Viking

-

Posts

4,695 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

3 hours ago, EBITDAg said:

My favorite quarterly commentary on energy (and commodities more broadly) is out. http://gorozen.com/research/commentaries

@EBITDAg , yes, thanks very much for posting.—————

The article you posted does a wonderful job of explaining why we are not seeing more aggressive drilling by oil and gas companies in the face of higher prices. And why this will continue - until Mr Market properly values the stock prices of oil and gas companies (at a much higher level than where they are at today).

A big part of the valuation problem is most of the large investors CAN’T invest in oil and gas (because of ESG constraints)… and this suggests to me the valuation discount could persist for years. The end result of low stock prices is oil supply will also remain constrained. And this will keep oil prices elevated.

We are in an oil boom where oil companies are generating record free cash flow. Which are being returned primarily to shareholders. And supply will remain constrained. So record free cash flow will be continuing, likely for years. It is such a good story that pretty much no one actually believes it! It’s got to be too good to be true, right? And that is why i love investing so much.

Despite the run-up in prices, most oil and gas companies continue to trade at crazy cheap valuations. Investors look at a stock price chart (vertical the past 2 years) and think… ‘missed that one’.

But what have oil and gas companies done with most of the record free cash flow they have earned the past 18 months? Primarily the free cash flow has gone to 3 activities: 1.) Debt reduction 2.) Dividends 3.) Share repurchases. Some has also gone to M&A. And, yes, a little has gone to growing production. The end result is supply growth has been much slower than expected (forcing the US to aggressively tap SPR). And this will support higher prices in the future.

As an example, i posted an update on Suncor yesterday. RBC is estimating free cash flow in 2022 of C$14.6 billion and $13.6 billion in 2023 (at US$91 WTI). Market cap today is C$60 billion. Stock is trading at 4.4x free cash flow. That is wicked cheap (i also expect oil to average more than $91 in the coming years… if so, the story gets even better). And what is Suncor doing with its free cash flow? Debt repayment, dividend, share buybacks. Minimal investment in growing production; any investments made have very high IRR.

—————

An investor in Suncor today is getting:

1.) dividend of almost 5%, growing at 10-15% per year moving forward

2.) annual share buybacks of around 8%; this will increase to around 12% end of Q1, 2023

3.) reminder going to debt reduction.

Debt targets could be hit by the end of 2023; then 100% of free cash flow will becoming to investors.

—————Another oil-sands play, Cenovus, is just getting to 100% shareholder return (they have, or are very close to, hitting their net debt target)… it really is a crazy time for oil and gas investors.

—————

Below is the conclusion from the article referenced at the start of my post

WHY WON'T ENERGY COMPANIES DRILL?“When you think about the challenges now being faced by the industry in these terms, you can easily see why oil company executives would keep the pace of development subdued. On the one hand, you could increase activity, risk attracting the ire of policymakers, have your stock price go down (investors want capital return NOT production growth), and deplete your irreplaceable asset. On the other hand, you could return capital to shareholders, stay under the radar of policymakers, have the market reward your capital discipline, and keep your Tier 1 assets for a later time when the market will better value them.

Is it any wonder energy companies are not drilling?

In past cycles, the “signal to drill” has often been determined by the oil and gas price. When oil prices fell from $100 to $27 between 2014 and 2016, the industry laid down rigs because they could not generate a return on drilling. As prices recovered in 2016 and into 2018, the rig count rebounded by 600 rigs. Because of record low valuations, this is the first time we can recall where the “signal to drill” is driven by valuation instead of oil price. As a result, higher prices have not incentivized increased activity.Until investors allocate capital to the space and valuation improves, we expect drilling activity to remain subdued and oil shale supply disappointments to continue.

-

2 hours ago, Gregmal said:

Kuppy’s most recent post? Oil could go to $300 in the next couple of months. Good thing higher oil prices don’t impact inflation at all…Those who see much lower inflation in the coming months had better hope Kuppy didn’t nail it this time.

—————

I like oil/gas as an investment. I think we could see $150 oil… likely when the next expansion gets started (12-18 months out). $300 oil over the next few months? I am not so sure.

—————

- https://adventuresincapitalism.com/2022/11/04/the-fed-is-fuct-part-5/

“I know that I touched upon this in Part 2 of this “Fed is Fuct” series, but I just cannot let go of this topic. It is simply too important of a question—in fact, it seems to be the only question in my mind as we find an event-path for “Project Zimbabwe” to re-accelerate.

Let’s try a thought experiment. Imagine that OPEC pulled back on their production and sent oil to $300. Given how tight the oil market currently is, it wouldn’t even be that hard for them to achieve this. Given how annoyed they are with Biden and Powell, it’s easy to see how they’d want to do this and prove a point. Meanwhile, the rapid spike in oil prices would dramatically increase OPEC’s revenue, even with fewer barrels sold—making you wonder why they haven’t already done this.

At $300 oil, the US economy would collapse. Sure, inflation prints would go parabolic, but with the rest of the economy in freefall, the Fed would be forced to stop chasing the CPI higher. In fact, I’d wager a healthy sum that in such a scenario, the Fed would dramatically reduce interest rates and flood the market with liquidity. The Fed would effectively ignore their inflation mandate in order to save the global economy from OPEC’s oil price spike—much like when they were fighting germs during March of 2020. In this scenario, the Fed would be responding to an exogenous event that threatened to take down the economy.

Now, what if oil didn’t go to $300 due to OPEC?? What if oil went there because our President has joined an end-of-days economic suicide cult, with a bizarre carbon obsession?? The oil price spike would be the same, yet the cause would be different. In this self-inflicted scenario, would the Fed chase oil higher and continue raising interest rates to fight inflation?? Or would the Fed bail out the economy?? Every investor needs to answer this question and answer it correctly as the range of outcomes is too extreme if you get it wrong. If the causes of the oil spikes are different, will the responses be different??

I think we’re about to play out this experiment in real time over the next few months as the SPR releases end, right as China re-opens. The investment choices in front of you are quite different in terms of how you answer this key question. Sure, you’re going to ride oil into the supernova, but when you switch investment horses, which one do you choose??

What will JPOW do when oil hits $300??

If you aren’t fixating on this conundrum, you’re going to be paralyzed when it happens.”

-

Well 70 million Americans will be getting an 8.7% increase. Starting in Jan 2023. Nice to see that inflation thing is in the rear view mirror.

—————“With the payment increase in 2023, Forbes said 8.7% more will equate to an average added monthly benefit of $144 for individuals and $240 extra for couples filing jointly.”

- https://ca.sports.yahoo.com/news/social-security-cola-2023-benefits-160922091.html—————

Where will the government be getting the money from to fund the increase? Someone will be paying higher taxes next year. The tax payers will then need higher income (consumer) or higher prices (businesses) to pay the higher taxes. That will lead to higher inflation and so the COLA for 2024 will be elevated again… and we get to do it all over again. Kind of like a wage and price spiral…. But i thought this inflation thing was transitory? (Some people also believe in Santa Clause, the Easter Bunny and the Tooth Fairy…).

—————Latest COLA

The latest COLA is 8.7 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 8.7 percent beginning with the December 2022 benefits, which are payable in January 2023. Federal SSI payment levels will also increase by 8.7 percent effective for payments made for January 2023. Because the normal SSI payment date is the first of the month and January 1 is a holiday, the SSI payments for January are always made at the end of the previous December. -

2 hours ago, glider3834 said:

viking I have been doing some stats on the underwriting - my question is around the 95CR estimate - what factors could affect this?

Fairfax's underlying combined ratio is sitting at around 89 annualised

Higher net earned premiums have reduced the underwriting expense ratio (component of combined ratio) which is now sitting at 13.2% annualised (4Q21 adjusted for loss portfolio transfers).

Fairfax has reduced reserves releases to -1.9% annualised

Over the last 4 years, catastrophes have averaged 5.5 CR points - lets round it up to 6 CR points

Putting the above together, if we assume no favourable reserve development in 2023 & underlying combined ratio holds then a combined ratio = 89 + 6 = 95 looks reasonable

A conservative -1% in favourable reserve development could drop that to 94.

The two elephants in the room are inflation & higher reinsurance rates. How will these impact the combined ratio?

With reinsurance rate increases expected in 2023 plus tighter terms for reinsurers - Fairfax has the potential , provided we get a normalised cat year, to write more reinsurance more profitably (lower combined ratio) in 2023. Fitch expects reinsurer CRs to drop by 4CR points from 98 to 94 in 2023.

I am not sure the overall impact of higher reinsurer pricing impacts combined ratio for insurance business - if they can pass on the rate increases then impact can be mitigated.

How the mix of inflation combined with higher premium rates impacts reserves releases remains to be seen - we will have to wait & see.

@glider3834 thanks very much for pulling this together and sharing with us. You have done a great job of providing historical trends for lots of important inputs. A 95CR estimate for 2023 is what I am using currently. I don't think it is aggressive and as you point out it could easily come in at 94 in 2023. That would be sweet.

I have net premiums earned growing 15% in 2023 to $22.3 billion, so a 94CR would deliver about $1.34 billion in underwriting profit. I am estimating $970 million in 2022 so this would be a sizeable YOY increase (+38%).

It will be interesting to see where Q4 CR comes in this year; last year Q4 came in at a CR = 88.1. This will be an important number.

Some thoughts:

- one key is where catastrophes come in. And this is unknowable, of course. Taking the average for the last few years makes sense as they have been high catastrophe years. Hard market in reinsurance should really help here.

- one benefit of the hard market of the past couple of years can be seen with the fall in the expense ratio (outlined beautifully in your chart)

- hopefully reserve releases can continue to come in around 1.9 CR points on average moving forward.

- yes, the inflation trend will be important to monitor. The good news is if there is development for the industry then it will likely prolong the hard market. I would be more concerned about inflation if we were in a soft market.

I think another important development this year has been the spiking in bond yields. This has hit the reported book value of all insurers hard. I am thinking this could extend the hard market. Most insurers will not see the benefit of higher rate in interest income for another couple of years (given the average duration for P&C insurers is close to 4 years) - and this assumes interest rates stay high for years to allow them to lock in higher rates. Add in the emerging risk of inflation running hot for the next couple of years (not saying this will happen), it makes sense to me insurers will need to be cautious and continue to get significant rate increases moving forward. The economy also continues to chug along and this should help insurers continue to push for rate increases. Putting it all together I don't think my estimate for top line growth of 15% (net premiums earned) is crazy high for 2023.

----------

There are others on this board that understand the inner workings of P&C underwriting far better than me. Perhaps they can chime in with their thoughts

-

Here is the math in Canada (Vancouver/Toronto) for an investor. Lose money on the carry (your purchase will be cash flow negative). Make a killing on price appreciation.

Where is the math? Well, the math is not important. Because real estate ONLY GOES UP.

—————

I am looking to buy where i live in Vancouver: 2 bedroom condo (800 sq feet)

- purchase price: C$800,000

- down payment = $240,000

- mortgage = $560,000

Revenue

- rent: $3,500/month = $42,000/year

- importantly, rent increases are controlled by prov gov’t. 2021 = 0%. 2022 = 1.5%. 2023 = 2% = 3.5% total increase last 3 years.

Expenses

- interest = $30,000 (5.5% interest rate)

- property taxes ==$2,500

- condo fee = $400/month = $5,000

- reno/misc costs = $2,500/year

Total expenses = $40,000/year

Opportunity cost of $240,000 down payment @8% (low) = $20,000/year

Revenue - Expenses (incl opp cost) = lose $20,000 per year

Conclusion: i can buy a condo and lose $20,000/year (including opportunity cost). And hope that future price appreciation will cover my loss and provide an acceptable return.

—————Alternative?

Invest my $240,000 and earn 8% = $20,000 per year. Hassle free.

- if i can earn more than 8% this option gets much better. (My long term average is a little over 15% = $36,000.)

—————So when i look at buying a condo where i live in Vancouver (through an investors eyes) it makes absolutely no sense for me.

————-

Other considerations:

- real estate offers diversification (from holding financial assets only)

- the rental market in Vancouver is nuts (hard to find and expensive)… my 3 kids will need to live somewhere after they graduate from university…

-

In terms of capital return, Fairfax has been pretty clear what the priorities are:

1.) solid financial position

2.) grow insurance subsidiaries in hard market

3.) buy back stock

We also know a US$10/share dividend is coming in January.

So investors know what they are getting when they invest in Fairfax.

—————Personally, i like what Fairfax has been doing on the capital allocation front the past couple of years.

1.) debt levels are a little elevated… most recent $750 million increase was used to increase stake in Allied World. Solid move.2.) top line has been growing at 20% the past couple of years. Love it.

3.) share count has been coming down aggressively the past few years. I am VERY interested to see what they are doing with proceeds from pet insurance sale that closed the end of October. I wonder if Fairfax is buying back stock as part of its NCIB… someone is buying a bunch of stock spiking shares higher. Love it!

4.) looking forward to $10 dividend payout in January.

Very shareholder friendly.

-

23 minutes ago, Gregmal said:

Aint it funny how folks now "stand with Chinese protesters", but were cool with Canadian truckers having their rights trampled?

Greg, what happened in Ottawa is an event that started as a protest and then eventually devolved into essentially what was close to a riot that ebbed and flowed for days. The issue is that the police did not get ‘the protest’ under control earlier. And as we know with riots, once they get out of control, there is no Disney solution to bringing law and order back in to play.

Much of what happened was in/close to residential areas. How long would you and your family tolerate big rigs driving down the street where you live blowing their air horns all times of the day and night? Three, four, five, six, seven days in a row. At what point do you say to the police/government… deal with this shit? Because the ‘protesters’ were not leaving.

I am all for protests. I also want law and order.

I am NOT a Trudeau fan. And i also do not agree with the method used to bring this mess under control. The ‘protest’ never should have been able to get out of control like it did - in my mind that was the fundamental mistake made. Mobs cannot be controlled once they hit a critical mass.

-

A pandemic hit the world back in 2020. Everyone was flying blind. We were very lucky in North America as we have about a 2-3 week head start as we could see what was happening in Asia and then Europe (and then here). I live somewhat close to one of the epicentres in the US in Kirkland, Washington State when it initially hit. Estimates are 35 deaths at this one facility were associated with covid. I remember watching the news reports in March 2020… this care home could have been on the moon. Covid was raging. People were dying. Care was non-existant. No one knew what to do. And the panic was real. No one wanted to be anywhere near this care home (given how little was known about the virus back then).

Fast forward to today… yes, we know much more. Very good vaccines were developed. Most people in the West were vaccinated. And the virus has changed massively (to a much less dangerous strain). So the response in Western governments has changed from what we saw earlier in the pandemic. That is what should happen.

China is the one outlier. They stuck with local vaccine’s that are not as good. They did not focus vaccinations on older people (those most at risk). They have not allowed the virus to run in a controlled way to get natural immunity. So if they open up now, even though Omicron is not that bad, the virus will still rip, hospitals will be overrun and a lot of old people will die. So their poor decision making the past 18 months is coming home to roost. They now have to choose between 2 bad outcomes. For now, they are sticking with lock-down. But it looks like the Chinese people are getting cranky. The problem in China is if you get cranky you likely end up in jail or worse.

-

18 hours ago, Viking said:

Fairfax has a number of significant tailwinds driving earnings higher. I have spent a fair bit of time posting on underwriting profit and interest and dividend income. There is a third item that is also spiking higher in 2022: share of profit of associates. Please note: I am not an accountant; I would appreciate it if other posters would point out any errors below (as I post to learn just like every else on this board… and I have thick skin!). I view this post as kind of a working paper... likely subject to lots of corrections/revisions.

----------

Over the 5 year period, from 2017-2021, ‘share of profit of associates’ averaged about $200 million per year for Fairfax. This year (2022) it should come in at around $1 billion for the full year. This surprised me. That is a big increase over the trend from the past few years. 2022 MUST BE an outlier and Fairfax should settle back to something closer to $200 million in 2023… right? Wrong. My guess is ‘share of profits of associates’ should be able to deliver around $1 billion again in 2023 and this number should actually grow nicely in the coming years. It’s like Fairfax in 2022 has magically found an incremental $35/share pre-tax ($800 million increase / 23.5 million shares). And this number could compound at +10% every year moving forward.

That is a staggering increase in a very short period of time. What happened? Put simply, the earnings power of the equity holdings captured in the ‘associates-equity accounted’ bucket are beginning to shine through. The turnarounds have (finally) turned around (Eurobank). The fast growers are executing well (like Atlas). The commodity bull is running (Resolute, Stelco, EXCO).

- Eurobank

- Altas

- Resolute Forest Products (will come out when sale closes in 1H 2023)

- Stelco (will be added in Q4)

- EXCO Resources

- Bangalore Airport

- Peak Achievement (Bauer hockey; 25% of Rawlings/Easton)

- Quess

- Kennedy Wilson Partnerships

- Grivalia Hospitality (moved to ‘consolidated equities’ in Q4)

- Other: Helios Fairfax, Astarta, IIFL Securities and more

—————

What is ‘share of profits of associates’? Let’s start by looking at the big picture. Fairfax has an equity portfolio of about $15 billion. The accounting rules for these holdings can be confusing for investors to understand.

From Fairfax’s 2020AR: “What we find useful in clarifying the accounting positions is to separate these common stockholdings into three buckets. Generally, for positions:

A.) where we hold less than a 20% economic interest and no control, we mark to market

B.) where we have an economic interest of 20% or more but no control (these holdings are called associates), we equity account

C.) where we have control or an economic interest above 50%, we consolidate.”

When Fairfax reports each quarter the specific results from each of their individual equity holdings will flow though the income statement and balance sheet in different ways depending on which bucket above the holding falls in to.

Impact on income statement:

A.) Mark to Market: Net gains (losses) on investments

B.) Associates: Share of profit of associates

C.) Consolidated: Other revenue & Other expenses

Any dividends paid to Fairfax by any equity holding will show up in: Interest and dividends

At Nov 23, roughly $5.6 billion, or 38%, of Fairfax’s $15 billion equity type holdings fall into the ‘Associates’ bucket. This $5.6 billion in equities will generate about $1 billion (pre-tax) in ‘share of profits of associates’ plus whatever is paid out over the year in dividends in the ‘interest and dividends’ bucket.

----------

Please note, in the table above, I have included the FFH total return swaps, debenture and warrant holdings in the ‘mark to market’ bucket.

—————

From page 50, Fairfax 2021AR: Investments in associates

Investments in associates are accounted for using the equity method and are comprised of investments in corporations, limited partnerships and trusts where the company has the ability to exercise significant influence but not control. An investment in associate is initially recognized at cost and adjusted thereafter for the post- acquisition change in the company’s share of net assets of the associate. The company’s share of profit (loss) and share of other comprehensive income (loss) of associates are reported in the corresponding lines in the consolidated statement of earnings and consolidated statement of comprehensive income, respectively.

As a follow up to my previous post, below is a fairly detailed build of what holdings are included in 'share of profit of associates' when Fairfax reports. The information by company is incomplete - but it is pretty complete for the larger holdings, which is what matters. I have gone through and pulled what information I could find in previous AR's.

If we focus on the big rocks we can see the path to Fairfax getting to $1 billion (and higher) in 'share of profits of associates' in 2023 and future years. Four companies will likely drive 80% of the total: Eurobank, Altas, EXCO and Stelco.

----------

You can also reverse engineer the numbers below by looking at the reported results of the individual holdings. My understanding is the number Fairfax reports is roughly the pre-tax operating earnings less dividends paid - as reported by the individual holdings - adjusted for Fairfax's ownership percent ('Fairfax's share'). Please correct me if I am wrong.

----------

When companies were added/removed to this bucket of holdings is also relevant. I think Altas was added in 2018. Eurobank was added Jan 2020. Eurolife was removed in 2021. Stelco will be added in Q4, 2022, now that Fairfax owns over 20% (24%). Grivalia Hospitality will be removed in Q4, 2022 and will move to the 'consolidated' bucket given Fairfax's increase in ownership to 80%. Resolute will be removed in 1H 2023 when its sale closes.

----------

What a home run Eurolife has become. My guess is Fairfax has likely made enough money on this one purchase to offset all the losses from the poor investments listed below.

---------

You can also see the fix for many of Fairfax's poor investments:

- APR: sold to Atlas who is slowly turning that ship (lots of work left to do but Altas is way better positioned to execute on this)

- Farmers Edge: moved to 'consolidated'; a big +$100 million write down this year. Likely on its way to zero (not far away now).

- AGRFI/Atlas Mara/Other Africa: I think these have been sold or largely written down? Helios looks like the real deal... although it will take 5 years to likely see material progress (which is fine).

Bottom line, most of the problem children holdings in this bucket have been dealt with. And the big dogs look like they will be barking loudly in 2023 and delivering good to very good results for Fairfax.

-

1 hour ago, Thrifty3000 said:

@Viking I'm not an accountant by any stretch. One thing jumped out at me. In section 8. there's an assumption of a 5% gain on the entire equity portfolio. Are you assuming the value of the non-mark to market equities will be revised upward or profitably divested over time? Otherwise, I'm curious if expecting $750 from the equities is a bit aggressive if the $6,851 mtm portfolio will have to produce the lion's share of that growth.

@Thrifty3000 good question. For 8.) Net Gains on Investments, I am assuming most of the $750 million gain in 2023 will be primarily from mark to market stocks/TRS. i am also assuming Fairfax will monetize at least a few assets and realize some sizeable gains on sale.

The mark to market equities have been severely marked down in 2022… that will help future returns. The wild card is asset sales (leading to sizeable gains) and my guess is we will see more happening in 2023.

-

27 minutes ago, returnonmycapital said:

But what will Fairfax do about C.) Consolidated?

Don't mean to be a downer but returns on capital have been almost non-existent for the group. Last year, operating earnings (pre-interest expense) were something less than $3/share. Things don't look a lot different this year and any interest expense/taxes aren't part of those figures. Equity is valued at almost $100/share. With things looking decent everywhere else, surely some attention will come to this basket.

With the take private, will Fairfax's treatment of Atlas be to consolidate or do they stick with equity method?

@returnonmycapital my guess is Bucket c.) will be a small good news story in 2023 with pre-tax earnings increasing to $250 million or so. Not earth shattering… but a solid improvement from the past 5 year average. What i am focussed on with all the line items on Fairfax’s income statement is the change: are each of the line items shrinking, staying the same or increasing in size (and how much).

Recipe (hit hard by covid) is the biggest holding by far. I think it could deliver +$125 million in pre-tax earnings. Grivalia Hospitality just moved to bucket C.) and this should help. Fairfax India and Thomas Cook (hit hard by covid) should do well. Dexterra is fixing its modular business so its results should improve moving forward. Farmers Edge was written down (impacting 2022 results for the group), although we could see another write down here.

-

Fairfax has a number of significant tailwinds driving earnings higher. I have spent a fair bit of time posting on underwriting profit and interest and dividend income. There is a third item that is also spiking higher in 2022: share of profit of associates. Please note: I am not an accountant; I would appreciate it if other posters would point out any errors below (as I post to learn just like every else on this board… and I have thick skin!). I view this post as kind of a working paper... likely subject to lots of corrections/revisions.

----------

Over the 5 year period, from 2017-2021, ‘share of profit of associates’ averaged about $200 million per year for Fairfax. This year (2022) it should come in at around $1 billion for the full year. This surprised me. That is a big increase over the trend from the past few years. 2022 MUST BE an outlier and Fairfax should settle back to something closer to $200 million in 2023… right? Wrong. My guess is ‘share of profits of associates’ should be able to deliver around $1 billion again in 2023 and this number should actually grow nicely in the coming years. It’s like Fairfax in 2022 has magically found an incremental $35/share pre-tax ($800 million increase / 23.5 million shares). And this number could compound at +10% every year moving forward.

That is a staggering increase in a very short period of time. What happened? Put simply, the earnings power of the equity holdings captured in the ‘associates-equity accounted’ bucket are beginning to shine through. The turnarounds have (finally) turned around (Eurobank). The fast growers are executing well (like Atlas). The commodity bull is running (Resolute, Stelco, EXCO).

- Eurobank

- Altas

- Resolute Forest Products (will come out when sale closes in 1H 2023)

- Stelco (will be added in Q4)

- EXCO Resources

- Bangalore Airport

- Peak Achievement (Bauer hockey; 25% of Rawlings/Easton)

- Quess

- Kennedy Wilson Partnerships

- Grivalia Hospitality (moved to ‘consolidated equities’ in Q4)

- Other: Helios Fairfax, Astarta, IIFL Securities and more

—————

What is ‘share of profits of associates’? Let’s start by looking at the big picture. Fairfax has an equity portfolio of about $15 billion. The accounting rules for these holdings can be confusing for investors to understand.

From Fairfax’s 2020AR: “What we find useful in clarifying the accounting positions is to separate these common stockholdings into three buckets. Generally, for positions:

A.) where we hold less than a 20% economic interest and no control, we mark to market

B.) where we have an economic interest of 20% or more but no control (these holdings are called associates), we equity account

C.) where we have control or an economic interest above 50%, we consolidate.”

When Fairfax reports each quarter the specific results from each of their individual equity holdings will flow though the income statement and balance sheet in different ways depending on which bucket above the holding falls in to.

Impact on income statement:

A.) Mark to Market: Net gains (losses) on investments

B.) Associates: Share of profit of associates

C.) Consolidated: Other revenue & Other expenses

Any dividends paid to Fairfax by any equity holding will show up in: Interest and dividends

At Nov 23, roughly $5.6 billion, or 38%, of Fairfax’s $15 billion equity type holdings fall into the ‘Associates’ bucket. This $5.6 billion in equities will generate about $1 billion (pre-tax) in ‘share of profits of associates’ plus whatever is paid out over the year in dividends in the ‘interest and dividends’ bucket.

----------

Please note, in the table above, I have included the FFH total return swaps, debenture and warrant holdings in the ‘mark to market’ bucket.

—————

From page 50, Fairfax 2021AR: Investments in associates

Investments in associates are accounted for using the equity method and are comprised of investments in corporations, limited partnerships and trusts where the company has the ability to exercise significant influence but not control. An investment in associate is initially recognized at cost and adjusted thereafter for the post- acquisition change in the company’s share of net assets of the associate. The company’s share of profit (loss) and share of other comprehensive income (loss) of associates are reported in the corresponding lines in the consolidated statement of earnings and consolidated statement of comprehensive income, respectively.

-

-

3 hours ago, Gregmal said:

Wage increases alone arent going to keep the charade going. You even started seeing the ramifications of this in October, in terms of playing that game. Folks like Powell dont want to end up on Capitol Hill having to explain why theyre targeting the average American worker and actively trying to cause them hardship. It just won't fly. And my belief all along has been that they dont even really intend to, they just have to talk a really tough game to keep things in order until the obviously necessary time passes in order to start the downward spiral with CPI.

If you can point to real things, and enough in aggregate, that are inflating in an unhealthy manner, they can keep playing the raise rates game. But so far, go back to this time last year...every single item held onto tightly by the inflation forever group...its imploded, one by one, as the one time stimulus drawdown inflected with supply chains or supply sources catching up. Only thing left to keep the gig going is the academic jobs/wages argument. But see above. And even just step back. That argument is as stupid in reality as it is on paper to anyone not holding a short position. Job and wage strength is a great thing for the economy. Everything else, even on the energy front which surprises me....seems to have been brought back to reality. I dont see a scenario where the kindred spirits take over ALL of those things again, at least not to the extent we start seeing wild inflation numbers again.

@Gregmal you seem to be in the inflation is transitory camp. Please correct me if i am wrong. So where do you think inflation will be 6 months from now? -

3 hours ago, dealraker said:

Based on energy market cap to total market cap three years ago I tied on the blindfold and threw darts for a while. Got a whopping 5% in the game before I stalled out --- that's of course appreciated to more than that now. While not buying now I do enjoy some back and forth on the energy/oil/gas world.

Best performers for me are OXY and First Solar.

@dealraker good for you. Nice when a plan comes together Are you buying anything today? Anything (stocks or sectors) you think are cheap and exceptionally well positioned looking out a year or two?

Are you buying anything today? Anything (stocks or sectors) you think are cheap and exceptionally well positioned looking out a year or two?

-

2 hours ago, StevieV said:

I don't know enough to say for sure that more nuclear is the right direction - but that's my guess and I'd like to see more nuclear. That being the case, is there really much of a nuclear push? Not in the US and lead times in the US would be much, much longer than 5 years. It would really take a pretty monumental shift in the US for any significant nuclear.

Is there big progress on nuclear elsewhere?

Oil was over $100 from 2011 to 2015. And the world economy chugged along just fine. I think there is a very good chance we see $150 oil when the global economy starts to normalize in another year or so. We already are seeing that price reflected in gas due to all the refining issues (and spiking differentials). If $150 oil is the new normal for a few years (and it looks like living standards will be coming down) then my guess is politicians/voters will start to become a little more open minded on the energy transition. Nuclear is the obvious choice (green, plentiful, secure etc). The narrative around nuclear is shifting and it will likely pick up steam. Adversity is the mother of invention.

i am very bullish on the economy in North America over the next 5 years. At the same time i think we have high commodity prices and a chronic shortage of labour. Which leads to higher than expected inflation (perhaps 3-4% per year?).

After 2000 (.com crash) what worked for investors changed from the previous decade. After 2008 (housing crash) what worked for investors changed. After 2020/2022 (unprofitable tech/spac/crypto crash) my guess is what works for investors will change again. Today, commodities (especially energy) and financials look best positioned. But i remain open minded.

-

1 hour ago, Spekulatius said:

Other wildcards:

Venezuela or Iran cranking up again

Demand lower over time due to China transition to other energy sources (nuclear power, EV’s for cars)

Shale getting traction in more geographies

Some whacko political moves which could go either way.

@Spekulatius , yes, there are risks to the bull oil/commodity thesis. However, when the world gets to the next global expansion i think we are screwed. Demand is going to spike and there will not be enough supply (for most commodities). Now in the short term we could see:1.) a severe global recession

2.) China could experience a hard landing (zero covid, property melt down, deglobalization, common prosperity etc).And yes, the world will transition to more green energy sources like nuclear. But it will take a minimum of 5 years or more of hard work to see an impact. Yes, Venezuela has lots of oil, but who is going to invest the significant money needed while the current government remains in power?

So i continue to think investors still do not appreciated the bull case for oil/gas looking out 2-3 years:

1.) Strategic petroleum reserve in US: is currently supplying about 1 million barrels per day and has been for much of 2022. This cannot continue indefinitely. And at some point these barrels will need to be replaced: a big source of supply will swing to a big source of demand.

2.) The energy complex is hated: we have seen peak capital flowing to the fossil fuel energy complex. Banks can’t lend (no debt). Pension funds (big money) can’t buy equity. The energy complex is being starved of capital and it will only get worse every year moving forward (energy is the new tobacco). This simply suggests future investment will likely struggle to stay flat and that is a problem with a resource that has a significant decline rate.3.) underinvestment past 7 years was real and historic. As current wells deplete, companies will have a more difficult time replacing production. Higher investment will be needed just to keep production flat. This will be a problem (see 2.)

4.) the energy complex is hated (part 2): Western governments hate big oil/gas. This is not hyperbole. Look at Biden and his relationship with big oil. Big oil in Europe is running from oil as fast as they can (to renewables). Policy coming from Western governments is going to hit the energy complex hard and only get worse moving forward. Investors have learned over the past decade: don’t fight the Fed. Energy companies/investors KNOW you can’t fight the government. The energy complex is effectively in run-off. You DO NOT invest significant new money in businesses that are in run-off mode. Investors in these types of investments understand you get your capital out as fast as possible. (I expect dividend payouts to increase in importance moving forward as this reality sinks in more fully).

5.) Russia: the energy complex in Russia is permanently impaired. The exiting of Western capital and know how is real. Sanctions are a negative. Hard to see how Russia keeps production flat. More likely we see Russia start to decline. Given its size (#2 producer) this will be a problem that will get worse each year.

6.) OPEC+ is back in control of the price. And it looks like Saudi Arabia and Russia are working together. And they want oil to stay above $80, ideally closer to $100. I think they have a good chance of succeeding.7.) Shale in US: will continue to grow but It will be more modest. The best (most economic) wells are gone. Capital is in short supply. Investors want to get paid. Bottom line, US shale will not be coming to the rescue of global oil markets.

8.) production growth for companies will happen via acquisitions not new production. (If you can buy existing oil/gas wells at fire sale prices why would you instead spend on new production?) This will not result in higher total production. European big oil is desperate to sell off assets and pivot to green energy. All non-Canadian oil/gas producers are aggressively exiting Canada ASAP. Even Tech, a Canadian based mining company, just sold its Fort Hills oil stake to Suncor at a fire sale price. BP recently unloaded both oil and refining assets to CVE. XTO (Exxon) made a big sale to Whitecap Resources.

9.) shortages are everywhere: labour and materials. This is driving costs on existing production through the roof.

This is not just an oil/gas thing. Pretty much every commodity is in a similar boat. Underinvestment for a decade. Hated by Western governments. Hated from an environmental perspective, making development of new sources of supply very challenging. Lead times are +5 years. Geopolitical competition for the best assets. Growing demand (driven by energy transition, deglobalization etc). -

The whole climate change debate today sounds like something written by Joseph Heller in Catch-22. ‘Circular reasoning’… and my favourite: ‘logical irrationality’.

—————So oil companies are making too much money today profiteering from climate change (the bastards). So governments introduce wind-fall profit taxes because that is not right/fair/moral (Yay!). And this then results in oil companies making even more money (WTF?). Simply delicious… (see my previous post for how this happens).

—————“Much of Heller's prose in Catch-22 is circular and repetitive, exemplifying in its form the structure of a Catch-22. Circular reasoning is widely used by some characters to justify their actions and opinions. Heller revels in paradox. For example: "The Texan turned out to be good-natured, generous and likable. In three days no one could stand him"; and "The case against Clevinger was open and shut. The only thing missing was something to charge him with." This atmosphere of apparently logical irrationality pervades the book.

- https://en.wikipedia.org/wiki/Catch-22

A "Catch-22" is "a problem for which the only solution is denied by a circumstance inherent in the problem or by a rule."[14] For example, losing something is typically a conventional problem; to solve it, one looks for the lost item until one finds it. But if the thing lost is one's glasses, one cannot see to look for them – a Catch-22. The term "Catch-22" is also used more broadly to mean a tricky problem or a no-win or absurd situation.

In the book, Catch-22 is a military rule typifying bureaucratic operation and reasoning. The rule is not stated in a precise form, but the principal example in the book fits the definition above: If one is crazy, one does not have to fly missions; and one must be crazy to fly. But one has to apply to be excused, and applying demonstrates that one is not crazy. As a result, one must continue flying, either not applying to be excused, or applying and being refused. The narrator explains:

There was only one catch and that was Catch-22, which specified that a concern for one's safety in the face of dangers that were real and immediate was the process of a rational mind. Orr was crazy and could be grounded. All he had to do was ask; and as soon as he did, he would no longer be crazy and would have to fly more missions. Orr would be crazy to fly more missions and sane if he didn't, but if he were sane he had to fly them. If he flew them he was crazy and didn't have to, but if he didn't want to he was sane and had to. Yossarian was moved very deeply by the absolute simplicity of this clause of Catch-22 and let out a respectful whistle. (p. 56, ch. 5)

Other forms of Catch-22 are invoked throughout the novel to justify various bureaucratic actions. At one point, victims of harassment by military police quote the MPs' explanation of one of Catch-22's provisions: "Catch-22 states that agents enforcing Catch-22 need not prove that Catch-22 actually contains whatever provision the accused violator is accused of violating." Another character explains: "Catch-22 says they have a right to do anything we can't stop them from doing."

Yossarian comes to realize that Catch-22 does not actually exist, but because the powers that be claim it does, and the world believes it does, it nevertheless has potent effects. Indeed, because it does not exist, there is no way it can be repealed, undone, overthrown, or denounced. The combination of force with specious and spurious legalistic justification is one of the book's primary motifs.

-

12 hours ago, kab60 said:

What's interesting is how well oil equities are holding up. IIRC energy is up like 60% this year, while oil prices are generally flat. I think it goes a way to show how undervalued and hated the sector was at the beginning of 2022. I have just as little idea as anyone as to where oil goes short term, but I do think Currie from GS has a credible case as to why the medium to LT looks good (for oil stocks). Structural lack of supply, and with the massive oil price volatility we've seen I don't think that's about to change despite a murky demand outlook (China, recession, SPR releases).

Sector has been massively de-levered during the last two years and most companies are now very close to their (very low) leverage targets and returning massive amounts of cash to shareholders. I've come across a lot of (sensible) capital returns targets from O&G companies this time around (they're all mostly buying back stock), not those dumb volume targets a lot of them chased up to 2014. When you layer in a lack of investments for close to 10 years, a lack of training in skilled engineers/flight of labor in the downturn and raising interest rates (all increasing costs/inflationary), select oil equities are still the best risk-rewards I come across at the moment. And that's without even layering ESG on top.

Lots of O&G companies are pursuing CCS projects, which seems like BS to me, but it looks quiet certain they'll get a lot of subsidies, and I wonder if you'll see all these dumb ESG folks piling in five years out when they get online. That'll probably be a good time to leave for greener pastures elsewhere, but so far the sector isn't getting much love despite how well equities have held up. I've been buying some Harbour Energy PLC in London lately (lots of legacy North Sea assets), which should do 2,1B FCF this year on a 2,6B market cap. Net debt was 1,1B end of September, but they could pay that off in a couple of months, if they so wanted (they've returned 500m in cash so far this year). Now as all investments it comes with some specific risks, and I don't want to make this about one particular equity, but despite the selloff in growth and tech this year, I still don't think a lot of that stuff looks reasonably priced yet (perhaps except for some big tech).

Great summary. Oil is setting up to be the mother of all ‘reopening’ trades. (When we get through the current ‘gully’ that the global economy is experiencing.) Demand will spike, driven by China/emerging markets. And supply will remain constrained - those SPR barrels will be coming off the market some time in 2023.

The energy complex is hated and it will only get worse every year looking forward. Climate change is real. I expect global natural disasters to continue too get worse every year; reinsurance pricing is the canary in the coal mine (Jan 1 renewals are expected to materially increase +30%?). And the energy complex is going to be blamed after every catastrophe hits. The drumbeat will only be getting louder. And then energy companies will report massive profits quarter after quarter… And that is not going to sit well with lots and lots of people (most of whom vote).

Energy investors will do well, and perhaps very well (primarily because energy stocks continue to be hated by investors). Governments will be coming after a portion of their record profits, which is a clear negative. But this will then force energy companies to return capital to shareholders as fast as possible (meaning limited investment in future production growth). This will pretty much ensure supply does not increase much in the coming years (supply will be chronically short of demand), and this will be a big positive for investors. And will extend the bull market in energy prices and stocks for years into the future. (The geopolitical set-up, and OPEC back in control, also favours higher prices in the coming years.)

And the ride for investors will be like a 6-Flags roller coaster trip. The more governments demonize and come after the energy complex the more money the energy complex will make. It will infuriate many.

—————

Where will the next mania be? Unsophisticated ‘investors’ need something big to gamble on. I wonder if commodities investing does not grow into the next big thing (over the next decade)…

-

Agreed. Each year we are reminded in many different ways of the gift we all have been given: the opportunity to build our families and lives as we choose. We all have lots to be thankful for. Happy Thanksgiving to everyone on the board.

-

7 hours ago, newtovalue said:

great points Viking - and thank you for all your knowledge sharing on this site!

FFH is already my largest position - but this board is making a lot of great points tempted to add more here. Normally don't like to forecast a stock doubling - but with FFH its not out of the realm of possibilities if they earn $150 CAD a share and trade at 10x.

@newtovalue you are welcome. Nice to hear that others find value in some of the posts. I use writing as a way to get my thoughts in order. And i love it when people take the other side as i spend a fair bit of time trying to figure out why i am wrong. I think my track record is pretty decent figuring out the earnings part of the equation. I am pretty terrible at figuring out the multiple expansion part of the equation (i tend to sell my big positions too early).-

2

2

-

-

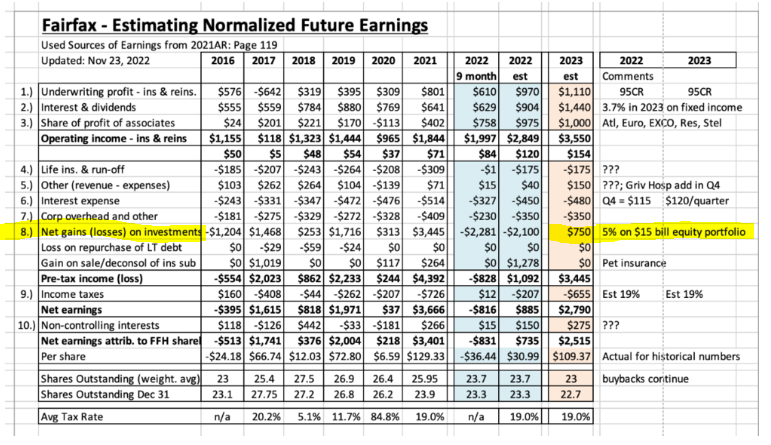

When I did my last update on Fairfax's earnings estimates for 2023 a couple of days ago, I noticed my spreadsheet had bunch of errors in it (mostly the historical information). I also:

- added a few more years of history

- added 2022 YTD numbers (to help forecast 2022 YE)

- made a few tweaks to my 2022 & 2023 estimates

----------

Below is a short summary of what is included in each row.

1.) underwriting profit: is just insurance and reinsurance. Not runoff and life insurance (which is captured a couple of lines down).

2.) interest and dividends: for all of Fairfax

3.) share of profit of associates: for all of Fairfax; includes associate equity, real estate and insurance holdings

4.) life insurance and runoff: just underwriting results

5.) Other: captures Fairfax's consolidated equity holdings

6.) Interest expense: for all of Fairfax

7.) Corporate overhead

8.) Net gains (losses) on investments: captures realized and unrealized gains on Fairfax's fixed income and mark to market equity holdings (including derivatives like the TRS on FFH)

10.) Non-controlling interests: primarily the parts of Allied, Odyssey and Brit that Fairfax does not own

I am least confident in my estimates for two buckets: Non-controlling interests and Income taxes.

----------

Below is a summary of Fairfax's equity holdings broken out by size and accounting treatment.

A.) Mark to market is captured in 8.) Net gains (losses) on investments

B.) Associates is captured in 3.) Share of profit of associates

C.) Consolidated is captured in 5.) Other (revenue - expenses)

-

1

1

-

-

16 hours ago, newtovalue said:

One concern I have with using book value to look at FFH is the goodwill on the balance sheet.

currently goodwill is $5.8 billion or $249 usd per share. If you back this out - Fairfax is trading at price to book of around 1.5x.

now I still think it’s super cheap based on earnings power and float - but using book value as a measure doesn’t align with BRK or MKL because they have much more tangible book values.

thoughts ?

@newtovalue good question. I like to look at multiple measures when valuing any company. My primary method is earnings. When it comes to insurers, book value appears to also be super important (for insurance analysts and other investors).

Of course all methods have their weaknesses. For example, where the earnings are coming from is important: asset revaluation (happens a lot with Fairfax) or from underwriting and/or interest and dividend income? One of the reasons i like Fairfax so much right now is the quality of the earnings coming in 2023 is very high: primarily underwriting profit and interest and dividend income, with a smattering of realized gains (like pet insurance and Resolute sales in 2022).

Book value is hard with a 37 year old company like Fairfax. They have bought so many companies over the years and nurtured many of them for decades. None of the insurance companies they purchased over the years come close to resembling the businesses they are today (except perhaps Zenith). Most were poorly run (the pre-2000 purchases), with CR usually over 100; Fairfax probably bought them to get their float. Today pretty much all the insurance companies are very well run, many now with large specialty businesses, with CR’s well under 100. They have all grown nicely over the years and their earnings power has increased significantly.

Part of the problem at Fairfax is the equity hedges eviscerated billions of earnings from 2010-2017 (with a final $500 million loss in 2020 when the last short position was finally closed). The insurance operations significantly increased in quality and size from 2010-2020 and little of this earnings potential is captured in BV today.

As an example, Fairfax just sold an asset (small pet insurance business) for $1.4 billion and booked a pre-tax gain of close to $1.3 billion… a big miss for reported BV. My guess is Fairfax has lots of other assets that are worth much more than the value they are currently captured at in Fairfax’s reported BV. And a few more will be likely be sold in 2023 and some nice realized gains will be booked.

I have been saying for some time now (I likely sound like a broken record) that Fairfax’s past results tell an investor very little about what Fairfax’s future results will be. There is too much noise in past results. That is why i focus so much on understanding each of the businesses Fairfax owns as they exist today. And what each of those businesses are likely to earn in 2023 and 2024.

The turnaround at Fairfax was largely completed in 2019. In 2020, covid threw a wrench into the progress that Fairfax had been making. However, in 2021 Fairfax came roaring back and delivered an outstanding year. In 2022 the greatest bear market in bonds happened and, surprise, surprise, Fairfax will likely finish the year with a small profit. Pretty impressive. Despite the economic backdrop, 2023 is poised to be a very good year for Fairfax. The super tanker has turned, is going in the right direction and is picking up speed. We will see.

-

Here is another stab at 2023 earnings for Fairfax. Would love to hear what others think. I am at about US$110/share for 2023 (see below for my rough math). With Fairfax currently trading at $560, forward PE ratio = 5. My guess is YE 2023 BV will be around $750 = forward P/BV = 0.75.

- underwriting: 95CR

- interest and dividend income: 3.7% portfolio yield

- share of profit of associated: $1 billion. I do need to spend more time on this bucket. if Fairfax can consistently earn $1 billion per year moving forward that will be another game changer. Compare 2022 to 2018, 2019 and 2020 (see my table below). You can really see the improvement in earnings from equity holdings, especially Eurobank.

- operating income from non-insurance: now includes Grivalia Hospitality and 84% owned Recipe. This bucket could start to generate a consistent +$150 to $200 million per year.

- net gains on investments: estimate of 5% on $15 billion = $750 million. This assumes no mark to market gains on bonds. Just mark to market gains on equities plus any realized gains. This assumes Fairfax will monetize one or more positions in 2023; perhaps EXCO?

The really really nice thing with Fairfax is the improvement in the business fundamentals is outpacing the increase in the share price. We could see the 'trifecta' in 2023:

1.) growing earnings - with the increase driven by operating earnings

2.) lower share count

3.) higher multiple - as Mr Market gets more comfortable with the earnings story of 'new Fairfax'

When the trifecta happens at the same time it is not crazy to see the stock price increase +20% each year for a couple of years. For example, If my estimate for 2023 is close, Fairfax's BV will be around US$750 at YE 2023. Given the increase in operating earnings, a multiple of 1X BV would be reasonable. From $560 today to $750 YE 2023 = 33% increase over 13 months. One can dream

----------

The biggest risks?

1.) a higher than normal year for catastrophes.

2.) a severe global recession

3.) a bear market in stocks (tied to 2.)

4.) asset write downs (if we get 2.) and 3.) above): Farmers Edge got written down in 2022. I wonder if we get a write down on Recipe in Q4.

----------

The biggest opportunities?

1.) share buybacks: Fairfax could be aggressive with NCIB... taking out 1% or even 2% of shares each and every quarter moving forward. With high operating income, they now should be generating the cash on a consistent basis.

2.) Fairfax could pull another rabbit out of its hat - like when it sold pet insurance or Resolute Forest Products or runoff or First Capital...

3.) Digit could IPO at $3.5 billion

4.) India / Anchorage... sounds like something is going on.

Edit: my old spreadsheet had a bunch of errors so I replaced it with a more accurate version (Nov 23)

Fairfax stock positions

in Fairfax Financial

Posted

This purchase builds on Eurobank’s initial investment in Hellenic Bank last year and now makes Eurobank the largest shareholder of the second largest bank in Cypress. Eurobank also has its own operations in Cypress.

It is clear Eurobank has aspirations to grow in size. One strategy it is executing is to slowly build out its presence into adjacent countries. Chug, chug, chug.

My guess is Eurobanks’s strong financial position is going to allow them ample opportunity to continue to expand over time. In a weak environment, the strong get stronger. The stellar work the past 5 years of the management team at Eurobank is beginning to really shine through.

Here is another article discussing the acquisition in a little more detail:

- https://cyprus-mail.com/2022/12/01/eurobank-to-become-hellenic-bank-majority-shareholder/

Eurobank on Thursday said that it has increased its stake in Hellenic Bank to 26 per cent, having now made an agreement for the acquisition of a 13.4 per cent share that currently belongs to video game company Wargaming, with the agreement pending regulatory approval.

Following the acquisition, Eurobank has now become Hellenic Bank’s majority shareholder, further expanding the bank’s involvement in the Cypriot banking sector. Eurobank also operates its own wholly-owned subsidiary on the island.