Viking

Member-

Posts

4,922 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

@73 Reds thank you for the comment. Regarding Berkshire Hathaway, i am a novice when it comes to understanding the company. So my comments are very high level. And they could be way off base. BRK appears to me to be a conglomerate today. Insurance is now one of many businesses. Float is a benefit, just much less of a benefit than it was 20 or 30 years ago. My read is for the past 5 years, perhaps longer, Berkshire Hathaway has been primarily run like a trust - with the focus on preserving the wealth of Berkshire Hathaway’s many, many long term and very wealthy shareholders (who have big tax issues if they sell). Berkshire Hathaway is no longer focussed primarily on building long term per share value for shareholders. Now this might change when Buffett is gone. But it adds a great deal of complexity for the new guy - because if he does something different and it doesn’t work out right away… well his job will just get that much more difficult. As per usual, i am probably way overthinking things. And i like to go to extremes sometimes when posting on the board - to test drive ideas… (thanks for pushing back Anyways, i don’t own BRK shares today. When i do, i usually hold it as a bond substitute.

-

I think the headwinds for Berkshire Hathaway have been growing over the past decade. The problems? 1.) The size of the company. 2.) its capital allocation policies - it looks to me like Buffett has painted himself into a corner. The problem is he likely has also painted his successor into a corner. An couple of examples: - buy and hold forever works best when you are growing rapidly - and earning returns of 20% per year. The queens in your portfolio dominate your dogs. But when you become an elephant and your growth slows - and your returns slow - your dogs become a bigger part of the total portfolio. The buy and hold forever mantra no longer works for BRK - but Buffett made promises decades ago to never sell. That bit of marketing is not going to age well. - not doing stock buybacks (starting much earlier and going heavier) has created the size problem for BRK today. But Buffett has couched buybacks in moral terms ‘taking advantage’ of BRK shareholders. Of course this is marketing. Buffett loves buybacks - look at Apple etc. Buffett also put Singleton on a pedestal and he was the king of buybacks. - is the focus on cash flow resulting in underinvestment at the companies? This appears to have been a big problem at Wells Fargo - they were more profitable than peers for year (and Buffett was constantly praising them) because they were underinvesting - and it blew up. It looks like the same thing has been happening at Geico - Progressive looks much better positioned from a technology perspective moving forward. Does BNSF have the same disease? Are the falling behind peers from a technology perspective? Anyways, i love Warren Buffett and i like BRK as a company. But i think they have some structural issues (some external and some internal) that might make it a challenge for them to outperform the S&P500 moving forward. I do think BRK will likely perform better than a balanced (stock and bond) portfolio. An alternative perspective…

-

Some initial thoughts: I think Sleep Country has been quite the success story over the past 30 years. Interesting to see Fairfax buying the whole company. This will be a significant add to the 'non-insurance consolidated' group of companies (Thomas Cook India, Recipe, Grivalia Hospitality, Dexter etc). It will be interesting to see if Fairfax keeps growing this bucket of companies. Fairfax has been heavily invested in this segment over the past decade, more recently with Leon's (the largest furniture retailer in Canada) and with The Brick before that. Bill Gregson, former CEO of the Brick, was probably involved. I wonder who the driver was of this deal: Prem / Wade / Other? Regardless, it will be interesting to hear what Wade Burton has to say about it on the Q2 conference call. Fairfax is buying Sleep Country at what must be at close to the bottom of the cycle. IF this is the kind of business you want to own - now is probably the right time to buy it. The housing market in Canada is terrible right now (interest rates ARE biting here). Another big private transaction. And another publicly traded holding is gone (Stelco). The publicly traded (especially the mark to market) part of Fairfax's equity holdings has been dramatically shrinking in recent years. The private part has been rapidly growing. Are more asset sales (like Stelco) on the way? What I want to know about Sleep Country (I know nothing about the company, other than it is usually where we shop - and have for decades - when we buy a new mattress set): How good is the management team? If they are good, are they all sticking around? What is the normalized earnings power of this business? How stable are earnings? What are the prospects for the business? What are the strategic reasons for this purchase? Cash cow type of business to be milked over time? Does this signify a trend to more aggressively grow the 'non-consolidated' bucket of holdings?

-

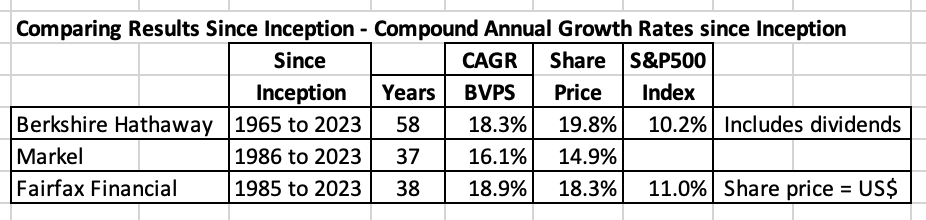

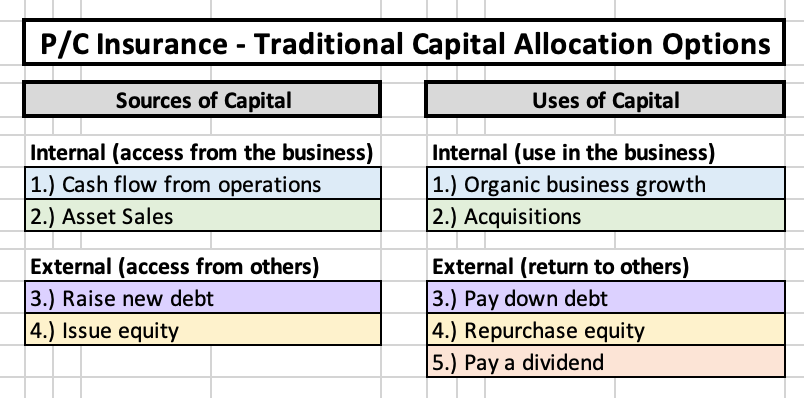

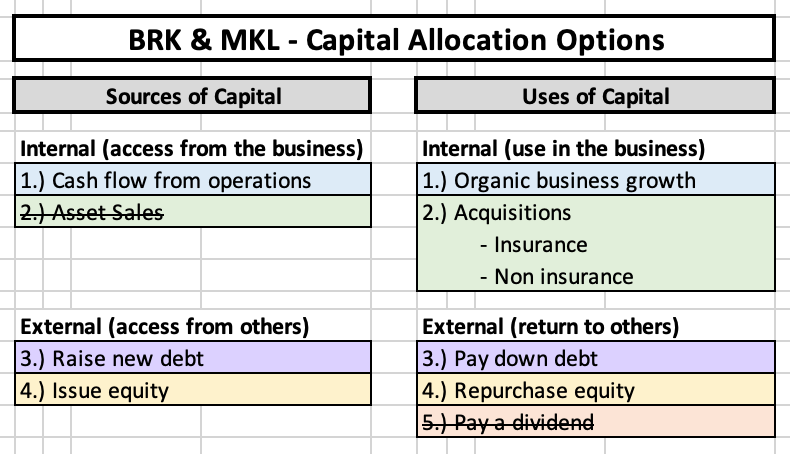

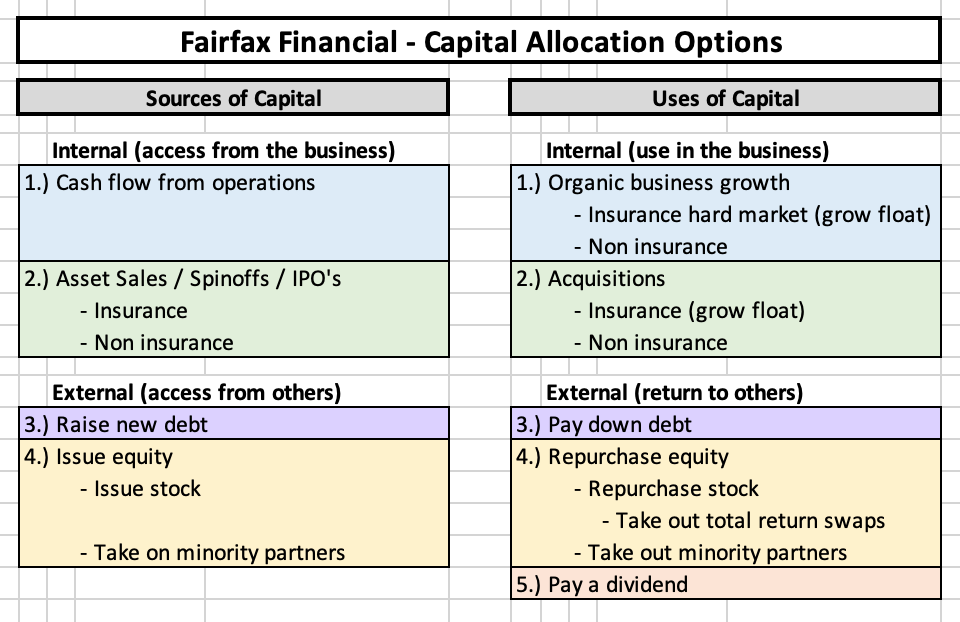

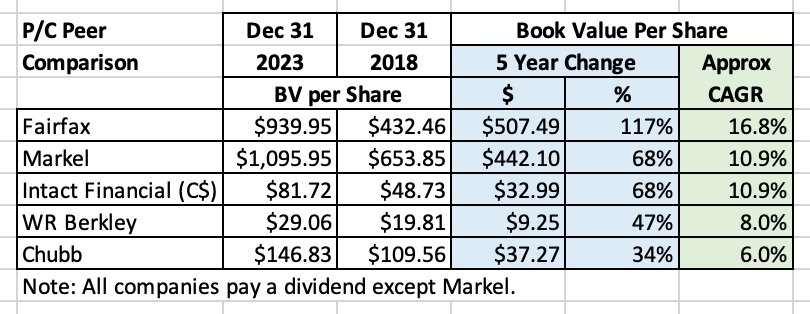

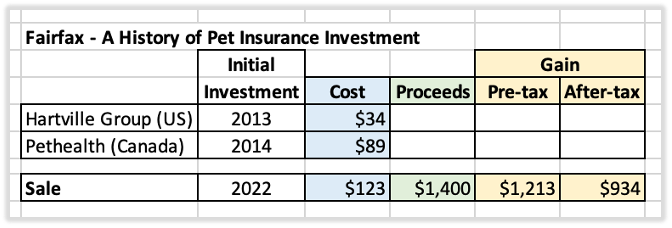

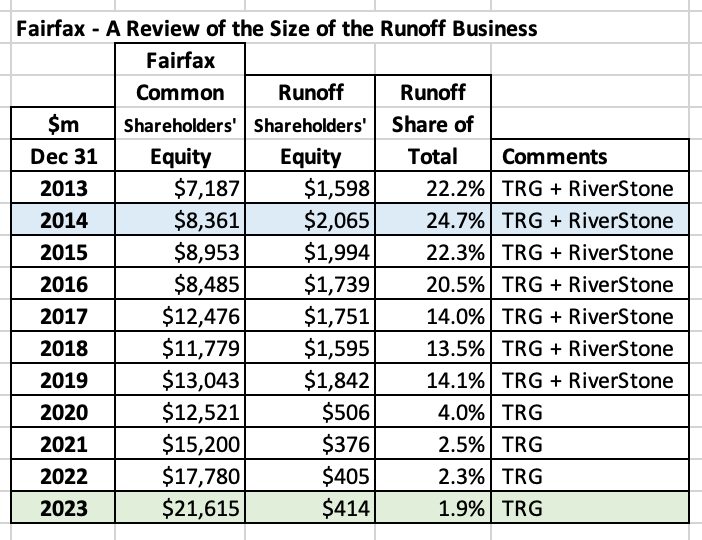

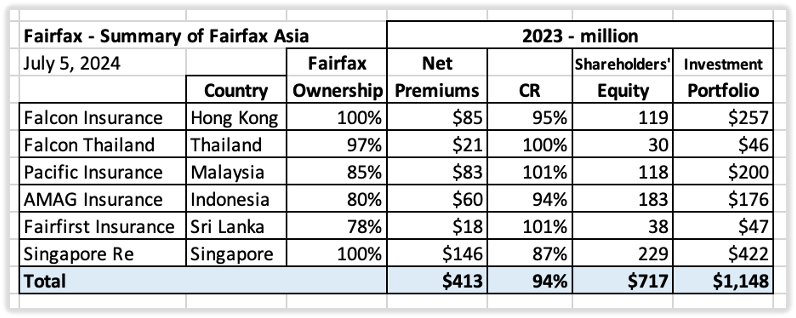

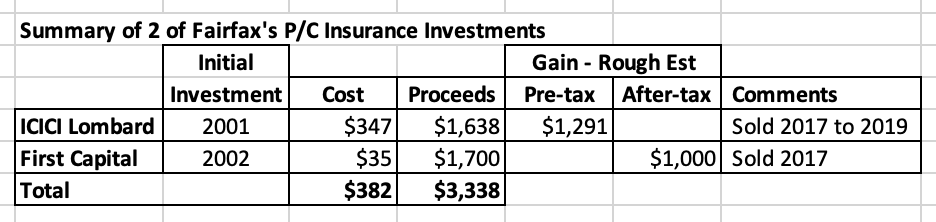

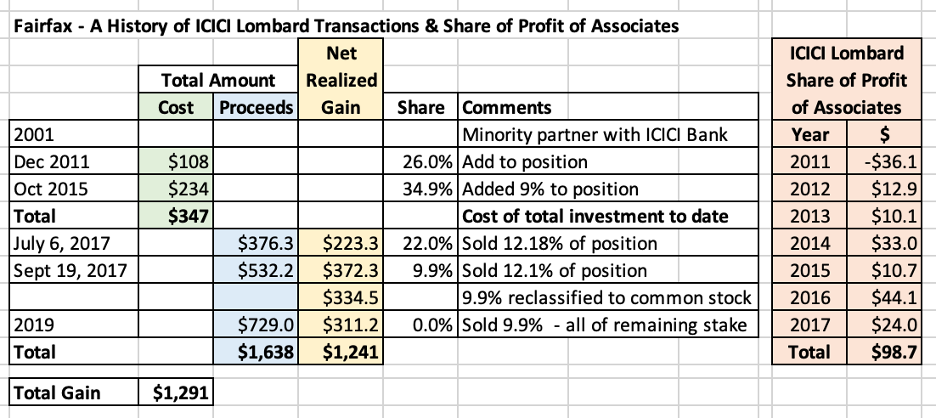

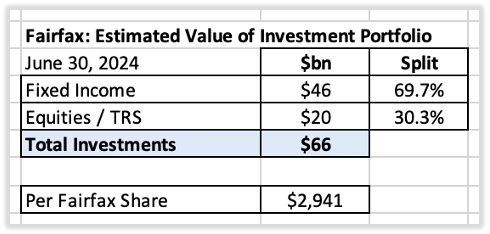

Fairfax - Unconstrained Capital Allocation All P/C insurance companies have two engines to drive earnings/business results over time: Insurance Investments Insurance Pretty much all P/C insurance companies try and do the same thing with their insurance operations - they try and generate an underwriting profit. Some are better at it than others. The combined ratio communicates how a company’s insurance business is performing. Investments Pretty much all P/C insurance companies generally do the same thing with their investment portfolio - they invest it primarily in bonds. The average yield on the investment portfolio communicates how a company’s investments are performing. Investors As a result, it is a pretty simple process for investors to evaluate most insurance companies. Warren Buffett Warren Buffett screwed everything up back in 1967 when Berkshire Hathaway purchased National Indemnity, a P/C insurance company. How did Buffett screw things up? Buffett knew something that apparently no one else at the time knew: equities earn a much higher return over time than bonds. So after he bought National Indemnity he began to put some of its investment portfolio into equities. And what was the result? Magic. Excess returns + compounding + time = exponential growth. And that is what happened to Berkshire Hathaway’s earnings and stock price. It was like Buffett had found a golden goose. Capitalism We all know how capitalism works. When someone discovers a better mousetrap - begins earnings outsized profits - everyone else will rush in and copy the better business model. And quickly compete the outsized returns away. And that is what happened. All the big P/C insurance companies began investing a part of their investment portfolio into equities and their returns over time improved markedly. And their investors made out like bandits. EXCEPT THAT IS NOT WHAT HAPPENED. Almost all P/C insurance companies did not copy what Warren Buffett was doing at Berkshire Hathaway. Why not? Are other P/C insurance companies run by stupid people? The fly in the ointment - Wall Street Volatility Efficient Market Hypothesis and Modern Portfolio Theory When it comes to equities, Wall Street says volatility is the same thing as risk. Stocks ARE volatile. So Wall Street decided this also meant that stocks were also very risky - and therefore more likely to go down in value. Of course, this is garbage. Here is what Warren Buffett had to say about risk at the BRK’s AGM in 1994: “We do define risk as the possibility of harm or injury. And in that respect we think it’s inextricably wound up in your time horizon for holding an asset. I mean, if your risk is that if you intend to buy XYZ Corporation at 11:30 this morning and sell it out before the close today, in our view that is a very risky transaction. Because we think 50 percent of the time you’re going to suffer some harm or injury. If you have a time horizon on a business, we think the risk of buying something like Coca-Cola at the price we bought it at a few years ago is essentially so close to nil, in terms of our perspective holding period. But if you asked me the risk of buying Coca-Cola this morning and you’re going to sell it tomorrow morning, I say that is a very risky transaction.” Short term focus Most P/C insurance companies are publicly traded companies. They are beholden to what Wall Street wants. Wall Street wants companies to hit quarterly earnings estimates - if a company misses, their stock usually gets punished. If this happens too many times, the CEO likely loses his job. Incentives matter. Most CEO’s want to keep Wall Street happy. As a result, they avoid volatility like the plague. The insurance business is volatile enough. Adding volatility to the investment side of the business is a bridge too far for most P/C insurance executives. So they have no interest in investing in equities. The odd ducks Well, there are a few odd ducks that decided to follow Warren Buffett’s lead: Markel Fairfax Financial What allowed these misfits to thumb their nose at Wall Street? Ownership structure Warren Buffett can do what he wants with Berkshire Hathaway because he is in control of the company. It just so happens the other two companies also have controlling shareholders: Markel - Markel family Fairfax Financial - Prem Watsa Long term focus This ownership structure allows each of these companies to focus on long term value creation for their shareholders. Higher lumpy returns (investing in equities) are preferred to lower smooth returns (investing exclusively in bonds). This can’t be right. This sounds too easy. How have these 3 companies performed over time? The long term performance of each of these 3 companies (since inception for each) has been epic. How did they achieve such impressive results? Their P/C insurance business was better than average (much better in the case of Berkshire Hathaway). But their outperformance overwhelmingly came from their investment results and their capital allocation decisions. What about today? A fork in the road. Berkshire Hathaway was so successful at investing in equities that it decided it wanted to own entire companies. This begat more success. Over the past 20 years, Berkshire Hathaway has morphed into a very successful conglomerate, with P/C insurance now only one part of a much larger company. Markel is doing its best to follow in Berkshire Hathaway’s footsteps and become a conglomerate itself. What about Fairfax Financial? Fairfax appears to have little interest in becoming a conglomerate like Berkshire Hathaway (notwithstanding their just announced purchase of Sleep Country). In fact, today Fairfax’s business model looks unique in the P/C insurance industry. Their uniqueness is not on the P/C insurance side of things. Here they have built one of the finest P/C insurance operations anywhere. They have a wonderful global platform. And they have forged a culture of strong underwriting discipline. All of this is similar to other well run P/C insurance companies. Fairfax’s uniqueness comes from how they approach capital allocation. Their approach is very different from traditional P/C insurance companies. And today it is also very different from the approach employed by both Berkshire Hathaway and Markel. When it comes to capital allocation, Fairfax is breaking new ground. Capital allocation Traditional P/C insurers At most P/C insurers, capital allocation is handled in a very traditional / straight forward manner. The basic options are captured in the table below. Berkshire Hathaway & Markel At Berkshire Hathaway and Markel, capital allocation is focussed on building long term shareholder value. But when it comes to capital allocation, certain options are not used and others are frowned upon. 1.) Assets are not sold. Buy and hold (ideally forever) is the goal. Therefore, this source of capital is generally not available. 2.) Equity is used in very limited way. Rarely is equity issued as a source of capital (looking at the past 10 years). Equity is used modestly used as a use of capital (share buybacks). 3.) Neither company pays a dividend. Fairfax Financial Setting the table: The most important source of capital is 'cash flow from operations'.' Fairfax is generating a record amount of cash flow from operations - and this record amount is expected to continue (and grow) in the coming years. Unlike traditional P/C insurance companies and Berkshire Hathaway and Markel, Fairfax uses all the capital allocation options at its disposal. But there is even more. Fairfax is finding new and innovative ways to allocate capital. They are doing some things that haven’t been seen from a P/C insurance company before. Like bringing minority equity partners on board when making large P/C insurance acquisitions. Fairfax has taken Warren Buffett’s original idea and made it even better: unconstrained capital allocation. The restaurant menu is stocked with choices: Sources of capital. Uses of capital. Internal. External. When it comes to capital allocation, Fairfax’s top priority is to be securely financed. After that, the goal is to allocate capital in a way that it results in the greatest long term per share value creation for shareholders. The key with this approach is to be: Open minded. Flexible. Creative. Opportunistic. Conviction - go big. With this capital allocation framework you take what Mr. Market gives you. And that is what Fairfax has been doing. Delivering a master-class in capital allocation. Here are some recent examples of what Fairfax has done: More than doubled the size (per share) of the P/C insurance business (NPW) over the past 5 years from $442/share in 2018 to $996/share in 2023. In late 2020/early 2021, purchased total return swaps - getting exposure to 1.96 million Fairfax shares at $373/share. This investment has increased in value by $1.5 billion over the past 3.5 years. In late 2021, via dutch auction, bought back 2 million Fairfax shares at $500/share. At March 31, 2024, Fairfax’s book value was $945/share. In late 2021, sold $5.2 billion in corporate bonds and shortened average duration of fixed income portfolio to 1.2 years - which shielded Fairfax’s balance sheet from billions in losses when interest rates spiked in 2022/2023. In 2022, sold the pet insurance business and realized a $1 billion gain after-tax. In 2022, sold Resolute Forest Products for $626 million (plus $183 million CVR) at the peak of the lumber market. In 2023, took out majority partner (KIPCO) and increased ownership in Gulf Insurance Group from 44% to 90% for total consideration of $740 million, securing Fairfax’s future in growing MENA region. In late 2023, extended the average duration of fixed income portfolio to about 3 years, locked in record interest income of $2 billion/year for the next 3 or 4 years. In January 2024, increased dividend by 50% to $15/share. In June 2024, Fairfax’s P/C insurance company in India, Digit, completed its successful IPO. In July 2024, sold Stelco (pending approvals) for consideration of $666 million, an 87% premium to where the stock had been trading. The list above is just a start. It really is amazing what Fairfax has been able to accomplish over the past 5 years. What really stands out is the number of tools - the breadth of options - that they have in their capital allocation toolkit today. They are proficient at using all of the tools. And they are using all of them: Organic growth Acquisitions Asset sales IPO Stock buybacks And look at the size/magnitude of the activities - many were +$1 billion in impact. The per share value creation for shareholders has been impressive. Importantly, Fairfax is not trying to copy someone else - like Berkshire Hathaway. Instead, Fairfax is now blazing their own trail. They are focussed on doing what they are really good at. Fairfax looks like a star athlete that is just hitting their prime. They have building towards this moment for 38 years. ————— If you want to better understand what is happening at Fairfax today you might want to read the following book. And pay special attention to the chapter on Henry Singleton - someone who will be the topic of a future post. “An outstanding book about CEOs who excelled at capital allocation.” Warren Buffett The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success by William Thorndike https://www.amazon.ca/Outsiders-Unconventional-Radically-Rational-Blueprint/dp/1422162672

-

“I would much much prefer that on the equity component Prem and Fairfax act like Warren B.” @Gautam Sahgal I used to think along the same line as you. But i am not so sure anymore. The more i think about/study Fairfax the more i am coming to understand and appreciate their unique approach/strengths to capital allocation. When i was a new sales manager my focus initially was on fixing problems (problem employees or weaknesses of good employees). I learned over time that i had it ass backwards. I shifted and spent most of my time feeding my best employees (stars) and getting my weaker performers to focus on their strengths. I want to see Fairfax do what they are outstanding at: - Flexible - Creative - Unconventional - Conviction - Long term focus Look at some of Fairfax’s best investment the past 4 years: - total return swaps: 1.96 million shares at $373/share - dutch auction taking out 2 million shares at $500/share - managing average duration of fixed income portfolio - selling pet insurance for $1 billion gain after tax - selling RFP at peak pricing. - the Stelco investment (buy and sell). - i could go on. Asset sales are a big part of Fairfax capital allocation framework. As is seeding startups like First Capital, ICICI Lombard and now Digit. Would Warren Buffet have done any of these things? Fairfax also appears to have no desire to become a conglomerate. And they appear to be dramatically shrinking the size of the company (with all the buybacks). Not what Warren would do. Fairfax’s capital allocation has been exceptional since 2018. For the past 5 years Fairfax’s management team has been best-in-class among P/C insurers. They are on a hot streak. Do you tell a star basketball player how to shoot a basketball? (I.E. tell Larry Bird he would be a better basketball player if only he shot the ball like Magic Johnson?) They look singularly focussed on growing long term per share value for shareholders. I hope they continue to do the things they are really good at.

-

Prem just resigned from the board in Feb so it likely was not an option to sell before then. Moving forward my guess is Fairfax will treat BlackBerry like any other equity investment - hold it if they see it delivering on their (15%?) hurdle rate for equity investments. BlackBerry does play in some very interesting verticals. What i like is the remaining position is so small that even of it went to zero it wouldn’t matter to Fairfax. I would love to see them sell it. Just to get it off the books - like Resolute Forest Products. Just so we can stop being reminded about it every time we look at Fairfax’s collection of equity holdings. But that is based on emotion. The big learning for me in reviewing Fairfax’s investment exits/sales over the past 7 years is just how much they have improved their underlying business/profitability: - late 2016 - exited equity hedges - this was the big one - 2019 - APR sold to Altas/Poseidon - late 2020 - exited last short position - late 2020 - exit Fairfax Africa - 2022 - sold Resolute Forest Products - 2024 - exited BlackBerry debenture ($500 million) This was an amazing pivot - in both size and philosophy. Its a little crazy, but Fairfax exiting the equity hedges in late 2016 was the belling ringing moment for shareholders that results/performance had bottomed. The equity hedge (we probably should include the short positions as well) was the root cause of Fairfax’s decade of underperformance. Value in the business has been growing since they exited those 2 positions, and significantly in recent years. Since late 2018 it looks like Fairfax has been on mission to optimize its equity holdings. Stop the hemorrhaging of cash. Get rid of the dogs. Reallocate the cash to better opportunities. The job looks pretty much done to me. What now? Watch the cash roll in. And the intrinsic value build. My guess is we start to see more sales like Stelco - perhaps one per year - where Fairfax surfaces significant value. Great time to be a shareholder.

-

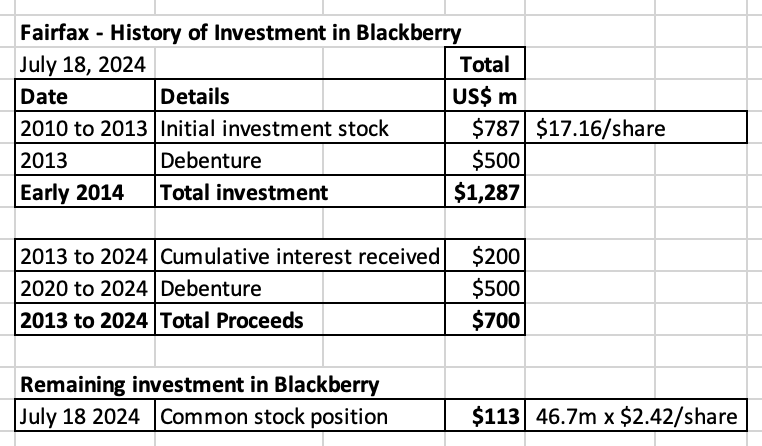

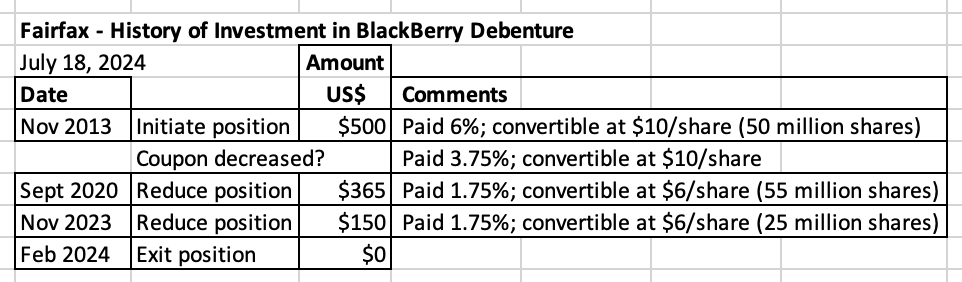

BlackBerry Debenture – 2020 to 2024 – Exiting a Big Mistake Blackberry has been one of Fairfax’s great investing mistakes (that is putting it politely). Fairfax began investing in BlackBerry in 2010 (it was called RIMM back then). By early 2014, Fairfax had invested a total of $1.287 billion. As of July 2024, Fairfax has received proceeds of about $700 million (interest and exit of debenture position). The value of the common stock position in BlackBerry, which Fairfax continues to hold, is $113 million. Bottom line, over the past 10 years Fairfax’s investment in BlackBerry has fallen in value by $474 million. Of course the financial cost to Fairfax and its shareholders has been much higher - when you factor in opportunity cost. Let’s assume in early 2014 that instead of investing in BlackBerry, Fairfax instead invested $1.287 billion in another company. Let’s assume that investment earned 8.5% per year (a modest hurdle rate). Today, that investment would be worth $2.9 billion. The ‘swing’ in value - what the BlackBerry investment is worth today ($813 million) versus what an alternative investment could have been worth ($2.9 billion) is $2.1 billion. That is a very rough approximation of how terrible the investment in BlackBerry has been for Fairfax. But the cost to Fairfax of its investment in BlackBerry goes well beyond financial. When you own such a large position is such a terrible investment the cost to the organization - in terms of resources and time - is likely enormous. On February 15, Prem announced his resignation from the Board of BlackBerry after serving since November 2013. Prem is a busy man (as are other people at Fairfax). The time spend on BlackBerry over the years added no value for Fairfax and its shareholders (in aggregate) - actually it appears to have subtracted significant value. Blackberry has also done significant repetitional damage to Fairfax - it was a high profile 10-year slow moving train wreck. Bottom line, the cost to Fairfax - financial, time, reputation - has been significant. Exiting a big mistake The fact that Fairfax has been materially reducing its exposure to BlackBerry over the past 4 years is a big deal. And great news for shareholders. In 3 separate transactions Fairfax has completely exited its $500 million debenture investment. Fairfax continues to hold its common share position, which today has a market value of $113 million. This holding is a market to market holding for Fairfax (so the significant losses have already been reflected in the financial statements over the years). Today, BlackBerry is Fairfax’s #24 largest equity holding at 0.6% of the equity portfolio (of $20 billion). BlackBerry is now a tiny investment for Fairfax. Fairfax shareholders can now put the BlackBerry investment behind them. Mistakes Mistakes are a fact of life when it comes to investing. What to do when you recognize you made one? Made sure you learn the lesson - so you do not repeat the mistake. And you probably exit the position and move on. What was Fairfax’s mistake with BlackBerry? When Fairfax made their initial investment in BlackBerry way back in 2010, they completely misjudged: The quality of the management team in place. The prospects for the company. Like with AbitibiBowater, when things got worse they then: Significantly increased the size of their investment. Thought they were a turnaround shop - and could ‘fix’ BlackBerry. I call this investing framework ’old Fairfax.’ Turning a lemon into lemonade Value investing framework: Right around 2018, it looks to me like Fairfax made important changes to their value investing framework. I have recently written about this so I won’t repeat myself. Bottom line, since 2018 Fairfax has been allocating capital exceptionally well. Shifting capital from poor investments to better opportunities: Exiting the BlackBerry debenture investment has freed up $500 million in capital that has been re-invested into better opportunities where Fairfax should be able to earn a much higher rate of return. When Fairfax does this it is like they are creating a new, growing income stream. Freeing up management’s time: The senior team at Fairfax has also exited a big headache. They can now spend their time on much more productive endevours. That is also a big win for shareholders. This move improves the overall quality and earnings power of the equity holdings. Over time this will result in more value creation for shareholders. Fairfax detractors They can’t let go. Yes, Fairfax has made some big mistakes. BlackBerry was a big one. But guess what... Fairfax has made many, many more great investments. And they appear to have stopped making big mistakes back in 2018. For the past 6.5 years, the team at Fairfax has been hitting the ball out of the park. At the same time they have been fixing ALL of the mistakes made in the past. Exiting the BlackBerry debenture is just one of many examples. As a result of this (and other developments), Fairfax has been transformed as a company. But some investors still refuse to see it - their dislike of the company is still too intense. Crazy but true. ————— Comments from Prem from Fairfax’s 2023AR: "That brings me to a major mea culpa! We began investing in Blackberry in 2010 and helped John Chen become CEO in November 2013 by investing $500 million in a convertible debenture at the same time. Blackberry had come down from $148 per share (down 95%) and had $10 billion in sales. I joined the Board in 2013. Our total investment in BlackBerry early in 2014 was $1.375 billion ($500 million in the convertible and $787 million in common shares). "When John joined the company, BlackBerry reported a loss of $1.0 billion – in one quarter and most analysts were predicting bankruptcy! BlackBerry was indeed in difficulty! John saved the company by quickly bringing it to breakeven on a cash basis and then on a net income basis. No CEO worked harder but, unfortunately, John could not make it grow! Revenues for the year ending February 2023 were $656 million. John retired from the company at the end of his contract on November 14, 2023 and I retired from the Board on February 15, 2024. We got our money back on our convertible ($167 million in 2020, $183 million in 2023 and $150 million in 2024) plus cumulative interest income of approximately $200 million. Our common stock position as of 2023 ($162 million or 8% of the company) which was acquired at a cost of $17.16 per share was valued on our balance sheet at $3.54 per share. Another horrendous investment by your Chairman. To make matters worse, imagine if we had invested it in the FAANG stocks! The opportunity cost to you our shareholder was huge! Please don’t do the calculation! No technology investment for me!"

-

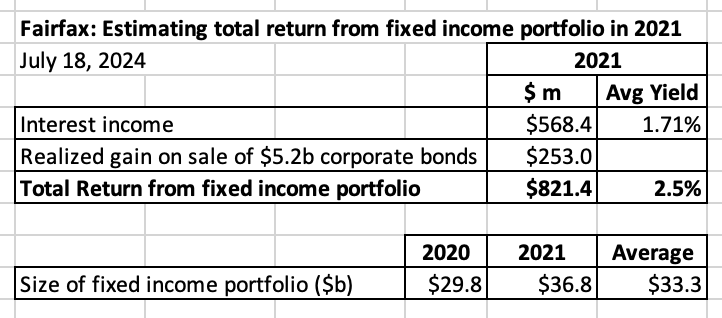

Corporate Bonds – 2021 – Value Investing 101 / Protecting the Balance Sheet Below is the next instalment in my review of asset sales at Fairfax from the past 7 years. My goal is to provide some additional insight into the transformation that has happened at Fairfax (especially earnings). And help us better understand what might be coming in the future. Please share your thoughts. ————— To set the table, below is a prescient quote from Warren Buffett from Berkshire Hathaway’s 2020AR: “And bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.” ————— In 2021, Fairfax sold $5.2 billion of corporate bonds and realized a $253 million gain. The bonds were sold at a yield of approximately 1%. Most of the bonds had been purchased in March/April of 2020 during the Covid panic which caused credit spreads (and yields) to spike temporarily. The greatest bond bubble in history 2020 and 2021, bonds were in the blow off top (bubble high) part of the greatest bull market in history. Like .com stocks in 1999, bonds were selling at crazy high prices (well over their intrinsic value) - and their yields were at record low levels. In 2020 and 2021, there was no ‘margin of safety’ when purchasing bonds, especially those of longer duration. Instead, there was actually a very high probability that future returns for investors would be terrible. In 2020 and 2021 the risks of owning bonds had never been higher. Like past bubbles, when it came to bonds, Mr. Market had lost its mind. Value investing 101 Value investing is the central framework used by Fairfax and is used in both of its core businesses: insurance and investments (equities and bonds). What is a value investor to do when a historic bubble is blowing ever bigger? A value investor sells. And that is what Fairfax did in 2021 when they sold $5.2 billion in corporate bonds. It was a brilliant move. And highly contrarian; especially for a P/C insurance company. Protect the balance sheet And they did another thing that was even better. They moved the average duration of their fixed income portfolio to 1.2 years (they had been doing this for years). They did this to protect their balance sheet - protect it from significant losses should bond yields unexpectedly rise. Who else was thinking along the same lines as Fairfax? Some guy named Warren Buffett who manages a company called Berkshire Hathaway. What about other P/C insurance companies? Most P/C insurance companies have a stated policy of matching the average duration of their fixed income portfolio with the average duration of their insurance liabilities. This makes good sense - almost all of the time. But it is a terrible thing to do in an historic bond bubble. So why did they continue to do it? Even when it was obviously becoming more and more risky? The institutional imperative What is the institutional imperative? Warren Buffett defines it in Berkshire Hathaway’s 1990AR: “the tendency of executives to mindlessly imitate the behavior of their peers, no matter how foolish it may be to do so.” Pretty much all P/C insurance companies match the average duration of their bond portfolio with the average duration of their insurance liabilities. What would be the consequences if this strategy blew up? There would be none - because they were all doing it. As a result they were all safe. Who could have known? What happened to P/C insurance companies when the bond bubble popped in 2022? When the bond bubble popped in 2022, the balance sheets of most P/C insurance companies got shredded - for many companies their book value fell 10% to 15% - for some it was more. The management teams at most P/C insurance companies had completely dropped the ball. Their risk management had been terrible. They were reckless and their shareholders would now pay a steep price. And what happened to the management teams? Nothing, of course. ‘Who could have known’ they all collectively said. How about Fairfax? Book value at Fairfax increased in 2022. Fairfax shielded their shareholders from billions in losses. That is outstanding risk management. Narrative Fairfax realized a nice gain of $253 million on their sale of $5.2 billion in corporate bonds in 2021. More importantly, by shortening the average duration of their fixed income portfolio to 1.2 years in late 2011, they protect their balance sheet - and shielded the company and investors from billions in losses. This is a great example of exceptional risk management. This is just another of many recent examples of how Fairfax has been running circles around the management teams of other P/C insurance companies in recent years. Fairfax’s growth in book value over the past 5 years has left peers in the dust. It is a testament to the benefits of active management. And value investing. And superior management. It is also an example of the benefit of having a majority/controlling shareholder. It’s not a fluke that it was all the publicly traded P/C insurance companies that were blindly following the herd over the cliff in 2020 and 2021. ———— Interest income update Interest income at Fairfax bottomed out at $568.4 million in 2021. When you add in the gain from the sale of $5.2 billion in corporate bonds, the total return on the fixed income portfolio was $821.4 million or 2.5% (calculated off the average size of $33.3 billion). Given the exceptionally low average duration of of the fixed income portfolio of 1.2 years at Dec 31, 2021, the earn though over the past 2.5 years from spiking interest rates has been much quicker for Fairfax than pretty much all other P/C insurance companies. As of Q1, 2024, interest income at Fairfax has ballooned to about $570 million per quarter and the yield on the fixed income portfolio (now $46 billion in size) is now 5%. It is amazing what the fixed income team at Fairfax has accomplished over the past 3 years. ———— From Fairfax’s 2021 Annual Report: “During 2021, we sold $5.2 billion in corporate bonds, mainly acquired in March/April of 2020, at a yield of approximately 1%, for a gain of $253 million. At the end of 2021, our fixed income portfolio, inclusive of cash and short term treasuries, which effectively comprised 72% of our investment portfolio, had a very short duration of approximately 1.2 years and an average rating of AA-.” Fairfax 2021AR

-

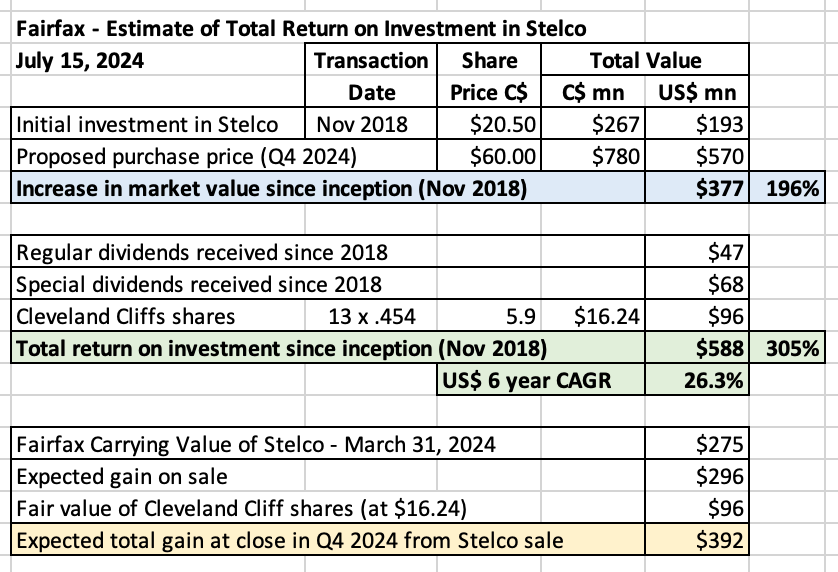

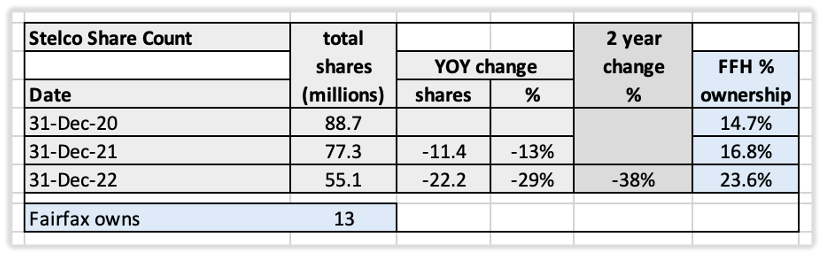

Stelco - Reaping the Rewards of New Fairfax On July 15, 2024, Stelco announced that the company had been sold to Cleveland-Cliffs for about C$70/share (C$60/share cash + .454 share of CLF). Total proceeds to Fairfax should be about US$666 million ($570 million for Stelco + $96 million for CLF shares). The deal is expected to close in Q4 of 2024. Stelco is a great example of what I like to call ‘new Fairfax.’ In about 2018, Fairfax appeared to ‘tweak’ their value investing framework when it came to new equity purchases. One of the important changes was putting a much higher premium on partnering with great CEO/founders/owners. Fairfax’s new equity purchases since 2018 have been very good. Stelco was purchased in November 2018. Fairfax decided to partner with Alan Kestenbaum (CEO/founder/owner of Stelco). Over the past 7 years, Kestenbaum has put on a clinic on how to do capital allocation (see below for more). In short, Kestenbaum has been a rock star - even Billy Idol would agree. How has Fairfax’s investment in Stelco performed? I know… I know… Show me the money! In November 2018, Fairfax paid $193 million for 14.7% of Stelco. Over the past 3 years Stelco has repurchased 38% of all shares outstanding - so Fairfax now owns 23.6% of Stelco. When Fairfax announced their Stelco purchase in late 2018 I hated it. At the time, it screamed ‘old Fairfax’ to me. Boy was I wrong. Over its 6 year holding period, Fairfax stands to earn a total return of about $588 million, or 305%, on its investment in Stelco. The 6-years CAGR is 26.3%. That is an outstanding return. The return is made up of: Regular and special dividends = $115 million ($47 + $68). Expected proceeds from sale: Stelco shares sold = $570 million Cleveland-cliffs shares received = $96 million Fairfax has a carrying value for Stelco of $275 million (Q1 2024). When the deal closes in Q4, Fairfax will likely book a total pre-tax gain of about $392 million. New Fairfax - Reaping the Rewards Stelco is only one of the very good new investments that Fairfax has made since 2018. Fairfax has also ‘fixed’ most of their underperforming legacy equity holdings (purchased before 2018). As a result, the quality and earnings power of Fairfax’s current collection of equity holdings has never been better. Most importantly, the intrinsic value of their collection of equity holdings has been marching higher each year. Fairfax is monetizing one asset today. More asset sales are coming - I think this sale might be signalling the beginning of the next wave of equity monetizations. And like the sale of Stelco, when they happen they will surface significant hidden value for shareholders. I think most investors do not fully grasp this part of Fairfax’s business model. It has been so long since this part of Fairfax was working (equities) its like they have forgotten about it. This is leading many investors to underestimate the future earnings of Fairfax. Which is leading them to undervalue (still) the company. Yes, that sounds nuts. But I think it is true. Value investing 101 - the Fairfax Model - Sell high and buy low There is a second even bigger benefit to what Fairfax is doing. Realizing significant value hiding on the balance sheet is good (selling high). But reinvesting the proceeds back into undervalued assets (buying low) is even better - when you include the power/effect of compounding over time. In recent years, Fairfax has been putting on a clinic of the benefits of the P/C insurance / value investing business model. As a result, earnings, ROE and book value are spiking. For the past 4 years most investors have been one step behind what is actually happening under the hood at Fairfax. I think this continues to be the case today. And I love it - because it tells me that despite the run up in the shares over the past 4 years, much more likely lies ahead (as Fairfax delivers earnings and ROE that continues to ‘surprise’ to the upside). Stock buybacks In 2024, Fairfax continues to aggressively buy their back stock. Why? They know the stock is still very undervalued. Why? They see the value of all the assets residing on their balance sheet - and they know many will be monetized in the future - surfacing an incredible amount of incremental shareholder value over time. And they know the proceeds will then be reinvested into wonderful undervalued opportunities - creating even more shareholder value over time. The set-up for Fairfax and its shareholders has never looked better. Fairfax detractors But talk to Fairfax detractors - and my guess is they still view Stelco as a shitty investment. They explain it away with ‘Fairfax got lucky.’ It is a commodity producer after all! It cracks me up when I hear the detractors talk about Fairfax’s equity holdings. They usually have no idea what they are talking about. But boy do they ever have a lot of conviction when they express their views. What has made Stelco such a good investment for Fairfax? The CEO of Stelco, Alan Kestenbaum. Since buying Stelco out of bankruptcy in 2017 (via Bedrock Industries) his capital allocation decisions have been outstanding. Some examples: What did Stelco do with the earnings windfall from the historic bull market in steel in 2021 and 2022? He bought back 38% of shares outstanding. And he did not overpay. That was freaking brilliant. Fairfax’s ownership in Stelco increased from 14.7% to 23.6% - with no new money invested. A significant amount was paid out in the past 6 years in dividends = C$11.03/share Regular dividends = C$3.90/share and special dividends = $7.13/share. Two other brilliant moves by Kestenbaum: April 2020 - Minntac deal: at a cost of $100 million, got an 8-year supply agreement with US Steel with option to purchase 25% of Minntac (the largest iron ore mine in the US) – done when Covid was raging. June 2022: real estate sale of ‘Stelco lands’ for C$518 million. The timing of this sale is looking brilliant - at what might be close to the peak of Canada’s real estate bubble. And the final act? Selling the entire company for C$70.00 Kestenbaum has been schooling the steel industry on capital allocation for the past 7 years. ————— A short history of Fairfax’s investment in Stelco In November of 2018, Fairfax invested US$193 million in Stelco, buying 13 million shares at C$20.50. At the time, it was a deeply contrarian purchase. I did not like it. It screamed ‘old Fairfax’ to me: buy a bad business in a bad industry. Boy, was I wrong. ————— Stelco Corporate Presentation - Q1 2024 Results https://s201.q4cdn.com/143749161/files/doc_earnings/2024/q1/presentation/Q1-2024-Earnings-Presentation-FINAL.pdf ————— News release on sale from Stelco Cleveland-Cliffs to Acquire Stelco for C$70 per Share - July 15, 2024 https://investors.stelco.com/news/news-details/2024/Cleveland-Cliffs-to-Acquire-Stelco-for-C70-per-Share/default.aspx HAMILTON, Ontario--(BUSINESS WIRE)-- Stelco Holdings Inc. (TSX: STLC) (“Stelco” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Arrangement Agreement”) with Cleveland-Cliffs Inc. (NYSE: CLF) (“Cliffs”), pursuant to which Cliffs has agreed to acquire all of the issued and outstanding common shares of Stelco (the “Transaction”) at a price of C$70.00 per share (the “Consideration”), consisting of C$60.00 in cash and 0.454 of a share of Cliffs common stock (equivalent to C$10.00 based on the closing price of Cliffs common stock on July 12, 2024) per Stelco share. The total enterprise value pursuant to the Transaction is approximately C$3.4 billion. The Consideration represents an 87% premium to Stelco’s closing share price of C$37.36 on July 12, 2024, and a 37% premium to Stelco’s 52-week high. Fairfax Financial Holdings, an affiliate of Lindsay Goldberg LLC, Alan Kestenbaum, and each of the other directors and executive officers of Stelco collectively holding approximately 45% of the current outstanding Stelco common shares have entered into support agreements to vote in favour of the Transaction, subject to customary exceptions. ————— Comments from Prem about Stelco from Fairfax's 2022AR. “2022 was an active and successful year for Alan Kestenbaum and the talented team at Stelco. The company ended the year with its second-best fiscal result since going public despite an approximately 50% decline in steel prices over the summer. Stelco is benefiting from the Cdn$900 million it has invested in its Lake Erie Works mill since 2017, which has made the mill one of the lowest-cost operators in North America. Stelco entered 2022 with an extremely strong balance sheet and put its capital to good use, completing three substantial issuer bids during the year, thereby repurchasing approximately 29% of its outstanding shares. These repurchases have resulted in Fairfax’s ownership increasing to 24% from 17% at the beginning of the year. In addition to share repurchases, Stelco paid a Cdn$3 per share special dividend and increased its regular dividend to Cdn$1.68 per share from Cdn$1.20 per share. Stelco maintains over Cdn$700 million of net cash on its balance sheet and we anticipate that it will continue to be active both investing in its operations and efficiently returning excess capital to shareholders. We are excited to continue as a significant investor in Alan Kestenbaum’s leadership at Stelco.” Prem Watsa – Fairfax 2022AR ————— Details of Stelco’s Hamilton land sale in 2022, for proceeds of $518 million. “Stelco Holdings Inc. (TSX: STLC) (“Stelco” or the “Company”) announced today that its wholly-owned subsidiary, Stelco Inc., has successfully closed a sale-leaseback transaction with an affiliate of Slate Asset Management (“Slate”). Stelco Inc. has sold the entirety of its interest in the approximately 800-acre parcel of land it occupies on the shores of Hamilton Harbour in Hamilton, Ontario to Slate for gross consideration of $518 million. In conjunction with the sale, Stelco Inc. has entered into a long-term lease arrangement for certain portions of the lands to continue its cokemaking and value-added steel finishing operations at its Hamilton Works site in Hamilton, Ontario.” https://www.thespec.com/news/hamilton-region/all-of-stelco-s-hamilton-land-sold-in-deal-that-would-see-it-transformed-into/article_17a333af-8198-5f97-9866-8c61ed8f799f.html? ————— Details of Stelco’s agreement with US Steel in 2020 to securing long term supply for iron ore pellets. Stelco Announces Option To Acquire 25% Interest In Minntac, The Largest Iron Ore Mine In The United States, And Entry Into Long-Term Extension Of Pellet Supply Agreement With U.S. Steel “Stelco will pay US$100 million, in cash, to U.S. Steel in consideration for the Option (the "Initial Consideration"). The Initial Consideration is payable in five US$20 million installments, with the first installment paid upon closing of the Option Agreement and the remaining four installments payable every two months thereafter. Upon the exercise of the Option, Stelco would pay a net exercise price of US$500 million.” Transaction Highlights: Secures long-term future of Stelco's steel production and solidifies Stelco's low-cost advantage Provides supply of high-quality iron ore pellets from a well-understood and consistent source for the next eight years, or longer if the Option is exercised Increases annual pellet supply to level required for Stelco's higher production capacity following this year's blast furnace upgrade project Supports Stelco's tactical flexibility model to deliver highest margin outcomes based on prevailing market conditions Creates a secure pathway for Stelco to become a vertically integrated player in the future through ownership in a low-cost iron ore source which is the largest producing iron ore mine in the Mesabi iron range Structured in stages that will preserve Stelco's strong balance sheet and financial flexibility https://investors.stelco.com/news/news-details/2020/Stelco-Announces-Option-to-Acquire-25-Interest-in-Minntac-the-Largest-Iron-Ore-Mine-in-the-United-States-and-Entry-into-Long-Term-Extension-of-Pellet-Supply-Agreement-with-U.S.-Steel-04-20-2020/default.aspx ————— Here is a little more information of Kestenbaum’s initial investment in Stelco in 2017. Purchase of Stelco out of bankruptcy: Bedrock gets steelmaker for less than $500 million https://www.thespec.com/business/stelco-deal-bedrock-gets-steelmaker-for-less-than-500-million/article_da943b70-1a93-5a35-acb4-92a6da05946a.html?

-

I was one of them. Here is an update on Fairfax’s investment in Stelco. Stelco is just one example of the significant value that is building on Fairfax’s balance sheet that will be realized in the coming years. This is the big thing most investors do not grasp (leading them to undervalue the company - still). This is likely a big reason why Fairfax continues to aggressively buy back stock at current prices - they know the value (although hidden) is there.

-

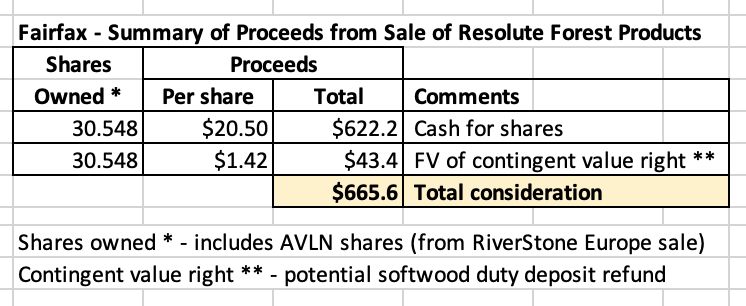

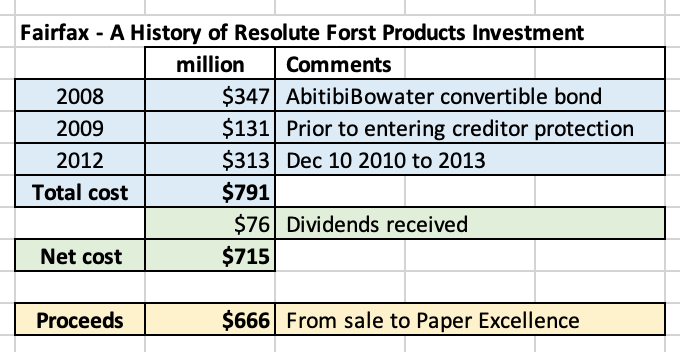

Resolute Forest Products – July 2022 – Being Opportunistic and Exiting a Mistake Below is the next instalment in my review of asset sales at Fairfax from the past 7 years. What do we see? Fairfax fixing their biggest problems. But I am getting ahead of myself. My goal is to provide some additional insight into the transformation that has happened at Fairfax (especially earnings). And help us better understand what might be coming in the future. Please share your thoughts. ————— In July 2022, Fairfax sold Resolute Forest Products (RFP) to Paper Excellence Group (a global diversified manufacturer of pulp and specialty, printing, writing and packaging papers) for total consideration of $665.6 million ($20.50/share). Fairfax accomplished 3 things with this sale: Got a great price for the asset - they sold it at the peak of the bull market in lumber. Were able to shift the proceeds/capital into much better investments/opportunities. Exited a big mistake - got one of their worst ever equity purchases off their books. ————— RFP was sold at $20.50/share. For perspective, back in March 2020, RFP shares traded as low as $1.20/share. Fairfax owned 30.5 million shares, so RFP’s market cap in March of 2020 was a total of $37 million. Two short years later Fairfax sold it for total proceeds of $665.6 million. Wow! Pre-pandemic, RFP’s shares traded at an average of about $6/share. In the historic lumber bull market of 2021, RFP’s shares traded at an average of about $12/share. Bottom line, at $20.50, Fairfax got an outstanding price for this company. But price is just the beginning of why this was a great move for Fairfax and its shareholders. RFP also owned some pretty crappy businesses: newsprint, paper and tissue. And the ‘good’ business, lumber, was/is getting killed by higher interest rates. I think RFP also had a large pension liability on its books. Bottom line, Fairfax sold what was overall (still) a very challenged business. The timing of the sale - in the middle of bear markets in both bonds and stocks - was also significant. It gave Fairfax the opportunity to redeploy the proceeds into opportunities with much better long term prospects. This sale improved the quality/earnings potential of Fairfax’s equity portfolio. There is also the psychological benefit of Fairfax selling RFP. This shouldn’t matter - but it does. AbitibiBowater/RFP was one of Fairfax’s worst-ever equity investments. I am guessing there are lots of long-term shareholders of Fairfax who are very happy that Fairfax sold RFP. It is a great example of another one of the ghosts of ‘old Fairfax’ being laid to rest by the current team at ‘new Fairfax’. ————— Old Fairfax - A short history of a terrible long term investment In 2008, Fairfax made an initial investment of $347 million in RFP (called AbitibiBowater back then). What did they get? Fairfax got a company - AbitibiBowater - that was: Poorly managed. Had a very stressed balance sheet (massive amount of debt). Had a terrible core business/prospects (newsprint and paper). Was statistically cheap - traded well below book value. I like to call the investment framework used by Fairfax at the time as ‘old Fairfax.’ It appeared to be some kind of deep value investing - focussed pretty much exclusively on finding statistically cheap companies (trading at big discounts to book value). What could possible go wrong? In 2010 AbitibiBowater filed for creditor protection. What did Fairfax do? They then decided they were a turnaround shop - and they pumped in even more money and time. By 2012, Fairfax had ‘invested’ a total of $791 million in RFP (AbitibiBowater was renamed RFP in 2011). Also buried in RFP’s sad history was the smelly (putting it politely) take-out in 2012 of Fibrek (SFK Pulp). Fairfax’s carrying value for RFP bottomed out at $134 million in 2020. To be fair, the management team at RFP had been doing a better job in recent years. The purchase of the three lumber mills in the US south in 2020 (at the bottom of the lumber cycle) was perfectly timed. Bottom line, the management team got RFP to a position where it was sold at a very high price. RFP is a great example of what Fairfax’s value investing framework USED TO LOOK LIKE. Not surprisingly, investments like RFP caused the returns on Fairfax’s investment portfolio to lag for much of the decade from 2010 to 2020. And this caused Fairfax's stock price to underperform over the same time period. ————— Why was Abitibi-Bowater / RFP one of Fairfax’s worst ever investments? Opportunity cost. From 2008 to 2012, Fairfax invested a total of $791 million in RFP/AbitibiBowater. 10 years later (2022), after dividends received and total proceeds of $665.6 from the sale, Fairfax was still underwater on its original investment. The real ‘cost’ of Fairfax’s investment in RFP was the opportunity cost. Over a 10 year period a $791 million investment should have returned more than $1 billion to Fairfax and its shareholders (if we assume a very low return of only 8.5% per year). ————— Was the problem with this investment that value investing in general was not working? This reason/excuse drives me crazy. Value investing has always worked. And it will likely always work in the future. But bad investing (usually) does not work - especially if you keep doing it. You might get lucky for a while. But eventually reality sets in. Buying a company that: Is poorly managed. Is highly leveraged. Has poor prospects. And then doubling down (money and time) when things go from bad to worse? That is not value investing. That is bad investing. Sorry there is no way to put lipstick on this pig. What AbitibiBowater/RFP investment (fiasco) illustrates is Fairfax had a problem with its value investing framework. It was a problem because the terrible investments (back in the 2014-2017 period) did not just include AbitibiBowater/RFP. It was also BlackBerry. And Eurobank (the initial investment). And Sandridge Energy. And Exco Resources. And Fairfax Africa. And APR Energy. And Farmers Edge. Fairfax had too many dogs in its equity portfolio all at the same time. To 'discover' the source of the problem - well, Fairfax needed to take a good hard look in the mirror. And that is what they did. But there is a silver lining to this story - The Emergence of New Fairfax From 2016 to 2017 it looks to me like Fairfax had its ‘come to Jesus’ moment with how it was managing its investment portfolio - Fairfax likely got tired of the investment portfolio’s constant bleeding of money (hundreds of millions every single year). And the fact it was stuffed with a bunch of shitty companies - so its prospects were bleak. In his shareholder letter in the 2018AR, Prem admitted that RFP had been ‘a very poor investment.’ It seems Fairfax’s was ready to embark on a new course. What did they do? Here is what I think happened (around 2018): Overhauled their value investing framework. Put a premium on: Partnering with quality management/founders. Strong balance sheet. Solid prospects. Got to work dealing with all the shitty holdings. New money would go to the top opportunities/performers - not to the shitty companies in need of more cash to keep the lights on (like had been happening). Fairfax would no longer be a piggy bank for poorly run equity holdings. Look at Fairfax’s new equity purchases beginning in 2018. They have been stellar (as a group). And over the past 6 years they also have been able to clean up most of the shitty holdings. Selling RFP for $665.5 million in 2022 was a very important part of this renewal process. We will review a few other of the larger sales in future posts. Over the past 7 years we have witnessed a remarkable turnaround in Fairfax’s equity portfolio - it has improved markedly in terms of overall quality/earnings power. Fairfax's equity portfolio of today (2024) does not resemble the equity portfolio that existed in 2017. And in recent years, we have also started to see the impact of the turnaround in Fairfax’s record reported results. Instead of bleeding money every year, Fairfax’s equity holdings are now delivering solid returns. And the good news story is just getting started. ————— The Genesis of Fairfax’s initial investment in AbitibiBowater in 2008 The 2 newspaper articles linked below provide some additional information on Fairfax’s initial investment in AbitibiBowater in 2008. From The Globe & Mail (April 2, 2008) "It may be tiny by global mergers and acquisitions standards, but the life-saving $350-million (U.S.) investment by Fairfax Financial Holdings Ltd. in troubled AbitibiBowater Inc. is giving deal makers lots to chew on. "For one thing, Fairfax's convertible debenture investment was crafted in three short days over the Easter weekend after Abitibi called late Thursday night to say the plan was the best offer it had on the table after weeks of negotiating with other unidentified suitors. "Within two days we went from zero to a fully drafted deal," said Fairfax's chief legal officer Paul Rivett, who credits his former Shearman & Sterling LLP Toronto partners Chris Cummings and counsel Stephen Centa with closing the deal so quickly. Assisting the group was Torys LLP partner David Chaikof." https://www.theglobeandmail.com/report-on-business/fairfax-abitibi-pact-sends-a-message-of-caution/article17983261/ From The Globe and Mail (March 14, 2008) - describing the initial transaction: Fairfax gambles on better times at AbitibiBowater https://www.theglobeandmail.com/report-on-business/fairfax-gambles-on-better-times-at-abitibibowater/article20383961/ It appears Paul Rivette was front and center with the AbitibiBowater investment for Fairfax. Paul ‘retired’ from Fairfax in February of 2020. Today Paul is Executive Chair and Director of Greenfirst Forest Products - a forestry company that closely resembles an ‘old Fairfax’ type of investment. ————— Comments from Prem about Resolute Forest Products from Fairfax’s 2022AR. “In July 2022, Resolute agreed to be purchased by the Paper Excellence Group. The cash portion of the deal, $20.50 per share, represented a 64% premium to Resolute’s pre-announcement price. Resolute’s shareholders will also receive contingent value rights tied to potential duty deposit refunds of up to $500 million. Fairfax, which held 40% of Resolute, agreed to vote in favour of the deal.” “Paper Excellence’s acquisition of Resolute closed on March 1, 2023. Our journey with Resolute began in a significant way in April 2008 with the purchase of approximately $350 million of an 8% AbitibiBowater convertible bond (at $10 per share) – almost 14 years ago! We added to our investment in Resolute in common shares and bonds over the years with a net investment after dividends of $715 million. With the interest income received on our bonds, sale proceeds of $622 million and with a little bit of good fortune on our remaining holdings in the contingent value rights, we may end up breaking even over this long holding period – although clearly a very poor long-term return. A big thank you to Remi Lalonde, Duncan Davies and Brad Martin for leading a strong turnaround in Resolute’s results over the last few years.” Prem Watsa – Fairfax 2022AR Comments from Prem about Resolute Forest Products from Fairfax’s 2018AR. “We have invested $791 million in Resolute and received a special dividend of $46 million, for a net investment cost of $745 million. Our initial investment was a convertible bond purchased in 2008 for $347 million. We invested an additional $131 million prior to Resolute entering into creditor protection and most of the remainder during the period from December 2010 to 2013. Subsequent to write-downs and our share of profits and losses over time, at December 31, 2018 we held our 30.4 million Resolute shares in our books at $300 million ($9.87 per share). The current fair market value of these shares is $244 million ($8.03 per share). You can see that Resolute has been a very poor investment to date!” Prem Watsa – Fairfax 2018AR ————— For long term shareholders, here is a trip down memory lane for RFP. A link to historical milestones at the company from 2008 to present… https://www.resolutefp.com/About_Us/Our_History/

-

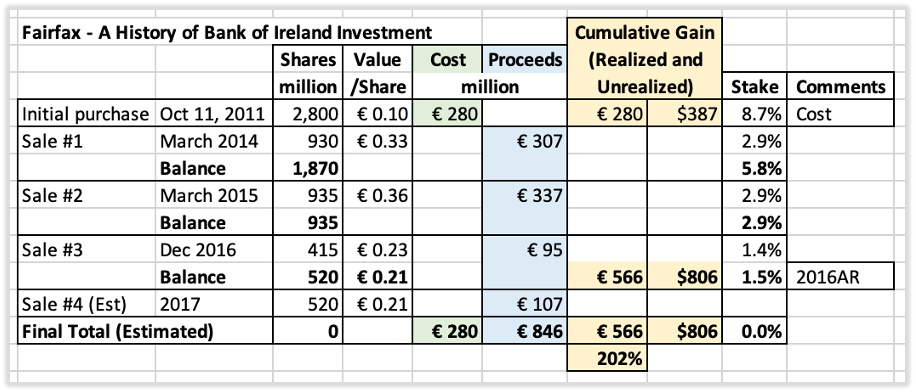

Bank of Ireland – 2014 to 2017 – Value Investing 101 Over the next week my plan is to continue reviewing a number of Fairfax's asset sales - this time from the investment management side of the business. We will start with Bank of Ireland. We will also review the following 'sales': Equity hedges/shorts (2016/2020), Fairfax Africa (2020), Corporate bonds (2021), Resolute Forest Products (2022), Blackberry Debentures (2020/2024). What do you see with most of these sales? Fairfax fixing their biggest problems. But I am getting ahead of myself. My goal with reviewing the sales in detail is to provide some additional insights - that should provide a little more colour into the transformation that has happened at Fairfax (especially earnings). And help us better understand what might be coming in the future. Please share your thoughts / insights. ---------- Value investing is at the core of how Fairfax/Hamblin Watsa manage their investments. Fairfax’s investment in Bank of Ireland provides a great ‘how-to-do’ example of value investing. Ben Graham, the father of value investing, taught that stocks should be purchased when they trade at a large discount to their intrinsic value. Buying stocks with a large ‘margin of safety’ provides an investor with downside protection (should they be wrong) and significant upside potential (should they be right). Stocks trading at a large margin of safety are usually deeply out of favour. And Graham also taught that stocks should be sold when they are ‘dear’ or trade at a premium to their intrinsic value. Rinse and repeat. ————— One of Fairfax’s great investments made in the decade of the 2010s was Bank of Ireland. In October 2011, Fairfax invested €280 million ($387) for an 8.7% stake in Bank of Ireland. Fairfax exited their position in 4 sales made in 2014, 2015, 2016 and 2017. How did they do? My estimate is Fairfax realized a total gain on this investment of about $800 million, or about 200%. That is an outstanding return over a 6-year period (with 1/3 of the position exited in year 3 and another 1/3 exited in year 4). My final number (gain) is an estimate. Fairfax provided us with an update in March of 2017 (the 2016AR). My guess is they sold their remaining position in 2017 at close to where Eurobank was marked when they provided their update. It is interesting that Fairfax never provided a final summary for this investment in the 2017AR. Value Investing 101 Maximum pessimism is often a great time to buy out of favour and undervalued stocks. Buying an Irish bank shortly after the biggest real estate bubble in history popped was a deeply contrarian thing to do. In 2011, when Fairfax made its investment, Bank of Ireland was trading at a significant discount to book value. Concentration When they find the right opportunity, Fairfax is not afraid to concentrate their position. At the time, Bank of Ireland was a large investment for Fairfax (common shareholders’ equity was $7.4 billion at Dec 31, 2011). Bottom line, Bank of Ireland is a great example of value investing done well by the team at Fairfax. Some additional thoughts: the power of relationships/connections and deal flow The idea to invest in Bank of Ireland came from Bill McMorrow at Kennedy Wilson. The initial investment was made with big partners: Wilbur Ross, Mark Denning (Capital Research) and Will Danoff (Fidelity). After stepping down as CEO of Bank of Ireland in 2016, Ritchie Boucher worked as an advisor to Fairfax, Eurobank and Kennedy Wilson. ————— Comments from Prem in Fairfax’s 2011 Annual Report “And there is more to the McMorrow story. While Bill was negotiating the purchase of some real estate loans from Bank of Ireland, he was really impressed with Ritchie Boucher, the Bank’s CEO. Bill introduced Ritchie to us, and we too were very impressed. With the help of our friends at Canadian Western Bank, one of the best banks in Canada, we thoroughly reviewed the opportunity and then quickly formed an investment group with Wilbur Ross, Mark Denning from Capital Research and Will Danoff at Fidelity, which purchased $1.6 billion of Bank of Ireland shares on a rights issue (Fairfax’s share was $387 million). This issue reduced the Irish government’s stake in Bank of Ireland from 36% to 15%. In spite of having hundreds of years of history and the strongest credit culture in the country, Bank of Ireland barely survived the real estate crisis in Ireland, where both house prices and commercial real estate prices dropped by approximately 50% from their highs. It is the only major Irish bank to survive that crisis – the rest of the Irish banking industry is now government owned. The rights issue plus other capital generated by Bank of Ireland has resulted in the Bank having capital to withstand an even further drop in Irish commercial real estate prices and Irish house prices. Bank of Ireland is very strongly capitalized, led by an excellent banker, Ritchie Boucher, and its shares were available at a significant discount to book value. We look forward to being long term shareholders of Bank of Ireland and hope to make more investments in that country as it continues under strong leadership diligently remedying its economic problems. Ireland by the way is a leading location of choice for foreign direct investment because of its talent, tax regime and technology capabilities together with its unique pro-business environment. Our nSpire Re subsidiary has been in Dublin since 1990 and was a great help in making our decision to invest in Bank of Ireland.” Prem Watsa - Fairfax 2011AR Comments from Prem in Fairfax’s 2013 Annual Report “It is amazing to witness the transformation that has taken place in Ireland. In 2011, when we made our investment in the Bank of Ireland at €0.10 per share, 10-year Government of Ireland rates were 12%, housing prices had come down 40% and sentiment was bleak. Since then, 10-year Government of Ireland rates have dropped to 3.1%, house prices have bottomed out and have begun to rise, Ireland has access to the bond markets again and capital is flooding into Ireland! Under Richie Boucher’s strong leadership, the Bank of Ireland continues to do well as it recently refinanced its government-owned €1.8 billion preferred by doing a €580 million equity issue at €0.26 per share and selling the rest into the marketplace. Also, it did a €750 million unsecured five-year bond financing at 3.34%! The Irish Government has now had all its loans to the Bank of Ireland paid back and its 13.95% ownership of the common stock is in a sizeable profit position. We thank the Irish Government for its exceptional support of the Bank of Ireland and look forward to the Bank’s continued progress under Richie’s leadership. “As this letter went to print, because of the significant appreciation in our position in the Bank of Ireland, we rebalanced that position by selling a third of it at approximately €0.33 per share. The Bank of Ireland has been one of our most successful investments because of the outstanding performance of Richie and his management team. We continue to be strong supporters of Richie and the Bank of Ireland.” Fairfax 2013AR Comments from Prem in Fairfax’s 2016 Annual Report “Richie Boucher at the Bank of Ireland had another outstanding year in 2016 as the Bank earned €793 million. In 2016, the Bank continued to improve: non-performing loans fell by €4.1 billion (34%); pre-tax profit exceeded €1 billion for the second straight year; the pension deficit narrowed to €0.45 billion (from €1.19 billion); the CET1 ratio improved from 12.9% to 14.2%; and the Bank was number one or number two in every major product line in Ireland. Bank of Ireland is on firm footing and is poised to benefit from Ireland’s recovering economy – estimated GDP growth in 2016 was 5.2% and unemployment is projected to fall to 6.8% in 2017.” “We purchased 2.8 billion shares of Bank of Ireland stock in late 2011 at €0.10 per share. As of today, we have sold 85% of our position at €0.32 per share, for a total realized and unrealized gain of approximately $806 million. Richie has produced outstanding results for us and we are fortunate that he consented to join the Eurobank Board. Bank of Ireland is expected to announce its first dividend in the last eight years in 2017!” Fairfax 2016AR

-

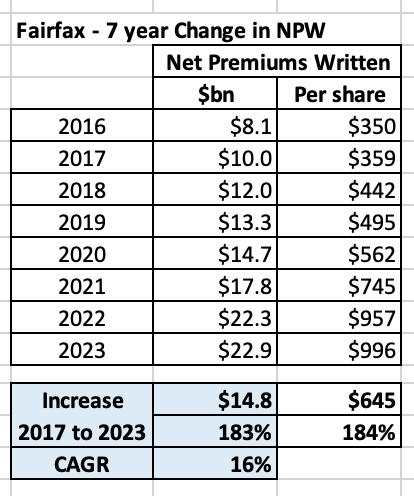

Summary of Fairfax's P/C Insurance Asset Sales Over the past week we have reviewed 4 different asset sales that Fairfax made in its P/C insurance business from 2017 to 2023. In my summary below I have included a 5th sale - Ambridge Group. It is smaller than the other sales, but still of a meaningful size. The total proceeds from the 5 sales made from 2017 to 2023 was about $6.4 billion. The pre-tax gain was more than $3.8 billion or an average or about $540 million per year - for each of the past 7 years. WOW! What else have we learned? When looked at the 5 sales in aggregate: 1.) Delivered an outstanding return for Fairfax and its shareholders. - First Capital, pet insurance and Ambridge were all sold at premium valuations. 2.) Improved the quality of the company - Strategic pivot in India (from ICICI Lombard to Digit, where Fairfax now has a control position). - sold RiverStone Europe (run-off), one of their lower quality P/C insurance businesses. Both objectives of good capital allocation were achieved. But the story gets even better. Did the significant sales (proceeds were $6.4 billion) over the past 7 years materially shrink the size of Fairfax’s P/C insurance business? It makes sense that it would have. But it did not. In fact the opposite happened. It appears Fairfax was able to use the significant proceeds from the asset sales to accelerate their growth - by acquisition and then in the hard market. Fairfax grew net premiums written from $8.1 billion in 2016 to $22.9 billion in 2023, growth of 183% or a CAGR of 16%. We included the per share numbers. Importantly, the growth in NPW over the 7 years period (2016 to 2023) did not happen as a result of the issuance of new shares. Fairfax was able to have its cake (significantly grow NPW) and eat it too (monetize assets at premium valuations). Brilliantly executed. Value investing When most investors think of value investing, they think exclusively in terms of equities. The value investing framework is infused into all parts of Fairfax - investments (equities and fixed income) and P/C insurance. The benefits of active management Over the past 7 years, Fairfax has put on a clinic on the significant benefits of active management. The Fairfax team has been best-in-class among P/C insurers with their overall execution over the past 7 years. And it is not close. Most investors have not figured this out yet. Despite its monster run the past three years, Fairfax’s stock continues to trade at a big discount to peers. Investors in Fairfax are getting best-in-class management at a significant discount. What about the investment management business? Fairfax has two businesses: P/C insurance and investment management. We have completed our review of asset sales in the P/C insurance business. Next we will review asset sales from the past 7 years in Fairfax’s investment management business. What else can we learn? Much more to come over the next week. Our story will read like Charles Dickens classic 'A Tale of Two Cities.'

-