glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

https://www.cnbc.com/2021/11/02/squid-game-token-cost-one-investor-28000-after-coin-plunged.html Squid Game’ crypto token cost one Shanghai investor his life savings of $28,000 after coin plunged to near zero

-

With Blue Ant - I am unclear what Fairfax's ownership % is? 'In the U.S., huge investors have snapped up production companies for staggering sums; Blue Ant itself is privately owned, with Fairfax Financial holding a big stake.' https://www.theglobeandmail.com/business/rob-magazine/article-new-platforms-needs-lots-of-fresh-content-and-michael-macmillan-has/ We also partnered with Michael MacMillan and his team at Blue Ant Media through a Cdn$42 million investment in debt and warrants. Blue Ant is a media content and distribution company with brands such as Love Nature, one of the world’s largest libraries of 4K wildlife and nature content. Michael is very well known for winning an Oscar at the age of 27 and then going on to merge his film production business in 1998 to create Alliance Atlantis, the producer of the hit series CSI: Crime Scene Investigation, which was sold to CanWest and Goldman Sachs in 2007 for Cdn$2.3 billion. We trust that Michael and his team will have similar success with Blue Ant! (FFH AR 2016) Torstar acquired 25% stake in Blue Ant in 2011 for around $22.7 mil (put approx Blue Ant value at $90 mil) In 2016 Blue Ant raised capital & diluted Torstar stake down to 16% (did Fairfax boost its own ownership % during this dilution) but at a 40% higher value (according to Torstar Annual report) based on their average weighted cost (lets estimate Blue Ant value $126 mil) Then in 2021 Blue Ant had $100 mil windfall on their Enthusiast stake - but what is current value of Blue Ant business? I would guess adding this Enthusiast stake windfall to 2016 valuation - possibly have a value north of $200 mil - but what is Fairfax's ownership ??

-

great summary Viking I guess question with these $1 bil set of private investments - how much more potential value extraction could there be from monetisation? How does the fair value sit with carrying value? They have taken advantage of the attractive IPO market this year & sold/partnered up where they just don't have the expertise to move the business forward eg Toys r us We should be able to see some of the associates share of profit in AR 2021 to see how they are tracking - I think Exco is definitely one to watch provided they have not hedged too much of their production, they should be doing really well IMO with surge in natural gas prices.

-

Fairfax's insurance subsidiaries - what are they worth?

glider3834 replied to glider3834's topic in Fairfax Financial

Going back to looking at the above in terms of Fairfax's book value per share (BVPS) BVPS (adjusted for Eurolife consol etc) was $545 at 30 Jun-21 Add estimated $46 net gain on Digit (approval expected Q4) BVPS = $591 (incl Digit net gain on revaluation) Estimated CV at 30 Jun-21 of Insur/Reinsur subs (excl Digit revaluation) = $16.5 bil (my estimate of 10% increase in shareholder equity from 31 Dec-20 - see above post) Apply x 1.3 multiple = 21.45 bil Subtract Estimated CV at 30 Jun-21 of $16.5 bil Excess FV over CV estimate = $4.95 bil (or $190 per share pre-tax) Subtract tax at 18% estimate or $0.9 bil Excess FV over CV estimate (excl Digit revaluation) = $4.05 bil (or $156 per share after tax) So if the insurance/reinsurance subs were all sold - estimated BVPS would increase to US$591 + $156 = US$747 (or US$771 adjusted BVPS for excess of FV over CV of non-insurance subs of around US$24 after tax at 30 Jun-21) I am not suggesting we should value Fairfax on the basis that all their insurance subsidiaries are going to be sold, but it further underlines I think the replacement value of the insurance subs using a market based multiple. Another way to think about it, if Fairfax wanted to start from scratch & acquire the whole business again paying market values - I am estimating they would need to spend US$771 per share (using adjusted BVPS) & that compares pretty favourably to share price of US$404. -

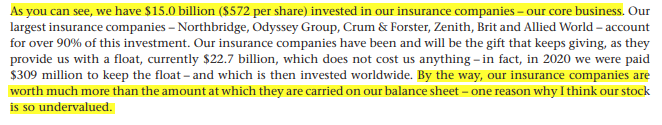

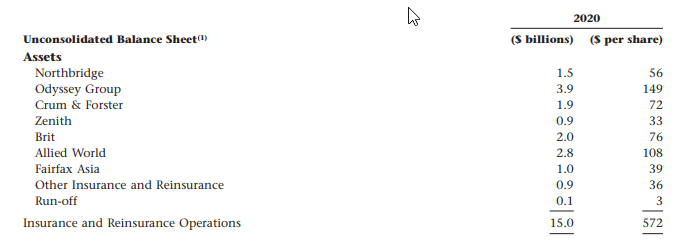

I thought this topic deserves to have its own thread. In 2020 AR shareholder letter, Prem wrote Prem believes insurance subs are worth much more than their carrying value of $15bil or $572 per share at 31 Dec-20. Here is the breakdown at 31 Dec-20 I have in previous posts put up a chart showing P/BV multiples for 15 of Fairfax's insurance peers. The median multiple was 1.3x shareholders' equity & I think thats reasonable to use on the basis Fairfax's CR (excl Covid) over last 3 years is close to peer median & Fairfax's NPW growth rate is at higher end of its peers. Fairfax doesn't break out by reporting segment its insurance subs carrying value at 30 Jun-21 - there are moving parts here such as divs to the holdco. Lets just assume 10% growth in shareholders equity to 30 Jun-21. I am then adding the $1.8 bil revaluation of Digit (Jul-21) that is subject to approvals expected Q4-21 which is Fairfax's share of Digit. 1. Estimate Carrying value at 30 Jun-21 = $15 bil x 1.1 = $16.5 billion 2. Apply 1.3x multiple to estimate market value of insur & reinsu subs = $16.5 bil x 1.3 = $21.45 billion 3. Add Fairfax's share of Digit revaluation = $1.8 bil Estimate Market value (attributable to Fairfax equity holders) at 30 Jun-21 = 21.45 bil + $1.8 bil = $23.25 bil Estimate Carrying value (attributable to Fairfax equity holders) at 30 Jun-21 = $16.5 billion Estimate excess fair value over carry value (excluding Digit revaluation) = $6.75 billion ( or $260 per share pre-tax based on 26 mil shares outstanding) So Prem believes the insurance subs are worth a lot more than their carrying value (or book value). I am estimating based on peer median multiples a number of around $6.75 billion. What does everyone else think? (Edit note I am assuming the 16.5 bil carrying value does not include the Digit revaluation. If we include the Digit revaluation as if it happened at 30 Jun-21, then you could add $1.8 bil to carrying value to get $18.3 bil , then subtracting this from market value estimate = $4.95 bil excess of fair value over carrying value which will make more sense if you read my post below where I try & tie these numbers back to book value per share)

-

I am expecting this will grow for 2022. If we use growth in book value as a rough proxy then we could expect subs statutory surplus to be higher - but we need to wait on Q3 results (Ida impact) & Q4 & also will depend on what they div out of the subs during the 2021 year. I agree that to get an immediate $5 bil buyback, we would need to sell a big sub. I actually believe Fairfax's insurance subs are being carried below their intrinsic worth & Fairfax have sold subs in the past like ICICI Lombard & First Capital & realised large capital gains. M&A for P&C insurers was around 1.2x BV in 2020 - I am guessing this would be higher now & then what would Fairfax's subs like Odyssey be worth - they have an excellent track record? I know Prem has said its their crown jewel & they would never sell but everything has a price & I believe they said they would never sell First Capital? We also need to go back to that buyback question? Is this the best decision? as @petecpointed out to me - we are in a hard market which provides an opportunity to really grow their net written premium substantially & premiums in insurance tend to be sticky so that will flow through later on in much higher net earned premium, underwriting profit & float. The best thing about growing organically is that they are underwriting that premium themselves, often with existing clients who they are already offering line/s of insurance to so its a safer & cheaper way to build than through acquistions. I think they will try & strike a balance between growth & buying back their shares but buybacks are not the only way to build intrinsic value & pushing capital into their insurance business at the moment to grow premium seems smart & makes sense. If you cast your eye across their peers, Fairfax are sitting at the higher end in terms of double digit premium growth while others who often have a more rigid geographic focus as well are growing at single digits.

-

https://www.livemint.com/companies/news/warren-buffett-goldman-sachs-win-from-fintech-gold-rush-in-india-11635823280259.html

-

@Daphneno nothing concrete just a guesstimate - in 2017 Fairfax took around 1% share (or 1.3 bil) of the $130 bil in insured losses, the estimated insured losses from Q3 (both Ida & European Storms) are probably in the US$40-50 bil area https://www.insuranceinsider.com/article/2923c79ber4dpafctaq68/aigs-mark-lyons-sees-q3-insured-catastrophe-losses-at-40bn so if we take 1% we are at say US$450 mil area but this is just a guess. Esimtating the CR is tricky because we don't know how much favourable reserve development or what other catastrophe exposure/lsosses they might have. But assuming no major reserve release in Q3 and an UWP of $185 mil (but for Ida etc), so if we subtract that from 450mil it probably puts them over 100CR for Q3 but I think they could still sit under or close to 100CR for 9mths if my estimates are close & also we still have Q4 to come - baring any major catastrophes you would expect a decent UWP there.

-

https://www.theinsurer.com/viewpoint/rock-solid-allied-world-in-bermuda/19054.article

-

I should just qualify my comment with that expected return, that I am expecting negative impact from catastrophe losses in Q3 but still expecting its manageable & so that we still get to a high 90s CR for full year.

-

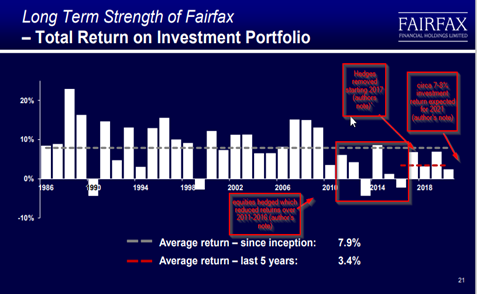

+1 agree - including Digit gain expected I guess now for Q4 - we are probably on track for an approx 7% or maybe closer to 8% total investment return for this year (assuming there is no major drawdown in markets by year end) which I think would be the biggest since 2014 Here is a visual on those hedges I put together a while back - I have edited in red show impact of hedge removal

-

I can't think of one successful investor that hasn't had a serious f*** up and Prem is no different - I guess that makes him human. I loved Buffett's reply in response to comment around his unsuccessful airlines investment & he replied our company still has more net worth than any other company on the planet....so true And not just in world of investing but even in sport, I still can't get over (for football fans) Zidane's headbutting incident in the world cup final against Italy - one of the greatest footballers on the planet making an absolutely worst possible decision at the worst possible moment - during a world cup final! But hey he is still one of the greatest footballers of all time. Prem & Fairfax's record will be judged by the investment community in the fullness of time - we're all lucky we don't have our records (and dirty laundry) on public display

-

I just realised if we back out the $1 bil probably in shorts over 2017-2020, they probably would have done a double digit growth in BVPS over 2017-2020 period versus 9% p.a reported.

-

I am not sure exactly what hedges/shorts they had in place - but assuming they had hedges on S&P500 - it has doubled since end of 2016 when it was around 2,300 when I gather Fairfax removed its hedges, so that probably also validates their shift to a more bullish stance. Even the corrections in 2018 & 2020 didn't push past that 2300 level from what I can see. Maybe they had individual shorts that could have been more optimally removed but I think what Fairfax did was say we are making a strategic decision & we will be consistent through the whole portfolio. I think they still will hedge to lock in gains on an individual equity positions but not speculative shorts where the potential losses are unlimited. Yes agree - I think their high % of cash & short term investments (versus other insurers) also provides a 'hedge' in some ways for their equity position - it provides liquidity given equity concentration & gives them opportunity to raise their bond allocation at higher yields.

-

thanks Viking for summary - yep glad they are gone

-

smart timing on their Enthusiast gaming sales - I like these 'platform content' bets (Blue Ant & Boat Rocker) by Fairfax because they have strong tailwinds (in our house we only watch streaming TV) - Boat Rocker still expects its revenue to materially ramp up in FY22 as fewer covid restrictions allow them to ramp up production - not too worried by the share price dip since IPO.

-

Partner re sold for around 1.28 x BV https://leaderpost.com/pmn/business-pmn/exor-covea-clinch-9-bln-partnerre-reinsurer-deal-on-pre-pandemic-terms-2

-

Yes its feels like policy makers have their heads in the sand https://www.reuters.com/breakingviews/crypto-poses-systemic-risks-that-need-swift-remedy-2021-09-07/ I often think what would the world be like if we could only invest in crypto & not in any other asset class? Well we would be massively capital starved & that would affect everything - the pace of innovation & the quality of all our lives would be considerably reduced. Like Bill Gates I think said said, better to invest in things that actually create goods & services that people need and want - thats creating real value for society. Yes the blockchain is incredible technology but the crypto currencies themselves have this primary utility as trading toys.

-

https://www.livemint.com/companies/start-ups/acko-turns-unicorn-after-255-million-fundraising-round-11635360200201.html Digit's rival Acko valued at $1.1 billion in recent fundraising round. Acko is growing GWP faster than Digit but off a smaller premium base. Acko targeting 1200 crore GWP for year end Mar-22 (FY22). Digit has written 2,200 crore in GWP in 1H FY22 https://indianewsrepublic.com/digit-insurance-is-targeting-premium-sales-of-sek-6500-by-october-2022/507088/ & assuming similar growth in 2H FY22, Digit will write 4x more premium than Acko. I think this provides a decent insurtech comparable & IMO further supports Digit's recent valuation.

-

FFH (US listing) vs S&P500 over last 5 years - yikes my data estimates below - for S&P data from https://www.multpl.com, FFH data from morningstar.ca https://www.morningstar.ca/ca/report/stocks/valuation.aspx?t=0P00006821&lang=en-CA except for Fairfax price to forward book from https://seekingalpha.com/symbol/FRFHF/valuation/metrics S&P multiple expansion y/e 2016 S&P price to book 2.91 & price to sales 1.95 (& div yield 2.0%) current S&P price to book 4.87 & price to sales 3.13 (& div yield 1.3%) FFH multiple compression y/e 2016 FFH price to book 1.18 & price to sales 1.13 (& div yield 1.9%) current FFH price to book 0.7 & price to sales 0.48 (& div yield 2.4%)

-

HWIC Asia Fund (parent FFH) looks like this is the investment vehicle through which FFH holds its IIFL positions https://trendlyne.com/portfolio/superstar-shareholders/custom/?query=Hwic Asia Fund Class A Shares note recent $15mil approx investment in 5paisa part of cap raising closed in July 2021 -https://inc42.com/buzz/zerodha-rival-5paisa-to-raise-over-inr-250-cr-through-equity-issue/ Other investments include - 49% stake in Quantum Advisors - US$3 bil Asset manager https://hedgefunddb.com/Home/FundDetails/801-70375/QUANTUM-ADVISORS-PRIVATE-LIMITED - 39% of Eagle Insurance - appears to be a small insurer in Mauritius https://www.eagle.mu/our-history - HWIC has 2.97% interest in JKH & remaining 10.75% held by FFH (via their broker Citigroup) - https://keells.com/resource/annual-report/John_Keells_Holdings_PLC_AR_2020_21_CSE.pdf

-

true -it probably makes sense from liquidity point of view to hold a big cash position if you are over-weighted on equities (like in 2020 they were able to hold all their equity positions & were not forced sellers). So maybe higher rates could see a shift to greater bond weighting & lower cash and potentially lower equities weighting - but I am just speculating.

-

I suspect they would want to make more than an extra 1% but just to illustrate P&L $ impact

-

Yes agree Viking I think they can do 700 UWP provided we have a normal cat year - will be pressure from Ida/Euro storms on Q3 so high 90s CR would be a decent result for 2021 I think the operating earnings picture (excluding investment gains) will become a lot more visible over next 12-18mths - if they can do 700 UWP, 700 approx interest & divs, 500 profit from Assoc and 100 from non-insurance businesses (incl Thomas Cook, Recipe etc) that would get them to $2 bil in revenue before any investment gains. Also interest on fixed income is the wild card here, 10yr has moved up to around 1.64% & Fairfax have around 39% or $18 bil in cash & short term investments (1/2yr treasuries) that are basically making close to nothing, if they can park say 50% into bonds earning an additional 1% yield, that would add $90 mil per annum to their interest income. Also Fairfax have I believe a duration of around 1.8 years on their fixed income portfolio which I think would put them at low end compared to their peers - so all else being equal if rates move higher, then Fairfax's BVPS is more insulated from higher rates (will fall less) plus they have the opportunity to dial up their interest income.

-

https://www.thehindubusinessline.com/companies/thomas-cook-india-witnessing-a-huge-surge-in-demand-for-leisure-travel/article37119888.ece