Viking

-

Posts

4,694 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

On 1/21/2023 at 8:21 AM, giulio said:

AR 2021:

"For our stock price to match our book value’s compound rate of 18.2%, our stock price in Canadian dollars should be $1,335. And our intrinsic value exceeds book value, a principal reason being that our insurance companies generate huge amounts of float at no cost. This is the reason we continue to hold total return swaps with respect to 1.96 million subordinate voting shares of Fairfax with a total market value of $968 million at year-end."

AR 2020:

"Investment returns are very sensitive to end date values, so with a stock price of only $341 per share at the end of December 2020, our five and ten year and longer returns have been affected. We expect this to change as Fairfax begins to reflect intrinsic values again. Nothing that a $1,000 share price won’t solve!"

Also on the TRS, Prem said this in 2020:

"since the latter part of 2020 Fairfax has purchased total return swaps with respect to 1.4 million subordinate voting shares of Fairfax with a total market value at the time of those agreements of $484.9 million ($344.45 per share). We think this will be a great investment for Fairfax, perhaps our best yet!"

I don't see anything wrong with giving shareholders clues about intrinsic value, especially when the stock is trading meaningfully below IV.

Buffett gave clues when starting the share buyback. Ackman provided a share price in its latest report.

What's wrong is talking your stock up, with no regard to IV, like someone expecting 50% CAGR on her portfolio!

Fairfax is trading at about US$600 today. Fairfax getting to a share price of US$1,000 anytime sounds like a cruel joke. Right? Actually, i think there is a fairly credible path for Fairfax to get to $1,000 in about 24 months. Assumptions:1.) CR = 95 or lower for 2023 & 2024

2.) return on investment portfolio of 6.2% for 2023 & 2024

3.) Mr. Market valuing shares at multiple of 1.2 x BV in Jan 2025

I don’t think these are heroic assumptions. A successful Digit IPO would likely accelerate the time line. A material share buyback would also accelerate the time line.

Of my three assumptions above, i am least confident in 3.) and the multiple Mr Market attaches to Fairfax. Sentiment in Fairfax is improving. And if Fairfax is able to deliver back to back years of ROE of 16% that should push the P/BV multiple higher. (Alternatively, if Fairfax generates slightly higher earnings than my estimates over the next 2 years, they could get to $1,000 share price with a 1.1 x multiple.)

Bottom line, it will be interesting to see what happens. I am focussed on Fairfax and their results (and execution). Strong earnings will translate into a higher stock price. Multiple expansion will be gravy.

—————

Well, lets do some basic math…

- Sept 30, 2022 BV = $570

- Dec 31, 2022 BV = $635 (my estimate)

- 2023 estimated earnings = $105/share

- Dec 31, 2023 BV = $740

- 1.1 x BV = $810

- 1.2 x BV = $890

- 2024 estimated earnings = $115/share

- Dec 31, 2024 BV = $855/share

- 1.1 x BV = $945

- 1.2 x BV = $1,026

-

2 hours ago, StubbleJumper said:

No, the premium will probably end up being sticky to a large extent. It's possible that net written could decline if pricing is really bad, but in general volume trends up over time. What is extraordinary is the favourable CR at the same time as a favourable investment return. Usually you get either one or the other, but not both. What it means is if I gave Prem $1 to use in an insurance sub, he could use it to write $2 of premiums. Those $2 of premiums would give him 8 or 10 cents of underwriting profit, and probably another 10 cents of investment income. Seriously, a 18% or 20% return on incremental capital in an insurance sub? That's fabulous.

Alternatively stated, it looks quite obvious that FFH will have little trouble making its target of 15% ROE during 2023....and maybe the real question is whether they are able to hit 20% or whether it's "just" 17% or 18% during 2023. This is not normal. This is Prem's "virtuous" part of the insurance cycle.

In the end, all of this must end up attracting new capital to the industry which results in pricing pressure. This is the nature of the insurance cycle. We can hope that FFH can squeeze out 2 or 3 more really good years, but at a certain point new money jumps in.

SJ

@StubbleJumper thanks for the insight. Makes a lot of sense. Lets keep our fingers crossed that the hard market keeps rolling… -

36 minutes ago, StubbleJumper said:

I don't disagree with any of that, but in general, "normalized" earnings would be an average taken across a whole insurance cycle. What we expect to see in 2023 is not a result that is normalized, but rather something that is extraordinarily favourable.

We expect to see in 2023 is to once again be in a situation that Prem described in his letter to shareholders in the 2003 AR as the "virtuous" part of the insurance cycle, where we expect to get solid underwriting profits, solid investment income AND solid realized gains. That's not at all normal, and that's not at all the average (but I'll happily take it!).

Other than nomenclature, I agree entirely with what you wrote.

SJ

@StubbleJumper thanks for the comments. So is it the 95CR or 6.2% return on the investment portfolio that you think is inflated (on a normalized basis). Or is it that the $22 billion in net written premiums or $51 billion investment portfolio that is inflated? Or some combination of the two?I understand the hard market has to end at some point. For a number of reasons it looks like it will continue to power on in 2023 (we will know much more in another week or two as insurance companies start reporting).

The investment side of the ledger looks very favourable for Fairfax looking forward. The size of the investment portfolio is growing. Interest income is growing. And fall in interest rates will likely result in sizable gains in the bond portfolio. Much of Fairfax’s stock portfolio has been marked down so we should see nice gains in equities moving forward.

Yes, i am ‘leaning out’ with my estimates. The hard market could quickly pivot to a soft market in 2023. And we could see another leg down in the current bear market for stocks. And interest rates across the curve could shoot higher. These events would likely drive Fairfax’s stock lower. So, we will see…

-

Two key inputs used to value Fairfax is combined ratio and return on its investment portfolio. My current estimate is for Fairfax to earn about $105/share in 2023 (what i call ‘normalized’ earnings). Sept 30, 2022 BV is $570. $105/share in annual earnings would put Fairfax’s ROE in the high teens.

$105/share in earnings assumes a 95 CR and a 6.2% return on Fairfax’s investment portfolio. Neither estimate is aggressive, in my mind. Why?

1.) The hard market in insurance is in its 4th year and is expanding to reinsurance. The top line is growing at 20% (yes, this will slow). The hard market should impact underwriting profitability (in a positive way) over time. From 2013-2016, Fairfax generated an average CR of 91 (it has happened in the recent past). I think it is likely that Fairfax’s CR improves from here. Every 1 point improvement on the CR = $220 million increase in underwriting profit.

2.) A 6.2% return on its investment portfolio moving forward is not aggressive. In fact, it is probably conservative. Why? Interest rates have moved much higher over the past year. And we have just had a bear market in equities so of Fairfax’s equity holdings have been market down. Fairfax also was an aggressive buyer of equities in 2022 at very attractive prices… which bodes well for future returns.

What does a 6.2% return on the investment portfolio look like?

- interest income of $1.34 billion = 3.7% yield on $36 billion fixed income portfolio

- equity return of $1.845 billion = 11.5% on $15 billion equity portfolio

- equity return = dividends ($100) + share of profit of assoc ($920) + other ($125) + net gains ($700)

If Fairfax is able to achieve a 7% return on its investment portfolio (0.8% increase fro my estimates of 6.2%) = $400 million increase in pre-tax earnings.

3.) Fairfax wild cards. We already know Ambridge is being sold for $400 million in 1H 2023, and likely for a significant gain. What else is coming? If we get a Digit IPO in 2023 then my guess is we could easily see Fairfax book a $1 billion gain. That is not part of my $105/share earnings estimate. Fairfax has lots of other levers it could pull in 2023 to surface more hidden value on its balance sheet.

4.) Share buybacks are another wild card. Fairfax will likely be generating record operating earnings in 2023. If they wanted, Fairfax could take out 1.2 million shares (5% of total) = $780 million (avg cost of $650/share).

Conclusion: i think my earnings estimate of $105/share for 2023 is not aggressive. But earnings of $105/share suggests Fairfax is capable of earnings high teens ROE moving forward (17 to 18% ish).

Shares are trading at $600. My guess is BV will be around $630-$640 at Dec 31. So investors today are able to buy for 0.95 x BV a well run insurance company that is poised to generate high teens ROE in the coming years.

————-Common shareholders equity at Sept 30, 2022 = $13.36 billion.

Common shares effectively outstanding Sept 30, 2022 = 23.4 millionBV/share = $569.97

-

Yesterday, I read Morningstar’s summary of their report for Fairfax. I thought what they wrote was pretty accurate. Just reading the Morningstar summary, an investor would be stupid to buy a share of Fairfax.

So why am I so bullish on Fairfax? Because I am focussed on the present and the future. Graham (the guy who taught Buffett) teaches us a stock is simply worth the present value of its future cash flows. Yes, the past matters... but what matters much more is the future.

The Morningstar report is focussed pretty much solely on the past. And this is generally ok for most companies. But it does not work for companies where things have changed. Turnarounds. And lots of important things have changed at Fairfax over the past few years. Things that will have a big, positive impact on earnings in 2023 and future years.

This explains, at least partially, why it takes turnaround type stocks like Fairfax so long to re-rate. It takes years of excellent results before analysts and investors get comfortable that things have indeed changed in a sustainable way for the better. Only after the new and improved financial results are embedded in historical results will the ‘narrative’ change. This actually makes sense for a company like Fairfax that was so out of favour.

—————

So what is Morningstar missing in their report?

1.) Growth in net premiums written: this has grown at Fairfax over the past 8 years from $6 billion (2014) to estimated $22 billion (2022) for compounded growth of 17% per year. That is pretty impressive.

2.) Underwriting: While Fairfax did post a poor average CR of just under 100 over the 4 years from 2017-2020, over the past 9 years the average CR is 95.7. Importantly, the CR in 2021 was 95 and 2022 is estimated to come in around 95 as well. I would not call underwriting at a CR of 95 ‘relatively poor’ as Morningstar does.

3.) Increase in interest rates, how Fairfax was positioned, and the impact on interest income in 2022 and the future: Fairfax has a fixed income portfolio of $36 billion; as the insurance business has grown over the past 8 years so has the fixed income portfolio. As those of us on the board know, Fairfax took the average duration of their bond portfolio to 1.2 years at Dec 31, 2021. This caused interest income to fall dramatically in 2021. Who cares? Well, for those not paying attention, interest rates have spiked higher and this is… drum roll please… resulting in spiking interest income.

As a result, Fairfax is poised to deliver record underwriting profit ($1.1 billion) and record interest and dividend income ($1.4 billion) in 2023. $2.5 billion / 23.4 million shares = US$107/share. Current stock price is US$600. They should earn even more in 2024.

The positioning of the duration of bond portfolio was an example of a ‘bold bet’ that is paying off exceptionally well for shareholders (driving billions in future value).

4.) ‘Watsa’s ability to produce alpha on the investment side’: Fairfax IS delivering alpha.

- share of profit of associates: will come in at a record $975 million in 2022 and $920 million in 2023 and future years.

- asset monetizations: pet insurance was just sold for close to $1 billion after tax gain. Resolute Forest Products was sold for $623 million (plus $183 million CVR). Ambridge Partners was just sold for $400 million.

Conclusion: Fairfax, as it exists today, is misunderstood. Most analysts and investors are stuck in the past. The good news is a stock is worth the present value of its future cash flows. And that is true for Fairfax.

So what is an investor to do? Patience and time. Fairfax needs to deliver results. The narrative will slowly change and reflect the current reality. And Fairfax shareholders should be rewarded handsomely.

—————-

Morningstar: While Its Primary Business Is Insurance, Fairfax Is in Some Ways More of an Investment Fund

“While its primary business is insurance, Fairfax is in some ways more of an investment fund. Chairman and CEO Prem Watsa has a history of bold investment bets and has shown a willingness to be unorthodox when it comes to portfolio construction. As a result, compared with other insurers, the company's results tend to be driven more by results on the investment side. We're somewhat skeptical of this approach, as we believe disciplined underwriting is a more maintainable path to long-term value creation, and Fairfax's underwriting record is relatively poor.

Fairfax collected a multibillion-dollar windfall during the financial crisis thanks to some large bearish bets but then remained cautious for many years afterward, resulting in weak overall results despite a significant improvement in underwriting performance over time. We think Fairfax's performance will continue to hinge on whether Watsa's investment theses play out, and the company has pivoted on this front.

Due to his bearish view, Watsa had fully hedged the company's still substantial equity portfolio in the post-crisis years. However, following the U.S. election of Donald Trump as president, Watsa did an about-face and banked on a strong equity market. Watsa’s optimism has largely worked to the company's advantage in recent years, but it has come with some volatility and the company essentially locked in the poor book value growth it had experienced through 2016. As the market turned in 2020, Fairfax went though a period of volatility but finished the year with a modest reduction in book value per share. During 2021, the company's bullish stance was a positive, before becoming a drag again in 2022.

We think investors attracted to the stock due to a belief in Watsa’s ability to produce alpha on the investment side should consider his record over the past decade, which includes some big wins but also substantial losses and missed opportunities. Fairfax has seen a lot of ups and downs, but since Watsa took control in the mid-'80s, its performance has been trending toward mediocrity.

In the near term, however, strong industry pricing should be a material tailwind for Fairfax and its peers.

-

Great up-to-date summary of why commodities are in a secular bull market. John Polomny is very well spoken (and now part of YouTube channel listings).

-

1 hour ago, Crip1 said:

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.”

― Edwin Lefèvre, Reminiscences of a Stock Operator—————

Fairfax India was trading at $9.50 Oct 31. Everyone KNEW it was wicked cheap. The only thing we didn’t know back then is the timing of when the stock would move higher. So here we are 10 weeks later and the stock is now trading 50% higher at $14.50. Who coulda known? Well, we all knew. Everyone on this board should have made out like a bandit with Fairfax India. It was a gift. All an investor had to do to make big money was buy (it was unambiguously crazy cheap) and SIT TIGHT.

Fairfax India, at $14.50 is still cheap: trading well below BV. Prospects for India have rarely looked better.

—————

What caused the move? probably a couple of things happening at the same time:

1.) excellent executions by the management team at Fairfax India

2.) opportunistic buybacks by Fairfax India: management team at Fairfax India monetized some assets over the past 18 months, locking in gains and raising cash

3.) investor sentiment towards India is improving. US$ weakness. Emerging market strength.

4.) halo effect from Fairfax: sentiment in Fairfax is improving and this will improve sentiment towards Fairfax India. Investors no longer hate Fairfax. Probably at neutral. Probably love in another year.

—————Recipe was another good example of the exact same thing when it traded around C$12 in 2022. Wicked cheap. Fairfax saw the gift and took it private at $20.73/share, which was probably a steal. Good for them. Everyone on this board KNEW Recipe was dirt cheap at under $12. What we didn’t know was the timing of the spike higher. Again, all an investor had to do to make big money was buy it and SIT TIGHT.

—————

Fairfax is a great current example. Stock is trading at US$600. BV Dec 31, 2022, could be around $640. 1.2 x BV = stock price of $768; suggests 28% upside to stock price.

Looking out 1 year BV could be around $730. 1.2 x BV = stock price of $875; suggests 45% upside to stock price from where it is trading today. 12 months is not that far away.

At some point in time, stocks that are dirt cheap eventually move to fair value. Often they actually move from undervalued all the way to overvalued. Why?

Does it matter? The important thing is to be right with your analysis. Scale your position size appropriately. And then sit tight.

i have made a bunch of money trading in and out of Fairfax the past couple of years. I have been lucky. Because a big move is coming. Moving forward my plan is to try and sit tight. Because that is how the big money is made.

-

January IEA oil report: rising global demand, slowing supply. Pretty bullish set up.

https://www.iea.org/reports/oil-market-report-january-2023

- Global oil demand is set to rise by 1.9 mb/d in 2023, to a record 101.7 mb/d, with nearly half the gain from China following the lifting of its Covid restrictions. Jet fuel remains the largest source of growth, up 840 kb/d. OECD oil demand slumped by 900 kb/d in 4Q22 as weak industrial activity and weather effects lowered use, while non-OECD demand was 500 kb/d higher.

- World oil supply growth in 2023 is set to slow to 1 mb/d following last year’s OPEC+ led growth of 4.7 mb/d. An overall non-OPEC+ rise of 1.9 mb/d will be tempered by an OPEC+ drop of 870 kb/d due to expected declines in Russia. The US ranks as the world’s leading source of supply growth and, along with Canada, Brazil and Guyana, hits an annual production record for a second straight year.

-

4 hours ago, SafetyinNumbers said:

It’s a really great piece and so is your writing Viking.I would love if he had included some float analysis. FFH float to market cap ratio is so much higher than the public peers and it seems like investors stopped paying attention to float after such a long period of almost zero interest rates.

@SafetyinNumbers Zero interest rates impacted Fairfax more than peers over the past couple of years. That is because Fairfax has well below average duration (when compared to peers) on their bond portfolio. They were a freakish 1.2 years average duration at Dec 31, 2021. This means interest income was low and falling pretty dramatically the past couple of years. In short, Fairfax dramatically under-earned in interest income when compared to peers (and adjusting for size of portfolio) over the past couple of years.

However, this is quickly reversing. And if interest rates stay higher for longer (allowing Fairfax to reinvest most of its low duration portfolio at much higher rates) then Fairfax could catch and pass some peers (in terms of total portfolio yield) in 2023. The ‘run rate’ for interest and dividend income was $950 million at Q2 and $1.2 billion in Q3. It will be very interesting to see what run rate they report for Q4.

If Fairfax is able to get the interest yield on their $36 billion bond portfolio to something around 4% = $1.44 billion in interest income, then i think analysts and investors will start to drink the Fairfax Kool-Aid again. That would be US$60/share in just interest income. Nuts for a $600 stock.

-

It is encouraging to see the pop in Fairfax India’s stock price the past couple of months. I wonder if Fairfax India has been active on the share buyback front. We will find out when they report Q4.

2023 should be an interesting year. I wonder if we see an Anchorage IPO at some point. Fairfax India has been monetizing some assets the past couple of years, most recently 9.8% of IIFL Wealth.

Fairfax’s ownership of Fairfax India is up to 42%. Is there a maximum it can go to? Or can Fairfax just keep increasing its stake each year?

—————

I expect Fairfax to be active in India in 2023. Fairfax India is their preferred vehicle to grow in India. The problem is how do you put a significant chunk of new money into Fairfax India? You can’t raise it in the public markets (with such a low share price).

Perhaps Fairfax will begin investing directly again in new opportunities in India. Perhaps with partners like OMERS etc if the transactions are large.

—————June 2022: “Billionaire investor Prem Watsa proposes to have $7 billion more worth of investments in India over the next five years where he believes the country is in an "impressive" phase with the goal of 10% economic growth in front of it.”

-

2 hours ago, gfp said:

Saw this Q4 letter covered Fairfax. Is this investor a member of this forum?

https://www.edgepointwealth.com/article/Q4-2022-EdgePoint-commentary/

@gfp thanks for posting. Nice to see Fairfax getting some well served press. What I really liked about the article:

1.) it provides a concise, easy to understand history of Fairfax and bridges nicely to where the company is at today. This is not easy to do with Fairfax.

2.) identifies Fairfax as a GROWTH company. On this board we have done a good job of highlighting how cheap Fairfax is - looking at PE (about 6 x 2023 estimated normalized earnings) or P/BV (about 0.95 x Dec 31, 2022 estimated BV).

Fairfax has grown like crazy. Over 9 years (2014-2023), a very long time, it has compounded net premiums at an incredible rate of 16% per year. Net premiums are up 300% over the past 9 years - from $6.1 billion to $24.6 billion in 2023 (my estimate).

----------

And growth is one of the critical inputs in determining an appropriate P/BV multiple for insurance companies. The really interesting things with Fairfax is the growth of 16% per year HAS ALREADY HAPPENED. But it is not yet priced into the stock price.

That is a great set up for current shareholders. Multiple expansion will come... Mr. Market will eventually figure it out.

And growing earnings + multiple expansion + lower share count = exceptional returns for investors.

-

On 1/12/2023 at 9:13 AM, StubbleJumper said:

It's always possible, I suppose. There might be some sort of time limit on their TRS contract, or there might be some sort of escalator in the carry cost that would provide an incentive to do the buyback. But failing that, we should consider some of the things that FFH could do with excess capital/cash and evaluate where the TRS might fit in the hierarchy of uses. I'm numbering some of these possible uses of capital/cash, but the sequence doesn't necessarily reflect where I see them in the capital allocation hierarchy:

1) Pay back debt

2) Keep/inject capital into the insurance subs to enhance underwriting volume

3) Buy back the minority interests from outfits like OMERS (eg the 10% Odyssey position)

4) Make an acquisition

5) Buyback shares on the open market through the NCIB or through another SIB

6) Close out the TRS

There's a financial return to shareholders from each of these, but those returns vary drastically. So, paying back debt would provide a pre-tax return of perhaps 5% annually, which probably doesn't meet FFH's hurdle for excess capital at this time. Buying back some of the minority interests would provide a pre-tax return of perhaps 8% or 9% (because that's the ballpark dividend that FFH pays to OMERS), which is a bit of a better return on capital for shareholders (buying some Fairfax India would be an even better return). While Prem has promised that acquisitions will not be a priority, if something can be bought cheaply enough, that might provide a double-digit return on capital for shareholders. Buybacks through the NCIB or SIB might provide a one-time double-digit return for shareholders, depending on your views of FFH's intrinsic value compared to the prevailing market price.

So, those are some of the alternative uses of capital. What do we get from closing out the TRS? What is FFH paying the counterparty annually? Personally I am guessing that it's more than the 5% that they could get from retiring debt, but less than the 8% or 9% that they could get by buying out OMERS's positions. Unless there is a contractual reason to do it immediately, I can't imagine it's a priority for FFH.

That being said, I can't explain who else has been moving 250,000 shares at a time. Maybe it's time to take another look at the major holder list to see who might be getting out of FFH. The shares are currently trading at perhaps 1.01x or 1.02x adjusted BV. Would any of the large value guys dump FFH at that valuation when it seems obvious that FFH should have little trouble making its goal of 15% ROE during 2023? It seems to me like a no-brainer to hold FFH given the current prevailing share price and economic prospects. Unless there's some value guy out there who is selling because he sees a better opportunity than FFH during 2023?

Anyway, just a bit of navel gazing...

SJ

@StubbleJumper capital allocation will be super interesting to watch with Fairfax in 2023. Driven by hard market (20% top line growth), much higher interest rates (spiking interest income) and continued asset monetizations, Fairfax looks like it is in a multi-year period where it will have $2 to $3 billion to allocate each and every year.

Asset monetizations late in 2022: proceeds of $1.4 billion pet insurance sale (Oct). Fairfax India also closed on ICICI Wealth sale late last year.Asset monetizations 1H2023: Resolute sale ($600 million) and Ambridge ($400 million) set to close in 1H 2023

What will Fairfax do with all the cash they are generating?

Capital allocation options:

1.) strong financial position - top priority. Cash at hold co was US$800 million at the end of Q3, well below $1 billion minimum target. Makes sense to me Fairfax will want to get this to $1.1 billion = $300 million

2.) dividend: at US$10 paid in late January = $234 million

3.) grow insurance in hard market: Fairfax has said repeatedly this is a top pick. It appears the hard market is continuing into 2023. Most insurance subs look well capitalized to fund growth on their own; perhaps C&F (keep some proceeds from pet insurance sale) and Brit get top ups.

4.) Runoff: might need a top up of $200 million or so. Lots of long tail stuff (impact of inflation?)… we will know much more when Fairfax reports Q4 (and they have completed their actuarial review).The top 4 items are pretty straight forward. Deciding what to do among the remaining options is where things get really interesting. The weightings are what i wonder about.

5.) Mergers and acquisitions: other than bolt on purchases (like Singapore Re in 2021), Fairfax has said repeatedly that they are done with big insurance purchases. They are happy with their global footprint. Fairfax actually has been a seller (at attractive prices): runoff in 2021, pet insurance in 2022 and Ambridge so far in 2023.

6.) FFH stock buybacks: it is a given Fairfax will buy back stock in 2023. I think a stock buyback of 500,000 shares is a good baseline number = 2% of shares outstanding. This is similar to where 2022 will likely come in.

7.) buy back minority interests (Allied, Odyssey and Brit): Fairfax was very active on this front in 2022, spending $750million to buy back a significant chunk of Allied. My guess is we see another spend of $500-$750 million in 2023.

- some on the board feel this activity is similar to Fairfax doing a buyback. It does result in Fairfax shareholders owning a larger share of Fairfax earnings.

8.) buy equities - current holdings: Fairfax’s biggest spend in 2022 was increasing its ownership of existing equity holdings = $1.14 billion. Makes sense we see a step down here in 2023.a.) take private: Recipe = US$340 million, Grivalia Hospitality = $195 million

b.) increasing ownership: Kennedy Wilson, Fairfax India, Altas, Altius, Ensign, John Keels, Foran, Myrilineos = $800 million in total.

9.) buy equities - new positions: Fairfax spent a significant amount on large cap equities/private equity in 2022 = $550 million. Perhaps Fairfax increases this amount in 2023.

a.) large cap US: Bank of America, Chevron, Occidental, Micron (add) = $350 million

b.) private equity: JAB investment fund = $200 (another $250 million in notes)

When you look back at 2022 you see a very balanced approach by Fairfax:

- grow insurance +20% in hard market - opportunistic

- pay $10 dividend

- sell high: pet insurance - opportunistic

- buy back Fairfax stock - opportunistic

- take out minority partners

- increase ownership of equities already owned - opportunistic

- seed new equity positions - opportunistic

For 2023 i see Fairfax doing more of the same as 2022. Balance. Rational. And as a shareholder, i applaud it. Lots of low risk / high return decisions that will benefit shareholders for years to come.

What changes from 2022 could we see in 2023?

1.) I think we will see some more purchases in India; and perhaps a very large one. I love Fairfax’s long term track record in India. But big purchases and Fairfax still makes me nervous… so we will see.2.) perhaps we see Fairfax get more active on the stock buyback front. But i am not sure. Looking at 2022, Fairfax appears to prefer buying other equities trading at bear market lows.

3.) large cap US stocks: coming out of the Great Financial Crisis, Fairfax was flush with cash (thank you credit default swaps) and they put more than $1 billion into large cap US stocks. Looks like they might be doing the same thing again.

Bottom line, i love how Fairfax allocated capital so far in 2022. And i look forward to seeing what they did in Q4 and what they do in 2023. Interesting and exciting times for Fairfax shareholders.

-

1

1

-

-

27 minutes ago, Sweet said:

So many pundits predicting economic catastrophe in Europe this Winter and in 2023. We are only a month in to be fair, but those predictions are already looking sour.

@Sweet There is always new news. That is why forecasts are usually always wrong. And that is not because people making forecasts are stupid. Investors need to attach probabilities to forecasts and expected future outcomes. Tail events can happen.

Bottom line, record warm temperatures in Europe in winter have impacted the accuracy of forecasts from 3 and 4 months ago. That is a wonderful outcome for Europe.

Does Europe (and the world) no longer have energy issues? Of course we do. How will it all play out? Not sure. Oil stocks are a 20% weighting for me today. I remain bullish on the sector (especially looking out a year or two). Happy to collect close to a 5% dividend and wait and see what happens. I expect we will see wicked volatility.

-

5 hours ago, cwericb said:

Yes it looks like the debt to Fairfax is being paid out. However, I thought it interesting that Paul Rivett was involved.

I am of the opinion that Fairfax shifted their equity investing approach somewhere around 2018. Since 2018 they are just making much, much better decisions with their equity investments (especially when compared to 2016-2017).

Paul left Fairfax in 2019 and i wonder if his leaving was not tied to Fairfax’s shift in strategy with its equity holdings (‘fit’, i like to call it). Fairfax Africa was Paul’s baby and it was a complete dog costing Fairfax hundreds of millions in cash and also significant damage to its reputation (lots of investors in Fairfax blindly invested in Fairfax Africa too and lost their shirts). It has taken Fairfax years to ‘fix’ the many poorly performing equity investments purchased before 2018. Paul continues to be Executive Chairman of Recipe and that stock was a another dog for minority shareholders who owned it long term.

Clearly Paul didn’t leave Fairfax to ‘retire’. What companies does he continue to be actively involved with? He is currently CEO and Executive Chairman with Greenfirst. That company has ‘old Fairfax’ written all over it (poorly managed, terrible cost structure, very tough current environment). Where do minority shareholders fit? Good luck. Paul is also involved with Torstar. Currently he and Bitove are engaged in a very public falling out.

I am not suggesting Paul is not an outstanding person. Or that he will not make himself and shareholders a bunch of money moving forward. Having said that, i am very happy that Fairfax appears to have learned from their past mistakes and has moved up the quality ladder (with top notch management at the top of the list) when making equity purchases.

i think it is very instructive to look at who replaced Paul at Fairfax… Peter Clarke. Peter does not look like he is actively driving the bus on equity purchases. I don’t know this but his role in the company appears to be a little different than Paul’s role was in the past.

Fairfax has a $51-$52 billion investment portfolio. They look well positioned today in terms of management.

-

2 hours ago, cwericb said:

Has anyone taken a close look at Chorus Aviation?

"Chorus’ vision is to deliver regional aviation to the world. Headquartered in Halifax, Nova Scotia, Chorus is an integrated provider of regional aviation solutions, including asset management services. Its principal subsidiaries are: Falko Regional Aircraft, the world’s largest aircraft lessor and asset manager focused solely on the regional aircraft leasing segment; Jazz Aviation, the sole provider of regional air services to Air Canada; and Voyageur Aviation, a provider of specialty air charter, aircraft modification, and parts provisioning services to regional aviation customers around the world."

Interesting to note that both Fairfax and Brookfield are involved with Chorus and Paul Rivett is on the board of directors. Picked up a few shares in CHR last week and may acquire some more next week.

@cwericb i am confused. When i read the press release from Chorus’ web site it sounds to me like the debentures Fairfax owned were repaid early. And the 24 millions warrants Fairfax had expired worthless.Does this not mean that Fairfax no longer has an investment in Chorus?

—————

—————

- https://chorusaviation.com/chorus-aviation-closes-redemption-of-its-6-00-senior-debentures/

HALIFAX, NS, Dec. 29, 2022 /CNW/ – Chorus Aviation Inc. ("Chorus") (TSX: CHR) today announced that it has closed the redemption of $115,000,000 principal amount of Chorus’ 6.00% Senior Debentures due December 31, 2024 (the "Debentures"), representing all of the Debentures that were outstanding immediately prior to the redemption. Chorus previously announced its intention to redeem the Debentures on December 14, 2022.

The Debentures were secured by certain Dash 8-100 and Dash 8-300 aircraft and real estate property owned by Chorus’ subsidiaries (the "Collateral Security"). The Collateral Security has now been released.

In connection with the issuance of the Debentures, Chorus issued 24,242,424.242 warrants to affiliates of Fairfax Financial Holdings Limited ("Fairfax") entitling the holder thereof to acquire, on exercise of each warrant and subject to certain adjustments, one Class A Variable Voting Share or Class B Voting Share of Chorus at a price of $8.25 per share (the "Warrants"). The Warrants have now expired.

-

Fairfax has been simplifying the ownership structure of its assets in India. It owned IIFL Finance and IIFL Wealth both directly and via Fairfax India. Late in 2021 it sold its direct holdings in IIFL Finance and IIFL Wealth.

In 2022, Fairfax India sold its holding of IIFL Wealth down to a 3.8% positio. Why? It appears at least one reason was to get their ownership of various assets in India compliant with regulators to allow a Digit IPO.

—————-Fairfax bought 49.2% ownership position in Quantum Mutual Funds for $43 million in 2015. It would be interesting to know what the position is worth today…

—————-

Fairfax looks to settle mutual fund cross-holding norms case with Sebi

- https://economictimes.indiatimes.com/markets/stocks/news/fairfax-looks-to-settle-mutual-fund-cross-holding-norms-case-with-sebi/articleshow/93883299.cms?from=mdr—————-

“The Securities and Exchange Board of India (Sebi) rules do not allow any entity to hold more than a 10 per cent stake in more than one mutual fund house. Fairfax has more than 10 per cent shareholding in two mutual fund houses - Quantum Mutual Fund and IIFL Mutual Fund.”

“HWIC Asia, an affiliate of Fairfax Financial Holdings, has a 49.2 per cent stake in Quantum Advisors, the sponsor of Quantum Asset Management Company and Quantum Mutual Fund.”“Similarly, FIH Mauritius Investments, an entity of Fairfax Group, owns a 13.62 per cent stake in IIFL Wealth Management, which is the sponsor of IIFL AMC and IIFL Mutual Fund, the latest shareholding data with BSE showed.”

“The capital markets regulator, in October 2021, issued a show cause notice against Fairfax Financial Holdings Limited (FFHL), the ultimate parent entity of Fairfax Group, alleging a violation of mutual fund rules by FFHL, according to the draft IPO documents of Go Digit General Insurance Limited.”

“Go Digit, a firm backed by Canada-based Fairfax Group, filed preliminary papers with Sebi on August 14 to raise funds through an initial public offering (IPO).”

“FFHL had filed a settlement application dated June 3, 2022, with Sebi under the Sebi (Settlement Proceedings) Regulation, 2018," the company disclosed in the draft IPO documents.

“The company further said that FIH Mauritius Investments, in which FFHL indirectly holds shares, has since entered into a binding agreement for the sale of certain of its shareholding in IIFL Wealth Management, the sponsor of IIFL Asset Management and IIFL Trustee.” -

Given all the positive press India is getting these days (fastest growing major economy in 2023 and over next decade) I thought it might be interesting to provide an update on Fairfax's ownership position in Fairfax India.

If there is one thing we can say with certainty... Fairfax knows how to invest in India. On the insurance side of things, Fairfax started with ICICI-Lombard back in 2000 and then pivoted to Digit in 2017. They realized $1.1 billion in gains on their 18 year investment in ICICI-Lombard. Digit is shaping up to be an even bigger winner for Fairfax - especially if we see a Digit IPO in 2023.

On the equity side of things, Fairfax's first big investment in India was Thomas Cook in 2012. Thomas Cook in 2013 then bought 75% of IKYA Human Capital Solutions for $47 million (re-named Quess). Quess was eventually spun out as a separate company and has been a huge winner for Fairfax (although not as much was we initially thought in 2019). Thomas Cook was to be Fairfax's investment vehicle in India, but that all changed in 2014.

In 2014 Modi, with a pro-business agenda, was elected Prime Minister of India. As a direct result of Modi's election win, Fairfax launched Fairfax India in 2015. Fairfax wanted to accelerate their growth in India. And accelerate it they have. Fairfax India has invested in more than 10 difference companies. However, the 'crown jewel' was its investment in Bangalore International Airport (BIAL) in 2016.

When Fairfax India was started back in 2015, Fairfax owned a 28.1% interest. As of Sept 30, 2022, Fairfax owned 42.1% = 50% increase over 7 years. This is great news for Fairfax shareholders.

Fairfax India management has done an outstanding job over the past 7 years. Book value has increased from $9.50/share in 2015 to $18.75/share at Sept 30, 2022.

What about Fairfax India's share price? it closed at $13.26 on Friday. Is 2023 the year where investors finally give Fairfax India some love?

-

6 hours ago, no_free_lunch said:

I think the next step is to go after India for their continued support of Russia. Why should the west do business with them? They need us as much as the west needs them.

Geopolitics is all about national self interest. Not right and wrong.

India is primarily looking after India. Geopolitically, India has never been aligned strongly with the West. The West was aligned strongly with Pakistan (and against India) during a couple of wars. Much if India’s military equipment is of Russian origin. India’s primary geopolitical threat is China. It is complicated. But it should not surprise anyone that India is going to try and not pick sides in the Ukraine war (the West versus Russia/China).

India is still trying to raise much of its population out of poverty. Running water. Electricity. Basic stuff. Lots of work needs to be done. India will take Russian energy at well below market prices.

India looks to be shifting more to the West economically (Modi’s reforms). However, for decades India was aligned with the Soviet Union / Russia. My guess is those ties still run deep (culturally). It will take India decades to pivot culturally to more of a Western economic model. And it would not take much to push the economic train off the rails. So Modi likely needs to be careful.

The West will want to pull India into its orbit. It will be interesting to see how things play out the next couple of years. India is projected to be the fastest growing major economy in the coming years - that also matters.

—————

India has a unique cultural/political/economic model (with a crazy amount of diversity). there are lots of other posters on this board who can offer way more insight than me.

https://www.greaterpacificcapital.com/thought-leadership/indias-diversity-is-a-strategic-asset

“India is more like a continent than a country, in terms of the diversity of its peoples and the scale of its diversity.”

-

10 hours ago, jfan said:

Sorry I'm a slow learner but FFH's ROE since 2002 has averaged 8% (with a wide dispersion) and a median of 6% (IQR25 2%, IQR75 12%).

With it trading at P:E of 6x, is the investment narrative here that FFH can sustain its current earnings for a longer period of time relative to its historical performance? Is then the hope here, that their PE multiple will expand to 10x?

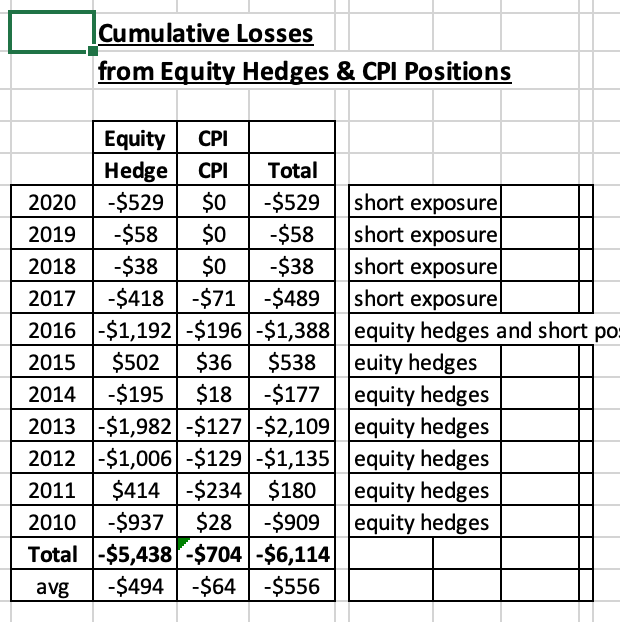

@jfan my view is looking at historical numbers for Fairfax (especially 2010-2020) is pretty much useless in helping an investor determine what the company will earn in 2023 and future years. Why? Equity hedges. Those two words that make long term investors in Fairfax curl up in a fetal position and weep loudly.

From 2010 to 2020 Fairfax lost $5.4 billion on its equity hedge positions (pre-tax). This was a average loss of $500 million per year for straight 11 years (see my table below).

Now i don’t want to get sidetracked in of why Fairfax did this. Here is the good news for investors today… Fairfax has stated numerous times that they will no longer short individual companies or indices (final position was exited in 2020). What a forward looking investor needs to understand is these losses were one-time in nature and will not be repeated in the future.

It is like a $500 million annual expense (from 2010-2020) suddenly ended for Fairfax on Jan 1, 2021. Fairfax shareholders should have organized a parade or something! What is the value to Fairfax shareholders of that happening?

Guess what losing $500 million per year for 11 years does to your historical (backward looking) ROE calculation over that time period? Or your earnings? Or book value? Yes, not pretty.

But guess what happened to Fairfax’s underlying business did over the 2010-2020 period? Its insurance business went from $4.4 billion in net written premiums to $15 billion in 2020 (and est $22 billion in 2022). Total investments grew from $21 billion to $43 billion (and est $52 billion in 2022).

Fairfax’s earnings power has exploded higher from 2010 to today. Fairfax is like a 100m sprinter who had been racing for 11 straight years will $500 million weights wrapped around their ankles. Except, today the ankle weights have been removed. And the sporting world has no idea how fast this sprinter can actually run. We all got a glimpse in 2021 (record earnings). But the spiking of bond yields (and subsequent $1.4? billion in losses on bond portfolio) resulted in a false start in 2022.And here we are at the starting line in 2023. All the journalists (investors and analysts) are looking at the sprinters (P&C insurers). They are wondering about this Fairfax guy. They still think he is the sprinter they saw in 2010-2020 who finished last in every race (ROE, growth in BV, stock price). They think the results from 2021 were a fluke - a first place finish (my guess). A few journalists are wondering if the sprinter we saw in 2021 is for real… Well, we will all get our answer in 2023 and 2024. With the $500 million shackles removed, i think Fairfax is going to surprise everyone with how much it is going to earn moving forward.

----------

The 'equity hedge' strategy was 'officially' ended way back in late 2016. So most of the losses were incurred from 2010-2017. The final position was exited in 2020, giving Fairfax investors one more nasty surprise. But really from 2018 the size of the losses from the equity hedges had dropped significantly and by the start of 2021 they had ended completely. (And what do you know... 2021 was a record year for earnings for Fairfax).

----------

In a bizarre twist, Fairfax's 'equity hedge' position of the past is a gift for new(er) shareholders. It is the single largest reason Fairfax stock (still) sells at such a cheap price today.

-

Greece has been an interesting geography for Fairfax for the last decade. Fairfax has about $2 billion (current market value) invested in 4 Greek equities = 13.3% of their $15 billion equity portfolio. They also own 80% of Eurolife, with a carrying value of $450 million (I think). Bottom line, Greece is an important jurisdiction for Fairfax.

Over the past couple of years Greece has been slowly emerging from its financial catastrophe. A pro-business government has been busy restructuring the Greek economy. Tourism and property markets are once again doing well. Greece is one of the countries leading Europe in GDP growth in 2022 and this is expected to continue in 2023.

So what assets does Fairfax own in Greece today?

- Eurobank: 32.2% ownership of a well managed bank that includes a very large and profitable property company (former Grivalia Properties); its balance sheet is fixed and 2022 has been a breakout year for profitability. This is the second largest equity holding for Fairfax (based on market value).

- Grivalia Hospitality: 78.4% ownership - deploys capital in the very attractive high-end hospitality sector in Greece, Cypress and Panama. Managed by Grivalia Management (also manages real estate for Eurobank).

- Mytilineos: 4.68% ownership - a global industrial and energy company.

- Praktiker: 100% ownership - a Home Depot type business. Much smaller than the other companies listed above.

- Eurolife: 80% ownership of a well managed and profitable insurance company; 20% owned by Eurobank. Has 31% share of the total life and general insurance market for 2021 in Greece.

What is the approximate value of Fairfax’s investments in Greece?

- Eurobank $1,430 mill Jan 11, 2023 market value

- Grivalia Hospitality $340 44.5% cost $195 million

- Mytilineos $140 Jan 11, 2023 market value

- Praktiker $50? My guess - purchased for $29 million in 2014

- Eurolife $450?

—————

Eurobank stock is hitting what looks to me like a new 5 year high; today (Jan 11) the stock is trading at €1.15. Dec 31, 2022 it was €1.055. So Fairfax’s stake is up to $1.42 billion as we start 2023 (an increase of $120 million over Dec 31, 2022). Not too shabby. There is a good chance the dividend will be reinstated in 2023. This will be another catalyst for Eurobank shares. (Fairfax had a carrying value for Eurobank of $1.351 billion as of Dec 31, 2021.)

Eurobank had set a target to earn €0.14/share in 2022. Mid-year, management increased the target to €0.18/share. This means Eurobank stock is trading today at a P/E of 6.4. Very cheap. Attach a P/E of 8 to 2022 earnings and you get a share price of €1.44 (US$1.55). Fairfax has an original cost on its position in Eurobank of US$0.92/share. A price of US$1.55 = 70% return for Fairfax off its original cost base.

Eurobank had a break-out year in 2022. Fairfax’s share of Eurobank’s pre-tax earnings:

- est $310 million FY 2022 ($230 million to Sept 30)

- $162 million in 2021

- -$12 million in 2020

Earnings from Eurobank is jumping year over year and is spiking ‘share of profit of associates’ for Fairfax to record levels.

Bottom line, compared to 2 or 3 years ago, Eurobank is a good example of a Fairfax equity holding that is much better positioned today to deliver significant value to Fairfax in the coming years.

- Q3, 2022 Eurobank investor presentation: https://www.eurobankholdings.gr/-/media/holding/omilos/grafeio-tupou/etairikes-anakoinoseis/2022/3q-2022/3q2022-results-presentation.pdf

—————

Fairfax’s 10 year history in Greece has had a couple of triumphs (Grivalia, Eurolife), one catastrophe (initial investment in Eurobank), adversity, heroes, villains, a depression, a pestilence, loyalty, creativity (merger of Grivalia Properties with Eurobank) and years of hard work - it all reads like one of the books of the Iliad by Homer.

Below is a short summary of the odyssey of how Fairfax got to where it is today with its Greek investments. All good stories always start at the beginning. So…

Why did Fairfax invest in Greece? Answer: Ireland. What?

Fairfax had outstanding success investing in a distressed Irish bank (Bank of Ireland) in late 2011 after the Great Financial Crisis (I think they made +$800 million on this investment - tripled their money in a little over 5 years). And business partner, Kennedy Wilson, had great success investing in real estate in Dublin. So as the cash register was ringing on their Irish investments, Fairfax saw similar opportunities in Greece.

What was the timeline of the Greek purchases?

-

2011: purchased 3.8% position in Grivalia (Europroperties)

- run by George Chryssiko who is one of the heroes of this story

- the Greek journey begins

- Aug 2012: Grivalia (Eurobank Properties REIT) - Fairfax increased ownership from 3.8 to 18% for $50 million

- 2013: Grivalia (Eurobank Properties REIT) - Fairfax increased ownership to 41% for $20 million (plus?)

-

Dec 2014: Eurobank: Fairfax makes initial investment of 400 million Euro with group of investors (including Brookfield, Wilbur Ross, Fidelity, Mackenzie, Capital Research and Management)

- unemployment rate in Greece in 2014 is 28%!

-

Nov 2015: Eurobank recapitalization

- forced by ECB, definitely one of the villains of our story, Fairfax invests an additional 350 million Euro

- ownership increases from 12.5% to 17%.

- 1 for 100 reverse share split; sold new shares for 1 euro.

-

Aug 2016: Eurolife: Fairfax purchases 80% ownership; 40% to Fairfax for $181 million and 40% to OMERS for $181 million.

- purchased from Eurobank. Fairfax was aided in its bid by its ownership in Eurobank (viewed as being good partner); important to Eurobank because the bank was retaining 20% ownership and much of Eurolife’s business was transacted through Eurobank distribution channels.

- referendum in Greece in 2015; Tsipras/Syriza elected; Syria refugees

- 2017: Grivalia - Fairfax Increased ownership to 52.7% for $100 million

- 2018: Eurolife - Fairfax increased ownership to 50%; bought 10% from OMERS (whose ownership decreased to 30%)

-

Nov 2018 (closed May 2019): Eurobank - Fairfax increases stake to 32.4% via merger with Grivalia Properties.

- all stock transaction valued at US$866 million

- Fairfax owned 18% Eurobank and 54% of Grivalia; on close Fairfax owned 32.4% of new Eurobank

- Grivalia paid 40.5 million Euro special dividend

- Eurobank launched property management business run by Grivalia CEO

- July 2019 In Greek national election, pro-business party New Democracy elected, led by Kyriakos Mitsotakis, which received nearly 40% of the vote and won 158 seats, an outright majority.

-

July 2021 Eurolife: Fairfax increased ownership to 80% (purchased OMERS 30% stake for $142.6)

- Eurobank owns remaining 20%

- July 2022 Grivalia Hospitality: Fairfax increased ownership from 33.5% to 78.4% for $195 million

- Dec 2022 Mytilineos: Fairfax increased ownership to 4.68% for $53 million

————————-

Other Greek investments:

2013 Mytilineos - 5% for 30 million Euro ($41 million)

2014 Praktiker Hellas AE - bought 100% for 21 million Euro

————————-

Why is Eurolife considered a gem?

2019AR: Through the crisis in Greece, we acquired a gem in Eurolife, a Greek property and casualty and life insurance company that operates predominantly in Greece but also in Romania. Alex Sarrigeorgiou has run Eurolife since 2004, following Eurobank’s decision to grow its insurance business, and we acquired it with OMERS as our partner in 2016. Since our initial 40% purchase of Eurolife in 2016 for Euro163 million, Eurolife has earned Euro347 million and paid dividends of Euro298 million and shareholders’ equity has increased from Euro400 million to Euro720 million at the end of 2019 after the payment of dividends. This phenomenal performance was predominantly because Eurolife had a significant holding of Greek government bonds whose rates went from 8% to 1% during that time period while its non-life business had an average combined ratio of 72%. We currently own 50% and equity account for Eurolife but plan to buy the rest of OMERS’ shares in 2020.

2020AR: Finally, in Greece, Eurolife has been an extraordinary investment for Fairfax. Writing both Life and Property/Casualty lines, the company in 2020 generated over $500 million of gross premiums written and produced net income of $130 million. Led by Alex Sarrigeorgiou, Eurolife has a track record second to none in the Greek market.

2021AR: On July 14, 2021 the company increased its interest in Eurolife FFH Insurance Group Holdings S.A. (“Eurolife”) to 80.0% from 50.0% by exercising a call option valued at $127.3 to acquire the joint venture interest of OMERS for cash consideration of $142.7 (€120.7). The assets, liabilities and results of operations of Eurolife’s life insurance business were consolidated in the Life insurance and Run-off reporting segment and those of Eurolife’s property and casualty insurance business were consolidated in the Insurance and Reinsurance – Other reporting segment, pursuant to which the company remeasured its 50.0% joint venture interest in Eurolife to its fair value of $450.0 and recorded a net gain of $130.5 in gain on sale and consolidation of insurance subsidiaries in the consolidated statement of earnings, inclusive of foreign currency translation gains that were reclassified from accumulated other comprehensive income (loss) to the consolidated statement of earnings. The remaining 20.0% equity interest in Eurolife continues to be owned by the company’s associate Eurobank. Eurolife is a Greek insurer which distributes its life and property and casualty insurance products and services through Eurobank’s network and other distribution channels.

(5) Includes a redemption liability of $124.9 on non-controlling interests as the company’s associate Eurobank may put its 20.0% equity interest in Eurolife to the company commencing in 2024 at the then fair value of that interest.

—————————

2021AR: Eurobank, led by Fokion Karavias with support from George Chryssikos, had an outstanding year in 2021 as it expects its non-performing loan ratio to drop to 7%, return on tangible equity to increase to over 8%, and capital ratio (CETI) to be strong at approximately 13%. Under Fokion’s leadership, Eurobank’s profitability is expected to grow significantly with Greece’s strong economic growth. As I have said previously, Greece is blessed with a great prime minister, Mr Mitsotakis, who is very business friendly and has dramatically improved the economic outlook of Greece since he got elected three years ago. Greece’s GDP is expected to grow by 8.5% in 2021, its unemployment ratio fell to a decade low of 12.8% and real estate prices continued to increase. Since December 31, 2021, Eurobank shares have increased to a high of 1.14 euros per share – still a far cry from the book value of 1.47 euros per share. Eurobank is ready to begin paying dividends again (the first time since May 2008), subject to regulatory approval. The future is very bright for Eurobank.

—————————

Here is a little more information on Grivalia which is now part of Eurobank. With property prices on a multi-year move higher Grivalia is an important profit engine for Eurobank.

2017AR: In 2017, we raised our equity interest in Grivalia to 52.7% by buying 10.3% for $100 million when Eurobank decided to divest its interest in Grivalia. It has been six years since we first met George Chryssikos, the outstanding CEO of Grivalia. Through Wade Burton, we took our first position in Grivalia in 2011 at Euro5.77 per share. George has navigated the Greek economic crisis superbly by buying only the highest quality commercial buildings and shopping centres at huge discounts to replacement cost and unlevered returns of 8% to 10%, not using excessive leverage and always focusing on the long term. We are very excited to be partners with George and his team as they build a fantastic real estate company. Like Bill McMorrow at Kennedy Wilson, George has a unique nose for value in real estate! And like all our Fairfax companies, he is building a fine company, focused on its customers, looking after its employees, making a return for shareholders and gratefully reinvesting in the communities where it operates. Business is a good thing!!

—————————

2019AR: Merger of Grivalia Properties REIC and Eurobank Ergasias S.A.

Early in 2019, Fokion Karavias (CEO of Eurobank) and George Chryssikos (CEO of Grivalia) came up with the idea of merging Grivalia into Eurobank, to strengthen the capital position of Eurobank, and accelerating its non-performing loan stock reduction through spinning out Euro7.5 billion of non-performing loans from the bank to its shareholders. We thought it was a brilliant idea but the process took time as it was subject to shareholder approval at Eurobank and Grivalia and regulatory approval from the ECB. As part of the same plan, Eurobank sold its non-performing loans management unit, FPS, to doValue S.p.A. (a public company listed in Italy) for Euro360 million. We expect all these transactions to close by March 31, 2020 and Eurobank to be well capitalized and on its way to earning 10% on its shareholders’ equity in 2020. Last year, Greece had an election in which the business friendly party of Kyriakos Mitsotakis won a majority in the parliament. As the new Prime Minister, Kyriakos has the opportunity to transform Greece by encouraging foreign investment into the country and by being business friendly. Ten-year Greek government bonds, which peaked at a yield of 37% in 2012, came down to 10% in 2016 and are now trading below 1%. Recently, Greece did a 15-year bond issue at 1.9% and a 30-year issue at 2.5%. The animal spirits are coming back to Greece and we think the Greek economy and Greek companies will thrive. Eurobank should benefit!! Our cost of 1.2 billion shares of Eurobank after the Grivalia transaction is now 94¢ versus a book value of approximately 135¢ per share post the transaction. At year end, Eurobank was selling at 68% of book value and 6.5x normalized earnings. We still believe it will be a good investment for us.

On May 17, 2019 Grivalia Properties REIC (‘‘Grivalia Properties’’) merged into Eurobank Ergasias S.A. (‘‘Eurobank’’), as a result of which shareholders of Grivalia Properties, including the company, received 15.8 newly issued Eurobank shares in exchange for each share of Grivalia Properties. Accordingly, the company deconsolidated Grivalia Properties from the Non-insurance companies reporting segment, recognized a non-cash gain of $171.3 and reduced non-controlling interests by $466.2. In connection with the merger, Grivalia Properties had paid a pre-merger capital dividend of Euro0.42 per share on February 5, 2019. The company owned approximately 53% of Grivalia Properties and 18% of Eurobank prior to the merger, and owned 32.4% of Eurobank upon completion of the merger.

————————

Eurobank: https://www.eurobank.gr/en/group

Grivalia Management: https://www.grivalia.com

Grivalia Hospitality: https://grivaliahospitality.com/about-us.html

Eurolife: https://www.eurolife.gr/en

Mytilineos: https://www.mytilineos.gr/who-we-are/mytilineos-company/

————————

-

I use RBC. Even though they are all self directed, my accounts are large enough that i get access to all their research reports (company/industry etc). I find i get a lot of value from the reports their analysts put together. Not the final number… but the build. The logic of how they get to that number. Often i learn some important things i was not thinking about (i am also not an accountant).

i also find the Q&A sessions with analysts on earnings conference calls is also valuable. The analysts usually ask at least a few important questions.

—————Having said all that, i do find going directly to the sources is the best: company earnings releases and conference calls.

-

1

1

-

-

Fairfax: Sources of Net Earnings

3.) Share of profit of associates

Fairfax has a number of significant tailwinds driving earnings higher. I have already posted on two: underwriting profit and interest and dividend income. There is a third item that is also spiking higher in 2022: share of profit of associates.

----------

Over the 5 year period, from 2017-2021, ‘share of profit of associates’ averaged about $200 million per year for Fairfax. This year (2022) it should come in at around $1 billion for the full year. This surprised me. That is a big increase over the trend from the past few years. 2022 MUST BE an outlier and Fairfax should settle back to something closer to $200 million in 2023… right? Wrong. My guess is ‘share of profits of associates’ should be able to deliver around $900 million in 2023 and this number should grow nicely in the coming years.

That is a significant increase in one year. What happened? Put simply, the earnings power of the equity holdings captured in the ‘associates-equity accounted’ bucket are beginning to shine through.

Four companies make up 85% of total ‘share of profits of associates’.

- After 8 years, the turnaround at Eurobank is complete. Eurobank is also benefitting from higher interest rates and also one of the strongest economies in the Eurozone (yes, Greece).

- Atlas is growing rapidly driven by its aggressive new-build strategy. a significant number of new-build deliveries are expected to happen in 2023 and 2024. A consortium, lead by David Sokol and supported by Fairfax and the Washington family, is attempting to take Atlas private in 2023.

- Energy is the best performing sector in 2022 and EXCO Resources, a US natural gas producer, is well positioned to continue to benefit.

- The commodity bull is running and this will benefit Stelco in the coming years. Fairfax sold Resolute Forest Products and the deal is expected to close in 1H 2023.

Over the past 5 years, Fairfax has quietly built out another significant source of passive earnings that will benefit shareholders for years to come.

-

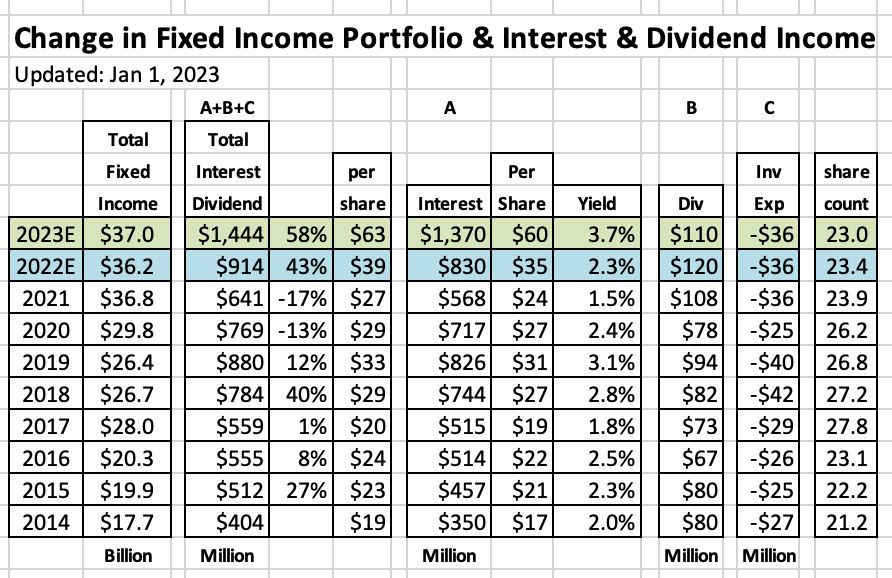

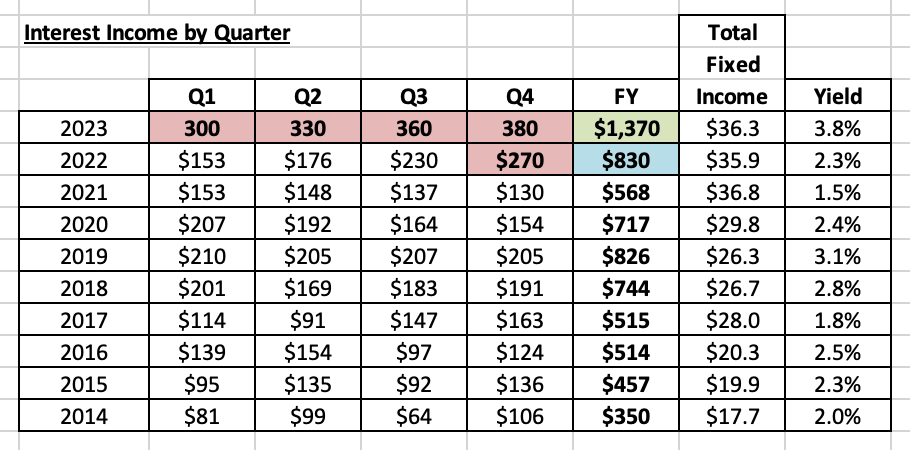

Fairfax: Sources of Net Earnings

2.) Interest and Dividend Income

Of all of the many positive developments at Fairfax in 2022, the increase in interest rates (and interest income) is one of the most exciting.

—————

Summary: Fairfax earned $641 million ($27/share) in interest and dividend income in 2021. For 2022, my estimate is $914 million ($39/share), or +43% year over year. This will be a new record. For 2023, my estimate is $1.444 billion ($63/share), or +58% year over year. Yes, this will be a new record. These are significant increases in both 2022 and 2023.

—————

Interest & dividend income = interest income + dividends - investment expenses.

—————

A.) Interest Income: In 2021, Fairfax earned $568 million in interest income = 1.5% yield on their $36.8 billion fixed income portfolio. In 2022, Fairfax is on track to earn $830 million in interest income = 2.3% yield on their $36.3 billion fixed income portfolio. In 2023, my estimate is Fairfax will earn $1.37 billion in interest income = 3.7% yield on their $37 billion fixed income portfolio.

What has driven this significant increase in interest income?

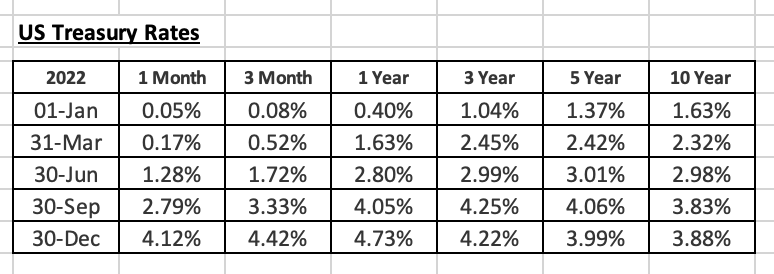

1.) spiking interest rates: see table of ‘US Treasury Rates’ below.

2.) extremely low duration of bond portfolio: 1.2 years at Dec 31, 2021.

3.) steadily growing size of fixed income portfolio: increased from $17.7 billion in 2014 to $36.2 billion in 2022.

Fairfax timed their move to short duration in their fixed income portfolio exceptionally well. With rates spiking higher, the low duration allows Fairfax to roll their significant fixed income portfolio more quickly into higher yielding securities. Most P&C insurers have an average duration on their fixed income portfolio of closer to 4 years on average.

B.) Annual dividend income: Fairfax currently earns about $110-$120 million in dividends from its equity holdings.

C.) Annual investment expenses: Fairfax incurs investment expenses of about $36 million per year.

When it reported Q2 results, Fairfax said the then run-rate for interest and dividend income was about $950 million/year. When it reported Q3 results, Fairfax said the current run-rate for interest and dividend income was about $1.2 billion. This is a significant increase of $250 million in just 3 months. Of the $1.2 billion total, about $1.1 billion is interest income = 3.0% yield on $36.2 billion fixed income portfolio. So at the end of Q3 Fairfax was tracking to a 3% yield on its fixed income portfolio which is double what it was in 2021.

Of interest, Fairfax confirmed with Q3 results that they are starting to extend the duration of their fixed income portfolio. At the end of Q2 it was 1.2 years. At the end of Q3 it was 1.6 years. Fairfax said they were buying primarily 3 to 5 year US treasuries in Q3. This will be something to watch in the future. Extending the duration will allow Fairfax to lock in current high yields for years into the future.

Where will interest rates go in 2023? Current expectations are for the Fed Funds rate to get close to 5.25% in Q1, 2023. If this happens my estimated 3.7% yield on Fairfax’s fixed income portfolio for 2023 could be low.

-

Fairfax: Sources of Net Earnings

1.) Net premiums and underwriting profit

At its core, Fairfax Financial is an insurance company. The size of Fairfax's insurance business has increased dramatically over the past 9 years (2014-2022). Net premiums written have increased from $6.1 billion in 2014 to $22 billion in 2022 (my estimate) for a compounded growth rate of 17.3% per year over the past 9 years. On a per share basis, Fairfax has grown net premiums written from $289/share to $940/share for a compounded growth rate of 16% per year. The share count is up 10.4% over this time period (2014 to 2022). Fairfax is now one of the 25 largest P&C insurers in the world.

What has driven this significant growth? Two very different factors have been responsible:

1.) For the first 5 years (2014-2018) growth was driven mostly by acquisitions: Brit (2015), International (2016) and Allied World (2017).

2.) For the past 4 years (2019-2022) growth has been mostly organic and driven by the hard market.

Looking back, Fairfax timed their large insurance acquisitions perfectly - right before the hard market started.

The hard market in insurance looks set to continue in 2023 and is spreading to reinsurance - which is a big business for Fairfax. 2023 could see net premiums written increase to $24.6 billion, up $2.6 billion, or 12%, from 2022.

Why do we care what net premiums are? Because this is a key input in determining underwriting profit. And underwriting profit is a key input in determining what an insurance company will earn in a year. And earnings ultimately determine what a company is worth.

Assuming a combined ratio (CR) of 95, Fairfax is on pace to earn an underwriting profit of $970 million in 2022 ($41/share). A new record for one year. The previous record was $801 million in 2021 ($31/share). Assuming another CR of 95, my estimate for 2023 is for Fairfax to earn an underwriting profit of $1.1 billion ($48/share). Another record. Bottom line, the combination of significant growth in net premiums and solid underwriting is resulting in Fairfax earning record underwriting profit.

----------

Important: My numbers do NOT include runoff (to keep them consistent with how Fairfax reports them). My guess is the cost of runoff will come in at $100 to $150 million per year.

Fairfax 2023

in Fairfax Financial

Posted

@StevieV yes, that was a typo on my part. Meant 2024. I edited my post. Thanks for catching my error.