Viking

Member-

Posts

4,920 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

There are two angles to Fairfax being added to the S&P/TSX60: 1.) short term impact on supply/demand for shares - as funds get positioned 2.) long term impact on demand for shares My view is index investing is only going to increase in popularity. As a result, demand for broad based index funds is likely to grow strongly in the coming years. As has been pointed out by @SafetyinNumbers, these buyers are largely price agnostic. My guess is an add to the S&P/TSX60 will be a modest tailwind for Fairfax’s stock price in the coming years.

-

The challenge with selling Fairfax is we keep discovering ‘there’s more gold in them thar hills.’ Which boosts intrinsic value higher. Which then boosts what you thought was a reasonable selling price. The most recent example is excess of FV over CV for non-insurance associate and consolidated holdings. It has ballooned to $1.9 billion (pre-tax), up a staggering $900 million in 2024. That is a $40/share (pre-tax) increase in intrinsic value just in 9 months of 2024. That is not included in EPS. Or book value. But is real value creation… just ask Buffett. Economic value vs accounting value. Should investors only pay attention to accounting value? What do you think Buffett would say? Excess of FV over CV is up $2.5 billion over the past 4 years (it was in a $600 million deficiency in 2020). The fair value marks for a few large holdings (like Fairfax India) is criminally low. So the actual increase in intrinsic value the past 4 years is even higher than $2.5 billion. More gold - well for investors who are willing to look for it. Fairfax’s reported EPS in each of the past few years is understated. By quite a bit. As a result, book value is understated. By quite a bit. So the ROE thar people are using from the past few years is understating what Fairfax is actually delivering. This means the P/BV multiple investors are using is also too low. This ‘problem’ is only going to get worse. Eurobank’s share price is still below TBV. Poseidon looks like it is turning the corner. BIAL is growing like a weed. There are more examples. And Fairfax is growing the size of its non-insurance associate and consolidated holdings, with Sleep Country being the most recent addition. I love it when i discover these kinds of problems. They just keep popping up with Fairfax…

-

@SafetyinNumbers, this is an interesting take. Makes sense. Fairfax is a total return investor. If they get an opportunity to sell/monetize an asset at an attractive price they probably will. This is one area where they differ from Buffett/BRK. I like Fairfax’s approach (for them).

-

@nwoodman, that is great insight. I hope Fairfax is following Buffett’s model and only buying companies where the management team wants to stick around and continue to run the business. The senior team at Sleep Country is very good. That can only help Fairfax’s other large Canadian holdings, like Recipe. The team at Peak Achievement also looks pretty good - they have executed a pretty solid turnaround over the past 6 years.

-

Sleep Country: An Introduction With the Sleep Country acquisition closing on October 1, 2024, it is time to do a high level review of this company to see what we can learn. Fairfax has been generating a record amount of net earnings and free cash flow in recent years. This is expected to continue. What is Fairfax doing with all the cash they are generating? One of the major themes in recent years has been building out their collection of non-insurance private business holdings (reported in the ‘non-insurance consolidated companies’ bucket). Are we in the early stages of a shift at Fairfax from pure P/C insurance company to a conglomerate model (like Berkshire Hathaway)? Perhaps. This is something to monitor moving forward. ————— Fairfax closed its purchase of Sleep Country on October 1, 2024. Total purchase consideration was $880.6 million (C$1.2 billion). The financing of the deal is interesting. Purchase consideration was made up of two components: Cash of $562.7 million, paid by Fairfax. Debt of $317.9, which was assumed by Sleep Country after close (and is non-recourse to Fairfax). A few things jump out with this transaction: Its size - At $880.6 million, it is a large purchase. After Seaspan/Atlas, this is Fairfax’s second largest equity investment made over the past 6 years. Type of transaction - It is a take private deal. Sleep Country was a publicly traded company (260th largest in size on TSX). Fairfax continues its aggressive build out its ‘non-insurance consolidated companies’ bucket of holdings. The use of leverage - Debt was used to fund 34% of the total purchase price. Fairfax is not afraid to use a modest amount of leverage when making acquisitions. We will dig into each of these things, and more, in the rest of this post. What return does Fairfax target when making investments like Sleep Country? Fairfax has a stated goal of earning 15% (pre-tax) per year on their equity investments. Importantly, they hope to achieve this return objective over the life of the holding - it is their long term goal. With Sleep Country, a 15% (pre-tax) return equates to about: $562.7 million cash investment x 15% = $84.4 million (pre-tax) per year Over the last couple of years, pre-tax net earnings at Sleep Country averaged about $80 million (C$110 million per year). Driven by Covid, Sleep Country over-earned in 2021 and 2022. However, due to a poor housing market and economy in Canada, Sleep Country likely under-earned in 2023 and especially YTD 2024. Moving forward, interest expense at Sleep Country will be elevated due to the incremental $317.9 million in debt taken on. So my guess is Sleep Country will not hit Fairfax’s 15% return target over the next couple of years. However, Fairfax thinks long term when they make their investments. They obviously feel there is a good chance that over time, the management team at Sleep Country will be able to grow the business and deliver their targeted return. What does Fairfax like about Sleep Country? My guess is Fairfax likes: The senior management team. The size and stability of the earnings stream that Sleep Country is generating. The long term prospects of the business. Fairfax bought a quality business for a fair price. Exactly the sort of thing that many investors have been hoping Fairfax would do more of. Welcome to ‘new Fairfax.’ For a good review of Sleep Country’s business, see the attached report from Fairway Research from April 2023. https://www.fairwayresearch.com/p/sleep-country-deep-dive-tsx-zzz Fairfax has a long history of being invested in the mattress segment in Canada Fairfax understands the mattress market in Canada very well. Back in 2004, Fairfax invested in the Brick, a large furniture retailed in Canada. In 2013, the Brick was merged with Leon’s creating the largest furniture retailer in Canada (Fairfax became a large shareholder in Leon’s). Mattress sales were one of the company’s core businesses. Fairfax sold its entire stake Leon’s in late 2021 (for C$25 per share) when the stock was trading at a Covid high. Sleep Country is likely the best managed/performing large company in the furniture retailing market in Canada over the past 20 years. Sleep Country has likely been on Fairfax’s radar for many years. Using debt to help finance acquisitions Why use debt? 1.) To achieve the long term strategic goals of the company. To be opportunistic - strike when the opportunity presents itself. To make larger acquisitions. To make private/control acquisitions. 2.) To maximize value creation for shareholders. To improve the return profile of the acquisition. Bottom line, debt is a tool in Fairfax’s capital allocation toolbox. This strategy (having the acquired company take on debt to help fund the purchase) is similar to what private equity shops do with leveraged buyouts. Except in Fairfax’s case, the total amount of debt used is modest. And the debt gets paid down over time (I think). With Sleep Country, 34%, or $317.9 million, of the total purchase price of $880.6 was financed with debt. Fairfax did a similar thing with the Recipe when it was taken private in 2022. The plan will likely be for Sleep Country to use some of its free cash flow in the coming years to pay down some of the debt taken on to help finance the deal (I think this is what Recipe has done). It does not appear that Fairfax is looking to permanently lever up the balance sheets of the companies it purchases/takes private. Strategic importance of the Sleep Country purchase Fairfax has 5 income streams that drives its earnings. The first 4 are: Underwriting profit Interest and dividend income Share of profit of associates Investment gains The 5th income stream is ‘non-insurance consolidated companies.’ This is the smallest income stream. But since 2022, Fairfax has been aggressively building out this collection of holdings: 2022: Recipe take private = $342 million 2022: Grivalia Hospitality = $195 million 2023: Meadow Foods (UK) = purchase price unknown 2024: Sleep Country = $880.6 million 2024: Peak Achievement = purchase price unknown (expected to close in Q4, 2024) Wade Burton’s comments on Fairfax’s Q3-2024 conference call: “Looking back over the last two years, we’ve made three significant long term equity investments, one in Meadow Dairy, a dominant milk ingredients company in the U.K. that is doing very well; another in Sleep Country, a dominant mattress distributor and retailer in Canada; and now a third, Peak, a dominant sporting goods company focused on hockey and lacrosse. All immediately are or will contribute to our earnings, and we believe all will continue to contribute more and more as their businesses progress.” With the Sleep Country and Peak Achievement purchases, the size of the ‘non-insurance consolidated companies’ bucket of holdings has likely reached critical mass. The size of the earnings generated by this group of companies has now become a meaningful contributor to Fairfax’s total results. From a run rate today of about $150 million annually, earnings could increase to over $300 million annually as soon as 2025 or 2026. And it is poised to be Fairfax’s fastest growing income stream in the coming years. Jen Allen’s comments on Fairfax’s Q3-2024 conference call: “As Wade noted, with our recently announced Sleep Country and Peak Achievement transactions, we expect the operating income from our non- insurance companies reporting segment will grow in the future periods, reflecting the operating income diversity these investments will add to the segment.” This 5th income stream provides Fairfax with many structural and strategic benefits: Earnings diversification: The earnings from this income stream are not correlated with the P/C insurance cycle. Liquidity: These holdings provide Fairfax with an important source of liquidity - holdings could be sold if Fairfax needed cash. Capital allocation benefits: Retained earnings from the various holdings can be re-invested into the best available opportunity within the Fairfax organization. An important trend at Fairfax over the past 6 years with its equity portfolio has been a steady shift from public to private holdings. It will be interesting to see if this trend continues in the coming years. The benefits of being a private company under the Fairfax umbrella Being a publicly traded company has big disadvantages. The CEO must spend a great deal of their time with public relations / keeping Wall/Bay Street happy. And the business has to be run with a short term focus (like hitting the ‘expected’ quarterly number). As a private company under the Fairfax umbrella, management can focus on running the business for the long term. And Fairfax is there to help with capital allocation. Understanding value creation at Fairfax moving forward There are problems with the ‘non-insurance consolidated companies’ bucket of holdings at Fairfax. The information that is available to shareholders on these holdings is pretty limited. We usually only get a top line summary once per quarter. Often 2 or more companies are grouped together, making it even more difficult to understand what is going on under the hood (fundamentals etc). This makes it quite difficult to understand the change in intrinsic value that is happening with each of the holdings, especially over a couple of years. As this bucket of holdings increases in size and importance, the lack of information will likely start to create a Berkshire Hathaway type of problem for Fairfax: the economic value of the holdings will increase at a faster rate than the accounting value captured in book value. Over time, book value will become more understated / less relevant as a tool to use to value Fairfax. However, there might be a silver lining for investors. Over time, Fairfax does tend to find creative ways to surface and recognize value that is hiding within its collection of businesses (in earnings and book value). ————— Additional information on Sleep Country From Fairfax’s Q3-2024 Interim Earnings Report Acquisition of Sleep Country Canada Holdings Inc. “On October 1, 2024 the company, through its insurance and reinsurance subsidiaries, acquired all of the issued and outstanding common shares of Sleep Country Canada Holdings Inc. ("Sleep Country") for purchase consideration of $880.6 (Cdn$1.2 billion) or Cdn$35.00 per common share. The total purchase consideration was comprised of cash of $562.7 (Cdn$759.9) and new non-recourse borrowings of $317.9 (Cdn$429.2) by a newly formed purchasing entity, which amalgamated with Sleep Country upon close. The company will commence consolidating Sleep Country in its Non-insurance companies reporting segment in the fourth quarter of 2024. Sleep Country is a specialty sleep retailer with a national retail store network and multiple e-commerce platforms.” Sleep Country 2023AR https://filecache.investorroom.com/mr5ir_sleepcountry/345/SCCHI_AR_2023_vX_CMYK.pdf

-

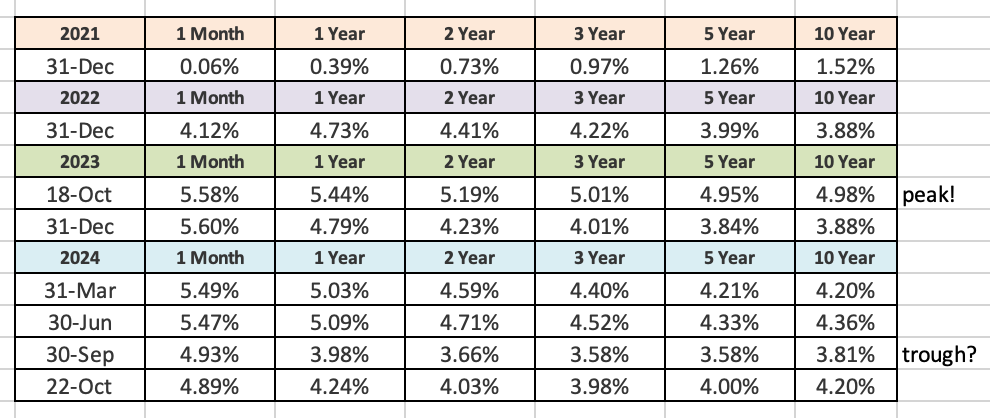

@nwoodman, thanks for the update and attaching the files. They were very helpful. The Eurobank story just keep getting better and better - the management team at this bank is exceptional. ROTE of +15% looks likely for the foreseeable future (management guide and they are conservative). It will be very interesting to see if they bump capital return to 50% and what the allocation is to buybacks. My guess is if they can buy back stock below (or close to) tangible book value they are going to buy as many shares as they can get (and rightly so). And their profit growth profile is so strong any shares they take out moving forward will look like a steal in another couple of years. Eurobank has so many irons in the fire… Eurobank is Fairfax’s largest equity holding. It is poised to grow and deliver exceptional returns in the coming years. Poseidon also looks like it should grow earnings nicely moving forward. The FFH-TRS should continue to increase in value. If we ever see that Anchorage IPO, Fairfax India should see a nice pop in value. Fairfax’s largest equity holdings look very well positioned. This suggests a 15% return on the equity portfolio is not only possible but perhaps likely. PS: The fixed income portfolio currently has an average yield of 4.7%… The investment portfolio looks very well positioned.

-

I must say i just started reading this thread late. I am surprised by all the negativity about conditions in the US today. Really? Back in 2008 to 2010, I get it. But today? For starters, anyone that owns a house in the US since 2013 has likely seen its value increase substantially. At the same time, anyone with a pension (company or 401K) has likely done extremely well return wise over the past decade. And the set-up for both housing and equity markets looks very promising. These two tailwinds - housing and equities - benefit more than the top 1%, or the top 10%. My guess is well over 50% of all Americans have seen their net worth (including pensions/savings) pop significantly over the past decade. Coming at it from another angle, the opportunities to get educated have never been better. Whether that be from formal (post secondary) or informal sources (internet/YouTube etc). Education is a primary determinant in quality of life. Yes, the desire (to learn) also needs to be there. Coming at it another way, the invention and adoption of broad based index funds like VOO (thank you Mr Boggle) has been a game changer for small/unsophisticated investors. It allows them to earn returns that likely are much better than the very wealthy (who likely use full service advisors that clip their 2%). I could go on and on about how much better off people are today than ever before. And I don’t think its close. Another way to look at today is to compare it to the recent past. Are things today in the US as bad as the 2008-2010 period. My guess is today things are infinitely better. I remember time when i was a kid when inflation was over 10%, interest rates (to buy a home) were over 15% and unemployment was over 10%. That was a shit show - good luck finding a job back then, any job. Good luck trying to learn something (hello local school or public library). I think the commission to buy a stock was 1.5% or 2% (same when you sold a position, which normally needed to happen to buy something new). The entire decade of the 1970’s or early 1980’s was better than today? I think the big problem is most people look at the past through rose coloured glasses. They remember the good things as being much better than they really were. And they largely ignore all the bad and terrible things that existed. That is not to suggest that everything is better. Of course it’s not. And every 20 years (generation) there tends to be different winners and losers. So to live a great life we do need to be open minded and flexible - and learn and be able to play both good offense and good defense. At the end of the day, when it comes to understanding how good things are today I think the optimism of Buffet and Munger is a great mental model to have. And if you don’t see it - to find the problem, probably a good place to start is to look in the mirror.

-

Stelco – Rock Star Alan Kestenbaum / Reaping the Rewards of ‘New Fairfax’ With the closing of the sale of Stelco to Cleveland Cliffs in November 1, 2024, it is time to do a final long form post on this investment. Let's evaluate the performance of the management team at Fairfax. And see what else can we learn about Fairfax from this investment. ---------- On July 15, 2024, Stelco announced that the company had been sold to Cleveland-Cliffs for about C$70/share (consisting of C$60.00 in cash and 0.454 of a share of Cliffs common stock). Fairfax owned 13 million shares of Stelco. Total proceeds to Fairfax will be about US$639 million ($561 million in cash + $78 million in CLF shares). With the deal closing on November 1, 2024, Fairfax is expected to book an investment gain of $366 million (pre-tax) when it reports Q4, 2024 results. How has Fairfax’s investment in Stelco performed? (All amounts are in US$) I know… I know… Show me the money! In November 2018, Fairfax paid $193 million for 14.7% of Stelco (13 million shares at C$20.50/share). When Fairfax announced their Stelco purchase I hated it. At the time, it screamed ‘old Fairfax’ to me. Boy was I wrong. Fairfax’s return on its investment in Stelco has come from 3 sources: Gain on the increase in the value of Stelco shares …..…..…… $368 million Regular and special dividends paid by Stelco ……………………. $115 million Value of Cleveland Cliffs shares received as part of sale ……. $78 million Over its 6-year holding period, Fairfax earned a total return of about US$568 million (+294%) on its $193 million investment in Stelco. The 6-year CAGR is 25.5%. That is an outstanding return. Bottom line, the team at Fairfax/Hamblin Watsa absolutely crushed their investment in Stelco. What made Stelco such a good investment for Fairfax? The CEO of Stelco, Alan Kestenbaum. Since buying Stelco out of bankruptcy in 2017 (via Bedrock Industries) Kestenbaum's capital allocation decisions have been exceptional. Some examples: What did Stelco do with the earnings windfall from the historic bull market in steel in 2021 and 2022? They bought back 38% of shares outstanding. And they did not overpay. That was freaking brilliant. As a result of the significant buybacks Fairfax’s ownership in Stelco increased from 14.7% to 23.6% - with no new money invested. A significant amount was paid out to shareholders over the past 6 years in dividends (regular and special dividends). Two other brilliant moves by Kestenbaum: April 2020 - Minntac deal: at a cost of $100 million, Stelco got an 8-year supply agreement with US Steel with option to purchase 25% of Minntac (the largest iron ore mine in the US). Stelco struck this deal when Covid was raging - other CEO’s were in capital preservation mode and Kestenbaum was thinking long term value creation. At Fairfax’s annual general meeting in April 2023, Kestenbaum re-told the story of the incredible support he received from Prem/Fairfax in 2020 that allowed him to pull the trigger on this deal. June 2022: Stelco sold their real estate holdings in Hamilton (the Stelco Lands) for C$518 million. The timing of this sale was brilliant - at what might be close to the peak of Canada’s real estate bubble. And remember, Kestenbaum paid a total of about C$500 million for all of Stelco in 2017. And the final act? Selling the entire company for C$70.00 in July 2024. Kestenbaum has been schooling the North American steel industry on capital allocation and building shareholder value for the past 7 years. In short, Kestenbaum has been a rock star - even Billy Idol would agree. The incredible power of share buybacks (when done well) Over a 2 year period Stelco reduced shares outstanding by 38%. What is interesting is Fairfax has also been very aggressive, reducing their shares outstanding by 20.1% over the past 6.75 years. As a result, Fairfax shareholders got a double benefit - and they saw their per share ownership interest in Stelco increase substantially over the past 6 years as a result of two large buybacks. Importantly, both Stelco and Fairfax bought back their shares at very low prices. The result is incredible value creation for long term shareholders of Fairfax. How does Kestenbaum’s performance compare with Goncalves, CEO of Cleveland-Cliffs? Many investors hold Lourenco Goncalves, CEO of Cleveland Cliffs, in high regard for his capital allocation skills. In November 2018, Cleveland Cliffs shares traded at about $10/share. Today CLF trades at about $13/share. Since 2018, CLF has paid dividends of $0.38/share. Over the past 6 years, a shareholder in CLF has earned a total CAGR of 5% per year. Over the past 6 years, Kestenbaum has delivered to Stelco shareholders a CAGR of 25.5%. Kestenbaum’s strategic vision, execution, results and timing have been exceptional. Much better than Goncalves (and that is an understatement). As a result, over the past 6 years, shareholders of Stelco have done much, much better than shareholders of Cleveland-Cliffs. —————- Reaping the rewards of the 'new Fairfax' Stelco is a great example of what I like to call ‘new Fairfax.’ In about 2018, Fairfax (and the team at Hamblin Watsa) appeared to ‘tweak’ their value investing framework when it came to new equity purchases. As a result of these changes, Fairfax’s new equity purchases made since 2018 have performed very well. One of the important changes Fairfax made to their value investing framework was putting a much higher premium on partnering with great CEO/founders/owners. Stelco/Kestenbaum is a wonderful example of the incredible value creation that the changes made by Fairfax 6 years ago are now delivering to Fairfax shareholders. Importantly, Fairfax, via their many investments, is now partnered with many outstanding CEO’s/leaders/founders and the quality (in terms of earnings power) and prospects of their $20 billion equity portfolio has never looked better. Capital Allocation - Asset Sales Asset sales are a very important and underappreciated part of Fairfax’s capital allocation framework. It is something that separates Fairfax from both Berkshire Hathaway and Markel. Why sell an asset? Because someone values it much more than you do - and they are willing to pay you far more than it is worth. Selling Assets at Nosebleed High Prices Cleveland Cliffs paid consideration of C$70/share (cash and CLF shares) that was an 87% premium to Stelco’s closing share price of C$37.36 on July 12, 2024, and a 37% premium to Stelco’s 52-week high. In selling the company, Stelco (and Fairfax) were being highly opportunistic - they were able to take advantage of the consolidation fever that has gripped the North American steel industry in recent years. Fairfax did something similar twice in 2022: Insurance: Sold their pet insurance business for $1.3 billion, booking a surprising $1 billion gain after-tax. Pet assets were in a bubble (driven by a race to consolidate). At the time, no one even knew Fairfax had a pet insurance business. Non-insurance: Sold Resolute Forest Products at the top of the lumber cycle for a premium price of $626 million (plus $183 in million contingent value rights). At the same time, the sale resulted in the disposal of a chronically underperforming asset - which improved the overall quality of their remaining equity portfolio. As these three recent examples demonstrate, selling assets (insurance and non-insurance) can create significant value for long term shareholders. And improve the quality of the company. Fairfax detractors But talk to Fairfax detractors… my guess is they still view Fairfax’s purchase of Stelco as a shitty investment. They explain it away with ‘Fairfax got lucky.’ After all, Stelco is a commodity producer! It cracks me up when I hear the detractors talk about Fairfax’s equity holdings. They usually have no idea what they are talking about. But boy, do they ever have a lot of conviction when they express their views. =========== For those board members who are interested in going on a trip down memory lane, below are links to some of the important events in Stelco's life since Kestenbaum purchased the company out of bankruptcy in 2017. A short history of Fairfax’s investment in Stelco In November of 2018, Fairfax invested US$193 million in Stelco, buying 13 million shares at C$20.50. At the time, it was a deeply contrarian purchase. News release from Stelco announcing the company’s sale to Cleveland-Cliffs Cleveland-Cliffs to Acquire Stelco for C$70 per Share - July 15, 2024 https://investors.stelco.com/news/news-details/2024/Cleveland-Cliffs-to-Acquire-Stelco-for-C70-per-Share/default.aspx HAMILTON, Ontario--(BUSINESS WIRE)-- Stelco Holdings Inc. (TSX: STLC) (“Stelco” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Arrangement Agreement”) with Cleveland-Cliffs Inc. (NYSE: CLF) (“Cliffs”), pursuant to which Cliffs has agreed to acquire all of the issued and outstanding common shares of Stelco (the “Transaction”) at a price of C$70.00 per share (the “Consideration”), consisting of C$60.00 in cash and 0.454 of a share of Cliffs common stock (equivalent to C$10.00 based on the closing price of Cliffs common stock on July 12, 2024) per Stelco share. The total enterprise value pursuant to the Transaction is approximately C$3.4 billion. The Consideration represents an 87% premium to Stelco’s closing share price of C$37.36 on July 12, 2024, and a 37% premium to Stelco’s 52-week high. Fairfax Financial Holdings, an affiliate of Lindsay Goldberg LLC, Alan Kestenbaum, and each of the other directors and executive officers of Stelco collectively holding approximately 45% of the current outstanding Stelco common shares have entered into support agreements to vote in favour of the Transaction, subject to customary exceptions. Comments from Prem about Stelco from Fairfax's 2023AR and 2022AR. 2023: "In a year of volatile steel prices, Stelco performed well, highlighting its competitive cost structure. Stelco’s talented team – led by Alan Kestenbaum, Sujit Sanyal, and Paul Scherzer – continues to be excellent stewards of the business with a keen focus on creating shareholder value. We believe that Stelco owns the best-in-class blast furnace assets in North America, which is highlighted by its industry leading margins. The company’s Lake Erie Works facility has had recent upgrades to its blast furnace, coke battery, a newly constructed co-generation facility and a new pig iron caster. Nippon recently announced an agreement to acquire US Steel at a multiple of 7.8x 2024 EBITDA, a significant premium to Stelco’s trading multiple. We believe the US Steel acquisition highlights the value of blast furnace operations. Stelco continues to have significant net cash on its balance sheet, providing management with flexibility to take advantage of both organic and inorganic growth opportunities. The company rewarded shareholders with a Cdn$3 per share special dividend in addition to its Cdn$1.68 per share regular dividend in 2023. Stelco has raised its regular dividend for 2024 to Cdn$2.00 per share. We believe Stelco has a bright future under Alan Kestenbaum’s leadership. Stelco is carried on our books at $22.44 per share versus a market price of $37.84 per share." Prem Watsa - Fairfax 2023AR 2022: “2022 was an active and successful year for Alan Kestenbaum and the talented team at Stelco. The company ended the year with its second-best fiscal result since going public despite an approximately 50% decline in steel prices over the summer. Stelco is benefiting from the Cdn$900 million it has invested in its Lake Erie Works mill since 2017, which has made the mill one of the lowest-cost operators in North America. Stelco entered 2022 with an extremely strong balance sheet and put its capital to good use, completing three substantial issuer bids during the year, thereby repurchasing approximately 29% of its outstanding shares. These repurchases have resulted in Fairfax’s ownership increasing to 24% from 17% at the beginning of the year. In addition to share repurchases, Stelco paid a Cdn$3 per share special dividend and increased its regular dividend to Cdn$1.68 per share from Cdn$1.20 per share. Stelco maintains over Cdn$700 million of net cash on its balance sheet and we anticipate that it will continue to be active both investing in its operations and efficiently returning excess capital to shareholders. We are excited to continue as a significant investor in Alan Kestenbaum’s leadership at Stelco.” Prem Watsa – Fairfax 2022AR Details of Stelco’s Hamilton land sale in 2022, for proceeds of $518 million. “Stelco Holdings Inc. (TSX: STLC) (“Stelco” or the “Company”) announced today that its wholly-owned subsidiary, Stelco Inc., has successfully closed a sale-leaseback transaction with an affiliate of Slate Asset Management (“Slate”). Stelco Inc. has sold the entirety of its interest in the approximately 800-acre parcel of land it occupies on the shores of Hamilton Harbour in Hamilton, Ontario to Slate for gross consideration of $518 million. In conjunction with the sale, Stelco Inc. has entered into a long-term lease arrangement for certain portions of the lands to continue its cokemaking and value-added steel finishing operations at its Hamilton Works site in Hamilton, Ontario.” https://www.thespec.com/news/hamilton-region/all-of-stelco-s-hamilton-land-sold-in-deal-that-would-see-it-transformed-into/article_17a333af-8198-5f97-9866-8c61ed8f799f.html? Details of Stelco’s agreement with US Steel in 2020 to securing long term supply for iron ore pellets. Stelco Announces Option To Acquire 25% Interest In Minntac, The Largest Iron Ore Mine In The United States, And Entry Into Long-Term Extension Of Pellet Supply Agreement With U.S. Steel “Stelco will pay US$100 million, in cash, to U.S. Steel in consideration for the Option (the "Initial Consideration"). The Initial Consideration is payable in five US$20 million installments, with the first installment paid upon closing of the Option Agreement and the remaining four installments payable every two months thereafter. Upon the exercise of the Option, Stelco would pay a net exercise price of US$500 million.” Transaction Highlights: Secures long-term future of Stelco's steel production and solidifies Stelco's low-cost advantage Provides supply of high-quality iron ore pellets from a well-understood and consistent source for the next eight years, or longer if the Option is exercised Increases annual pellet supply to level required for Stelco's higher production capacity following this year's blast furnace upgrade project Supports Stelco's tactical flexibility model to deliver highest margin outcomes based on prevailing market conditions Creates a secure pathway for Stelco to become a vertically integrated player in the future through ownership in a low-cost iron ore source which is the largest producing iron ore mine in the Mesabi iron range Structured in stages that will preserve Stelco's strong balance sheet and financial flexibility https://investors.stelco.com/news/news-details/2020/Stelco-Announces-Option-to-Acquire-25-Interest-in-Minntac-the-Largest-Iron-Ore-Mine-in-the-United-States-and-Entry-into-Long-Term-Extension-of-Pellet-Supply-Agreement-with-U.S.-Steel-04-20-2020/default.aspx Here is a little more information of Kestenbaum’s initial investment in Stelco in 2017. Purchase of Stelco out of bankruptcy: Bedrock gets steelmaker for less than $500 million https://www.thespec.com/business/stelco-deal-bedrock-gets-steelmaker-for-less-than-500-million/article_da943b70-1a93-5a35-acb4-92a6da05946a.html?

-

@SafetyinNumbers , i finally got the time to listen to your podcast (I am just finishing up my vacation). You did a fantastic job! It was very comprehensive. It was a great review for me on many topics. And i also learned a great deal. It also provided me with some ideas that might make interesting long post articles in the future. Thank you!

-

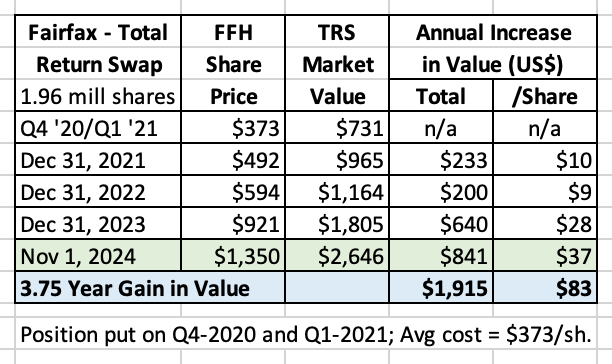

Fairfax's total return swap investment (giving it exposure to 1.96m $FFH.TO shares) is up $841m 2024YTD. And up $1.9b (before carrying costs) in 3.75 years. Outstanding capital allocation. Opportunistic. Creative. Concentrated position - a needle mover. How does one calculate the internal rate of return that Fairfax has generated from this investment? Any suggestions? The total return of $1.9 billion in 3.75 years is amazing. But when you compare the return to what it has cost Fairfax to put this position on and keep it on... the internal rate of return from this investment has to be astronomical. Fairfax's shares are trading at about $1,350/share. If they return 15% over then next 12 months (likely a mildly conservative assumption) that would result in a $200 increase in the share price. That would translate into a $400 million increase (pre-tax) in the value of the FFH-TRS position. A 20% return would result in a gain in the FFH-TRS of $540 million. These are big numbers (larger than the notional value when the position was put on originally). Compounding and time is working its magic. With the shares trading at $1,350, it will be interesting to see if Fairfax continues to be aggressive on the share buyback front. My guess is holding the FFH-TRS and share buybacks might be linked strategically from a Fairfax perspective. But I am not sure. If Fairfax is confident they will be able to deliver an average ROE of 15% per year over the next 3 or 4 years, perhaps they continue to hold the FFH-TRS position, regardless of what they decide to do with buybacks. This single investment is so instructive about Fairfax on so many different levels. Why it is so different from not only traditional P&C insurance companies, but also how different it is from Markel and Berkshire Hathaway. Unconstrained capital allocation (Fairfax's business model) can be a wonderful compounding machine when executed by the right management team. The FFH-TRS is one of many examples of where the senior team at Fairfax has been executing exceptionally well over the past 6 years or so. Mr. Market is starting to wake up to the fact that Fairfax has once again become a compounding machine - with its glide path for the next 4 years largely set. “We think this will be a great investment for Fairfax, perhaps our best yet!” Prem Watsa 2020AR

-

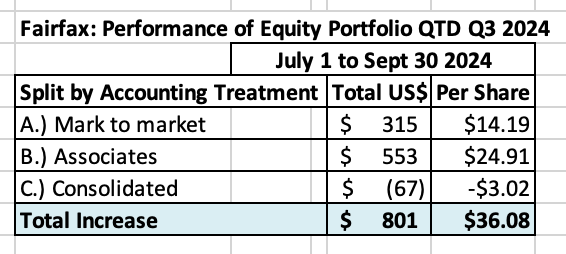

FFH Q3 Earnings Summary. I apologize in advance for posting this in the 'Fairfax 2024' thread. I just think this is the better place to put my long-form posts (so they don't get lost). Summary: 9 months into 2024, Fairfax has: 1.) Increased book value per share from $940 to $1,033, an increase of $93. 2.) Paid a dividend of $15/share. 3.) For non-insurance associate and consolidated holdings, increased excess of FV over CV from $1 billion to $1.9 billion, an increase of $900 million (pre-tax). This is significant value that has been created that is not captured in book value. Also, the 'fair value for some of these holdings looks stupidly low (meaning book value is even more understated). Their stake in Fairfax India has a fair value of $857 million? It should be much more than this (driven by BIAL). The fair value for Poseidon, at $2 billion, has not changed in 2024. Sokol at Fairfax's AGM in April said the cost to build new containerships had increased 30%. Atlas is just taking delivery of the last of its newbuilds as part of its massive expansion strategy executed over the past 3 years - the value of which has just increased by around 30%. Yet the 'fair value' on Fairfax's balance sheet has not changed? There are more good examples. 4.) Effective shares outstanding have been reduced by 1 million = 4.3%. Much lower share count boosts investment per share, float per share and future earnings per share. As Buffett teaches us, to properly evaluate a management team, investors should be following and focussed on the change in per share metrics over time and not simply the change in the total $ metrics. Bottom line 2024 is shaping up to be another very good year for Fairfax and its shareholders. Fairfax has not done anything flashy. Just lots of solid execution. Boring. Kind of like watching paint dry. Expect more of the same in the coming years. (PS: That is what a compounding machine looks like.) ---------- Below is a summary of some of the key learnings from Fairfax’s Q3 results. They are based primarily on the company’s news release and conference call (as I have not had time to go through the interim report). The conference call was one of the better ones in recent years. The commentary from the management team at Fairfax was concise and informative. And the analyst Q&A session was also very informative. 1.) Insurance What is growth in net premiums written? Excluding Gulf, +3.2%. What is CR? 93.9% = $390 million in underwriting profit. What is level of catastrophe losses? $434 million = 6.8 combined ration points. What is level of favourable development? $130 million (was $56 million in Q3 2023). Commentary on growth in Q4 and 2025: Odyssey and Brit have been headwinds over the past 12 months. They could flip to modest tailwinds in Q4 and moving forward. Perhaps we see Fairfax grow at 4 or 5% (ex Gulf) moving forward. “In Q4, Odyssey will have lapped the exited quota share contract: “Odyssey’s gross premiums written were down 4.7% due to the previously disclosed non-renewal of a large quota share in the fourth quarter of 2023. Excluding the quota share contract, Odyssey’s business was up 7.2% in the third quarter, driven by its reinsurance operations.” Peter Clarke “Our international operations excluding Gulf are growing quite nicely as well - they are up 9%, and then you have Odyssey that were down 5%, but as I mentioned, that includes that one-off quota share treaty, that the effects of that will unwind in the fourth quarter, so it will be more normalized growth going forward, and Brit then were down 4% in the third quarter, and I think you’ll see that turn around as well as they’ve been--you know, they’ve been really focusing on the margins in their business and cutting back and reallocating capital to more profitable lines, so I would expect that you’ll see Brit on the positive side of premium growth going forward.” Peter Clarke Commentary on Milton and potential impact on Q4 results: Losses from Milton look to be manageable. “I can’t give you an exact number, but we can point you in the right direction. We’re still collecting the information. We had our model losses, but it’s been slow, the reported losses coming in. We really think that it will easily come within the cat margin for the fourth quarter, and so it should not have a significant effect on the combined ratio.” Peter Clarke Commentary on reserving trends: Reserving continues to be an under appreciated strength for Fairfax. “As… I said in my opening remarks, we’re just going through the full actuarial review at all our companies in the fourth quarter, and we’ll have more to report on our year-end call and in our annual report. But for the year, we’ve had $300 million of favorable development, so our reserves continue to run off well - 130 of that was in the third quarter, and we really believe we have a great process in place instilled within the companies for conservative reserving - it’s very important. This is our--you know, last year was our 17th year in a row that we’ve had favorable development, and for the first nine months we’ve had $300 million." “But in regards to the U.S. casualty, it’s an industry--the industry is feeling the effects of these social inflation and nuclear verdicts. Our companies are seeing it as well, as I said in the past, mainly Crum & Forster and Allied, and they have been strengthening some of these accident years, 2014 to 2018 in particular, but more or less have had IB&R up or offsetting redundancies in other lines of business, so in total we’ve--you know, our reserving has been quite strong.” “In the third quarter, there was no--on these years, there’s been no significant strengthening on the U.S. casualty reserves, so overall we think our reserves are in really good shape.” Peter Clarke 2.) Investments Total investment portfolio = $69 billion Fixed income = $49 billion Equities = $20 billion “Of the $49 billion in fixed income, $35 billion are in U.S. treasuries, other government bonds and cash. There is another $5 billion in mortgages and $9 billion in short dated investment-grade corporates. Including cash, average maturity is 3.7 years and the yield is 4.7%.” Wade Burton 3.) Interest and dividend income Interest and dividend income came in at $610 million in Q3. This was down slightly from $614 million in Q2. With the Fed (and global central banks) cutting, short term rates are coming down. As a result, Fairfax will be earning less on its short term investments. So Q2 is likely the peak in interest and dividend income for now (at least in terms of total $). However, there are a couple of factors that will support this important bucket of earnings: Fairfax continued to add to its investment in the Kennedy Wilson’s debt platform - it is now at $5 billion. This portfolio yields well above the 4.7% average for Fairfax. Fairfax continues to grow the size of its fixed income portfolio. Fairfax continues to aggressively buy back its shares (4.3% year to date). Bottom line, after 3 years of being a strong tailwind, interest and dividend income has now shifted to being a modest headwind (for now). But interest and dividend per share, which is what really matters to investors, might hold up better than expected moving forward. The average duration of the fixed income portfolio increased significantly in Q3 to 3.5 (3.7?) years. The average yield is a very healthy 4.7% Of note, Fairfax did receive a dividend of $128 million from Eurobank. Eurobank is equity accounted. Therefore the dividend is not reported in ‘interest and dividends’. The carrying value of Eurobank was reduced by this amount. 4.) Share of profit of associates Share of profit of associates came in at $260.2 million, driven primarily by Eurobank and Poseidon. 5.) Non-insurance consolidated companies Given the acquisitions in recent years, and the acquisition of Sleep country and Peak Achievements in Q4, earnings from non-insurance consolidated companies should grow considerably from current levels and be a solid tailwind in the coming years. “As Wade noted, with our recently announced Sleep Country and Peak Achievement transactions, we expect the operating income from our non- insurance companies reporting segment will grow in the future periods, reflecting the operating income diversity these investments will add to the segment.” Jen Allen 6.) Investment gains “Net gains on equity exposures of $322.9 million principally reflected a net gain of $229.5 million on the company's continued holdings of equity total return swaps on 1,964,155 Fairfax subordinate voting shares… and net gains on common stocks of $99.2 million.” “Net gains on bonds of $828.6 million principally reflected net gains of $502.5 million on U.S. treasuries as interest rates declined during the quarter.” “Net gains on other of $135.8 million principally reflected unrealized gains of $184.0 million on the company's holdings of Digit compulsory convertible preferred shares.” FFH Q3 news release. 7.) Excess of fair value over carrying value for associate and non-consolidated equity holdings This 'bucket' of holdings has created significant value for Fairfax shareholders over the past 4 years. YTD 2024 (Sept 30) it has created $900 million in value, and now totals $1.9 billion, or about $87/share pre-tax. This value is not captured in Fairfax’s earnings or book value. But much of it will get captured and reflected over time. The most recent example is Stelco. The sale is expected to close in early November - and when it does - Fairfax will realize a gain of $366 million. This will be a nice boost to earnings and book value. This 'bucket' is only going to get more important for Fairfax moving forward - the holdings in Fairfax's equity portfolio have been slowly shifting from mark-to-market holdings to associate and increasingly consolidated holdings. It will be important for investors to understand the changes over time in 'excess of FV to CV for associate and non-insurance consolidated holdings' to properly evaluate Fairfax's performance and to value the company's stock. “At September 30, 2024, our excess of fair value over carrying value of our investments in the non-insurance associates and market traded consolidated non-insurance subsidiaries was $1.9 billion compared to the $1 billion at December 31, 2023. That pre-tax excess of $1.9 billion or $87 per share is not reflected in our book value per share but is regularly reviewed by management as an indicator of the underlying investments’ performances, and included in that $1.9 billion is an approximately $366 million gain anticipated to be recognized by the company in the fourth quarter of 2024 relating to our sale of Stelco’s common shares.” Jen Allen 8.) Capital allocation Part 1: Asset sales / purchases Purchase of Sleep Country Fairfax paid a total of $881 million to purchase Sleep Country. It is interesting that Fairfax had Sleep Country take on $318 million in debt to help finance the acquisition. This reduced Fairfax’s actual cash outlay to $563 million. This is a similar strategy Fairfax used when they took Recipe private. Like Fairfax did with Recipe, the plan will likely be for Sleep Country to use free cash flow in the coming years to pay down some of the debt taken on to finance the purchase. “On October 1, 2024, the company through our insurance and reinsurance subsidiaries acquired all of the issued and outstanding common shares of Sleep Country Canada for purchase consideration of US $881 million. That total purchase consideration was comprised of cash of $563 million and new non-recourse borrowings to the holding company of $318 million by a newly formed purchasing entity which amalgamated with Sleep Country upon close.” Jen Allen Stelco sale. Expected to close in early November. Will result in a pre-tax gain of $366 million. Asset sales are an important part of Fairfax’s capital allocation framework. Fairfax sold Stelco to Cleveland Cliffs at a significant premium (Fairfax did something similar in 2022 when they sold Resolute Forest Products at the top of the lumber cycle). In 7 short years, Stelco has turned into a stellar investment for Fairfax. It is a great example of Fairfax beginning to harvesting the rewards of what I like to call ‘new Fairfax’ (beginning in 2018, Fairfax started making much better purchase decisions with its new equity investments). Peak Achievements purchase (bought out majority partner) On the Q3 conference call, Wade Burton went into a little detail on Fairfax’s purchase of Peak Achievement. His commentary gives investors good insights into the framework that Fairfax is using today when it makes large equity investments: Very good management team. Solid track record. Solid prospects (highly consolidated industry). Willing to pay a fair price. “We did make one significant announcement in the quarter. We bought out our main partners in Peak Achievement, an athletic wear and equipment company focused on hockey and lacrosse. It is an outstanding business operating in a highly consolidated industry, well run by Ed Kinnaly and his team, incredible track record, and we paid a fair price. We think we will make a very good return over the long run for our shareholders, and importantly, Ed runs the company very much in tune with the Fairfax culture.” Wade Burton In the quote below, Wade expands further on Fairfax’s equity investment framework: Dominate in their respective markets/industries. Focus on earnings generation - over the long term. “Looking back over the last two years, we’ve made three significant long term equity investments, one in Meadow Dairy, a dominant milk ingredients company in the U.K. that is doing very well; another in Sleep Country, a dominant mattress distributor and retailer in Canada; and now a third, Peak, a dominant sporting goods company focused on hockey and lacrosse. All immediately are or will contribute to our earnings, and we believe all will continue to contribute more and more as their businesses progress.” Wade Burton 9.) Capital allocation Part 2: Share repurchases Share buybacks: ‘Effective shares outstanding’ have fallen by 1 million shares YTD 2024 (from 23 million at Dec 31, 2023 to 22 million at Sept 20, 2024. Stock buybacks, YTD at $1.1 billion, has been Fairfax’s largest capital allocation decision in 2024. The average price paid is $1,113/share which is slight premium to current BVPS of $1,033/share. If we include excess of FV to CV of associate and non-insurance consolidated holdings, Fairfax has been buying back shares at about 1 x BVPS, which is exceptional value. Buying back a meaningful amount of shares at a low valuation continues to deliver solid value and be a good decision for long term shareholders. “In the first nine months of ’24, we’ve purchased for cancellation a little over one million subordinate voting shares principally under our normal course issuer bid at a cost of $1.1 billion, or US $1,113 per share, of which 159,000 subordinate voting shares at a cost of $181 million were completed in the third quarter of 2024.” Jen Allen 10.) Tax rate The tax rate has increased. From a little over 20% in 2023, it is currently tracking in the 25% range. Fairfax says to use 22% to 25% as a guide moving forward. “As Peter indicated, there are a lot of moving parts within the global tax regime. As you indicated, our effective tax rate is sitting at 25.1%, elevated over 2023. A couple things driving that - in 2024, we now are under the global minimum tax, where there is a 15% mandated tax in certain jurisdictions that we didn’t have prior, primarily being in Bermuda, so on a YTD basis included in that number is about $107 million, about $30 million expense in the quarter. We also have a change in the tax rate legislation in India, where they changed their long term capital gains rate - that also cost us another about $50 million in the quarter.” “There’s a couple of other things we’re still closely watching, which is the interest limitation tax rule that’s in place - currently no impact materially on our financials, but there could be, that’s where the 30% limitation rule could come into play at the holding company, and then we’re still tracking quite closely the capital gains rate, the inclusion rate change that’s coming in Canada as well, so as Peter indicated, a lot of moving parts on tax. I think trying to normalize what that effective tax rate would be is a little difficult, but I would say it is going to be elevated from prior year. If you kind of put in maybe a 22% to a 25%, you’re probably going to be in the ballpark where we’ll land.” Jen Allen 11.) Book value per share At Sept 30, 2024, BVPS = $1,033/share (from $980/share at June 30). 12.) Impact of change in interest rates of Fairfax’s reported results The substantial decline in interest rates in Q3 resulted in a mild net benefit of $64 million to Fairfax’s reported results. Loss on discounting (IFRS 17) was $765 million Mark to market gain on bond portfolio was $829 million. The duration of Fairfax’s fixed income portfolio is now roughly equal to the duration of their insurance liabilities (at 3.5 to 3.7 years). This means changes in interest rates will have a minor impact on Fairfax’s reported results. This will remove a potentially significant source of volatility to Fairfax’s earnings - as long as the durations remain roughly matched. “The duration on our bond liabilities are around 3.5 years, so it’s a little longer than it was last quarter, and if you look at our liabilities, it’s relatively close. We don’t match on purpose, but where we sit today, our liability duration is close to our asset duration. You can sort of see that in the IFRS 17 numbers, that we had a big loss on the discounting, about $750 million, $760 million that was offset almost--very closely with the $800 million-plus of gains on our bond portfolio, so we’re pretty much matched where we are today.” Peter Clarke 13.) Succession planning Fairfax continues to demonstrate that they executing very well when it comes to succession planning. Bob Sampson will be appointed CEO of RiverStone effective Jan 1, 2025. Nick Bentley will transition to/remain as Chairman of RiverStone. This is just another, in a long list of examples, of how the senior team at Fairfax has been effectively grooming and then transitioning the management of their various business units to the next generation of leaders.

-

"To someone with a hammer, every problem looks like a nail" is a phrase often attributed to Charlie Munger. “The quote refers to the idea that people tend to use the tools they're most familiar with, even when better options are available. This can lead to approaching problems in ways that are not helpful or even destructive.” ————— The fundamental problem with Brett Horn’s ‘analysis’ is he appears to be using a standardized model to analyze P&C insurance companies. The model also looks like it is primarily built on long term historical results - it is largely weighted to what happened 5 to 15 years ago. And he already knows what his conclusions are for Fairfax (the same conclusions he had 5 years ago, and likely the same conclusions he had 10 years ago and even 15 years ago). Fairfax is not a traditional P/C insurance company. So Horn’s ‘model’ is not a good fit. And over the past 4 years, Fairfax has just completed a remarkable turnaround in its earnings. So Fairfax’s numbers from 5 to 15 years ago have little relevance today. As a result, Horn’s model/framework appears broken when it comes to understanding and valuing Fairfax today. When it comes to Fairfax, Horn’s model actually forces/requires him to ignore the facts (because they don’t fit into his model/framework). The bottom line, and as one would expect, Brett Horn’s ‘analysis’ of Fairfax has been epically bad for the past 5 years. His analysis of Fairfax over the past 5 years (the body of work) has to be some of the worst ‘research’ that Morningstar has ever produced on a single company. That is sad. Because it has likely cost many investors an enormous amount of money. What is the problem? Probably hubris. Horn appears to lack the ability to admit he has been completely wrong with his understanding and analysis of Fairfax in recent years. As a result, he is now stuck. In an ironic twist, Horn now appears to be afflicted with the same disease that afflicted Fairfax from 2010 to 2016. PS: how does a ‘no moat’ company compound book value at close to 20% per year for 38 straight years?

-

@Parsad , great point. Volatility freaks out lots of Fairfax shareholders - but extreme volatility over the past 5 years is when Fairfax made their best investments. It’s very counterintuitive. In 2024 with volatility low in financial markets, Fairfax has resorted to hitting solid singles. Still gets the baserunners around the bases and across home plate. Still scores lots of runs.

-

So 9 months into 2024, Fairfax has: 1.) Increased book value per share from $940 to $1,033, an increase of $93. 2.) Paid a dividend of $15/share. 3.) For non-insurance associate and consolidated holdings, increased excess of FV over CV from $1 billion to $1.9 billion, an increase of $900 million (pre-tax). This is significant value that has been created that is not captured in book value. Also, the 'fair value for some of these holdings looks stupidly low (meaning book value is even more understated). Their stake in Fairfax India has a fair value of $857 million? It should be much more than this (driven by BIAL). The fair value for Poseidon, at $2 billion, has not changed in 2024. Sokol at Fairfax's AGM in April said the cost to build new containerships had increased 30%. Atlas is just taking delivery of the last of its newbuilds as part of its massive expansion strategy executed over the past 3 years - the value of which has just increased by around 30%. Yet the 'fair value' on Fairfax's balance sheet has not changed? There are more good examples. 4.) Effective shares outstanding have been reduced by 1 million = 4.3%. Much lower share count boosts investment per share, float per share and earnings per share. Bottom line 2024 is shaping up to be another very good year for Fairfax and its shareholders. Fairfax has not done anything flashy. Just lots of solid execution. Boring. Kind of like watching paint dry. Expect more of the same in the coming years. (PS: That is what a compounding machine looks like.) ----------

-

Another strategic shift Fairfax appears to be making is to build out the size of the non-insurance operating companies bucket. In 2022 they took out Recipe. They just added Sleep Country. And in Q4, with the takeout of Peak Achievement (Bauer) they will add one more. This could take pre-tax earnings for non-insurance operating companies from $150 million to perhaps $300 or $350 million per year - which now makes it a meaningful number. This income stream is different from the other 4 incomes streams Fairfax has: - It is not correlated with the insurance business/cycle - so provides important diversification to earnings. This benefits the income statement. - It also provides an important source of liquidity for the company - they are owned/controlled assets that could be sold if needed. This benefits the balance sheet. It will be interesting to see if Fairfax continues to grow the non-insurance consolidated companies bucket in the coming years.

-

Looks like another solid quarter to me. A question for board members: are the gains from the Stelco sale and the take out of Peak Achievement (Bauer) not yet realized? I.E. they will be realized when Fairfax reports Q4 earnings? “On July 15, 2024 Cleveland-Cliffs Inc. ("Cliffs") entered into a definitive agreement with Stelco to acquire all outstanding common shares of Stelco for consideration of Cdn$70.00 per share (consisting of Cdn$60.00 cash and Cdn$10.00 in Cliffs common stock), which received shareholder approval on September 16, 2024. Subsequent to September 30, 2024, Stelco received final regulatory approvals and expects the transaction to close on November 1, 2024. Accordingly, on July 15, 2024 the company measured its investment in Stelco as held for sale and ceased applying the equity method of accounting. The company's current estimated pre-tax gain on sale of its holdings of approximately 13 million Stelco common shares is approximately Cdn$495 ($366), calculated as the excess of consideration of approximately Cdn$881 ($652 or $50 per common share) over the carrying value of the investment in associate at September 30, 2024 of approximately Cdn$387 ($286.2).” “September 30, 2024 it was announced the company will, through its insurance and reinsurance subsidiaries, increase its investment in Peak Achievement Athletics Inc. ("Peak Achievement") to a controlling interest by acquiring the 42.6% equity interest owned by Sagard Holdings Inc. The company currently applies the equity method of accounting to its investment in Peak Achievement and expects to consolidate Peak Achievement in its Non-insurance companies reporting segment upon closing, which is anticipated to occur in the fourth quarter of 2024, subject to customary closing conditions. Peak Achievement is engaged in the design, manufacture and distribution of performance sports equipment and related apparel and accessories for ice hockey, roller hockey, and lacrosse, under brands such as Bauer Hockey, Cascade Lacrosse and Maverik Lacrosse.”

-

@whatstheofficerproblem, thanks for the kind words. Happy to hear you found the PDF useful

-

@SafetyinNumbers, thanks for posting. Earnings expectations look like a pretty low bar to me (putting it mildly). It basically says one of two things (or some combination of the two): 1.) Fairfax is massively over-earning today. 2.) When it comes to the near record earnings that Fairfax is delivering, when it comes to capital allocation, the management team will destroy capital moving forward. Really? I love that set up. Looks like we are at the ‘climbing the wall of worry phase’… Definitely no where near the ‘euphoric, blow off top’ stage.

-

@ourkid8, I will admit i do not fully understand the situation in the middle east all that well. i try and understand the big picture. This helps me process the specific events that are happening. Can you explain to me where Hamas and Hezbollah fit in to what is happening? I think it is true that Hamas has as part of its charter the destruction of Israel (and killing Israeli’s will get you to into heaven etc). I think Hezbollah is largely the same. Hamas is the government body of Gaza and Hezbollah is firmly in control of the government in Lebanon (at least it was). To come into power, both Hamas and Hezbollah killed off all those who stood in their way. My understanding is neither Hamas nor Hezbollah accept Israel's right to exist. As a result, they have no desire to peacefully co-exist with Israel. When i hear people talk about Palestinians and they do not state their position on Hamas and Hezbollah i am not able to process or understand what they are saying. It is not possible to separate the people from government in power.

-

Super interesting to read the comments on Fairfax on the board today. They get to lots of important questions for an investor: - Valuation? - Prospects? - Concentration / portfolio weightings? Of course, there are two more important inputs: - How is a person is wired? - What is there life situation? And i would add one more input: - What are the alternatives? What each of us does will depend on how we answer each of the questions above. i think the key to valuing Fairfax is getting a good handle on: 1.) What is underlying book value today? - Reported book value + excess of FV to CV + hidden value - As more assets get taken private (a clear trend in recent years) the ‘hidden value’ bucket will continue to grow and more quickly. Fairfax will find a way to surface this value over time. - ‘Hidden value’ examples: BIAL is probable the best. Grivalia Hospitality. Peak Achievements (this will likely be surfaced with the take private deal). There are more (i.e. what is Recipe worth today?). 2.) What is the ‘normalized’ earnings power of the company today? - What number should get plugged in for realized/unrealized investment gains? - What is the ‘normalized’ ROE today? 3.) How much will earnings grow over the next 3 to 5 years (from normalized level)? - This will be driven primarily by the capital allocation decisions made by the management team today and in the coming years. Their track record the past 6 years has been stellar (Does this matter?). - It looks to me like Mr Market expects little to no earnings growth from the company over the next 3 to 5 years. - Of course, earnings per share is what matters. (Mr Market appears focussed on earnings.) 4.) How should the company be valued today? - What price to (true) book value multiple is appropriate? Two other inputs for me are the following: 1.) Share buybacks: Is the company buying back shares? If so, how much? - Fairfax has been very aggressive with buybacks in 2024. Does this continue? - Fairfax is on pace to reduce effective shares outstanding by around 5% in 2024. All things being equal, this by itself will drive per share growth of 5% in 2025. What matters are investments per share, float per share and earnings per share. Materially lowering the share count matters. A lot. 2.) FFH - TRS position: Is the company continuing to hold this position? The truth is Fairfax has seen such a significant transformation in its earnings power over the past 3 years we are still learning what the answers are to the questions i posed above.

-

Below are a few of the things i will be watching for when Fairfax reports Q3 earnings. The order of items reflects my level of interest - not how important they are to Fairfax and its performance over the long term. Anything missing from my list? 1.) Impact of substantial decline in interest rates in Q3 When Fairfax reports Q3 results the 800lb gorilla will likely be the impact of the big decline in interest rates that we saw in Q3. Rates were down significantly across the curve. This will have two big impacts of Fairfax: Change in value of the fixed income portfolio - resulting in a big unrealized gain. Impacts of IFRS accounting - resulting in a big loss. My guess is the two impacts will net into a nice unrealized gain for Fairfax. How big? No idea. What do other board members think? Of interest, so far in Q4 we have seen bond yields spike higher. Should this hold, this will reverse some of the net effect that happens in Q3. Fairfax also tends to be pretty active in how they manage their fixed income portfolio (from an historical perspective). It will be interesting to see if they are able to find a way to take advantage of the extreme volatility we have seen in the bond market over the past 3 months. 2.) Capital allocation Update on effective shares outstanding Under 22 million? any commentary? Still view shares as being significantly undervalued? (Are they still holding FFH-TRS position?) Asset sale / purchase: any commentary? Purchase of Sleep Country. What will it deliver pre-tax to non-insurance consolidated bucket? Sale of Stelco. Pre-tax investment gain = $397 million, expect Q4 close? 3.) Insurance What is growth in net premiums written? What is CR? What is level of catastrophe losses? In line with expectations? What is level of reserve releases? Commentary on hard market? 4.) Interest and dividend income Is it still growing? Flat? Declining? Interest and dividend income was $590 million in Q1 and $614 million in Q2. Is Fairfax’s investment in Kennedy Wilson’s debt platform continuing to increase in size? 5.) What is share of profit of associates? Eurobank? Chug, chug, chug? Poseidon? Are we seeing green shoots? 6.) Equities What are investment gains from equities? The equities I track suggests mark to market gains from equities will be solid in the quarter. For Associate holdings, what is the excess of market value to carrying value? This is value that is not being captured by book value. 7.) What is book value per share? At June 30, 2024, BVPS = $979.65 8.) Miscellaneous topics Some notes from 1H 2024 results: Tax rate looks elevated. Q3? Amount of earnings accruing to non-controlling interests looks elevated. Q3 Currency has been a headwind to BV in 1H. Tailwind in Q3? Life-ins/runoff costs look elevated. Does trend continue in Q3? Due to new issuance, the interest cost has popped higher. What is the new run rate?

-

@TB As a general rule, i try and keep politics out of my investing framework, especially for those investments i view as medium to long term holdings. I am following what is going on. As with all my investments, I will follow the facts and fundamentals and make adjustments as needed. It is the same approach I am taking with the US election. PS: I do not own any Fairfax India today (it is on my watchlist).

-

Do you plan to continue holding Berkshire once Buffett is gone?

Viking replied to Milu's topic in Berkshire Hathaway

This is a very interesting topic for me. Specifically the ‘sitting on a big capital gains’ angle. Given Fairfax’s run the past 4 years, my guess is many investors are sitting on significant capital gains in taxable accounts. Most of our assets were in tax deferred accounts. That changed when we sold our house in 2021 - now a growing portion are in taxable accounts. My strategy with Fairfax over the past 4 years has been to be pretty aggressive with realizing part of the growing capital gain each year. This works for me because: 1.) Both me and my spouse are ‘retired.’ So we decide which bucket to pull our income from each year (non-registered, LIF, RRSP, TFSA). Tax considerations play an important role in determining how much we pull from each bucket. - In Canada today, capital gains are taxed at a pretty low level. 50% of capital gains are free. We are only taxed on 50% of the gain. I am not sure this will stay this way. 2.) I may want to use the funds sitting in my taxable accounts in the coming years to make a real estate purchase. Nothing imminent. As a result, i do not like the idea of sitting on a big (and growing) tax liability indefinitely. This leads me to prioritize selling some Fairfax in our taxable accounts each year and paying tax. 3.) Selling Fairfax in my taxable account does not impact the number of shares of Fairfax i hold. This is because i have the ability to purchase an equal number of shares in my tax deferred accounts (TFSA, LIF and/or LIF). - When selling Fairfax in my taxable accounts I have been able to do it when Fairfax has hit new all time highs. Each time I have actually been able to re-buy the Fairfax shares in the same account, usually within a month or two later, at a slightly lower price. I have done this because i do want my best ideas in my taxable account (#2 priority after TFSA). 4.) I greatly value simplicity. All things being equal, i don’t want to be sitting on a big tax liability with a big part of my non-registered accounts. I am ok paying a little tax now to lessen an issue - and give me more flexibility in the future. Anyways, everyone’s situation is different. Now that my non-registered accounts are growing in size, i am having to learn some new things - like how to think about and manage a big (and growing) tax liability. Bottom line, this is a great problem to have. But it certainly does have a lot of layers to it. The key has been to have a multi-year plan - and then to opportunistically execute the plan. And each year i modify the plan as needed (based on our evolving situation, new information and as my knowledge improves). -

Fairfax is earning about $600 million in interest income/dividends each quarter. The Stelco sale is expected to close in Q4. Their insurance subs have started dividending significant amounts to Fairfax. My guess is catastrophes like Milton will be a short term headwind to earnings (Q4) and a medium term tailwind to earnings (extend the hard market in reinsurance another year or two). Fairfax has been cutting back on its catastrophe exposure in recent years. One of the worst thing that could happen to Fairfax is a soft market. No hurricane losses over a couple of years would likely bring one on.

-

I agree. I also think the transition at Markel from being Markel (family) run to the current management structure also explains a big part of the underperformance in recent years (when compared to Fairfax). Prem is still firmly in charge at Fairfax and has been instrumental in the renaissance the company has experienced over the past 6 years. I am less impressed by Gaynor the longer he is at the helm of Markel (and I find Gaynor's constant and over-the-top marketing to be more than a little nauseating - actually a little insulting). Succession planning is so important (and unknowable). PS: At Fairfax's AGM this year, I also found Prem's comments about long term shareholders to be a little off-putting. (My view is a rational investor SHOULD have sold Fairfax when management lost their way with investments. To pretend otherwise is an insult to their intelligence.)