nwoodman

Member-

Posts

1,388 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

Spot on. Thanks

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Brilliant, will be watching. Season 1 is one of my GOATS. Season 2 not so much, didn’t even realise until your post that there was an S03, is it worth a watch or jump to S04? -

Nicely put

-

@SafetyinNumbers, @Viking my pleasure and it still looks undervalued. As always we take analysts with a grain of salt but I have enjoyed Nida Iqbal’s (MS Analyst) work over the last couple of years. It’s getting close to fruition that we bought a position in a bank, a shipping business, an airport plus an option on the fastest growing insurance sector with the ops and other positions throw in for free. They were some pretty helpful conversations only a couple of years ago. I find Fairfax, at times a little flighty, but their backing of Eurobank hopefully cries to the market patient and supportive capital.

-

MS just upgraded their PT for Eurobank from €2.01 to €2.33. They had this to say: ‘We upgrade Eurobank to Overweight: The Greek banks are on the top of our order of preference within our CEEMEA Banks coverage, given the most attractive risk reward. Our PT for Eurobank moves up by ~16% following a 7% and 12% upgrade to 2024 and 2025 estimates on better NII, consolidation of Hellenic Bank acquisition in Cyprus in 2025. On our revised PT of EUR2.33 we have ~40% upside to the stock from current levels.” and “The Greek banks are expected to restate dividend payouts with FY23 results. With growing capital ratios into 2025, we see upside optionality from excess capital being returned to shareholders in higher dividend payouts, and/or higher earnings growth via deployment into asset growth. Eurobank is testament to this, with its planned Hellenic Bank acquisition. Our estimates now assume higher payouts of 35-50% for the Greek banks by 2025. Our analysis suggests 140-520bps of excess capital over minimum management buffers by 2025 (620-940bps vs min regulatory requirement) for the Greek banks, with NBG standing out. We show below the potential upside of up to 9-38% to earnings from deployment of this excess capital over management buffers. We expect the reinstatement of dividends and return of capital to shareholders to be a key catalyst for the Greek banks in the coming months.” Report attached for those interested EEMEA_20240115_0001.PDF

-

Cheers, exactly what I was after. In a nutshell, you were forced, via the trust, to observe the power of compounding and that lesson was a game changer. Good for you Wishing Angela all the best for a speedy recovery.

-

You sir, are a true enigma, in the most intellectually respectful sense. I would have thought, given your considerable skills, you would give alpha a crack for a bit longer. Here’s hoping that Fairfax outperforms but never quite reaches your notion of “fair value” .

-

+1. Great post. On holidays at the moment so you have given me some new ideas to think about.

-

Thanks, a really interesting anecdote for my boys. Greatly appreciated I always find it helpful to learn more about the parents of people I am interested in. Could I trouble you for a short anecdote on Dad and how he came to be invested in Berkshire in the first place? I realise you are travelling so no hurry.

-

Indulge us. From what you have mentioned Berkshire and Gallagher have been key stakes. Your posts have been really helpful in terms of developing my own views on investing and in particular the Charlie Munger’s view of “sitting on your hand”. I am in the process of trying to illustrate this concept to my kids (young adults). I think your journey would provide a useful analogy in addition to the usual investing gurus as I believe your net worth delta is arguably more impressive as it did not rely on OPM?

-

I’ll take the $84 bn market cap right now if it’s in the offing , kind of thought that might be a story for 2030+. However very pleasing to see that they have some other assets in mind other than, perhaps, a particular bank

-

The way I don't lose too much sleep over the potential appointment is to think about Ben more along the lines of Howard Buffett's future chairmanship of Berkshire. I will say that listening to Ben's recent interviews etc, he seems to be pretty sharp. It wasn't that long ago that Prem was going to start giving the CCs a miss and leaving it up to the other execs, and there are some talented folks in that mix. Perhaps we will see Prem consider pulling back a little now that the share price has recovered somewhat. He is certainly a lot quieter in terms of media at the moment, it wasn't that long ago it was "Prem Everywhere". There is zero value in hauling it over the coals, but it sure is a different Fairfax post Paul Rivett, too.

-

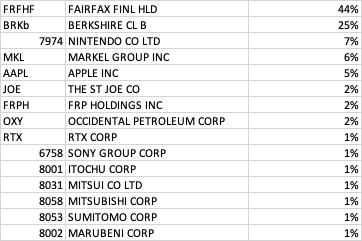

Personal Account Retirement Account Last year https://thecobf.com/forum/topic/20016-share-your-portfolio-2023/?do=findComment&comment=517254

-

+1 or perhaps that should be +1200 USD.

-

It sounds like the sale will be delayed until after the election (April/May). As far as I can tell it is still a two horse race: https://www.financialexpress.com/business/banking-finance-no-hurried-merger-if-another-bank-acquires-idbi-bank-3283816/

-

If there was a single narrative that could get Fairfax trading at 1.5x’s book it would have to be India

-

Good way to look at it. I would normally be in the bitching camp but am ambivalent as it it is great to see them having the confidence in their current financial position.

-

Zeihan on India - demographic tailwinds good for at least 40 years

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

+1 Brilliant. The first two seasons were good but S3 seems to have turned it up a notch. -

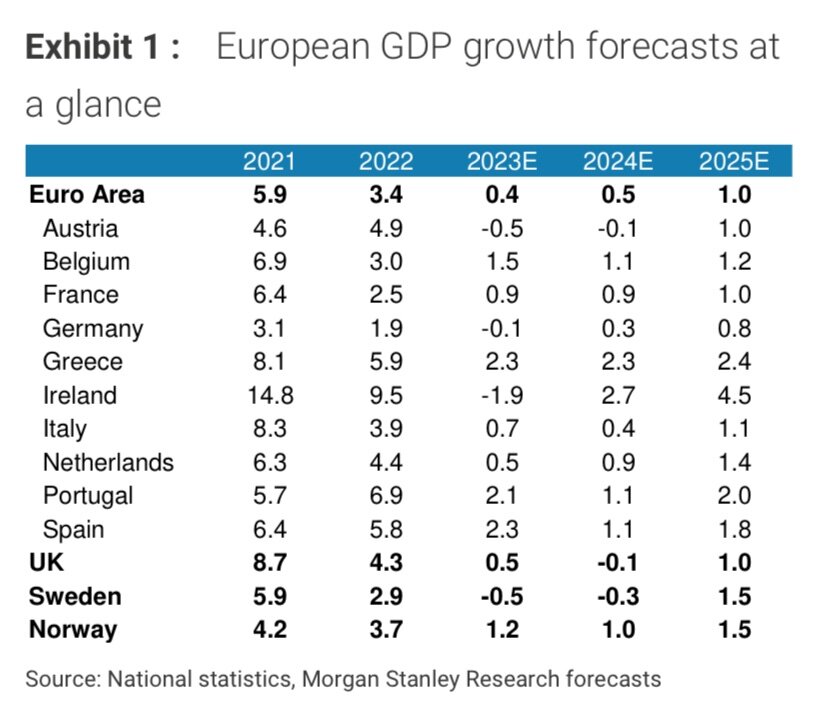

Well deserved and are likely to outperform over the next couple of years. MS recently released their outlook for 24/25 and this forecast caught my eye: While growth is forecast to slow they are still likely to be one of Europe’s top performers. They also had the following to say: “Fiscal consolidation under way: Greece has returned to primary surplus already in 2023. With the country's debt/GDP ratio at around 170% of GDP as of end of 2022, fiscal consolidation is a priority for the government. We expect the government to converge to a 2% primary surplus already in 2024. Debt/GDP should remain on a downward trajectory, reaching 148% of GDP by the end of 2025 on our forecast. Even if interest rates remain elevated, the debt comprises mostly institutional loans at a fixed rate, making its interest rate bill less sensitive to interest rate increases. Back to investment grade: After more than a decade, Greece returned to IG (DBRS and S&P). Moody’s and Fitch remain below IG, and we think that it will only be a matter of time before the two agencies also move to IG, the latest in 1H24, in our view. One of the more immediate benefits of IG status will be Greece's inclusion in indices as well as eligibility under the ECB’s collateral framework, and hence for ECB asset purchases. Current rules, with the exception of PEPP, list that a government bond needs to hold IG status from at least one of DBRS, S&P, Fitch and Moody’s. The upgrade of Greek government bonds to IG should also have positive spillovers onto the Greek economy by lowering the country’s cost of borrowing as well as by attracting more investment.” Non- paywalled link to the Economist Article https://archive.is/dx5Qj YEARAHEAD_20231112_2100.PDF

-

+44%. Thanks FFH and Mr Market. Running 1.3x’s leverage, so I take my hat off to those unleveraged board members with alphas of 20-40%, truly impressive.

-

Merry Christmas. Thank-you one and all for so much food for thought, such a magnificent collection of clever people.

-

Haven’t fully crunched the numbers but this growth in lending seems somewhat higher than GDP growth. Eyeballing it seems around 12-13% CAGR over the 9 years from the graph. Something to keep an eye on and a good test for the RBI. https://asia.nikkei.com/Business/Business-Spotlight/Indian-consumer-borrowing-surges-raising-fears-of-defaults “The central bank's change of risk weightings could prod lenders to increase rates, thereby discouraging consumers from reckless borrowing, analysts say. If banks choose to absorb the cost, their margins will shrink, making unsecured loans a less attractive segment. Financial services company Paytm said in a statement that it would reduce the disbursal of small loans "on the back of recent macro development and regulatory guidance." "That nudge from RBI to be cautious on unsecured retail lending can push lenders to slow growth in this segment, which can also impact overall bank credit growth by up to 100 basis points," research company Jefferies wrote in a note.”

-

What are you listening to ? (Music thread)

nwoodman replied to Spekulatius's topic in General Discussion

Now that’s my kind of funeral. RIP Shane McGowan Full Service https://www.youtube.com/live/tO8rWUq1U_A?si=_JmDkmBHp6CEmj8h