glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

I just had a listen to the Farmer's Edge Q3 conference call - they expecting to be cash flow positive on annualised basis in 2024 - expect their cash burn to reduce going forward - they believe they have enough cash on hand until they become cash flow positive (so hopefully no further funding needed from Fairfax ) - expect Digital Agronomy revenues to be 33% higher in Q421 (over Q420) which should reduce their cash burn to b/w 5-10 mil in Q4. - they have largely a fixed cost structure so path to break even & beyond comes down to acquiring new acres & selling related services. - they are continuing to develop financial services products & insurance products in conjunction with Fairfax such as yield prediction feature (used by lender & insurers to manage underwriting risk) - expect revenue growth from carbon offsets

-

Here is a chart I put together to show Fairfax's investments per share multiple versus peers. What you do notice straight away is that insurers with lower combined ratios (higher levels of underwriting profitability) tend to trade on lower investments per share multiples. And this makes intuitive sense - the less profitable the underwriting, the higher the investment returns need to be for investors (ie you would require more investments for each $1 invested to earn an attractive return). I estimate Fairfax had an average combined ratio (excl covid loss) over 2018-2020 of 96. By my calcs, Fairfax's peers that have average combined ratios between 95 & 97, over same period, are trading on investments per share multiples of 1.5 to 2.3x . However, Fairfax's investments per share multiple looks to be 3.5x - much higher!

-

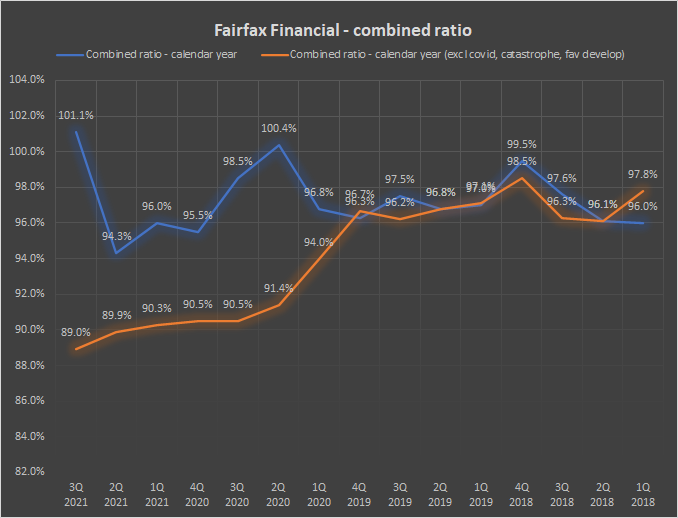

yes viking I think 96-97 sounds reasonable - I have done some calcs below as well Worth noting too that while Q4 is usually cat heavy, it looks like this US hurricane season will likely a bit lighter in Q4 https://www.local10.com/weather/2021/11/12/hurricane-season-is-likely-over-yet-again/ Underlying CR (excluding covid, cats, favourable develop) looks to be on a downward trend on back of this higher net earned premium - so I think could potentially hit 88s region in Q4. Q420 90.5 Q121 90.3 Q221 89.9 Q321 89.0 Q421 (88s??) I would expect covid to have minimal impact based on Q3. So remaining impact on CR will come from fav development and catastrophes. Fav development has averaged 1.2% over last 3 quarters & was 5% in Q420. So for favourable development I would estimate around 1-2% in Q4. Lets say 1.5% slightly more than quarterly as would expect them to be conservative around releases pending the Q4 audit. On the flipside, I think economic inflation is something which will probably encourage them to be more restrained on any Q4 release. For catastrophe losses, 6.6% in Q420 & 8.9% in Q419. Lets estimate catastrophes at the mid-point at 7.7% although noting that a lighter hurricane season could reduce this further. Underlying CR 88.5 (lets estimate) + Fav devopment -1.5CR points + Catastrophes 7.7CR points = 94.7 CR estimate for Q4. That would give an annualised CR of around 96.4 Of course, this is all guesswork as we are at the mercy of the weather

-

yes agree @Viking not every investment is going to work & its the overall bottom line result at the end of the day - on that point Fairfax's equity portfolio is continuing to do well & still looks to be up by over $500 mil since 30 Sep (including common stocks & consolidated/equity accounted positions) - Boat Rocker & Dexterra on track & some of Fairfax's largest holdings have also seen solid Q3 results Atlas Corp, Stelco, Recipe, Kennedy Wilson - Eurobanks results still to come...

-

sorry should clarify its being carried at around 303 mil (at 31 Dec) & mkt value around 94 mil - I think high probability of impairment on this holding in Q4.

-

Well in stark contrast to Stelco & Atlas Corp, the Q3 results from Farmers Edge are out - results look terrible with a very high cash burn - fortunately this is not a major position for Fairfax (circa 100 mil now) - cost structure 23.1 mil for Q3 looks ridiculous against the revenue number of 6.8 mil . What I can't understand is how their annual recurring revenue has increased from 53 mil (Q420) to 64 mil in latest quarter - but they are only generating 6.8mil in quarterly revenue - maybe its a timing issue?? I am going to check out the Q3 analyst call which might provide some insight & expectations around Q4 ^& Fy22. https://www.farmersedge.ca/wp-content/uploads/2021/11/Third-Quarter-2021-Results.pdf

-

1.8% I believe thats a record market share for them - we have to take IRDAI numbers with pinch of salt I think because they are not audited & 3rd party but still I think it does indicate Digit are continuing to generate premium at very strong growth rate - so they look to be on track

-

Well hopefully Fairfax will be able to start deploying their cash/st investments into higher yielding fixed income but given their continued cash/st investments build over Q3 (to 44% of their total portfolio) I suspect they are not ready to move just yet - I think interest rates probably need to go higher but I also think that move will be tempered to a degree as there are still covid related 'temporary' drivers which are impacting the recent inflation numbers https://www.cnbc.com/2021/11/10/us-bonds-treasury-yields-climb-as-investors-eye-key-inflation-test.html At September 30, 2021 the company's insurance and reinsurance companies held portfolio investments of $48.1 billion (excluding Fairfax India's portfolio of $2.1 billion), of which approximately $21.2 billion was in cash and short dated investments representing approximately 44.1% of those portfolio investments.

-

Atlas's results are out & they look great on an underlying basis - Fairfax's largest equity holding so important that Atlas does well Atlas Corp. Third Quarter 2021 Financial Performance Compared to Third Quarter 2020 Revenue growth of 17.0% to $451.9 million Adjusted EBITDA(4) growth of 29.0% to $322.2 million Funds From Operations ("FFO")(1) growth of 42.9% to $248.0 million and FFO Per Share(1) growth of 36.8% to $0.93 Earnings per diluted share of $0.30 Adjusted diluted EPS(1) of $0.56, representing growth of 107.4%, excluding $70.9 million non-cash charge, or $0.26 per diluted share, related to loss on debt extinguishment https://ir.atlascorporation.com/2021-11-08-Atlas-Reports-Third-Quarter-2021-Results

-

https://www.moneycontrol.com/news/business/startup/what-is-driving-optimism-in-the-indian-insurtech-space-7688641.html At least 30 percent of first-time insurance buyers over the next few years will be the younger population in the age bracket of 16 to 21 years. They are digital natives and their buying experience and expectations around their experience will be completely digital,” says Jaikrishnan. He expects insurtech aggregators and brokers to grow five-fold over the next few years. Back-end service providers and pure tech insurance service provider companies are likely to see year-on-year growth of around 50 percent as capabilities will have to be added to cater to growing demand

-

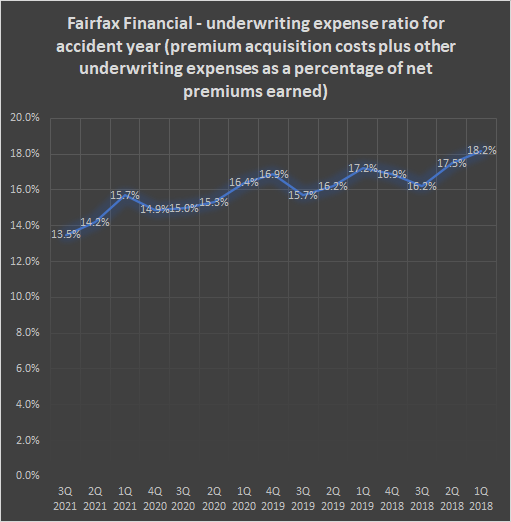

I have done up a few charts incorporating the latest Q3 result - according to my estimates underlying combined ratio appears to show continued improvement. 1. Covid - appears had a fairly minimal impact on Q3-21 results - actually was positive and reduced CR by 0.2 CR points (so still watchful on this but hopefully we are now through the worst of covid) prior year adverse development - covid -0.5% Loss & LAE - current year - covid +0.3% Net impact on CR -0.2 points 2. Underlying Combined ratio (stripping out impact of covid, catastrophes & favourable development)looks to be 89% (1st chart below) - continuing the downward trend & appears due mostly to hard market driving higher net earned premium effectively reducing the underwriting expense ratio - now down to 13.5% (2nd chart below). My takeaways - would expect covid to have lesser impact going forward on CR - expect catastrophes and reserve development will have main impact on CR going forward - with Q3'21 showing the lowest underlying combined ratio (stripping out impact of covid, catastrophes & favourable development) since 2018 with downward trend continuing - this raises the probability of lower combined ratios & higher underwriting profitability going forward - assuming both catastrophe losses & favourable development in line with prior years.

-

@petecactually maybe I shouldn't have used 'forward' - you are right it should be current BV - but I wanted to capture residual Digit revaluation (deal done more timing issue) and portfolio increase since 30 Sep - maybe return on adjusted book value is a better expression. Hope that makes sense.

-

Taking the above estimates, lets think about Fairfax's Earnings yield (incl net investment gains) going forward in terms of current share price - how about we use Return on Forward Adjusted BVPS as a proxy for ROE 7.5% ROFABV = $47 (Earnings yield 11%) 10% ROFABV = $63 ( Earnings yield 15%) 12% ROFABV = $75 (Earnings yield 17%) 15% ROFABV = $95 (Earnings yield 22%) I think over time they can do around 12% Return on Adjusted BV (and everything over this is a bonus), however, even if they end up in high single digits eg 7.5%, the earnings yield on current share price still works out to be in low double digits at ie 11% - Fairfax's shares still look very cheap IMO (Edit note: removing the word 'forward' as its confusing - adjusted book value incorporates remaining Digit revaluation $37)

-

thanks Viking - using your estimate I have estimated adjusted forward book value per share Adjusted Forward BVPS - current estimate BVPS (30 Sep) 562 (reported) Digit revaluation 37 (expected Q4'21 or possibly Q1'22) Pre-tax excess 15 (19 pre-tax) (reported) Adjusted BVPS 614 Add Unrealised gain (post-30 Sep) 17 (21 pre-tax) (using estimate per Viking update) Adjusted Forward BVPS 631 USD ( 788 CAD) Stock Price (5 Nov) 432 USD (538 CAD) Price to Adjusted Forward BVPS 0.68 (edit note : removing word forward as its confusing - adjusted bvps incorporates Digit revaluation expected Q4 or Q1'21)

-

Eurobank - Fairfax slightly increased its share holding over Q3'21 from 30.5% to 32.2% Atlas Corp - it doesn't appear Fairfax exercised any warrants in Q3 as shareholding about the same as Q2

-

Here are few quick thoughts but I need time to digest - honestly I thought this would be a flattish result after a strong 1H21 Compared to 2017 insured losses where Fairfax had 1% share - it looks to be very close to that here on Ida & Euro storms - I actually thought their combined ratio would be higher - if Q4 is decent they could very well end up closer to 95-96 area for Fy21. Yes Brit needs to do a lot better on the other hand look at the 94.4 CR for Allied World which is excellent compared to their results in 2017 - I think a lot of great work has been done here - also with Brit small point but we need to factor in that expenses from Ki which is a start up are increasing the CR but also driving increase in NWP in Q3 44% increase with Ki (& 17% increase without Ki). Q3 result looks fine to me - $561 in book value with a further $37 from Digit to come in Q4 (looks like they took $9 MTM earlier than I thought) - unrealised gains on both their on non-insurance subs & common stocks - I suspect they are they up since Q3 end? But I need to do the calcs. I think a positive surprise in Q3 is the operating profit contribution from associates ($172 mil) & non-insurance subs ($25 mil) - this will be one to continue to watch Their quarterly run-off exp has almost gone to zero - is that a one-off or new normal??

-

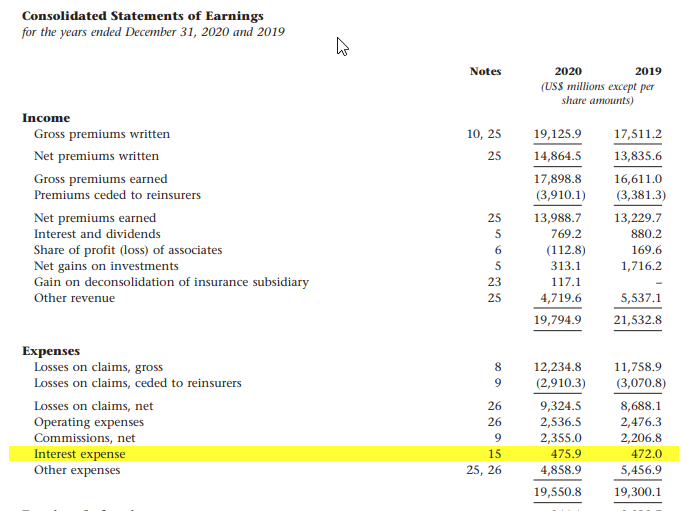

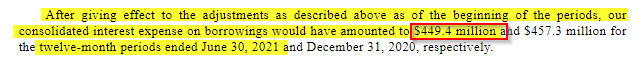

@modiva it looks like Fairfax has reduced its annualised interest expense by around 5.5% this year from $475 mil in 2020 to $449 mil current. AR2020 https://www.sec.gov/Archives/edgar/data/0000915191/000110465921120474/tm2127687-4_f10a.htm

-

Yes plus the Digit revaluation (1.2bil approx- $46 per share- Q4 expected closing I guess) will further lower the Debt to Capital ratio

-

@modiva it is worth looking at the debt in three buckets 1. holdco debt 2. insurance/reinsurance subs debt 3. non-insurance subs debt So on 3. non-insurance subs debt. When we have a controlling interest in a company (for example, Recipe or Thomas Cook India), we are required to consolidate that company’s financial statements into our own financial statements even though we do not guarantee the debt – and quite often it is an investment in a public company. (AR 2020) So this debt is not guaranteed by Fairfax - if Fairfax instead of owning these non-insurance subs replaced them with small shareholdings (<20%,non-controlling) then this debt would disappear. The debt is required to be consolidated under accounting rules because Fairfax is a controlling shareholder. So when you are looking at Debt to Capital ratios & comparing to other insurers just keep 3. in mind, as Fairfax generally has more concentrated equity positions than other insurers which might own ETFs, or more diversified equity portfolios.

-

Kennedy Wilson https://finance.yahoo.com/news/kennedy-wilson-reports-third-quarter-201500851.html "Our strong 3Q and year-to-date results reflect the tremendous progress we have made in growing our business over the last 18 months," said William McMorrow, Chairman and CEO of Kennedy Wilson. "We saw exceptional rent growth across our portfolio in 3Q resulting in continued growth in the value of our real estate portfolio. I am also pleased to report that the Board of Directors increased the quarterly dividend by 9% to $0.24 per share."

-

@Viking yep I think so too - I think because its a private company they are keeping a lot of the financial stuff confidential

-

yes agree - considering that 30% of operating weeks were still affected by Covid looks like a stronger result than Q3'19 - revenue & EBITDA per restaurant is higher & adjusted net quarterly earnings 27.6 mil vs 19.5 mil - Q4 will continue to be affected by vaccine passport requirement & higher labour/food costs but moving along nicely - will be interesting to see what they can do when covid restrictions are closer to 0% level & I wonder if they can continue to still do reasonable level of ecommerce sales (how much will still remain when restrictions fully eased)

-

article on Eurobank re JP Morgan - at new 52 week high (last time I commented on Atlas reaching 52week high $16 it promptly fell to $14 so look out More specifically, it points out that it maintains an overweight stance for Eurobank and Alpha due to growth (with Eurobank remaining its top choice) as well as for the National Bank due to its defense balance sheets, while maintaining a neutral stance for Piraeus, underlining the significant transformation which also notes the very good history of the administration, but noting that it shows lower capital cushions and has a longer way to normalize ROTE. Thus, it gives a target price of 1.5 euros for Alpha with a margin of 35%, 1.20 euros for Eurobank with a margin of 29%, 3.30 euros for Ethniki with a margin of 20% and 1 , 90 euros for Piraeus with an increase margin of 29%. https://www.capital.gr/oikonomia/3592324/to-taxidi-tis-jp-morgan-stin-athina-kai-ta-minumata-gia-tis-ellinikes-trapezes-ti-tha-enisxusei-to-elkustiko-story-tou-kladou

-

Transaction records from BscScan appear to show the token’s anonymous creators collected least $3.4 million in investor funds. The crypto ecosystem is rife with so-called “rug pull” schemes wherein token founders abruptly abandon their project and take investor funds with them by swapping the project coin for cash. “Squid Game Dev does not want to continue running the project as we are depressed from the scammers and is overwhelmed with stress,” Squid developers posted Monday in their Telegram channel, which now has more than 89,000 members.