 2023 compared to prior year. Fairfax is seeing a much quicker earn through to interest income from higher interest rates than other P/C insurers. A big win for shareholders.Is the issue quality of management?Well given the most important function for a management team is capital allocation, I can’t see a problem here (given what Fairfax has actually accomplished the past 5 years and especially the past 3 years).Is the issue Fairfax’s past?Yes, Fairfax messed up pretty badly from 2010-2016. However, it recognized its mistakes and got to work to fix them - and fixed them. It took a couple of years to turn the super tanker. From about 2018 Fairfax has been executing exceptionally well.When I weave it all together I see a company that is firing on all cylinders (insurance and investments). Most importantly, it is delivering a record amount of quality operating earnings and strong earnings overall - and extending the average duration of the bond portfolio to 3.1 years ensures interest income will be strong for the next three years. Fairfax's prospects have never looked better. Yes, the stock has been one of the best performing financial stocks over the past 3 years (up more than 200%). But the fundamentals have also been significantly improving. So even at US$900, the stock continues to look very undervalued.So again, I come back to my original question. A company that has delivered all that I quickly outlined above is worth 1 x 2024BV? I think you are a very hard marker Or, more likely, you see something that I am missing.

I try and be inquisitive and open minded. Clearly, I am not understanding something important regarding Fairfax. I would appreciate any feedback you are able to provide.Regards.Viking

Or, more likely, you see something that I am missing.

I try and be inquisitive and open minded. Clearly, I am not understanding something important regarding Fairfax. I would appreciate any feedback you are able to provide.Regards.VikingI received a response to my question to RBC regarding why they valued Fairfax at 1 x BV. Copied below is their response. I was impressed they got back to me.

----------

On Nov 8, 2023, at 6:41 AM:Hi (Viking),Fairfax has never traded with the peers you are citing (most of the time has been below book in recent years). I think there are a few factors to consider including Fairfax being a more complex business vs. some peers in terms of where they write business, international (not U.S. or Bermuda based), larger non-insurance exposures that can have volatility, larger equity exposures, track record, not trading on major U.S. exchanges, little analyst coverage. I don’t dispute your points but these are a few reasons (those could change over time) – not about the fundamentals of the business right now. Thanks for the email.Best,Scott -

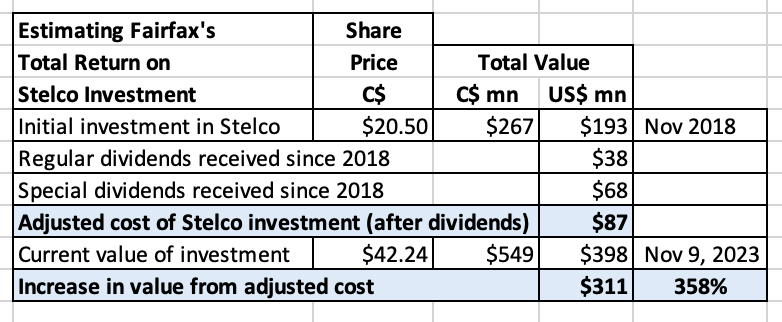

Nov 9: This post was updated to reflect the 12% increase in Stelco's stock price today.

----------

Stelco today (Nov

announced another special dividend of C$3/share, along with the regular quarterly dividend of C$0.42/share. Fairfax will earn a total of US$32 million, payable Nov 28, 2023. That will provide a nice bump to interest and dividend income in Q4 when Fairfax reports. Below is an update to the summary I have posted before on Stelco.

announced another special dividend of C$3/share, along with the regular quarterly dividend of C$0.42/share. Fairfax will earn a total of US$32 million, payable Nov 28, 2023. That will provide a nice bump to interest and dividend income in Q4 when Fairfax reports. Below is an update to the summary I have posted before on Stelco.

----------

In November of 2018, Fairfax invested US$193 million in Stelco, buying 13 million shares at C$20.50. At the time, it was a deeply contrarian purchase. I did not like it. It screamed ‘old Fairfax’ to me: buy a bad business in a bad industry. Boy, was I wrong.

What has made this such a good investment for Fairfax?

The CEO of Stelco, Alan Kestenbaum. Since buying Stelco out of bankruptcy in 2017 (via Bedrock Industries) he has been putting on a clinic in capital allocation. (I'll come back to this.)

Stelco Corporate Presentation Q3-2023

Here is a little more information of Kestenbaum’s initial investment in Stelco in 2017.

Purchase of Stelco out of bankruptcy: Bedrock gets steelmaker for less than $500 million

How has the investment performed for Fairfax?

Over the past 5 years, Fairfax has received dividend payments (regular and special) from Stelco of $106 million. This has reduced Fairfax’s cost base from $193 million to $87 million.

Fairfax’s investment in Stelco has a market value today of $398 million. Fairfax’s investment in Stelco is up $311 million or 358%. That is an amazing return over a 5-year period.

What are prospects for Stelco?

Very good; just like for the big US steelmakers.

Kestenbaum - Schooling the Steel Industry on Capital Allocation

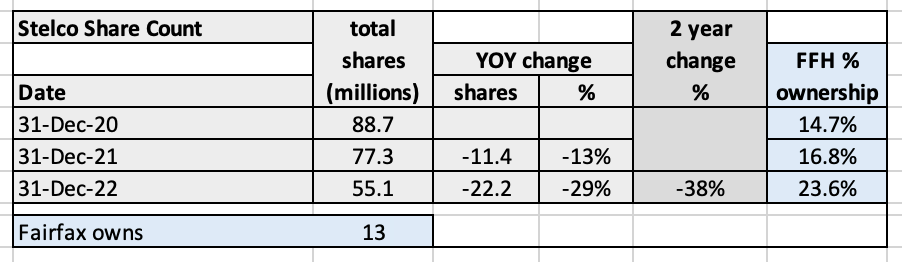

What did Stelco do with the earnings windfall from 2021 and 2022? He bought back stock 38% of shares outstanding. And he did not overpay. That was freaking brilliant.

Fairfax’s ownership in Stelco has increased from 14.7% to 23.6% - with no new money invested.

Two other brilliant moves by Kestenbaum:

- April 2020 - Minntac deal: 8-year supply agreement with option to purchase 25% of Minntac (the largest iron ore mine in the US) for $100 million – done when Covid was raging.

- June 2022: real estate sale of ‘Stelco lands’ for C$518 million. The timing of this sale is looking brilliant - at what might be close to the peak of Canada’s real estate bubble.

—————

Comments from Prem about Stelco from the 2022AR.

“2022 was an active and successful year for Alan Kestenbaum and the talented team at Stelco. The company ended the year with its second-best fiscal result since going public despite an approximately 50% decline in steel prices over the summer. Stelco is benefiting from the Cdn$900 million it has invested in its Lake Erie Works mill since 2017, which has made the mill one of the lowest-cost operators in North America. Stelco entered 2022 with an extremely strong balance sheet and put its capital to good use, completing three substantial issuer bids during the year, thereby repurchasing approximately 29% of its outstanding shares. These repurchases have resulted in Fairfax’s ownership increasing to 24% from 17% at the beginning of the year. In addition to share repurchases, Stelco paid a Cdn$3 per share special dividend and increased its regular dividend to Cdn$1.68 per share from Cdn$1.20 per share. Stelco maintains over Cdn$700 million of net cash on its balance sheet and we anticipate that it will continue to be active both investing in its operations and efficiently returning excess capital to shareholders. We are excited to continue as a significant investor in Alan Kestenbaum’s leadership at Stelco.” Prem Watsa – Fairfax 2022AR

Details of Stelco’s Hamilton land sale in 2022, for proceeds of $518 million.

“Stelco Holdings Inc. (TSX: STLC) (“Stelco” or the “Company”) announced today that its wholly-owned subsidiary, Stelco Inc., has successfully closed a sale-leaseback transaction with an affiliate of Slate Asset Management (“Slate”). Stelco Inc. has sold the entirety of its interest in the approximately 800-acre parcel of land it occupies on the shores of Hamilton Harbour in Hamilton, Ontario to Slate for gross consideration of $518 million. In conjunction with the sale, Stelco Inc. has entered into a long-term lease arrangement for certain portions of the lands to continue its cokemaking and value-added steel finishing operations at its Hamilton Works site in Hamilton, Ontario.”

Details of Stelco’s agreement with US Steel in 2020 to securing long term supply for iron ore pellets.

Stelco Announces Option To Acquire 25% Interest In Minntac, The Largest Iron Ore Mine In The United States, And Entry Into Long-Term Extension Of Pellet Supply Agreement With U.S. Steel

“Stelco will pay US$100 million, in cash, to U.S. Steel in consideration for the Option (the "Initial Consideration"). The Initial Consideration is payable in five US$20 million installments, with the first installment paid upon closing of the Option Agreement and the remaining four installments payable every two months thereafter. Upon the exercise of the Option, Stelco would pay a net exercise price of US$500 million.”

Transaction Highlights:

- Secures long-term future of Stelco's steel production and solidifies Stelco's low-cost advantage

- Provides supply of high-quality iron ore pellets from a well-understood and consistent source for the next eight years, or longer if the Option is exercised

- Increases annual pellet supply to level required for Stelco's higher production capacity following this year's blast furnace upgrade project

- Supports Stelco's tactical flexibility model to deliver highest margin outcomes based on prevailing market conditions

- Creates a secure pathway for Stelco to become a vertically integrated player in the future through ownership in a low-cost iron ore source which is the largest producing iron ore mine in the Mesabi iron range

- Structured in stages that will preserve Stelco's strong balance sheet and financial flexibility

-

Fairfax is on track to earn a record amount of operating earnings in 2023 of around $4.3 billion. My guess is it increases further in 2024 and 2025 to more than $4.5 billion each year.

At the same time, it appears the hard market is slowing. Of all P/C insurers, Fairfax appears to be the most disciplined today, with premium growth slowing to 5%.

When the hard market ends what is Fairfax going to do with its $4.5 billion in operating earnings?

If its share price falls $200 Fairfax will be buying Fairfax shares hand over fist. The gushing cash flow we are seeing today and in 2024 and 2025 are a perfect complement to the TRS-FFH position. Especially with the hard market in its late innings.