-

Posts

4,878 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by John Hjorth

-

-

Somehow, this last post of yours hit a nerve at me, Mike [ @boilermaker75 ],

My personal biggest worries related to the conflict and all its ramifications, as of right now, and ordered :

How to stop the meaningsless loss of so many lives,

How to stop the meaningsless loss of all kind of infrastructure, homes etc., &

How to get the adoption of Sweden in Nato on the fly. [If some of my fellow CoBF members don't understand the importance of Sweden in this respect, just look up an updated map for the NATO area in the Nordics. It is about protecting the integrity of Finland.]

-

Book mentioned in the The NVO - Novo Nordisk topic here on CoBF.

Danish version : Gads Forlag : Kurt Jacobsen : Novo Nordisk,

English version : Gads Forlag : Kurt Jacobsen : Novo Nordisk [English edition]. [Which will be released on April 14th 2023.]

I reveived the Danish version of the book yesterday. Started reading a bit of it late in the evening, ended up reading on in the bed, after I hit the hay. Very hard for me to let it go, to go sleep.

Kurt Jacobsen is a professor at Copenhagen Business School, he is a holder of a ph.d. in history, with a certain interest in business history. I immediately "fell in to the book" [got hooked] while I started reading.

The book has been produced in celebration of the predecessors of Novo Nordisk reaching the age of 100 years, while the company granting Kurt Jacobsen unlimited access to the archives of the company.

It's thorough and meticulous in all matters covered, to an extreme degree. It's actually written as was it a ph.d. thesis. From what I have read so far, I got a lot of knowledge about Insuline and Diabates in the early days, now 100 years ago.

-

1 hour ago, rkbabang said:

The US is a big country with many different internal cultures. I live in New Hampshire with the least restrictive gun laws in the US and a murder rate of about 1.55/100,000. Which is less than Canada (~2.0/100,000) and just a little worse than France (1.3/100,000). Overall it's one of the safest places in the world to live and everyone owns guns (even the leftists and liberals), it isn't unusual to see people open carrying firearms in public places and no license at all is needed to buy, own, carry openly, or carry concealed. I read somewhere that New Hampshire has the highest rate of machine guns per population. Of course if you use a gun irresponsibly in New Hampshire you will go to jail, we aren't New York or California.

Thanks for the color, @rkbabang.

-

I just want to schime in here and say as an European CoBF member, that reading this topic as of lately, is simply heartbreaking.

Reading this makes me appreciate my own living conditions up here in the northern part of Europe.

Here, we certainly have our challenges with getting our public health care system to work properly, but nothing like the described societal problems recently in this topic here.

-

3 hours ago, dealraker said:

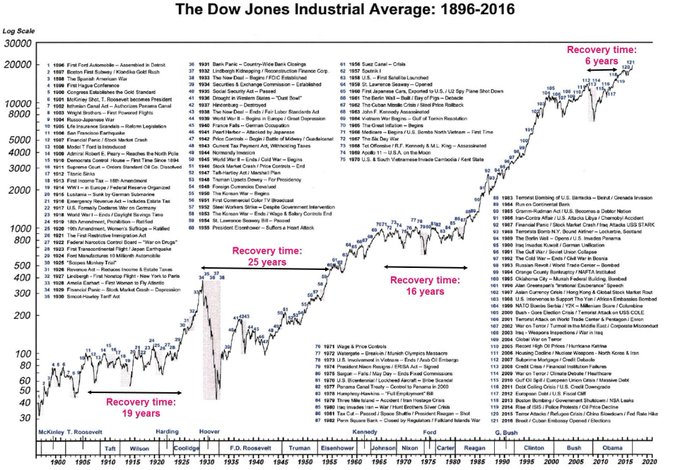

Hey John...the August/September 2011 panic out of stocks was one I remember very well. It even almost, but not quite, got some of my otherwise very solid family members. But it wiped clean the equity stakes of many I know...

...right at the dead bottom! Stocks, expecially according to the younger guy in my investment club, were to be avoided at any cost. We had some 1 vote victories to keep stocks like Lowe's. It was a very close call with cut-and-run.

Years of fear dominated from March 9th 2009 and the only thing that got the conversation changed was the lust for Bitcoin. Not that family members or club members did much biting on the bit, it was just the Bitcoin story was so fascinating that these people forgot they were supposed to be in panic mode!

But a full decade of horrors and fears conversation with those making ten times their fear stating point would in most cases get people to stop talking about it. But not this bunch.

Of course fears seem far more rational today. The problem is simply that that's always the case.

Sell before May...they say!

I really appreciate that you are taking your personal time to respond to my posts.

This :

-

Off topic, and then - after all - not at all,

New book from Morgan Housel on its way to its audience - as I understand things, it is set to be published later this year :

-

19 minutes ago, Saluki said:

I enjoyed this book also. It isn't your usual finance book but it's got some thought provoking reframing of common attitudes. It's not so much a "how-to" book as a "think about why" book. It reminds me of Your Money or Your Life by Joe Dominguez and Vicki Robin, but with less emphasis on F.I.R.E. stuff.

Thank you, @Saluki,

To me, The above is just so true, nailing it. Thanks for the recommendation.

-

1 hour ago, thowed said:

Personally, I have hugely enjoyed some of his blog entries, but found the book disappointing - I didn't find the narrative structure worked for the duration.

I appreciate I am in a tiny minority!

I hear you, @thowed,

Parts of the book are likely to most active CoBF members a bit trivial, I think. Yeah, likely you are a minority being disappointed, - I don't recall where I saw it, but Harriman House sale of this book has now exceeded 3 million copies. That's a lot!

-

19 hours ago, dealraker said:

... My view is that some businessmen, via their reasonably priced stocks, are going to get filthy rich during the years of this discussion.

First I got a good laugh reading it the first time, now I see the topic continue at good clip - with no response or reaction towards you. Now I can't help it any longer.

-

21 hours ago, gfp said:

Surprising that Berkshire is flexing their 80% muscles and replacing Pilot Company's CEO with two executives from Berkshire. This follows a shut down of some of Pilot's energy trading activities that Berkshire didn't care for.

Thank you, @gfp,

My immediate thought - perhaps more a kind of a question - here is : Is this perhaps a token for Mr. Abel taking more control and putting his own personal fingerprints on things and processes in the privately held [non-listed] non-insurance companies?

-

The subtitle of the book is : "Timeless lessons on Wealth, Greed and Happiness".

The subtitle says it all. The book is covering 19 short stories, covering concepts about human behavior and rationality [, or lack thereoff] related to money. Many of those concepts are one way or an other covered or touched during the activity here on CoBF about every day.

It's very well written.

I have really enjoyed reading the book.

-

10 minutes ago, dealraker said:

... This is, by far...by leaps and bounds, the most obsessed over, most predicted rampant inflation and recession in the last 50 years.

These overriding themes, dwarfing, overriding and overshawing everything [well, naturally not everything] and creating a certain negative sentiment has been going on pretty constantly also here on CoBF, as long as I've been around [, and that's now more than decade], which I think is somewhat mentally unhealthy to adopt to.

To which degree do they matter? Well, naturally it matters in respect to how one is invested. So if these macro things keeps one awake at night, perhaps the solution would be to invest differently than what one already does?

Based on the "Pro Business" attitude I posses based on education and professional training etc., I'm a firm beiever in the on CoBF former technical platform signature by @Spekulatius :

QuoteTo be an optimist, you have to believe in miracles.

[This is not nice, but] I find it striking that some CoBF members are more active in these kind of topics than in the Investment Ideas forum.

Keep the eyes on the ball. The ball here is your own portfolio. This not the same as as stating all "macro-talk" on CoBF has no relevance, i.e. for real estate is matters a lot.

-

Personally, I don't think there is anything wrong with the work provided and shared - public - Mr. Bloomstran. There may be shades and nuances, - here and there, where you may be left at on your own discretion - till example last year, Mr. Bloomstran handicapped the Berkshire AAPL position by USD 50 B - talk to me about variant perception! - Or was that the year before?!

To me, in the end, it is all about aiming for return vs. patience and risk taking. I do not consider Mr. Bloomstran bad in that regard. He just has some preferences outside my own circle of competence [, in general called energy], that causes me to never really *click* with him.

And after all, - in the end - he is just another money manger, - with a personal agenda - that applies to such people.

- - - o 0 o - - -

The only difference compared to Mr. Buffett [the younger version of him] I've personally been able identify is a swimming pool [, but what do I know, I may be wrong here].

-

On 4/4/2023 at 10:44 PM, Xerxes said:

To me, it appears as somebody - has - more or less - forgotten - who to serve first [clients]. Because I'm not actually a customer, my perception may thus be totally wrong.

To me, it's just dishonest and disingenious to allocate a material part of capital from limited partners to Berkshire, instead of asking the limited partners buying Berkshire stock themselves to hold.

Maybe the content of this post can be boiled to that I'm about to have had enough of Mr. Bloomstran.

By further thoughts, I may be absolutely unreasonbly here, because actually, not much really material happens at Berkshire during a year, forgetting the material leaps in some years.

-

Backdrop

I follow a Twitter account. It's one of those thingies on the Web, that - at least to me - just keeps on giving and giving, while I deliver nothing. Here, I'm almost hit by bad conscience by things being so. A person just "by nature" wired to share good and interesting stuff - never even asking for anything in return [here, for me, Substack and SA comes to mind].

The Twitter handle is Massimo, and the Twitter account is @ Rainmaker1973.

The combination of a visible curiosity and an enourmous intellectual capacity to adapt and adopt across multiple sciences [mathematics / physics / chemistry / biology / astronomy ], combined with high energy levels can create something outstanding, to the benefit of other people, if the sharing mindset is based on sincerety and honesty, without no other - perhaps not so honorable - motive, likely based on some kind / shade / dimension of egoism.

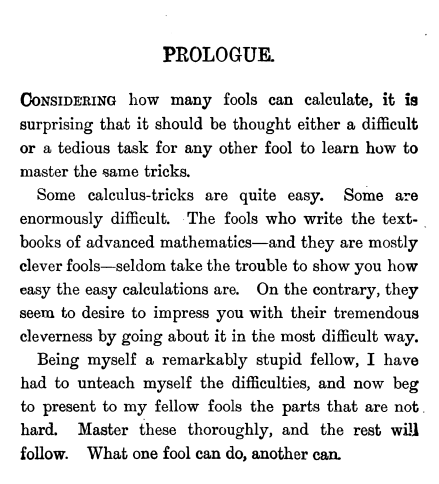

Book:

Today, I was - again - handed a gem - by Massimo - for free :

Silvanus P. Thompson - Calculus made easy [pdf-file].

Open source project for sharing : Calculus made easy.

Personally, I think every investor being serious about their doings should read the chapter: On true Compound of Interest and the Law of of Organic Growth .

- - - o 0 o - - -

As an advid book collector, I will not try to search for physical specimens of this book. I have a feeling the price asked - if any even available - will be in a major conflict with my scope of not committing large outlays to unproductive assets. I may even not afford it.

If this post has caught your interest, I hope you may enjoy your experience.

Teaser 1:

Teaser 2:

-

On 3/31/2023 at 2:58 AM, Xerxes said:

This is the first time I have seen that the "Cheers!" is not on a new line

Gotcha !

21 hours ago, Parsad said:

21 hours ago, Parsad said:Yup...if there is no "cheers" then it is either a discipline post or somebody died.

Otherwise the "cheers" have been ending my posts since February 20, 2002 when the COBF first started!

Cheers!

This is soo funny to me!

Personally, I have experienced quite a bit here on CoBF in the last decade [yes, now more than a decade - many other still active on here and esteemed CoBF members beat that by multiples!]

- During that period ,in wich I've been a CoBF member, I have experienced quite a lot on here, all things not always a pleasant experience.

I've actually from time to time had thoughts about "leaving" / logging out for good [I would never delete my CoBF account] - that has been when the posting style from someone [or several someones] has been confrontational, personal, here including namecalling and I don't know what.

Those periods in the existence of CoBF are fortunately over now, and has been so for many years now - and will hopefully not come back again.

- - - o 0 o - - -

Just to share here my experience from back then here on CoBF when you may be in personal trouble, based on your posting :

I have always thought that a CoBF member should in any circumstance just "be your honest inner self" while posting.

-

23 hours ago, Sweet said:

Agree but I see disruption coming potentially. I’ve always had a reason not to buy these companies and it’s always been a mistake. Probably no different this time.It happens from time to time, that you may be undecided about certain companies, from what you may read here CoBF from other board members and other stuff.

Do you really need a firm and high conviction of your own then to engage? It's all about making yourself comfortable with regard to position sizing, based on "if you don't try, you'll never get to grasp the knack of it!"

I've now owned for many years V, MA & CSU [based on reading the respective topics of those investments back then in time here on CoBF] [each their own indivial investment cases], based on that approach. Pretty awesome experience, I might say [I and - naturally - should add : Thank you! - to the CoBF posters sharing their work and thoughts with me back then].

It is about dividing your own conviction more granular, the "too hard" pile divided from : "Too hard", in to "Too hard" and "Perhaps too hard for me", but if you don't try, you'll never learn it."

It is all about personal adaption, adoption & improvement over time, to get better.

-

3 hours ago, Spooky said:

Buffett definitely saw this coming. Does anyone have any guesses why he kept BAC?

I think it may have to do with a large deferred tax surfacing while disposing the BAC position, and taking that fact into consideration while assessing the risk involved continuing holding and thereby continuing deferring that tax versus whatever available investment alternative considered while reinvesting the BAC sales proceeds after that tax.

-

There is actually a very good discussion of PAH3 lately in the Volkswagen topic here on CoBF. Porsche Holding SE is by it's basic nature by now a much different beast than Ferrari, uncomparable Ferrari, simply because it owns a large stake in Volkswagen, which holds brands totally different than Porsche and Ferrari [no element of really top class vehicles / luxury].

-

18 minutes ago, Whensthepaintdry? said:

Good point! Does anyone think in the next 5 years or so BRK will just become a cannibal story or is that pretty much already happening.

Time will tell. As always, it will depend on the share price compared to other available opportunities at a given moment.

-

Honestly, too many money managers brought in play to my taste above [, including you, @Spooky

].

].

Please give me some European industrialists [two or three] with a proven track record. Jacob Wallenberg, chairman, Investor AB, Sweden, as an example. He does not qualify right now, because he's not mature yet - he hasen't yet left the diapers stage in life [born 1956].

-

16 hours ago, WayWardCloud said:

In my 30s, no kids, 3 cats

From the "no kids" I perceceive it as if you have a siginificant other. Please accept my deepest and sincere sympathy for living a life with 4 rulers, among them 3 owners of you.

-

1

1

-

-

-

23 hours ago, dymanojbabu said:

With all respect and politiliness, we don't need - blank - links to substack items here on CoBF. What we may demand is your personal comments to such, expressing your opinion at the matters at hand.

Otherwise, we all drown in posts here on CoBF about etc. how many shares has Mr. Abel acquired this week et. al.- or what do I know.

In short, please put our own personal angles to your postings to spice things up, and those will be met by a lot constructive interaction.

BREAKING: Fed Chair Jerome Powell Delivers Surprise Message for the Bulls

BREAKING: Fed Chair Jerome Powell Delivers Surprise Message for the Bulls

Share your Portfolio 2023!

in General Discussion

Posted · Edited by John Hjorth

Jeff, [ @DooDiligence ],

Why are you imposing these "Berkshire" restrictions with regard to [[postion size] and [thereby return?!?!]] to yourself? - To me, it makes no sense.