-

Posts

15,169 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

I Need a Laugh. Tell me a Joke. Keep em PC.

Spekulatius replied to doughishere's topic in General Discussion

-

Sold LEVI in my tax deferred accounts. Got scared by reports about "peak denim".

-

There has been some decline in defense stocks in particular LHX which has two mergers pending (AJRD and a sateeite business) so i think it ight be interesting again. No position currently but it looks interesting from a LT perspective because the threats that may increase defense spending are still present. LHX is lower now than at the start of the Russian invasion, which doesn't seem right. Just from a fundamental POV, the stocks including LHX don't look cheap yet.

-

It's also interesting that these cruise missile systems didn't get intercepted by Russia and have been able to penetrate deep into Russian air space. One of the targeted airbases was close to Moscow. Ukraine may be able to fly one of these ones right into the Kremlin.

-

Looks like they mostly invest in US tech, so the hurdle should be QQQ. And, yes, their DIA return seems completely off. I get a similar result than @Dinar using this freeware calculator: https://finmasters.com/stock-calculator/?sa=DIA&d=20080930&a=1000

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

I highly recommend Retrograde - a documentary about the US pullout from Afghanistan in 2020-21 from a soldier POV (US and Afghan). https://films.nationalgeographic.com/retrograde It streams on the National Geographic channel on Disney+ -

Every manager who holds a large position in CVNA needs to consider their analytical process. This blowup wasn't exactly hard to predict. I do think that @changegonnacome is correct that style drift occurred with many money managers because it worked very well for some time.

-

Yay -the paper clip is back. This makes sense. The openAI Chatbot is actually pretty good to create outlines for some standardized stuff. i can find these online as well, but having this AI Chatbot directly in Word or Excel maybe is more convenient.

-

Geico really does not have a good bundle of auto with homeowners. They used a different company (I think it was Travelers) for the homeowner part and when I was looking at them, it was two separate bills. The lack of homeowner bundle is a weakness of Geico. I had Geico at the beginning, but once I bought a home in 2002, they were not competitive with a bundle for me any more.

-

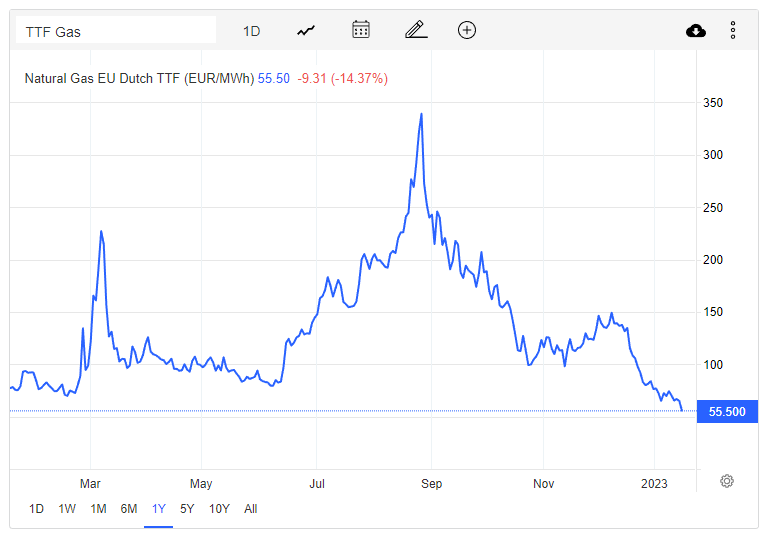

I believe the German NG storage capacity is ~240 Terrawatt and the annual consumption is ~1000 terrawatt. Of course consumption is higher in winter. However, I think there is no way that Germany can run out of NG this winter any more. Russian NG was almost 50% of the supply at peak but the two newly operational NG terminals should take care of ~12% of the total already with a couple more coming online. There are is additional supply from North Africa and Norway coming. It's not just the warm winter either. The first month in November/ early December was way colder than average and then it got warmer.

-

Yes. I think this winter is done. Storage levels in Germany are ~90.5% and often, the winter in Germany is over by late February. At least one and soon another LNG terminal went operational this winter, which partly replaces the Russian NG. Putin lost his NG gambit. Game over. His NG is now stranded and he has to move it to other sources - Turkey and China which is going to take years to get the expensive infrastructure ready. Once ready, he will have to sell it for way cheaper than he was able to do to Europe, even compared to pre- invasion prices.

-

Yes, I see it the same way. I think prices will drift in the 30 Euro range over time. That's about $10/ mm BTU.

-

I agree with Dinar here- Europe/ the US opening borders for Russian's would bleed Russia much more so than the war casualties . They could even have the pick of the people they allow in. It's likely cheaper too and net beneficial from a demographics POV. The people that like Putin are to a large extend not the one going to war. Think old people who grew up with the Sovjet Union was a superpower. There are even quite a few older people in Germany who seem to like the DDR still, even though their life has improved by leaps and bounds.

-

Hilarious chart for European NG prices. my guess is that they will go below 50 Euros and then stay there. i think before late 2021, the prices were below 25 Euros. They unlikely will go back to this level, but i don't think they will be 3x that former level either. For reference 55 Euro (3.412 conversion factor* 1.08 EURO/USD) is still 17$/mmBTU and US prices are around $3.6/mmBTU.

-

Putin may not be able to afford losing this war, but that doesn't mean he won't. Japan was willing to sacrifice all heir soldiers too and it didn't help them. Now the technological delta between what the west can supply and what Russia can get is way larger than during WW2. Russia simply can't make up the difference in combat worthiness with conscripts serving as meat shields. Let's see what happens, but I am willing to bet that Ukraine get's quite a few tanks for an offensive. The UK has already greenlighted a few Challenger tanks (only 14) but that's just a signal for the NATO meeting in Ramstein where the next Aid package will be decided and that will likely include more tanks from Germany. Also note that the German defense Minister Lambrecht just stepped down. She has been reluctant to supply heavy weapons to Ukraine but likely due to directions from the Chancellor Olaf Scholz, but I think she has become the sacrificial lamb to allow a change in policy on this matter. https://www.cnbc.com/2023/01/16/german-defense-minister-christine-lambrecht-resigns-amid-ukraine-war-backlash.html

-

I looked at SAFT as a stock and heard they are middle of the road so to speak from a customer perspective. The insurance agency I work with carries Plymouth Rock, but for some reason, they don’t recommend them for me. For insurance, I simply go with an insurance agency and let them figure it out. I got the agency recommendation from my realtor when you bights the house. I checked the Google rating and they were good, so I went along and so far my experience has been good. Inhavent had any claims though. 1) I bundle all my insurance needs with one insurance co (told that to my agency but they tend to do so anyways.). That‘s car (2 soon to be 3) our home and umbrella. 2) I use relatively high deductible ($1K if it makes sense for premiums) 3) from time to time, I run a control with another broker. Last one was with a guy who had Liberty Mutual and the prelim quote for the homeowners looked much lower. I simple sent them a pdf of my current insurance package and then let them firgure it out. When it was all said and done, the package from Liberty Mutual came out a bit lower but not much. So I stick with my current package. When I lived in Long Island, I had a different broker and they put our package with Narrangasset Bay insurance. I checked the rate was much lower than Geico could offer for car. In California I was with Western Mutual and later with Mercury. Mercury in particular gave us an awesome deal for the bundle.

-

I am with Quincy mutual and a “Robinson” in Progressive Lingo. I have seen rate rises, but nothing too crazy. I like the Mutual insurers and have been using them for a while. They don’t have telematics or any of the fancy stuff at all. I ran a comparison and could save some bucks going with Liberty Mutual, but according to my broker, their claim experience is worse than with Quincy , so I stayed away from them.

-

The west will leave India alone, because the problem of India being aligned with Russia solves itself. As long as India does not deliver weapons to Russia, nothing will happen. The reason the problem solves itself are as follows: 1) Russia’ economy is very small and does not have gravitational pull. They have nothing to offer but cheapish energy. 2) Russia has aligned themselves with China, which is an India’s biggest enemy (besides Pakistan). 3) India has purchased a lot of weapons from Russia, which have been found vastly inferior to western or even a Ukrainian weapons. They are also inferior to China’s weapons at this point most likely. So this issue of India being aligned with Russia will solve itself over time. There is no reason for the west to push India around.

-

Tried this out for the first time and I am sort of impressed. It’s better than some essays I habe seen. my son also really had piano lessons even though I didn’t really put this in my input.

-

Russian NG was never that cheap in Europe, Europe had already to deal with higher energy costs for a while, that’s nothing new. Now Europe is going to pay spot and later contract prices for LNG to replace the natural gas. Those prices are higher than what they used to pay , but much lower than the prices that they are paying now. I don’t see a widespread de- industrialization but I think some industries that use a lot of Ng like basic chemicals and steel production are going to be challenged. I do think that the current situation in Europe will lead to even more renewables for energy but how to ensure grid reliability with all those fluctuations in production is going to be a challenge. I also think we are going to see a boom in defense spending for perhaps a decade pretty much everywhere (Europe, US, Asia, China).

-

Can the Visa and Mastercard moat be bridged?

Spekulatius replied to Sweet's topic in General Discussion

Hm, I checked their release and it looks like they smashed the VISA piggy bank to compensate for other losses, At least it reads that way. VISA shares have held up pretty well (as did their business) so I see how it is enticing to sell those shares, especially if you expect an economic hurricane. -

A cording to Ukrainian sources, the Russians are losing 500-600 soldiers on average/ day. That estimate of combat count casualties may be a tad optimistic, but I think Russia also loses people where Ukraine does see them (thickness, accidents, weather related and other attrition losses etc). If the losses are about correct, and we take a 550 average loss number per day, then Russia is going to lose 200k soldiers/ year and will need to new recruitment drive every year to keep this up. The 300k they raised in fall 2022 will be spent next fall. We probably need to give Ukraine more decisive weapons that allow for deceive wins in addition to the ability to strike these drone bases that continue to bash the Ukraine infrastructure. Europe is a relatively good shape. My brother is telling me that energy prices even for consumers are now rapidly dropping and the economy isn’t too bad. The meltdown from an energy crisis has been avoided for sure. Gas is at 64 Euros/MWH down from a peak of over 300 Euros, but still tripple the price from 2020. It’s won’t get all the way back to 2020, but I think it could go to 30-40 Euro pretty quickly. Storage in Germany is still 90.7% full and 83% in Europe overall. Further ore, the discounts on Russian crude keep increases as they have to dump this on fewer and fewer buyers apperntly.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

Yield curve is deeply inverted now. So far, its 5/5 while I have been "watching" markets predicting recessions: -

Why would a person in the US have a brokerage account with Schwab when Fidelity offers exactly the same thing, but gives you interest on your cash (currently ~3.7% in SPAXX) when Schwab pays you almost nothing (unless they changed this recently). Besides IBKR, Fidelity is about the only mainstream broker that gives you decent interest on cash balances / MM funds.

-

Reason 1) The labor market is about the only thing that the Fed has an influence on, by increasing interest rates to slow the broader economy . The Fed has no impact on crude, energy, food prices and many other things. Since the tight labor market presumably means persistent wage pressure, it is a number that the Fed is closely looking at, since it impacts core inflation. Reason 2). The Fed has dual mandate of facilitating price stability and maximum employment. Typically the two are contradicting each other - full employment means wage pressure which leads to inflation and that contradicts the primary mandate of price stability. Price stability is the most pertinent issue right now, so the fact that we do have basically full employment (which has in the past been defined as unemployment rate <5%) it means that the Fed should tighten to reduce inflation as long as the full employment mandate is not impacted.