Leaderboard

Popular Content

Showing content with the highest reputation since 01/28/2025 in all areas

-

Because board members are ruining existing threads as they move like parasites from one thread to another spewing political garbage, I will be automatically be doing 30 day member bans for any new political comments festering any threads. Trolls will also be dispatched quickly! Cheers!1 point

-

Four Nations USA vs Canada on right now. Probably some of best hockey you’ll ever see.1 point

-

Yes, I do. I wouldn’t have been buying up to last week and have 49% of my net assets in it if I didn’t think so. As I tried to explain in the substack, I use a 10% hurdle rate which means there are an abundance of opportunities in the current market that meet my hurdle. What makes FFH special enough to demand half my capital is twofold. To start, the hurdle rate seems likely to be exceeded over the next 5 years by a wide margin. I consider the chances average ROE exceeds 15% over that period to be 90%+ so the odds of exceeding 10% are even higher. I think the odds of 25% are higher than 10% by a wide margin. As a probabilistic investor, that’s a very special set up on fundamentals alone but on top of that the odds for multiple expansion seem very high and are open ended. There is lots of support for the multiple to expand including index add potential, potentially 10 years averaging >15% ROE (4 down, 6 to go) which leads to holders less likely to sell, 7m shares already repurchased or under TRS leaving less supply. I think people selling this week are playing a relative return game and not an absolute return game with a reasonable hurdle. I think the latter is most of the shareholder base but there will always be marginal holders. The less marginal shares available though means the higher the share price will go when passive and Canadian active PMs have to buy without regard for value.1 point

-

1st share cost me under $1k, including commissions (5% of pp back in those days). Many more since. Buffett created many multi millionaires. Count me as one.1 point

-

I assume the dividend is so Prem and the employees can afford to do some good works with their wealth while they are still alive! Also, it’s probably better for people to not get used to selling if they are going to enjoy the whole ride.1 point

-

I feel if FAIRFAX changed their name from all caps to a mixed cap fAIrfax, the multiple will explode.1 point

-

Here is Francis's Q4 activity as disclosed on the 13F (so, no foreign info, OTC info, etc) https://www.dataroma.com/m/m_activity.php?m=ca&typ=a The Chou Associates portfolio (again, 13F) here https://www.dataroma.com/m/holdings.php?m=ca Sold completely out of Navient and Occidental1 point

-

I'm not sure I followed your post but that doesn't mean it isn't right. Basically it's just a financing deal - the banks hedge their end of the contract so they aren't taking any directional risk. That could mean balancing a portion of it with other market participants that want to put the opposite TRS on (unlikely in the case of Fairfax stock but quite likely for other assets) or, as in this case, just buying the shares to offset the directional risk completely. The fees and interest rate are where the bank makes money. They are the bookie, not a fellow gambler. The counterparty also gets the dividend, which is factored in to what they charge FFH. There is a cost to Fairfax to keep the trade going. But when the contracts are terminated - the hedge shares become available to either hit the market for sale, or as is more likely here, get bought up by indexers and closet indexers when Fairfax gets added to the S&P / TSX 60 index.1 point

-

1 point

-

because banks are “financial services” companies and they are providing financial services to a corporate client, who has decided to take a position on itself and needs a product that fits the needs. Ideally banks makes their dough via fees And not taking a directional position for or against the corporate client. I.e so they would have been long the FFH shares to balance the TRS, if the risk officer was clear minded1 point

-

1 point

-

https://www.globenewswire.com/news-release/2025/02/13/3026345/0/en/Fairfax-Financial-Holdings-Limited-Financial-Results-for-the-Year-Ended-December-31-2024.html Book value per basic share at December 31, 2024 was $1,059.601 point

-

My household and I have been continuous shareholders of FFH.TO since 30th April 2013.1 point

-

March 2007. I was wondering who has CDS bets.1 point

-

Started nibbling around a year ago in the 1200s CAD when the short report from muddy waters was published.1 point

-

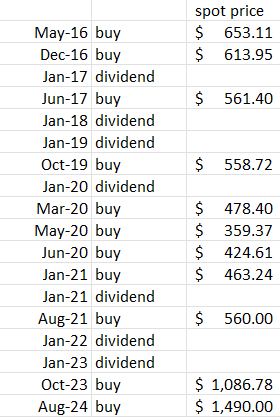

First bought in 2016 as a tracker position at $653 CAD. Leaned-in in the past 5 years. Three-quarters of shares were bought post-2020. Nothing has been sold. Based on my archives, my average cost bottomed at $494 CAD in January 2021, then average cost has been going up. Today's average cost is at $660 CAD.1 point

-

@Buffett_Groupie, I just wanted to say… I really appreciated you asking the question you did at the AGM last April. That took a lot of guts. And you handled it with class. Fairfax needs to hear from shareholders like you - so they don’t get complacent. Especially now that they are on a hot streak. I look forward to chatting with you again at this year’s AGM!1 point

-

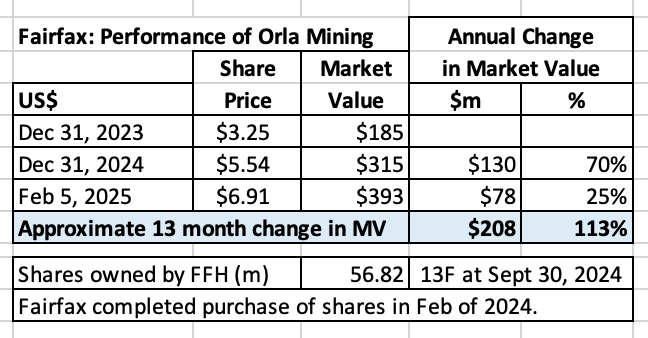

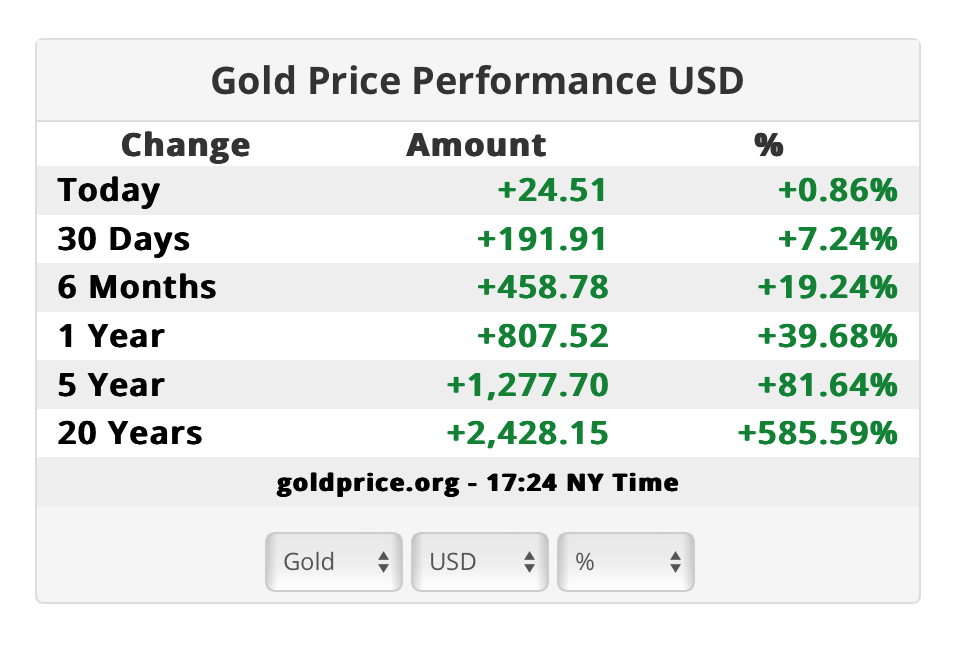

The share price of Orla Mining has been on fire the past 13 months. Gold has been in a strong uptrend for the past year. And a Trump presidency appears to be the latest catalyst. Fairfax finished building out their common share position in Feb of 2024. They own about 57 million shares = 18% of common shares outstanding (not including convertible note issued in Nov 2024). The market value of Fairfax's stock holding is about US$400 million today. It is up about $200 million over the past 13 months (+100%). In November, 2024, Fairfax also participated in a convertible notes offer by Orla of US$200 million (not sure how much of the $200 million that Fairfax purchased). There are three components to the convertible notes offer: Interest rate = 4.5% Convertible into shares of Orla at C$7.90/share Warrant = .66 share convertible at C$11.50/share At current market value, Orla is likely a +$500 million investment for Fairfax (including the convertible notes).1 point

-

If you really want to be more of a contrarian, you would flip from somewhere in the middle, as the A's have probably been picked through first, and second order thinking would have the Z's to be picked through, leaving you with.. somewhere in the middle. Unless you do a 3rd order thinking, leaving you with... random order. Whatever you pick, enjoy your treasure hunt! It is a real luxury to sit down with your favorite drink, and some reading to keep your mind occupied and fed.1 point

-

Politics matter as the decisions can have economic impact and drive markets. The problem is that threads tend to get derailed in drivel and become worthless for investment purposes. I created one topic recently that went so far of the rails that I asked @Parsad to delete it. Fact is - nobody’s else gives a damn about your opinion but you.1 point

-

If you can pay for business class without flinching, then you are definitely comfortable. Even then, depending on your psychological makeup, you still might flinch. I'm comfortable, but I still bristle when I see business class flight prices, so I generally go in the middle...premium economy! If I get an upgrade... great, that's icing on the cake! You still get priority boarding, lots of leg room and shoulder room, plus you pretty much get all the food and alcohol you want on the flight. And they still give you a pillow and little duvet! Then again, I didn't have any problem dropping $12K for two nights at the Fairmont Hotel Vancouver the weekend before Christmas for a 3-bedroom Gold Level Suite and a fully catered and serviced Christmas Dinner for 14 people in our suite's dining room. It was awesome! I'm ok spending a lot of money on experiences with my family. Even my nieces and my nephew had their own little dining area off the living room where they had their own server for the evening. Plus they had that Home Alone 2 sundae...16 scoops of ice cream with all sorts of toppings and syrups! And the hotel threw in the Christmas tree for my living room! We've been doing this for about 10 years...on a much smaller scale when I had less money...but this was the grandest year...Fairfax's return in 2024 was worth celebrating! Me personally...I still shop at Walmart because I like a bargain! I'm incredibly frugal except when it comes to experiences. I would rather spend money on something like this than a Rolex or some other material object. Cheers!1 point

-

Not entirely. The U.S. banks and most foreign banks operating in Canada (outside of HSBC which is now part of Royal Bank) operate as Schedule II banks, not Schedule I. So there are restrictions on what lines of business and what they can offer Canadian consumers. Essentially they are only half banks, like Trump is only half human! Cheers!1 point

-

Lucky. Just like when they sold Resolute at the top of the lumber cycle. Just like when they sold pet insurance when there was a mania in cats and dogs. Just like when the average duration of their bond portfolio was 1.2 years and bond yields spiked. Just like when they did a dutch auction and bought 2 million Fairfax shares at $500/share. I could go on… Maybe they aren’t lucky… maybe its skill… And if it is skill, the question becomes: “is it reflected in the stock price?” My guess is no. As a result, it is like an investor today is getting a free call option on this aspect of Fairfax. ( @Hoodlum , FYI, my comment above is not directed at you )1 point

-

Don't confuse volatility with risk. With $40B in bonds and $8B in cash, Fairfax is extremely well-positioned to take advantage of undervalued opportunities and hardly any of their businesses will be affected by tariffs. They should be licking their chops if things get volatile! Cheers!1 point

-

In 2017, first took a very small position only because it appeared that Fairfax's insurance business had improved significantly, and the stock simply looked very cheap. They had also mostly stopped the shorts/hedges which had held them back for years. In 2020, became far more interested in the company (beyond just a "cheap stock") after reading some very convincing posts here on COBF (much thanks to Viking and others). When Prem announced his purchase of ~$150 million worth of shares in 2020, I said "game on" and I decided to swing big myself. Bought my largest chunks of shares around $280 - 320 (US). ((I also had concerns that the huge amounts of Covid stimulus $ being pumped into the economy would eventually lead to higher inflation and higher interest rates, and FFH felt like a safe way to invest in something that would potentially benefit from higher rates. In hindsight, this was probably a silly "macro bet" mentality which would have been difficult to defend at the time. But there were plenty of other good reasons to invest!)) 2022 was particularly stressful, as my employer (at the time) was in the process of shutting down my plant (chemical plant operations mgr). Oddly enough, it turned out to be a wonderful problem, because after I left this job I had the option to "rollover" my old 401k into an IRA which gave me the opportunity to buy additional FFH shares with funds that had previously been restricted mostly to index funds. I was following this very board closely (mostly lurking and reading, rarely posting since I didn't feel I had much to contribute) and had been amazed the stock price had not increased much. Bought another large chunk at ~$460. Folks will call me crazy for doing this, but over the past 5 years my Fairfax investment has ranged between 60% - 90% of my net worth. Currently trying hard to re-diversify and get it back down below 50%, but I struggle to find investments where I have the same level of conviction. Slowly but surely I am diversifying, although I have a fair amount in my taxable account which I will probably never sell. It has been a life-changing investment for me and my family, and I can't say enough to thank people here. Cheers, Kevin1 point

-

I'm sure Prem would accomodate, but the AGM is really about Fairfax businesses and their philanthropy, so I would rather not. They do plenty to support the dinner that Rob is doing. Thanks for the thought, though! Cheers!1 point

-

As I've posted several times there's been ways to make an incredible amount of money being "associated" with Fairfax through the years regardless of Fairfax's stock price. The Hub insurance brokerage connection is or was the most important wealth builder for me outside of Berkshire and AJ Gallagher and probably the most significant investment I've ever made. It was just as successful as Fairfax has been in the last few years, an incredible literally guaranteed investment - but only in plain sight if you were associated with Fairfax.1 point

-

Not smart at all, Sanjeev because being smart means the ability to accumulate FFH in 2020, not 2 decades too early (1998), i.e. smart folks can time it right before it started to rise while I had to hold 26 years to get the same result1 point

-

I'm in the 1-3 years category. I made my first investment in September 2023 at about 1140 CAD and have since rapidly become confident enough to nearly quintuple my holding to become my largest concentrated position, adding FRFHF and FFH.TO during the Muddy Waters short decline (910 USD and 1365 CAD) and at later points in 2024 (1535 CAD, 1570 CAD, and 1455 CAD). My current expectation is that it will compound at a baseline 15%+ CAGR (albeit lumpy) in the long term with some quite possible kickers to boost that return especially in the near term. My intention right now is to let it run even if becomes very outsized in my portfolio. Anything that replaces all or part of my Fairfax position would probably need a superior long term outlook. Huge thanks to all the people who post here for helping me quickly gain that confidence, in particular Viking and SafetyInNumbers. Viking's posts (and the PDF book/compilation) read like a really rational and well constructed crash course on Fairfax and its hidden value drivers and really do have a hugely worthwhile impact. I do understand how the writing process can help you clarify your own thoughts and to check facts but I wanted to acknowledge how much they had clarified mine too and how much in accord with my investing style theirs is that I had very little to fill in from my own research to become very confident in making it my largest position. It could have been too easy for me as someone casually interested in Fairfax a couple of years ago to dismiss the run up in the last few years as "I missed the boat already" and to retain the impression I had carried that Fairfax's investing was a bit too macro oriented (hedges, now abandoned had seemed to be chasing a replication of their last enormous success of profiting from the GFC) or prone to falling into value traps (Blackberry), when's the truth is the portfolio as a whole had for years been doing just fine with many exceptional investments more than making up for those that haven't been great. The discipline and patience to keep bond duration short while rates were so low then lock them in for longer duration as they went higher is good risk management and capital allocation that inspired confidence. Combine that with disciplined underwriting and a Hard Market that may persist for longer than historically normal due to the whole industry that 1. fears falling interest rates and bond returns, and 2. has perhaps been conditioned by a decade of low interest and bond returns to avoid chasing market share and float instead of underwriting profit 3. is conscious of recent extreme weather events, including many where the losses weren't as bad as they might have been, pandemics and other geopolitical risks. So not only did I feel early last year that at least four years earning $125+ annually (and probably closer to $160+) was pretty much locked in thanks largely to the bond duration, but also that there's still a fair chance that this hard market won't swing to a soft market very quickly, given how recent history has affected the other actors in the insurance market, hopefully extending Fairfax's appetite to write a lot of well priced business and maintain good float leverage on mostly pretty safe investment assets that far exceed the market cap of Fairfax, thus amplifying a solid and sometimes boring single digit return on that portfolio to a mid teens+ return on equity. Thanks to everyone here for sharing their thoughts on Fairfax.1 point

-

Different recap…”when I went all in” always owned shares sometimes much less than others. 2002/2003 Peter Cundill was buying Fairfax hand over fist and that is what brought me here. I was able to buy shares in free fall at $67 per share during bear raid in 2003. It was an american holiday and it was an epic crash day i will never forget it. Sanjeev put a crew of vagabonds together and we all made small fortunes on the upswing into $300. (Cdn) analyzing and more appropriately believing in Prem Watsa…we have bonded (pardon the pun) forever. Brian Bradstreet had a billion dollar gain on “the long bond” bet in 2003 and that was the size of the market cap at the time. (I recently came across momento’s from that time and sent them to Prem’s office) 2007/2008 We were able to calculate the credit default swap values by looking at the financials and calling traders for quotes in the marketplace. Our AI! Fairfax made $2b plus on those bets and we all knew it but the market did not…had 50% of my net worth in Fairfax. It was the third best performing stock in the world in 2008 up 50%. Did you know that Brian Bradstreet offered to buyout all Michael Burry’s clients at 100 cents on the dollar? Very disappointed Fairfax was not in “the big short”. Covid debacle/2021 Once again I loaded up in the $350 range…unfortunately I sold the largest of my position after the tender offer…there were many other bargains around but i highly regret missing a lot of the $700 move up…I have been a buyer this year though Fairfax has become a powerhouse! There are high quality people on this board and with regards to Fairfax that certainly could be a movie but they would rather watch “Roaring Kitty”! Lol. Sign of the times. I cut my teeth here and Prem and Fairfax are the foundation of what I am good at…we learned how to fish on this board and I will never forget it. Thank you Fairfax team you have been feeding my family for more than two decades. cheers, Dazel1 point

-

Bought my first shares in FFH way back when SAC was trying to put FFH under. Everything about it was just flat out wrong; and super pissed about it, I bought some shares cheap, and found COBF. Crip, Dazel, and a few others were the main posters at the time ... and I learnt at the feet of the many masters. Hopefully; I gave back as much as I learnt! We haven't been in FFH for many years, but periodically visit as dividend, climate change, and short attack (MW) opportunities present. Had CS not blown up, and the BTC-ETF not become a 'thing', we would probably be using FFH as one of our 'near' cash equivalents FFH is a great learning experience, but all fledglings eventually need to leave the nest and do their own thing. Today, we're good enough at risk management that we can comfortably afford the higher risks that we take, and earn that higher 'Sharpe' ratio. There's a reason for the 'Sharper' in SharperDingaan! Good luck to all. SD1 point

-

But also, if you invest i think 1m then your annual fee drops to 0.5% and higher it drops to 0. But still, id hate to pay 20% of my gains above 6% to some guy who does 0 trades for 8 years drinking coffee at home and reading books Consider this: You give Guy Spier 800k of your money. He takes 1.5% annually of that->12k a year, for investing close to half of his fund into Berkshire, Exor, Prosus and Nestle. So i pay him 500 bucks a month just to hold these stocks HA! And mastercard, bank of america? Are these hard to understand mega cap stocks you need to have 5 years of training to understand when to buy and when to sell? I am envious, he makes bank for doing quite literally nothing Thats why i think Nick Sleep was the best fund manager ever. He told you the truth: Get out of this fund and just buy Berkshire, Amazon and Costco and do nothing. Thats transparent, thats honest and thats of high moral character. And also @John Hjorth, if you want to invest with Semper or Guy you need to prove yourself to be of the right "character" for the fund, they ask you if you panic liquidate etc so you HAVE to have background knowledge in investing in order to get in at the first place.1 point

-

Point is, it is morally of lower character to charge money for investing other peoples money while then outsourcing that capital to someone else who invests the money for you. While that's not exactly what guy spier and Semper are doing, they are still half way with the foot in the water. IF you are smart enough to give someone like guy spier your money, shouldn't you be smart enough to just copy him/invest your money into BRK etc? Thats where I wonder, who are their investors? If you are smart enough to not invest in your expensive local bank fund and find intelligent guys like the ones I mentioned, why wouldn't you just skip the middleman? Guy doesn't do any trading, you can find all of his positions online. You can simply copy it and be done. Yes in a crash maybe he does a few things but id say with his style of investing the best really is to do nothing. A mystery!1 point

-

I very much disagree with your opinion towards climate change. Average global temperatures have increased at an unprecedented rate starting about 200 years ago or so. This directly correlates with humanity’s large usage of fossil fuels for energy. I’m not a fanatic who stands in front of cars and demands for oil executives to be hung, I think fossil fuels have done an unbelievably great service for humans. However, I do think people need to consider how we are going to transition from our current energy situation. The future of the world depends on it.1 point

-

The book is fantastic. One of my favorites in the past few years. the story is really a good one but it just doesn’t translate into tv well. Ewan is great but the casting is mostly bad and they basically butcher the whole thing. I also am confused by the colour blind casting. Do the directors not care about making realistic representations? What’s the point of making a movie off a book if your going to make it so shit and poorly represented. Chernobyl series was awesome. I wish the same people made this because the book is really good.1 point

.thumb.png.e9643dd797bb6bfa93083ce1311ba74d.png)