Viking

Member-

Posts

4,833 -

Joined

-

Last visited

-

Days Won

39

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@Sweet There is always new news. That is why forecasts are usually always wrong. And that is not because people making forecasts are stupid. Investors need to attach probabilities to forecasts and expected future outcomes. Tail events can happen. Bottom line, record warm temperatures in Europe in winter have impacted the accuracy of forecasts from 3 and 4 months ago. That is a wonderful outcome for Europe. Does Europe (and the world) no longer have energy issues? Of course we do. How will it all play out? Not sure. Oil stocks are a 20% weighting for me today. I remain bullish on the sector (especially looking out a year or two). Happy to collect close to a 5% dividend and wait and see what happens. I expect we will see wicked volatility.

-

I am of the opinion that Fairfax shifted their equity investing approach somewhere around 2018. Since 2018 they are just making much, much better decisions with their equity investments (especially when compared to 2016-2017). Paul left Fairfax in 2019 and i wonder if his leaving was not tied to Fairfax’s shift in strategy with its equity holdings (‘fit’, i like to call it). Fairfax Africa was Paul’s baby and it was a complete dog costing Fairfax hundreds of millions in cash and also significant damage to its reputation (lots of investors in Fairfax blindly invested in Fairfax Africa too and lost their shirts). It has taken Fairfax years to ‘fix’ the many poorly performing equity investments purchased before 2018. Paul continues to be Executive Chairman of Recipe and that stock was a another dog for minority shareholders who owned it long term. Clearly Paul didn’t leave Fairfax to ‘retire’. What companies does he continue to be actively involved with? He is currently CEO and Executive Chairman with Greenfirst. That company has ‘old Fairfax’ written all over it (poorly managed, terrible cost structure, very tough current environment). Where do minority shareholders fit? Good luck. Paul is also involved with Torstar. Currently he and Bitove are engaged in a very public falling out. I am not suggesting Paul is not an outstanding person. Or that he will not make himself and shareholders a bunch of money moving forward. Having said that, i am very happy that Fairfax appears to have learned from their past mistakes and has moved up the quality ladder (with top notch management at the top of the list) when making equity purchases. i think it is very instructive to look at who replaced Paul at Fairfax… Peter Clarke. Peter does not look like he is actively driving the bus on equity purchases. I don’t know this but his role in the company appears to be a little different than Paul’s role was in the past. Fairfax has a $51-$52 billion investment portfolio. They look well positioned today in terms of management.

-

@cwericb i am confused. When i read the press release from Chorus’ web site it sounds to me like the debentures Fairfax owned were repaid early. And the 24 millions warrants Fairfax had expired worthless. Does this not mean that Fairfax no longer has an investment in Chorus? ————— - https://www.newswire.ca/news-releases/chorus-aviation-announces-redemption-of-its-6-00-senior-debentures-and-sale-of-two-wholly-owned-aircraft-873908141.html ————— - https://chorusaviation.com/chorus-aviation-closes-redemption-of-its-6-00-senior-debentures/ HALIFAX, NS, Dec. 29, 2022 /CNW/ – Chorus Aviation Inc. ("Chorus") (TSX: CHR) today announced that it has closed the redemption of $115,000,000 principal amount of Chorus’ 6.00% Senior Debentures due December 31, 2024 (the "Debentures"), representing all of the Debentures that were outstanding immediately prior to the redemption. Chorus previously announced its intention to redeem the Debentures on December 14, 2022. The Debentures were secured by certain Dash 8-100 and Dash 8-300 aircraft and real estate property owned by Chorus’ subsidiaries (the "Collateral Security"). The Collateral Security has now been released. In connection with the issuance of the Debentures, Chorus issued 24,242,424.242 warrants to affiliates of Fairfax Financial Holdings Limited ("Fairfax") entitling the holder thereof to acquire, on exercise of each warrant and subject to certain adjustments, one Class A Variable Voting Share or Class B Voting Share of Chorus at a price of $8.25 per share (the "Warrants"). The Warrants have now expired.

-

Fairfax has been simplifying the ownership structure of its assets in India. It owned IIFL Finance and IIFL Wealth both directly and via Fairfax India. Late in 2021 it sold its direct holdings in IIFL Finance and IIFL Wealth. In 2022, Fairfax India sold its holding of IIFL Wealth down to a 3.8% positio. Why? It appears at least one reason was to get their ownership of various assets in India compliant with regulators to allow a Digit IPO. —————- Fairfax bought 49.2% ownership position in Quantum Mutual Funds for $43 million in 2015. It would be interesting to know what the position is worth today… - https://www.business-standard.com/article/markets/fairfax-to-buy-49-2-stake-in-quantum-advisors-115110600879_1.html —————- Fairfax looks to settle mutual fund cross-holding norms case with Sebi - https://economictimes.indiatimes.com/markets/stocks/news/fairfax-looks-to-settle-mutual-fund-cross-holding-norms-case-with-sebi/articleshow/93883299.cms?from=mdr —————- “The Securities and Exchange Board of India (Sebi) rules do not allow any entity to hold more than a 10 per cent stake in more than one mutual fund house. Fairfax has more than 10 per cent shareholding in two mutual fund houses - Quantum Mutual Fund and IIFL Mutual Fund.” “HWIC Asia, an affiliate of Fairfax Financial Holdings, has a 49.2 per cent stake in Quantum Advisors, the sponsor of Quantum Asset Management Company and Quantum Mutual Fund.” “Similarly, FIH Mauritius Investments, an entity of Fairfax Group, owns a 13.62 per cent stake in IIFL Wealth Management, which is the sponsor of IIFL AMC and IIFL Mutual Fund, the latest shareholding data with BSE showed.” “The capital markets regulator, in October 2021, issued a show cause notice against Fairfax Financial Holdings Limited (FFHL), the ultimate parent entity of Fairfax Group, alleging a violation of mutual fund rules by FFHL, according to the draft IPO documents of Go Digit General Insurance Limited.” “Go Digit, a firm backed by Canada-based Fairfax Group, filed preliminary papers with Sebi on August 14 to raise funds through an initial public offering (IPO).” “FFHL had filed a settlement application dated June 3, 2022, with Sebi under the Sebi (Settlement Proceedings) Regulation, 2018," the company disclosed in the draft IPO documents. “The company further said that FIH Mauritius Investments, in which FFHL indirectly holds shares, has since entered into a binding agreement for the sale of certain of its shareholding in IIFL Wealth Management, the sponsor of IIFL Asset Management and IIFL Trustee.”

-

Given all the positive press India is getting these days (fastest growing major economy in 2023 and over next decade) I thought it might be interesting to provide an update on Fairfax's ownership position in Fairfax India. If there is one thing we can say with certainty... Fairfax knows how to invest in India. On the insurance side of things, Fairfax started with ICICI-Lombard back in 2000 and then pivoted to Digit in 2017. They realized $1.1 billion in gains on their 18 year investment in ICICI-Lombard. Digit is shaping up to be an even bigger winner for Fairfax - especially if we see a Digit IPO in 2023. On the equity side of things, Fairfax's first big investment in India was Thomas Cook in 2012. Thomas Cook in 2013 then bought 75% of IKYA Human Capital Solutions for $47 million (re-named Quess). Quess was eventually spun out as a separate company and has been a huge winner for Fairfax (although not as much was we initially thought in 2019). Thomas Cook was to be Fairfax's investment vehicle in India, but that all changed in 2014. In 2014 Modi, with a pro-business agenda, was elected Prime Minister of India. As a direct result of Modi's election win, Fairfax launched Fairfax India in 2015. Fairfax wanted to accelerate their growth in India. And accelerate it they have. Fairfax India has invested in more than 10 difference companies. However, the 'crown jewel' was its investment in Bangalore International Airport (BIAL) in 2016. When Fairfax India was started back in 2015, Fairfax owned a 28.1% interest. As of Sept 30, 2022, Fairfax owned 42.1% = 50% increase over 7 years. This is great news for Fairfax shareholders. Fairfax India management has done an outstanding job over the past 7 years. Book value has increased from $9.50/share in 2015 to $18.75/share at Sept 30, 2022. What about Fairfax India's share price? it closed at $13.26 on Friday. Is 2023 the year where investors finally give Fairfax India some love?

-

Geopolitics is all about national self interest. Not right and wrong. India is primarily looking after India. Geopolitically, India has never been aligned strongly with the West. The West was aligned strongly with Pakistan (and against India) during a couple of wars. Much if India’s military equipment is of Russian origin. India’s primary geopolitical threat is China. It is complicated. But it should not surprise anyone that India is going to try and not pick sides in the Ukraine war (the West versus Russia/China). India is still trying to raise much of its population out of poverty. Running water. Electricity. Basic stuff. Lots of work needs to be done. India will take Russian energy at well below market prices. India looks to be shifting more to the West economically (Modi’s reforms). However, for decades India was aligned with the Soviet Union / Russia. My guess is those ties still run deep (culturally). It will take India decades to pivot culturally to more of a Western economic model. And it would not take much to push the economic train off the rails. So Modi likely needs to be careful. The West will want to pull India into its orbit. It will be interesting to see how things play out the next couple of years. India is projected to be the fastest growing major economy in the coming years - that also matters. ————— India has a unique cultural/political/economic model (with a crazy amount of diversity). there are lots of other posters on this board who can offer way more insight than me. https://www.greaterpacificcapital.com/thought-leadership/indias-diversity-is-a-strategic-asset “India is more like a continent than a country, in terms of the diversity of its peoples and the scale of its diversity.”

-

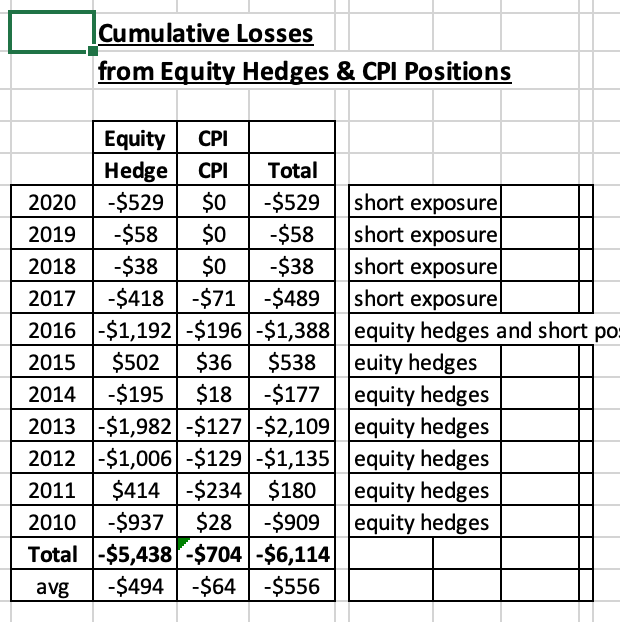

@jfan my view is looking at historical numbers for Fairfax (especially 2010-2020) is pretty much useless in helping an investor determine what the company will earn in 2023 and future years. Why? Equity hedges. Those two words that make long term investors in Fairfax curl up in a fetal position and weep loudly. From 2010 to 2020 Fairfax lost $5.4 billion on its equity hedge positions (pre-tax). This was a average loss of $500 million per year for straight 11 years (see my table below). Now i don’t want to get sidetracked in of why Fairfax did this. Here is the good news for investors today… Fairfax has stated numerous times that they will no longer short individual companies or indices (final position was exited in 2020). What a forward looking investor needs to understand is these losses were one-time in nature and will not be repeated in the future. It is like a $500 million annual expense (from 2010-2020) suddenly ended for Fairfax on Jan 1, 2021. Fairfax shareholders should have organized a parade or something! What is the value to Fairfax shareholders of that happening? Guess what losing $500 million per year for 11 years does to your historical (backward looking) ROE calculation over that time period? Or your earnings? Or book value? Yes, not pretty. But guess what happened to Fairfax’s underlying business did over the 2010-2020 period? Its insurance business went from $4.4 billion in net written premiums to $15 billion in 2020 (and est $22 billion in 2022). Total investments grew from $21 billion to $43 billion (and est $52 billion in 2022). Fairfax’s earnings power has exploded higher from 2010 to today. Fairfax is like a 100m sprinter who had been racing for 11 straight years will $500 million weights wrapped around their ankles. Except, today the ankle weights have been removed. And the sporting world has no idea how fast this sprinter can actually run. We all got a glimpse in 2021 (record earnings). But the spiking of bond yields (and subsequent $1.4? billion in losses on bond portfolio) resulted in a false start in 2022. And here we are at the starting line in 2023. All the journalists (investors and analysts) are looking at the sprinters (P&C insurers). They are wondering about this Fairfax guy. They still think he is the sprinter they saw in 2010-2020 who finished last in every race (ROE, growth in BV, stock price). They think the results from 2021 were a fluke - a first place finish (my guess). A few journalists are wondering if the sprinter we saw in 2021 is for real… Well, we will all get our answer in 2023 and 2024. With the $500 million shackles removed, i think Fairfax is going to surprise everyone with how much it is going to earn moving forward. ---------- The 'equity hedge' strategy was 'officially' ended way back in late 2016. So most of the losses were incurred from 2010-2017. The final position was exited in 2020, giving Fairfax investors one more nasty surprise. But really from 2018 the size of the losses from the equity hedges had dropped significantly and by the start of 2021 they had ended completely. (And what do you know... 2021 was a record year for earnings for Fairfax). ---------- In a bizarre twist, Fairfax's 'equity hedge' position of the past is a gift for new(er) shareholders. It is the single largest reason Fairfax stock (still) sells at such a cheap price today.

-

Greece has been an interesting geography for Fairfax for the last decade. Fairfax has about $2 billion (current market value) invested in 4 Greek equities = 13.3% of their $15 billion equity portfolio. They also own 80% of Eurolife, with a carrying value of $450 million (I think). Bottom line, Greece is an important jurisdiction for Fairfax. Over the past couple of years Greece has been slowly emerging from its financial catastrophe. A pro-business government has been busy restructuring the Greek economy. Tourism and property markets are once again doing well. Greece is one of the countries leading Europe in GDP growth in 2022 and this is expected to continue in 2023. So what assets does Fairfax own in Greece today? Eurobank: 32.2% ownership of a well managed bank that includes a very large and profitable property company (former Grivalia Properties); its balance sheet is fixed and 2022 has been a breakout year for profitability. This is the second largest equity holding for Fairfax (based on market value). Grivalia Hospitality: 78.4% ownership - deploys capital in the very attractive high-end hospitality sector in Greece, Cypress and Panama. Managed by Grivalia Management (also manages real estate for Eurobank). Mytilineos: 4.68% ownership - a global industrial and energy company. Praktiker: 100% ownership - a Home Depot type business. Much smaller than the other companies listed above. Eurolife: 80% ownership of a well managed and profitable insurance company; 20% owned by Eurobank. Has 31% share of the total life and general insurance market for 2021 in Greece. What is the approximate value of Fairfax’s investments in Greece? Eurobank $1,430 mill Jan 11, 2023 market value Grivalia Hospitality $340 44.5% cost $195 million Mytilineos $140 Jan 11, 2023 market value Praktiker $50? My guess - purchased for $29 million in 2014 Eurolife $450? ————— Eurobank stock is hitting what looks to me like a new 5 year high; today (Jan 11) the stock is trading at €1.15. Dec 31, 2022 it was €1.055. So Fairfax’s stake is up to $1.42 billion as we start 2023 (an increase of $120 million over Dec 31, 2022). Not too shabby. There is a good chance the dividend will be reinstated in 2023. This will be another catalyst for Eurobank shares. (Fairfax had a carrying value for Eurobank of $1.351 billion as of Dec 31, 2021.) Eurobank had set a target to earn €0.14/share in 2022. Mid-year, management increased the target to €0.18/share. This means Eurobank stock is trading today at a P/E of 6.4. Very cheap. Attach a P/E of 8 to 2022 earnings and you get a share price of €1.44 (US$1.55). Fairfax has an original cost on its position in Eurobank of US$0.92/share. A price of US$1.55 = 70% return for Fairfax off its original cost base. Eurobank had a break-out year in 2022. Fairfax’s share of Eurobank’s pre-tax earnings: est $310 million FY 2022 ($230 million to Sept 30) $162 million in 2021 -$12 million in 2020 Earnings from Eurobank is jumping year over year and is spiking ‘share of profit of associates’ for Fairfax to record levels. Bottom line, compared to 2 or 3 years ago, Eurobank is a good example of a Fairfax equity holding that is much better positioned today to deliver significant value to Fairfax in the coming years. - Q3, 2022 Eurobank investor presentation: https://www.eurobankholdings.gr/-/media/holding/omilos/grafeio-tupou/etairikes-anakoinoseis/2022/3q-2022/3q2022-results-presentation.pdf ————— Fairfax’s 10 year history in Greece has had a couple of triumphs (Grivalia, Eurolife), one catastrophe (initial investment in Eurobank), adversity, heroes, villains, a depression, a pestilence, loyalty, creativity (merger of Grivalia Properties with Eurobank) and years of hard work - it all reads like one of the books of the Iliad by Homer. Below is a short summary of the odyssey of how Fairfax got to where it is today with its Greek investments. All good stories always start at the beginning. So… Why did Fairfax invest in Greece? Answer: Ireland. What? Fairfax had outstanding success investing in a distressed Irish bank (Bank of Ireland) in late 2011 after the Great Financial Crisis (I think they made +$800 million on this investment - tripled their money in a little over 5 years). And business partner, Kennedy Wilson, had great success investing in real estate in Dublin. So as the cash register was ringing on their Irish investments, Fairfax saw similar opportunities in Greece. What was the timeline of the Greek purchases? 2011: purchased 3.8% position in Grivalia (Europroperties) run by George Chryssiko who is one of the heroes of this story the Greek journey begins Aug 2012: Grivalia (Eurobank Properties REIT) - Fairfax increased ownership from 3.8 to 18% for $50 million 2013: Grivalia (Eurobank Properties REIT) - Fairfax increased ownership to 41% for $20 million (plus?) Dec 2014: Eurobank: Fairfax makes initial investment of 400 million Euro with group of investors (including Brookfield, Wilbur Ross, Fidelity, Mackenzie, Capital Research and Management) unemployment rate in Greece in 2014 is 28%! Nov 2015: Eurobank recapitalization forced by ECB, definitely one of the villains of our story, Fairfax invests an additional 350 million Euro ownership increases from 12.5% to 17%. 1 for 100 reverse share split; sold new shares for 1 euro. Aug 2016: Eurolife: Fairfax purchases 80% ownership; 40% to Fairfax for $181 million and 40% to OMERS for $181 million. purchased from Eurobank. Fairfax was aided in its bid by its ownership in Eurobank (viewed as being good partner); important to Eurobank because the bank was retaining 20% ownership and much of Eurolife’s business was transacted through Eurobank distribution channels. referendum in Greece in 2015; Tsipras/Syriza elected; Syria refugees 2017: Grivalia - Fairfax Increased ownership to 52.7% for $100 million 2018: Eurolife - Fairfax increased ownership to 50%; bought 10% from OMERS (whose ownership decreased to 30%) Nov 2018 (closed May 2019): Eurobank - Fairfax increases stake to 32.4% via merger with Grivalia Properties. all stock transaction valued at US$866 million Fairfax owned 18% Eurobank and 54% of Grivalia; on close Fairfax owned 32.4% of new Eurobank Grivalia paid 40.5 million Euro special dividend Eurobank launched property management business run by Grivalia CEO July 2019 In Greek national election, pro-business party New Democracy elected, led by Kyriakos Mitsotakis, which received nearly 40% of the vote and won 158 seats, an outright majority. July 2021 Eurolife: Fairfax increased ownership to 80% (purchased OMERS 30% stake for $142.6) Eurobank owns remaining 20% July 2022 Grivalia Hospitality: Fairfax increased ownership from 33.5% to 78.4% for $195 million Dec 2022 Mytilineos: Fairfax increased ownership to 4.68% for $53 million ————————- Other Greek investments: 2013 Mytilineos - 5% for 30 million Euro ($41 million) 2014 Praktiker Hellas AE - bought 100% for 21 million Euro ————————- Why is Eurolife considered a gem? 2019AR: Through the crisis in Greece, we acquired a gem in Eurolife, a Greek property and casualty and life insurance company that operates predominantly in Greece but also in Romania. Alex Sarrigeorgiou has run Eurolife since 2004, following Eurobank’s decision to grow its insurance business, and we acquired it with OMERS as our partner in 2016. Since our initial 40% purchase of Eurolife in 2016 for Euro163 million, Eurolife has earned Euro347 million and paid dividends of Euro298 million and shareholders’ equity has increased from Euro400 million to Euro720 million at the end of 2019 after the payment of dividends. This phenomenal performance was predominantly because Eurolife had a significant holding of Greek government bonds whose rates went from 8% to 1% during that time period while its non-life business had an average combined ratio of 72%. We currently own 50% and equity account for Eurolife but plan to buy the rest of OMERS’ shares in 2020. 2020AR: Finally, in Greece, Eurolife has been an extraordinary investment for Fairfax. Writing both Life and Property/Casualty lines, the company in 2020 generated over $500 million of gross premiums written and produced net income of $130 million. Led by Alex Sarrigeorgiou, Eurolife has a track record second to none in the Greek market. 2021AR: On July 14, 2021 the company increased its interest in Eurolife FFH Insurance Group Holdings S.A. (“Eurolife”) to 80.0% from 50.0% by exercising a call option valued at $127.3 to acquire the joint venture interest of OMERS for cash consideration of $142.7 (€120.7). The assets, liabilities and results of operations of Eurolife’s life insurance business were consolidated in the Life insurance and Run-off reporting segment and those of Eurolife’s property and casualty insurance business were consolidated in the Insurance and Reinsurance – Other reporting segment, pursuant to which the company remeasured its 50.0% joint venture interest in Eurolife to its fair value of $450.0 and recorded a net gain of $130.5 in gain on sale and consolidation of insurance subsidiaries in the consolidated statement of earnings, inclusive of foreign currency translation gains that were reclassified from accumulated other comprehensive income (loss) to the consolidated statement of earnings. The remaining 20.0% equity interest in Eurolife continues to be owned by the company’s associate Eurobank. Eurolife is a Greek insurer which distributes its life and property and casualty insurance products and services through Eurobank’s network and other distribution channels. (5) Includes a redemption liability of $124.9 on non-controlling interests as the company’s associate Eurobank may put its 20.0% equity interest in Eurolife to the company commencing in 2024 at the then fair value of that interest. ————————— 2021AR: Eurobank, led by Fokion Karavias with support from George Chryssikos, had an outstanding year in 2021 as it expects its non-performing loan ratio to drop to 7%, return on tangible equity to increase to over 8%, and capital ratio (CETI) to be strong at approximately 13%. Under Fokion’s leadership, Eurobank’s profitability is expected to grow significantly with Greece’s strong economic growth. As I have said previously, Greece is blessed with a great prime minister, Mr Mitsotakis, who is very business friendly and has dramatically improved the economic outlook of Greece since he got elected three years ago. Greece’s GDP is expected to grow by 8.5% in 2021, its unemployment ratio fell to a decade low of 12.8% and real estate prices continued to increase. Since December 31, 2021, Eurobank shares have increased to a high of 1.14 euros per share – still a far cry from the book value of 1.47 euros per share. Eurobank is ready to begin paying dividends again (the first time since May 2008), subject to regulatory approval. The future is very bright for Eurobank. ————————— Here is a little more information on Grivalia which is now part of Eurobank. With property prices on a multi-year move higher Grivalia is an important profit engine for Eurobank. 2017AR: In 2017, we raised our equity interest in Grivalia to 52.7% by buying 10.3% for $100 million when Eurobank decided to divest its interest in Grivalia. It has been six years since we first met George Chryssikos, the outstanding CEO of Grivalia. Through Wade Burton, we took our first position in Grivalia in 2011 at Euro5.77 per share. George has navigated the Greek economic crisis superbly by buying only the highest quality commercial buildings and shopping centres at huge discounts to replacement cost and unlevered returns of 8% to 10%, not using excessive leverage and always focusing on the long term. We are very excited to be partners with George and his team as they build a fantastic real estate company. Like Bill McMorrow at Kennedy Wilson, George has a unique nose for value in real estate! And like all our Fairfax companies, he is building a fine company, focused on its customers, looking after its employees, making a return for shareholders and gratefully reinvesting in the communities where it operates. Business is a good thing!! ————————— 2019AR: Merger of Grivalia Properties REIC and Eurobank Ergasias S.A. Early in 2019, Fokion Karavias (CEO of Eurobank) and George Chryssikos (CEO of Grivalia) came up with the idea of merging Grivalia into Eurobank, to strengthen the capital position of Eurobank, and accelerating its non-performing loan stock reduction through spinning out Euro7.5 billion of non-performing loans from the bank to its shareholders. We thought it was a brilliant idea but the process took time as it was subject to shareholder approval at Eurobank and Grivalia and regulatory approval from the ECB. As part of the same plan, Eurobank sold its non-performing loans management unit, FPS, to doValue S.p.A. (a public company listed in Italy) for Euro360 million. We expect all these transactions to close by March 31, 2020 and Eurobank to be well capitalized and on its way to earning 10% on its shareholders’ equity in 2020. Last year, Greece had an election in which the business friendly party of Kyriakos Mitsotakis won a majority in the parliament. As the new Prime Minister, Kyriakos has the opportunity to transform Greece by encouraging foreign investment into the country and by being business friendly. Ten-year Greek government bonds, which peaked at a yield of 37% in 2012, came down to 10% in 2016 and are now trading below 1%. Recently, Greece did a 15-year bond issue at 1.9% and a 30-year issue at 2.5%. The animal spirits are coming back to Greece and we think the Greek economy and Greek companies will thrive. Eurobank should benefit!! Our cost of 1.2 billion shares of Eurobank after the Grivalia transaction is now 94¢ versus a book value of approximately 135¢ per share post the transaction. At year end, Eurobank was selling at 68% of book value and 6.5x normalized earnings. We still believe it will be a good investment for us. On May 17, 2019 Grivalia Properties REIC (‘‘Grivalia Properties’’) merged into Eurobank Ergasias S.A. (‘‘Eurobank’’), as a result of which shareholders of Grivalia Properties, including the company, received 15.8 newly issued Eurobank shares in exchange for each share of Grivalia Properties. Accordingly, the company deconsolidated Grivalia Properties from the Non-insurance companies reporting segment, recognized a non-cash gain of $171.3 and reduced non-controlling interests by $466.2. In connection with the merger, Grivalia Properties had paid a pre-merger capital dividend of Euro0.42 per share on February 5, 2019. The company owned approximately 53% of Grivalia Properties and 18% of Eurobank prior to the merger, and owned 32.4% of Eurobank upon completion of the merger. ———————— Eurobank: https://www.eurobank.gr/en/group Grivalia Management: https://www.grivalia.com Grivalia Hospitality: https://grivaliahospitality.com/about-us.html Eurolife: https://www.eurolife.gr/en Mytilineos: https://www.mytilineos.gr/who-we-are/mytilineos-company/ ————————

-

What do you think of Analyst Estimates and how useful are they?

Viking replied to Luke's topic in General Discussion

I use RBC. Even though they are all self directed, my accounts are large enough that i get access to all their research reports (company/industry etc). I find i get a lot of value from the reports their analysts put together. Not the final number… but the build. The logic of how they get to that number. Often i learn some important things i was not thinking about (i am also not an accountant). i also find the Q&A sessions with analysts on earnings conference calls is also valuable. The analysts usually ask at least a few important questions. ————— Having said all that, i do find going directly to the sources is the best: company earnings releases and conference calls. -

Fairfax: Sources of Net Earnings 3.) Share of profit of associates Fairfax has a number of significant tailwinds driving earnings higher. I have already posted on two: underwriting profit and interest and dividend income. There is a third item that is also spiking higher in 2022: share of profit of associates. ---------- Over the 5 year period, from 2017-2021, ‘share of profit of associates’ averaged about $200 million per year for Fairfax. This year (2022) it should come in at around $1 billion for the full year. This surprised me. That is a big increase over the trend from the past few years. 2022 MUST BE an outlier and Fairfax should settle back to something closer to $200 million in 2023… right? Wrong. My guess is ‘share of profits of associates’ should be able to deliver around $900 million in 2023 and this number should grow nicely in the coming years. That is a significant increase in one year. What happened? Put simply, the earnings power of the equity holdings captured in the ‘associates-equity accounted’ bucket are beginning to shine through. Four companies make up 85% of total ‘share of profits of associates’. After 8 years, the turnaround at Eurobank is complete. Eurobank is also benefitting from higher interest rates and also one of the strongest economies in the Eurozone (yes, Greece). Atlas is growing rapidly driven by its aggressive new-build strategy. a significant number of new-build deliveries are expected to happen in 2023 and 2024. A consortium, lead by David Sokol and supported by Fairfax and the Washington family, is attempting to take Atlas private in 2023. Energy is the best performing sector in 2022 and EXCO Resources, a US natural gas producer, is well positioned to continue to benefit. The commodity bull is running and this will benefit Stelco in the coming years. Fairfax sold Resolute Forest Products and the deal is expected to close in 1H 2023. Over the past 5 years, Fairfax has quietly built out another significant source of passive earnings that will benefit shareholders for years to come.

-

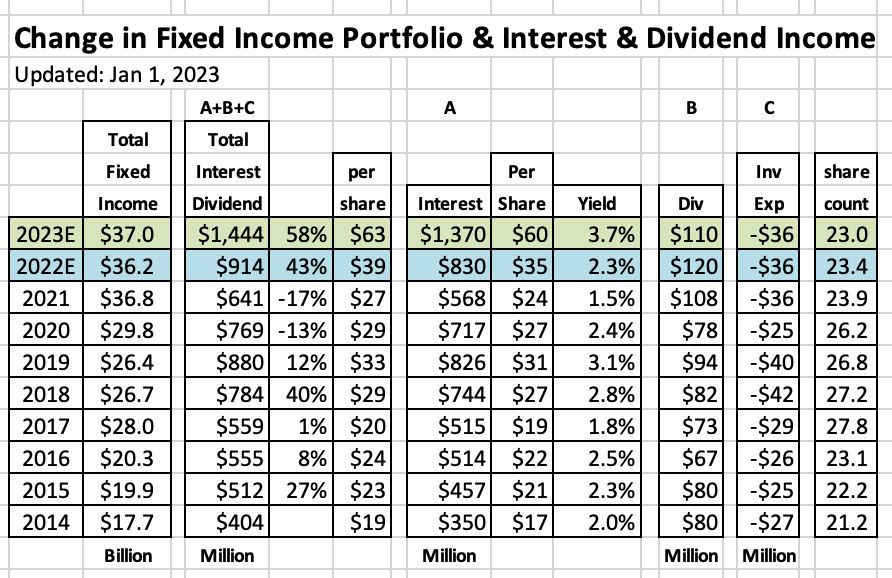

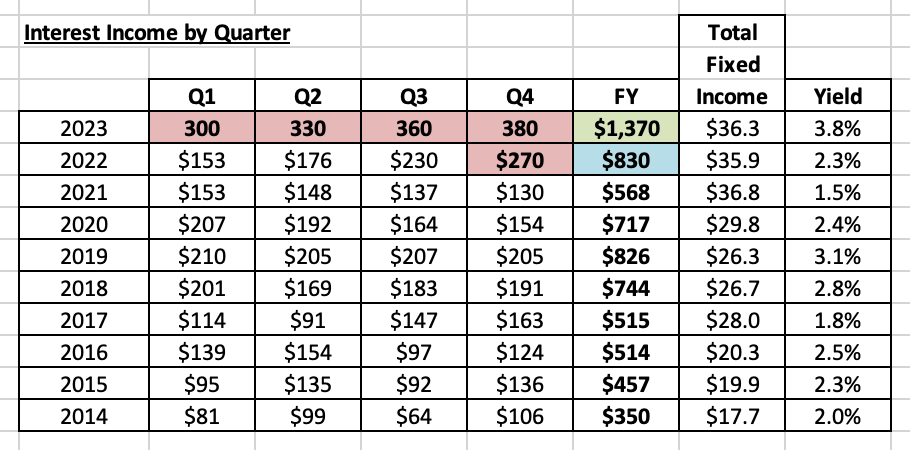

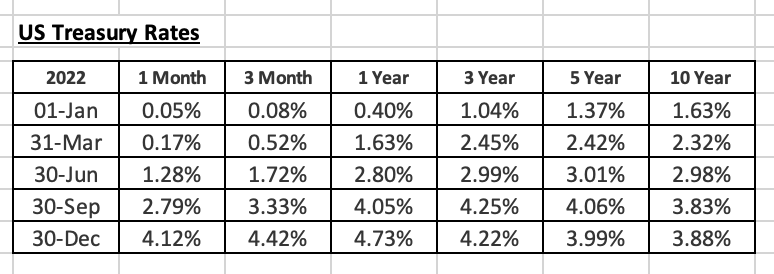

Fairfax: Sources of Net Earnings 2.) Interest and Dividend Income Of all of the many positive developments at Fairfax in 2022, the increase in interest rates (and interest income) is one of the most exciting. ————— Summary: Fairfax earned $641 million ($27/share) in interest and dividend income in 2021. For 2022, my estimate is $914 million ($39/share), or +43% year over year. This will be a new record. For 2023, my estimate is $1.444 billion ($63/share), or +58% year over year. Yes, this will be a new record. These are significant increases in both 2022 and 2023. ————— Interest & dividend income = interest income + dividends - investment expenses. ————— A.) Interest Income: In 2021, Fairfax earned $568 million in interest income = 1.5% yield on their $36.8 billion fixed income portfolio. In 2022, Fairfax is on track to earn $830 million in interest income = 2.3% yield on their $36.3 billion fixed income portfolio. In 2023, my estimate is Fairfax will earn $1.37 billion in interest income = 3.7% yield on their $37 billion fixed income portfolio. What has driven this significant increase in interest income? 1.) spiking interest rates: see table of ‘US Treasury Rates’ below. 2.) extremely low duration of bond portfolio: 1.2 years at Dec 31, 2021. 3.) steadily growing size of fixed income portfolio: increased from $17.7 billion in 2014 to $36.2 billion in 2022. Fairfax timed their move to short duration in their fixed income portfolio exceptionally well. With rates spiking higher, the low duration allows Fairfax to roll their significant fixed income portfolio more quickly into higher yielding securities. Most P&C insurers have an average duration on their fixed income portfolio of closer to 4 years on average. B.) Annual dividend income: Fairfax currently earns about $110-$120 million in dividends from its equity holdings. C.) Annual investment expenses: Fairfax incurs investment expenses of about $36 million per year. When it reported Q2 results, Fairfax said the then run-rate for interest and dividend income was about $950 million/year. When it reported Q3 results, Fairfax said the current run-rate for interest and dividend income was about $1.2 billion. This is a significant increase of $250 million in just 3 months. Of the $1.2 billion total, about $1.1 billion is interest income = 3.0% yield on $36.2 billion fixed income portfolio. So at the end of Q3 Fairfax was tracking to a 3% yield on its fixed income portfolio which is double what it was in 2021. Of interest, Fairfax confirmed with Q3 results that they are starting to extend the duration of their fixed income portfolio. At the end of Q2 it was 1.2 years. At the end of Q3 it was 1.6 years. Fairfax said they were buying primarily 3 to 5 year US treasuries in Q3. This will be something to watch in the future. Extending the duration will allow Fairfax to lock in current high yields for years into the future. Where will interest rates go in 2023? Current expectations are for the Fed Funds rate to get close to 5.25% in Q1, 2023. If this happens my estimated 3.7% yield on Fairfax’s fixed income portfolio for 2023 could be low.

-

Fairfax: Sources of Net Earnings 1.) Net premiums and underwriting profit At its core, Fairfax Financial is an insurance company. The size of Fairfax's insurance business has increased dramatically over the past 9 years (2014-2022). Net premiums written have increased from $6.1 billion in 2014 to $22 billion in 2022 (my estimate) for a compounded growth rate of 17.3% per year over the past 9 years. On a per share basis, Fairfax has grown net premiums written from $289/share to $940/share for a compounded growth rate of 16% per year. The share count is up 10.4% over this time period (2014 to 2022). Fairfax is now one of the 25 largest P&C insurers in the world. What has driven this significant growth? Two very different factors have been responsible: 1.) For the first 5 years (2014-2018) growth was driven mostly by acquisitions: Brit (2015), International (2016) and Allied World (2017). 2.) For the past 4 years (2019-2022) growth has been mostly organic and driven by the hard market. Looking back, Fairfax timed their large insurance acquisitions perfectly - right before the hard market started. The hard market in insurance looks set to continue in 2023 and is spreading to reinsurance - which is a big business for Fairfax. 2023 could see net premiums written increase to $24.6 billion, up $2.6 billion, or 12%, from 2022. Why do we care what net premiums are? Because this is a key input in determining underwriting profit. And underwriting profit is a key input in determining what an insurance company will earn in a year. And earnings ultimately determine what a company is worth. Assuming a combined ratio (CR) of 95, Fairfax is on pace to earn an underwriting profit of $970 million in 2022 ($41/share). A new record for one year. The previous record was $801 million in 2021 ($31/share). Assuming another CR of 95, my estimate for 2023 is for Fairfax to earn an underwriting profit of $1.1 billion ($48/share). Another record. Bottom line, the combination of significant growth in net premiums and solid underwriting is resulting in Fairfax earning record underwriting profit. ---------- Important: My numbers do NOT include runoff (to keep them consistent with how Fairfax reports them). My guess is the cost of runoff will come in at $100 to $150 million per year.

-

Below is an update of my net earnings estimates for Fairfax for full year 2022 and 2023. My guess is Fairfax will finish full-year 2022 with net earnings of about US$35/share. To Sept 30, 2022, Fairfax had a net loss of $35/share so my guess is they will earn about US$70/share in Q4. The closing of the pet insurance deal will be the big driver. We should also see solid results from underwriting, interest and dividend income, share of profit of associates and investment gains (driven by equities). My guess is Fairfax can earn a ‘normalized’ US$100/share in 2023. This is not an aggressive number. My estimate assumes: 1.) underwriting achieves a 95 combined ratio 2.) the fixed income portfolio delivers an average yield of 3.7% 3.) share of profits of associates delivers similar results to 2022 4.) investment gains rebound modestly from 2022 levels The 2 big wild cards for 2023 are: 1.) level of catastrophes 2.) financial market volatility (stocks and bonds) Fairfax’s stock is trading today at about US$600. If Fairfax earns $100/share in 2023 that would put the forward PE multiple at 6 times earnings. Crazy cheap. Fairfax stock is like a coiled spring. Notes: Underwriting profit: includes insurance and reinsurance; does not include runoff or Eurolife life insurance. Interest and dividends: includes insurance, reinsurance and runoff. ————— Below are more detailed updates to the first three buckets: 1.) underwriting profit 2.) interest and dividend income 3.) share of profit of associates

-

Very good news for Fairfax on the reinsurance renewal front. Cha ching... Here is RBC's Summary: January 1 reinsurance renewal observations: January 1 saw a banner renewal period for reinsurers. For property classes, it was a true hard market rate with property catastrophe reinsurance rates up +37%, the largest rate gain since 1992. Casualty and specialty reinsurance rates were up around mid-single-digits and far higher for loss-impacted accounts. Reinsurers were able to secure better terms & conditions (retentions, deductibles, losses covered) and held back capacity in some areas. A vintage year alongside 2013 and 2006. There are few times we can say this but we think reinsurers got what they wanted (and possibly even more) at 1/1 renewals. That may not be true in every line or geography but it was as strong an outcome as we have seen since at least 2013 and probably back to 2006. Howden reported that global property catastrophe rates averaged +37% at this past 1/1, which was the largest percentage increase since 1992 (post Andrew). For comparison sake, property cat rates were up a solid +9% at last year’s 1/1 renewal period. Howden also noted +45% average rate increases for direct & facultative business and +50% for retrocessional cover. For casualty and specialty lines, it was more of a routine and normal renewal period with rates up around single digits give or take. The word “stable” came up consistently in the commentary we have heard thus far. Rates were generally described as being up somewhere in the mid- single digits so not that different from what is happening in the primary market and certainly nothing that is overly disruptive. Overall, appetites to write casualty reinsurance seemed high at this past renewal period and we expect capital was willing to be deployed to a fair number of accounts and risks... In all, this renewal period was everything that reinsurers had hoped for after so many years of high hopes but no material pricing actions. While last year’s 1/1 renewal period was constructive, this year was a true hard market for many classes and not just property cat risks. High cats, inflation, reserving concerns, and lower capacity drove measured changes in pricing as well as terms & conditions. We will be interested to see the extent to which our covered companies with reinsurance books (AIG, Arch, Fairfax, and W.R. Berkley in particular) pressed on the accelerator and aggressively grew their reinsurance books at 1/1. For now, reinsurance is having its day in the sun.

-

The sale of Ambridge for $400 million should result in a sizeable realized gain for Brit/Fairfax. Brit purchased 50% of Ambridge in 2015 (shortly after Fairfax purchased Brit). Brit purchased the remaining 50% in 2019 for $46.6 million. In 2021, Brit combined their US operations (not sure size) with Ambridge. Brit is the weakest large insurance operating unit of Fairfax. This sale should result in a a meaningful realized gain for Brit. What will Brit/Fairfax use the proceeds for? 1.) dividend to FFH? 2.) Brit uses to grow business in current hard market? 3.) Brit uses to buy back minority interest held my OMERS? Bottom line, Fairfax looks to be monetizing an asset at a very good price. With lots of great opportunities to re-invest the proceeds at a very attractive prices. The management team at Fairfax continues to execute exceptionally well. --------- Of interest, Fairfax purchased Brit for $1.657 million in 2015. Ambridge is being sold for $400 million. --------- FFH 2015AR: In December, Brit made an investment in Ambridge Partners, one of the world’s leading managing general underwriters of transactional insurance products. These products insure losses as a result of breaches or inaccuracies in warranties and indemnities relating to M&A, restructuring activities, business financing and tax issues. Ambridge, which has been a partner of Brit for the last nine years, produces $128 million of premiums and is highly profitable. We welcome Jesseman Pryor (CEO), Jeffery Cowhey (President) and their team of 29 employees to Fairfax. FFH 2016AB: In 2015 Brit purchased 50% of Ambridge Partners, one of the world’s leading managing general agencies of transactional insurance products. In 2016 Ambridge produced gross premiums written of $32 million for Brit at a combined ratio well below 100%. FFH 2019AR: On April 18, 2019 Brit acquired the 50.0% equity interest in Ambridge Partners LLC (‘‘Ambridge Partners’’) that it did not already own for $46.6, remeasured its existing equity interest to fair value for a gain of $10.4, and commenced consolidating Ambridge Partners. From Brit 2021 YE Press Release: In 2021, we combined our US operations to create a single operation under the Ambridge brand. It now operates as a global MGA, managing over $600m of premium in the US and internationally. Our clients have the benefit of the well- recognised Ambridge MGA model giving them better access to products and enhanced service, and our underwriting teams are better able to capitalise on business opportunities.

-

@LearningMachine great question. We talk about 'oil' but there are lots of important variables that come in to play when trying to compare oil companies. Too many for me to really be able to comment with any specificity or conviction: - production method: mined or drilled? - oil type: light/sweet, light/sour, medium/sweet, medium/sour, heavy/sweet, and heavy/sour - nat gas exposure? - geography: Canada, US, OPEC, Russia etc? WCS, WTI, Brent? - transportation: pipelines or ship? - refining? - retail? - vertical integration? My strategy has been to stick with what I have followed for years... the large Canadian producers: SU, CNQ and CVE. SU at C$40 looks like a gift to me. CNQ under $65 or CVE under $22 would also be sweet. ---------- The big risk for Canadian oil sands oil is it has a big bulls-eye painted on its back. It is hated in Canada (especially Quebec). Public sentiment will only get worse moving forward. What is a 25 year asset worth in such a scenario? What makes sense to me is the big Canadian producers will essentially go into runoff with all of their long life assets and only spend incremental funds on projects that have exceptionally quick/high payback. With this framework, dividends (large base and big special) make the most sense to me. Buybacks may not actually result in a higher share price over time. You might just take out all the big forced sellers - like the big pension funds - who want out anyways. And all the massive debt repayment might actually be poor capital allocation. Perhaps oil companies should lever back up and throw gobs of cash at shareholders... The dividend yields would astronomical. There is my crazy thought of the day (I am only allowed one of these each day).

-

I think the key variable affecting PE multiple for any company is narrative. Narrative is closely tied to type of investor. I remember when Apple traded at a PE under 10 (2013?). Everyone hated Apple. Steve Jobs had passed. Tim Cook was no visionary. Samsung was going to rule the world. I think the PE for Apple was over 30 last year. Everyone loved Apple last year. No price was too high for the stock. Set and forget. But at its core, Apple was essentially the same company in 2022 that it was in 2013. The big US banks in 2016 were still hated… investors could not get the great financial crisis narrative out of their heads. Even though the big US banks were completely different animals by 2016 and operating in a very different regulatory regime. My view is Fairfax is a turnaround play that had has turned around. But most investors do not understand it or believe it. I think the turnaround really got going in 2018. More good things happened in 2019. In 2020 covid hit and their equity portfolio got crushed. This is when sentiment in Fairfax (and the stock price) hit a multi-year low. Performance (BV growth, stock price) over the previous decade had been terrible. Trust in management was gone. The last of the long term investors in the company capitulated and sold their shares. The narrative in Q2/Q3 2020 was that Fairfax was a broken company. How did the management team actually perform in 2020? Pretty well. 2021 was one of the best years in Fairfax’s history. 2022 was a very good year (although you wouldn’t know it by just looking at earnings or growth in BV). Looking at the 5 year span from 2018-2022, the management team at Fairfax has done an outstanding job with both insurance and investment businesses. i think the narrative for Fairfax has slowly started to shift over over the past year. The negativity on this board towards Fairfax is largely gone. Most now grudgingly think it might do ‘ok’ moving forward. 2023 is looking like it will be another very good year for Fairfax. If Fairfax executes well, my guess is the narrative will continue to shift and start to reflect the current earnings power of the business. But narratives take years to change - it is a very slow process. So i am not expecting the PE multiple to expand a great deal in 2023. I hope it does - that could provide rocket fuel to the stock price.

-

@MMM20 great chart. BV was US$570/share at end of Q3. My guess is earnings in Q4 will come in around $70/share (the pet insurance sale by itself is +$40). If my estimate is accurate then BV at Dec 31, 2022 is about $640. Shares are trading today at $597, so P/BV = 0.93. One on my questions for Fairfax for 2023 is what multiple will the shares trade at? As your chart outlines very well, pre-pandemic (2014-2019), Fairfax shares generally traded in a band between 1.1 and 1.3 x BV. Post pandemic, Fairfax shares have generally traded between 0.8 and 0.9 x BV. As i outlined above, as of today they are trading at about 0.93 X BV. My guess is Fairfax will earn about US$100/share in 2023. This would put 2023 year end BV at about $730 (adjusting for the $10 dividend). Here is where Fairfax shares would trade Q1 2023 based on various P/BV assumptions: 1.) 0.9 = $660 = +10% from stock price today of $597 2.) 1.0 = $730 = +22% 3.) 1.1 = $800 = +33% 4.) 1.2 = $870 = +45% My guess is Fairfax could start to trade back at a 1.1 x multiple in 2023. The primary reason is the $100 in earnings i am modelling are very high quality… coming primarily from underwriting profit, interest and dividend income and share of profit of associates. Only a modest amount is coming from investment gains. (Large investment gains will push my $100/share earnings estimate higher). So it will be very interesting to see if Fairfax starts to trade closer to its pre-pandemic P/BV multiple in 2023. Growing earnings AND multiple expansion = very good returns for shareholders.

-

As we think about investing ideas for 2023, i thought it would be interesting to bring forward the same thread from the start of 2022. Lots to learn. Druckenmiller’s advice is especially useful at this time of the year: be inquisitive… and open minded.

-

So what are board members best investment ideas to make $ in 2023? So what can a board member buy on Tuesday and expect to earn a reasonable return in 2023 (which i define as +10%)? It can be a specific stock. Or a sector. Please include a couple of bullet points as to why you like the idea. To get things started my highest conviction ideas today are: 1.) Fairfax. Stock was up 20% in 2022; value of business increased much more over the year. So the stock, closing at US$594, is cheaper today than it was Dec 31, 2021 when it closed at US$492. I think Fairfax will earn US$100 in 2023 (and this is my conservative estimate). Misunderstood stocks trading at a normalized PE of 6 times earnings are a layup. Fairfax is the gift that keeps on giving. 2.) oil. Not as cheap as it was Dec 31, 2021. But still cheap. Especially if the world does not go into a big recession in 2023 (and I don't think it will). Growing demand + constrained supply = higher prices for any commodity. Throw in terrible government policy, the religion of ESG, war in Ukraine, China emerging from covid, US ending SPR releases... - what stocks to own? I tend to stick to large cap Canadian players: CNQ, CVE and SU. My largest holding today is SU. They have had some issues and the stock looks cheaper today than CNQ and CVE. Lots of good options in oil in both Canada and the US. - for me oil is a trade. Buy low and sell high. Rinse and repeat. This strategy worked great in 2022. 3.) US big tech looks cheap (GOOG, AMZN, META). Down 50% from highs is good enough for me. I have a 1/2 position in each today. I hope they keep selling off… so i can continue buy and get to a full position. - i have also started to add smaller positions in PYPL, QCOM, CIBR. Nvidea is on my watch list (i might just buy SOXX). 4.) US financials look cheap. If they go much lower from here on recession fears I will likely get aggressive. Small holding today… There is lots of other stuff that is cheap. Definitely a stock pickers market.

-

+28% Lucky. What I liked/understood did very well this year. It usually does not work that way (in 2018 I was down 4% on the year). Fairfax, oil and cash drove all of my returns this year. Cash? Not losing a bunch of money sometimes feels like making money. 1.) in Dec of 2021 I started to load up on oil. It was my number one pick to start the year. I got lucky as it worked way better than I thought it would. 2.) when the Fed got aggressive with raising interest rates I got conservative and moved a big chunk of my portfolio to cash. Lucky? I don't think so. Following the Fed has been the best single strategy for the past 10 years... and it continued to work in 2022. 3.) extreme volatility in oil and Fairfax allowed me to but low and sell high a couple of times. This was simply being opportunistic. Fairfax went to US$450 twice in 2022... I messed up a little the first time in March but nailed the second time in Oct (that concentration thing that Druckenmiller talks about). Looking ahead to 2023 my favourite picks: 1.) Fairfax. Stock was up 20% in 2022; value of business increased much more over the year. So the stock, closing at US$594, is cheaper today than it was Dec 31, 2021 when it closed at US$492. I think Fairfax will earn US$100 in 2023 (and this is my conservative estimate). Misunderstood stocks trading at a normalized PE of 6 times earnings are a layup. Fairfax is the gift that keeps on giving. 2.) oil. Not as cheap as it was Dec 31, 2021. But still cheap. Especially if the world does not go into a big recession in 2023 (and I don't think it will). Growing demand + constrained supply = higher prices for any commodity. Throw in terrible government policy, the religion of ESG, war in Ukraine, China emerging from covid, US ending SPR releases... 3.) US big tech looks cheap (GOOG, AMZN, META). Down 50% from highs is good enough for me. 4.) US financials look cheap. If they go much lower from here on recession fears I will likely get aggressive. There is lots of other stuff that is cheap. Definitely a stock pickers market. What about the Fed? Not sure. Nothing obvious comes to mind right now.

-

I have updated my equity spreadsheet for Fairfax to Dec 30. The equity portfolio that I track is up about $1 billion in Q4. Of the total, about $380 million is mark to market (about $17/share pre-tax). Bottom line, Fairfax's equity portfolio has held up much better in the bear market of 2022 compared to what happened in the bear market of 2020. Big movers: 1.) FFH TRS +$250 million 2.) Eurobank +$331 million 3.) Atlas +$181 million 4.) Fairfax India +$150 million 5.) Quess - $130 million ----------- For board members who might not know... my spreadsheet attached below has a number of tabs you might find useful: Tab 1: 2022 = where I track Fairfax's various equity holdings Tab 2: Moves = various purchases Fairfax has made going back to 2010 Tab 3: 2022 Estimated Earnings = with history back to 2016 Tab 4: Premiums = net premiums written going back to 2014 - also includes losses from equity hedges and CPI positions (2010 to 2020) Tab 5: Interest = interest and dividends going back to 2010 Tab 6: Associates = Associate holdings going back to 2017 Tab 8: Fairfax India holdings - my contain errors Fairfax Equity Holdings Dec 30 2022.xlsx

-

Fairfax Top 10 Events of the Year - Driving Shareholder Value

Viking replied to Viking's topic in Fairfax Financial

@glider3834 thanks for all your help over the past year. As you likely see, I am good at stealing other posters good ideas Putting together the Top 10 List helped me a lot. I had a pretty good handle on: 1.) top line growth and underwriting profit 2.) the bond portfolio and interest and dividend income 3.) share of profit of associates What I missed this year was the size of the equity investments, with a spend of about $2 billion. For reference, equity purchases most years have been under $1 billion. The other big takeaway is Fairfax is buying much higher quality equities compared to 2017 and prior years. From 2018-2022 they have had very few misses with their equity purchases. I attached my Excel spreadsheet (see 'moves' tab) that tracks most of Fairfax's purchases by year all the way back to 2010 - board members can scroll through and see the style evolution. Fairfax Equity Holdings Dec 30 2022.xlsx -

Fairfax Top 10 Events of the Year - Driving Shareholder Value

Viking replied to Viking's topic in Fairfax Financial

2022 Top 10 List: Part 2 I started the list yesterday… here are the remaining items driving shareholder value at Fairfax. What am i missing (good and bad)? Look forward to discussing what other people are thinking. 5.) asset monetization: sale of Resolute Forest Products to Domtar for cash of $626 million + $183 million contingent value right (tied to duties collected). The timing of this sale was perfect. Resolute was sold at a high price ($20.50/share). When it closes proceeds can be rolled into other investment opportunities at bear market lows. Regulatory approval for the deal was just given (late Dec). As much as I like the lumber part of the business over the next 5 years or so... the newsprint/paper part of the business looks pretty ugly. Very happy with this transaction. ————— With (likely) record underwriting profit and interest and dividend income and significant asset sales, Fairfax generated a significant amount of cash in 2022. We should see more of the same in 2023. This is a significant development for Fairfax. Cash is a very good thing, especially when you are in a bear market and both bonds and equities are on sale (that buy low thing). So what did we see Fairfax do with all that cash in 2022? Record equity investments of around $2 billion. Surprised? 6.) take private of 2 businesses: Fairfax spent $537 million as follows: July - Grivalia Hospitality ($195 million), August - Recipe ($342 million). These are two businesses Fairfax understands very well as they had already owned significant stakes in both for years. Both purchases were highly opportunistic given they were made as we were just emerging from covid and the price paid likely reflected depressed earnings (at least in the case of Recipe). 7.) increase ownership stakes in businesses already owned: Fairfax spent $506 million as follows: February - Fairfax India ($65 million), March - exercise of Atlas warrants ($201 million), April - exercise of Altius warrants ($78 million) and Ensign Energy debenture conversion ($9), June - John Keels debentures ($75 million), Oct - exercise Foran Mining warrants ($25 million), Dec - Mytilineos ($53 million). 8.) increase partnership: Fairfax spent $300 million on preferred equity in Kennedy Wilson. Fairfax has a long history with Kennedy Wilson, going back to 2010. Kennedy Wilson has been Fairfax’s real estate partner for over a decade. When you put 6.) + 7.) + 8.) together… Fairfax spent $1.343 billion, a significant chunk of money, increasing its ownership in businesses that it was already invested in. These are businesses and management teams that Fairfax understands well. 9.) US large cap purchases: over the first 9 months of 2022, Fairfax spent about $350 million: Micron Technologies ($152 million), Bank of America ($96 million), Occidental Petroleum ($54 million) and Chevron ($45 million). - of interest, coming out of the Great Financial Crisis, Fairfax spent over $1 billion on a bunch of large cap US stocks: Wells Fargo, J&J, US Bancorp, and USG. It would not surprise me to see Fairfax continue to build out their holdings of large cap US stocks in Q4 and into 2023. 10.) increase private equity holdings/partnerships: as part of the pet insurance sale, Fairfax invested $450 million in two separate deals with JAB Holdings. JAB is a privately held German conglomerate. The two transactions: $250 million in debentures + $200 million in JAB - JCP V investment funds. Fairfax already had significant investments/partnerships with other private equity shops like BDT Capital Partners and ShawKwei. The investment in JAB expands and diversifies Fairfax’s significant portfolio of private equity type holdings. When you put 6.) + 7.) + 8.) + 9.) + 10.) together… Fairfax spent around $2 billion on a collection of businesses that look like solid additions to Fairfax’s existing portfolio of equity holdings. Nothing flashy. Boring. Low risk. Good value / opportunistic purchases. Sold upside. Just what many Fairfax shareholders have been asking for… Fairfax is once again planting lots of seeds. Over time, these investments will all grow and compound in value to the benefit of Fairfax shareholders. A larger equity portfolio will drive higher future earnings. And this will drive the stock price higher. This is just another of many catalysts in place at Fairfax. Fairfax is once again playing offence with its investment portfolio. ————— 11.) continue to take out minority shareholders of insurance businesses: On Sept 27, 2022 Fairfax increased its ownership interest in Allied World to 82.9% from 70.9% for total consideration of $733.5 million ($228 million hit to retained earnings) funded via $750 million debt offering. Fairfax buying out minority partners is a solid use of cash. Low risk. Solid return. 12.) Fred VanVleet - bet on yourself update: FFH total return swap (TRS) investment continues to perform exceptionally well, up $200 million in 2022. FFH share price: Dec 30, 2022 = $594. Dec 31, 2021 = $492. TRS = 1.96 million FFH shares. ($594 x 1.96 million shares = $1.164 billion market value.). Given Fairfax shares remain crazy cheap, my guess is Fairfax continues to hold this position. 13.) share buybacks: to Sept 30, 2022 Fairfax had repurchased 419,000 shares = 1.8%. Common stock effectively outstanding was 23.445 million at Sept 30,2022 and 23.865 million at Dec 31, 2021. My guess is Fairfax continued to buy back shares in Q4, especially after the pet insurance deal closed the end of October. It will be interesting to see how aggressive Fairfax gets with share buybacks in 2023. 14.) share buybacks at Fairfax equity holdings: both Fairfax India and Stelco bought back shares in 2022 and this boosted Fairfax’s ownership stake in each company. - Fairfax owns/controls 58.4 million shares of Fairfax India (as of Feb 2022). Total share count at Fairfax has fallen: Dec 31, 2020 = 149.4 million; Dec 31, 2021 = 142.2 million; Sept 30, 2022 = 138.7 million. Fairfax's ownership at Fairfax India increased from 37.3% to 42.1%. - Fairfax owns 13 million shares of Stelco. Total share count at Stelco has fallen significantly: Dec 31, 2020 = 88.7 million; Dec 31, 2021 = 77.3 million; Nov 1, 2022 = 55.1 million. Fairfax's ownership at Stelco increased in 2022 from 16.8% to 23.6% (significant). 15.) Proposed privatization of Atlas: a group (lead by D. Sokol) has proposed to take Atlas private at $15.50/share. Fairfax (with 45% stake) is supportive of the deal. Fairfax is not obligated to purchase any additional shares. The deal is expected to close in 1H 2023. This is a massive deal and involves Fairfax’s largest equity holdings. I don’t have a strong opinion on the proposed deal right now. All things being equal, I think being a private company is better for Atlas. However, I do not like the lack of financial details available on Fairfax’s private holdings. Negatives 1.) increase in net debt of $1.3 billion: Sept 30 = $7.6 billion. Dec 31, 2021 = $6.3 billion. The pet insurance sale closed the end of October so the net debt number of $1.3 billion will come down when Q4 is reported. It will be interesting to see if Fairfax decides to bump the minimum $1 billion cash at hold co to a higher number moving forward. 2.) impairment charge: non-cash impairment charge on goodwill of Farmers Edge of $109.2 recognized in the second quarter of 2022. Like all large companies, Fairfax has a few warts. 3.) continued losses from what is left of runoff; what will average loss be moving forward? -$25 million/quarter? -

Over the past week: SU, GOOG, AMZN, META, QCOM, DIS I also rebuilt my dividend portfolio (mostly Canadian stuff): TRP, ENB, T, BCE, VZ, BNS, CM, CWB, WFC, C, SLF, GWO, DXT