glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

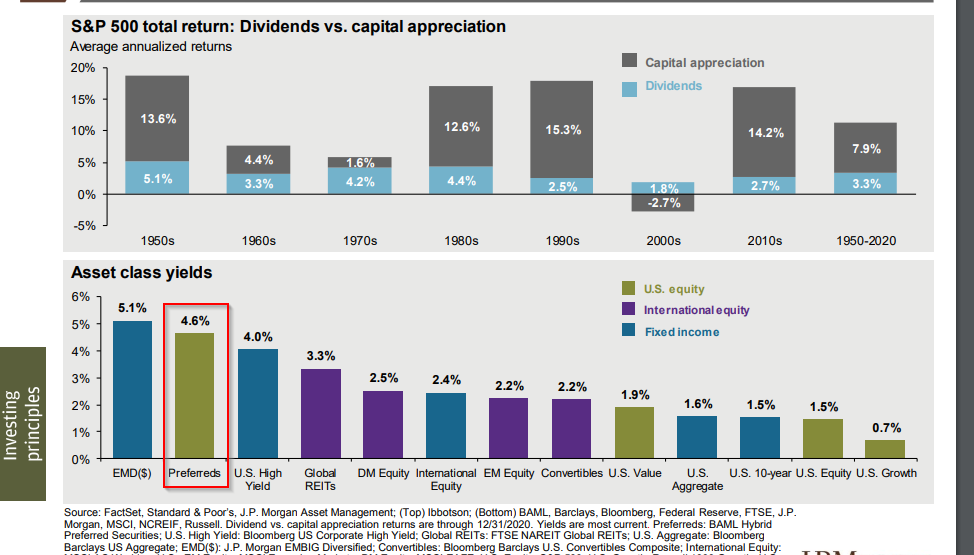

if (?) they have structured it as a preferred, then I agree I think that is more realistic than 9 or 10% but I am still not sure what the structure is. https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/mi-guide-to-the-markets-us.pdf

-

if (?) they have structured it as a preferred, then I agree I think that is more realistic than 9 or 10% but I am still not sure what the structure is.

-

Amazing - it was oversubscribed! Happy with the result.

-

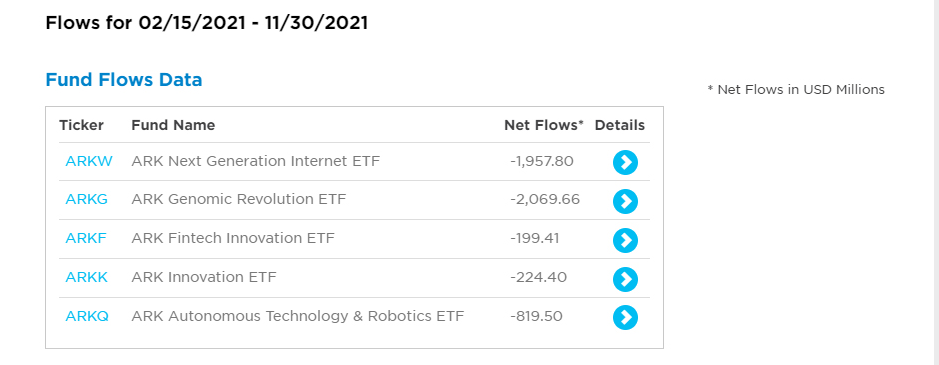

The fund flows picture doesn't look great up to November https://www.etf.com/sections/features-and-news/ark-funds-leaking-assets I checked & over the last month the same ETFs are down between 14-22%. What will net fund flows look like for December?

-

I have done a little work on Brit - I have scooped the data from Brit's reported financials (again try to be careful but always double check my numbers ;)) It looks to me like premium rate increases (due to hard market) have improved Brit's underlying combined ratio (excluding covid loss, cat loss & reserve releases) over last 3 years. You can see that successive price decreases from 2014 to 2017 (as market suffered from over-capacity & excessive competition) resulted in higher underlying combined ratios. Then from 2018 to 2020, successive price increases have helped reduce Brit's underlying combined ratio from 97.4 to 92.5. A further, 10% increase in first 6mths of 2021, took the total aggregate price increases since 2018 to 30%. The overall combined ratio (excluding covid losses) looks to have improved over 2018-2020 as a result of these rate increases. Now lets turn to Q3 result which appeared to be disappointing. Brit's combined ratio increased from 94.6 in 6mths to Jun-21 to 105.3 for 9mths to Sep-21 (103.1 excluding start up Ki) due largely to losses from Hurricane Ida of $169 mil. This appears to combination of Brit having a material exposure to North Atlantic hurricane risks and also proportionally more exposure to Louisiana in their open market property book. To manage this exposure, it looks like Brit also uses excess reinsurance & on Q3 call Peter Clarke said their aggregate cat losses for year are close to their retention level so Q4 result should be better. And lastly at Brit, they didn't get any benefit from their cat reinsurance program. So basically as of now, their aggregate cat losses for the year are just coming up to their the retention of their cover. So the good news is any further, any further development or losses in the fourth quarter will be minimal for Brit. My take is that I think Brit is showing improvement on underwriting front as rate increases reduce their underlying combined ratio. Key to them achieving a consistent sub 100 combined ratio will be their ability to also effectively manage their cat loss risk exposure.

-

still too early to say but initial estimates are a single digit billion dollar event https://www.artemis.bm/news/weekend-tornado-storm-losses-to-run-into-billions-of-dollars/ https://www.insuranceinsider.com/article/29g01n5bkms47pokxasjk/fatal-tornadoes-a-manageable-loss-but-outsized-disruption-for-reinsurers looks like Fairfax had approx 1.1% of loss from Ida (340 mil loss on 30 bil or so event) So if we are looking at single digit billion dollar event, then I would guess loss for Fairfax is likely less than $100 mil

-

https://bfsi.eletsonline.com/our-aim-is-to-empower-humans-with-technology-and-not-replacing-them-vijay-kumar-ceo-and-principal-officer-go-digit-general-insurance/

-

thanks SJ for posting - here is another article too https://www.theglobeandmail.com/canada/british-columbia/article-preliminary-insurance-cost-estimates-for-bc-floods-point-to-a-massive/ Widespread flooding across southern British Columbia in November is now estimated to have caused $450-million in insured damages, making it the most costly severe weather event in the province’s history, new figures from the Insurance Bureau of Canada show. But that figure reflects only a small portion of the total price tag, in part because many residents affected were in high-risk flood areas and floodplains where insurance coverage is not available.

-

Thrifty its good you have raised this, its something we have to factor in with ATCO - I think for Fairfax there is a hedge to this risk with Fairfax's high cash/ST invest allocation. I guess the big question if Fed moves, how much to get to neutral & also how quickly will they move rates? (I haven't read Vanguard report) It looks like ATCO are forecasting avg LIBOR rate (figures from Q2'21 earnings presentation) at 0.48% for 2022 0.96% for 2023 1.3% for 2024 ATCO have $3.4 bil of variable rate credit facilities at 30 Sep-21 with fixed rate swaps on around $1 bil (rounded) of that amount. So lets say $2.4 bil of variable rate debt at risk to higher interest rates. Then I would guess that if LIBOR is 1% higher than Atlas Corp's projections above(assuming it approximates Fed rate) - it would approximate to an increase in interest exp of $24 mil (using Sep-21 balance). However, with new builds & deliveries, that variable debt balance would I think be higher - Thrifty you or someone else might know? Does anyone know what ATCO projecting for their variable debt balance for 2022,2023,2024 in modelling their profit forecasts? Cheers

-

-

could be they are raising liquidity due to their share buyback at holdco level or to make another portfolio purchase - may be different reasons

-

https://www.livewiremarkets.com/wires/what-you-need-to-know-about-india-s-structural-growth-story We maintain a very positive view on India’s long-term structural growth prospects. This is because the country has strong demographics — its 1.4 billion population is not only behind China, but younger (with a median age of 28 years) and growing more rapidly. India is expected to add 200 million people to its workforce between 2020 and 2050. As these extra hands join the workforce, they will contribute to GDP growth as well as add to the country’s consumer base. Also, India has one of the lowest penetration of goods and services such as automobiles, white goods, electronic devices and services such as mortgages, credit cards and online travel.

-

Just a quick comment on Greece with Fairfax having significant investments there (Eurobank, Eurolife etc) Greece was the second fastest growing economy in the Eurozone in 9mths YTD & fastest growing in the 3rd Quarter. Greece also recorded their highest GDP in the last decade over the Sep-21 Qtr https://www.fortunegreece.com/article/staikouras-protathlitria-anaptixis-stin-evrozoni-to-trito-trimino-i-ellada/ Greece has been a long & painful road for Fairfax, but the steady flow of data now coming out in terms of GDP growth, property prices growing, increased foreign investment (Amazon. Pfizer, Microsoft to name a few), lower unemployment etc all further supports the view that things are well & truely improving for Greece and thats good news for Fairfax's banking, insurance & property businesses there. Also the Greek PM & government are really doing a great job (I have to pinch myself now because I am complimenting politicians!) but they have had a difficult task & have really made a lot of progress - they are making it much easier for foreign companies to invest in Greece & its now paying off as well as lowering taxes & other policies to encourage Greeks to return to Greece or foreign workers to move to Greece - I have now watched a few interviews with the PM & came away very impressed - & the results are starting to show in higher GDP growth etc. Eurobank are also expecting Greece to have the busiest year in tourism in 20 years in 2022 based on bookings to date (provided covid doesn't flare up again!). Also GDP growth over time will become less dependant on tourism (obviously big hit from covid) as Greece is seeking to expand its economy in other sectors - nearly 23% of foreign investment in Greece in 2000 was in software & IT. https://greekreporter.com/2021/07/14/foreign-investments-greece-soar-77-percent-2020/

-

looks like a subscription required :(

-

Yes agree - also as Fairfax repurchases its common stock (via SIB & NCIB), existing holders will effectively end up owning a bigger percentage of Fairfax India via Fairfax's stake. Fairfax is repurchasing its common stock at up to 80% of BV & in that BV Fairfax India's shares are being carried at close 0.5x BV or around $10 per share. So assuming Fairfax repurchases at 0.8x BV multiple (and we feel that Fairfax's BV is at a minimum being carried appropriately - its fair value is higher IMO ) then we can say that Fairfax are effectively buying Fairfax India shares at 0.4xBV or approx $8 per share.

-

Looking the most recent Ki share allocation/capital injection, both Fairfax (via Brit) and Blackstone appear to be contributing on a 20/80 split, so I suspect that out of the $500 mil capital commitment - $100 mil is going to be funded from Fairfax via Brit & $400 mil via Blackstone. Not sure whether Fairfax can at any point have the option to contribute a higher percentage - we just don't know what the terms of the $500 mil commitment are. Also the wording of the $500 mil commitment are its coming from Fairfax & Blackstone, why not write Brit & Blackstone (or does Fairfax potentially have option to put money in from its own pockets ??) Yes would be nice for Fairfax to own a greater share of Ki, but at the same time we can look at it in the context of what the world was like in Sep-20 - we had no vaccine & Blackstone would have been spoilt for choice in terms of investments. Why would they commit to invest in a promising tech start up with no revenues? They would need a decent % of the equity to compensate them for that risk. For Fairfax & Brit, getting this new tech start up off the ground & scaling up quickly (with other competitors out there) would have been important. Plus Fairfax tipped in around $520 mil into Brit during 2020 to support their underwriting capital & they had to pull down on their credit facility to do this. Putting a further $400 mil into KI as well was probably a bridge too far & again in the context of Sep-20, Fairfax would have been prioritising its own capital position plus would have been spoilt for choice on investment side. Anyway thats my take - but as SJ said this is just speculation because we need to get it from the source.

-

Ok according to May-21 update for Ki Financial Ltd - it looks like Blackstone has around 79% of the ownership, Brit 20% (so Fairfax via Brit 17.2%) & less than 1% held by company officers. Brit have majority voting rights of 51%. https://find-and-update.company-information.service.gov.uk/company/12594708/filing-history On 23 September 2020 and 24 November 2020, Brit Limited invested US$15m and US$16m respectively into Ki Financial Limited. The Group holds 20.0% of the share capital of Ki Financial Limited and 51.0% of the voting rights. The entity is consolidated in full by the Group. https://www.annualreports.com/HostedData/AnnualReports/PDF/LSE_BRE_2020.pdf

-

article on Ki & its potential to be IPO'd at some point (Interesting they note that Ki's premiums could potentially double in 2022!) https://www.insuranceinsider.com/article/29ee5pw6no1rnvrtsvfgg/the-typtap-playbook-lessons-for-hiscox-brit-and-canopius Brit launched Ki in November 2020 with $500mn in backing from Fairfax and Blackstone’s Tactical Opportunities fund, while its technology was developed in collaboration with Google Cloud. The business stands out as having the fastest year-one start of any tech-enabled underwriting enterprise, and is on course to write $400mn of premiums this year. By way of comparison, Lemonade was launched in 2015 and had premiums in force of $347mn at the end of Q3. Ki has approval from Lloyd’s to double during 2022, pointing towards potential for $800mn of top line next year. But as it is scaled the early benefits of being umbrella’d by Brit will lessen, and there would be scope for Brit and Fairfax to look to crystallise value through an IPO. Indeed, this path could also make sense as a liquidity event given Blackstone’s involvement, or as a means of raising additional capital to support surging growth. Also worth noting, Ki won the Digital Insurance Award at the National Insurance Awards 2021, held in London in July. https://www.britinsurance.com/news/ki-wins-digital-insurance-award

-

Tidefall have posted some quotes from the CIBC report below

-

https://www.forbes.com/sites/billybambrough/2021/12/03/300-billion-bitcoin-and-crypto-price-crash-after-stark-fed-warning-ethereum-bnb-solana-cardano-and-xrp-in-free-fall/?sh=e05be3522fd5 I don't believe that Bitcoin or Ethereum are worthless like JD suggested - IMO they have a value - I am not sure what that value is. I won't go into the positives & negatives of crypto but crypto does seek to address some of the problems inherent in national currencies & that has some value. However, unlike stocks, crypto are not tied down by this pesky metric of discounted cash flows. So this then opens the gates for people to espouse these unbelievable forecasts around what what BTC or other crypto should trade at - you can basically throw any number out there just throw in a lot of zeros at the end! Often you see prominent people like Tim Cook interviewed & they say I have dabbled in BTC - but what is rare to see is a prominent investor putting in a conviction trade on BTC which would actually get my attention (ie significant % of their personal wealth not a 1 or 2% trade). The reality is that most prominent investors don't want to do that, because they don't know what its actual value is - that 1 or 2% investment is just to hedge their bets because they are looking at a chart that seems to only ever be going in one direction at an exponential rate. And that goes to the heart of the matter for me - the reason I have avoided & will continue to avoid BTC etc - it is the biggest driver of these massive returns on one hand (no cash flows to tie down valuation, throw any number out there) & it is also the achilles heel of crypto IMO.

-

saw this today but I haven't read their report Fairfax Financial Holdings Ltd (FFH.TO): CIBC initiates coverage with "outperform" rating https://www.reuters.com/markets/stocks/tsx-futures-flat-omicron-dents-sentiment-propped-by-stronger-crude-2021-12-03/

-

Interesting insights thanks viking

-

viking I know you are following RFP closely - in terms of damage to transportation infrastructure (rail lines etc) - how that might impact their movement of lumber? If they can't move the lumber until Feb, could they lock in the current favourable pricing?

-

Looks like FFH (via HWIC Asia Fund) to me & then Fairfax India would hold its IIFL Finance shares through FIH Mauritius (see below) As of September 2021, HWIC Asia Fund held 7.48 per cent stake in IIFL Finance, FIH Mauritius Investments, a subsidiary of Fairfax, owned 22.32 per cent stake in the company https://www.business-standard.com/article/markets/prem-watsa-backed-fairfax-sells-3-2-stake-in-iifl-finance-for-rs-365-crore-121120101508_1.html