Viking

-

Posts

4,694 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

It appears the non-insurance consolidated companies/equities now have a pre-tax earnings run-rate of about $400 million per year ($100 million per quarter). Moving forward this will be another nice sized and growing ‘bucket’ of earnings for Fairfax that is not reflected in prior year results. As earnings roll in for this bucket it will likely come as a ‘surprise’ for most investors.

Which Fairfax holdings are included in ‘non-insurance consolidated companies’ bucket?

1.) Fairfax India

2.) Recipe - Oct 2022, take-private, increased stake to 84%

3.) Thomas Cook India

4.) Dexterra

5.) Grivalia Hospitality - July 2022, increased stake to 78.4%

6.) AGT

7.) Boat Rocker

8.) Golf Town

9.) Farmers Edge - written down by $131 million in 2022

The take private of Recipe in Q4 of 2022, is a significant move for this bucket of earnings. Recipe will provide a much larger, relatively smooth source of earnings for Fairfax moving forward. We also got clarity on the Q4 conference call as to how the take private of Recipe was funded: Fairfax paid $243 million in cash, Recipe added $100 million in debt = $342 million purchase price. Fairfax was able to take Recipe private for only $240 million in cash at a price based off of trough earnings. Smart, opportunistic buggers.

—————

Why is looking at past results not helpful for this group of companies? The pandemic significantly affected many of the companies included in this bucket in 2020, 2021 and even the start of 2022 (especially Recipe, Thomas Cook India, Dexterra and BIAL). Also, in 2022, Fairfax wrote down its investment in Boat Rocker by $131 million. As we begin 2023, we should see the actual earnings power of the companies in this bucket shine through.

Kind of like we saw with the Share of Profit of Associates bucket in 2022 when earnings there spiked to over $1 billion and caught everyone by surprise. Moving forward, Share of Profit of Associates of $900 million + Non-insurance Consolidated of $400 million = $1.3 billion. Significant.

—————

From Fairfax Q4 Conference Call:

“Secondly, on October 28, 2022, the company acquired all the multiple voting shares and subordinate voting shares in the capital of Recipe, other than the shares that were owned by the company and approximately 9.4 million multiple voting shares that were owned by Kara Holding Company at a cash purchase price of CAD20.73 per share or US$342 million in aggregate. That was comprised of cash consideration of $243 million and an increase in borrowings by Recipe of $100 million.

As a result of that transaction, the company recorded a loss in retained earnings of $66 million and a decrease in non-controlling interest of $276 million at December 31, 2022 and we had an equity ownership in Recipe of 84%, inclusive of the Recipe shares that are held in the ABLN that we entered into with RiverStone Barbados. Recipe was then subsequently delisted from the Toronto Stock Exchange.”

-

1 hour ago, glider3834 said:

I agree Viking - put another way FFH is on a forward 15% after tax yield - see Prem's comment Q4 call - name one other insurer globally thats trading that cheaply?

I agree with @Parsad that all of us want FFH to continue to improve the quality of its equity investments/operating businesses & raise credit rating & cash at holdco.

I think with holdco they are in full growth mode with the insurance ops while we are in a hard market & the insurance subs as hard market starts to ease, will be receiving this 1.5B in interest/div income etc - they will be in a stronger position with excess capital & they can dividend back to the holdco - holdco's cash will increase & holdco will be in position to buyback shares or add to equity/bond holdings or buy operating businesses. So its coming, we have to be patient but as a shareholder you want them to be expanding, taking advantage of this hard market while pricing is good.

On quality of the underlying operating businesses - I don't mind if they own fractional shareholdings or wholly own subs - but agree we don;t want to see them allocating money to speculative start ups (like Farmers Edge) we want them to be investing in mature, cash generative operating businesses. Now I would argue the last 3 years supports the idea that they recognise this - if you look at their larger equity purchases they are well established, cash generative businesses and examples of recent additions Mytilineos, Kennedy Wilson, Atlas, Bank of America, Micron Technology, Grivalia Hospitality, Recipe - none of these are speculative, start ups.

Also I think there has been organic improvement with quality of underlying operations eg two examples Eurobank & Stelco - if you go back 3-5 years & compare to now - quality of underlying business has been raised a lot due to management.

For the first time in more than a decade (ever?) Fairfax will likely be generating billions in operating earnings. This is a significant amount of cash they can then redeploy. At the same time, we are in a bear market. So Fairfax is generating gobs of cash right at the same time stocks and bonds are in a bear market (i.e. cheap to wicked cheap). This bear market is an incredible gift for Fairfax and Fairfax shareholders. Buying at bear markets lows + compounding = value investor heaven. Investors in Fairfax today are underestimating what will be coming (in terms of investment gains) looking out a couple of years. BECAUSE PAST RESULTS IS STILL PRETTY MUCH USELESS IN INFORMING AN INVESTOR WHAT FUTURE EARNINGS WILL BE. That is usually the case for turnarounds like Fairfax.

If Fairfax is able to make $1.5 billion in new investments at bear market lows that generate an 10% return (low) moving forward = $150 million incremental in investment gains/increase in intrinsic value. Do that for a couple of years and by 2025 we will see an incremental $450-$500 million in gains EACH YEAR (compared to today).

Rightly so, investors in Fairfax today are focussed on spiking interest and dividend income; it is an amazing story. It is also sowing the seeds of the next big uptick in earnings for Fairfax - this one from investment gains. The Fairfax story continues to get better….

—————

Perhaps Fairfax also buys back another 10% of shares outstanding over the next three years. Perhaps Fairfax buys back another slug of Allied World. Bottom line, Fairfax has lots of cash and lots of obvious, solid return investment opportunities. Capital allocation has likely never been easier.—————

I continue to be amazed at the decision made in late 2020 and early 2021 to buy the TRS on FFH shares = 1.96 million (i call that the Fed VanVleet - bet on yourself - decision). Now i do not expect future capital allocation decisions to be as lucrative for shareholders as this single investment. But it certainly will be interesting to follow what they do with all the cash they are currently generating.

-

At the end of the day, what i care about is total return. From today (even after its stellar run over the past 1 and 2 years) my guess is Fairfax’s total return will outperform both Markel and Berkshire in both 2023 and 2024 and probably by a lot.

Berkshire is in full-on wealth preservation mode. Buffett has said so repeatedly in recent years. The goal is to preserve the wealth of long term shareholders. BRK has morphed into a bond like equity. That is not a bad thing. But it is what it is. Perhaps BRK starts to mildly outperform the S&P over the next 5 years.

Markel is not nearly as cheap as Fairfax so it already has one hand tied behind its back (in the total return race). And Markel’s bond portfolio is longer duration so they are not getting the tailwind of higher interest rates to the same degree as Fairfax. The increase in interest income is the biggest driver of the spiking operating earnings at Fairfax (up $1 billion in 2023 compared to 2021).

All three are solid companies. My read is the stars have aligned for Fairfax. And that will drive continued outperformance over the near term.

—————What about looking 4 or 5 years out? No idea. There are simply too many moving parts to be able to conclude anything with any degree of accuracy.

-

7 hours ago, Munger_Disciple said:

I haven't spent a lot of time valuing Fairfax but it seems to me that assuming 97% CR is part of "normalized earnings" is quite aggressive. Even at Berkshire, Buffett guides us to assume 100% CR for their world leading insurance businesses. Fairfax's insurance business is much improved (yes!) but I highly doubt it is as good as Berkshire's. And as most of us realize, the "normalized" return on bonds depends a lot on medium to long-term treasury bond yields which are somewhat unknown so prudence dictates that we should be somewhat conservative in estimating the LT "normalized" bond returns.

@Munger_Disciple when did Berkshire guide that Berk shareholders should assume a 100CR for their business? In a low/zero interest rate world (which we had for much of the last decade) that number is nuts.

I don’t see why 95 is not a good/realistic target for Fairfax over the next couple of years. It was 95 in 2021 and 94.7 in 2022. My baseline for 2023 is 94.5. Why? We have a just had a 3+ years hard market. And 2023 should be decent. Absent the sudden emergence of a very soft market, my guess is underwriting results should be good. The risk, of course, is a record year for catastrophes. Always a possibility. But the opposite is also possible - a benign year for catastrophes. If that were to happen the CR would likely be in the low 90’s.

—————Given average duration of bond portfolios (4 years or so), it will take a few years for insurance companies to realize the benefit of higher interest rates. This really is a big benefit for Fairfax - one that will benefit them for a couple of years. This will likely extend the hard market a little longer.

-

I have not updated my models yet (family reunion), but given Fairfax’s Q4 results, here are some quick thoughts:

- US$120/share in earnings for 2023 might be the new normalized number.

- BV Dec 30, 2022 = $658.

- est BV Dec 30, 2023 = $768 (deducting $10 dividend payment)- Stock is trading today at $693.

So stock is trading at:

- PE < 6 x 2023 earnings

- P/BV = 1.05 x Dec 30, 2022BV

- P/BV = 0.90 x est Dec 30, 2023BV

What about 2024? Another $120/share in earnings look likely.

What does this tell me? Fairfax continues to be dirt cheap. Not as cheap as it was 4 months ago. But dirt cheap given the near term earnings visibility (2023 & 2024). Or compared to other P&C insurers. Or compared to the overall market.

What about 2025 and beyond? Given what i have seen from Fairfax over the past 5 years I think they are going to continue to deliver good to very good results. What will the puts and takes be? No idea. So i will follow the company and update my thesis as new information becomes available.

What we are learning is just how stupid cheap Fairfax got multiple times over the past 2 years. Ambridge Partners sale = $275 million gain. The TRS on FFH shares continues to print money (up $250 million YTD). Those two items alone = $525 million in gains = $22/share pre-tax. My guess is we will see FFH buying back more shares. They have billions in operating earnings rolling in that they are actively redeploying - those significant, new investments will start their compounding magic. Fairfax has so may levers to pull to compound shareholder value - it is unlike any period over the past 10-12 years.

The ‘narrative’ around Fairfax is also shifting. Delivering exceptional results year after year (as they have done recently) will do that.

Growing earnings + growing market multiple + lower share count = spiking stock price. Fairfax is firing on all three cylinders… and the party is likely just getting started.

-

At the end of the day the key for any investor is fit. In terms of positioning of their bond portfolio, Fairfax has nailed it over the past 18 months:

- in 2021 they shortened duration to 1.2 years.

- in 2022 they extended duration to 1.6 years.- on the Q4 conference call Prem said the plan is to extend the average duration to 2 years in 2023.

Fairfax has a very good long term track record in managing its fixed income portfolio. Perfect? No, of course not. Am i happy with how they are positioned as we begin 2023? Yes.

Now we will see what happens with bond yields moving forward. And what Fairfax does with its fixed income portfolio (and the rest of its business). As the Fairfax story evolves i will manage my holdings accordingly.

-

Fairfax Q4 results look good to me. The caveat is i am not an accountant, so regarding IFRS 17, and the restatements coming when they report Q1 results, i have nothing to add to what the company disclosed in their release. Is IFRS 17 a positive for shareholders? Perhaps others can wade in and educate us all.

Insurance:

1.) what is top line growth?

- Gross premiums written in Q4 came in at 5.1%. This is a big surprise to me. We all knew the hard market had to slow at some point. Is it terrible? No, of course not. What is far more important is that Fairfax underwrites profitably.

2.) what is Q4 CR? 90.9 is very good.

- What is full year CR? 94.7 is very good.

- Any adverse development? Small net favourable development (ex runoff)

- where does Brit come in? Q4 was 88.2 and FY was 97.9 (including Ki)

- what is adverse development for runoff? Less than last year. Amount?

3.) update on hard market. What is outlook? Looks like it is slowing quickly.

will get more colour on conference call.

Bond portfolio4.) what kind of increase do we see in interest income? $961.8 million.

- What is new run rate for interest and dividend income? $1.5 billion. Holy moly Batman!

- (Was $950 million end of Q2 and $1.2 billion the end of Q3.) $1.5 billion.

5.) what changes, if any, do we see in composition of bond portfolio? ???

6.) what is average duration? 1.6 years; same as Q3.- (1.2 years at June 30 and 1.6 years at Sept 30)

7.) any mark to market losses? Small gain in Q4 of $63.8 million.

Equity Portfolio

8.) what is amount of mark to market gain? $521.9 million

9.) and material changes in holdings? No. ???

10.) any commentary on Atlas take private?

Other

11.) share of profits of associates? $256 million

12.) Book value? $658/share; up bigly from Q3.

- Fairfax is one of the few insurers to grow BV in 2022.13.) share buybacks during quarter? 23.32 million (bought back about 130,000 in Q4)

- (At Sept 30 there were 23.45 million common shares effectively outstanding.)

14.) what is net debt at year end?

15.) capital allocation priority moving forward? We will see what Prem says on conference call.

Updates/Commentary:

16.) pet insurance sale closed Oct 31: proceeds used for? Any remaining proceeds to be used for?

17.) Resolute Forest Products sale: set to close 1H 2023… any update?

18.) Ambridge Partners: $400 million sale. Expect $275 million gain pre-tax at close = +$10/share after tax. Excellent.19.) update: regulatory approval to take control of Digit? Status of IPO?

—————

Is Fairfax on glide path to earn $2.4 billion from underwriting income + interest and dividend income in 2023? No. This number is too low. Glide path likely needs to get increased to $2.6 or $2.7 billion. Wow!

-

1 hour ago, nafregnum said:

As opposed to "What's the Fed gonna do next?", I think this kind of "macro" has to be at least as actionable as weather reports following the path of a hurricane. Sure, a hurricane can change direction and make landfall somewhere else, but that doesn't mean weather reports are useless noise.

So, as mortgage rates in Australia and Canada begin to climb, what will happen?

- Mortgages become more expensive. Real estate prices see downward pressure. Some areas suffer more than others, depending on demand as people move to where they can afford to live.

- If rents go higher, do people move further from big cities out into the suburbs?

- In general, people have less money to spend?

- Maybe foreclosures go up?

In the aggregate, what behaviors change when people are feeling the pinch?

- Less eating out at restaurants?

- Cut back on travel plans?

- Start shopping at DollarTree and Walmart type stores?

- More people do their own car maintenance?

Some of you could add some good insights to add to these bullet points based on your wide reading and long experience. I remember reading that Allan Mecham (who used to run a fund called Arlington Value) wrote that AutoZone would benefit during downturns because as people have less money to spend, those who know how will start doing their own oil changes. I always thought that was an interesting detail to notice, and I often find myself trying to think of new insight like that.

If a mortgage debt hurricane is threatening Vancouver and Australia, how would you prepare for the financial storm?

In Canada anyone with a mortgage or line of credit is now (or will be shortly) paying much, much more in interest expense. $100/month more doesn’t matter. $1,000/month more does matter. $2,000/month matters even more. This is an after-tax increase in expenses. At the same time food costs are way up. Insurance costs are way up. Flight costs are way up. Vehicle costs are way up (if you can even find one). Etc, etc. Wages? Up a little.

What does it all mean for an investor? Not sure. It will likely take years to fully play out. But given the magnitude of the impact, there will be big winners and losers. And that is the fun part about investing… skate to where the puck is going…

—————

Having said all that, Canada has minted tens of thousands of millionaires over the past decade (real estate). House prices have come down over the past year; but real estate prices are still much higher that what they were 2 short years ago. That wealth is real and those people are spending.

So i am not doom and gloom. I am remain very optimistic. 2023 is shaping up to be another super interesting year.

-

37 minutes ago, thepupil said:

yes. @wabuffohas pointed this out a lot that in aggregate raising rates puts money in households pockets because they have more cash/bonds than debt. obviously that "in aggregate" is doing a lot of work. Someone with $2mm of 1 year treasuries is making $100K risk free that they weren't 2 years ago. anyone (people assets and corporations) with significant net floating rate debt is hurting.

Here in Canada, a reasonably large subset of the population carries lots of debt (mortgages and LOC) thanks to our housing bubble. Lots of people own multiple properties with big mortgages (that were already cash flow negative at historically low interest rates). Most of this debt is variable, especially if interest rates stay high for years (even 20% of those 5 year fixed mortgages come due every year).

The real estate bubble has also created a mental rental market: here in Vancouver it is not uncommon to pay C$1,500-$1,700/month for a one bedroom and $2,800-$3,000 for a two bedroom - if you can find one (crazy low vacancy rate). Landlords with mortgages are going to need big increases in rental rates given their mortgage costs are going through the roof.

The learning is you do not want to blow a housing bubble because it usually causes big problems for years when it corrects. The US learned its lesson in 2008-2010. China is in even worse shape than Canada.

The Bank of Canada is really boxed in. Their answer is to stop rate hikes. Even in the face of high inflation (Canada has lots of very large public sector unions) and a very tight labour market. Government spending looks like it is accelerating.

No idea how it plays out here. Super happy i have no debt.

-

What i find interesting is the Fed has taken short term interest rates up to 5%. At the same time, QT is like another 100 to 200 basis points of tightening. So over the past 12 months interest short term rates have effectively increased 6-7%. And they will be moving higher in the coming months… probably another 50-75 basis points. So that gets us to short term interest rates of 7 to 7.5%.

And the impact on the economy? Not much. Yes, interest sensitive sectors, like housing, have taken a hit. But the economy appears to be digesting higher rates and chugging along. THAT IS AMAZING. Given the amount of tightening over the past year.

What the hell is going on? That is the million dollar question. Has basic economic theory been turned on its head? Fed tightening no longer matters?

Perhaps the economy is still experiencing the ‘benefits’ of:

1.) 10 years of zero interest rates (i.e. it takes much longer than just 12 months to get this out of the economy).

- a decade of asset inflation made lots of people multi millionaires… with asset prices rebounding as we start 2023, last years fall in assets was a minor dent for most of these people.

2.) all the stimulus spent governments during covid

Of course, there are also the covid ‘boomerang’ effects. Travel is going to boom. China is just coming out of covid and its economic growth is going to pop higher.

What does all this mean? One possibility is higher interest rates. Like Fed funds of 6%? Not on anyones radar right now. Continued QT… that would be be significant tightening. And at some point i would expect basic economic theory to start to work again - slowing economy/mild recession.

What is an investor to do? As yields move higher, bonds are looking more attractive. Interesting times!

—————

So far, the economy (the deer) has escaped the increase in interest rates (the croc)…

-

Another indicator that India has arrived… As India continues to shift from public to private ownership it looks like it is using it as an opportunity to create more home grown companies that will have the scale to be able to compete on the global stage. Interesting model of development. With big winners.

—————

How secret London talks led to Air India’s gigantic plane order

- https://www.theglobeandmail.com/business/international-business/article-how-secret-london-talks-led-to-air-indias-gigantic-plane-order/Air India’s record aircraft deal has put the Tata Group-owned airline in the league of aspiring global carriers.

On Tuesday, it provisionally agreed to acquire almost 500 jets from Airbus and Boeing to take on domestic and international rivals.

Striking the largest ever deal by one airline took months of secret talks carried out a stone’s throw from Britain’s Buckingham palace and culminating in a celebration over coastal Indian curries, according to people involved in the talks.

Confidentiality was lifted on Tuesday as leaders hailed the accord in a diplomatic embrace between leading G20 nations. Tata Group, which regained control of Air India last year after decades of public ownership, put out just six paragraphs.

-

With the Fairfax Q4 report set to be released after markets close on Thursday here are a few of the things i will be watching.

Insurance:

1.) what is top line growth? Mid teens? Other insurers are reporting deceleration in top line (still healthy).

- what increases is reinsurance seeing? What is outlook for 2023?

2.) what is Q4 CR? What is full year CR? Does it come in with a 95 handle? Some insurers reported adverse development.

- where does Brit come in?

- what is adverse development for runoff? $150-$200 million?

- Q4 is when Fairfax does its actuarial review.

3.) update on hard market. What is outlook?

Bond portfolio4.) what kind of increase do we see in interest income? What is new run rate for interest and dividend income? (Was $950 million end of Q2 and $1.2 billion the end of Q3.)

5.) what changes, if any, do we see in composition of bond portfolio?

6.) what is average duration? (1.2 years at June 30 and 1.6 years at Sept 30)7.) any mark to market losses?

Equity Portfolio

8.) what is amount of mark to market gain? (My estimate is around $300 million.)

9.) any material changes in holdings?

10.) any commentary on Atlas take private?

Other

11.) share of profits of associates? $250 million?

- what are earnings from consolidated equities? (Recipe, Grivalia Hospitality, Dexterra etc)

12.) Book value? (Was US$570/share at Sept 30.)

13.) share buybacks during quarter? (At Sept 30 there were 23.45 million common shares effectively outstanding.)

14.) cash at hold co? (Fell to $800 million at Sept 30; below $1 billion target)

- net debt? Change from Q3?

15.) capital allocation priority moving forward?

- level of debt is ok (although $750 million added in Q3)

- continue to fund growth at subs in hard market?

- buy back stock?

- invest in equities?

- other?

Updates/Commentary:

16.) pet insurance sale closed Oct 31: proceeds used for? Any remaining proceeds to be used for?

17.) Resolute Forest Products sale: set to close 1H 2023… any update?

18.) Ambridge Partners: $400 million sale. Details? Size of realized gain?19.) update: regulatory approval to take control of Digit? Status of IPO?

—————

Is Fairfax on glide path to earn $2.4 billion from underwriting income + interest and dividend income in 2023?

-

6 hours ago, Xerxes said:

Bed Bath Beyond Canada is up for sale !

Its not the $100 million purchases/decisions i worry about. Its the $500 million and up purchases/decisions. But Fairfax has been putting alot of cookies back in the cookie jar the past couple of years with their big decisions:1.) TRS on FFH: up to this point… a brilliant purchase. With a long runway ahead of it (with lots of expected volatility).

2.) Atlas: looks good. Could be great. But i have a hard time understanding the business and there is so much going on with take private, new builds, interest rates spiking, violent economic swings of post covid world (shift from goods to services in 2023), geopolitical strife affecting trade routes etc.

3.) bond duration at 1.2 years at Dec 31, 2021: not an equity purchase… but this was a big swing and could end up making Fairfax serious money over the next couple of years (while also protecting their balance sheet in 2022 at the same time the bond market was in a historic bear market).

4.) pet insurance sale for almost $1 billion after tax. WTF? Really?5.) Eurobank: has this actually turned into a great investment seemingly overnight? It has played out like some Greek version of Disney’s Cinderella. (I am getting all teary eyed…). Shares closed at 1.365 Euro on Friday.

6.) Resolute Forest Products sale: sold at the top of the lumber cycle for what could work out to $800 million (if the CVR pays out). Tissue, newsprint, paper… don’t let the door hit you on the ass on your way out

The only big miss i can identify the past 3 years has been Blackberry and not finding a way to unload it in 2021. Fairfax did restructure the debenture (smaller in size) and at much more favourable terms. That sale would have been cathartic in so many ways.

But, hey, you rarely get everything you want in life. Gotta take the good with the bad. And with Fairfax, we have been getting spoiled a little with all the good the past few years.

-

19 minutes ago, Xerxes said:

While at the company level they may have nail the portfolio-duration and having optionality, it does make one wonder why their bond guys couldn’t talk to their equity guys !?!

The same pin that in 2022 burst the bond bubble also bursts the growth equity side. Ultimately while their equity short view was not wrong, it was totally wrong in terms of execution, which means somehow the folks in Fairfax did not appreciate (or didn’t figure out) how much of the equity bubble was underwritten by very low rates.

@Xerxes i think most investors in insurance companies (me included) have little appreciation for approximately how the sausage is made. For a company like Fairfax, my guess is there is a great deal of complexity:1.) while mostly in the US, their business is very geographically dispersed. Much more than most large insurers.

2.) they are 75% P&C insurance and 25% insurance

3.) their P&C insurance business is very diverse

4.) they continue to have a legacy runoff business

5.) their industry is highly regulated - and regulations vary by country

6.) their investment style is extremely varied and opportunistic

- equities: deep value, private equity, commodities, real estate, emerging markets, non-traditional

Perhaps i am over-stating the complexity. Bottom line, i try and understand Fairfax at 10,000 feet. It is difficult to get too in the weeds as to how everything is coordinated within Fairfax. My guess is it is all coordinated in some fashion (insurance, investments, op co, geography).

-

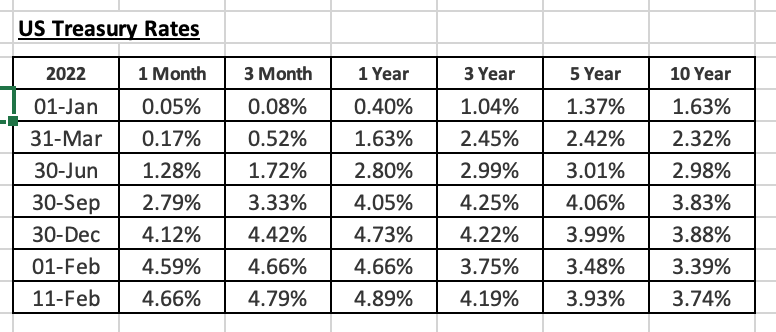

Since bottoming out Feb 1, US Treasury yields have been spiking again. This is good news for Fairfax given the very short average duration of their bond portfolio (of 1.6 years at Sept 30). It will be very interesting to see what Fairfax does with its bond portfolio in 2023.

1.) Do they continue to extend duration? (It increased from 1.2 years at June 30 to 1.6 years at Sept 30.)

2.) Do they shift portfolio composition from government and more to to corporates to take advantage of higher yields?

The Fed is telling us that they will be taking the Fed Funds rate to over 5% in the coming months and will likely be keeping it there for all of 2023. We will see.

When Fairfax reports on Thursday we will see interest income spike higher. We will also learn what the average duration of the bond portfolio is.

----------

Looking back 12 short months ago it is amazing to see the significant increase in Treasury rates right across the curve. Fairfax's positioning of its bond portfolio on Dec 30, 2021 might just turn out to be one of its best calls in its history (of course, like the horse story, we will see...). Now Fairfax was positioned similarly (very short duration) for years... so there was definitely significant opportunity cost over many years. But for an investor in Fairfax today (with shares trading today at US$650) the future certainly looks bright... and a big reason is the positioning of the bond portfolio even the current interest rate environment.

-

On 2/7/2023 at 5:24 AM, SharperDingaan said:

Shush

SD

@SharperDingaan i do not follow the drillers at all. Precision Drilling (PD.TO) got killed today (expensing stock based compensation can be a bitch). Do you (or other posters) have any thoughts on current valuation? Oil/gas services companies look very well positioned to grow profitability in coming years. -

Below is an interesting presentation regarding the energy transition. I am starting to wonder if ‘energy transition’ is not similar to the US housing bubble around 2005 or 2006. In terms of how completely wrong/unrealistic the dominant narrative is/was. And as reality sets in both will have/had enormous impacts on the global economy.

The housing bubble bursting almost took down the global economy in 2008. The ‘energy transition’ is going to result in prices for metals/energy to spike to unheard of levels and that will have an equally enormous impact on the global economy.

The energy transition (as its currently constructed) looks to me like a slow motion train wreck. Using basic logic, it is pretty much an impossibility when you look out just 2 or 3 years. What should an investor do?

1.) buy oil stocks. Oil is going to be needed in INCREASING quantities for decades. But we are massively underinvesting in it. The ‘energy transition’ is going to happen much slower than people currently think (due to shortages of raw materials).

2.) buy metal stocks. Prices are going higher than people can imagine. Bringing new metal supply on stream is even more difficult than oil (takes 5-7 years). The ‘energy transition’ is going to be much, much more expensive that people currently think.

3.) elevated inflation will be the new norm (with lots of volatility). Unheard of prices for metals and oil will drive global inflation.4.) geopolitical strife will increase. China has enormous leverage, especially in processing of metals. At some point they will play that card.

Bottom line, the world over the next 10 years will be very different than the world of the past 20 or 30 years. Not worse. But very different.

—————Humanity is going to continue to invent. Machines need to eat too…

—————

If anyone comes across a video/presentation that provides a counter argument (to the thesis Mark lays out in his video below) please attach it. I remain inquisitive and open minded

-

10 hours ago, dealraker said:

Very likely because I've seen so many cycles from 20% interest rates down to basically zero, inflation from way up in the double digits to whatever it was when lower, I'm far-far-far away from the fears that seem to be geared toward "folks" that just don't know enough. I personally think for most investors, including those thinking they are smart and thus able to maneuvre around thus escaping the downs, that the biggest risk is not being a participant.

Again, I know endless wealthy people - to some degree I was incredibly lucky to have lost my parents early and thus forced to get out and about and I had endless connections from both family in political and business positions and ownership. For me I summarize it this way:

People who are in business and who avoid crappy endeavors, trendy/silly things...people diversified (to some degree) who stay owners of business? They have ALL the money.

People who sell, people who go to cash or skirt in and out of endeavors, and especially older people who go to cash, tax free bonds, or whatever they do to distance themselves from operating businesses? They family money simply goes away...and NOT slowly. Inflation and spending send it flying away to others.

And it really doesn't get much more complex than that--- given a lot of time. And most of you here have a lot of time left. The more direct your connection is to successful businesses the more money you will have over time.

My biggest fear is the big boys take away all the good businesses while little people chant "I won" by selling out (at what they thought was great life altering price).

@dealraker i love the comments… please keep them coming. Great wisdom. As i get older i am starting to question if Buffett’s and Lynch’s wisdom - that an average person can learn to successfully invest on their own - is actually realistic/possible (for most people). I just see so few people who are actually able to figure it out over time. Worse, i know a fair number of people who have tried and failed… some miserably. None of my family members have been able to figure it out. Why not? I am wondering if the vast majority of people simply do not have the required emotional make-up to be successful self-directed investors. So few people get rich the way Warren Buffett did (financial markets) - perhaps its not as easy as it looks.—————

By ‘successfully invest’ i mean they are able to achieve results (over decades) that are better than the relevant market benchmark.

-

The energy story continues to improve.

1.) china re-opening: likely to add 1 to 1.5 million barrels per day to demand2.) US pretty much ending SPR releases: removing 800,000 barrels per day from supply

3.) And as oil companies report Q4 earnings, we are learning we will see limited production growth from US shale. If true, that is a big deal.

4.) Russia remains a wild card… with the risk skewed 90% to the down side (meaning they will supply less oil moving forward).

If US shale does not ramp production in 2023 (more than forecast) then global oil supply is going to come up short. While demand keeps increasing. The question is not IF the oil price is going higher. The question is HOW HIGH will the oil price go? (Patience will be required… it will could take until Q3 for the supply - demand imbalance to really start to bite.)

—————

Occidental’s CEO Says Stock Buybacks Take Priority Over Oil Growth

- https://finance.yahoo.com/news/occidental-ceo-says-stock-buybacks-184029344.htmlOccidental Petroleum Corp. may redeem Berkshire Hathaway Inc.’s preferred stock this year as the oil giant prioritizes share buybacks over production growth, said Chief Executive Officer Vicki Hollub.

”There won’t be significant growth from us because there’s still a lot more value to be gained for us by continuing to focus on delivering value to shareholders through share repurchases,” Hollub said during an interview with Bloomberg TV at the Smead Investor Oasis conference in Scottsdale, Arizona. “A big focus for us in 2023 is repurchasing our common and potentially the preferred.”

Warren Buffett’s Berkshire bought $10 billion of preferred stock in Occidental during the driller’s 2019 takeover of Anadarko Petroleum. Berkshire is also the biggest owner of Occidental common stock with a 21% stake, according to data compiled by Bloomberg.

Occidental climbed 0.5% to $61.53 a share at 1:31 p.m. in New York even as the S&P 500 Energy Index dropped 0.6%.

The decision by Occidental, one of the biggest shale oil producers, to focus on buybacks rather than production growth is another sign that US output is unlikely to accelerate much this year, despite companies being flush with cash. In recent days, Exxon Mobil Corp. and Chevron Corp. have both said shale growth will slow this year. Most publicly traded producers, who have indicated growth will likely stand below 5% annually, are due to report earnings and announce their capital spending plans later this month.

-

I recently came across the attached video on Peter Lynch. I think it is an excellent introduction for people who do not know him. And also a good review for the rest of us. His book “One Up On Wall Street” is one of my top 5 best books on investing for the impact it had on me when i was getting started and still today. (At the same time i first read Lynch’s book i was also reading: Ben Graham’s “Intelligent Investor”, Robert Hagstrom’s “The Warren Buffett Way” (1st Edition), Burton Malkiel’s “A Random Walk Down Wall Street”… amazing the information available to investors, even back then.)

In terms of educating investors, I put Peter Lynch in the same category as Buffett and Graham (close enough for me). Lynch has lots of very useful advice:

- if you don't have the time/interest/skill to buy individual stocks buy an ETF (called a mutual fund in his day)

- only invest in what you know/understand well - this might be his most important point (and often gets drowned out by all the other good things he has to say)

- volatility is opportunity

- sell only when the story changes/deteriorates (don't pull the flowers and water the weeds)

- you don't need to be right with every pick

- it helps if you have an edge

- ignore macro / general news media

- market timing doesn't work

My add (and I am sure Lynch would agree): small investors have three more big advantages today compared to 1994:

1.) access to information has never been better - see my bolded point above!

2.) transaction costs have dropped significantly which increases return for investors

3.) tax advantaged accounts are now available (in Canada - RRSP, TFSA, RESP and soon to start Home Buyer Plan) which increases after-tax return for investors

-

CVE and a smaller amount of SU. Shares are cheap (both were taken out behind the woodshed the past 5 days). Free cash flow is large. What to do? Buy back stock hand over fist. Canadian oil companies are going to be buying back large amounts of shares in 2023. Should also provide a floor in the stock price.

-

3 hours ago, StubbleJumper said:

People should ignore this. Three or four years ago, I expressed caution about quality of earnings when Fairfax cobbled together some paper gains from reorganizing certain holdings. I reassert that caution about the quality of losses for 2022 and the quality of some of the gains in 2023. FFH has demonstrated every intention to hold the bulk of its fixed income portfolio to maturity. Therefore, we would be well served to completely ignore the M2M losses that we saw in 2022 and the M2M gains that we will probably see from the fixed income port in 2023. It's a nothing.

The one thing that we might get from the M2M losses/gains on the fixed income port is that sometimes Mr. Market responds to headline EPS numbers. Last fall, Mr. Market hated FFH's EPS numbers and the stock traded off to US$450ish. That was a very attractive buying opportunity. Will we shoot the other direction in 2023? Will the M2M gains result in Mr. Market giving us an attractive selling opportunity?

As a shareholder, the bond gains and losses are pretty irrelevant from an economic perspective, but maybe stupidity will reign in the opposite direction in 2023? If it happens, I'll take it. Just remember, M2M gains/losses on bonds for Fairfax are not real or relevant in any way.

SJ

@StubbleJumper i agree philosophically with what you are saying. The challenge is most investors do not follow insurance companies closely enough to be able to ‘look through’ volatility in investments. Especially a company like Fairfax with all of its complexity. So when investment markets go down a lot (like last year), and earnings and BV get hit, most investors do not adjust their numbers. They look at reported numbers and take them at face value. Same with most analysts.So in Q4 and again in Q1 we will likely see big gains in equities as stock prices return to fair value. We also will see gains in bonds as interest rates normalize (go lower). In turn, this will normalize Fairfax’s BV - which in Fairfax’s case means it will increase a fair bit. And given P&C insurers are largely valued primarily using BV, a higher BV should result in a higher share price.

—————

It will be interesting to see what changes Fairfax has made to its investment portfolio in Q4:

1.) bonds: Dec 31, 2021 average duration was 1.2 years. Sept 30, 2022 average duration had increased to 1.6 years. Did Fairfax extend duration further out in Q4? Hopefully, yes.2.) stocks: Fairfax has been very active adding to their equity holdings all year. This added exposure will benefit shareholders in many different ways. Fairfax also tends to be very opportunistic in down markets so i am looking forward to seeing if they have done anything creative to get extra exposure to stocks while prices are low (total return swaps?).

-

Net gains (losses) on investments - both bonds and stocks - was a significant headwind for Fairfax in the first three quarters of 2022. Fairfax had a great year in 2022 but the significant losses in their bond and stock portfolio made reported results look terrible, at least over the first three quarters. In Q4, stocks rebounded and the losses likely stopped in bonds.

My earnings estimate for Fairfax for 2023 is about US$105/share. One of the key inputs is net gains on investments = $750 million for the year.

Well one month into 2023 how are we looking? I think we might be close to my $750 annual estimate after 1 month. How?

1.) Ambridge Partners sale for $400 million. We don't know the gain yet. Brit paid $100 million for Ambridge but also merged it with part of their operation. I am going to assume a gain on sale of $200 million. Note, this deal might close in Q2.

2.) Mark to market equity gains are tracking at about $370 million today (total equity portfolio is up about $810 million as of today).

3.) Investment gains on bonds. This is the hard one for me (I don't have a model for this). Given the big decline in bond yields we are seeing 3 years and further out on the yield curve, my WAG for $250 million in gains on the bond portfolio.

Total: $200 + $370 + $250 = $820 million

Bottom line, from here it would not be a stretch for Fairfax to report +$800 in net gains on investments in Q1. Early days; but something to watch. And a big headwind in 2022 is poised to be a big tailwind in 2023.

----------

So in 2023 we could see record underwriting income, record interest and dividend income and near record share of profit of associates. And perhaps also a big bounce back year in net gains on investments. The story keeps getting better and better...

----------

-

1 hour ago, Crip1 said:

From the Q4 Markel press release:

Development on prior years loss reserves within our general liability and professional liability product lines in 2022 was impacted by broader market conditions, including the effects of economic and social inflation, and was most pronounced on the 2016 to 2019 accident years, which was before we began achieving significant rate increases for these product lines.

There's a yin and yang to this. First, one has to think that as time goes on this (economic inflation) is going to be seen throughout the industry. This has to have a negative impact on loss ratios for everyone which will negatively impact earnings for the foreseeable future. At the same time, this will either delay the end of the current hard market or mitigate the "softness" of the market. It is going to impact the whole industry and, like other macro trends, some companies will navigate it better than others.

-Crip

Mr Market did not like Chubb's earnings; stock was down today 6.2% in a strong market. Travellers was also down 3.1% and WRB was down 1.5%. Looks like the best days of the hard market are now behind us. Still a decent position for most companies. But discipline will be more important than ever moving forward, especially if companies see development in prior year loss reserves like Markel.

Fairfax 2023

in Fairfax Financial

Posted · Edited by Viking

With Q4 results out I thought this would be a good time to update my 2022 actuals and 2023 estimates for Fairfax. I will do it in a couple of posts over the next couple of days. Much of the wording is copy/edit (from my previous posts) so if it looks familiar you have likely seen it before.

---------

At its core, Fairfax Financial is an insurance company. The size of Fairfax's insurance business has increased dramatically over the past 9 years (2014-2022). Net premiums written have increased from $6.1 billion in 2014 to $22.3 billion in 2022 for a compounded growth rate of 17.5% per year. That is a staggering increase. On a per share basis, Fairfax has grown net premiums written from $289/share to $957/share for a compounded growth rate of 16.1% per year. The share count is up 10% over this time period (2014 to 2022). The exceptional growth Fairfax has achieved over the past 8 years has occurred with a very modest increase in the share count. Fairfax is now one of the 25 largest P&C insurers in the world.

What has driven this significant growth? Two very different factors have been responsible:

1.) For the first 5 years (2014-2018) growth was driven mostly by acquisitions: Brit (2015), International (2016) and Allied World (2017).

2.) For the past 4 years (2019-2022) growth has been mostly organic and driven by the hard market.

Looking back, Fairfax timed their large insurance acquisitions perfectly - right before the hard market started.

The hard market in insurance looks like it is slowing as we begin 2023. Some segments, like property cat reinsurance, are just entering a hard market. As a result of Q4 results and commentary across the P&C industry, I am reducing my growth estimate for Fairfax to 8% for 2023 = net premiums written increase to $24.1 billion (from $22.3 billion in 2022). This would be a 300% increase in net premiums written over the past 9 years (2014-2023). Not too shabby.

Why do we care what net premiums are? Because this is a key input in determining underwriting profit. And underwriting profit is a key input in determining what an insurance company will earn in a year. And earnings ultimately determine what a company is worth.

Fairfax finished with a CR of 94.7 for 2022. My estimate is Fairfax will finish with a CR of 94.5 in 2023. Why a slight improvement in CR? I expect the hard market of the past 4 years to provide a small tailwind. This would deliver an underwriting profit of $1.27 billion in 2023 ($55/share) which would be a new record for one year. The previous record was $1.1 billion in 2022 ($47/share).

Bottom line, the combination of solid growth in net premiums and solid underwriting should result in Fairfax earning another record underwriting profit in 2023.

----------

Important: My numbers do NOT include runoff (to keep them consistent with how Fairfax reports them). I am estimating common stock effectively outstanding will fall to 23 million in 2023.