Viking

-

Posts

4,640 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

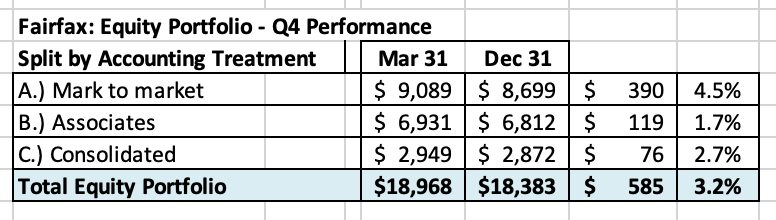

Change in value of Fairfax’s equity portfolio in Q1 - 2024

Fairfax’s equity portfolio (that I track) had a total value of about $19 billion at March 31, 2024. This is an increase of about $585 million (pre-tax) or 3.2%, which is a solid start to 2024.

I include the FFH-TRS position in the mark to market bucket and at its notional value.

My tracker portfolio is not an exact match to Fairfax’s actual holdings. My summary has been updated to include information from Fairfax’s 2023 annual report.

My tracker portfolio is useful only as a tool to understand the rough change in Fairfax’s equity portfolio (and not the precise change).

Split of total holdings by accounting treatment

About 48% of Fairfax’s equity holdings are mark to market - and will fluctuate each quarter with changes in equity markets. The other 52% are Associate and Consolidated holdings.

Over the past couple of years, the share of the mark to market portfolio has been shrinking. This means Fairfax's quarterly results will be less impacted by volatility in equity markets.

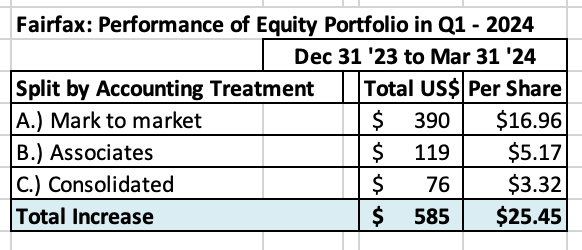

Split of total gains by accounting treatment

The total change is an increase of $585 million = $25.45/share

The mark to market change is an increase of $390 million = $16.96/share. The change in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter.

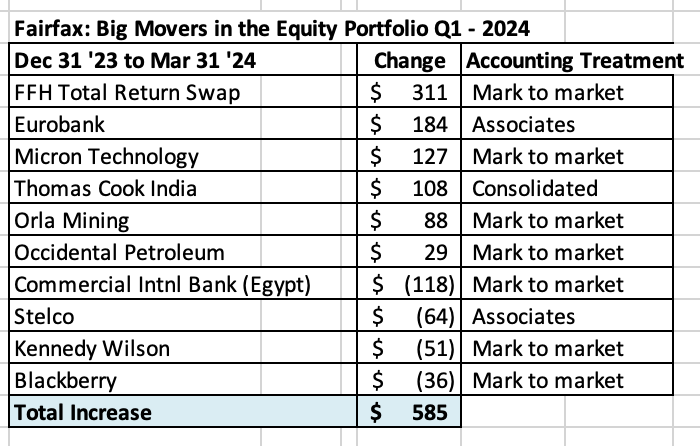

What were the big movers in the equity portfolio Q1-YTD?

- FFH-TRS is up $311 million. This position is now Fairfax’s second largest holding.

- Eurobank is up $184 million and it is now Fairfax’s largest equity holding at $2.4 billion.

- Micron Technology is up $127 million. It is now a top-10 holding at $461 million.

- Thomas Cook India is up $108 million. TCIC continues its strong performance.

- Commercial International Bank is down $118 million. Egypt devaluated its currency 40% on March 7. It is a well run bank. Country is an economic mess.

Excess of fair value over carrying value (not captured in book value)

For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1,206 million or $52/share (pre-tax). Book value at Fairfax is understated by about this amount.

- Associates: $722 million = $31/share

- Consolidated: $484 million = $21/share

Equity Tracker Spreadsheet explained:

We have separated holdings by accounting treatment: mark to market, associates – equity accounted, consolidated, other Holdings – total return swaps.

We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency.

This spreadsheet contains errors. It is updates as new and better information becomes available.

-

16 hours ago, Parsad said:

I think this is attributable primarily to Andy Barnard on insurance and Wade Burton/Lawrence Chin on investments. The culture is now there of quality at a fair price, rather than lesser quality at a great price. Cheers!

@Parsad I wonder if Fairfax has not been a tale of two businesses over the past decade. My guess is the insurance operations have been slowly improving in quality since Andy was put in his role (overseeing all insurance operations) in 2011. Every year Fairfax makes a couple of tweaks to its insurance operations to improve them - in 2023 it was reducing Brit's catastrophe exposure. Bottom line, insurance has been a solid business at Fairfax for the past decade. When I describe Fairfax as a turnaround play I am really doing a dis-service to the insurance operations.

Where the wheels came of Fairfax was on the investment side of the business. Yes, global central banks zero interest rate policies stunted the returns of the fixed income portfolio over the past decade (pre-2022). But fixed income wasn't really the problem.

Fairfax's problems from 2010-2020 were twofold:

1.) equity hedges / shorts

2.) equity portfolio

The first problem has been addressed. And, looking at the decisions the team at Hamblin Watsa has been making over the past 6 years, it looks to me like the second problem has also been addressed. At the AGM I would like to ask Wade Burton a question - what is the investing framework Hamblin Watsa uses today when investing in equities? Have there been any tweaks to the framework over the past 6 years or so?

-

On 3/26/2024 at 9:36 AM, This2ShallPass said:

Yes, that's the question I was trying to ask Viking - is Fairfax equity holdings high quality? They have knocked it out of the park in the last 6 years and it's been amazing. But, looking at the equity portfolio list, are the current holdings that different from this list from 2017 (without the benefit of hindsight of course)..

Atlas - most metrics have worsened. Not a good industry

Recipe - what has fundamentally changed to make it a better business?

Grivalia - yet to be proven, seems like a jockey bet on the CEO

Kennedy Wilson - down 50% last year and 35% ytd, temporary blip or fundamental issues?

Mining - cyclical industry, why is this different than buying Resolute 10 years back?

John Keels / CIB - is Sri Lanka and Egypt the best places for money. What specific advantage Fairfax has investing in these countries?

BDT/Shaw Kwei - what are their historical returns and why are they different from Mosaic capital

Dexterra - what has changed

I'm not suggesting these are poor businesses, but the portfolio is starting to slightly worry me. One of the concerns many here had back in the day was Fairfax always buys very cheap and low quality businesses, how can we be sure they're not going back to old habits.

@This2ShallPass , great discussion. I am preparing a longer post on this topic because I think it is important.

Quick question: how do you define 'high quality'? What metrics/criteria do you look at to help you determine if a company is 'high quality'?

-

4 hours ago, Hoodlum said:

it looks like Fairfax invested a total of $24M US in 2018/19 for their 50% ownership of Onlia. I have not found any other mention of this investment since then so I have no idea of its current value.

Looks to me like Fairfax is exiting an investment was probably not working out as hoped/expected. Time to move on.

From Achmea’s website:

- https://news.achmea.nl/achmea-and-fairfax-sell-canadian-start-up-onlia/

“Achmea and Canada's Fairfax Financial Holdings Limited have reached an agreement on the sale of online insurance agency Onlia to Southampton Financial Inc. (“SHFI”). Both parties expect that healthy growth and further development of the start-up will be better guaranteed outside the Achmea Fairfax combination. The financial impact of this transaction is limited.

“Onlia was founded in 2018 as a joint venture between Achmea and Fairfax (both 50% shareholders). The online IT platform of InShared, Achmea's digital non-life insurer, served as the basis for this. Onlia now has around 24,000 customers and a premium turnover of €44 million with home and car insurance. Southampton will take over the entire customer portfolio, while respecting and continuing the existing contractual agreements regarding Onlia's services to customers.

“SHFI is a holding company backed by strategic value-adding investors in the Canadian property and casualty distribution space. It provides strategic guidance and oversight, access to capital, new markets and back-end support services, including a leading-edge insurance technology platform to its portfolio companies, allowing them to focus on organic growth and to develop market leading insurance propositions serving the needs of a variety of consumers. SHFI shareholders are a group of industry veterans, (i.e. insurance companies, MGUs and brokerages) who benefit from an exceptional network and deep operational experience.”

-

9 hours ago, valueventures said:

This is helpful, thank you! Sounds like you've outperformed by being patient, waiting for a fat pitch, and then backing up the truck when the odds were heavily in your favor (rather than investing in a number of small positions and over-diversifying). "Calculated risk-taking", as you mentioned.

I appreciate the anecdote and am glad I've "gotten on the train". Hopefully it sets me up similarly well for the future.

@valueventures it should be noted that most of my investments are held in tax free accounts. Not having to think about taxes is a big deal. Simplicity usually leads to better results.

Here are some random thoughts on concentration. Stanley Druckenmiller has some pretty good thoughts on this topic.

1.) My first large investment when i was much younger was Bre-X. Went to zero. And it was the best $5,000 that i ever spent. Because it taught me lots of great lessons… one being the extreme danger of concentration.

Another lesson was it taught me the difference between speculating and investing. My Bre-X loss was very very painful - i hate to lose money. It motivated/pushed me to read:

- The Warren Buffett Way - Hagstrom

- The Intelligent Investor - Graham

- One Up on Wall Street - Lynch

- A Random Walk Down Wall Street - Malkiel

I stole ideas from each of those 4 books and began to stitch together what eventually became my current investing framework - one that fits my psychology/how i am wired. This is critical. And i know it works. This is also critical. To be successful you need both.

2.) My sample size is very small (times i was very concentrated). The fact i did not blow up my portfolio is partly due to luck. How much? Impossible to know. Bottom line, the investing gods have been very kind to me. They aren’t always - you can be right and still blow up. Eyes wide open - if you are going to play the game this way.

3.) I do believe making concentrated bets can lead to extreme outperformance (of the market averages). My 20 year average return is about 20% per year.

Not all of this outperformance is due to concentration. For example, I also pay attention to macro at times - this has worked out very well for me over the years but is likely a terrible idea for most people. As a stated earlier, most of my investments are in tax free accounts so i can easily make changes.

4.) I only concentrate in positions i think i understand extremely well - and where i think i have an angle/perspective that is materially different than Mr. Market. So i tend to fish in a very small pond (as people can see from my posts). Patience is important.

Fairfax was a big position for me in 2003. And again from 2006-2009. And again in late 2020.

Of interest, i was building a large position in Fairfax in late 2019. I thought things were getting better way back then - and the stock looked cheap. But i reversed course and went 100% cash in Feb of 2020 as Covid was rampaging its way across the globe and towards North America. I remember the day i sold everything. I was skiing with my son and a couple of his buddies at Cypress mountain in Vancouver. After a couple of runs in i told my son i needed to go into the lodge. It was clear/obvious to me that Covid was going to wreck financial markets. I sold every stock i owned that day. If i was right? I would miss the big downdraft. If i was wrong? I would miss a small gain - stocks hadn’t sold off yet. The risk/reward set-up for stocks was completely wrong (in my estimation). My son and i talked about it on the drive down the mountain - we both remember the conversation like it was yesterday (his buddies were passed out in the back of the van). I was lucky. Covid crushed stocks like Fairfax - in fact, Fairfax was still way down as late as October of 2020. Thankfully, Sanjeev was pounding the table and he got my attention (I started buying Fairfax again). When the Covid vaccine got announced in November of 2020 i got aggressive with my Fairfax position/research.

5.) I don’t like to be concentrated for extended periods of time. As a result, I was often too quick to take profits - although that likely saved me with Fairfax a couple of times. That cost me with Apple when i sold way too early (I exited right around the time Buffett started to buy).6.) Really, really good ideas (needle-moving) only come along about once every 5 years or so - at least for me. I do invest in lots of other things - the collective returns on these ideas probably track whatever the market averages are doing. Which is making me question why bother? Why not put this part of my portfolio into index funds?

7.) I wonder if my being drawn to concentration as a strategy is not a psychological flaw - where i am simply looking for a quick way to building wealth. Concentration is also very easy. Am i just looking for something that is easy to do?

8.) as i move from wealth accumulation to wealth preservation my plan is to concentrate much less than in the past - use broad based index funds more. Today index funds are 30% of my total portfolio - i have already started down this path and i love it (so far). My plan is to get this over 60% in the next couple of years.

-

14 hours ago, This2ShallPass said:

Thanks @Viking for another great post. Appreciate your deep dives into various aspects of Fairfax.

BDT and ShawKwei partners, combined investment is $1.2B. Has anyone followed them, are these good inv managers?

They have done great on their big investments, but when looking at this portfolio, first thought that comes to me is why is this high quality? Most investments seem to be in cyclical industries, economically / politically unstable countries (Sri Lank, Egypt) etc.

Even Atlas doesn't look to be doing that great from @nwoodman post. Pretty much all the metrics seemed to have worsened. I haven't followed Atlas, is this really a homerun investment? They are in a not so great industry though.

@This2ShallPass you ask a great question: “is Fairfax’s equity portfolio high quality?” (I am paraphrasing your question so please correct me if i got it wrong.)This is a hard question to answer. Compared to what?

Here is the question i am asking: “is Fairfax’s total equity portfolio increasing in quality?”

Using a time horizon of 6 years or more, I think the answer to this second question is an unambiguous yes.

Go back to 2017 and look at Fairfax’s equity portfolio. Blackberry was a big position (when you include the debentures). Exco. Fairfax Africa. Farmers Edge. APR Energy. AGT Foods. Mosaic Capital. Astarta. Resolute Forest Products. Recipe. Eurobank.

Back in 2017, the drag on the equity portfolio was twofold:

- many positions were poor performers - definitely not hitting Fairfax’s 15% return target.

- many holdings were actually bleeding money - in total, hundreds of millions every year (losses, write-downs, etc).The underperformance/losses from equity portfolio was a material amount. For years, this depressed the total return Fairfax was earning on its equity portfolio. This bled through to Fairfax’s total results and structurally lowered earnings and ROE for years. This in turn lowered the P/BV multiple Mr Market assigned to Fairfax’s share price.

Fast forward to 2024. It is amazing to me the transformation that has happened within Fairfax’s equity portfolio. When you look at the change that has happened over the past 6 years, it’s like someone came in and completely cleaned house. Think of a sports franchise where the GM and coach both get fired at the same time and a new regime takes over - with a new philosophy.

With Fairfax, it looks to me like a new regime has taken over except we don’t know what happened internally (yes, i am talking metaphorically here). And it is pointless to speculate (and not fair to the people involved). Of course, i am exaggerating to make my point. And as per usual i am getting off topic.

What were some of the changes?

Internal

1.) restructured: Exco2.) put into ‘run-off’: Fairfax Africa, Farmers Edge, Boat Rocker

3.) sold: APR, Mosaic, Resolute Forest Products

4.) take private: AGT, Recipe

5.) other: Blackberry $500 million debenture has been exited

External

1.) Greece elected a pro-business government in 2019/2023: Eurobank

Six years later, we are almost to the finish line. Farmers Edge and Boat Rocker might deliver another $50 million in losses/writedowns moving forward.The equity portfolio will always have a few laggards. Fairfax’s problem in 2017 was it was stuffed with problem children.

Looking forward

Importantly, it looks to me like Fairfax has a new framework for how it manages its equity portfolio. Hamblin Watsa is not a turn-around shop. A higher premium has been put on management. All holdings are now expected to deliver an acceptable return - Fairfax will no longer be a piggy bank for chronically underperforming units. Moving forward, capital will go to the best risk/adjusted opportunities. Bottom line, really like what i have seen from management since 2018.

Why do we care today?

If the quality of the equity holdings is materially better than it was pre-2017 then the return it will be capable of delivering moving forward will be much higher than in the past. The change is the key. Higher earnings = higher ROE = higher P/BV multiple.

The best example of the improvement is the ‘share of profit of associates’ bucket. Driven by Eurobank, is is now delivering +$1 billion per year in pre-tax earnings.

I think the non-insurance consolidated holdings are getting ready to pop higher in the coming years.

And i think the table is getting set for Fairfax to start delivering higher than expected ‘gains on investments’ - unrealized and realized.

The great thing is investors are currently expecting historical (low) returns from Fairfax’s equity portfolio - sustainable higher future returns is not built into Fairfax’s stock price today.

Two things drive earnings at Fairfax:

1.) insurance - underwriting profit

2.) investments - average return on investments

I think Fairfax’s insurance business and investment portfolio has been slowly, incrementally improving in quality since 2017. If my thesis is correct then future earnings will likely continue to surprise to the upside. It will take years for all the positive changes to fully flow through to earnings. As i stated already, higher earnings = higher ROE = higher P/BV multiple.

-

4 hours ago, valueventures said:

I'm a big fan of your writings on FFH, which have played a big role in me making it a large position. I'm 30 years old and still fairly early in my compounding journey.

Curious if you have general tips on what has worked best for you (20% annual compounding!) in terms of philosophy / strategy, types of companies / setups you invest in, portfolio construction (concentration / diversification), etc. I plan to manage 50%+ of my portfolio passively via index funds, but reserve a portion for active management via ideas generated on CoBF, investor fund letters, my own research, etc. Thanks for all the valuable insight you've added here!

@valueventures if my writings have helped you then that is great to hear. But make no mistake about it, any success you have experienced from reading my writings actually has very little to do with me. Your success is primarily the result of your investment framework / actions. And the action thing is super important. That would be tip #1.

But don’t confuse action with volume. I might make one big decision every couple of years.

Now, of course, there is a lot more involved. But your question is so broad i think it is best answered in pieces.

I hope other board members also chime in with their thoughts.

—————

When i worked at Kraft Foods i was at a company sales convention. The guy running Kraft Canada had just announced his retirement and i was lucky enough to get invited to his send off. He said a few words…. Here is what i remember. Of course i am paraphrasing…

“I am not smarter or more talented than most people. So how did i do it (become very successful - personally / professionally)? Whether you realize it or not, every day the train stops outside your door. You decide every day if you want to get on it or not. The reason i am in the position i am today is because 20 years ago i decided to get on the train. And 20 years later here is where it has taken me.”

Most people rarely ever decide to get on the train. Their whole life. Even though it is stopping outside their door every day. They are much too risk averse.

Calculated risk taking, with a bias to action, is extremely powerful when done well. Why? You think through all the bad things that can happen - they are usually knowable. And you usually way underestimate the good things. The ‘positive unintended consequences’ can be massive. The risk / reward is way, way more skewed to the upside than people think.

Every big decision i have made in my life has worked out way better than i expected - and i have made a bunch. And much of the upside was unknowable when i made the decision - that is the mind bending part of ‘calculated risk taking.’

There is an important investment angle to this as well…

————-Now to be a risk taker, first you actually have to think about things. And in my experience this is where most people fall down. Most people don’t think enough about the important stuff.

I remember doing performance reviews with staff. I would have them review themselves on their own. I would prepare their review on my own. And then we would get together and compare notes. Most of my staff disliked this format.

Why? I learned over time that most people do not have the ability to jump out of their own skin and evaluate themselves in an unbiased way. And they also don’t actually have a plan when it comes to their career.

Both of these things are important to being a successful investor.‘Most people are grazing the planet waiting to die.’ I am not sure where i heard/read this. But it has stuck with me over the years. I use it as a self motivator (not to judge the choices of others). There are lots of ways to live your life - and there is no right or wrong way. But the choices we make do have consequences. And most people fail to grasp that doing nothing (grazing) is actually a choice.

Sorry, this post just got way off base…

-

46 minutes ago, ICUMD said:

Speculative, but Fairfax taking Fairfax India private is the best and most likely play.

Consider:

- Recent all cash offer for IDBI by Fairfax - the are serious bidders.

- BIAL is a jewel company with guaranteed return and growth. I suspect they view IDBI as another diamond in the rough. It probably is.

- They only coinvest with select pasive investors like OMERS. (They weren't too happy with GMR and paid a premium to kick them out of BIAL). Coinvestment only helps them manage their risk at the expense of their ownership and control. I doubt they will be keen to be part of a consortium to purchase IDBI when then can do so easily via FFH. Plus, they will need to share ownership with the government and LIC as it is.

- Fairfax India has performed poorly in North America, but Anchorage will truly value their Indian asset base. This I think will occur after they take Fairfax India private, since doing so before risks inflating the share price and increasing the price of a buyout.

- The only advantage I can see of Fairfax India trading publically is it's ability to raise capital through sale of shares. Ironically, due to depressed share price x 10 yrs now, they are now capital constrained to make large purchases, such as IDBI.

- They have used their 200M in the bank to back stop IIFL. They will need a billion or two in short order if they get IDBI.

- When your kid needs money in short order for a worthy venture, who is most likely to offer it?

@ICUMD thanks for sharing… your take makes a lot of sense. -

13 hours ago, ICUMD said:

This is the billion dollar question.

Fairfax has said aside from insurance, Fairfax India will be the vehicle for all other investments in India. They have recently placed an all cash offer for IDBI bank. Where does the cash come from?

If they aren't issuing new shares at discounted market prices as previously stated, their only other option is to find an investment partner, like Omers.

Alternatively, could money laden Fairfax opt to buyout Fairfax India and take it private? They would then have deep enough pockets to chase IDBI. It would also optically solve their issue of discount.

Pretty sure Prem wants to close that IDBI deal badly.

@ICUMD below are some thoughts building on your post.

1.) prior to Modi’s election, Fairfax’s vehicle for investing in India was Thomas Cook India. That is why Quess started out there. After Modi was elected Fairfax decided they wanted to get much more aggressive investing in India. But they had a problem… Thomas Cook was the wrong vehicle / structure. Solution? Do what any rational actor does in investing - when the facts change - you pivot your strategy. And Fairfax India was born.

Today Fairfax has an opportunity to make what could be a once in a generation purchase of a massive bank in India. But they have a problem. Fairfax India is likely the wrong vehicle / structure (as it exists today). What to do? What any rational actor does - pivot/update the strategy to fit the facts/reality as they exist today.

2.) i have long thought the ‘solution’ to Fairfax India’s big discount in recent years is for Fairfax to take it private. Step one - approach the remaining large shareholders and see if they are interested - and what price. Step two - take out remaining small shareholders - perhaps at BV.

To fund a big price of the takeout, Fairfax India could sell down some assets. The real prize for Fairfax would be getting 100% of Fairfax India’s position in BIAL.

As @Redskin212 notes, the perspective of insurance regulators likely matters.

Regardless, India is shaping up to be a super interesting geography for Fairfax in 2024:

- rumours regarding bid for big bank

- Digit IPO

- possible Anchorage IPO / next steps for BIAL

- what all this means for Fairfax’s strategy in India

- what all this means for Fairfax India

-

Operating Income of Non-insurance Consolidated Companies

Over the past couple of years Fairfax has been materially increasing the size of its non-insurance consolidated holdings. Revenue and ‘normalized’ earnings have been moving higher. However, the improving results over the past 2 years has been masked by large temporary or one-time write-downs/losses - so most investors are not aware of the many positive changes that have been happening under the hood. My guess is the earnings power for this group of holdings will begin to shine through fully in 2024. In the coming years, this bucket is poised to become a much more important income stream for Fairfax - in terms of size and consistency.

Let’s begin by getting some context.

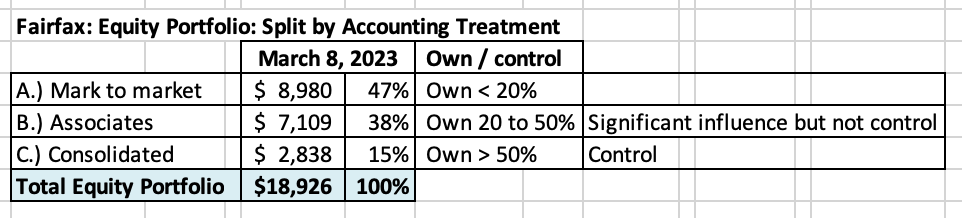

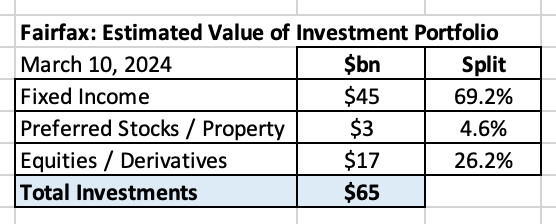

The big picture

Fairfax has a very large equity portfolio – as of March 8, it has a total value of about $19 billion (including the FFH-TRS position at its current notional value of $2 billion). From an accounting perspective, equity holdings can be grouped into one of three buckets – based on how much of the company Fairfax owns and how much control it exerts.

In this post we are going to review the equity holdings that fall into the ‘Consolidated’ bucket. These are the holdings where Fairfax owns more than 50% (or has more than 50% voting control) and therefore has a control position.

The common stock ‘Consolidated’ holdings have a total value of about $2.8 billion, which is about 15% of Fairfax’s total common stock portfolio. I don’t think holdings like AGT Food and Ingredients and Sporting Life are included in the $2.8 billion. Bottom line, the group of ‘Consolidated’ holdings likely has a market value of well over $3 billion.

From an accounting perspective, the results of ‘Consolidated’ holdings are captured on the Consolidated Statements of Earnings in the ‘Non-insurance revenue’ and the ‘Non-insurance expenses’ line items.

What holdings are captured in this bucket?

Below is a list of all the companies - with a brief description of their primary business - that are included in the ‘Consolidated’ bucket.

Non-insurance companies

This reporting segment is comprised as follows:

- Restaurants and retail – Comprised principally of Recipe, Golf Town, Sporting Life and Toys “R” Us Canada (deconsolidated on August 19, 2021).

- Fairfax India – Comprised of Fairfax India and its subsidiaries, which are principally NCML and Privi (deconsolidated on April 29, 2021).

- Thomas Cook India – Comprised of Thomas Cook India and its subsidiary Sterling Resorts.

- Other – Comprised primarily of AGT, Dexterra Group, Boat Rocker, Farmers Edge, Grivalia Hospitality (consolidated July 5, 2022), Pethealth (deconsolidated on October 31, 2022) and Mosaic Capital (deconsolidated on August 5, 2021).

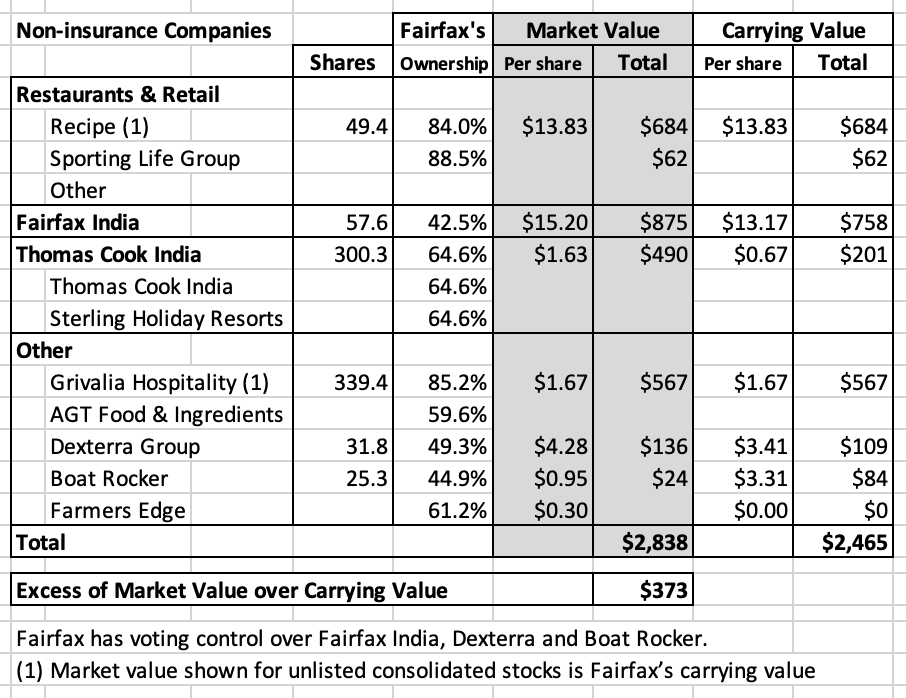

How much of each holding does Fairfax own? And what is the value?

The information below is from page 15 of Fairfax’s 2023AR and captures what they call the ‘common stock holdings’. My guess is their list does not capture a couple of important holdings: AGT Food and Ingredients, Sporting Life and possibly Meadow Foods. We were given the carrying value for Sporting Life in a different section so I have added that. However, we were not given a carrying value for AGT or Meadow and I have not bothered to guess. So the total for both carrying value and market value in the chart below are likely understated by quite a bit.

Interestingly, the excess of market value to carrying value for this collection of holdings is about $373 million. This number is also likely understated by quite a bit.

What do the financials look like for this group of holdings?

Over the past three years, revenue has increased 39% to $6.6 billion. However, pre-tax income has been low and stagnant, averaging about $60 million over the past three years.

Below is the split by reporting segment.

Notes:

- Pre-tax income (loss) before interest expense; excludes interest and dividends, share of profit (loss) of associates and net gains (losses) on investments.

- The majority of Fairfax India’s earnings fall into the ‘Share of Profit of Associates’ bucket.

What is driving the significant top line growth?

- Improving fundamentals: Companies in this bucket of holdings were significantly impacted by Covid, which was a significant drag on results from 2020 to 2022. Recipe (full serve, dine-in restaurants), Thomas Cook India (travel) and Dexterra (facilities management). Results from these these companies rebounded in 2023.

- Significant new addition: Grivalia Hospitality was added in 2022 when Fairfax increased its stake from 33.5% to 78.4% at a cost of $195 million. The position was increased further in 2023 to 85.2%.

- Significant increases in ownership: in 2022, Fairfax increased its stake in Recipe from 46% to 84% at a cost of $342 million. In 2022, Fairfax increased its stake in Sporting Life from 71% to 88.5% (funded via retained earnings).

-

There also were a few notable sales / deconsolidations:

- Restaurants & retail: Toys “R” Us Canada (deconsolidated on August 19, 2021)

- Fairfax India: Privi (deconsolidated on April 29, 2021).

- Other: Pethealth (deconsolidated on October 31, 2022) and Mosaic Capital (deconsolidated on August 5, 2021).

Bottom line, top line should grow nicely in 2024 and future years. And now a much larger share of earnings for these companies will flow through to Fairfax shareholders.

Pre-tax income at this group of holdings has been low the past four years due to significant temporary or one-time items.

As mentioned already, Covid was a significant headwind for Recipe, Thomas Cook India and Dexterra from 2020 to 2022. Thomas Cook India had a fantastic 2023. Recipe continues to right-size its business/structure/systems after a decade of rapid consolidation.

Farmers Edge took very large write downs in 2022 ($133.4 million) and 2023 ($112 million in losses) and the business is now carried at a $0 valuation. It was taken private by Fairfax in March of 2024. My guess is this business will stop bleeding money later in 2024.

Boat Rocker also saw a write down in 2023 ($26 million). This is now a small holding for Fairfax.

Grivalia Hospitality took a loss of $66 million in 2023. For the past couple of years, Grivalia has been investing heavily in building out its collection of ultra-high luxury resorts. 5 are now open. Revenue should materially increase in 2024. The company is pivoting its business from the investment phase to the operating phase which should lead to improving financial results.

The significant temporary / one-time events of the past couple of years will likely decline in size moving forward. Headwinds will become tailwinds. And when they do, the earnings power of this collection of businesses will be released like a coiled spring.

Summary

The companies in this bucket of holdings have been undergoing significant positive changes over the past couple of years. (Just like the rest of Fairfax’s equity holdings.)

Poor performers are being wound down. Underperforming companies have been executing turn-around plans for the past couple of years and improved results are starting to show up. New holdings have been added in recent years. And Fairfax owns more of existing holdings.

Bottom line, the intrinsic value of the companies captured in this bucket has been increasing over the past three years. We should see earnings start to materially improve in the coming years. This group of companies is poised to become another meaningful and growing income stream for Fairfax.

Earnings estimate for 2024 and 2025

My current estimate is for this collection of holdings to deliver pre-tax earnings of $150 million in 2024 and $200 million in 2025. For reasons laid out above, these estimates will likely prove to be very conservative.

—————

A strategy question

Do we see Fairfax continue to build out this bucket of companies?

Do they aspire to become more of a holding company like Berkshire Hathaway in the coming years?

Are there strategic advantages to Fairfax of having a few large wholly owned cash generating equity holdings to complement their P/C insurance business?

What do board members think?

I don’t think Fairfax wants to go full Berkshire in the coming years. Unlike Berkshire, at the appropriate time, Fairfax sells assets - I expect Fairfax will monetize one or more of its non-insurance consolidated holdings in the coming years. And I suspect it is still a priority for Fairfax to grow its P/C insurance business.

----------

From Prem's Letter, FFH 2023AR: "As the table on page 15 shows, the consolidated investments include the following: Recipe, Fairfax India, Grivalia Hospitality, Thomas Cook India, Dexterra Group and Boat Rocker Media. Our consolidated investments are significant, producing total revenue of $6.6 billion and pre-tax income of $271 million in 2023. Fairfax India had pre-tax income of $380 million, Recipe $38 million, Thomas Cook $27 million and Dexterra $29 million. Those were offset by losses at Grivalia of $66 million, Boat Rocker $26 million and Farmers Edge of $112 million which included impairments of $64 million."

From Prem's Letter, FFH 2022AR: "As the table on page 13 shows, consolidated investments include the following: Recipe, Fairfax India, Grivalia Hospitality, Thomas Cook India, Boat Rocker Media, Dexterra Group and Farmers Edge. Our consolidated investments are significant, producing total revenue of $5.6 billion, EBITDA of $743 million and pre-tax income of $303 million (excluding a $133 million writedown of Farmers Edge) before minority interest in 2022."

-

35 minutes ago, This2ShallPass said:

Just curious, why did you sell?

@This2ShallPass Fairfax has always been my preferred core holding for a whole bunch of reasons. Fairfax has been cheap since Covid hit in 2020 - so i have been way overweight Fairfax since then. And when i am way overweight Fairfax i am not really interested in holding a big position in Fairfax India.

In addition to my core positions, i also will do some tactical trades with a small part of my portfolio. Stocks i think i understand pretty well. Positions of maybe 1% or 2% of my portfolio. Buy when they get cheap and sell when they run up for hopefully a quick 5% or so gain. My trades are done in tax free accounts. I call it mucking around.

Fairfax India is a stock i usually trade in and out of a couple times a year. I haven’t this year because it hasn’t dropped to my buy price. Instead i have traded in and out of Canfor (CFP.TO) a couple of times already. And also Baytex (BTE.TO). I recently also bought some BCE.TO and T.TO (Canadian telecom stocks are hated right now).

If i ever get my Fairfax weighting down to something more reasonable then i probably would take a closer look at Fairfax India as more than just a quick trade type of holding. I like management at Fairfax India a lot. And i love BIAL.

My biggest issue with Fairfax India is liquidity. I find it very difficult to build out a position - without causing the price to move. My bigger concern is if i ever need to quickly liquidate my position. Solution? Keep it a small position.

-

20 minutes ago, nwoodman said:

If history is any guide, that would be at the bottom of my thesis list. Not saying they have acted with impropriety but your interests rank much lower than you think.

@nwoodman I agree. However, I was quite surprised by how much (little) Fairfax paid to take out Recipe. Fairfax got a good to great deal. But at the time I thought they could have paid less and still got it through. Is this another new trend? -

My view is Fairfax India has been a gift for investors for at least the past 5 years. The stock has been on perpetual sale. And for lengthy periods of time it has been available at obscenely low prices (sub $10).

Performance fee? It is what it is. There are the facts as to how it works (the mechanics). But in terms of debating whether it is good or bad... well, from my perspective, it is kind of like trying to debate the weather.

With any investment, fit is always paramount. If you don't like the fee don't invest in Fairfax India. I am not saying the fee structure is good or bad - each person needs to decide that on their own based on their analysis of the situation and how they are wired.

Personally, the fee structure has never impacted my decision to invest in Fairfax India (I don't own any today, but I have held large positions in the past).

1.) To me the key question with Fairfax India is what is BIAL worth? The answer to this question is going to drive your future return on this investment over the next 5 years much more than anything else.

2.) The next question (linked to the first) is what does Fairfax India do with Anchorage and when? (This, of course, gets back to BIAL.)

3.) The emerging question is what is Fairfax India's involvement with the bid for IDBI Bank? This would be a massive purchase. Where is the significant $ going to come from? And what does that mean for current Fairfax India shareholders? I am pretty sure Prem said at the AGM last year that Fairfax India would not be issuing any new shares for less than book value (perhaps someone else can confirm/deny this).

4.) And finally, how serious is the current regulatory issue with IIFL Finance? That is Fairfax India's second largest holding and the stock has been bludgeoned lately.

-

On 3/18/2024 at 8:02 AM, frommi said:

Sold FFH after my thesis has played out and the stock has re-rated. Don't like betting on further multiple expansion.

@frommi congrats on your investment in Fairfax. I suspect many people on this board are sitting on pretty spectacular gains and wondering what to do. One of the keys to investing is to have a plan and then (usually) stick to it - and not keep moving the goal posts.

My thesis with Fairfax has evolved over the past couple of years. The quality of the insurance business is higher than I thought (and getting better - I think). The quality of the equity holdings is also getting better (the dogs keep shrinking in size each year). Significantly extending the duration of the fixed income portfolio in 2023 was a big deal. The kicker is the size and quality of operating earnings is large and largely set for the next 4 years. When I weave it all together I think Fairfax deserves to trade at a higher multiple than it has over the past 10 years - 1.3 x BV on the low end. The fundamentals just keep getting better and better - that has been a surprise for me.

I am just finishing a post on non-insurance consolidated holdings (coming in the next day or two). I think that bucket is the next coiled spring that is set to go off. Similar to what happened with 'share of profit of associates' a couple of years ago. Perhaps we see a new $400 million and growing earnings stream as soon as 2025? I am modelling $200 million in 2025. That is not on anyones radar right now. My point is there are still lots of different tailwinds.

BV was $930 at Dec 31, 2023. Let's assume BV grows $150 in 2024 and 2025 (subtracting $15 dividend). That would get us to a BV of $1,230 at Dec 31, 2025. Apply a 1.3x BV multiple (at the low end in my mind) and we get a stock price of $1,600 in 24 months. Including dividends, that would deliver a return of 45%. Pretty solid return over 2 years. I don't think these are particularly aggressive assumptions.

There are also a number of wild cards. One that intrigues me is @SafetyinNumbers speculation of what happens if Fairfax gets added to the Canadian benchmark index in 2024 or 2025. I think indexing is only going to become a bigger phenomenon in the coming years - so the lift to Fairfax's stock if it was to get added could be significant.

The key risk today (company controlled) is capital allocation - after a couple of very good years, does hubris set in (again)? Not a concern today - but something I am monitoring.

My post is not to try and talk anyone into not selling down a position. People sell for all sorts of reasons. The spike in Fairfax has taken most of us by surprise. I am still trying to understand what it all means. And yes, I have a big smile on my face as I think about it.

-

1 hour ago, Crip1 said:

Part of the benefit would presumably be not having to talk about the share price any more. It's now "out of sight, out of mind" so if it does go fully belly up, it's a non issue. If, by the grace of God, somehow it starts making money, it could be sold eventually not unlike the Pet Insurance business. Improbable, but not impossible.

-Crip

I think in the past @glider3834 has pointed out that there may be some tax loss benefits as well. But i am not an accountant so can’t speak to those sorts of things.

-

2 hours ago, Hoodlum said:

Farmers Edge deal will close on Thursday.

One step closer to being able to (finally) close the book on this perpetual money-losing holding. It would be interesting to know what the benefits are to Fairfax of taking it private. -

2 hours ago, dartmonkey said:

The mark to market portion of the equity portfolio was $8.7b on Dec 31st, according to the annual report, and on March 8th, Viking estimated (posted here) that it might be worth $9.0b.

The other 2 portions, associates and consolidated, were worth $7.1 and $2.8b, respectively, for a total equity portfolio of $18.9, but the earnings from these other 2 portions are already included in the estimate.

@dartmonkey you are spot on. My current estimate has Fairfax's mark-to-market equity portfolio at about $9 billion. About $2 billion of this is the FFH-TRS.

My earnings estimate for 'net gains on investments' is $1 billion for 2024:

- FFH TRS = $2 billion = $250 x 1.96 million = $500 million

- Remaining mark-to-market holdings = $7 billion x 7% = $500 million

-

2 hours ago, Dinar said:

@Viking, I thought that the equity portfolio was USD 15bn, no?

@Dinar , here are Fairfax's numbers as of Dec 31, 2023.

In my equity spreadsheet summary I include the FFH-TRS at its current notional (market) value of +$2 billion. This bumps the value of Fairfax's equity portfolio to $19 billion.

-

17 hours ago, Hamburg Investor said:

Regarding TRS you are actually calculating share price being nearly flat (or up 25 dollars, so 2.5%) until end of 2024 for the next 3 quarters and two weeks, or do I misunderstand how the TRS works?

Of course the share price could be higher or lower within such a short timeframe, but of course you have to assume something. But what’s the rational behind $250 for 2024? Wouldn‘t it be rational to e. g. assume a share price end of 2027 (whatever that would be) and than draw a straight (or compounding) line to that point? Than it would maybe be rational to readjust that line each time you recalculate your forecast? Otherwise you maybe would come to the point, where you would have to assume a negative return to the end of the year, if you assume a fixed return per calendar year and the share price gets above that?!

I am just asking

Why are net gains in investments lower in 2025 than in 2024? Intuitively I‘d think one would assume Fairfax to get 7% again but on 107% of 2024 equity, so it should be higher. Same with the TRS: If shareprice goes up algorithmic, than it should be higher 2025 than 2024; or is this a function of the good start of Fairfax share price in 2024, so you adjusted 2024, but not 2025?

In general I totally understand, that you have to be conservative with your assumptions the longer you look into the future (that’s what all good investors do - margin of safety) at the same time looking at the numbers I ask myself:

If Fairfax just manages a roe around 15% in 2024 and 2025 like in your foecast (so for times with a hard market, good hand with equity investments and bonds, very good crs…) and Prem at the same time gives out the goal of a roe of 15% on average (he said stock return or book value compounding should be 15%; but roughly that’s the same as having a roe of 15% as a goal. Or am I wrong?), than the question occurs: Is that goal doable if he just manages 15% as a roe in such good times, where not only management performs near perfection, but the circumstances (hard market etc.) give an extra tailwind?

If Prem doesn’t manage 18%, or 20% or more on average in such good times, he won‘t make 15% over time.

My best guess is, that this difference to 18% or 20% or even more is just a function of you being conservative with your estimates (which is very fine!). What do you think?

@Hamburg Investor good questions. I am modelling $1 billion in ‘net gains from investments’ in 2024. When i built my forecast, the rough math was $500 million from FFH-TRS ($250/share x 1.96 mn shares) and another $500 million from the mark-to-market equity holdings ($7 billion x 7% return on portfolio).

From my perspective, a total of $1 billion is the important number. There are numerous ways to get there… i identified one potential path above. Given the continued increase in Fairfax’s share price to start 2024, my forecast of $1 billion in total gains is looking pretty conservative right now.

But things can change fast. And there will be puts and takes for all buckets as the year plays out.

With my 2024 forecast i want to lean out a little, but not get too far in front of my skis.

In terms of forecasting for 2025, there is more uncertainty - we are forecasting for two years. Yes, i am modelling a slightly lower ‘net gains from investments’ number in 2025 - primarily bacause i think the contribution from FFH-TRS will slow in 2025 (compared to 2024). High conviction? No. Just what seems like a reasonable guess.

Importantly, trying to guess what Fairfax is going to do with capital allocation is quite difficult looking out to 2025. Does Fairfax take a big swing (like buying a big bank in India?) or do they play it safe like they have been doing the past couple of years and continue to buy out minority partners (insurance and equity holdings). The risk / reward set-up is quite different for shareholders.

-

Starter position in Saputo SAP.TO. In recent days it has dropped to my buy price of under C$26.

They have been working on a turnaround for the past 3 years. They think the benefits should start showing up in results beginning in the April to June quarter (Q2 of calendar 2024). Each quarter more tailwinds should flow to reported results.

This company is pretty hated right now. The management team has been consistently over promising and under delivering for the past 5 years.

The Saputo family controls the company. They will keep at it until the fix happens. The question is in 1H 2024 are investors going to get another rug pull? Or have financial results hit bottom and are now poised to move higher over 2024?

-

As per @glider3834's suggestion I want to add Sporting Life to my spreadsheet that tracks Fairfax's large equity holdings. It is a consolidated holding and it has a carrying value of $82 million. However, the carrying value for the 'other' bucket for 'Consolidated Stocks - Consolidated' holdings in the summary below has a value of zero.

This suggests to me that the values for Sporting Life is not included in the summary below provided in Prem's letter in Fairfax's annual report?

Is this also the case with AGT Food Ingredients?

-

1 hour ago, Maverick47 said:

Appreciate the update @Viking, and I like the historical data as well. As I scan the years columns from left to right, I appreciate the growth in interest rate and dividend income relative to underwriting results as well as the share of profits of associates and gains on investments. Rough mental math indicates it would take quite a severe worsening of underwriting results to offset completely the expected normalized income from the other sources given current expectations for them. Something like a Combined Ratio of 115 or so might result in no income (but also no loss) for a future year. Given attention to managing cat exposure, and the fact that a good portion of the premium volume is related to reinsurance, which ought to be able to react somewhat faster to poor underwriting results than a typical primary insurer, as well as the global spread of exposures among a number of independent insurance providers, it’s unlikely in my opinion for that kind of underwriting result to occur, but I do like to get some sense of how bad something might get for the companies I invest in, and a 115 CR is about a 20% worsening from the ideal target of 95. That’s a pretty poor underwriting result, not very likely in my opinion, but a reasonable worst case scenario, and it comes nowhere near to damaging the future viability of the company.

I continue to believe we have significant upside for the company, and limited downside

@Maverick47 I agree. I think underwriting profit at Fairfax is about 20% of its various income streams. I think most P/C insurance companies are closer to 40% or more. So moving forward, a really bad year for catastrophes will affect Fairfax much less than peers. In fact - counterintuitively - long term Fairfax investors should probably be hoping for a really bad cat year. It would likely extend the hard market and Fairfax would likely be a big net winner over time. This is a big difference from 'old Fairfax' and 'new Fairfax.' New Fairfax looks like it is becoming a much more financially resilient company.

In terms of financial stability, Fairfax is getting to a very good place. The different earnings streams are growing meaningfully in size and new streams are getting built out. I think Fairfax has been executing a strategic plan that we are just now starting to fully grasp.

-

4 hours ago, Thrifty3000 said:

Amazing analysis as always. Many thanks!

Another datapoint investors should probably keep in mind is the fully diluted EPS.

Looks like the fully diluted version of your estimates would land around:

$146 per share for 2024

$149 per share for 2025

Fairfax’s share-based plans have a longer vesting period than most companies. So it’s less of a near-term concern, but something to be aware of.

@Thrifty3000 you bring up a very good point. As you are aware, I only ever look at (use) 'effective shares outstanding'. I have not spent much time looking at (or thinking about) fully diluted shares. And that is because I don't know how to think about fully diluted shares at Fairfax.

Do you have a mental model / framework for how to understand fully diluted share count at Fairfax and what it all means for Fairfax investors?

I do notice that each year Fairfax buys back shares and not all of them are retired.

Lot's of good questions / comments on Fairfax today. Keep them coming!

-

5 hours ago, gfp said:

Thanks for sharing your work Viking. On Eurobank dividends, if we are already recognizing our entire pro-rata share of Eurobank's earnings, why would we benefit from their dividend? Cash in FFH's hands is different than cash retained at Eurobank, but it should not be double counted.

@gfp good question. I have some questions of my own as to how Eurobanks dividend will flow through Fairfax's income statement and balance sheet when it starts.

But before I get into the accounting, here is a general thought. I am hoping Fairfax continues to grow the 'interest and dividend' bucket. I think it is generally viewed by investors to be the most important income stream for a P/C insurer (with underwriting profit being a close second) because it is usually not very volatile year to year. As more of Fairfax's earnings come from 'low volatility' sources we should see multiple expansion.

My assumption is when Eurobank starts paying a dividend it will drop into 'interest and dividends' for Fairfax. If this is not the case, someone please let me know. As I have said many times before, I am not an accountant - so there will be errors in how I look at things. And that is a real strength of this board - we are all to learn from each other and improve our understanding/analysis.

What happens to 'share of profit of associates' for Eurobank? Is this number each quarter affected by the dividend payment? The short answer is I don't know. Perhaps you or someone else can enlighten me?

Is share of profits of associates an income statement item (share of pre-tax net income)? And the dividend a balance sheet item (return of capital)?

My understanding is Fairfax's carrying value for Eurobank will get updated each quarter as follows:

- Eurobank prior quarter carrying value + share of profit of associates - dividend amount paid to Fairfax.

If this is not accurate, please let me know.

The other question I have regarding the Eurobank dividend is, once approved, how will it be paid out... quarterly? or will it be in a lump sum?

Thanks again for the question.

Fairfax stock positions

in Fairfax Financial

Posted · Edited by Viking

Gang, great discussion on the FFH-total return swaps. Question for board members: at what P/BV will Fairfax begin to exit the position? I will wade in with my estimate after others have chimed in.

What Fairfax does with this position in the coming year (s) will be very interesting to watch. What they do with this position will likely give us a good indication of how they view their stock's valuation:

- keep the position in place as long as they view the shares as being undervalued.

- exit the position when they assess the shares are approaching fair value.

My guess is they will not want to hold the position if the shares are approaching fair value. It makes sense to me that they would start selling down the position when shares hit 95% of their fair value calculation. It is leverage - and as Buffett likes to remind us, leverage can cut both ways.

But with the EPS estimate being so robust over each of the next three years (at least) they probably will be very patient.

The wild card is all the cash Fairfax is earning right now. With buybacks, Fairfax has the ability to drive their share price higher and probably much higher. So they have an important element of control over their share price - which somewhat reduces the risk of holding this position.

It really is a crazy good set up right now.

---------

I am working on a valuation update post for Fairfax. I think the stock could return 50% over the next 24 months. If that happened the FFH-TRS would deliver a gain of $1 billion, or $500 million per year. That would be absolutely nuts.

What is the math to get to a 50% gain over the next 24 months? (2024 EPS = $160 + 2025 EPS = $165) x 1.3 P/BV. Not a crazy estimate.