-

Posts

4,877 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by John Hjorth

-

-

33 minutes ago, DooDiligence said:

That looks more like an off ramp at Augusta.

That did not provide the information asked for to this "Dumb Dane" you communicate with over the the pond and the internet, you piano & guitar playing redneck. I'm not amused at all!

Please see : Wikipedia : Die Dummen Dänen [Manner of speaking].

I hope all is well with you and yours, Jeff! [ @DooDiligence ]

-

Is this just funny for me as a citizen in Nothern Europe, or is it me who haven't any clue of the layers in American humor, so that it is actually extremely funny for you, too, my fellow American CoBF members?

-

4 hours ago, SharperDingaan said:

Just to make this very clear ...

The risk here isn't the bank, it is the sudden transfer in ownership of IB's share of the bank. The strong possibility that it temporarily rocks the market.

I suggest Riksbank as the bank is systemically important, experienced, and well placed to orchestrate a subsequent share sale. Typically the event itself draws a lot of negative press, and a short period of 'phony bank', before greed kicks in. Puts to capture the initial announcement, immediately rolled into long calls right afterward. However, you still need to live while all this takes place; hence staying under deposit insurance caps, and keeping a higher cash balance on hand. Experience.

SD

When people ask me if I have any money, I grab to the inside of the pockets in my trousers, turning them inside out, not saying anything. In most cases, I'm then left alone for my self. If people then actually proceed - despite that - and ask me what I'm doing [in the meaning : "for a living"], my aswer is simply "nothing".

I simply have no real and serious money available, anytime - my experience from 2020 taught me that, as chiseled into a stone. Basically fully invested - all the time. If I had panicked by being down ~35% within a period of approx. a month from late February 2020 to approx. the middle of March 2020 - by selling anything -, I would have screwed up just soo dearly!

Our investment bank Nordnet Bank AB is Swedish [listed in Stockholm, btw.] - we are customers in the Danish branch, subject to Danish laws, supervision by both the Swedish and Danish FSA, with both Danish and Swedish "FDIC" coverage [here, in Danish, it's called "indskydergarantiordningen"].

So for me, it's actually just a matter of one click to make some cash avaiable, after execution of the selling order the cash is available immidiately. I'm then charged for one or two days days interest related to clearing of [allowed] going above my credit line for margin, which is zero. That's it.

I'm not interested in SBB at all as an investment. To me, it's a turd built by an empty suit with a Ph.D. degree. I spend time on this whole complex, and work on it, in the hope to get the opportunity to grab some Swedish CRE with quality, that is mispriced because of the general sentiment, to hold for the long haul. I may fail on this, at least then I've got to know a few interesting companies to engage with on another day, based on the Kjoules I'm spending on it now.

- - - o 0 o - - -

Yeah, it's frustrating here to be a mere mortal market participant, while having a sense of that a lot is going on behind the curtains in this complex, especially over this weekend. There is nothing to do, other than waiting for some press realease without even knowing from where before market opening here at 9:00 AM tomorrow my local time.

-

Here are screenshots of sheets of The Norwegian Pension fund global holdings of Swedish listed commercial real estate companies :

1. Sorted by exposure in NOK :

2. Sorted by percentage of holding in each separate entity :

This is a miniscule exposure, compared to the investment capacity of the fund. It could easily engage here, I think.

The fund is materially underinvested in real estate [direct ownership of properties - all outside Norway [not to overheat anything domestic ... - what a luxury constraint, btw.] Naturally somebody must be sitting in Bankplattssen, Oslo, looking to the E/SE about what is going on at and among those obvious poor neighbours, short of cash [at least some them!], that speak exactly as weird as all those filthy rich Norwegians! [, but still a bit different.]

- - - o 0 o - - -

Supplementary calculation and data :

Size of Norwegian Pension Fund Global according to front webpage : NOK 15.4

BT [<-!],Norwegian population according to World Stats as of today : 5,544,607.

Thus every Norwegian newborn child born today is equipped with a pension account - at birth! - of :

NOK 15.4 T * [1 / [5,544,607 +1]] = NOK 2,777,473 - and counting!

-

We actually alreday have discussion topic for Vonovia in the Investment Ideas forum :

I remember that I back then [2018] cooled a lot after looking at the financing. It reminded me of what has happened to GGP. And now see how Brookfield has fared with x3 averaging down in such stuff [GGP 39% -> GGP 100% -> Taking BPY private]. In that topic there is link to a paper analyzing what went wrong for GGP in the first place.

And ref. the information posted by @Spekulatius, has business conditions for Vonovia since worsened materially.

-

In taxable accounts :

15% withheld by our investment bank. The bank is Swedish [Nordnet] and sends the withheld tax money to the Swedish IRS. By my yearly tax return I get credit for the Swedish tax witheld by the bank. The bank is by Danish tax law liable to report both the divdidends and the taxes withheld directly to the Danish IRS without my participation at all, so those fields in my tax return are automaticly filled in my webinterface to the Danish IRS, I only have to check the numbers, and there have only been few errors during the years, typically under splits, spin-offs and such. So while under the calculation of my taxable global dividend income according to Danish rules, I get credit for dividend taxes paid in Sweden, converted in numbers from SEK to DKK. It's simply soo pleasant to deal with, and no hazzle.

And as you can understand from the above, there is no tax leakage here for me. [Tax on dividends here is 27% / 42% on a progessive scale].

In tax deferred accounts :

Also 15% withheld with the same mecanism for moneyflow and information to the Danish IRS as described above. Here, we are subject to tax deferred accounts consisting of a 15.3% tax on dividends, realized gains and unrealized gains. Just for the humor in it, it's called PAL-tax. Naturally it varies wildly year by year and is now the by far largest tax in our household. The tax is paid by funds in the account on Januar 15th for prior year. The bank takes out the tax of the account on that date without any notification, so the cash has to be available on exactly that date, or the process is like a margin call. Never tried that though so far. It's a dreadfull experience after a good year to mess around with this and selling stocks in the first two weeks of the new year. I simply hate it. I'm a slow starter at that time of the year, because it's dark as a hellhole outside here when I get up, likely also cold, rainy and windy, and when we reach the midlle of week 1, it all starts with correctional attitude towards my behavior, because I haven't really started doing anything, so I get asked to stop reading whatever I'm reading or to log off CoBF to fix the taxes for the Lady of House.

So no tax leakage here, too.

- - - o 0 o - - -

To understand the Swedish taxation of these investment holding companies you need to study a pure play of where no investment is included in a normal line-by-line consolidation. Industrivärden AB is such case to look at to understand it. It provides a degree of tax free compounding I as a Dane can't anywhere else.

-

Elaboration on what @Spekulatius posted on CRE in Europe more in general :

Bloomberg [June 3rd 2023] : A New Wave of Real Estate Pain Is Coming After European Rout.

-

1 hour ago, alwaysinvert said:

... Have we had a housing/RE bubble? Sure. Will it cause major credit losses? Not likely, unless rates keep moving higher quickly.

Perhaps as a reference to the post above by @alwaysinvert :

I'm in the camp, that believes interest rates will gradually over time come down going forward, and the actually quite high inflation ATM will gradually find a lower level [, but what do I know about that? : Exactly the same as you do : Nothing!].

-

Fantastic background primer above from a native Swedish CoBF member, who I know for a fact [Substack posts] has followed closely over a longer period how this has evolved over time, especially related to Rutger Arnhult and the companies in his personal sphere.

Thank you, @alwaysinvert, and trevlig helg.

Edit:

As alluded to by both @Spekulatius and @alwaysinvert:

Wikipedia : Sveriges Riksbank [Somehow, I managed in the first place to type "Sveriges Riskbank", but got it fixed

] What a brutal history over time to get to something that actually seems to work! - Absolute crazy to think about!, &

] What a brutal history over time to get to something that actually seems to work! - Absolute crazy to think about!, &

-

Now back to IB and his privatly held personal holding company.

Annual report 2021 attached, so far the latest available. [Please note : Public information, if you know to get it in your hands - I'm not a criminal person!]

There is a language barrier here for the majority of the CoBF members, I think, - you will have to live with that, if interested here.

Please refer to the chart in the starting post in this topic with the "yarn wrench". This is the company owned by IB, which holds a large stake in SBB.

According to note 14 we see a book value [market price] of the companys shareholding in SBB of SEK 3.072 B at YE2021.

A quick, dirty and brutal calculation gives us :

Market price SBB B shares YE 2021: SEK 66.42 / share. [It's likely unlisted A shares - I don't give a damn - You can put what ever premium on those A shares you see fit, it does not matter for the conclusion below.]

Market price SBB B shares Friday June 2nd 2023 : 5.275.

Equity YE 2021, ref. above : SEK 4.584 B, minus

Reduction equity January 1st 2022 - June 2nd 2023 : [SEK 3.072 * [66.42 - 5.275]/66.42] = SEK 2.828 B, equal to

Equity June 2nd 2023 = SEK 1.756 B.

So now - this company - paribus ceteris, give or take - has an equity of SEK 1.756 B with no dividends in sight from its largest holding - in SBB -, and a public listed bond debt of SEK 1.182 B to serve, total debt in the area of SEK 1.6 B.

Please give me a break - it's a zombie - dead man walking, just waiting for the final neck shot from a bank, so the banks can get in a control position for the fate of SBB.

- - - o 0 o - - -

According to note 23 has IB provided a loan to the company of SEK 92 M. IB was not born with a silver spoon in mouth. He is an immigrant of modest origin, with a former career as politican in Sweden. That does not provide a fat wallet to lend own private holding entity that kind of money. A major part of it he must personally owe to someone.

- - - o 0 o - - -

So, no matter which death criterion you may apply [brain death or permanent cardiac arrest], IB him self, personally, is already dead, too.

-

19 hours ago, maplevalue said:

Thanks for sharing this with us. I put this in the pile of financial imbalances that built up over a time period of very low interest rates. Rates have not even gone up that much and some big cracks starting to appear!

It is so true, @maplevalue,

Bad financial planning and execution, combined with a financial strategy without any margin of safety. It was doomed to go bad.

-

Yeah, that was a harsh round for the Icelandic population, @SharperDingaan,

I still remember reading about Icelandic households in default on their morgages, where families weren't evicted from their homes, because reposessions did not make any economic sense, because there were no buyers on auctions. Husbands and wifes were struggling every day to get food on the table for the kids. Absolutely heartbreaking reading. [Meaning : Worst for the men, I think : Mothers with no food in the fridge for the kids aren't exactly a pleasure for the husband : "Do something - now! - or I'm all "crossed legs" for you as a wife!"]

A bit like what you have told here on CoBF about what you have experienced in Canada under oil bubble burts as a fairly young oil engineer [oil bug] back in those days for you. Just soo wild. [ I will never forget what you have told us about that and how it has shaped you.]

Wikipedia : 2008–2011 Icelandic financial crisis.

- - - o 0 o - - -

This Swedish hickup is likely a pleasant breeze compared to that. Not that bad.

-

I a firm believer in it. It seems to be able to fix everything, it even appears to be able to fix the development pipelines in the Swedish Real Estate Sector for the contractors, when the Swedish corporate real estate companies have problems with access to [further] liquidity in the banks or the bond market. [J/K]

[Voted 1995.]

-

7 minutes ago, rkbabang said:

... The fact that he is telling people and selling online courses to teach people tells me that either it doesn't really work or he's incredibly stupid.

Touché!

-

6 hours ago, Spekulatius said:

Nobody outside Sweden gives a hoot if those real estate business go to zero. I personally don't think they are suitable investments anyways if you are US based because of dividend taxation alone. This part of the story ends here for me. ...

Yes, perhaps, @Spekulatius, for you?

Please at least leave some room for discussion among others with interests not similar to yours, without you feeling obliged to have an on CoBF expressed opinion here on CoBF on everyting discussed here on CoBF, without you doing any real work on facts discussed here on CoBF [, while it's at the same time evident to me, by your posts in this topic, that you haven't] , nor providing any new facts or investment related assessments by your posts in this topic,

thank you.

-

1 hour ago, SharperDingaan said:

... House prices only fall if mortgagees can no longer cover the cost, everyone has to sell, and all at the same time. Very, very unlikely in Iceland as prices are held up by repatriation dollars and relatively few with mortgages. It might look a little different in Sweden, but it is hard to see it being much different than Iceland.

Just keep an eye on how many residents you see walking around with options/investment textbooks.

It doesn't work out too well !!

SD

- It's almost killing me!

- It's almost killing me!

Yes, the Icelandic financial crisis back then was bad, really bad. Not anywhere similar to what is at discussion about what's going on in Sweden by now, I think.

-

4 minutes ago, mattee2264 said:

It is a strange dynamic.

In a market dominated by growth stocks recession is pretty bullish as it means lower interest rates and it also helps that AI helps investors project dazzling future growth rates which helps them overlook that recent earnings have been pretty disappointing. ...

... And it seems a similar dynamic. Instead of embracing 5% bonds as safe havens investors are loading up on Big Tech priced at 30-40x earnings.

Please remember, this is about the marginal buyer [, in the meaning : not you, nor for that sake me, if we are discarding those prices]. In short, they don't matter that much, if you don't feel inclined to engage.

-

1 hour ago, formthirteen said:

The average length of a mortgage term in Sweden used to be around 140 years in 2016.

This is not an article from The Onion or Babylon Bee:

Sweden cuts maximum mortgage term to 105 years (the average is 140)Why do you even qoute a source like The Telegraph and / or the like, when you have the financials [Annual Reports] for all these Swedish RE suckers available as a fact at your finger tips, describing just about everything related to the debt - maturity profile of the long term debt, roll over / refinancing risk, hedging of currency risk, interest rate risk, hedging of that and such?

- Please grab the Annual Report 2022 for i.e. SBB, Castellum or Balder and take a look for your self how the financing has been set up and engineered. Rest assured it is to me about three persons with certain personally disorders with regard attitude towards OPM, combined with megalomania, who haven't been stopped in time by incompetent, or dumb ,or both bankers [and greedy? - with regard to banking business volume].

None of those three persons appear to have any clue about the concept of risks related to the debt involved in what they are doing, and it is to me personally likely, that they also don't care. [Bon appetite!].

There is no language barrier here for you, just approach each individual website, upper right corner you can switch to English language, and there will a pdf file available for you in English also of the last Annual Report.

-

Yes & thanks, @Luca,

That's the purpose of the topic. I'm also feeling quite confident now, that it is a pure play RE bubble that is about to burst.

- - - o 0 o - - -

I think yesterday, we passed denial mode on the way downhill, so next will be panick setting in.

Sveriges Riksbank [June 1st 2023]: The risks in the financial system have increased.

Here is the public response from Rutger Arnhult [who is in severe problems with his M2, Castellum [partly solved by now though] and Corem :

SvD [June 1st 2023] : Arnhult defies Thedéen - continues with dividends.

In short : Rutger Arnhult does not give a damn!

The same day that he has been asked by the head of Sveriges Riksbank to slash dividends, take in more capital and sell properties.

I suppose he will not be asked kindly again after that. To me this behavior just demonstrates total lack of situational awareness.

I suppose he will not be asked kindly again after that. To me this behavior just demonstrates total lack of situational awareness.

It's certainly getting really entertaining now!

- - - o 0 o - - -

Edit #1:

I also yesterday looked at some things related to Balder and the city Göteborg, that indicates that sound reason, business related motives [among them motives to generate profits] aren't the basis for decision making any longer some places in the sector, meaning (towers = tulips). I will share that information later.

- - - - o 0 o - - -

Edit #2:

Bloomberg [June 1st and 2nd 2023] : SBB Attracts Brookfield Interest in Bid to Rescue Landlord.

- - - o 0 o - - -

Edit #3:

Backdrop for Edit #2 :

- - - o 0 o - - -

Edit #4:

From the press release from Sveriges Riksbank above :

Quote... The Riksbank has long noted the risks associated with the property sector in Sweden. Property companies are now under pressure from the higher interest rates, partly because their funding costs are increasing and partly because the value of their properties is falling. Several companies have large borrowing needs. The Riksbank considers it important that companies continue to strengthen their balance sheets. The banks also have an important role to play, both by maintaining the supply of credit to viable companies and within the framework of their lending, by requiring property companies to take measures to reduce their financial risks. ...

I have never in my life seen anything like this in the Nordics. This will include follow-up by the Swedish FSA ["Finansinspektionen"] at the banks. "The party" has just begun. I say poor bond holders and shareholders in those legal entities, that get the verdict "non-viable".

All that said, I personally think it's the right thing to do, as acting head of Sveriges Riksbank to stop the folly and to instate systematic damage control based on factbased realism, sound reason and professional assessments.

- - - o 0 o - - -

Edit #5:

SBB Press Release [June 2th 2023] : Leiv Synnes replaces Ilija Batljan as CEO of SBB.

[Pretty impressive velocity today here, I would say!]

-

An understandable stance of yours , which I certainly respect, @Spekulatius,

The development pipelines in each of these Swedish suckers will be postponed, stalled, mothballed or cancelled, because of lack of access to financing, thereby hitting the Swedish construction sector hard [in a *classic* way in a downturn], and spread into the general Swedish economy from there.

The SEK is very low ATM compared to EUR [and DKK, pegged to EUR], which will help exporting Swedish industrials short term. I do not follow Swedish macro, though, and thus not able to comment further.

The banks are in a priviged position as creditor, because they have the real estate as collateral for now. While the holders of the bonds that are getting downgraded to non-investment grade are unsecured, causing refinancing getting difficult or directly impossible. These bond holders want their money back and out of this mess asap. So all these companies are on their knees in the banks for financing to substitute the bond debt coming due. So the banks have a firm grip in the long end of the tow, with thumbs up/down de facto decision power in every single refinancing case for maturing bond debt. No part of this mountain of debt, be it to banks or to bondholders, is on non-recourse terms.

We just need one bank or one bondholder per company of these companies in distress losing patience and temper, and the whole thing starts coming down in a huge *kapow!* like a demolished collapsing tower.

If the banks have done their homework in each case individually while lending in the first place, they will likely be relatively fine, I think, and the bond holders ending as the bagholders, together with some shareholders. I have no idea of who are holding all these bonds, and thereby who will be hit.

I consider the market cycle downturn as unavoidable by now, I feel confident a fire sale will take place, alone SBB is a big mouthful even for the Swedish market, but lets see. The more violent it may become, the bigger will the opportunities be, the faster it will over and the more violent the swing-back of the pendulum to the better will be.

Edit :

I really feel that the Swedish FSA [called "Finansinspektionen"] has failed here since this has come so far. It would never happen by now on this side of Øresund [, meaning here in Denmark].

Here, credit hasen't been low hanging fruit since the GFC. The Danish FSA [called "Finanstilsynet"] has been really brutal from to time - if you weren't the one getting beaten up, you were an observer, making sure to get in line, by looking at examples made of others.

-

So far, It just pop corn & wacthing from the sidelines. It very educational. But I would like to own more RE in the Nordics.

I consider SBB, Castellum & Balder all uninvestable at the moment. I consider the financial design of these companies flawed.

My guess is that SBB will be forced to file for backruptcy [financial recontruction] monday morning. SBB hasen't any properties, that to me to have future economic potential.

Both Castellum and Balder own properties that I would like to partcipate in for the long term. But both need to get their fundamentals right.

Wihlborgs and Fabege I consider interesting, too.

I consider it a game of monopoly for now, where the players able to play from a position of strength are Paulsson / Backahill AB and Fredrik Lundberg / Lundbergföretagen AB.

I think all the larger banks in Nordics : Danske Bank, Nordea, Swedbank, SEB, Svenska Handelsbanken and DNB are involved in the risks in this mess.

An interesting catch / angle on this is that Fredrik Lundberg is among the Swedish RE tycoons and at the same time a material degree of control over Svenska Handelsbanken [Vice Chairman of the bank], a large personal shareholder in the bank [for years now he has been buying SHB shares for his received didends from L.E. Lundbergföretagen AB - typically in lots of 500,000 shares per day], L.E. Lundbergföretagen is itself a material SHB shareholder, too, and L. E. Lundbergföretagen is the controlling shareholder of Industrivärden AB, which is also a large SHB shareholder.

I think the Lundberg sphere could easily ramp up an acquisition capacity of SEK 20 - 30 B in total in Hufvudstaden, which is a 100+ years old geriatric with low leverage and a lot of deferred taxes and in Lundbergs Fastigheter, which is almost free of external debt, for both of them, combined.

Personally I'm already involved here by holding of LUND_B.STO & SHB_A.STO for now almost a decade.

Backahill AB is one of the most impressive privately held family owned holding companies in the nordics, that I have ever looked at, cenetered about swedish real estate in many dimensions with an actual equity [adjusted for hidden reserves] in the area of SEK 20 B as per YE 2021.

I've been basically extremely inactive for a long period now, doing basically nothing, just nibbling SCHO.CPH now and then for dividends recieved.

So I'll have to let something go, to engage here, if I decide to.

We are not at panick, nor capitulation, in this complex situation here yet, I think.

Let's see how things evolves.

-

It's OK - at least for my part, personally, @Xerxes,

The NATO dilusion [in the meaning of cost sharing][not to be confused *delusion*!

] of NATO defence spending is a great thing.

] of NATO defence spending is a great thing.

I personally think a contract on the head of the *unmentional* would be cheaper [, at least short term]. In Denmark, decisions have now been made, so we now ramp up immediately to the required 2% of BNP on military budgets, according to NATO membership requirements.

No sweat, here, we're doing fairly well.

-

We have - since interest rates have started to crawling up, and inflation has arrived, both, many places on the world - had discussions of the implications and ramifications for investing in general and for banking and real estate in the General Discussion Forum. Those discussions have mainly focused on North America conditions, I think.

There are issues in other parts of the world, too. Here, I try to focus on Corporate Real Estate in Sweden, while I assess for now Danish Corporate Real Estate cooling a lot, it it's not in distress, I think, while things are turning really bad nowadays in Sweden.

Danish banks are in general in good shape, I think, while I have nu clue what the near future will bring for banks involved in financing of Swedish Corporate Real Estate. I think it appears bad - really bad.

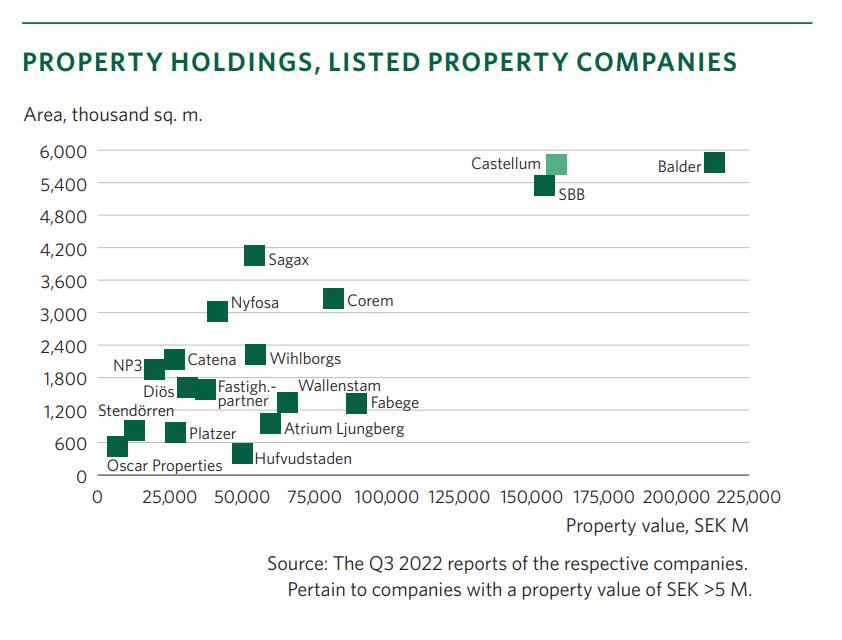

For staters, here is a chart from the 2022 Annual Report for Castellum AB [CAST.STO] :

Please combine the information in that chart with the information in the following chart from the above mentioned report by IMF :

Please note the last chart is from 2021, and thus not totally up to date. But more importantly, note the errors about listed/non-listed for Fabege, Wihlborgs, Diös, Catena & Hufvudstaden all been listed [, also in 2021].

To me, it's almost as a yarn wrench of all kinds af cross holdings. Key persons on the weak side are Ilija Batljan [SBB], Rutger Arnhult [Castellum] & Erik Selin [Balder]. Mentioned here in the order I personally think they will loose their shirt in this mess, because their individual personal and private holding companies / entities are also levered to the sky.

How much capital [understood as equity] is there in this "total system* when RE prices are their way down, also considering nneded write-downs on cross holdings?

All have basically been applying same financing strategy, cheap bond financing [unsecured] based on rating, combined with bank financing where the properties are collateral for the banks, now the companies are getting downgraded to junk on their bond issues, making bond refinancing on maturing oustanding bonds impossible, so there are like likely only a few options left, getting on their knee in the banks the most immediate option.

This game unfolding now involves hundreds of billions of capitalization in SEK, and I think it has the potential go really bad, worse than the GFC.

I think we have just left denial sentiment on the way headed into to entering panick mode.

-

Saluki,

If you chose to visit Oslo, the capitol of Norway, I would suggest you to visit the HQ of Norges Bank Investment Management [http://www.nbim.no][The Norwegian Gorvernment Pension Fund Global] [the worlds largest investment fund].

The location is fairly close the Oslo Opera and the Oslo Stock Exchange. The adress is :

Bankplassen 2,

NO-0107 Oslo,

Norway.

The underwhelming experience of such visit will likely overwhelm you and your spouse dearly. It's really a "wtf?" experience.

The Swedish Corporate Real Estate Crisis [2022 to ?]

in General Discussion

Posted · Edited by John Hjorth

@Spekulatius, thanks,

I actually respect the "Church Tower principle" instated here in Denmark for regional banks here in Denmark, projected to Real Estate investments, too [, meaning : "Don't get involved in things you can't see from your local church tower!"] - There is a lot of inner logic and sound reason to it.

For me, the case is that Denmark is actually pretty small in that respect, and most of the Danish listed CRE companies have some issues, just not to directly call them crap or sh**cos, that I personally would not touch with a long pole.

There is however one - one! - exemption, though. The company name is Jeudan A/S. Website : www.jeudan.dk. And I have owned it for a long time. I have posted a bit about it long time ago here on CoBF, and I sensed no interest at all, so I haven't opened a topic about it here on CoBF, also because there is a language barrier here.

Language barrier, untill I actually really checked and tried again today. Attached is a machine translation of the Annual Report 2022 for Jeudan A/S provided for free by using Google Translate, from Danish to English. I have checked the first few pages, It actually looks right to me, a bit to my surprise, I must say. [Awesome!, actually!]

Somebody on the other side of Öresund from here could learn a thing or two just by studying what this company has been doing with its financing, just not to say : A lot!

The incumbent CFO is not exactly a financial illiterate, I would say. That goes for his now retired predecessor, too. Basically all the financing is based on non-callable [unless default] 30 years long mortage loans on annuity basis with variable interest rates, with several different periods before interest update/renewal/roll-over. On top of that there has been put interest rate swaps in place - close to the rock buttom! - to eliminate I think about 90% of all interest risk on the 30 years non-callable financing for the next 10 years!

This company can ride out and endure a vacanacy rate in the area of 50 percent without even having to discussing anything with its banks. Now try to compare that to the margins of safety at its Swedish colleages. There is no comparison.

I'm such a happy camper here, with a Berkshire-like return here, without any worries at all. I have never read anything from the company that has disappointed me.

It's so easy!, and that is perhaps also an indicator to the direction of the *problem* for me here, which actually is me! I'm simply bored as heck, there is no hurdle for me to just buy more, or in stead of just enjoying the ride, and focusing on somehing else, not in Sweden, and "without hair".

Jeudan AS - Annual Report 2022 - Machine translated by Google Translate from Dansih to English - 20230604.pdf