Viking

-

Posts

4,689 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

Fairfax is on track to earn a record amount of operating earnings in 2023 of around $4.3 billion. My guess is it increases further in 2024 and 2025 to more than $4.5 billion each year.

At the same time, it appears the hard market is slowing. Of all P/C insurers, Fairfax appears to be the most disciplined today, with premium growth slowing to 5%.

When the hard market ends what is Fairfax going to do with its $4.5 billion in operating earnings?

If its share price falls $200 Fairfax will be buying Fairfax shares hand over fist. The gushing cash flow we are seeing today and in 2024 and 2025 are a perfect complement to the TRS-FFH position. Especially with the hard market in its late innings.

Yes, there are risks to holding the TRS position. All investments have risks. I continue to think Fairfax shares are crazy cheap. 6 x normalized earnings? 1 x BV for a 15%ROE? The TRS position could easily gain +30% over the next year and +50% over the next 2 years. Ramping share buybacks higher are the ace in the hole.

-

26 minutes ago, Thrifty3000 said:

Maybe a 1x BV valuation is just another way of saying they don’t have enough reason to expect FFH’s long term ROE to exceed whatever discount rate they’re modeling.

@Thrifty3000 I could buy that if other P/C insurers were being valued the same way. Other P/C insurers have been significantly underperforming Fairfax for the past 4 years. The multiples RBC is using for companies is largely the same as it was 4 years ago (with some minor modifications). Please note, i am not complaining. How can i complain about a stock being up 200% in 3 years - that is still wicked cheap. Fairfax is climbing the wall of worry right now. -

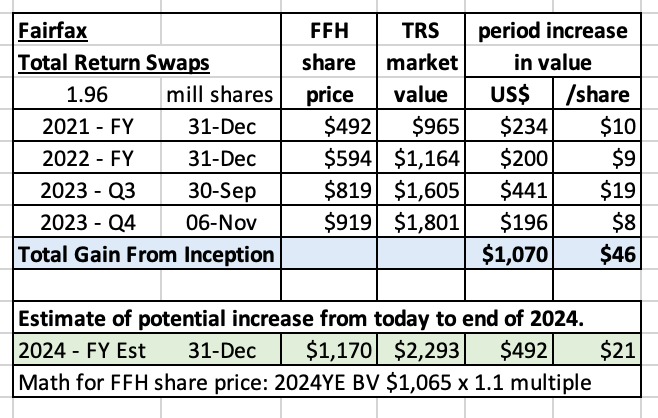

Below is an update to a previous post I did on the TRS-FFH position. In the last couple of days, the position passed the $1 billion mark in gains. I still have a hard time wrapping my head around this investment. It is a mind bender. And a fantastic investment. Could its best days still be ahead?

----------

Fairfax Total Return Swaps – 1.96 million shares

The table is set for total return swap (TRS-FFH) to become one of Fairfax’s best investments ever. As of today, the investment has a total value of $1.8 billion and it now shows a gain of $1.07 billion since inception (over the last 34 months). Already in Q4 the position is up another $196 million or $8/Fairfax share. Wow!

What about moving forward? I think it could deliver another $500 million in gains ($21/share) from today to the end of 2024. What are my assumptions? Fairfax earnings of about $160/share in 2024. And the company trades at a 1.1 x multiple to book value - which I estimate at $1,065/share at Dec 31, 2024. These look like pretty reasonable assumptions to me.

“We think this will be a great investment for Fairfax, perhaps our best yet!” This is what Prem said in his letter in the 2020 annual report when first describing this investment. Clearly, Fairfax was thinking big when they made this investment.

The genius of this single investment is still lost on most investors/analysts. Probably because the TRS is a non-traditional type of investment. So, it is largely ignored by investors/analysts in their analysis of the company and its potential impact on future earnings.

Well let’s do a deep dive on this investment to better understand just what I am talking about.

What is the TRS-FFH investment?

In late 2020 and early 2021, Fairfax purchased total return swaps giving it exposure to 1.96 million Fairfax shares with an average notional amount (cost) of US$373/share.

At the time, Fairfax had about 26.2 million effective shares outstanding, so this investment represented 7.5% of the company’s shares. Effective shares outstanding at the end of Q3, 2023 dropped to 23.1 million so this investment now represents 8.5% of the company’s shares.

Fairfax’s equity portfolio is about $16.5 billion in size. The TRS-FFH position currently has a market value of $1.8 billion = 11% of the total equity portfolio. This is Fairfax’s third largest equity position, slightly smaller than Poseidon and Eurobank. It is a very large investment for Fairfax.

Why did Fairfax make this investment?

Fairfax's stock was trading at a crazy cheap valuation in late 2020. It was, by far, the best investment opportunity available to Fairfax at the time. To state the obvious, it was an investment they understood very well. So, it was a very low risk and very high return opportunity.

Comments from Prem about the total return swap purchase from the 2020AR.

“Throughout much of last year (2020) following the pandemic-induced market plunge, I made public statements to the effect that our belief was that Fairfax shares were trading in the market at a ridiculously cheap price. In the summer I backed that up by personally purchasing close to $150 million of shares. Additionally, following our value investing philosophy, since the latter part of 2020 Fairfax has purchased total return swaps with respect to 1.4 million subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 per share). We think this will be a great investment for Fairfax, perhaps our best yet!” P.Watsa FFH 2020AR

Prem’s answer to question from Mark Dwelle (RBC) on the Q4 conference call in Feb 2021.

Mark Dwelle: “My second question relates to executing the total return swap with respect to Fairfax shares. I guess, I was just curious why you pursue that structure, rather than just buying back the stock, if you felt like that was the good opportunity? I mean, is this a capital constraint that you couldn't really buy back that much?”

Prem Watsa: “We have to be careful, right? So not so much -- yes, we have to be very careful in terms of how much we can buy back. When we looked at Fairfax as a stock price and looked at everything else that we could buy, which is not over return swap on Fairfax. Right now, we paid US$344 per shares, our book value is $478. I mean, if you want the math, just on our book value basis, we'd have about $200 million gain. And Fairfax stock price for book value is worth another 200 million. We just think it's a terrific investment and our total return swap structure was a very good way for us to do it. And so we did it.”

Why buy the TRS-FFH versus simply buying back stock?

Fairfax did not have the cash at the time to buy back a significant amount of Fairfax stock directly.

Again, from the Q4 2021 conference call.

Mark Dwelle: “I don't disagree with you that it was a good a good strike price, I guess it was really -- the form of the transaction rather than just actually buying the shares, using a derivative instead is just -- it's a little bit unusual. I haven't usually seen that with most of the companies that I've followed. So that was really my main question.”

Prem Watsa: “Yes, so, Mark, our point is just that we wanted to keep up -- we could -- where you have more than $1 billion in cash and the only company once -- or almost have down $375 million, we just wanted to be financially sound, and in all ways, as opposed to use that cash at this point in time.”

This investment demonstrates Fairfax’s management team at their best:

- Rational: best available opportunity

- Opportunistic: buy when the stock was crazy cheap

- Creative: didn’t have the cash to do a buyback. Hello TRS.

- Conviction: wanted to buy a significant stake. Hello TRS (leverage).

Simply a brilliant investment - especially given the circumstances.

What is the outlook and for this investment?

The outlook for this investment is very good. Despite the run up over the past 34 months, Fairfax’s stock price still looks cheap. This means the value of the TRS-FFH could be understated today. Having a low starting point matters greatly when calculating future returns for an investment.

Three possible catalysts:

- Record consistent cash flow: It looks promising for the next three years.

- Lower share count: Average decline of around 2% per year looks like a good estimate.

- Growing multiple to book value: Over time, Mr. Market will likely come to understand and appreciate the Fairfax story.

All three happening together could drive Fairfax’s stock price higher - which of course means the value of the TRS-FFH investment would also be driven higher. This investment is poised to continue to generate solid returns for Fairfax in the coming years.

What are sell-side analysts saying?

This group doesn’t know how to model Fairfax’s equity holdings. The FFH-TRS position is a head scratcher for this group. So, they ignore it. I am serious.

Most sell-side analysts estimate Fairfax will earn $140 to $150/share next year. That translates to a $300 million gain in the FFH-TRS position.

Most sell-side analysts estimate investment gains of about $500 to $600 million for Fairfax in 2024. That is for their total investment portfolio of $56.5 billion. Bonds and stocks. And FFH-TRS.

If my estimate is accurate and the FFH-TRS delivers $500 million in gains next year it means analyst estimates are likely way, way low.

What is the lesson here for investors?

Sell-side analysts are like a limb on the body of Mr. Market.

What does Ben Graham teach us about Mr. Market? He (she) is there to serve you – not to inform or advise you. Mr. Market often gets things wrong. You job as an investor is to profit from Mr. Markets mistakes.

A note on share buybacks

Capital allocation is one of the most important decisions for a management team. Fairfax has said they believe their stock is very undervalued. They have also said that as the hard market in insurance slows, they will look to use excess capital to buy back their stock more aggressively.

Fairfax is likely motivated to drive the share price higher. Every $100 increase in the share price equals a $200 million before-tax investment gain. The TRS-FFH investment makes share buybacks an even more compelling capital allocation decision for Fairfax.

Is the TRS-FFH investment like a buyback? The TRS-FFH is the next best thing to doing a big buyback. Buybacks are powerful because they improve per-share financial metrics: EPS & BVPS.

- Buybacks lower the denominator (per share). If the buyback is large and sustained – and pushes up the share price over time - the TRS position could gain significantly in value.

- At the same time, the TRS- FFH investment increases the numerator (earnings and BV).

Investors get a double benefit.

—————

Comments from Prem about the total return swap position from the 2022AR.

“During 2022 the company entered into $217.4 notional amount of long equity total return swaps for investment purposes. At December 31, 2022 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount of $1,012.6 (December 31, 2021 – $866.2), which included an aggregate of 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 (Cdn$935.0) or approximately $372.96 (Cdn$476.03) per share at December 31, 2022 and 2021. During 2022 the long equity total return swaps on Fairfax subordinate voting shares produced net gains of $255.4 (2021 – $222.7). Long equity total return swaps provide a return which is directly correlated to changes in the fair values of the underlying individual equities.” Prem Watsa – Fairfax 2022AR

Comments from Prem about the total return swap position from the 2021AR.

“For our stock price to match our book value’s compound rate of 18.2%, our stock price in Canadian dollars should be $1,335. And our intrinsic value exceeds book value, a principal reason being that our insurance companies generate huge amounts of float at no cost. This is the reason we continue to hold total return swaps with respect to 1.96 million subordinate voting shares of Fairfax with a total market value of $968 million at year-end.” Prem Watsa – Fairfax 2021AR

Comments from Prem about the total return swap position from the 2020AR.

“Throughout much of last year following the pandemic-induced market plunge, I made public statements to the effect that our belief was that Fairfax shares were trading in the market at a ridiculously cheap price. In the summer I backed that up by personally purchasing close to $150 million of shares. Additionally, following our value investing philosophy, since the latter part of 2020 Fairfax has purchased total return swaps with respect to 1.4 million subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 per share). We think this will be a great investment for Fairfax, perhaps our best yet!”

“Investment returns are very sensitive to end date values, so with a stock price of only $341 per share at the end of December 2020, our five and ten year and longer returns have been affected. We expect this to change as Fairfax begins to reflect intrinsic values again. Nothing that a $1,000 share price won’t solve!” Prem Watsa Fairfax 2020AR

Total Return Swap: Some Additional Details

The other major benefit of a total return swap is that it enables the TRS receiver to make a leveraged investment, thus making maximum use of its investment capital. Unlike in a repurchase agreement where there is a transfer of asset ownership, there is no ownership transfer in a TRS contract.

This means that the total return receiver does not have to lay out substantial capital to purchase the asset. Instead, a TRS allows the receiver to benefit from the underlying asset without actually owning it, making it the most preferred form of financing for hedge funds and Special Purpose Vehicles.

There are several types of risk that parties in a TRS contract are subjected to. One of these is counterparty risk. When a hedge fund enters into multiple TRS contracts on similar underlying assets, any decline in the value of these assets will result in reduced returns as the fund continues to make regular payments to the TRS payer/owner.

If the decline in the value of assets continues over an extended period and the hedge fund is not adequately capitalized, the payer will be at risk of the fund’s default. The risk may be heightened by the high secrecy of hedge funds and the treatment of such assets as off-balance sheet items.

Both parties in a TRS contract are affected by interest rate risk. The payments made by the total return receiver are equal to LIBOR +/- an agreed-upon spread. An increase in LIBOR during the agreement increases payments due to the payer, while a decrease in LIBOR decreases the payments to the payer. Interest rate risk is higher on the receiver’s side, and they may hedge the risk through interest rate derivatives such as futures.

https://corporatefinanceinstitute.com/resources/derivatives/total-return-swap-trs/

-

13 minutes ago, MMM20 said:

@Viking have you heard back from these analysts when you’ve contacted them in the past? My understanding is you shouldn’t expect a response (at least not much more than a sentence) unless you’re managing $100mm+ and/or paying RBC a whole lot of commissions. But anyway, that email is a great summary of the situation.

@MMM20 , in the past I emailed Mark Dwelle at RBC. He got back to me... and said he was impressed that someone was actually reading his reports on P/C insurance. Cracked me up at the time. I think he retired a couple of months ago. I really enjoyed reading Mark's stuff... he educated readers, was thorough and had a wicked sense of humour. I am wondering if Scott is perhaps US based and just doesn't follow Fairfax.

-

RBC sent out their research report on Fairfax last night. It was pretty positive on the company - with earnings estimates increased. Price target was increased by US$40 to US$1,020. But there was one head scratcher for me... they feel Fairfax should be valued at 1 x BV. Really? After what we have seen Fairfax deliver over the past 3 years? And how they are poised moving forward? So late last night I decided to ask RBC (Scott) what he is seeing that I am missing. I'll let you know if/how he responds.

----------

RBC increased price target for Fairfax to US$1,020 (based on 1 x 2024YE book value). They forecast EPS of $151 in 2023 (up from $135), $140 in 2024 (up from $130) and $150 for 2025 (new).

From: VikingSubject: Fairfax QuestionDate: November 5, 2023 at 11:57:09 PM PSTTo: scott.heleniak@rbccm.comHello Scott. I am a long time RBC customer. I always enjoy reading your weekly research report on insurance and the companies in the P/C insurance space. It is a sector i have followed for about 20 years. I follow Chubb, WR Berkley and Fairfax pretty closely. Currently I only own shares in Fairfax.I have a question on Fairfax. Why do you have a price target of 1 x 2024YE book value? Clearly you are seeing something that I am missing. And I can’t pick it up reading your report (lots of good news and increases in estimates - similar to past quarters). My experience is P/C insurance companies that receive a 1 x BV multiple are ‘problem children:’ expected to deliver poor returns and are also poorly managed.My math says Fairfax will deliver an ROE of around 20% in 2023. Based on your earnings estimates for 2024 and 2025 (which are not aggressive) the company should deliver a mid-teens ROE. That would put them +15% average over 3 years. In 2022, Fairfax’s performance was best-in-class among P/C insurers (they actually grew BV). Weaving it all together, that type of performance (past and expected) is worth a multiple of 1 x 2024 BV?Fairfax is trading at a PE of 6 x earnings. With solid earnings expected in 2024 and 2025. That also looks very low (i.e. the stock looks very cheap at $900). Based on your earnings estimate, Fairfax will earn close to 50% of its market cap in three years (2023-2025). That type of actual and expected earnings is ‘worth’ a multiple of 1 x 2024BV?Is the issue poor operating earnings?- From 2016-2020 the average for operating earnings was $1 billion per year.

- In 2021 it doubled to $1.8 billion.

- In 2022 it tripled to 3.1 billion.

- In 2023 it is tracking to quadruple to $4.3 billion.

- In 2024 it will likely increase further (driven by interest income) to +$4.5 billion.

My guess is the increase in operating earnings we are seeing with Fairfax is best-in-class among P/C insurers.Operating income = underwriting profit + interest and dividend income + share of profit of associatesIs the issue capital allocation?- In late 2020 and early 2021 they initiated the total return swap position giving exposure to 1.96 million Fairfax shares. Their average cost was $372/share. This investment has made Fairfax shareholders over $1 billion in less than 3 years.

- In late 2021, Fairfax bought back 2 million shares at US$500/share. With shares trading today at $900 that is looking like a spectacular move for shareholders. (Total share count has come down more than 16% over the past 5 years.)

- In 2022, Fairfax sold their pet insurance business for $1.4 billion. This delivered shareholders a $992 million after tax gain. another big win for shareholders.

- In 2022, they sold their position in Resolute Forest Products for $626 million (plus $183 million CVR). They sold Resolute at the top of the lumber cycle; great decision for shareholders.

- In 2023, Fairfax announced they will be buying out partner Kipco to take their ownership in GIG to 90%. Smart strategic acquisition. When this transaction closes later this year it will significantly boost Fairfax’s insurance premiums and the investment portfolio. Another significant and solid move.

Fairfax also owns one of the fastest growing insurers in India - Digit. They seeded this company as a start-up in 2017 and their investment of $154 million is now worth over $2 billion. This positions Fairfax very well in what is expected to be the fastest growing economy in the world over the next decade (India).I could list many more examples… but I think you get my point. But wait, here is one more example…The best ‘capital allocation’ decision they have made in recent years is how they have navigated the bear market in bonds.They moved their $37 billion fixed income portfolio to 1.2 years average duration in late 2021 (sold their corporate bonds at a 1% yield and shifted to short term treasuries). In October of this year they have moved their $41 billion fixed income portfolio to 3.1 years average duration. These two moves were brilliant. They protected the company’s balance sheet (unlike other insurers, book value per share has grown meaningfully at Fairfax the last 2 years). And they now allow Fairfax to spike interest income - which doubled in Q3, 2023 compared to prior year. Fairfax is seeing a much quicker earn through to interest income from higher interest rates than other P/C insurers. A big win for shareholders.Is the issue quality of management?Well given the most important function for a management team is capital allocation, I can’t see a problem here (given what Fairfax has actually accomplished the past 5 years and especially the past 3 years).Is the issue Fairfax’s past?Yes, Fairfax messed up pretty badly from 2010-2016. However, it recognized its mistakes and got to work to fix them - and fixed them. It took a couple of years to turn the super tanker. From about 2018 Fairfax has been executing exceptionally well.When I weave it all together I see a company that is firing on all cylinders (insurance and investments). Most importantly, it is delivering a record amount of quality operating earnings and strong earnings overall - and extending the average duration of the bond portfolio to 3.1 years ensures interest income will be strong for the next three years. Fairfax's prospects have never looked better. Yes, the stock has been one of the best performing financial stocks over the past 3 years (up more than 200%). But the fundamentals have also been significantly improving. So even at US$900, the stock continues to look very undervalued.So again, I come back to my original question. A company that has delivered all that I quickly outlined above is worth 1 x 2024BV? I think you are a very hard marker Or, more likely, you see something that I am missing.

I try and be inquisitive and open minded. Clearly, I am not understanding something important regarding Fairfax. I would appreciate any feedback you are able to provide.Regards.Viking

Or, more likely, you see something that I am missing.

I try and be inquisitive and open minded. Clearly, I am not understanding something important regarding Fairfax. I would appreciate any feedback you are able to provide.Regards.Viking-

1

1

-

10 hours ago, steph said:

I have always been amazed by Brian Bradstreet and I am surprised he is not better known. He is a true legend. I suppose Bill Gross had a good track record in bond investing, but nobody comes even close to Brian’s track record. And in the end, fixed income is the most important part of the portfolio of any insurance company.

@steph , I agree. Over the past 2 years, have we just witnessed the one of the greatest investments in the recent history of the P/C insurance industry? When he retires (hopefully not any time soon), my guess is Brian Bradstreet will be a unanimous selection for entry into the fixed income Hall of Fame for P/C insurers. Yes, that sounds like hyperbole. But outside of Berkshire Hathaway, can anyone provide me with a better example?

1.) aggressive move to 1.2 years average duration late 2021. Selling all corporates (locking in realized gains) and moving into treasuries. This protected Fairfax’s balance sheet.2.) aggressive move to 3.1 years average duration in Oct 2023 with the long end of the curve around 5%. This locks in record/high interest income for the next 3 years.

The team at Fairfax just successfully navigated Fairfax (and Fairfax shareholders) through the greatest fixed income bear market in history. The bond market was in a bubble of epic proportions - and it popped in late 2021 and 2022. It will take years for the carnage to fully play out (it is still mostly hidden on balance sheets).How many billions did this freaking crazy set of decisions make Fairfax shareholders over the past 2 years? Does anyone have an estimate of what the financial benefit to Fairfax shareholders has actually been?

- The avoidance of losses?- The ability to quickly pivot into higher yielding fixed income instruments?

- And now the extension of duration locking in higher yields (likely in the 5% range)?

This string of decisions was done with a portfolio close to $40 billion in size. WTF?

And the table is now set for Fairfax to earn in the range of $2 billion in interest and dividend income in each of the next 4 years. Add underwriting profit and share of profit of associates and you are over $4 billion per year. My guess is some people on this board do not yet grasp the significance of what Prem opened the Q3 conference call with - so is it surprising Mr Market doesn’t get it yet?

Q3 Conference Call - Prem: “As I've said for the last number of quarters, the most important point I can make for you is to repeat what I have said in the past. For the first time in our 37-year history, almost 38 years now, I can say to you we expect, of course no guarantees, our operating income to be more than $3 billion annually for the next three years.” (Edit: this number is now comically low…).

“Operating income consisting of $1.5 billion-plus from interest and dividend income we earned $1.4 billion year-to-date, $1 billion from underwriting profit, we made $943 million year-to-date, and $500 million from associates and management companies versus $1 billion year-to-date. This works out to be over $100 per share after interest expenses overhead and taxes.” (Edit: Fairfax has exceeded their annual guidance in 9 months…)

“We continue to exceed our expectations for the year with the year-to-date operating income already at $3.1 billion, excluding the effects of discounting and risk margin. Fluctuations in stock and bond prices will be on top of that. And this only really matters, as I've said many times, over the long-term.”

(Edit: this is the really important part) “Recently, in October, during spike in treasury yields, we have extended our duration to 3.1 years with an average maturity of approximately 4 years, and yield of 4.9%.”

(Edit: and the table is set for the next possible move) “In the next four years, we are likely to have a recession in the United States, resulting in corporate spreads widening, allowing us to extend our maturities further.”—————

Fairfax detractors say “yes, earnings are great in 2023 but they are not sustainable.” Well, we have just learned earnings ARE sustainable.

$150/share is the new baseline for earnings. This number should grow nicely over time (as capital allocation and compounding work their magic).

What is an appropriate PE? 8X is low. That would be a share price of US$1,200.

What is an appropriate P/BV? 1.3 is low (given a +20% ROE in 2023 and high teems ROE likely continuing for the next few years). That would be a share price of about $1,200 (assuming BV comes in around $920 at year end).

So US$1,200/share looks like a cheapish reasonable valuation for today. Add in E$160/share in earnings in 2024 and that would bump the share price to $1,360 as a reasonable target looking out 12 months. Shares closed Friday at $897. That suggests significant return potential over the next 12 months. Despite the stellar run up over the past 3 years, Fairfax's shares still look significantly undervalued to me. The gift that keeps on giving...

-

1

1

-

-

58 minutes ago, UK said:

Yes, it is second thing I am not sure how awesome it is:). Seems this makes up some 31 per cent of total pretax earnings in Q3 (24 percent in 9M). Excluding this, EPS would be ~30 USD, much closer to analyst estimates for the quarter. Not sure how to think about this item, making up almost 1/3 of the earnings, but dynamics of which nobody seems fully understand:)

Not sure how to estimate net insurance liabilities change in the Q3, but I suspect (or am afraid), this thing is much more change in discount (interest) rate, than change in reserves, driven. Somebody should just ask on the earnings call plain and simple, if this damned thing will reverse as quickly as it grew, if interest rates will go substantially lower in the future.

@UK , thanks for attaching the screen shot from Fairfax’s Q3 report. Yes, it would be good to get your question answered: “Somebody should just ask on the earnings call plain and simple, if this damned thing will reverse as quickly as it grew, if interest rates will go substantially lower in the future.”But with Fairfax extending duration of their fixed income portfolio, if interest rates decline they will get a large unrealized gain. Perhaps the two (average duration of insurance liabilities and fixed income portfolio) largely offset each other now. I am not concerned - but i need to keep learning.

The important things for me are:

1.) underwriting - CR

2.) yield/duration of fixed income portfolio

3.) quality/performance of equity holdings

4.) shares outstanding

5.) capital allocation decisions

Quarterly movements in the value of the fixed income or equity portfolio or now insurance liabilities (IFRS 17) is largely just noise. Every quarter there are puts and takes with each - so i would like to understand them.

-

Great quarter. I am travelling so my comments will be short. Below are some answers to the questions I asked a couple of days ago. The conference call in the morning will provide some more answers. The big news is the extension of duration of the bond portfolio.

1.) Topline growth? Slowing from 8% to 5%.

- This is lower growth than peers.

- Positive if this means Fairfax is exercising discipline when it comes to underwriting.

2.) underwriting profit/CR? Very strong 95%

- CR was 100.3% in Q3 2022

- CR was 93.9% in 1H 2023

- Is Fairfax moving up the quality chain (of insurers) when it comes to underwriting?

- After Q3 results, can you still say Markel is a better underwriter than Fairfax?

3.) Interest and dividend income for Q3? $512.7 = +100% to prior year. Right around what I had modelled.

- Q1 = $382.3 million

- Q2 = $464.6

- Q3 2022 = $256.5

4.) Average duration of bond portfolio? We should learn this on the conference call.

- At Q2, it was 2.4 years

- What Fairfax has done here is likely the most significant development of the quarter.

5.) Share of profit of associates? $291.5 = much stronger than expected.

6.) Investment gains (losses): $56 (see chart)

- Equities = +$273 million

- Bonds = - $196.6

7.) IFRS 17 offset (effects of discounting and risk adjustment): looks to me like it was a big tailwind about $450 million? Big number, if my estimate is accurate.

8.) Share buybacks during quarter?

- At September 30, 2023 there were 23,115,838 common shares effectively outstanding.

9.) Book value? $876.55

- Q2 = $834/share

10.) GIG update - still expected to close in 2023? Yes.

-

4 hours ago, SafetyinNumbers said:

How long would you extend duration?

Do we know what the average duration of Fairfax’s insurance liabilities are?

As an investor, a risk to Fairfax is if short term interest rates crater. How? Bad recession in 2024. Or something breaking in financial system causing central banks to aggressively ease. Not a base case. This would likely cause interest income to decline.

It makes sense to me to get average duration on fixed income closer to average duration of liabilities. Because, with the move up in yields further out on the curve, you are (finally) getting paid for duration today. (And you were not for much of the past decade.)

As an investor i like certainty - so i am hopeful they extend duration. 2.6 years? 2.8 years? WR Berkely, who is also at 2.4 years average duration telegraphed on their call that they may begin to extend duration of their fixed income portfolio.Having said that, Fairfax has many factors to consider when deciding on average duration of their fixed income portfolio. What i might want as an investor is not on their list of factors (and it shouldn’t be). They have a very good fixed income team. They will have good reasons for whatever average duration they report with Q3 results.

-

5 hours ago, StubbleJumper said:

That nicely summarizes the principal levers. A couple of comments:

I am looking forward to seeing the interest and dividend number for Q3. I think you've significantly improved the method for estimating interest income, so it will be interesting to see how closely reality tracks your estimate. I suspect it will track reasonably well.

Thinking back to Q3, wasn't it a reasonably light Q3 for cats? Usually Q3 is the worst for hurricanes and other nasty weather, but I'm having trouble recalling much in the way of really large storms. I guess Hilary was a remarkable storm, but my recollection was that the insurable damage wasn't too bad. I think we will be pleasantly surprised for Q3's CR.

SJ

@StubbleJumper , i am with you. Interest and dividends is the number i am looking forward to seeing the most. Duration? Composition (any shift into corporates)? The problem with a quarterly forecast is Fairfax is probably pretty active each quarter and we don’t know what amount is actually maturing each quarter. So we will see…

Joseph Wang (the Fed Guy) has nailed the move higher in interest rates over the past year. He thinks interest rates might be in the peaking at current levels (for now). Might be a good time to lock in some duration. Pretty much everyone is in the higher for longer camp today… and a year ago everyone thought a recession was imminent (they were completely wrong). Locking in duration looks like such fat pitch right now.

-

With Fairfax set to report Q3 results after markets close on Thursday here are a few of the things i will be looking for:

1.) Topline growth?

- Over or under recent trend of 8%?

- What is outlook for remainder of 2023 and outlook for hard market for 2024?

2.) underwriting profit/CR?

- CR was 100.3% in Q3 2022

- CR was 93.9% in 1H 2023

3.) Interest and dividend income for Q3?

- Q1 = $382.3 million

- Q2 = $464.6

- Q3E = $521?

- Q3 2022 = $256.5

4.) Average duration of bond portfolio?

- At Q2, it was 2.4 years

5.) Share of profit of associates?

- What is build: Eurobank, Poseidon, Exco, other?

6.) Investment gains (losses):

- Equities: tailwind

- Fixed income: headwind

- IFRS 17 offset: small tailwind

7.) Share buybacks during quarter?

- Is there any commentary about future buybacks on conference call?

8.) Book value?

- Q2 = $834/share

9.) GIG update - still expected to close in 2023?

-

1 hour ago, Spekulatius said:

Looks like he gave it exactly 10 years and then calls it quits.

Or the board has decided that it/Blackberry needs to move on from John. I don’t follow Blackberry (to much personal baggage for me). -

4 hours ago, Spekulatius said:

I think the direction of interest rates determined the outcome here. Rising and now higher for longer interest rates are detrimental to the private equity model, especially the Brookfield variant where they hold large stakes in subsidies.

The high leverage packed on assets works both ways great when prices move up and interest rates go lower, but mot so much when things go the other way.

@Spekulatius , i agree interest rates have been a big factor. But Fairfax’s performance has also been driven by many other very good decisions my management:1.) buying total return swaps giving the company exposure to 1.96 million Fairfax shares at a cost of $373; this has delivered about $900 million so far.

2.) buying back 2 million shares at $500/share.

The creativity to execute these two deals was exceptional.

3.) selling pet insurance for $1.4 billion ($992 million after tax gain) was exceptional.

There have been many more smaller ‘decisions’ made over the past three years that have worked out very well for Fairfax shareholders. In short, ‘active management’ has also worked out exceptionally well in the current whipsaw financial/economic environment.

-

2 hours ago, Whensthepaintdry? said:

These were awesome posts to read through. I’m Curious, what made you pick BAM other than youth for the 10 year hold? Especially since you nailed the Fairfax call so well I would of expected you to go with Fairfax.

Of the three companies, BAM was (is) the company i understand the least. Back in Nov 2020, i voted largely based on Flatt’s public reputation/track record over previous decade. @dealraker ‘s posts on BAM have got me thinking a little more critically about Flatt and BAM/BN today.

What is interesting is the turnaround in the business results of Fairfax. And the reputation of the company and Prem. Far exceeded what anyone thought possible three years ago. Reinforces the importance of doing the work, trusting the analysis, acting on the findings, monitoring the situation. It really has been a crazy three year period.

-

This thread is awesome. It is always a little humbling to read what you posted a year ago… even more so 2 years ago. A key learning? Be inquisitive. Be open minded. And when the facts change… update your thesis/views.

The changes in the macro environment has been crazy the past 3 years. The lingering effects of Covid (from goods to services). Inflation spiking to double digit high levels. Historic swing in interest rates. Bear markets in stocks and bonds. Emergence of of authoritarian China. De-globalization. War in Ukraine - accelerating the decline of Russia. War in the middle east. So much going on that significantly impacts intrinsic value of all companies.

-

@treasurehunt and @UK , it is important to note that Evan Greenberg (and Rob Berkley) do a good job of talking their own book on conference calls. So i do take what they say with a grain of salt…

I think the point that Evan is trying to make is, at least on the casualty side, the risk of future inflation is likely higher than what most insurers have modelled. So they need rate today to get prepared for what might happen in the coming years.

It also sounds like some European reinsurers have said current levels of social inflation (legal costs) for casualty are higher than they expected/modelled. Both WRB and Chubb laughed at this (the being surprised part).

The other aspect, as @vinod1 points out, is duration of fixed income portfolio matters. Chubb has an average duration of about 4.6 years so the benefit of higher interest rates will take a couple of years to play out. However, for short duration fixed income portfolios like Fairfax and WRB - who are at 2.4 years, they will see the benefit of higher interest income much more quickly. But i think Fairfax and WRB are outliers (in P/C insurance) with such short duration in their fixed income portfolios. And both are focussed on profitability - not market share.

Bottom line, for most insurers, the risk of inflation/rising costs is offsetting a chunk of the slow increase they are seeing in interest income. So they need to be very careful until they know what is happening with inflation and its impact on loss costs.

—————

Personal lines/auto insurance looks like it has been a hot mess that past couple of years. This line is not out of the woods yet. My guess is insurers where auto is a big part of their business are needing to keep their margins high in non-auto lines to keep their overall profitability and return targets in line.

—————

The renewed increase in interest rates in Q2 and Q3 is causing another round of large unrealized losses in fixed income portfolios for P/ insurers - leading to stagnant to declining book values. This likely is keeping P/C insurers rational on the growth/pricing front. With book values declining significantly at lots of P/C insurers over the past 18 months my guess is ratings agencies / regulators today will not be happy with insurers who get stupid with pricing in an attempt to aggressively grow market share. The last thing a management team at a P/C insurer wants right now is to be put on a ratings watch/downgrade.

—————

Please note, i am not an insurance expert. My comments above could be way off base.

-

Many sceptics who follow P/C insurance companies are waiting with baited breath for the hard market to end. High interest rates HAVE TO cause the end of the hard market. Right? Well, maybe not. Why? Chubb provided some context on the casualty side of the insurance business. It looks to me like 2024 could see similar top line growth as 2023 of 8 to 10%. Similarly, company combined ratios could also come in similar to 2023. Excellent news for P/C insurance companies if that is what happens.

From the Chubb Q3 conference call:

Brian Meredith

…Evan, a little bigger picture here, just thinking about just generally, the casualty lines here. As you kind of pointed out, really attractive combined ratios that you're printing and in the industry in general. And now we're also looking at long-term interest rates that are, gosh, decade high, right? Are we seeing any weakness at all from a pricing perspective? Do you anticipate that's going to start happening here in the next 12 months, just given the return profile of the business and how attractive it is?

Evan Greenberg

I haven't seen it really, because higher interest rates are also a proxy for loss cost inflation. So, you've got an industry that I think is trying to stay on top of loss cost or has that impetus behind them to stay on top of loss cost in casualty. And other than in workers' comp, it hasn't been totally benign as you well know, and it's been around for a while. So, I think that higher yields are ameliorating.

And by the way, if you do the math and you translate the higher yields to what it means to earn the same return, what combined ratio affect you would get to achieve the same return, it's modest in combined ratio relatively, 1 point here, 1 point there. It’s not like, wow, I can raise my combined ratio by 5 points to achieve the same 15%, as an example, risk-adjusted return. No, you can't, and we run the math.

-

Chubb reported results yesterday. Lots of the same themes as WRB… hard market is not ending. Investment income is increasing. Chubb is a well run P/C insurer; very good at the insurance side of the business.

Investments

- Portfolio yield finished Q3 at 4.1%; was 3.4% a year ago.

- Average reinvestment rate is 6.2%.

- investment income was up 34% in the quarter.

—————

The question and answer below made me think of Fairfax and the international insurance platform they have patiently been building out over the past 20 years. Not just in SE Asia, but also in India.—————

From the Chubb Q3 conference call:

Alex Scott

Hi. I wanted to ask about the environment broadly in Asia, across the different countries… Where do you see the growth opportunities looking ahead?

Evan Greenberg

…Asia and North America are the two regions, I think that will have the greatest economic growth potential over the next decade or two.

And Asia, get out of China, Asia is very vibrant, very dynamic. North Asia, older population. Southeast Asia with over 700 million people, young populations, and those economies are growing more quickly and they're emerging. Look at Vietnam today. Look even where Indonesia is going today. Singapore, those markets are all -- and Thailand, those markets are so dynamic with a lot of opportunity, but it's hard work.

You have to really know those markets, and we've been there for decades. And we have spent the time to build and build and build capability on a local market basis. It's nothing to say you're in Asia. It's where are you in your capability in Thailand or Vietnam or any of these markets. They're distinct and you've got to have local capability, knowledge and a good command and control around underwriting. I'm very energized about what I see for this company over time in Asia. And I think it will continue to represent over time a greater share of our business.

-

Below are some of my key take-aways from WR Berkley’s earnings. They have very low duration with their fixed income portfolio. As a result, interest income is spiking higher. At the same time, we are in a hard market in insurance - top line growth is very good and underwriting profit is very good.

P/C insurance is in the sweet spot right now. Both investments and insurance are gushing cash. But P/C insurance is such a small segment of the overall market… few seem to be noticing. Well, WRB shares have popped higher the past 2 days so perhaps this is changing.

Because of unrealized losses from bonds, despite strong EPS, book value per share has gone sideways the past 2 quarters at WRB. But WRB has very low duration on their fixed income portfolios. It will be interesting to see what reported BV/share for other insurers come in at when they report.

WR Berkey Q3 results: a few key take-aways

1.) hard market continues to roll along. Top line growth actually ticked higher to 10.5%2.) investment income is popping higher

- Book yield 4.5%

- Average duration is still short at 2.4 years.

- new money yield is 6% up from 5.4% in Q2

3.) book value per share was flat quarter over quarter

- Q3 = $26.80

- Q2 = $26.74

- Q1 = $26.45

4.) reported ROE was 19.8%

“Record quarterly net investment income of $271 million grew by 33.6% with the core investment portfolio increasing by 59.3%. There are two main drivers for the significant increase in the core portfolio, including the rising interest rate environment benefiting the reinvestment of fixed-maturity securities as they mature or are redeemed. And second, the increase in the size of the portfolio, due to continuous record levels of operating cash flows.”

“As of September 30, 2023, reflected in common stockholders equity are after-tax unrealized investment losses of $944 million an unrealized currency translation losses of $379 million. As of December 31, 2022, after tax unrealized investment losses were $893 million an unrealized currency translation losses were $372 million.”

-

Well, it appears what is going on in the middle east is a big nothing-burger for financial markets. The S&P started the week around 4,300 and appears set to finish the week higher at 4,330. Bonds have had a minor sell off, but only further out on the curve. Good to know! Phew, what a relief!

Of course, I jest with my post above. I continue to think financial markets are not respecting the tail risks of what is likely to come in the middle east in the coming weeks and months. My read is the real war has not started yet. How will it play out? No idea. And that is my point. It looks to me like financial markets are whistling past the graveyard. Of course, I could be completely wrong. And that is what i love about financial markets.

-

I don’t think the middle east is de-escalating. The ante keeps getting raised. What if neither side is bluffing?

—————

Israel Orders More Than 1 Million People to Leave Northern Gaza

Gazan officials told Palestinians not to comply. The U.N. said the order to relocate about 1.1 million people would lead to “devastating humanitarian consequences.”

https://www.nytimes.com/live/2023/10/13/world/israel-gaza-war-hamas

—————

Iran Says New Front Possible If ‘Israeli War Crimes’ Continue

Iran-backed militants could open a new front in Israel’s war against Hamas if the blockade of Gaza and “war crimes” there continue, Iran’s Foreign Minister said, signaling a potential expansion of the conflict.

-

8 hours ago, Thrifty3000 said:

@Thrifty3000 and @UK and @SafetyinNumbers (and others), thanks for wading in on this topic. It is great to be able to get others perspectives and debate ideas. Slowly I am learning (yes, I hate that when it happens!).

I have made a few changes to my 2023-2025 forecasts for Fairfax, based on the feedback I have been getting from my last update (just a couple of days ago). I think I have said before, I am constantly updating my model to reflect 'new news' (usually weekly). Please keep the questions and comments coming... I will keep making updates to my model and I will keep the updates coming. Continuous improvement is out goal...

1.) For 2024 and 2025, I adjusted 'Effect of discounting and risk-adjustment' down. The 2023 number has been increasing as interest rates rise. My assumption for 2024 and 2025 is interest rates stay roughly where they are today - of course, this will likely not be the case. So, I think it makes sense to go with a lower number for 2024 and 2025. Is this number still too high? Too low? Not sure. Like all the other numbers in the spreadsheet, I'll keep an open mind and adjust as needed moving forward.

2.) For 2023, I adjusted 'Effect of discounting and risk-adjustment' up and 'Net gains (losses) on investments' down to reflect the continued increase in bond yields in Q3. Currency will also be a headwind for Fairfax in Q3, given the US$ strength.

Putting it all together, my new forecast is earnings of about $150/share in 2023 and around $160/share in 2024 and 2025.

The bear market in bonds had an impact on Fairfax in Q2, 2023. It will be the same in Q3, 2023. So today I am thinking earnings in Q3 might come in closer to $20/share (unrealized losses on bonds/currency will be the headwind). That would put Q4 earnings closer to $40-$45, which seems reasonable (and assumes the GIG acquisition closes in Q4).

Please keep the questions coming... the more questions/discussion/debate the better.

-

9 hours ago, Thrifty3000 said:

@Viking why are you adding $480 annually for this adjustment? If you're assuming interest rates remain flat wouldn't that make the annual adjustment for this $0? And, wouldn't that reduce the EPS by around $20 per share in 2024 and 2025?

@Thrifty3000 I don’t think i can give a better explanation than @SafetyinNumbers has already provided. I would appreciate others providing their thoughts - that CofBF collective wisdom thing.

‘My estimate here could be a little messed up.’ Bottom line, i am still learning about this bucket. It will take me a few more quarters to better understand the build and see how this number evolves at Fairfax. As i learn more i will update my forecasts.

-

1 hour ago, Sweet said:

My thinking is this. Israel will need Western arms and support if there is a large scale war in the Middle East. I don’t think they take any action without running it by their Western partners.

Example - if they strike against Iran they will make sure that the Americans at the very least are in their corner and willing to go to war with Iran too.

@Sweet My read is Israel is going to do whatever they think they need to do to crush Hamas once and for all… with or without the support of the West.

Fairfax stock positions

in Fairfax Financial

Posted · Edited by Viking

Nov 9: This post was updated to reflect the 12% increase in Stelco's stock price today.

----------

Stelco today (Nov announced another special dividend of C$3/share, along with the regular quarterly dividend of C$0.42/share. Fairfax will earn a total of US$32 million, payable Nov 28, 2023. That will provide a nice bump to interest and dividend income in Q4 when Fairfax reports. Below is an update to the summary I have posted before on Stelco.

announced another special dividend of C$3/share, along with the regular quarterly dividend of C$0.42/share. Fairfax will earn a total of US$32 million, payable Nov 28, 2023. That will provide a nice bump to interest and dividend income in Q4 when Fairfax reports. Below is an update to the summary I have posted before on Stelco.

----------

In November of 2018, Fairfax invested US$193 million in Stelco, buying 13 million shares at C$20.50. At the time, it was a deeply contrarian purchase. I did not like it. It screamed ‘old Fairfax’ to me: buy a bad business in a bad industry. Boy, was I wrong.

What has made this such a good investment for Fairfax?

The CEO of Stelco, Alan Kestenbaum. Since buying Stelco out of bankruptcy in 2017 (via Bedrock Industries) he has been putting on a clinic in capital allocation. (I'll come back to this.)

Stelco Corporate Presentation Q3-2023

https://s201.q4cdn.com/143749161/files/doc_earnings/2023/q3/presentation/Q3-2023-Earnings-Presentation-FINAL.pdf

Here is a little more information of Kestenbaum’s initial investment in Stelco in 2017.

Purchase of Stelco out of bankruptcy: Bedrock gets steelmaker for less than $500 million

https://www.thespec.com/business/stelco-deal-bedrock-gets-steelmaker-for-less-than-500-million/article_da943b70-1a93-5a35-acb4-92a6da05946a.html?

How has the investment performed for Fairfax?

Over the past 5 years, Fairfax has received dividend payments (regular and special) from Stelco of $106 million. This has reduced Fairfax’s cost base from $193 million to $87 million.

Fairfax’s investment in Stelco has a market value today of $398 million. Fairfax’s investment in Stelco is up $311 million or 358%. That is an amazing return over a 5-year period.

What are prospects for Stelco?

Very good; just like for the big US steelmakers.

Kestenbaum - Schooling the Steel Industry on Capital Allocation

What did Stelco do with the earnings windfall from 2021 and 2022? He bought back stock 38% of shares outstanding. And he did not overpay. That was freaking brilliant.

Fairfax’s ownership in Stelco has increased from 14.7% to 23.6% - with no new money invested.

Two other brilliant moves by Kestenbaum:

—————

Comments from Prem about Stelco from the 2022AR.

“2022 was an active and successful year for Alan Kestenbaum and the talented team at Stelco. The company ended the year with its second-best fiscal result since going public despite an approximately 50% decline in steel prices over the summer. Stelco is benefiting from the Cdn$900 million it has invested in its Lake Erie Works mill since 2017, which has made the mill one of the lowest-cost operators in North America. Stelco entered 2022 with an extremely strong balance sheet and put its capital to good use, completing three substantial issuer bids during the year, thereby repurchasing approximately 29% of its outstanding shares. These repurchases have resulted in Fairfax’s ownership increasing to 24% from 17% at the beginning of the year. In addition to share repurchases, Stelco paid a Cdn$3 per share special dividend and increased its regular dividend to Cdn$1.68 per share from Cdn$1.20 per share. Stelco maintains over Cdn$700 million of net cash on its balance sheet and we anticipate that it will continue to be active both investing in its operations and efficiently returning excess capital to shareholders. We are excited to continue as a significant investor in Alan Kestenbaum’s leadership at Stelco.” Prem Watsa – Fairfax 2022AR

Details of Stelco’s Hamilton land sale in 2022, for proceeds of $518 million.

“Stelco Holdings Inc. (TSX: STLC) (“Stelco” or the “Company”) announced today that its wholly-owned subsidiary, Stelco Inc., has successfully closed a sale-leaseback transaction with an affiliate of Slate Asset Management (“Slate”). Stelco Inc. has sold the entirety of its interest in the approximately 800-acre parcel of land it occupies on the shores of Hamilton Harbour in Hamilton, Ontario to Slate for gross consideration of $518 million. In conjunction with the sale, Stelco Inc. has entered into a long-term lease arrangement for certain portions of the lands to continue its cokemaking and value-added steel finishing operations at its Hamilton Works site in Hamilton, Ontario.”

https://www.thespec.com/news/hamilton-region/all-of-stelco-s-hamilton-land-sold-in-deal-that-would-see-it-transformed-into/article_17a333af-8198-5f97-9866-8c61ed8f799f.html?

Details of Stelco’s agreement with US Steel in 2020 to securing long term supply for iron ore pellets.

Stelco Announces Option To Acquire 25% Interest In Minntac, The Largest Iron Ore Mine In The United States, And Entry Into Long-Term Extension Of Pellet Supply Agreement With U.S. Steel

“Stelco will pay US$100 million, in cash, to U.S. Steel in consideration for the Option (the "Initial Consideration"). The Initial Consideration is payable in five US$20 million installments, with the first installment paid upon closing of the Option Agreement and the remaining four installments payable every two months thereafter. Upon the exercise of the Option, Stelco would pay a net exercise price of US$500 million.”

Transaction Highlights:

https://investors.stelco.com/news/news-details/2020/Stelco-Announces-Option-to-Acquire-25-Interest-in-Minntac-the-Largest-Iron-Ore-Mine-in-the-United-States-and-Entry-into-Long-Term-Extension-of-Pellet-Supply-Agreement-with-U.S.-Steel-04-20-2020/default.aspx