Viking

Member-

Posts

4,833 -

Joined

-

Last visited

-

Days Won

39

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

Bond yields have been spiking higher over the past month. The entire yield curve is now over 4%, including the 30 year treasury. The 10 year Treasury is almost at 4.1% and the 2 year is almost at 5%. When people ask Buffett about the valuation of the stock market (cheap or expensive) he usually says to look at the yield of the 10 year bond. The 10 year is now trading at a 15 year high yield. What about earnings? Dropping. S&P500 EPS Estimates - June 2022 = $252 - Dec 1 = $231 - Jan 1 = $229 - Today = $222 Bond yields are at 15 year highs (and trending higher). Earnings falling (with guidance weak). So where does the stock market averages go from here? Not rocket science. What should an investor do? Of course, that depends on your situation, strategy, objectives etc.

-

How are Fairfax's equity holdings doing so far in Q1? The positions I track are up about $1.074 billion, with the following split: - mark to market = $382 million = $16/share - associates = $660 million = $28/share - consolidated = $32 million Portfolio is up about +7.2%. Solid performance. Yes, it will be volatile. What were the big movers? 1.) Eurobank = +$543 million - This position has been on fire and is now valued at $1.85 billion. Atlas is at $2 billion. Not that long ago @glider3834 suggested Eurobank may pass Atlas as Fairfax's largest equity holding and he might be proven right in 2023. Looks like the turnaround at Eurobank is complete. 2.) FFH TRS = +$198 million - this is turning into a brilliant purchase. As a reminder, this position gives Fairfax exposure to 1.96 million Fairfax shares at an initial average cost of US$354. FFH shares are trading today at $695 = a double in a little more than 2 years. Since inception, this position is up about $670 million (with a notional value of $1.36 billion). 3.) Stelco = +$136 million - as was pointed out by another board member, HRC steel prices are back up over $1,000. As a result, Stelco is up. As a reminder, Fairfax bought 13.7% of Stelco in Nov 2018 for US$193 million. Since then Fairfax has been paid more than $40 million in dividends. Despite putting no new money in, they now own 23.6% of Stelco that is today worth $560 million. Stelco also has $800 million in cash on its balance sheet. With all the infrastructure spending happening in North America the next decade, Stelco is exceptionally well positioned. Looks like a pretty attractive acquisition target to me I have attached my Excel spreadsheet below. In addition to most of Fairfax's equity holdings, lots of additional tabs that board members might find interesting. Fairfax Equity Holdings March 1 2023.xlsx

-

@MMM20 i am likely in a unique situation. Most of my investments are in tax free accounts (RRSP, LIRA, TFSA, RESP). As a result, i can flex position sizes (both up and down) and not worry about taxes. in other words, holding because of a tax benefit does not exist for most of my investment portfolio. This greatly simplifies things for me. I also do not think in terms of 5 year holding periods (let alone 10). That’s not to say i won’t hold a position for 5 years. When i buy a stock i usually have a holding period of 18-24 months in mind. I have a pretty good confidence level in my analysis over that period of time (3 years or more into the future… things get pretty murky). I mostly only buy stuff that is cheap. And i only concentrate if it is very cheap (so risk/reward is highly skewed in good way). It should be noted, all companies can blow up. Including Berkshire Hathaway. Especially when Buffett/Munger/Jain are no longer around. All companies die. Eventually. There is no buy and hold forever (in a practical sense) - of course, i am exaggerating… a little. What could cause Fairfax to blow up? 1.) record catastrophe(s). It will happen. We just don’t know when. I.E. 1906 type earthquake on West Coast. - cybersecurity is an interesting caveat. - geopolitical tensions are escalating. What happens if large parts of US power grid get taken out? And life ceases to exist as we know it? (I.E. cell phones, computers, credit cards don’t work for a couple of weeks). 2.) company specific losses - do i really understand Allied World’s business model? No. Odyssey’s? No. Ki’s? No. Could something happen at an insurance sub that might cause big problems at Fairfax? I’m sure its possible. Is it likely? No, I don’t think so. 3.) loss of key personnel. This would’t necessarily cause Fairfax to blow up. But losing ‘glue’ type people like Brian Bradstreet, Andy Barnard etc would be a big concern. If i got the feeling Fairfax was losing key people and the new guys were sub par, i would not want to hold the stock for +10 years. Quality of management is key. 4.) big bet risk. Do we get another ‘equity hedge’ type bet at some point in the future? Didn’t blow the company up but it did cause it to stagnate for 7 years. 5.) there are other smaller watch-outs for me: - Atlas: i don’t understand this business very well. This is my problem. Not Atlas’s. Just lots going on right now. Significant new builds getting completed. Cost of debt is spiking (in general… not sure of exact impact on Atlas). China is quickly becoming a pariah. Global supply chains are shifting. What does it all mean for the container shipping market? No idea. - Eurobank: What if pro-business government in Greece is defeated in next election and is replaced by hard left government. What if yields on Greek sovereign debt spike? Will total debt levels in Greece become a problem again? Bigger picture, what if Euro (currency) blows up? Not likely. But possible. - India: what if Modi loses next election and new PM shifts country economically hard left? There are more (i am sure). Every company has risks. Fortunately, the really bad ones are very low probability so will likely never happen.

-

Having followed Fairfax for about 2 decades, narrative/sentiment is key with this stock (all stocks actually). Sentiment hit rock bottom in Q3 of 2020. The terrible performance from 2010-2016 (equity hedges), combined with the equity losses during the pandemic (which hit Fairfax especially hard because of their specific holdings) resulted in even the last of the long term holders unloading their shares. My guess is a bunch of these former investors will never own Fairfax again. How many ugly divorcees get back together again a few years later? Fairfax is in the process of establishing a new narrative. 2021 was a record year. 2022 was a very good year. 2023 is shaping up to be another record year. Word is getting out… just look at what the share price has done over the past 5 months. Someone is buying shares and in volume. +50% in 5 months gets people’s attention. Trading at a 5.5 x PE (2023 earnings) is getting people’s attention. Trading at 0.9 x est 2023 year ending BV is getting people’s attention. Significantly outperforming in a bear market for the second year in a row will get people’s attention (I think people hate to lose money). And these are all conservative valuation metrics (actual results could easily be much better). People are about to discover that Fairfax has: 1.) a massive, well run global insurance business (top 25 in the world). - including a fast grower in India called Digit 2.) a $38 billion fixed income portfolio that is perfectly positioned for the current environment (low duration) 3.) a $16 billion equity portfolio that is diversified and well positioned (commodities, energy, India, private equity etc) 4.) run by a strong management team that is very good at capital allocation - including US$10 dividend plus lots of share buybacks Already looking forward to the Q1 earnings release. The true earnings power of the company will increasingly show up in actual results. With each passing quarter more and more investors will start to finally grasp the ‘new Fairfax’ story. The narrative will continue to get better. Sentiment will flip. Greed will kick in. It is the way of financial markets… PS: the crazy thing for me is that the story just keeps getting better and better. What rabbits will Prem and co. pull out of the hat in 2023? Was the sale of Ambridge it for this year? Will Digit execute its IPO? Last year was the pet insurance sale (realized gain of almost $1 billion) and sale of Resolute for $625 million + $180 million ATV (at top of lumber cycle). In 2021 it was the $1 billion buyback (taking out 2 million shares at a pathetic US$500/share). Late 2020/early 2021 it was the TRS on FFH (1.96 million shares at US$372/share). Nothing against Berkshire or Markel… but the past couple of years Fairfax has hit the ball out of the park repeatedly. And i don’t think they are done.

-

@ValueMaven are you able to provide a quick explanation as to why? To be super conservative, there is a pretty good chance Fairfax is able to earn US$120/share both in 2023 and 2024. Stock is trading at US$700. I think Fairfax is by far the cheapest of all three. I also think the near term set-up is best for Fairfax (in terms of earnings growth). Is it: 1.) management? 2.) holding period? Want to buy and hold long term? 3.) the collection of assets? Others are higher quality?

-

One of my key take-aways was the West cannot allow Putin to win in Ukraine as it will simply embolden Russia, China, Iran, North Korea etc to take more (of whatever they want) knowing that the West has no spine (will fold like a tent at the first sign of trouble). Appeasement with characters like Putin and Xi never works.

-

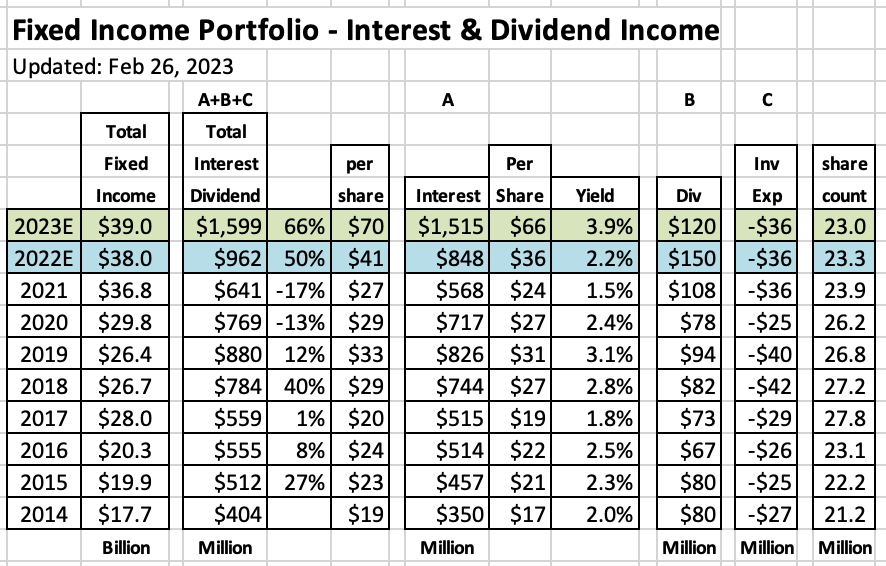

A couple of days ago I provided an update on how underwriting profit was tracking at Fairfax. Let’s now take a look at interest and dividend income. Of all of the many positive developments at Fairfax over the past 12 months, the increase in interest rates (and interest income) is one of the most exciting developments for shareholders. ————— Summary: In 2022, Fairfax earned $962 million ($41/share) in interest and dividend income. This is a new annual record. In 2021 Fairfax earned $641 million ($27/share). For 2023, my estimate for interest and dividend income is $1.6 billion ($70/share), or +66% year-over-year. Put simply, that is a massive increase. ————— Interest & dividend income = interest income + dividends - investment expenses. ————— A.) Interest Income: In 2021, Fairfax earned $568 million in interest income = 1.5% yield on their $36.8 billion fixed income portfolio. In 2022, Fairfax is on track to earn $850 million in interest income = 2.2% yield on their $38 billion fixed income portfolio (we will know the exact amount when they publish the 2022 annual report in March). In 2023, my estimate is Fairfax will earn $1.6 billion in interest income = 3.9% yield on their $39 billion fixed income portfolio. What has driven this significant increase in interest income? 1.) spiking interest rates: see table below of ‘US Treasury Rates’. 2.) extremely low duration of bond portfolio: 1.2 years at Dec 31, 2021 and 1.6 years at Dec 31, 2022. 3.) steadily growing size of fixed income portfolio: increased from $17.7 billion in 2014 to $38 billion in 2022. Fairfax timed their move to short duration in the fixed income portfolio exceptionally well. With rates spiking higher, the low duration allows Fairfax to roll their large fixed income portfolio more quickly from very low yielding into much higher yielding securities (spiking interest income higher). Most P&C insurers have an average duration on their fixed income portfolio of closer to 4 years on average (so it will take them many years to fully realize the benefit of higher bond yields via higher interest income). B.) Annual dividend income: Fairfax currently earns about $110-$120 million per year in dividends from its equity holdings. In 2022, Fairfax earned about $150 million in dividends driven by a special dividend in Q4 from Stelco of +$30 million. C.) Annual investment expenses: Fairfax incurs investment expenses of about $36 million per year. How has ‘interest and dividend income’ trended at Fairfax over 2022? - Q2 report: run-rate had increased to $950 million per year. - Q3 report: run rate had increased to $1.2 billion per year. - Q4 report: run rate had increased to $1.5 billion per year. Given bond yields have continued to move higher in Q1 2023, my guess is when Fairfax reports Q1 results in April we will learn the run rate has increase further to $1.6 billion or higher. What is the average duration of the bond portfolio at Fairfax? How is it changing? - at Dec 31, 2021, the average duration of the bond portfolio was 1.2 years. - at Dec 31, 2022 the average duration of the bond portfolio had increased to 1.6 years. Fairfax communicated during the Q4 conference call that they would like to increase the average duration to 2 years during 2023. Extending the duration will allow Fairfax to lock in current high yields for years into the future. In February 2023, bond yields have been spiking again approaching the highs last reached in Oct and Nov 2022 (yields on 3 year Treasuries are at 4.49%). It appears Fairfax is currently being given a wonderful opportunity by the bond market to extend the duration of their bond portfolio.

-

@glider3834 nice catch. It appears Eurobank is looking to be a banking consolidator in SE Europe. Makes a lot of sense… scale is critical in banking. Eurobank’s strong financial position has to be a big advantage right now for them. I know Eurobank has talked about re-establishing a dividend again. But i wonder if using excess cash to consolidate banking in the region does not make more sense for long term shareholders. The issue, of course, is management. Can the acquisitions be done sensibly? I think Eurobank’s management team is good… Your post suggests their purchase of Hellenic Bank shares was opportunistic.

-

Cash. Back up to 50% cash weighting. Opportunity to lock in a 12% gain YTD. Collect 3.5% while i wait in the weeds for Mr Market to serve up the next fat pitch. ————— i was listening to a podcast today and the host was talking about why Buffett likes to hold so much cash - he likes the optionality it provides. Except today, he is getting paid 5%. Making it even more valuable. ————— Warren Buffett's Unique Way Of Thinking About His Cash - Cash As A Call Option - https://www.businessinsider.com/cash-as-a-call-option-2012-9 “Ms. Schroeder argues that to Mr. Buffett, cash is not just an asset class that is returning next to nothing. It is a call option that can be priced. When he thinks that option is cheap, relative to the ability of cash to buy assets, he is willing to put up with super-low interest rates, said Ms. Schroeder, who followed Mr. Buffett for years before she became his biographer. “He thinks of cash differently than conventional investors,” Ms. Schroeder says. “This is one of the most important things I learned from him: the optionality of cash. He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price.” It is a pretty fundamental insight. Because once an investor looks at cash as an option – in essence, the price of being able to scoop up a bargain when it becomes available – it is less tempting to be bothered by the fact that in the short term, it earns almost nothing. Suddenly, an investor’s asset allocation decisions are not simply between earning nothing in cash and earning something in bonds or stocks. The key question becomes: How much can the cash earn if I have it when I need it to buy other assets that are cheap, versus the upfront cost of holding it?”

-

What a frightening video. What do we know with 100% certainty? Trump demands from his people loyalty to Trump above all else. So if relected what is job #1? To remake the US military in his image. To replace all the top leaders with people who put loyalty to Trump above the US Constitution, rule of law etc. Now where have we seen this playbook before? He says he will end Ukraine war in 24 hours. Seriously? There are two ways to do this: 1.) throw Ukraine under the bus 2.) give Putin whatever he wants

-

After adjusting for what we learned from Q4 earnings release/conference call, my updated estimate for Fairfax earnings for 2023 is US$130/share. If this happens, BV will finish 2023 at about US$780 = ($660+$130-$10 dividend). Fairfax stock trades today at $680 < 0.9 x 2023YE est BV. This could be viewed as the optimistic take as I am not building in any big bad events: record year of catastrophe losses, global recession etc. Look forward to hearing others thoughts. Assumptions/build: 1.) underwriting profit = $1.27 billion - top line grows at 8-10% and CR = 94.5 - i am expecting average year for catastrophes and small tailwind from hard market; reserve releases similar to 2022. 2.) interest and dividends = $1.6 billion - current run rate is $1.5 billion. Interest rates continue to move higher. Bond portfolio continues to increase in size. 3.) Share of profit of associates = $900 million - less than last year reflecting sale of Resolute (once it closes). Exco and Stelco will be volatile. Earnings at Atlas, Eurobank and GIG should grow. 4.) Life Insurance and Run-off = similar to 2022 5.) Other (non-insurance consolidated companies) = $300 - Driven by Recipe/Fairfax India/TC India/Dexterra i think this could come in close to $400 million; but I chickened out and only put in $300 million. 6.) Interest expense = $505 million - Q4 was $125 million 7.) Corporate overhead and other = similar to 2022 8.) Net gains on investments = $800 - 5% of $16 billion equity portfolio. TRS on FFH are up $180 million YTD (yes, this will be volatile). - Ambridge sale = $275 million gain before tax 9.) Income tax = guess (19%?) 10.) Non-controlling interests = wild guess (I have no idea) One big wild card is share repurchases. It would not surprise me to see Fairfax take out 1 million or more shares in 2023. I am using 23 million as my number for weighted avg 'effective shares outstanding'. Impact of FFH adoption of IFRS17 when they report Q1 is not built into my estimate. ---------- Notes: - Underwriting profit: includes insurance and reinsurance; does not include runoff or Eurolife life insurance. - Interest and dividends: includes insurance, reinsurance and runoff.

-

@glider3834 The short answer is i think Prem mis-spoke - or he is just being extremely conservative. Of course there are risks. We could get a severe global economic contraction. But to hit $500 million total in Share of Profit of Associates and Non-Insurance Consolidated Companies would require Altas, Eurobank, Fairfax India and Recipe all to blow up at pretty much the same time. Possible but unlikely. Especially given the glide path they are all on today. My guess today is Fairfax in 2023 should earn: 1.) Share of Profits of Associates = $900 million. Less than 2022 because of lower contribution from Resolute. Exco Resources and Stelco will be volatile. But i would expect earnings from both Atlas and Eurobank to be higher in 2023 than 2022. GIG should also be up nicely in 2023 from 2022. 2.) Non-Insurance Consolidated Companies = $400 million. Contribution from Recipe should increase materially from 2022. Dexterra should also be up. Fairfax India should chug along. When i forecast i tend to lean heavily on the recent trend. And then i make adjustments for known one-time items and new news. I do this because so much is changing at Fairfax under the hood going back too far with historical numbers is pretty useless (garbage in, garbage out). Once i come up with my estimate i try and identify where i might be wrong. I tend to ignore what i think are low probability events (like guessing what business might get written down moving forward, exactly when an economic contraction will happen, when a management team at an equity holding is suddenly going to get stupid etc). The big risks are big write-downs, like what happened with Farmers Edge in 2022. But i think most of the big write-downs have happened. Fairfax has done a very good job of ‘fixing’ most its problem children over the past 5 years: EXCO Resources (emerged from bankruptcy), AGT (take private), Fairfax Africa (merged with Helios), APR (sold to Atlas), Farmers Edge (written down). Mosaic Capital was merged. Other historically problem holdings like Eurobank have clearly turned the corner and are solidly profitable. I do expect we will see more write-downs at Fairfax in the future. I just think they are hard to predict, will be smaller in size and should be easily absorbed by Fairfax. ————— Fairfax Q4 Conference Call “And the impact of this, you've recognized it now, but what's happened is for the longest time, we didn't reach for yield. And so, at the end of 2021, we had interest and dividend income of $500 million, $530 million to be exact. 50% of our portfolios were in cash and short term earnings 6 basis points, nothing. But we take a long-term view and in 2022, our interest and dividend income went up significantly, and they're running today at $1.5 billion, and we are slowly increasing duration to two, which means that '23, $1.5 billion, '24, $1.5 billion. That's probably more than we've ever had in the past, interest and dividend income of that amount. Underwriting profit with our business, as you've seen, $1.1 billion last year, $1 billion, we think, is not -- it's conservative. And associates, which Jen highlighted very well. Associates and non-insurance income is -- on a conservative basis is $0.5 billion. So you add that up, $1.5 billion, $1 billion of underwriting profit, $0.5 billion, $3 billion of operating income, which was equates to about $100 a share for Fairfax shareholders. This would be the first time that we can make that comment that we've got $100 of earnings per share for the next couple of years. And then on top of that, historically, we've made a lot of gains. And as you know, value investing is coming back nicely. So that's how we see our company, not on a quarter-by-quarter basis, but over time. We built our company over the long-term. It's quite transformational, going from $13.6 billion to $27.6 billion now. That's all in U.S. dollars. And with operating income, on a conservative basis of $100 a share. And that's -- on top of that, we expect to make gains as we have for 37 years, we just completed 37 years. So I just wanted to put that in perspective for you, Tom.”

-

With Q4 results out I thought this would be a good time to update my 2022 actuals and 2023 estimates for Fairfax. I will do it in a couple of posts over the next couple of days. Much of the wording is copy/edit (from my previous posts) so if it looks familiar you have likely seen it before. --------- At its core, Fairfax Financial is an insurance company. The size of Fairfax's insurance business has increased dramatically over the past 9 years (2014-2022). Net premiums written have increased from $6.1 billion in 2014 to $22.3 billion in 2022 for a compounded growth rate of 17.5% per year. That is a staggering increase. On a per share basis, Fairfax has grown net premiums written from $289/share to $957/share for a compounded growth rate of 16.1% per year. The share count is up 10% over this time period (2014 to 2022). The exceptional growth Fairfax has achieved over the past 8 years has occurred with a very modest increase in the share count. Fairfax is now one of the 25 largest P&C insurers in the world. What has driven this significant growth? Two very different factors have been responsible: 1.) For the first 5 years (2014-2018) growth was driven mostly by acquisitions: Brit (2015), International (2016) and Allied World (2017). 2.) For the past 4 years (2019-2022) growth has been mostly organic and driven by the hard market. Looking back, Fairfax timed their large insurance acquisitions perfectly - right before the hard market started. The hard market in insurance looks like it is slowing as we begin 2023. Some segments, like property cat reinsurance, are just entering a hard market. As a result of Q4 results and commentary across the P&C industry, I am reducing my growth estimate for Fairfax to 8% for 2023 = net premiums written increase to $24.1 billion (from $22.3 billion in 2022). This would be a 300% increase in net premiums written over the past 9 years (2014-2023). Not too shabby. Why do we care what net premiums are? Because this is a key input in determining underwriting profit. And underwriting profit is a key input in determining what an insurance company will earn in a year. And earnings ultimately determine what a company is worth. Fairfax finished with a CR of 94.7 for 2022. My estimate is Fairfax will finish with a CR of 94.5 in 2023. Why a slight improvement in CR? I expect the hard market of the past 4 years to provide a small tailwind. This would deliver an underwriting profit of $1.27 billion in 2023 ($55/share) which would be a new record for one year. The previous record was $1.1 billion in 2022 ($47/share). Bottom line, the combination of solid growth in net premiums and solid underwriting should result in Fairfax earning another record underwriting profit in 2023. ---------- Important: My numbers do NOT include runoff (to keep them consistent with how Fairfax reports them). I am estimating common stock effectively outstanding will fall to 23 million in 2023.

-

It appears the non-insurance consolidated companies/equities now have a pre-tax earnings run-rate of about $400 million per year ($100 million per quarter). Moving forward this will be another nice sized and growing ‘bucket’ of earnings for Fairfax that is not reflected in prior year results. As earnings roll in for this bucket it will likely come as a ‘surprise’ for most investors. Which Fairfax holdings are included in ‘non-insurance consolidated companies’ bucket? 1.) Fairfax India 2.) Recipe - Oct 2022, take-private, increased stake to 84% 3.) Thomas Cook India 4.) Dexterra 5.) Grivalia Hospitality - July 2022, increased stake to 78.4% 6.) AGT 7.) Boat Rocker 8.) Golf Town 9.) Farmers Edge - written down by $131 million in 2022 The take private of Recipe in Q4 of 2022, is a significant move for this bucket of earnings. Recipe will provide a much larger, relatively smooth source of earnings for Fairfax moving forward. We also got clarity on the Q4 conference call as to how the take private of Recipe was funded: Fairfax paid $243 million in cash, Recipe added $100 million in debt = $342 million purchase price. Fairfax was able to take Recipe private for only $240 million in cash at a price based off of trough earnings. Smart, opportunistic buggers. ————— Why is looking at past results not helpful for this group of companies? The pandemic significantly affected many of the companies included in this bucket in 2020, 2021 and even the start of 2022 (especially Recipe, Thomas Cook India, Dexterra and BIAL). Also, in 2022, Fairfax wrote down its investment in Boat Rocker by $131 million. As we begin 2023, we should see the actual earnings power of the companies in this bucket shine through. Kind of like we saw with the Share of Profit of Associates bucket in 2022 when earnings there spiked to over $1 billion and caught everyone by surprise. Moving forward, Share of Profit of Associates of $900 million + Non-insurance Consolidated of $400 million = $1.3 billion. Significant. ————— From Fairfax Q4 Conference Call: “Secondly, on October 28, 2022, the company acquired all the multiple voting shares and subordinate voting shares in the capital of Recipe, other than the shares that were owned by the company and approximately 9.4 million multiple voting shares that were owned by Kara Holding Company at a cash purchase price of CAD20.73 per share or US$342 million in aggregate. That was comprised of cash consideration of $243 million and an increase in borrowings by Recipe of $100 million. As a result of that transaction, the company recorded a loss in retained earnings of $66 million and a decrease in non-controlling interest of $276 million at December 31, 2022 and we had an equity ownership in Recipe of 84%, inclusive of the Recipe shares that are held in the ABLN that we entered into with RiverStone Barbados. Recipe was then subsequently delisted from the Toronto Stock Exchange.”

-

For the first time in more than a decade (ever?) Fairfax will likely be generating billions in operating earnings. This is a significant amount of cash they can then redeploy. At the same time, we are in a bear market. So Fairfax is generating gobs of cash right at the same time stocks and bonds are in a bear market (i.e. cheap to wicked cheap). This bear market is an incredible gift for Fairfax and Fairfax shareholders. Buying at bear markets lows + compounding = value investor heaven. Investors in Fairfax today are underestimating what will be coming (in terms of investment gains) looking out a couple of years. BECAUSE PAST RESULTS IS STILL PRETTY MUCH USELESS IN INFORMING AN INVESTOR WHAT FUTURE EARNINGS WILL BE. That is usually the case for turnarounds like Fairfax. If Fairfax is able to make $1.5 billion in new investments at bear market lows that generate an 10% return (low) moving forward = $150 million incremental in investment gains/increase in intrinsic value. Do that for a couple of years and by 2025 we will see an incremental $450-$500 million in gains EACH YEAR (compared to today). Rightly so, investors in Fairfax today are focussed on spiking interest and dividend income; it is an amazing story. It is also sowing the seeds of the next big uptick in earnings for Fairfax - this one from investment gains. The Fairfax story continues to get better…. ————— Perhaps Fairfax also buys back another 10% of shares outstanding over the next three years. Perhaps Fairfax buys back another slug of Allied World. Bottom line, Fairfax has lots of cash and lots of obvious, solid return investment opportunities. Capital allocation has likely never been easier. ————— I continue to be amazed at the decision made in late 2020 and early 2021 to buy the TRS on FFH shares = 1.96 million (i call that the Fed VanVleet - bet on yourself - decision). Now i do not expect future capital allocation decisions to be as lucrative for shareholders as this single investment. But it certainly will be interesting to follow what they do with all the cash they are currently generating.

-

At the end of the day, what i care about is total return. From today (even after its stellar run over the past 1 and 2 years) my guess is Fairfax’s total return will outperform both Markel and Berkshire in both 2023 and 2024 and probably by a lot. Berkshire is in full-on wealth preservation mode. Buffett has said so repeatedly in recent years. The goal is to preserve the wealth of long term shareholders. BRK has morphed into a bond like equity. That is not a bad thing. But it is what it is. Perhaps BRK starts to mildly outperform the S&P over the next 5 years. Markel is not nearly as cheap as Fairfax so it already has one hand tied behind its back (in the total return race). And Markel’s bond portfolio is longer duration so they are not getting the tailwind of higher interest rates to the same degree as Fairfax. The increase in interest income is the biggest driver of the spiking operating earnings at Fairfax (up $1 billion in 2023 compared to 2021). All three are solid companies. My read is the stars have aligned for Fairfax. And that will drive continued outperformance over the near term. ————— What about looking 4 or 5 years out? No idea. There are simply too many moving parts to be able to conclude anything with any degree of accuracy.

-

@Munger_Disciple when did Berkshire guide that Berk shareholders should assume a 100CR for their business? In a low/zero interest rate world (which we had for much of the last decade) that number is nuts. I don’t see why 95 is not a good/realistic target for Fairfax over the next couple of years. It was 95 in 2021 and 94.7 in 2022. My baseline for 2023 is 94.5. Why? We have a just had a 3+ years hard market. And 2023 should be decent. Absent the sudden emergence of a very soft market, my guess is underwriting results should be good. The risk, of course, is a record year for catastrophes. Always a possibility. But the opposite is also possible - a benign year for catastrophes. If that were to happen the CR would likely be in the low 90’s. ————— Given average duration of bond portfolios (4 years or so), it will take a few years for insurance companies to realize the benefit of higher interest rates. This really is a big benefit for Fairfax - one that will benefit them for a couple of years. This will likely extend the hard market a little longer.

-

I have not updated my models yet (family reunion), but given Fairfax’s Q4 results, here are some quick thoughts: - US$120/share in earnings for 2023 might be the new normalized number. - BV Dec 30, 2022 = $658. - est BV Dec 30, 2023 = $768 (deducting $10 dividend payment) - Stock is trading today at $693. So stock is trading at: - PE < 6 x 2023 earnings - P/BV = 1.05 x Dec 30, 2022BV - P/BV = 0.90 x est Dec 30, 2023BV What about 2024? Another $120/share in earnings look likely. What does this tell me? Fairfax continues to be dirt cheap. Not as cheap as it was 4 months ago. But dirt cheap given the near term earnings visibility (2023 & 2024). Or compared to other P&C insurers. Or compared to the overall market. What about 2025 and beyond? Given what i have seen from Fairfax over the past 5 years I think they are going to continue to deliver good to very good results. What will the puts and takes be? No idea. So i will follow the company and update my thesis as new information becomes available. What we are learning is just how stupid cheap Fairfax got multiple times over the past 2 years. Ambridge Partners sale = $275 million gain. The TRS on FFH shares continues to print money (up $250 million YTD). Those two items alone = $525 million in gains = $22/share pre-tax. My guess is we will see FFH buying back more shares. They have billions in operating earnings rolling in that they are actively redeploying - those significant, new investments will start their compounding magic. Fairfax has so may levers to pull to compound shareholder value - it is unlike any period over the past 10-12 years. The ‘narrative’ around Fairfax is also shifting. Delivering exceptional results year after year (as they have done recently) will do that. Growing earnings + growing market multiple + lower share count = spiking stock price. Fairfax is firing on all three cylinders… and the party is likely just getting started.

-

At the end of the day the key for any investor is fit. In terms of positioning of their bond portfolio, Fairfax has nailed it over the past 18 months: - in 2021 they shortened duration to 1.2 years. - in 2022 they extended duration to 1.6 years. - on the Q4 conference call Prem said the plan is to extend the average duration to 2 years in 2023. Fairfax has a very good long term track record in managing its fixed income portfolio. Perfect? No, of course not. Am i happy with how they are positioned as we begin 2023? Yes. Now we will see what happens with bond yields moving forward. And what Fairfax does with its fixed income portfolio (and the rest of its business). As the Fairfax story evolves i will manage my holdings accordingly.

-

Fairfax Q4 results look good to me. The caveat is i am not an accountant, so regarding IFRS 17, and the restatements coming when they report Q1 results, i have nothing to add to what the company disclosed in their release. Is IFRS 17 a positive for shareholders? Perhaps others can wade in and educate us all. Insurance: 1.) what is top line growth? - Gross premiums written in Q4 came in at 5.1%. This is a big surprise to me. We all knew the hard market had to slow at some point. Is it terrible? No, of course not. What is far more important is that Fairfax underwrites profitably. 2.) what is Q4 CR? 90.9 is very good. - What is full year CR? 94.7 is very good. - Any adverse development? Small net favourable development (ex runoff) - where does Brit come in? Q4 was 88.2 and FY was 97.9 (including Ki) - what is adverse development for runoff? Less than last year. Amount? 3.) update on hard market. What is outlook? Looks like it is slowing quickly. will get more colour on conference call. Bond portfolio 4.) what kind of increase do we see in interest income? $961.8 million. - What is new run rate for interest and dividend income? $1.5 billion. Holy moly Batman! - (Was $950 million end of Q2 and $1.2 billion the end of Q3.) $1.5 billion. 5.) what changes, if any, do we see in composition of bond portfolio? ??? 6.) what is average duration? 1.6 years; same as Q3. - (1.2 years at June 30 and 1.6 years at Sept 30) 7.) any mark to market losses? Small gain in Q4 of $63.8 million. Equity Portfolio 8.) what is amount of mark to market gain? $521.9 million 9.) and material changes in holdings? No. ??? 10.) any commentary on Atlas take private? Other 11.) share of profits of associates? $256 million 12.) Book value? $658/share; up bigly from Q3. - Fairfax is one of the few insurers to grow BV in 2022. 13.) share buybacks during quarter? 23.32 million (bought back about 130,000 in Q4) - (At Sept 30 there were 23.45 million common shares effectively outstanding.) 14.) what is net debt at year end? 15.) capital allocation priority moving forward? We will see what Prem says on conference call. Updates/Commentary: 16.) pet insurance sale closed Oct 31: proceeds used for? Any remaining proceeds to be used for? 17.) Resolute Forest Products sale: set to close 1H 2023… any update? 18.) Ambridge Partners: $400 million sale. Expect $275 million gain pre-tax at close = +$10/share after tax. Excellent. 19.) update: regulatory approval to take control of Digit? Status of IPO? ————— Is Fairfax on glide path to earn $2.4 billion from underwriting income + interest and dividend income in 2023? No. This number is too low. Glide path likely needs to get increased to $2.6 or $2.7 billion. Wow!

-

In Canada anyone with a mortgage or line of credit is now (or will be shortly) paying much, much more in interest expense. $100/month more doesn’t matter. $1,000/month more does matter. $2,000/month matters even more. This is an after-tax increase in expenses. At the same time food costs are way up. Insurance costs are way up. Flight costs are way up. Vehicle costs are way up (if you can even find one). Etc, etc. Wages? Up a little. What does it all mean for an investor? Not sure. It will likely take years to fully play out. But given the magnitude of the impact, there will be big winners and losers. And that is the fun part about investing… skate to where the puck is going… ————— Having said all that, Canada has minted tens of thousands of millionaires over the past decade (real estate). House prices have come down over the past year; but real estate prices are still much higher that what they were 2 short years ago. That wealth is real and those people are spending. So i am not doom and gloom. I am remain very optimistic. 2023 is shaping up to be another super interesting year.

-

Here in Canada, a reasonably large subset of the population carries lots of debt (mortgages and LOC) thanks to our housing bubble. Lots of people own multiple properties with big mortgages (that were already cash flow negative at historically low interest rates). Most of this debt is variable, especially if interest rates stay high for years (even 20% of those 5 year fixed mortgages come due every year). The real estate bubble has also created a mental rental market: here in Vancouver it is not uncommon to pay C$1,500-$1,700/month for a one bedroom and $2,800-$3,000 for a two bedroom - if you can find one (crazy low vacancy rate). Landlords with mortgages are going to need big increases in rental rates given their mortgage costs are going through the roof. The learning is you do not want to blow a housing bubble because it usually causes big problems for years when it corrects. The US learned its lesson in 2008-2010. China is in even worse shape than Canada. The Bank of Canada is really boxed in. Their answer is to stop rate hikes. Even in the face of high inflation (Canada has lots of very large public sector unions) and a very tight labour market. Government spending looks like it is accelerating. No idea how it plays out here. Super happy i have no debt.

-

What i find interesting is the Fed has taken short term interest rates up to 5%. At the same time, QT is like another 100 to 200 basis points of tightening. So over the past 12 months interest short term rates have effectively increased 6-7%. And they will be moving higher in the coming months… probably another 50-75 basis points. So that gets us to short term interest rates of 7 to 7.5%. And the impact on the economy? Not much. Yes, interest sensitive sectors, like housing, have taken a hit. But the economy appears to be digesting higher rates and chugging along. THAT IS AMAZING. Given the amount of tightening over the past year. What the hell is going on? That is the million dollar question. Has basic economic theory been turned on its head? Fed tightening no longer matters? Perhaps the economy is still experiencing the ‘benefits’ of: 1.) 10 years of zero interest rates (i.e. it takes much longer than just 12 months to get this out of the economy). - a decade of asset inflation made lots of people multi millionaires… with asset prices rebounding as we start 2023, last years fall in assets was a minor dent for most of these people. 2.) all the stimulus spent governments during covid Of course, there are also the covid ‘boomerang’ effects. Travel is going to boom. China is just coming out of covid and its economic growth is going to pop higher. What does all this mean? One possibility is higher interest rates. Like Fed funds of 6%? Not on anyones radar right now. Continued QT… that would be be significant tightening. And at some point i would expect basic economic theory to start to work again - slowing economy/mild recession. What is an investor to do? As yields move higher, bonds are looking more attractive. Interesting times! ————— So far, the economy (the deer) has escaped the increase in interest rates (the croc)…

-

Another indicator that India has arrived… As India continues to shift from public to private ownership it looks like it is using it as an opportunity to create more home grown companies that will have the scale to be able to compete on the global stage. Interesting model of development. With big winners. ————— How secret London talks led to Air India’s gigantic plane order - https://www.theglobeandmail.com/business/international-business/article-how-secret-london-talks-led-to-air-indias-gigantic-plane-order/ Air India’s record aircraft deal has put the Tata Group-owned airline in the league of aspiring global carriers. On Tuesday, it provisionally agreed to acquire almost 500 jets from Airbus and Boeing to take on domestic and international rivals. Striking the largest ever deal by one airline took months of secret talks carried out a stone’s throw from Britain’s Buckingham palace and culminating in a celebration over coastal Indian curries, according to people involved in the talks. Confidentiality was lifted on Tuesday as leaders hailed the accord in a diplomatic embrace between leading G20 nations. Tata Group, which regained control of Air India last year after decades of public ownership, put out just six paragraphs.

-

With the Fairfax Q4 report set to be released after markets close on Thursday here are a few of the things i will be watching. Insurance: 1.) what is top line growth? Mid teens? Other insurers are reporting deceleration in top line (still healthy). - what increases is reinsurance seeing? What is outlook for 2023? 2.) what is Q4 CR? What is full year CR? Does it come in with a 95 handle? Some insurers reported adverse development. - where does Brit come in? - what is adverse development for runoff? $150-$200 million? - Q4 is when Fairfax does its actuarial review. 3.) update on hard market. What is outlook? Bond portfolio 4.) what kind of increase do we see in interest income? What is new run rate for interest and dividend income? (Was $950 million end of Q2 and $1.2 billion the end of Q3.) 5.) what changes, if any, do we see in composition of bond portfolio? 6.) what is average duration? (1.2 years at June 30 and 1.6 years at Sept 30) 7.) any mark to market losses? Equity Portfolio 8.) what is amount of mark to market gain? (My estimate is around $300 million.) 9.) any material changes in holdings? 10.) any commentary on Atlas take private? Other 11.) share of profits of associates? $250 million? - what are earnings from consolidated equities? (Recipe, Grivalia Hospitality, Dexterra etc) 12.) Book value? (Was US$570/share at Sept 30.) 13.) share buybacks during quarter? (At Sept 30 there were 23.45 million common shares effectively outstanding.) 14.) cash at hold co? (Fell to $800 million at Sept 30; below $1 billion target) - net debt? Change from Q3? 15.) capital allocation priority moving forward? - level of debt is ok (although $750 million added in Q3) - continue to fund growth at subs in hard market? - buy back stock? - invest in equities? - other? Updates/Commentary: 16.) pet insurance sale closed Oct 31: proceeds used for? Any remaining proceeds to be used for? 17.) Resolute Forest Products sale: set to close 1H 2023… any update? 18.) Ambridge Partners: $400 million sale. Details? Size of realized gain? 19.) update: regulatory approval to take control of Digit? Status of IPO? ————— Is Fairfax on glide path to earn $2.4 billion from underwriting income + interest and dividend income in 2023?