nwoodman

Member-

Posts

1,373 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

-

Not that there is much in it but 8001.T also runs a slightly higher thru-cycle ROE. Surprisingly resilient during COVID too. All the Sogo Shosha should still provide high single/low double digits. Not that appealing in absolute terms but becomes mildly appealing if you think Japanese rates are likely to stay lower for longer. The old boy nailed this one

-

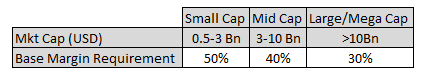

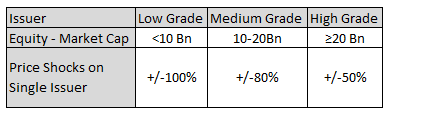

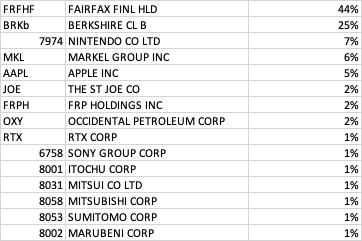

Running 1.35 at the moment in 2 currencies. AUD and JPY. I am pretty bearish on the AUD long term. JPY margin is 3/4 invested in Japanese stocks so it is a bit of a currency hedge too. Similar to @ICUMD it is partly directional, partly a tax offset against divs. Contrary to what others have suggested I wouldn’t recommend leverage to those starting out. It could be a very slippery slope. Not sure how other brokerages work but mine has prescribed LVRs based on market capitalisation. I simply would not have been able to use margin on the smaller companies I cut my teeth on. 98% of my investments these days are >$10bn so reduces but doesn’t eliminate the dreaded margin call in a 50% sell off The other issue is position sizing. Margin favours a more diversified portfolio. Mine at the moment is about as concentrated as it has ever been. The Single Issuer Concentration applies across all assets in the client portfolio, this determines the largest exposure on a single issuer. The single issuer concentration requirement will be determined based on the worst loss result from different price shocks according to the market capitalization in equity

- 32 replies

-

- using leverage on alibaba was a mistake

- leverage

- (and 2 more)

-

It’s interesting to ponder, I agree they would have locked if they could. All involved have played the interest rate cycle better than most. @Viking is 100% correct (as usual) that the take private was the right move. I bemoaned it at the time but they would likely be a single digit stock price by now. They gave us all the opportunity to invest in the parent which has worked out well. This is not to say they aren’t building long term value. There is an embedded non linearity as credit ratings of all involved improve.

-

Pretty much. They hedged IR but that has limits. Jury is out but this probably not going to be Prem’s Mid American moment. The beautiful thing is that they are continuing to pile up capital allocation options. This has been the epiphany for me with this company. Deal flow is critical, and a constant reminder of what will move the needle for a circa $25bn company vs $750 bn company. You can water them or let them wilt or just stick around for the cycle to turn. Poseidon, will no doubt be one of those 2030 stories, which suits me just fine

-

India Overtakes Hong Kong as World’s Fourth-Largest Stock Market “India’s stock market has overtaken Hong Kong’s for the first time in another feat for the South Asian nation whose growth prospects and policy reforms have made it an investor darling. The combined value of shares listed on Indian exchanges reached $4.33 trillion as of Monday’s close, versus $4.29 trillion for Hong Kong, according to data compiled by Bloomberg. That makes India the fourth-biggest equity market globally. Its stock market capitalization crossed $4 trillion for the first time on Dec. 5, with about half of that coming in the past four years.” https://www.bloomberg.com/news/articles/2024-01-23/india-overtakes-hong-kong-as-world-s-fourth-largest-stock-market?cmpid=socialflow-twitter-business&utm_content=business&utm_campaign=socialflow-organic&utm_source=twitter&utm_medium=social&embedded-checkout=true

-

+1 for better or for worse. No particular insight but I think he looks at the accrued cap gain tax owing as zero cost leverage to justify the position.

-

and they kept going up

-

Market expectations vs CoBF expectations

nwoodman replied to SafetyinNumbers's topic in Fairfax Financial

I tend to agree. There has been enough examples of valuation extremes over the last couple of years to suggest to me that the market is becoming less efficient rather than more so. This aligns with the view that it is passive (dumb) capital that is sloshing around. Throw in leverage and a speculative element and you have the underpinnings of some of these valuation extremes. This has created a lot of opportunities as is evidenced by some of the stellar performances by CoBF board members. As discussed at length, if Fairfax can move up in quality i.e. GARP then they should do 10%+. Looking at their current portfolio I would say they have a fair shot at doing this with their Greek and Indian exposure. Who knows even OXY might be able eke out 10%+. There is an asymmetry to that investment with Berkshire providing a $55 put that is appealing. -

I don’t disagree. However, I believe there is a share price that they would unwind the position today (IV). The fact that they haven’t (AFAIK) means we aren’t there yet. It is quite a unique situation. When they do eventually unwind the position it should create some short term downward selling both from physical availability of shares and sentiment. A problem for a much higher share price.

-

Hardly an original thought but while the TRS position remains open at a carrying cost of Libor + spread they are expecting something north of book value as a multiple.

-

Spot on. Thanks

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Brilliant, will be watching. Season 1 is one of my GOATS. Season 2 not so much, didn’t even realise until your post that there was an S03, is it worth a watch or jump to S04? -

Nicely put

-

@SafetyinNumbers, @Viking my pleasure and it still looks undervalued. As always we take analysts with a grain of salt but I have enjoyed Nida Iqbal’s (MS Analyst) work over the last couple of years. It’s getting close to fruition that we bought a position in a bank, a shipping business, an airport plus an option on the fastest growing insurance sector with the ops and other positions throw in for free. They were some pretty helpful conversations only a couple of years ago. I find Fairfax, at times a little flighty, but their backing of Eurobank hopefully cries to the market patient and supportive capital.

-

MS just upgraded their PT for Eurobank from €2.01 to €2.33. They had this to say: ‘We upgrade Eurobank to Overweight: The Greek banks are on the top of our order of preference within our CEEMEA Banks coverage, given the most attractive risk reward. Our PT for Eurobank moves up by ~16% following a 7% and 12% upgrade to 2024 and 2025 estimates on better NII, consolidation of Hellenic Bank acquisition in Cyprus in 2025. On our revised PT of EUR2.33 we have ~40% upside to the stock from current levels.” and “The Greek banks are expected to restate dividend payouts with FY23 results. With growing capital ratios into 2025, we see upside optionality from excess capital being returned to shareholders in higher dividend payouts, and/or higher earnings growth via deployment into asset growth. Eurobank is testament to this, with its planned Hellenic Bank acquisition. Our estimates now assume higher payouts of 35-50% for the Greek banks by 2025. Our analysis suggests 140-520bps of excess capital over minimum management buffers by 2025 (620-940bps vs min regulatory requirement) for the Greek banks, with NBG standing out. We show below the potential upside of up to 9-38% to earnings from deployment of this excess capital over management buffers. We expect the reinstatement of dividends and return of capital to shareholders to be a key catalyst for the Greek banks in the coming months.” Report attached for those interested EEMEA_20240115_0001.PDF

-

Cheers, exactly what I was after. In a nutshell, you were forced, via the trust, to observe the power of compounding and that lesson was a game changer. Good for you Wishing Angela all the best for a speedy recovery.

-

You sir, are a true enigma, in the most intellectually respectful sense. I would have thought, given your considerable skills, you would give alpha a crack for a bit longer. Here’s hoping that Fairfax outperforms but never quite reaches your notion of “fair value” .

-

+1. Great post. On holidays at the moment so you have given me some new ideas to think about.

-

Thanks, a really interesting anecdote for my boys. Greatly appreciated I always find it helpful to learn more about the parents of people I am interested in. Could I trouble you for a short anecdote on Dad and how he came to be invested in Berkshire in the first place? I realise you are travelling so no hurry.

-

Indulge us. From what you have mentioned Berkshire and Gallagher have been key stakes. Your posts have been really helpful in terms of developing my own views on investing and in particular the Charlie Munger’s view of “sitting on your hand”. I am in the process of trying to illustrate this concept to my kids (young adults). I think your journey would provide a useful analogy in addition to the usual investing gurus as I believe your net worth delta is arguably more impressive as it did not rely on OPM?

-

I’ll take the $84 bn market cap right now if it’s in the offing , kind of thought that might be a story for 2030+. However very pleasing to see that they have some other assets in mind other than, perhaps, a particular bank

-

The way I don't lose too much sleep over the potential appointment is to think about Ben more along the lines of Howard Buffett's future chairmanship of Berkshire. I will say that listening to Ben's recent interviews etc, he seems to be pretty sharp. It wasn't that long ago that Prem was going to start giving the CCs a miss and leaving it up to the other execs, and there are some talented folks in that mix. Perhaps we will see Prem consider pulling back a little now that the share price has recovered somewhat. He is certainly a lot quieter in terms of media at the moment, it wasn't that long ago it was "Prem Everywhere". There is zero value in hauling it over the coals, but it sure is a different Fairfax post Paul Rivett, too.

-

Personal Account Retirement Account Last year https://thecobf.com/forum/topic/20016-share-your-portfolio-2023/?do=findComment&comment=517254