-

Posts

3,484 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

You are right, it's late here, 356 in debt, 900m equity->debt gone->8% yield. Still, what's great here? A stable core business that will grow small forever? Debt also isn't vaporizing, has to be paid off, reducing IRR etc?

-

Is my currency conversion wrong? 1.7b CAD to USD->1.2b? https://www.reuters.com/markets/deals/fairfax-buy-retailer-sleep-country-124-bln-deal-2024-07-22/ Fairfax to buy retailer Sleep Country in $1.24 bln deal Or am I unware of something else? Please let me know.

-

So if they see that there is a lot juice left to squeeze at the mattress dealer that gets us to 7-8% yield with some expansion and margin improvement, maybe this isn't AS bad? Still looks expensive and quite some work/gambling... Would make a good opportunity to ask a question on this buy next earnings call if anybody here has the time with their fund!

-

I am not saying they should take LVMH private. But they can buy 1.2b worth of shares yielding 60m a year and probably will yield at least 120-150m in a decade. What will sleep Canada do in that time? 40% return? Someone with an MBA sitting at Fairfax earnings a couple 100k should do better no?

-

Just buy something like LVMH, Tencent, Nintendo...much better, higher yields even, much higher quality management...id understand the acquisition if yield would be 10-15% but 4% yield? Maybe selling/admin goes down and they can push it up to 6-7% yield, would feel quite better with that...maybe? Happy if anybody can change my mind on this/sees what the handsomely paid investment team sees vs me, a retail investor nerd

-

I mean, it's not like Fairfax only buys shitters but this acquisition stinks to me. Either I am ignorant and not able to see the attractiveness of price paid+valuation, or possible upside with Fairfax involvement? But there are many more things id like to buy at 4% earnings yield that are arguably a lot higher quality than Sleep Country and 1.2b is really quite a significant amount of cash. We need a lot better for multiple expansion and "100b market cap by 2034"... Not a seller of Fairfax at current prices but if they do 3 more of acquisitions like this and shoot out 1.5 years of their cashflow then ill consider trimming my very overweight position...

-

So I currently also see a LVMH at 5% earnings yield which will grow more and better than local mattress shop? Even a Hermes at 2% looks more attractive than mattress at 4%? Then commodity companies in US, Oil, Coal? Our beloved value stocks on the board here? Heck even berkshire looks better than this? Heck even the Index looks better? What does our grandmaster of Fairfax think about this @Viking? Cheers folks!

-

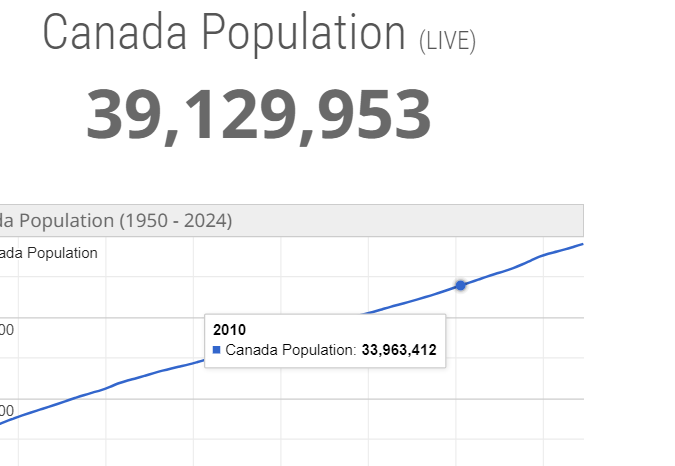

Paid 1.2b USD for this: 700m USD revenue ( up from 340m since 2014) 50m USD in earnings (4% yield) They had better years with less selling+admin costs at 70m USD earnings Share dilution from 20m-34m shares outstanding (acquisition? no real growth after adjusting for issued shares?) Margins sort of flattish looking at net income So basically a business that will grow earnings very slowly with population growth if they manage to build enough housing so trend wont revert? (skeptical)

-

Again, is anybody here happy with this acquisition? Do you think this is a good allocation of 1b USD of cash in the current opportunity field?

-

I agree that asset durability is important and i understand the acquisition from that POV. I also thought it was USD denominated but its CAD...confusing, not as large as I thought

-

Who is bullish because of this acquisition? 2b for this seems like a lot...

-

Interesting!

-

How much would you pay for untapped pricing power?

Luke replied to jfan's topic in General Discussion

Good video about problems in the luxury market and rolex/watches -

Guy buying the dip on Coal is a good sign, but probably just his dividends reinvested so not much more

-

COAAAAAAAAAAAAAAAALLLLLL #coaltwitter

-

Uff, stuff on sale with -4% :D? I like semiconductors going down and ASML deserves way more than -10% but hey. Still sitting on the sidelines in regards to semiconductors and US tech. Happy with Fairfax, Tencent, PDD, Oil/Coal, etc

-

Or go long a car supplier with significant moat and reasonable valuation (which is really hard to find now but wasn't 1-2 years ago)...

-

Yeah, a lot of the capex is defensive investments to prevent disruption. Everybody is experimenting and buying as much as they can so that they can protect their business. Koos Bekker said that in the Prosus special call very well. And they are right, AI will disrupt a lot but nobody knows who, when and where. Maybe businesses will disrupt themselves with AI haha. I shifted from 100% google search to around 60% google search 40% perplexity/GPT 4o. And perplexity is a lot better in many ways. I remain skeptical of the overall bottom line benefit to singular companies but think that overall market growth will benefit well and the chip suppliers as long as they can maintain their moat.

-

I am not sure because the jobs that will be lost won't spawn again and I think there needs to be workers compensation who can not find new jobs->higher corporate taxes->some sort of income to the declining labor market due to AI. They cant just cut costs a lot without heavy impact on the labor market and following demand. AI will lead to general productivity increases but that will be true too then for most businesses. AI is bullish for the overall market and for the suppliers. The rest will implement it together and is forced to do so to maintain competitiveness and viability with little growth coming from AI implementation solely but rather from a general efficiency increase for everyone leading to higher GPD growth/revenue growth for all.

-

Haha! Well deserved! New ATH today! Cheers!

-

If every company spends money on AI, everybody will make similar efficiency/productivity gains and incremental revenue is likely 0 due to that effect. Winners are the AI providers like Nvidia as we can see.

-

I like Exor but really like Prosus. Fundamentally much better business at much better valuation with management incentives to work on the discount

-

Sold Exor and bought more Prosus

-

“We will build a business environment that is more solidly based on the market and rule of law and is up to international standards,” Xi pledged. https://www.scmp.com/news/china/diplomacy/article/3268512/chinas-xi-jinping-vows-major-steps-deepen-reform-urges-end-iron-curtains?module=top_story&pgtype=homepage

-

1. China has a better banking system that invests in productive assets 2. China has a better and more educated labor force that enabled the manufacturing boom and business boom 3. Better ability to attract FDI and use the knowledge gained from FDI 4. Better Meritocratic political system where party members keep their jobs with better KPIs of their local economies 5. A lot better bureaucratic system for business owners and getting rid of legal barriers due to control of economy 6. Understaffed indian government. Open positions despite high unemployment-> Caste system/hierarchy of social categories creates problems 7. Intentional underfunding of local governments in India because bureaucrats want to keep control/caste system 8. Democracy problematic if country is underdeveloped, Authoritarian system in growth mode better (giving gifts to voters, having taxes low to get reelected while its harmful to the economy)