-

Posts

15,180 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

The chart really shows that 3 month worth of data isn't worth much imo. I actually agree that it looks like the worst is over, but we could still have a 5% inflation run rate right now. We cant use monthly data and I think YoY data is the right way to go about this. When you want to control something with a lot of noise, the last thing you want to do is react to every high frequency input.

-

Odd lots has a good podcast on the controversial stable coin Theter: https://podcasts.apple.com/us/podcast/this-is-what-we-know-about-how-tether-works/id1056200096?i=1000589836780 Looks like something build to be a black box - little is known about what they own and where they hold assets (supposedly Taiwanese banks). It's basically a crypto bank in the British Virgin island operating from HK. You can't really make this stuff off. Whoever holds this and is surprised when part or all the money is gone (peg is broken etc) is not paying attention. Mindboggling...

-

My main worry would be that Ukraine starts to shoot down cheap $20K drones from Iran with $500K missiles. What concerns do you have? Ukraine needs longer range weapons to destroy the drone / rocket bases from which Russia launches their missiles, imo. The US knows where they are (I presume) based on trajectories and satellite surveillance.

-

@Parsad That one may be more relevant: https://finance.yahoo.com/news/binance-withdrawals-surge-concerns-report-002040397.html Binance is probably toast. The owner seems weird and has been backstabbing other crypto exchanges. Looks right now that it may be his turn now.

-

The car/truck would need a huge generator to do so. It would be a waste for almost anyone.

-

This whole thing is so bizarre on many levels:

-

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

Going through the Ricky Lee Jones Apple Playlist today: That's some of the best Jazz/Folk/Pop of the 80's. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

To be sure, I am not sure which way GSHD goes - MLM marketing scheme or legit insurance franchise / operator or something in between. 1) GSHD has seen strong growth in recurring revenues recently 2) I don't understand how a 50/50 split works for a franchise. it seems very high to me, comparable what a real estate agent can get when he works with a franchise like Coldwell bankers etc. However in that case the real estate will do the complete back office, pay of the office space, some of the branding advertisement etc. that's way more than what GSHD seems to be doing for their franchisees (some call center and some software / connections with insurance cos ). I could be wrong, I have neither experience in insurance nor with real estate agencies. However, I have talked with my real estate agent about how this works (she ended up going alone later). -

Adding a bit more PBR A this AM. Anybody knows why it's down pre-market? I assume more political rumblings in Brazil.

-

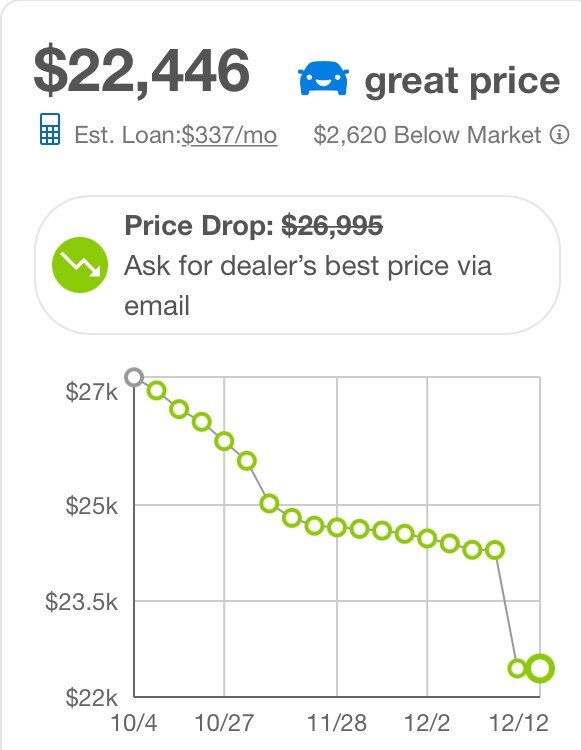

Actually used car values have been coming down quite a bit since Summer 2022. Lets take a typical sedan - Honda Accord: https://www.edmunds.com/honda/accord/2020/vin/1HGCV1F16LA089349/?radius=100 Most used car charts for different brands and models etc look like this. Fred shows this too, but their trend line lags a bit behind.

-

Ouch, that’s more than 5x the hugely inflated prices on the European continent! What does the Uk do to alleviate the situation? Germany builds LNG infrastructure like crazy to replace the Russian NG with LNG. The problem won’t solve itself.

-

@Blugolds11 The interview is almost 4 h long, so it didn’t watch it entirely. Yes, I mixed up in the interviewer with the Bustamante who seemed to have wrongly assessment the situation (claimed Russia was winning) based on what happened since the interview was given.

-

Onex looks more like a 10% annual grower than a 15% grower (which is their stated target), but that’s still cheap at ~50% NAV. They can add a few percent of growth just buying back shares below NAV. I don’t think this business is as good as those US alternative asset managers or even BAM nor does it need to be at this valuation.

-

@Grenville All insurance cos do this from time to time. You need to good agent to search out the right insurance for you. On the East coast where I live, it’s often a mutual insurance cos. I also bundle everything (homeowners, car, umbrella) into one. They are also very good on the claim side - at least that’s what my agent tells me (haven’t had any). I guess that goes into @dealraker thesis regarding insurance brokers. I used to do this all myself (finding cheap insurance), but the brokers are worth their money, if you find a good one.

-

Re MMM, the combat earplug and PFAS lawsuits will be expensive and take a long time. I think they are depressing MMM stock.

-

If stocks are cheap enough to pay out cash to shareholders, you don’t need rerating. I only buy energy stocks that pay our more than 10% on equity annually over a cycle and preferably much more. That way, you would get a return no matter what Mr Market is doing with the multiples. More often than not, betting on an expanding multiple is a fools errand especially for an entire sector. It could happen, but may not or may even go the other way. If I had to make a bet, hydrocarbon extraction is going to be a substantial business 50 years from now but probably smaller measured by volume than it is now. As for prices, I have no idea and they probably continue to fluctuate wildly.

-

It is important to keep in mind that this interview was done in August 2022 when Russia had advanced as far as they ever came, just having captured Severodoneskt. Since then, the Russians have lost a huge area around Kyiv as well as Kherson. Not a whole lot winning as far as I can tell here. So it seems like Lex Friedman has been wrong on this matter, plain and simple.

-

These buybacks only work LT (over many years) not short terms though. My guess is that energy securities have caught a bid, maybe funds want to show something that looks like a winning trade at the year end. We have seen similar things in the past. Who knows. As I stated, I think it gets resolved one way or another and the correlation between crude and XLE will tighten again.

-

I am looking forward at the first school essays written by this ChatGPT:

-

The AI mistakes seems surprisingly human like. Depending on what you want to accomplish this can be good or very bad.

-

Looks like energy stocks have diverged from the underlying crude. I think this divergence will close one way or another:

-

Bought a small Spec position in $PUBM this AM. Looks bombed out but is profitable (Sell side ad market place). It looks like something that could get bought out. Bull case here:

-

LOL about Bye Bye personal trainers. Pretty much everyone knows what they are supposed to do but nobody does it by himself due to lack of motivation. That's why personal trainers exist, not because of what they know. FWIW, i can see already about feeding garbage inputs into the AI and then getting people killed. Just like the people who drive off a cliff because they trust their GPS more than bother checking their environment. This does look like a fun tool though and I will try this out myself. Maybe let it try to write one of my sons college essays since he is limping along with those.

-

good read: https://www.wsj.com/articles/natural-gas-terminal-engineering-feat-germany-11670513353?mod=hp_lead_pos10

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

Spekulatius replied to tnathan's topic in General Discussion

Hmmm: https://valueinvestorsclub.com/idea/GOOSEHEAD_INSURANCE/2028354943#messages The 50:50 split for recurring business sounds egregious to me too, why would anyone agree to this as a franchisee?