-

Posts

3,484 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

Interesting thread, translation should be available I

-

1. Mohnish Pabrai 2. Sven Carlin 3. Tay Chi Keng 4. Patrick Boyle 5. Good investing talks 6. Asianometry 7. Aswath Damodaran 8. Thijs Nijenhuis 9. Unrivaled Investing 10. We study billionaires Those are the channels I regularly listen to if something interesting gets uploaded.

-

Curious what these investments are!

-

Highly interesting no matter what your opinion on this war is. Also questions about North Korea, all with great subtitles. Note: I can not guarantee correctness of subtitles

-

But there are certainly pessimistic scenarios too where China cant achieve what it wants either by external or internal forces, problems with execution government-wise due to lacking feedback mechanism and "yes-men" that Xi installed. Lots of unforeseeable problems arising. Geopolitical scrutiny against China etc. The good news is that nothing of the bull case is priced in, rather the opposite. And the bull case isn't egregious in its assumptions either which I am happy with.

-

Once the way of life and quality of life in China is so vastly superior to the internally struggling Western societies many will want to move closer to China than to G7/US. All that matters is technological advancement, strict execution of infrastructure and scientific progress, and delicate balancing of capitalistic forces to achieve maximum growth and development. They could probably solve their Taiwan problem that way too, if China is so wealthy, luxurious, and developed compared to the rest of the world, you will have people that will push for closer ties no matter what.

-

Yes, so the US will try to establish manufacturing in India, makes sense. China is changing its development model anyways to not being a cheap labor force for US goods but having their own brands, vertical supply chains and exporting them to the world and all of that at a more affordable price and partly even now better features. America can produce in India but that wont change the fact that China has more competitive products, supply chains, and talent pool. The production environment is probably a lot better in China than it is in India where many things have yet to be established. The best for the US would be to lure China into doing something they can use to isolate China from most countries and hope the competition evaporates so they can own the market again. This likely won't happen but I can see from public statements and media consensus that this is what they try to mentally prepare western societies for. "the china threat" is simply an economic threat that threatens to dethrone the richer Western standard of life and obviously the western governments will try to stop that from happening. Thats why voters wanna see trump and biden being "tough on china" because they simply are growing too fast, producing too fast and have the ability to disrupt so much. China has tremendous opportunity the next 10-20 years. They can actually challenge liberal democracies by increasing their wealth a lot more from internal scientific advancement and adaptations to the capitalistic system and rise to the center of the world again. Which is of course the plan of the CCP. I think its not unlikely this is going to happen but if you are the leader of a western liberal democracy which gets financed by wealthy western capital, your job is to try to stop China from achieving all that, destroying their influence with other countries and inflict as much damage as possible and getting away with it in the public eye.

-

Ironically many of these points are under active problem solving by China. Censorship of the media does a lot of work here too, just ban "sissy men" and control kids play time. There are advantages to their total political control and longterm planning power the west just cant match. "China builds an airport and the west holds a lecture" is something i read on a lot of african news channels that talk about china and the wests aim to stop cooperation with africa->china. Why arent we matching the developing power of china? Where is our belt and road? My government is currently betting on austerity and buying weapons for ukraine while fighting china with tariffs and deindustrializing the economy with absurd green energy plans that just wont work. Its an odd time and China is setting a lot of groundwork for a great economy and future IMO but is discounted to death.

-

China street food and local restaurants are dirt cheap for our salary. McDonalds etc are not as cheap and depending on location bit more than 50% off sounds right. Well guys, as far as i like the shareholder protections in the US, i like the prices and business more in China. BRICS also seeming to really getting further interest, Thailand interested too. They all also seem to not agree with the wests treatment of the ukraine conflict. China seems to secure access to a lot of markets of the global south and is better positioned in an area that will have way more growth than the US is. Both are fighting for influence in SEA/asia but China sits in the heart of it with closer supply chains and cultural proximity. Combined with the FUD and dislocation I still cant leave this space to invest in.

-

We had a tough crackdown on this kind of corruption and CCP leadership doesnt want to have this. Thats why some chinese decide to flee to the US where this behavior is allowed. And yes, China isnt transparent with government workings but the US isnt either and this elitism is sadly always a problem. I like that they sent a strong signal against it.

-

China wants meritocracy, not oligarchies where the rich buy themselves into elite schools and gatekeep high paying jobs. It is understandable that people with money move to a country that will protect them first and not a healthy and fair economy. I think a country that rewards effort, and promotes fairness in compensation will reach a healthier living environment and more flourishment than a society with very high inequality and unfairness. Yep, another sign of the progress they are making on all fronts.

-

The author writes really good articles, highly recommended

-

https://asiatimes.com/2024/06/whats-the-real-size-of-chinas-economy/ In May, the World Bank concluded one of its periodic International Comparison Program (ICP) assessments – the price survey which “officially” determines purchasing power parity GDP. Like college rankings, the league table of the world’s largest economies shifted just enough for the obsessives to notice while springing no real surprises. Harvard will be Harvard and whether Princeton ranks above or below Yale this year is largely irrelevant. For the obsessives, China’s lead versus the US expanded by 5.6%, India inched closer to China, Japan kept its ranking while sliding down a tick, Russia moved ahead of Germany, France ahead of the UK, Indonesia tumbled two places and Brazil rose one spot. The top 10 remained the top 10. The ICP is a massive undertaking. According to The Economist, World Bank researchers visited 16,000 shops in China alone to collect price data. The latest ICP assessment collected data in 2021, four years after the 2017 survey. And the conclusion is that China’s GDP was undervalued by US$1.4 trillion pushing China’s 2022 PPP GDP from 119% of the US to 125%. China’s PPP GDP is only 25% larger than that of the US? Come on people… who are we kidding? Last year, China generated twice as much electricity as the US, produced 12.6 times as much steel and 22 times as much cement. China’s shipyards accounted for over 50% of the world’s output while US production was negligible. In 2023, China produced 30.2 million vehicles, almost three times more than the 10.6 million made in the US. On the demand side, 26 million vehicles were sold in China last year, 68% more than the 15.5 million sold in the US. Chinese consumers bought 434 million smartphones, three times the 144 million sold in the US. As a country, China consumes twice as much meat and eight times as much seafood as the US. Chinese shoppers spent twice as much on luxury goods as American shoppers. It is prima facie ridiculous that China’s production and consumption, at multiples of US levels, can be realistically discounted for lower quality/features to arrive at a mere 125% of US PPP GDP. The United Nations System of National Accounts (UNSNA) provides voluntary guidelines and specifically states that nations should base their national accounts on local conditions. What that has meant in the West is to adopt all UNSNA “innovations” introduced over the years. Items like imputed rent, legal fees and R&D are now all included in GDP. The UK went hog wild with both illegal drugs and prostitution as now part of their GDP because… hey, why not? UNSNA’s 2008 guidelines explicitly recommend that illegal market activity should be included in GDP. China’s NBS stood its ground on a conceptual level. Rightly or wrongly, the Leninist MPS considers services necessary costs of material production rather than real value creation. In China’s first attempt at converting MPS to SNA in 1985, it tacked on a ludicrously low 13% to the MPS number and called it China’s services GDP. -------------------------------------------------------------------- The affordability crisis in Western economies, the US in particular, is largely driven by inflation of necessary services – rent, healthcare, education and childcare – not by manufactured goods. While these costs have also gone up in China, they have increased less and much are left out of GDP anyway. Also not captured by the ICP survey conducted in 2021 are the price and service wars that have broken out across industries and products – a bane on businesses but a boon for consumers. This is most visible in China’s car market with OEMs either cutting prices to the bone (Hyundai Sonatas down to $17,000 from $42,000) or offering cutting-edge technology for peanuts (a 2,000-kilometer range BYD Q plug-in hybrid electric vehicle for $14,000). The price of solar panels fell 50% in 2023 and continues to trend down in 2024. CATL has announced plans to cut lithium-ion battery prices in half by the end of 2024. Restaurants are offering white glove perks like hot towels, lotion by the sink and snazzy remodeled decors. Hairdressers hand out bottled water and fruit plates. Tech companies have slashed large language model (LLM) prices to basically free. Service quality in China, impossible to quantify, is now head and shoulders above the West and probably even Japan. Adherence to UNSNA has caused a breakdown in the meaning of GDP. As necessary services become an ever larger share of Western economies, their growth does not appear to result in discernable improvements in living standards. Are US healthcare and universities twice as good as they were in the year 2000? If US households have not gotten vastly improved healthcare, education, housing and childcare over the past two decades, then inflation has been systematically underreported and GDP growth may have, in fact, been less than 1% per annum (instead of 2%), which equals STAGNATION given 0.8% per annum population growth. This may go a long way in explaining popular anger and the meltdown of American politics. China’s material-focused GDP may be a better measure of the economy as it relates to living standards, especially since UNSNA has obviously lost its mind by now officially recommending drugs, prostitution, illegal gambling and theft be included in GDP. Western defense analysts are onto something when they come up with wildly inflated estimates for China’s defense spending. But it’s not China’s defense spending that is lowballed – it is Western defense spending, especially by the Pentagon, which needs to be reassessed. Somehow the $1 trillion a year the US devotes to defense (including intelligence and Energy Department programs) has caused the US Navy to shrink while China’s $236 billion budget has built the world’s largest navy by ship count. Similarly, analysts who lament that China accounts for 30% of the world’s manufacturing output but only 13% of household consumption are far off the mark. China accounts for 20-40% of global demand for just about every consumer product but much of the services it consumes have been left out of national accounts. So how much is it? How big is China’s economy really? About six months ago, this writer estimated that China’s GDP needed to be grossed up by 25-40% to be on a UNSNA basis. But after shopping for cars, buying a domestic brand carbon fiber road bike with all the bells and whistles for $2,600 (equivalent to a $15,000 Trek), paying $7.65 for Bluetooth earphones (much better than the $250 PowerBeats Pro they replaced), renting cars for $20 a day, staying at boutique hotels for $30 a night, buying an extremely solid heavy duty umbrella for $2.20 (and losing it right away) and undergoing an unfortunate series of medical interventions (both major and minor) for less than the deductible on expat health insurance and getting white glove customer service for the smallest of purchases, Han Feizi’s mental map of price and value has crumbled.

-

Thanks a lot for sharing!

-

Trump is gonna contest Biden in a Song duel in Chinese for this election folks!!! 2024 is getting even crazier!! https://www.instagram.com/p/C8VAURehSLF/

-

Cheap yen really puts the cherry on top of the vacation...you basically have twice to three times your income at the current level compared to EUR and USD

-

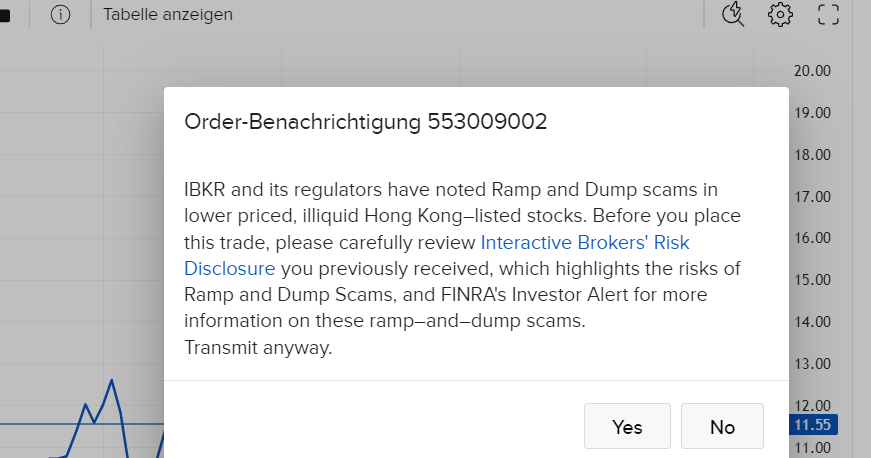

Interactive Brokers stops US, CAD, EU Investors from buying in China

Luke replied to Luke's topic in General Discussion

But isn't that true for any other stock exchange where low liquidity exists? And hacking an interactive brokers account is quite hard... -

Interactive Brokers stops US, CAD, EU Investors from buying in China

Luke replied to Luke's topic in General Discussion

Yes but still. Am i not allowed to take risk on Interactive Brokers? I thought I was on a real brokerage platform and not on "INACTIVE boomer local bank broker" haha! -

Interactive Brokers stops US, CAD, EU Investors from buying in China

Luke replied to Luke's topic in General Discussion

-

Its strange how people in the palestine camp tend to blend these facts out and ignore it. Quite black and white nowadays.

-

What are you listening to ? (Music thread)

Luke replied to Spekulatius's topic in General Discussion

The song is from 1975 Spek!!! -

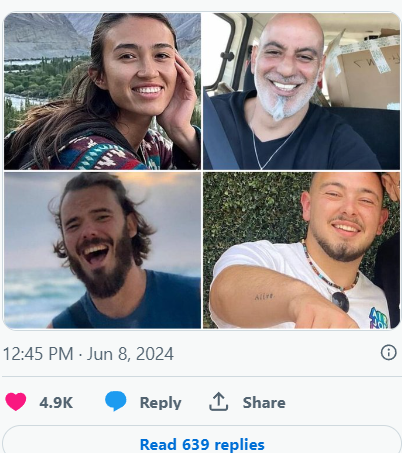

286 days as a hostage. At the same time: "Nidal Abdo, was shopping in Nuseirat on Saturday when he described a “crazy bombardment” hitting. “[It was] something we never witnessed before, maybe 150 rockets fell in less than 10 minutes, while we were running away more fell on the market,” he said. “There are children torn apart and scattered in the streets, they wiped out Nuseirat, it is hell on earth,” he said. Another local, Abu Abdallah, said the strike hit while people were sleeping, adding: “Dogs were eating people’s remains. We pulled out six martyrs, all torn up children and women, we risked our lives to get them to the hospital.” Footage from Al-Aqsa Martyrs Hospital shows trucks and ambulances transferring injured people and bodies to the hospital. The hospital’s emergency room is overwhelmed. People can be seen in the footage waiting on the hospital floor. Graphic video shows many Palestinians, including children, injured with blood on their faces and clothes. Footage from the hospital also shows people screaming and crying, huddled over bodies covered in blankets."

-

Yeah...more hostages freed today with 100 troops and complicated operation. Israels military said that Hamas was going for constant open fire on them including rocket launchers. Hostages were hidden in family homes with some hamas weaponized terrorists. What a situation... Protests at the white house for Palestine are escalating Maybe a wrong analogy but: Would it be okay to protest against the allied attacks on nazi germany? What choice is there to arrange security for Israel besides completely annihilating the Palestinian government and doing a colonialization mission like with Germany in 1945? Many germans died back then and they were as much normal citizens as the people in Palestine. Both citizens probably supported the violent government. Thoughts?

-

What are you listening to ? (Music thread)

Luke replied to Spekulatius's topic in General Discussion

Listening to some old stuff right now, this is a nice piano version from the boss that is not well known: