-

Posts

4,877 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by John Hjorth

-

-

Post from @Dinar in the BN topic about SBB :

Very short answer here :

1. Not interested, and bonds and notes - whatever kind we may talk about - it is not my turf, nor my game, nor my asset class, and it will never be again. I was a bond investor pre GFC, and I have no intention to look back, what so ever.

Furthermore :

2. I consider SBB as basically flawed by design. The assets of the company are basically long term annuities - inflation adjusted over time, I'll give that - but with some maintenance cost attached to the downside. There is to me no material upside on the assets, it is to me non-existent. Not exactly what I consider a bond to be like, bacuse of the downside. Now look at how great things are going here for SBB, based on the spike in inflation.

3. Then there is the issue with dumb leverage on top of that. [Think GGP here]. To invest in these kind of assets with success, patience is needed, and if using leverage, the use af patient debt is needed, on top of that getting the assets at a reasonable price, that is.

4. Combine 2. and 3. above, which is actually was has happened, where 2. should provide material upside - isolated. Then look at what happened with the company. Again, the company is flawed, by design.

5. Now add the [ab]use [<-?] of IFRS for valuation of properties in the P/L and B/S *pretty actively*, so that some properties are written up in the year of acquisition! [Some work needs to be done on that to chart it, though.] [I will do that, but haven't yet.]

6. I certainly take issues with IB, but I'm not going to elaborate on that here, more than what I have already posted in this topic. [Even in a boxing ring there are rules. [You have to go to neutral corner, when your opponent is in the canvas.]] The behavior of some members of the Swedish Press here is to me so apalling. If I choose to elaborate on that, it will go into separate topic in about SBB in the Investment Ideas forum, thereby only available for COBF members.

Now look at how great things are going here for SBB, based on the spike in inflation.

SBB is to me uninvestable, no matter which financial instrument you look at. The values stated in the reported balance sheets are to me - at least partially - non-existent. What I have done for myself is that I have looked at the Danish properties held by SBB [some of them basically in my backyard, so to say, and I can see just about everything about anything there related financial state, fiknancing, running operations, liquidity etc. because I have access all the financials of the non-listed SBB subs holding the Danish properties, [recipe : One property - one company] and I can just say, that I would not be willing to own any of those subs, not even on my loo for free.

It's to me a giant *POS*, - plain and simple. And thus, it's collapsing. First gradually, then suddenly.

- - - o 0 o - - -

Part one of Johns adventure into bonds:

I was a bond investor pre GFC. I even thought I was good at it!

- Not! To me, at least I thought - It worked very well, - untill it didn't. I was investing in bonds in tax deferred accounts that I de facto really couldn't afford because of basically fairly high income, miniscule savings and too high spending on all kinds of things of *BS* like cars, Italian shoes, silk shirts, expensive ties, suits, *now show me you love me* bling to the GF and I don't know what, investing in these bonds with the use of bank debt. No sweat. Turn a whip-saw so it has its teeths upwards, and hold it in this inverted state by the grib and point it in a 45o angle up to the right. That is actually a fairly good description of the loan balance over time.

- Not! To me, at least I thought - It worked very well, - untill it didn't. I was investing in bonds in tax deferred accounts that I de facto really couldn't afford because of basically fairly high income, miniscule savings and too high spending on all kinds of things of *BS* like cars, Italian shoes, silk shirts, expensive ties, suits, *now show me you love me* bling to the GF and I don't know what, investing in these bonds with the use of bank debt. No sweat. Turn a whip-saw so it has its teeths upwards, and hold it in this inverted state by the grib and point it in a 45o angle up to the right. That is actually a fairly good description of the loan balance over time.

- - - o 0 o - - -

Part two will be another day here on CoBF from me. Somehow I managed not only to survive these very bad and selfinflicted calamities in a period, but also to get back and get forward.

I actually think of this whole situation for SBB as if IB is similar in behavior to me [the "former John", that doesn't really exist any more], back then. So please consider me extremely biased here.

- - - o 0 o - - -

@Dinar, can we go to the BN topic - each for ourselves - in the Investment Ideas forum and delete our own SBB related posts there now, - to fix our own mess there, please?

-

On 6/9/2023 at 11:03 PM, whatstheofficerproblem said:

@Parsad Any plans on making a separate section for Fixed Income? Where we can discuss bonds, debt and munis?

I personally hope that day will be a day I don't experience. And I don't consider my self suicidal.

This is basically a place on the internet for stockpickers to meet.

All the crypto stuff allowed on here only outside the investment ideas forum may suffice, just like it is possible to talk about the weather in the big apple and it's implications, expectations to future development in inflation and rates.

I hope that bonds will suffer the same miserable existence as cryptocurencies here on CoBF.

I'm not like Mr. Munger - All I want to know is when I get laid next time.

-

The Wikipedia article about it on the main Wikipedia page [.org domain] in English adds up facts and observations about the event nicely, I think.

2022 Nord Stream pipeline sabotage.

It's to me kind of a fascinating Wikipedia page, because what's indicated by each single observation simply cant add up to one truth. Highly fishy odor.

Also take the map in the article :

Thousands of kms of gas pipelines in Ukraine. How much have we heard about them in relation to this armed conflict?

-

I highly appreciate the ongoing discussion in this topic, where variant perceptions etc. are discussed based a pratice of mutual respect among the participants. It's simply not possible not to become less ignorant by reading the stuff in this topic. Thank you to you all participating and contributing.

- - - o 0 o - - -

No matter how to look at it, in short, it's frigging ugly.

It's weekend - saturday , and at least here, the weather is beautiful - the summer has arrived!

So something nice here for the mind - and the eye :

"Know that you know nothing, that is the highest wisdom.

Often what we know is actually temporary knowledge, waiting to be updated in the future by more complete knowledge.

When the facts change, change your minds.

Be a true beginner, have strong convictions, but loosely held.

Let your mind be like water, be formless, and shapeless. Take the shape of the vessel water it is in. Let it flow, let it go."

Eugine Ng,

Investor, author, angel. Ex-JPM and Citi

-

2 minutes ago, ICUMD said:

... I will say that being a physician does have a way of becoming your identity making it hard to stop, regardless of pay. I see many senior physicians who simply can't walk away.

That is called a calling. It is certainly a thing for doctors and nurses, and a good one! Some day - within the next decade or so - , I expect you will reveal what the rest of the remaining three letters in your CoBF board handle is about.

[Intensive Care Unit?]

[Intensive Care Unit?]

-

-

Thank you for reminding us of that special circumstance related to foreign persons immigrating to Canada, who have capital with them at entry. I understand it as a fact provided to me, but I have never really understood how this was even possible. Are there mountains of cash laying around under pillows and in mattresses in the city of Vancouver? [Great place to pursue a carrieer as burglar then.]

Aren't there 'Known Your Client' [KYC] procedures in place, and 'Anti Money Laudering' [AML] counter measures in place in Canadian banks?

- - - o 0 o - - -

Here to me, these things have gone crazy here locally, it has become a monster and a nightmare in the administrative load on any Danish bank. No judgement based on KYC and some kind of trust - just totaly following some internal rules by their mechanics according to work - not guideline - more an order. So much for what has happened in DANSKE.

-

Thank you for elaborating, @Viking,

It reads pretty wild from here. So the Vaucouver real estate market is hot because of demographic trends, inflation etc. pushing demand higher, while rising interest rates may be expected to cool things down, but not in some kind of crash.

The city is also limited in a way with regard to growth horisontally, because of the North Shore Mountains [A bit like Hong Kong and Monaco], right?

-

We wil be referred to our ongoing speculations [, where we ATM all are entitled to our own] untill those reports get to see the daylight, when ever that may be, maybe never.

Like to you, to me this fact simply has an fishy odor in an open and enlighted democracy.

I have material different expectations to where European Energy and European Energy policy is headed from where we actually are right now, mine compared to the expectations of yours.

Have you ever heard of the Baltic Pipe Project, that commenced operations on December 1st 2022. Why should we buy gas from a thug, when we have friendly neighbours to the North that have so much gas that they are selling of it? We will in this case forget, understand and tolerate that they speak a bit funny!

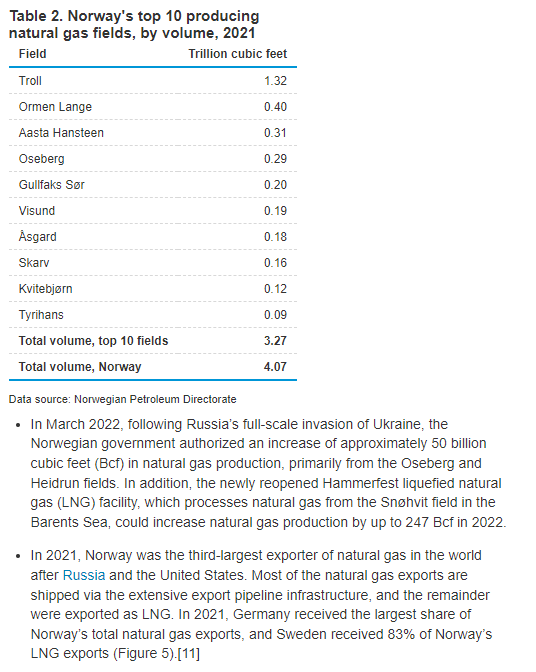

From EIA website on Norwegian gas production :

The Nordstream pipelines are actually owned by a German company called Nord Stream AG, a sub of Gazprom PJSC. That company is as far as I'm informed defunct and bankrupt, the pipelines in reality according to German law owned by the creditors of the company with an ideal share to each creditor corresponding to the share of the total debt in the bankruptcy estate.

Somebody forgot to pull the plug on the company website.

-

Thank you, @SharperDingaan,

I sense the same sentiment here locally, doomsday predictions for almost eternal hardship all over the place in the local press because of these interest rate increases. The fact is that the earnings in the Danish banks in general are actually on a great tear upwards, and from what I hear from those banks CEOs I'm interested in listening to, they can't see material weaknesses in their respective loanbooks.

Credit has in general been tight, and has tightned materially since the GFC here. The Danish FSA has been extremely brutal towards *culprits* not doing as they were told to do. Absolutely no mercy. Very close control of the FIs. Especially about loan provisions and reserves. Now for more than a decade.

-

I actually think that both the investigations have been finished and the reports have actually already been made, but are kept confidential at top level in the respective governments, including the Danish government.

My minister of foreign affairs Lars Løkke Rasmussen alluded to that in an interview on Danish television some time ago, without any elaboration or indication of the content and conclusions. Hard to judge what to think and what to get out that.

-

With regard to Nordstream I think it fits the total narrative that Russian behavior is to destroy infrastructure, if impossible to win. I Think it is the same here. F*** u* with a gas pipeline getting sacrified, if this is needed to break and bring down the total European economy. It not just failed - it backfired dearly, Europe now moving fast away from Russian gas as energy source, and this process will never be reversed after this.

So much for long term being a gas station with no customers.

So the greater picture of this is highly concerning with regard to what Russia is actually willing to do, if it can't get its way :

GIS Report [June 7th 2023] : Nordic media take aim at Russian threats - Stefan Hedlund

So a lot of things seems to go on under the surface , litteraly.

Think all these giant wind power installations in the waters around Great Britain, the Nordic countries and the Benelux countries, and add to that all the Norwegian O&G infrastructure at sea.

It's actually beyond comprehension how much damage a lunatic can do in that area.

- - - o 0 o - - -

On the dam :

CNN [June 8th 2023] : Here are the key theories on what caused Ukraine’s catastrophic dam collapse .

-

Well, the Canadian residential real estate market has over the years been discussed to skinlessness here on CoBF - I read all those discussions as about a bubble, that consistently, persistently and stubbornly refuses to burst.

What is your view and thinking on what will happen to the major Canadian banks in such a screnario? I think I have observed that you aren't shy of holding american banks when they are cheap, but I haven't seen you engage with Canadian banks at all, I think.

-

The dam disaster at the Dnipro shows that Russia is not waging war in Ukraine as a country that expects to rebuild what it has conquered.

What kind of imperialism in the imperialism playbook is that? It's simply beyond me.

That is based on the assumption that Russia has done this. That assumption may be wrong, but I doubt it is.

And I really don't care if the people hit severely by this action are Ukraines or Russians. It's a war crime. And the thug giving this order has to be held reponsible.

All this is going on a few thousand kms from where I live my cosy life.

-

I don't think there is any logical reasoning behind that, not even from a warfare perspective, but it may be me unable to comprehend things correctly as is.

And where the heck are all those international help organizations related to all the suffering of the people hit severely by that event with that dam?

-

These days I'm thinking quite a bit on/off about what is really the motives for this war for Russia by now the way it's carried out. Russia seems to try demolish everything in and on its way in Ukraine. As in "If we can't get it, we can a least tear it down" [a lot of unspecified reference here to what Mike [ @cubsfan ] has posted in this topic.

Is it the fertile and large "grain chamber" [land] or something else?

-

25 minutes ago, mattee2264 said:

... But if you avoid Big Tech and pick your spots you can probably do a whole lot better.

To me, it's amazing and mind provoking to read something like this here on CoBF. Nobody really knows, but everybody is opinionated on the matter, except me, I think.

-

-

All the helpful explanary posts to @benchmark to help to explain this are as such are totally correct as far as I can see. From an accounting perspective it roots a bit deeper, though, wich may perhaps provide some further conceptual clarity.

About 800 years ago, it was not the normal course of business to pay bills [costs] of a business with a share in the same business, and stock markets as such did not exist.

Wikipedia : Double entry bookkeeping.

The wonderfull thing here is that this system - now about 800 old - has proved to be timeless in this regard.

Principle of entry of a cash salary of USD 10,000 to a ledger :

Debit - Salaries [in the P/L] - USD 10,000

Credit - Cash [in the B/S] - USD 10,000

For a SBC it goes like this :

Debit - salaries [in the P/L] - USD 10,000

Credit - Equity [in the B/S] - USD 10,000,

Which also explains the cash flow statement adjustments needed in the cash flow statement mentioned above by @Spekulatius and @gfp.

-

Saw this from a guy in Swedish #fintwit - awesome description of the sentiment in Stockholm about this mess!

-

The situation for SBB is now tightening :

Bloomberg [June 5th 2023] : A Default Warning From Creditors Preceded SBB CEO’s Exit.

Letter sent by law firm Cleary points out covenant breach,

Creditors say open to talks if they conclude by end of June.

-

17 hours ago, realassetsvalue said:

As an investor focused on listed real estate, I did some poking around a bunch of these Swedish property company names over the weekend. I tend to be more interested in smaller companies in sectors where the fundamentals are easier to get comfortable with, which I see as being industrial and residential for Sweden as vacancy rates are low, rents are stable and / or rising, and there aren't existential threats on the horizon that you have to get comfortable with. You do have material new supply in each of these sectors, which has to be taken into account...

Across the board, the biggest issue for all these cos is that commercial property debt seems to have 3-5 year terms - both bank debt and bonds. This results in a 2-3 year average maturity with most companies seeing material maturities in the next 12 months that will have to be addressed. On the plus side, some of these smaller companies have sensibly eschewed dividends to focus on external growth, which provides for some capacity to delever over time.

The question in my mind is how to think about where the opportunities will emerge given (A) the listed sector looks to be significantly over-leveraged and (B) the cross-holdings of these Swedish property tycoons).

Focus on babies getting thrown out with the bathwater - smaller listed propcos not tycoon controlled that are selling off as investors flee the sector?

Look for consolidators - larger firms that have the capacity to gobble up distressed properties owned by other overleveraged listed propcos?

Develop a short-list of cos with good assets but broken balance sheets and be ready to potentially buy opportunistically as they recapitalize their balance sheets (already seeing a number of firms buy back bonds, initiate equity raises )?

Feels like avoiding the battlegrounds - the SBBs, Castellums, Corems, etc. - is worth it for a non-Swedish investor like myself who will always be behind the informational curve...

Thank you for a great post here, @realassetsvalue!,

It is a very solid basis for discussion of several issues and dimensions in this whole situation that is on my mind and that also I want to discuss. So I will remember it and get back to it in this topic.

- - - o 0 o - - -

I do not really remember to have read any of your earlier posts here on CoBF, btw, which really puzzles me, considering the number of post of yours. Then I looked at the date of registration, and then I did remember [

!] I was sick like a I don't what in that period of time. I have 7 weeks starting two weeks earlier from whjich actuallly can't remember anything [where at the point in time two weeks earlier we both here in the household buttomed out, my better half panicking because she thought her final hour was approachjing fast!

!] I was sick like a I don't what in that period of time. I have 7 weeks starting two weeks earlier from whjich actuallly can't remember anything [where at the point in time two weeks earlier we both here in the household buttomed out, my better half panicking because she thought her final hour was approachjing fast!

So here also a very belated welcome to CoBF to you, @realassetsvalue!

-

1 hour ago, alwaysinvert said:

It's unknown exactly how levered Selin is privately, but there aren't any bonds in the structure, which is a major part of the issues that Batljan and Arnhult have. He also previously (?) held 3 million shares in Evolution (+4B) and got about 700 million from the buyout of SWMA. He also holds about 800 million of Sagax stock which should be quite liquid and which he has cut down in the last few years. There is a bunch of other less liquid holdings, among them the private stake in Collector (+1B), Kfast (1.5B), SLP (700m). His Balder stake is worth 16B at market. There is 7B of short-term debt in the mother company per 2021. All in all, it doesn't seem totally outlandish.

From what I can tell, his issue is Balder and not his holdco.

Exactly, gilmour [ @alwaysinvert],

Those are some good and material points. It's important to note that the above here uploaded Annual Report for Erik Selins holding company is *history*, because the balance sheet date is now 17 months ago, and likely a lot happens when this is about an entrenant and very transactional guy like these gents. My eyes also caught the enourmous short term bank debt as stated for the time back then. Mr. Selin must have solved it in a for the bank[s] sactisfactory manner, or the company would have been defunct by now - which I can confirm that it isen't. Soon an update on this will be available.

-

Attached is the latest available Annual Report [2021] for Erik Selins personal and private holding company, called Erik Seling Fastigheter AB.

In short, it's levered up to the gills.

Erik Selin Fastigheter AB - Annual Report 2021 - 20230603.pdf

Russia-Ukrainian War

in General Discussion

Posted · Edited by John Hjorth

Ref. my talk upstream about Wind Power assets and O&G assets in the North Sea, at the Benelux shores and in the Nordic Waters I stumbled yesterday on an article about UK taking intiative to a new security pact bewteen the EU and UK related to to new security measures for all all these assets. It was an article from The Telegraph, but subsription protected. Unfortunately I haven't been able to find something similar about it, that is not subscription protected, so no link/source here from me.