glider3834

Member-

Posts

1,019 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

good pick up thanks Viking - its like that saying always go back to the source - I guess thats the potential issue with any 3rd party sites - not sure if yourself (or anyone) has a site they visit thats free which has analyst ratings, I prefer not to subscribe. I like to be aware of analyst ratings (& ideally if information is available understand their reasons & how they get there) not to rely on but rather if it is massively different from my own target it leads me to check, double-check & triple-check again my investment thesis

-

for what its worth - appears to be a few analyst upgrades for Fairfax since buyback announced https://www.marketbeat.com/stocks/TSE/FFH/price-target/

-

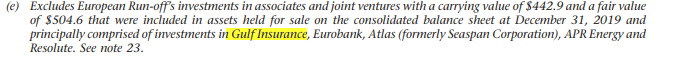

yes sure Viking - $475 mil cash purchase - partly funded via two capital raises Sep-21 - rights issue 50 mil KWD (circa US$165 mil) - was fully subscribed not sure Fairfax's final allocation https://www.gulfinsgroup.com/Home/Investor-Relations/Capital-Increase Oct-21 - perpetual bonds issue 60 mil KWD (circa US$199mil) S&P assigned 'BBB+' issue rating to the subordinated notes that GIG is issuing. This came after the group announced that it had obtained all the necessary regulatory approvals that it is issuing up to Kuwaiti dinar (KWD) 60 million (US$199 million) of Tier 2, junior, subordinated, perpetual notes, which will qualify in their entirety as capital for solvency purposes https://www.gulfinsgroup.com/Renderers/Showmedia.ashx?Id=9416b770-8dee-494c-a22b-419e8e3b2ca3&download=false assuming they fully participated in the rights issue, then I suspect Fairfax's ownership would remain around same %

-

cheers @wondering - I appreciate the contribution everyone makes on this board & try to return the favour as best I can

-

not a huge holding for Fairfax but LFL has launched a 10.7% substantial issuer bid after a record 3Q result - Fairfax stake around 9% or US$140mil approx now but could get pushed up further with this buyback- LFL looks to be trading for less than 10x PE - looks interesting I might take a look further at this one https://finance.yahoo.com/news/leons-furniture-limited-announces-intention-133000362.html https://www.lflgroup.ca/English/news/news-details/2021/LFL-Canadas-Largest-Home-Furnishings-Retailer-Releases-Record-Financial-Results-for-the-Third-Quarter-ended-September-30-2021/default.aspx

-

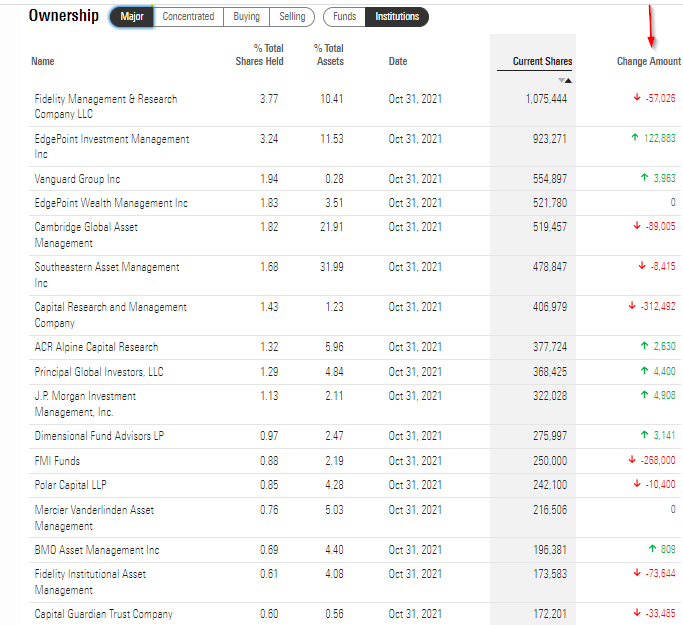

I just had a look on Morningstar here https://www.morningstar.ca/ca/report/stocks/ownership.aspx?t=0P00006821 Apparently the top 20 funds & institutions are sitting on around 11.89 mil of FFH TSX listed shares or 41.7% of total shares held. Also worth noting that there are institutional investors who appear to have been recently selling Fairfax shares, who are sitting on 100,000 or more share positions - I think the liquidity of this SIB at potential premium to current share if tendering up closer to US$500 (current price US$460) could be attractive - hey the US$40 extra might even help pay the deemed div tax (if applicable to that seller)!

-

Gulf Insurance group results look strong & obviously benefiting from AXA acquisition https://www.insurancebusinessmag.com/asia/news/breaking-news/gulf-insurance-group-profits-skyrocket-242-316608.aspx Shares have advanced close to a 52 week high - current market cap 313 mil KWD ( approx US$1.04 bil ) Fairfax ownership 43.4% - now worth approx US$450 mil) I think part of GIG investment is included in Riverstone sale - I think Fairfax will repurchase unless they want to sell in meantime - either way I believe this GIG - Riverstone portion will be reflected in Fairfax's earnings as a derivative gain (from GIG share price increase) on their repurchase contract option.

-

This has been bugging me & please disregard my last post on this one- here goes Outstanding shares = Float (public) + Restricted shares https://www.wallstreetmojo.com/outstanding-shares-stocks/ (figures below in thousands) Public float = 24,167 (below) Share-based award - dilutive 1,558 & anti-dilutive 1,269 = 2,827 (at 30 Sep-21 from Q3 '21 Interim report) Outstanding shares = 26,994 (which is close to figure announced I think of 26,986) So I suspect the basic outstanding shares number (used to calculate Fairfax's book value per share) has not changed too much from 30 Sep-21 - does the above sound right guys?

-

I think this is a bit of a litmus test - if SIB is successful in whole or in part, then I don't think they will stop there - if Fairfax 's shares stay cheap- I think they will continue to find ways & means to buyback more shares (maybe sell a further slice of Odyssey) but it won't be at the expense of their underwriting capital strength& thats why they chose this path from a risk management viewpoint. I am pleased Fairfax are showing here clear intent - they are not simply going to sit & pass up this opportunity. We all talked about this previously on this board - the only path was to sell all or part of a sub to fund a major buyback. Also just on the potential issues with SIB with taxes etc - maybe that is one of the reasons they entered into the TRS due to the practical side of running a SIB - just a thought

-

I should add disclosure - I have small indirect interest in BRK

-

+1 agree - thats why I prefer Fairfax over Berkshire

-

We could only wish - I am taking the view Berkshire could be a better investment when WB eventually makes his departure from this world which sounds a bit morbid but it may lessen investor appeal or cause a sell off, meanwhile they have a deep bench of talent. I wonder if Buffett do a TRS on Berkshire's stock if he could get it at 20% or greater discount to book value? He hasn't shied away from using derivatives in the past. Although given their cash position maybe unnecessary.

-

I think we should look at this substantial issuer bid from a liquidity perspective as well for institutional investors & not looking at it purely from a retail investor angle. If you are a large institutional investor who maybe has been holding onto Fairfax for a long period of time - the SIB provides an opportunity to divest - with the current avg daily trading volume just 50,000 shares - it makes it very difficult to sell a larger position & heavy volume selling will likely impact price negatively. Also if a institutional investor has made an internal decision to sell because they have fundamental reasons for not owning the company then tax considerations will be of secondary importance, their first consideration will be that they are stewards of their fund investors capital and they have other investments which they deem to be more attractive. Also they can tender their shares at US$500 a share - a decent premium to current price. We are also running into the end of the calendar year & for institutions that want to rebalance their portfolio this is the time they will want to do it - so the timing of this SIB is relevant IMO. Also from tax perspective institutions that are pension funds or running pension accounts may see it as more attractive, or if they are sitting on a capital loss then maybe they can minimise the tax impact. I wouldn't jump to the conclusion that this SIB won't succeed at least partially & if they soak up maybe 50% through the SIB & maybe another 50% using their NCIB over the next 3 months then that could still work - I have no doubt that Fairfax would have taken on feedback in the past from insitutional investors & would have done their own research internally prior to launching this - there is a cost associated with it as well.

-

+1 agree - the longer the time period the more expensive the TRS There are 3 discounts in the current FFH share price IMO - share price discount to BV and BV is understated because - insurance subs - fair value > carrying value - non-insurance subs - fair value > carrying value

-

SJ I think thats one reason why they wanted to keep $1.5 bil in holdco & 2 bil revolver undrawn - with the TRS it is around 2mil shares & 733 mil or so exposure - given their existing liquidity & other potential options to raise further liquidity- cash flow risk is well covered IMO with downside risk low given strike price - its a calculated risk but I wouldn't put it in the same category as their macro bet. long equity total return swaps on 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 million (Cdn$935.0 million) or approximately $372.96 (Cdn$476.03) per share.

-

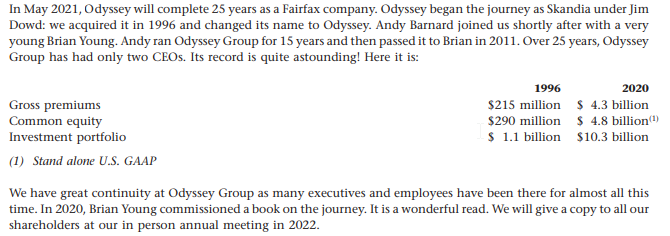

I need to correct this post - Odyssey's book value at 31 Dec-20 was 4.8bil using stand alone US GAAP (see below) - so it looks like this transaction was probably more in the 1.6x BV area (estimate Odyssey Group 30 Sep shareholder equity at 5.64 bil or 17.5% increase) . Anyway I am sure we will get more info on this transaction in due course.

-

ok thanks SJ I will take a look I guess Fairfax can also continue their NCIB (at market) to mop up shares that don't get tendered via SIB

-

how would this impact non-Canadian resident shareholders?

-

Yep I was unsure about this but it looks like restricted shares may have vested in Q4 (it seems like a lot but it may be a a consequence of Fairfax's expected profit/BV growth for 2021 which is likely to be a record result). Alternatively could it also be due to Odyssey sale transaction - there maybe clause to effect if Odyssey is sold for $X figure or a certain multiple of book value, then management/employees will receive incentive bonuses in the form of stock compensation or something along those lines.

-

Wow massive news Odyssey's carrying value which was 3.9 bil at 31 Dec-20 - they haven't reported 30 Sep-21 carrying value but lets assume around 17.5% increase in Fairfax's book value then its probably sitting around the 4.5 bil area - so sale price is around 2 x book value at 9 bil valuation by my estimate

-

hidden value at Eurobank? https://www.businessdaily.gr/epimonos-kipoyros/52739_oi-kryfes-yperaxies-tis-eurobank-oi-nees-tis-dei-kai-i-episkepsi-psalti-sti The news of the acquisition in Bulgaria of Raiffeisenbank (Bulgaria) by the Belgian KBC caused a lot of smiles in Eurobank , news that in Greece went to the "fine". KBC acquired 100% of the shares of the Bulgarian Raiffeisenbank for 1.015 billion euros, a price that corresponds to 13 times the P / E based on the expected profits of 2022 and 1.64 times the book value (also tangible book value, also of 2022) . And why are they smiling at Eurobank? Because, based on the size of Postbank, a subsidiary of Eurobank in Bulgaria, its respective valuation is set at 1.5 billion euros, when the market value of Eurobank on the Athens Stock Exchange is set at 3.5 billion. euro. And the forgotten value of the subsidiary in Bulgaria is not the only unrecognized value of the group.

-

AGT foods https://globalnews.ca/news/8035707/saskatchewan-commodity-trader-rail-network/

-

Media report that NSE IPO could happen soon The bourse is likely to be valued at over ₹2-lakh crore The much-awaited initial public offering of the National Stock Exchange (NSE) could be rolled out in the next few weeks since market regulator SEBI is all set to allow the bourse to re-file its prospectus for the share sale. https://www.thehindubusinessline.com/markets/stock-markets/nses-big-ticket-ipo-set-to-get-clearance-from-sebi/article37493243.ece

-

https://www.bloomberg.com/news/articles/2021-11-15/softbank-backed-policybazaar-jumps-in-mumbai-trading-debut PB Fintech Ltd., the operator of online insurance marketplace Policybazaar, surged as much as 23% in Mumbai, joining a flurry of Indian companies that recently jumped on their first day of trading. The startup climbed as high as 1,205 rupees as of 10:04 a.m. local time, after pricing shares in the initial public offering at 980 rupees apiece, the top of an indicative range. It raised about 57 billion rupees ($761 million) in the IPO that saw almost 17 times demand for shares on sale.