-

Posts

15,114 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

I disagree. You can expose assholes with humor and Prighozin and Putin deserve all the jokes they get and then some.

-

The problem with CNY is that they soft-peg their currency against the USD, but not their monetary policy. Currently China is lowering interest rates and otherwise easing money supply while the US is still tightening. That puts pressure on the USD-CNY ratio naturally. The bigger problem with CNY becoming a reserve currency is that it's not freely exchangeable in other currencies. You can get your money in the Yuan easily, but you may not be able to get it out.

-

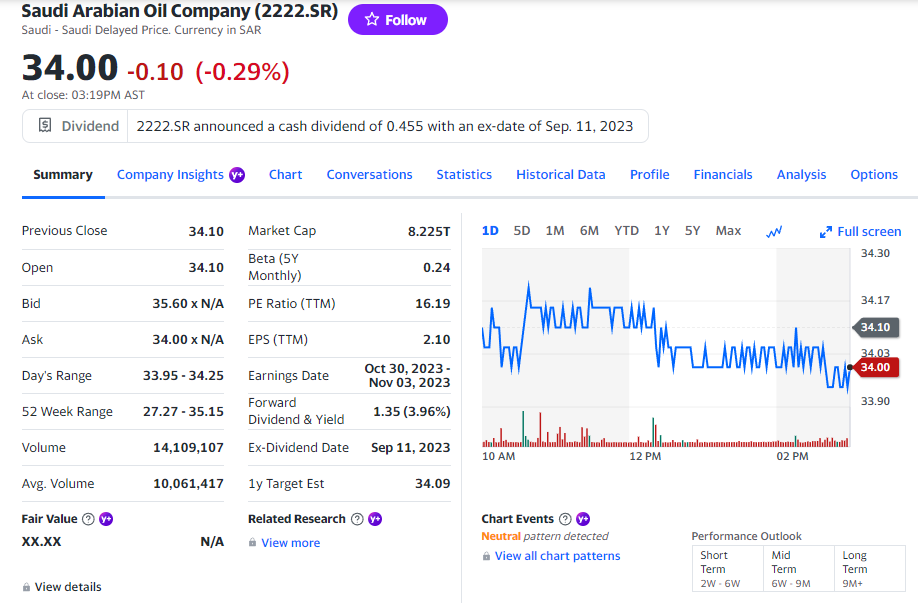

Aramco looks overvalued, not sure I got this right. If it paid 15% dividend yield and traded in an exchange I could actyhually buy it, I would think about it. Even then, I think PBR-A is actually a better investment.

-

Everything is obvious in hindsight. The Winners in 2050 that exist today will be obvious in hindsight. Same with losers.

-

Adding to LHX here. Shares are back all the way to 2020 levels. Main culprit is margin pressure and perhaps the AJRD buyout, which adds debt . Their order book is pretty healthy . I think they can overcome the margin pressure and I can see them earning $17/ share in a few years. Businesses is fairly capital light so most of the earnings go directly into FCF.

-

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

-

-

What App Do You Use for Watchlists/tracking?

Spekulatius replied to CorpRaider's topic in General Discussion

I use interactive brokers and Tikr watchlists. I used to use Yahoo/finance but they have been working hard to make it un-usable for a decade know and finally succeeded (imo) -

This article seems very speculative. I don't think anyone can know what is going on within the CCP inner circle.

-

Even if something is "un-investible" it can be an intelligent speculation.

-

Sold my KW 2/2030 bonds I had for a small profit. I am not feeling all that giddy about the collateral. I am surprised the equity still trades where it does (~$16/share).

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

Netflix has two great docu series: 1) We are Newcastle United - about the transformation of the Newcastle Football Club into a top tier team (with Saudi money) 2) Zero Gravity - a documentary about Wayne Shorter and his role in modern Jazz Both are extremely well made shows. I on,y watched one episode of both , but they are captivating and watching this Newcastle DOCU series you understand why rich owners like to own soccer teams or sports clubs in general. -

Tepper move seems more like a giant swing at a big tech which includes some Chinese securities as well. He used to be a distressed security investor - has he become a swingtrader now? I don’t think he was ever buy and hold.

-

Weather in FL is a bit of a question mark. I prefer the weather in the NE over FL except 4 month in winter. MA is not too bad with 5% state income tax and the revenue tax is actually a bit lower than FL. NH is hard to beat with no income and no revenue tax and it’s a beautiful place, except in winter. My wife thinks we should just move over the border once we retire and stay here in the area. The RE taxes are sort of high through, just like in MA. Many ways to slice the cake depending on your preferences. States like NY or IL are definitely not place to be when you are retired.

-

In addition, if you own a property in Maui, you are certainly not poor and probably in the top 3% or better in terms of wealth in the US population. That what we are really doing is welfare for the already rich. I can understand some help for those who work there in tourism and are displaced and need to rebuild their life elsewhere, but if you are homeowner in one of the most exclusive and expensive areas in the US. Sorry for the OT rant. On the insurance, let say you pay $5K more for is insurance than in the Northeast for a $500K house, that just offsets the higher cost of property taxes in the NE vs Florida. Fl taxes for a $500k house would be ~1% of the home value and $5k and more like 2% in the NE ($10k) roughly. So it’s probably not a game changer to prevent you from moving there unless it gets much worse.

-

German Taurus missile. These marketing departments for weapon manufacturers are getting better. There is a version to take down bridges too. RIP Kerch bridge once those bad boys arrive:

-

Well, my starter positions are small. I do agree there is a lot of uncertainty here.

-

With 15% of Floridians not having homeowners insurance ( I guess they have no mortgage) and 82% having no flood insurance, I think the implicit expectation is that any big catastrophe losses will be socialized.

-

Currency movements in China are not free and need approval from ministries. The Yuan is not freely convertible into other currencies in large volumes either. China is a bit like a roach motel, you can get money in easily but getting it out can be quite difficult. I suspect quite a bit of cash from international companies is trapped in China.

-

This should really be an IR deck for an air conditioning or backup generator company.

-

My wife is ethnically Chinese too, but grew up in Thailand. We know a lot of 1st and 2nd generation Chinese emigrants and they are deeply distrustful of what happens in China. Those living in HK or Macau want out or have already a foreign passport ready to go if needed. This was not the case 15 years ago.

-

Its is interesting that one of the new ideas was to sell dump a minority stake in ESPN to a strategic investor. I guess that's not going to happen. ESPN seems to be at the core of the dispute.

-

NXST (and other broadcasters) really get toilet flushed. Ouch.

-

Yes, now I see it too. It's odd that other media stocks are down more than Disney though. ESPN is the biggest racked in cable - it costs more than many streaming services.

-

buying a starter in NXST this AM. Why are all media stocks down this AM? Doom and gloom from writers strike?