Viking

Member-

Posts

4,833 -

Joined

-

Last visited

-

Days Won

39

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

The key is what Fairfax thinks: - fair value is for their stock is today (1.3 x BV?) - what the prospects are for earnings over the next 12, 24, 36 months (my base case is $120/year) - what the plan is for share buybacks (as the hard market ends, share buybacks could increase materially to reduction of +4% per year if they wanted) Fairfax, of course, has better information than we do. I would continue to hold the TRS.

-

Yesterday, the Bank of Canada delivered a surprise rate increase. Today they provided more details of why… what a shocker: “A lot of uncertainty remains. But it’s possible long-term interest rates will be higher in the coming years than what Canadians are used to,” Beaudry said on Thursday. By outlining these key forces, Beaudry said he hopes he “will help people be prepared in the eventuality that we have entered a new era of structurally higher interest rates.” ————— Bank of Canada Suggests Higher Rates May Not Have as Much Bite - https://www.bloomberg.com/news/articles/2023-06-08/bank-of-canada-flags-upside-risk-to-neutral-rate?srnd=premium-canada In a speech to the Greater Victoria Chamber of Commerce a day after policymakers raised the benchmark borrowing rate to 4.75%, Deputy Governor Paul Beaudry flagged concerns about a reversal in core inflation and said officials were surprised by household spending on goods and services. He also said that neutral rates — a theoretical level of borrowing costs that neither stimulate nor restrict the economy — may drift to higher levels compared to before the pandemic. Beaudry said stalling globalization, rising wages, and increasing investment opportunities in artificial intelligence as well as the transition to a low-carbon economy were contributing to the increase. “A base-case scenario where the real neutral rate remains broadly in its pre-pandemic range is possible, but the risks appear mostly tilted to the upside,” Beaudry said, adding that there was “meaningful risk” neutral rates could go up. While Beaudry was careful to note that the current neutral rate is still volatile, the comments will fuel speculation policymakers at the Bank of Canada are increasingly of the view their aggressive increases to interest rates are less restrictive. The statement, which came a day after the bank raised borrowing costs for the first time in three meetings, also highlighted the possibility rates need to move higher for longer in order to bring inflation to heel. “A lot of uncertainty remains. But it’s possible long-term interest rates will be higher in the coming years than what Canadians are used to,” Beaudry said on Thursday. By outlining these key forces, Beaudry said he hopes he “will help people be prepared in the eventuality that we have entered a new era of structurally higher interest rates.”

-

@giulio Sorry if my wording is not clear. My view is Buffett today has capital preservation as his single most important objective. It hit me like a bag of bricks when I watched him a couple of years ago when he had the online only annual meeting Q&A. He said that many long term shareholders had a majority of their wealth (and their families wealth) in Berkshire and he felt a massive responsibility to ensure that this wealth would be protected so it could be passed to future generations. Now don't get me wrong... Yes, Buffett also wants to make a decent return for shareholders. Now it is possible that Buffett has had the exact same mindset over the decades since he started. And Berkshires size is primarily what is causing returns to fall dramatically (from those earned in the past).

-

We have seen a massive increase in interest rates over the past year; far in excess of what anyone felt would happen. The Fed is also engaged in QT. We have a banking crisis at regional US banks, which is tightening credit. The Treasury needs to issue something like $1 trillion over the next 6 months to refinance and refill coffers (which will suck liquidity out of the system). Looks to me like risks to the economy are pretty elevated right now. Or traditional monetary policy no longer works - that new paradigm / this time is different thing. Does this mean people should move to cash? No, of course not. My base case is the US and global economies keep rolling along with slow growth. But i am very happy right now to lock in gains on a part of my portfolio. My cash weighting is back up to 35%. Happy to sit in the weeds (with cash earning a risk free 4%) and wait for some market dislocation where Mr Market serves up some fat pitches. I am pretty certain i will get at least a couple mouth watering opportunities in the coming months/year. Just like 2022. And 2021. And 2020… Buy and hold (index investing) worked like a charm when we lived in a QE world. It didn’t really matter what you owned… everything went up - every year. In the QT world of today, i wonder if active management might do a little better…

-

i agree. Prem has said that they feel their shares are worth much more than book value. My guess is he is probably thinking a minimum of 1.3 x BV (i am probably low). Fairfax also know earnings could total $300/share over the next 11 quarters. Book value today is $800. Book value could easily be $1,100 the end of 2025. At a 1.3 x multiple that would put the value of Fairfax shares (low end) at $1,400 at Dec 2025. Buying shares today at $750 is a bargain for Fairfax.

-

So in the 2019AR Prem said “After much thought and discussion, it became clear to me that shorting is dangerous, very short term in nature and anathema to long term value investing.” And what did we learn in the 2020AR? When Prem said what he said above they STILL HAD a massive short position on. And they kept it in place for another year. That cost Fairfax shareholders another $529 million. That stream of communication was not one of Prem’s finer moments. When questioned about the miscommunication i am pretty sure he said… well in 2019 i said i would not put on a NEW position. The loss was not a new position… so my previous communication was accurate. Technically correct, but… This was an example of terrible communication by a CEO. Fairfax is no longer a small family owned Canadian business. They are now a Goliath… a top 20 global insurer. Simply an amazing story. Put simply, Fairfax has entered the big leagues. Prem is now going to be held to a new standard in terms of communication. And rightly so. So many Canadian companies have failed to make this transition (Saputo being the best immediate example i can think of). If Prem wants to be viewed as a best-in-class global company he needs to improve on the communication (especially to shareholders). Or not. And suffer the consequences. His choice. ————— Just to be clear, i am not a Prem hater. I am a hard marker (ask my kids). Call a spade a spade. Prem has many strengths. He has been able to attract and retain outstanding people. People at Fairfax appear to really like him and enjoy working for the company. He/Fairfax has built a huge collection of amazing relationships in the business/political world. He is strategic. And focussed on the long term. I have no doubt that he is a first-class human being. He has Fairfax poised to do exceptionally well over the next few years. And like all of us, yes, he also has flaws. Am i happy he is CEO of Fairfax? Of course.

-

The problem is Fairfax does not run the business to attract a long-term shareholder base. The decisions/results/communication they delivered 2010-2020 are all the proof that is needed on that front. It was terrible (on balance). My guess is many long-term shareholders capitulated and sold in the bloodbath in 2020. Trust in management was lost and at an all time low. Fairfax is a blank canvas today. They are starting over and building a new relationship with shareholders. If they want long term shareholders they need to play their part. They need to re-establish trust. Communication needs to be stellar. Look at Buffett today. He is running Berkshire like a trust. Capital preservation is paramount; not return. And you see it in Berkshires results... they are not close to what they were. (I am not saying this is how Fairfax should be run.) Will I hold Fairfax long-term? I don't know is the honest answer. We are still too early into the turnaround. I love the set-up for the company right now. Management has delivered for the past 5 years. At the end of the day... I call it fit. To own a stock long term there has to be a match with how a shareholder is wired and how a company is run. ---------- At the AGM I asked Prem what lessons Fairfax had learned from the lost decade for shareholders (2010-2020). And had any processes changed within Fairfax to make sure the same TYPES of mistakes are not made again. I got a non-answer. Which of course WAS an answer. Another question at the AGM was if Fairfax carried too much debt (operated with too much leverage). Prem's answer was they could sell Odyssey and be debt free. I found the answers to both questions to be lacking. But I remain open minded.

-

I would also like to see a stock split. Perhaps 5 for 1. As you said, this would open Fairfax up to more smaller investors. This would also improve liquidity, especially in the US. I don't see a stock split as likely.

-

What is the intrinsic value of Fairfax's stock as of today?

Viking replied to Viking's topic in Fairfax Financial

Thanks to everyone who took the time to participate in the poll. The poll is still open if you have not voted yet and wish to do so. It is great to get an idea what a large group of board members are thinking at a specific point in time. I must say, i was surprised by the results. The COBF mob, 46 strong, assigned a fair value to Fairfax of about $1,070/share. Actually, this is low as 14 respondents chose the highest value option ($1,200 or more). The ranges on the poll were way off (needed fewer on the low end and more on the high end). My key take-away? Most board members who follow Fairfax feel, despite the run-up the past 30 months, that the stock is still very undervalued. What did I vote? $900-$999 = midpoint of US$950. Today. To come up with my number I used two rules of thumb: PE = $120/share (normalized earnings today) 8 x multiple = $960 P/BV = BV of $800 x 1.1 = $880 (I went with 1.1 here - instead of something higher - because of the significant one time bump from IFRS-17) Yes, both my earnings and book value multiples are very low. But that is how I see Mr. Market valuing Fairfax today (sentiment/confidence in management, while improving, is still low). As was mentioned by others, Fairfax is a complex animal. And there is the risk of another 'equity hedge' type of decision. There has been an enormous number of changes happening under the hood at Fairfax over the past couple of years. This makes it more difficult to forecast future earnings and book value growth - so most investors (not the ones on this board) continue to undervalue Fairfax. As Fairfax executes well and delivers solid results - and new (higher) run rates get reported (and baked into historical numbers) over the next couple of years this will get easier. As the larger investment community gets more comfortable that the higher numbers are durable we should see multiple expansion (hopefully closer to other insurance peers). It would not surprise me to see Fairfax's stock deliver another couple of years of 20% to 30% annual returns - driven by mid teens growth in book value and multiple expansion. -

What is the intrinsic value of Fairfax's stock as of today?

Viking replied to Viking's topic in Fairfax Financial

@kodiak i also see share buybacks as a potential catalysts for Fairfax. With all the cash they are currently generating it will be interesting to see how much they allocate to share buybacks: do they go big (5% or more in one year) or do they go small (2 to 3% in one year). Fairfax will likely be opportunistic… allocate capital to the best available opportunity. -

What is your estimate of the 'intrinsic value' of Fairfax's stock as of today? What says the COBF mob? The stock closed on Friday at US$734 = C$987. If your intrinsic value is a range, please vote where mid-point falls. After you vote, can you provide a brief comment (if you are comfortable): what is your number (or range) for intrinsic value? How did you come up with your estimate? Or simply comment on whatever you would like. I want to keep things pretty vague so we get as much original thinking as possible. Fairfax's stock has had a pretty incredible run the past 30 months. Has it passed your estimate of intrinsic value? Please let other board members know your thoughts. ---------- It would be interesting to know what management at Fairfax thinks the intrinsic value of their stock is as of today. ---------- What is 'intrinsic value' and how is it calculated? Go with whatever you think it is. Below is Buffett's definition. Buffett ( Berkshire Hathway’s manual ), “The intrinsic value can be defined simply. It is the discounted value of the cash that can be taken out of a business during its remaining life. As our definition suggests, intrinsic value is an estimate rather than a price figure. And it is definitely an estimate that must be changed as interest rates move or forecast or future cash flows are revised. Two people looking at the same set of facts almost inevitably come up with slightly different intrinsic value figures.”

-

Lot of quality companies hitting (or close) to new 52 week lows. Lots of commodity stocks hitting 52 week lows. Financials are hated. Most insurance stocks are selling off. Retail stocks got whacked today and many are dirt cheap. Lots of companies also trading where they were trading 5 years ago. It is like the market is in a bear market right in front of our face. Except we don't see it looking at the market averages - because of the run in AI stocks. So I started nibbling today on a bunch of different things. If stocks keep selling off this could get quite interesting...

-

I tend to hold concentrated positions. When i concentrate i like to get into the weeds. We are constantly getting new news. So the story is constantly changing. Sometimes the changes are minor… sometimes they are major. I like to post what i learn. And i enjoy the feedback from other posters. Be inquisitive and be open minded. Now that might look like ‘pumping’ a stock. I view it more as tending to the eggs in my basket. It works for me. With Fairfax, i have a core position - something i plan on holding for a few years (as of today). At times i will buy more and flex if bigger. Sometimes quite a bit bigger. Other times i will sell some and flex my position size lower. ‘Flexing’ will depend on lots of different things: changes to the FFH ‘story’ (fundamentals), the price of FFH stock (Mr Market), what is going on in the overall stock market (that opportunity cost thing)… too many variables to list. Fairfax is a VERY volatile stock - moves of 20-30% each year are not uncommon. We are entering hurricane season. Having said that, my guess is Fairfax will be aggressive buying back stock this year via the NCIB so the stock may continue to surprise to the upside. No idea where the stock price will go over the short term. But over the next few years i am confident the stock will continue to power higher. And i am confident because of the work i put in to understand the investment. It is a constantly evolving process - involving lots of lengthy posts along the way.

-

Rate the overall quality of the management team at Fairfax

Viking replied to Viking's topic in Fairfax Financial

Thanks to everyone for responding. The COBF mob gave Fairfax management an average grade of 7.7 out of 10, with 38 votes cast. That is a solid vote of confidence from a pretty knowledgeable group of investors, many of whom are also likely shareholders. It would have been interesting have done this poll 2 years ago. Please continue to vote if you have not yet done so and would like to. I voted 8. No company I follow would get a 10 (i am a hard marker, although that likely does not look like the case when I post on Fairfax). The big mis-step from the past (equity hedges) was the primary reason I did not go with a 9. The turnaround engineered by the management team at Fairfax the past 5 years has been impressive. The company is exceptionally well positioned today. With one arm no longer tied behind their back, I am looking forward to seeing what they are capable of doing over the next couple of years. -

Morningstar has a fair value for Fairfax of C$730 = US$537/share. Fairfax shares are trading today at US$714. What can we learn from Morningstar's report on Fairfax? Unfortunately, I think we learn much more about Morningstar from this 'report' than we do about Fairfax. And it does not inspire confidence. If this organization can be so out of touch on Fairfax - is this representative of the quality of rest of their research? ---------- Why am I so bullish on Fairfax? Because I am focussed on the present and the future. Graham (the guy who taught Buffett) teaches us a stock is simply worth the present value of its future cash flows. Yes, the past matters... but what matters much more is the future. The Morningstar report is focussed pretty much solely on the past. 2008. And 2010-2016. And this might generally be ok for most companies. But it does not work for companies where important things have changed. Turnarounds. And lots of important things have changed at Fairfax over the past few years. Things that already had a big, positive impact on earnings in 2021 and 2022. With much more to come 2023, 2024 and 2025. This explains, at least partially, why it takes turnaround type stocks like Fairfax so long to re-rate. It takes years of better/excellent results before analysts and investors get comfortable that things have indeed changed in a sustainable way for the better. Only after the new and improved financial results are embedded in historical results for years does the ‘narrative’ change. This actually makes sense for a company like Fairfax that was so out of favor. ————— What is Morningstar missing in their report? An analysis of Fairfax as it exists today: a company that is earning: 1.) record underwriting profit 2.) record interest and dividend income 3.) record share of profit of associates 4.) solid investment gains While also reducing their share count. They do not provide any detailed forward looking information and estimates. No detail of the important building blocks. No math. In sort, their analysis is exclusively backward looking. And as a result, worse that useless for a company like Fairfax (a turnaround). ---------- Conclusion: Fairfax, as it exists today, is misunderstood. Lots of analysts and investors are stuck in the past. So what is an investor to do? Patience and time. Fairfax needs to deliver results. The narrative will slowly change and reflect the current reality. And Fairfax shareholders should be rewarded handsomely.

-

Norm Rothery has a nice write-up on Fairfax in the Globe & Mail (sorry, for subscribers). Title is goofy, but that is picked by the editor. Why this money manager favours the oil patch over Silicon Valley - https://www.theglobeandmail.com/investing/markets/inside-the-market/article-why-this-money-manager-favours-the-oil-patch-over-silicon-valley/ A strange travelling festival moves from annual meeting to annual meeting each spring as investors gather to seek wisdom from famous investors. Along the way, the revellers stop to hear from Prem Watsa, the chief executive of Fairfax Financial, who holds forth at the firm’s annual meeting in Toronto. It moves on to culminate in Nebraska at the Berkshire Hathaway meeting, where Warren Buffett and Charlie Munger entertain a gathering of thousands. As it happens, Mr. Watsa followed Mr. Buffett’s example to grow Fairfax into one of the largest insurance-based conglomerates in the world. The journey has been a profitable one because Fairfax’s stock changed hands at $3.25 a share when Mr. Watsa gained control of the firm in 1985 and it’s now near the $1,000-a-share mark. Despite the gains, the firm is a relative bargain near 0.9 times book value. The Fairfax festivities provide the opportunity to catch up with old friends. This year I had the pleasure of sitting down with U.S. money manager James East, who I hadn’t seen since the year before the COVID-19 pandemic. He’s a big fan of Fairfax, which, after its recent surge, accounts for roughly 30 per cent of his fund’s assets. Mr. East runs a multifamily office and the ACI Partnership Fund LP (modelled after the partnerships Mr. Buffett offered in the 1960s) from his home base in Charlotte, N.C. The fund has been operating since the waning days of 2007, when Mr. East moved on from designing engine parts for NASA’s space shuttles to managing money for his friends and colleagues. …The market also hasn’t fully recognized the global insurance powerhouse Fairfax has become and Mr. East points to its insurance operations as being better than many of its “top tier” competitors – including Markel (MKL-N) and Berkshire Hathaway. (I hope he’s right, because Fairfax is currently my largest personal holding.) …

-

Good question. I am not sure who it is. Given Fairfax’s experience with the CDS during the housing crash my guess is they have thought this risk through pretty well.

-

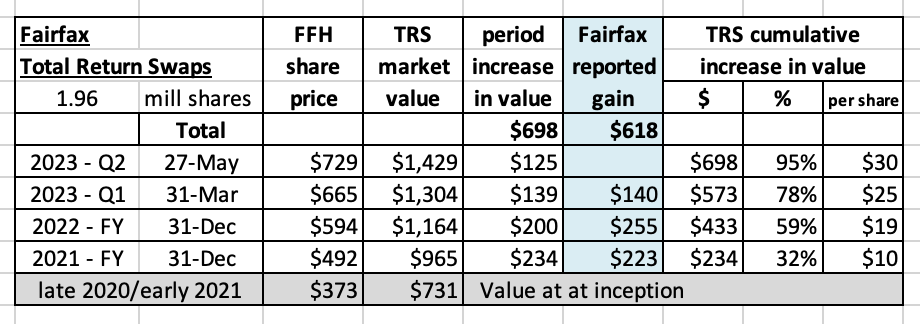

The table is set for the total return swaps (TRS-FFH) to become one of Fairfax’s best investments ever. It has delivered about $750 million in investment gains since inception (over the last 30 months). And i think it can deliver $1.5 to $2 billion in additional gains over the next 5 years. That would put total gains at $2.2 to $2.7 billion over a 7 year period. Not too shabby. “We think this will be a great investment for Fairfax, perhaps our best yet!” This is what Prem said in his letter in the 2020 annual report when first describing this investment. Clearly, Fairfax was thinking big when they made this investment. The genius of this single investment is still lost on most investors. Probably because the TRS is a non-traditional type of investment. So it is largely ignored by investors in their analysis of the company and its potential impact on future earnings. Well lets do a bit of a deep dive on this investment to better understand just what the freak i am talking about. What is the TRS-FFH investment? In late 2020 and early 2021, Fairfax purchased total return swaps giving it exposure to 1.96 million Fairfax shares with an average notional amount (cost) of US$373/share. At the time, Fairfax had about 26.2 million effective shares outstanding so this investment represented about 7.5% of the company’s shares. Effective shares outstanding at the end of Q1, 2023, have dropped to 23.2 million so this investment now represents about 8.4% of the company’s shares. Fairfax’s equity portfolio is about $15 billion in size. The TRS-FFH position currently has a market value of $1.43 billion = 9.5% of the total equity portfolio. This is Fairfax’s third largest equity position, behind Atlas ($2.04 billion) and Eurobank ($1.95 billion). Bottom line, this investment is a very large one for Fairfax. Why did Fairfax make this investment? Fairfax's stock was trading at a crazy cheap valuation in late 2020. It was, by far, the best investment opportunity available to Fairfax at the time. To state the obvious, it was an investment they understood very well. So it was a very low risk and very high return opportunity. Prem’s Letter 2020AR: “Throughout much of last year (2020) following the pandemic-induced market plunge, I made public statements to the effect that our belief was that Fairfax shares were trading in the market at a ridiculously cheap price. In the summer I backed that up by personally purchasing close to $150 million of shares. Additionally, following our value investing philosophy, since the latter part of 2020 Fairfax has purchased total return swaps with respect to 1.4 million subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 per share). We think this will be a great investment for Fairfax, perhaps our best yet!” Prem’s answer to question from Mark Dwelle (RBC) on the Q4 2020 conference call held in Feb 2021: Mark Dwelle: “My second question relates to executing the total return swap with respect to Fairfax shares. I guess, I was just curious why you pursue that structure, rather than just buying back the stock, if you felt like that was the good opportunity? I mean, is this a capital constraint that you couldn't really buy back that much?” Prem Watsa: “We have to be careful, right? So not so much -- yes, we have to be very careful in terms of how much we can buy back. When we looked at Fairfax as a stock price and looked at everything else that we could buy, which is not over return swap on Fairfax. Right now, we paid US$344 per shares, our book value is $478. I mean, if you want the math, just on our book value basis, we'd have about $200 million gain. And Fairfax stock price for book value is worth another 200 million. We just think it's a terrific investment and our total return swap structure was a very good way for us to do it. And so we did it.” Why TRS-FFH versus simply buying back stock? Fairfax did not have the cash at the time to buy back a significant amount of Fairfax stock directly. Again, from the Q4 2020 conference call: Mark Dwelle: “I don't disagree with you that it was a good a good strike price, I guess it was really -- the form of the transaction rather than just actually buying the shares, using a derivative instead is just -- it's a little bit unusual. I haven't usually seen that with most of the companies that I've followed. So that was really my main question.” Prem Watsa: “Yes, so, Mark, our point is just that we wanted to keep up -- we could -- where you have more than $1 billion in cash and the only company once -- or almost have down $375 million, we just wanted to be financially sound, and in all ways, as opposed to use that cash at this point in time.” This investment demonstrates Fairfax’s management team at their best: Rational: best available opportunity Opportunistic: buy when the stock was crazy cheap Creative: didn’t have the cash to do a buyback. Hello TRS. Conviction: wanted to buy a significant stake. Hello TRS (leverage). Simply a brilliant investment - especially given the circumstances. How is the investment performing? From Jan 1, 2020 to March 31, 2023 (9 quarters) the investment has resulted in cumulative investment gains of $618 million. And so far in Q2, 2023, the investment is up another $125 million. This puts cumulative investment gains close to $750 million, which is a 100% gain in less than 30 months. The S&P500 is up 12% over the same time period. So, I would grade this investment A+. What is the outlook for this investment? This is where things get really interesting for shareholders. This investment is poised to spike much higher in the coming years. Let’s make 2 assumptions: Fairfax will grow book value at an average compound rate of 14% over the next 5 years (2023 to 2027). For reference, i have Fairfax earning $150/share in 2023 = almost a 20% increase in book value. Fairfax stock will trade at 1.1 x book value in 5 years time (end of 2027). As Fairfax delivers a mid-teens growth in book value it is natural to assume Mr Market will reward the company with a 1.1 x multiple to book value. I view these two assumptions as being a reasonable base case. If Fairfax grows BV by 14% each of the next 5 years and Mr Market rewards it with a 1.1 x multiple at the end of those 5 years (2027) its share price will be $1,614. The TRS-FFH will be worth $3.1 billion and the investment gain will be $2.4 billion (from 2021-2027). In the table above i have done three scenarios - conservative (1 x BV), base case (1.1 x BV) and aggressive (1.2 x BV). The gain in the TRS-FFH investment ranges from $2.1 to $2.7 billion. What are the catalysts to the investment thesis? There are a number of catalysts to this investment. Despite the run up over the past 30 months, Fairfax’s stock price is still dirt cheap. This means the value of the TRS-FFH is understated today. Having a low starting point matters greatly when calculating future returns for an investment. Three catalysts: record, consistent free cash flow: largely locked and loaded for the next three years lower share count: average decline of 3% per year is likely a good estimate growing multiple to book value: over time, Mr Market will come to understand and appreciate the Fairfax story All three happening together will drive Fairfax’s stock price higher - which of course means the value of the TRS-FFH investment will also be driven higher. A note on share buybacks Capital allocation is one of the most important decisions for a management team. Fairfax has said they believe their stock is very undervalued. They have also said that as the hard market in insurance slows they will look to use excess capital to buy back their stock more aggressively. Fairfax is highly motivated to drive the share price higher. Every $100 increase in the share price = $200 million before-tax investment gain. The TRS-FFH investment makes share buybacks an even more compelling capital allocation decision for Fairfax. Conclusion The table is set for Fairfax to earn as much as $2.7 billion on its TRS-FFH investment (2021 to 2027). Investors, as per usual, are not looking forward and connecting the dots. As a result, they are grossly underestimating the size of gains that are coming. Cheap share price + Record cash flow + End of hard market + Increasing buybacks = much higher stock price = significant gains for TRS-FFH ========== Is the TRS-FFH investment like a buyback? The TRS-FFH is the next best thing to doing a big buyback. Buybacks are powerful because they improve per-share financial metrics: EPS & BVPS. Buybacks lower the denominator (per share). If the buyback is large and sustained - so that it actually pushes up the price of the share price over time - the TRS position will gain significantly in value. At the same time, the TRS- FFH investment increases the numerator (earnings and book value). Investors get a double benefit. ========== Education: Total Return Swap https://corporatefinanceinstitute.com/resources/derivatives/total-return-swap-trs/ The other major benefit of a total return swap is that it enables the TRS receiver to make a leveraged investment, thus making maximum use of its investment capital. Unlike in a repurchase agreement where there is a transfer of asset ownership, there is no ownership transfer in a TRS contract. This means that the total return receiver does not have to lay out substantial capital to purchase the asset. Instead, a TRS allows the receiver to benefit from the underlying asset without actually owning it, making it the most preferred form of financing for hedge funds and Special Purpose Vehicles (SPV). There are several types of risk that parties in a TRS contract are subjected to. One of these is counterparty risk. When a hedge fund enters into multiple TRS contracts on similar underlying assets, any decline in the value of these assets will result in reduced returns as the fund continues to make regular payments to the TRS payer/owner. If the decline in the value of assets continues over an extended period and the hedge fund is not adequately capitalized, the payer will be at risk of the fund’s default. The risk may be heightened by the high secrecy of hedge funds and the treatment of such assets as off-balance sheet items. Both parties in a TRS contract are affected by interest rate risk. The payments made by the total return receiver are equal to LIBOR +/- an agreed-upon spread. An increase in LIBOR during the agreement increases payments due to the payer, while a decrease in LIBOR decreases the payments to the payer. Interest rate risk is higher on the receiver’s side, and they may hedge the risk through interest rate derivatives such as futures. ========== Q1 2020 Conference Call Prem: "They are one year swaps and we've historically been able to extend it for as long as we like." Mark Dwelle: "My second question relates to executing the total return swap with respect to Fairfax shares. I guess, I was just curious why you pursue that structure, rather than just buying back the stock, if you felt like that was the good opportunity? I mean, is this a capital constraint that you couldn't really buy back that much?" Prem Watsa: "We have to be careful, right? So not so much -- yes, we have to be very careful in terms of how much we can buy back. When we looked at Fairfax as a stock price and looked at everything else that we could buy, which is not over return swap on Fairfax. Right now, we paid US$344 per shares, our book value is $478. I mean, if you want the math, just on our book value basis, we'd have about $200 million gain. And Fairfax stock price for book value is worth another 200 million. We just think it's a terrific investment and our total return swap structure was a very good way for us to do it. And so we did it." Mark Dwelle: "I don't disagree with you that it was a good a good strike price, I guess it was really -- the form of the transaction rather than just actually buying the shares, using a derivative instead is just -- it's a little bit unusual. I haven't usually seen that with most of the companies that I've followed. So that was really my main question." Prem Watsa: "Yes, so, Mark, our point is just that we wanted to keep up -- we could -- where you have more than $1 billion in cash and the only company once -- or almost have down $375 million, we just wanted to be financially sound, and in all ways, as opposed to use that cash at this point in time." ========== Q1-2023 News Release At March 31, 2023 the company continued to hold equity total return swaps on 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 million (Cdn$935.0 million) or approximately $372.96 (Cdn$476.03) per share, on which the company recorded $139.8 million of net gains in the first quarter of 2023. ========== 2022AR Long equity total return swaps During 2022 the company entered into $217.4 notional amount of long equity total return swaps for investment purposes. At December 31, 2022 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount of $1,012.6 (December 31, 2021 – $866.2), which included an aggregate of 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 (Cdn$935.0) or approximately $372.96 (Cdn$476.03) per share at December 31, 2022 and 2021. During 2022 the long equity total return swaps on Fairfax subordinate voting shares produced net gains of $255.4 (2021 – $222.7). Long equity total return swaps provide a return which is directly correlated to changes in the fair values of the underlying individual equities. During 2022 the company received net cash of $238.2 (2021 – $439.6) in connection with the closures and reset provisions of its long equity total return swaps (excluding the impact of collateral requirements). During 2022 the company closed out $63.0 notional amount (2021 – $1,876.7) of its long equity total return swaps and recorded net realized losses on investments of $8.1 (2021 – net realized gains of $243.0). ========== 2021AR For our stock price to match our book value’s compound rate of 18.2%, our stock price in Canadian dollars should be $1,335. And our intrinsic value exceeds book value, a principal reason being that our insurance companies generate huge amounts of float at no cost. This is the reason we continue to hold total return swaps with respect to 1.96 million subordinate voting shares of Fairfax with a total market value of $968 million at year-end. ————— Equity total return swaps – long positions During 2021 the company entered into $753.6 notional amount of long equity total return swaps for investment purposes which included long equity total return swaps on an aggregate of 969,460 Fairfax subordinate voting shares with an original notional amount of $403.3 (Cdn$508.5) or approximately $416.03 (Cdn$524.47) per share, all of which remained open at December 31, 2021. At December 31, 2021 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount at December 31, 2021 of $866.2 (December 31, 2020 – $1,746.2), which included an aggregate of 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 (Cdn$935.0) or approximately $372.96 (Cdn$476.03) per share. These contracts provide a return which is directly correlated to changes in the fair values of the underlying individual equities. During 2021 the company received net cash of $439.6 (2020 – $207.4) in connection with the closures and reset provisions of its long equity total return swaps (excluding the impact of collateral requirements). During 2021 the company closed out $1,876.7 notional amount (2020 – $878.8) of its long equity total return swaps and recorded net realized gains on investments of $243.0 (2020 – $216.7). ========== 2020AR: Throughout much of last year following the pandemic-induced market plunge, I made public statements to the effect that our belief was that Fairfax shares were trading in the market at a ridiculously cheap price. In the summer I backed that up by personally purchasing close to $150 million of shares. Additionally, following our value investing philosophy, since the latter part of 2020 Fairfax has purchased total return swaps with respect to 1.4 million subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 per share). We think this will be a great investment for Fairfax, perhaps our best yet! Investment returns are very sensitive to end date values, so with a stock price of only $341 per share at the end of December 2020, our five and ten year and longer returns have been affected. We expect this to change as Fairfax begins to reflect intrinsic values again. Nothing that a $1,000 share price won’t solve! ————— Amounts recorded in net realized gains (losses) include net gains (losses) on total return swaps where the counterparties are required to cash-settle monthly or quarterly the market value movement since the previous reset date notwithstanding that the total return swap positions remain open subsequent to the cash settlement. ————— During 2020 the company entered into $1,906.9 notional amount of long equity total return swaps on individual equities for investment purposes following significant declines in global equity markets in the first quarter of 2020. Included in those contracts were long equity total return swaps on an aggregate of 994,695 Fairfax subordinate voting shares with an original notional amount of $329.2 (Cdn$426.5) or approximately $330.95 (Cdn$428.82) per share, all of which remained open at December 31, 2020. Subsequent to December 31, 2020 the company entered into long equity total return swaps on an additional 413,169 Fairfax subordinate voting shares with an original notional amount of $155.7 (Cdn$198.5). At December 31, 2020 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount at December 31, 2020 of $1,746.2 (December 31, 2019 – $501.5). These contracts provide a return which is directly correlated to changes in the fair values of the underlying individual equities. During 2020 the company received net cash of $207.4 (2019 – paid net cash of $34.5) in connection with the closures and reset provisions of its long equity total return swaps (excluding the impact of collateral requirements). During 2020 the company closed out $878.8 notional amount of its long equity total return swaps and recorded net realized gains on investments of $216.7. During 2019 the company did not initiate or close out any long equity total return swaps.

-

What is board members assessment of the quality of Fairfax's management team? I am interested to learn what the COBF mob thinks. After you vote can you provide a brief comment: What 3 things influenced your vote the most? I want to keep things pretty vague so we get as much original thinking as possible.

-

Great discussion on all topics related to Ukraine. Gets to the core of many issues.

-

Looking out 4 and 5 years certainly is a challenging exercise. At a very high level, here are what i think are some of the the key metrics: 1.) net premiums earned? 2.) CR? 3.) size of investment portfolio? 4.) rate of return on investment portfolio? 5.) shares outstanding? (I would model this to drop by 2% per year on average for the next 5 years given the significant amount of cash coming in each year and how cheap the shares are). The CR and the rate of return will have to sum to a number that allows an insurance company to earn an acceptable ROE = min 10-12%. This is not specific to Fairfax. So the only way the ‘normalized’ CR goes to 98% is if the return on investments is high, perhaps 7 or 8% (i haven’t run the numbers). Likewise, if the ‘normalized’ return on investments is 3% then the CR will need to be under 95%. Yes, you could get very short periods where strange things happen… but that is not ‘normalized’, but more likely a bull or bear scenario. Insurance companies (as a group) will need to earn an acceptable ROE on average over the medium term. Otherwise investors will exit and their share prices will crater. No CEO will let that happen (for a ‘normalized’ or extended amount of time). Super low share prices (over an extended period) would likely lead to the next great consolidation of the industry.

-

On May 12, RBC increased their price target for FFH from US$775 to US$875. "Our view: Q1 results were solid all around with continued top-line growth, low 90s combined ratios, modest cat losses and continued strong growth of investment and associate income. Management has taken steps to lock in investment income for the next couple of years and combined with a still very favorable underwriting environment provides unusually high visibility to Fairfax earnings. With shares still trading at a discount to book value (even after solid gains last year) we continue to find Fairfax shares as among the most attractive opportunities in the P&C insurance space. We remain at Outperform." What I found especially interesting with the RBC report is they are politely telling investors to get their head out of their asses when it comes to looking at Fairfax's business today. It is not your fathers Fairfax. Their investment portfolio is best in class. And their underwriting is good. And this is how sentiment changes... slowly over time... "Investment income/investment positioning: ...Naturally there can be offsets from non-fixed income results and any related impairments but we think the investment positioning here is actually contrary to what many investors might expect. Which is to say normally investors view Fairfax as having a portfolio with a lot of complex exposures. While there is some truth to this on the equity and associate side of the book, that comprises only 25% of the portfolio – the remaining 75% of cash and fixed income is much more conservative than the average investment portfolio and this isn’t reflected in current valuations, in our view." "Combined ratio/premium growth: ...As we noted last quarter we think underwriting is an under-recognized strength of Fairfax."

-

Economic War-US/G7/West vs China (semiconductors)

Viking replied to Luke's topic in General Discussion

China’s model (political/economic) is simply not compatible with the West’s model. We have two different value systems. China played nicely for decades because they needed to take advantage of the West’s stupidity to accelerate their economic development (capital, technology transfer etc).. It worked brilliantly. Bottom line… China is a wolf… increasingly in wolf’s clothing. (It used to be in sheep's clothing.) Leadership in the West finally gets it. We are at economic war with China. And it is only going to get worse. War is a big word but it is accurate. What do you do when you are at war with someone… do you sell them advanced chips? Think about what that means. China’s model: 1.) keeping the communist party in power is the fundamental rule… EVERYTHING in life and society in China (and their interests abroad) exits to serve the CCP. Life. Laws. All subservient to the CCP. 2.) rule of law does not exist… see #1… 3.) individual rights do not exist… see #1… People can be thrown in jail and your life’s possessions can be confiscated at the pleasure of the CCP. No reason necessary. Businesses exist to serve the CCP. This includes foreign firms operating in China. 4.) freedom of the press does not exist… see #1… the press exists to serve the CCP (that propaganda thing). 5.) China’s interests abroad… also exist to serve the CCP. This is important. - Chinese living abroad are tools of the CCP (just look at the China’s active involvement in Canadian elections, on site at universities, actively targeting families of Chinese Canadians who are anti-CCP). it is simply the way the world works. The Disney movie is over. ————— Watch this video if you want to better understand the reality of living under the CCP/communist model of China. It is chilling. With all its flaws, living in a liberal democracy (of the West) is a wonderful gift. But liberal democracies are NOT the normal way. They are fragile. And can disappear if we do take it for granted and do stupid things. —————- Companies are figuring it out. Apple deciding to shift 25% of iPhone production to India is a seismic event. The Chinese economy has serious issues… they are still dealing with an epic property bubble. -

@glider3834 this part got my attention: “When the five planned projects are completed, Grivalia’s value, currently nearly €1 billion, will reach €1.5 billion, says Chryssikos.” I am not sure what exactly Chryssikos is referencing. Fairfax owns 78% of Grivalia Hospitality with a carrying value/market value = $410 million (Dec 31, 2022). The cost to develop and run these properties must be staggeringly high. Grivalia Hospitality will likely bleed significant sums of money until more locations are open and generating significant revenue. Interesting investment. Chryssikos has had the Midas touch for Fairfax when it comes to real estate in Greece. And we know Fairfax loves to bet heavily on winning horses…

-

How are Fairfax's equity holdings (that I track) doing at about the 60% mark for the quarter? They are up about $500 million = $22/share pre-tax. mark to market = +$130 million associate = +$370 million consolidated = flat Big movers? Eurobank = +$430 million FFH TRS = +$105 million Stelco = ($88 million) Bottom line, after a very strong Q1, the equity holdings are trending very well in Q2. Eurobank today has a market cap of $1.97 billion. Atlas is at $2.04 billion. As @glider3834 predicted not that long ago, Eurobank could shortly become Fairfax's largest equity investment. ---------- I updated my spreadsheet to capture the changes from the Q1 13F. I also re-ordered the ranking of the holdings by size. Fairfax Equity Holdings May 23 2023.xlsx