-

Posts

15,169 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

-

Reduced my position in CMCSA a bit pre-market. These quarterly results weren't really that great. Still holding most of my shares.

-

Some moves from the bottom have been astonishing: $TSLA almost 50% from it's bottom around $102. $META - 50% from the bottom around $92 $BABA almost 100% from the bottom around $62. $ASML - ~85% up from the bottom around $365. If you know how to bottom fish, l there is a lot of money to be made here.

-

I count 31 Abrahams, 14 Leo's, maybe some more Leo's from the Poles. Any ideas how many they will get? It will also take a while to get them operational. Guderian knew his stuff and said " Nicht kleckern sondern klotzen" - as it referred to tanks. This means loosely that tanks should be used en masse and not piecemeal like the French did in 1940. I think the best use of tanks is to use them to severe the land bridge to Crimea and get the Russian troops there bottled up there and destroyed. Taking out the bridge to Crimea would be necessary as well to accomplish this goal.

-

I bought 2/3 (roughly) $CPT and 1/3 $ESS position after pupil posted is multifamily Reit trade. I think i will do Ok, but probably not great on that one.

-

Whether tech stocks are dead (money) or not depends on if earnings in this sector will be growing or not. I don't think tech will be dead. Tech wasn't dead in 2002 either.

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

Looks like BRK sold USB close to the bottom. Another incidence where cloning does not seem to be a good idea. Results look pretty good and union bank will be a nice acquisition. Now USB needs to get their capital levels back up again before resuming buybacks. https://ir.usbank.com/static-files/8cd68595-d3df-4682-a972-4c6d0cdc3624 -

Operation Blau 2.0: Some good stuff getting some action - Abrahams, Leopards, Bradley's etc. I think Abrahams were sent to force Olaf Stolz to sent Leo's as well since he had the lame excuse he didn't want to go alone... https://www.dw.com/en/ukraine-updates-germany-approves-sending-of-leopard-2-tanks/a-64506202

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

I finally finishes this limited neo western series (The English) and think it's a masterpiece. It kept getting better each episode. Highly recommended. https://www.imdb.com/title/tt11771270/ -

I owned the closely related $VTRS but sold out of the stock. It's a tough business and there is a ton of debt to be serviced. I think they are a better bet than TEVA, if you think the generics business will improve. Maybe I have given up too early on $VTRS but the disappointments did keep coming. VTRS at least pays a decent dividend.

-

Well, the Burrito at Chipotle next to my work went from ~$7.5 in late 2018 to $11.4/7.5 - up 52% so that's about right.

-

@dealraker - if you never sell anything basically, where do the funds for new purchases come from? Dividends? BAX chart does not bombed out, but they do carry a lot of debt.

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

The English (On Prime Video) is a first rate Neo Western. I watch it now and highly recommend it. -

Great podcast episode recommendation thread

Spekulatius replied to Liberty's topic in General Discussion

Not a podcast, but Clare Hart from JPM sounds pretty good: -

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

Marmon is a conglomerate on its own. Marmon within Berkshire is a nested doll - a conglomerate within a conglomerate. -

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

I watched it when released on HBO. It’s a pretty good movie. In the similar genre, I watched the second season of Wiking Valhalla and wasn’t impressed. The first season of Valhalla (and of course the original series) was very good, but this one just didn’t cut it. I scratched Treason off my list. Looked already questionable and generic, so I am not going to put time in it @Xerxes -

China (most just China) got to keep the lights on at night: https://www.wsj.com/articles/shining-a-light-literally-on-how-much-dictators-manipulate-their-economic-stats-11674183190?mod=economy_lead_pos5 A recent paper, published in October, by the University of Chicago’s Luis Martinez shines a light on the extent to which autocratic governments might be juicing their estimates of gross domestic product, the commonly used measure of an economy’s size and might.

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

This probably means that Ajit does not want to die in his office chair in Farnam Street like Warren. Also Interesting: The Fiorenzas paid about $9.9 million, or $2,080 per square foot, for the unit in August, which means they sold it for a 60 percent markup in about eight months. -

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

I agree. It is much better than the reviews indicate in my opinion. It has an ominous feel throughout with the blueish color palette and the casting is strong as well. -

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

LOL. I also look forward from the discussion moving from inflation to deflation. Mr Market is always on the move. -

So What Exactly Is The "Short Homebuilders" Thesis At This Point

Spekulatius replied to Gregmal's topic in General Discussion

I was surprised to read that KBH's inventory value was actually down QoQ ($5.54B vs $5.74B). They have put he brakes on land acquisitions a while ago and now control less lots than a year ago. Inventory value YoY is still up ~15% https://www.sec.gov/Archives/edgar/data/795266/000079526623000004/exh991kbh-earningsrelease1.htm -

Yes, i think Ukraine targeting Moscow is unlikely. In addition, the Kremlin is a world heritage site (just learned that when i looked it up), so that would be another argument against this particular target. I could see something along the lines happening just to force Russia to disperse resources. This would be similar thinking than the first British bombing raid on Berlin in 1941 that had only symbolic value, but led the Nazis to disperse large resources to protect German cities.

-

Bought just a little of $DFS pre-market because I really liked the results, despite the headline of their customers showing weakness. Many positives like strong earnings, resumption of buybacks strong capital ratios etc.

-

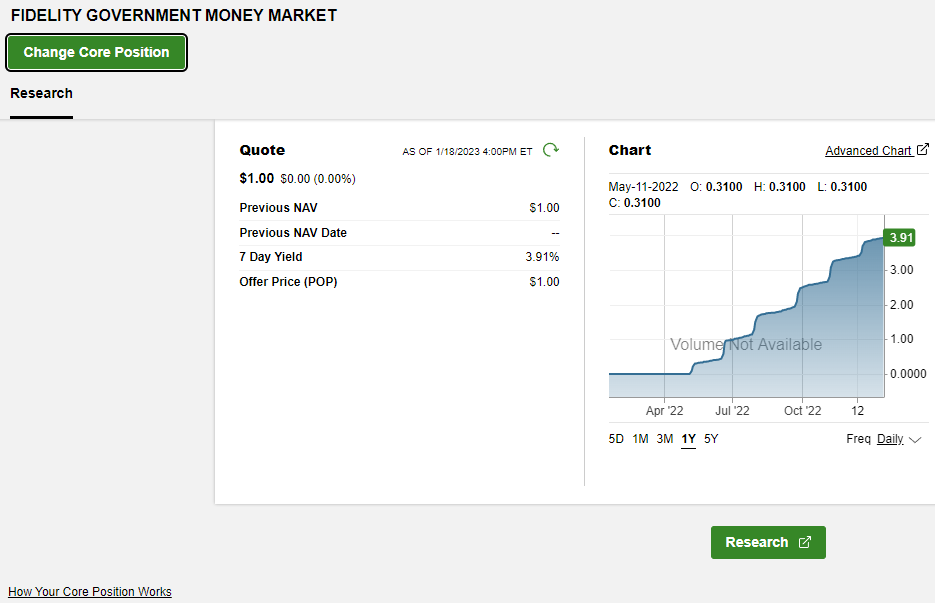

The Fidelity government MM fund currently yields 3.91%. I do nothing and that's where my cash goes to automatically in my Fidelity accounts:

-

Yes, you are absolutely correct that IAC looks cheap based on SOP. I do think that they have lately shown a lot of operational missteps. its not just Meredith but also with ANGI. Some of these mistakes seem strategical as well. I question why they get involved in Meredith at all, this is something that even if it works, is probably not going to create a lot of value and an acquirer like ZD which does these type of asset repositioning for a living seems to be better suited. With ANGI, they got over ambitious and intended to transform the ANGI/Homeadvisor marketing/ lead portal into a service portal and got nowhere. In the meantime, something like Thumbtack got traction and provides a much better customer experience imo. Those are just two things that come to my mind and they don't have just to do with the weakening economy.