Viking

-

Posts

4,694 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

Very good news for Fairfax on the reinsurance renewal front. Cha ching...

Here is RBC's Summary:

January 1 reinsurance renewal observations: January 1 saw a banner renewal period for reinsurers. For property classes, it was a true hard market rate with property catastrophe reinsurance rates up +37%, the largest rate gain since 1992. Casualty and specialty reinsurance rates were up around mid-single-digits and far higher for loss-impacted accounts. Reinsurers were able to secure better terms & conditions (retentions, deductibles, losses covered) and held back capacity in some areas. A vintage year alongside 2013 and 2006.

There are few times we can say this but we think reinsurers got what they wanted (and possibly even more) at 1/1 renewals. That may not be true in every line or geography but it was as strong an outcome as we have seen since at least 2013 and probably back to 2006.

Howden reported that global property catastrophe rates averaged +37% at this past 1/1, which was the largest percentage increase since 1992 (post Andrew). For comparison sake, property cat rates were up a solid +9% at last year’s 1/1 renewal period. Howden also noted +45% average rate increases for direct & facultative business and +50% for retrocessional cover.

For casualty and specialty lines, it was more of a routine and normal renewal period with rates up around single digits give or take. The word “stable” came up consistently in the commentary we have heard thus far. Rates were generally described as being up somewhere in the mid- single digits so not that different from what is happening in the primary market and certainly nothing that is overly disruptive. Overall, appetites to write casualty reinsurance seemed high at this past renewal period and we expect capital was willing to be deployed to a fair number of accounts and risks...

In all, this renewal period was everything that reinsurers had hoped for after so many years of high hopes but no material pricing actions. While last year’s 1/1 renewal period was constructive, this year was a true hard market for many classes and not just property cat risks. High cats, inflation, reserving concerns, and lower capacity drove measured changes in pricing as well as terms & conditions.

We will be interested to see the extent to which our covered companies with reinsurance books (AIG, Arch, Fairfax, and W.R. Berkley in particular) pressed on the accelerator and aggressively grew their reinsurance books at 1/1. For now, reinsurance is having its day in the sun.

-

1

1

-

-

2 hours ago, gfp said:

The sale of Ambridge for $400 million should result in a sizeable realized gain for Brit/Fairfax. Brit purchased 50% of Ambridge in 2015 (shortly after Fairfax purchased Brit). Brit purchased the remaining 50% in 2019 for $46.6 million. In 2021, Brit combined their US operations (not sure size) with Ambridge.

Brit is the weakest large insurance operating unit of Fairfax. This sale should result in a a meaningful realized gain for Brit. What will Brit/Fairfax use the proceeds for?

1.) dividend to FFH?

2.) Brit uses to grow business in current hard market?

3.) Brit uses to buy back minority interest held my OMERS?

Bottom line, Fairfax looks to be monetizing an asset at a very good price. With lots of great opportunities to re-invest the proceeds at a very attractive prices. The management team at Fairfax continues to execute exceptionally well.

---------

Of interest, Fairfax purchased Brit for $1.657 million in 2015. Ambridge is being sold for $400 million.

---------

FFH 2015AR: In December, Brit made an investment in Ambridge Partners, one of the world’s leading managing general underwriters of transactional insurance products. These products insure losses as a result of breaches or inaccuracies in warranties and indemnities relating to M&A, restructuring activities, business financing and tax issues. Ambridge, which has been a partner of Brit for the last nine years, produces $128 million of premiums and is highly profitable. We welcome Jesseman Pryor (CEO), Jeffery Cowhey (President) and their team of 29 employees to Fairfax.

FFH 2016AB: In 2015 Brit purchased 50% of Ambridge Partners, one of the world’s leading managing general agencies of transactional insurance products. In 2016 Ambridge produced gross premiums written of $32 million for Brit at a combined ratio well below 100%.

FFH 2019AR: On April 18, 2019 Brit acquired the 50.0% equity interest in Ambridge Partners LLC (‘‘Ambridge Partners’’) that it did not already own for $46.6, remeasured its existing equity interest to fair value for a gain of $10.4, and commenced consolidating Ambridge Partners.

From Brit 2021 YE Press Release: In 2021, we combined our US operations to create a single operation under the Ambridge brand. It now operates as a global MGA, managing over $600m of premium in the US and internationally. Our clients have the benefit of the well- recognised Ambridge MGA model giving them better access to products and enhanced service, and our underwriting teams are better able to capitalise on business opportunities.

-

6 hours ago, LearningMachine said:

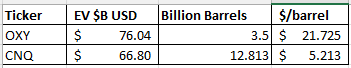

Has anyone looked deeper into why Mr. Market is effectively pricing reserves of oil majors so differently from company to company at $/barrel, even after taking into account operating costs/barrel?

For example, OXY is trading at $21.72/barrel and CNQ is trading at $5.21/barrel. If you look at the weighted average operating cost/breakeven price of what they report, including provincial royalties, etc., they are not that different, and arguably CNQ now has lower operating cost per barrel than OXY.

@SharperDingaan and @Viking, or anyone else, any thoughts you can provide?

Why is the difference so huge?

Could it be that Mr. Buffett and Mr. Market are pricing sub-optimally using FCF yield instead of $/barrel that an owner would be using to price an oil well or oil sands, along with operating costs, to purchase?

I understand- Oxy also has other businesses that you could subtract out to get lower value per barrel but that still doesn't account for the huge difference.

- some of the reserves are probably understated for both as technology improves and price goes up with inflation.

@LearningMachine great question. We talk about 'oil' but there are lots of important variables that come in to play when trying to compare oil companies. Too many for me to really be able to comment with any specificity or conviction:

- production method: mined or drilled?

- oil type: light/sweet, light/sour, medium/sweet, medium/sour, heavy/sweet, and heavy/sour

- nat gas exposure?

- geography: Canada, US, OPEC, Russia etc? WCS, WTI, Brent?

- transportation: pipelines or ship?

- refining?

- retail?

- vertical integration?

My strategy has been to stick with what I have followed for years... the large Canadian producers: SU, CNQ and CVE. SU at C$40 looks like a gift to me. CNQ under $65 or CVE under $22 would also be sweet.

----------

The big risk for Canadian oil sands oil is it has a big bulls-eye painted on its back. It is hated in Canada (especially Quebec). Public sentiment will only get worse moving forward. What is a 25 year asset worth in such a scenario?

What makes sense to me is the big Canadian producers will essentially go into runoff with all of their long life assets and only spend incremental funds on projects that have exceptionally quick/high payback.

With this framework, dividends (large base and big special) make the most sense to me. Buybacks may not actually result in a higher share price over time. You might just take out all the big forced sellers - like the big pension funds - who want out anyways.

And all the massive debt repayment might actually be poor capital allocation. Perhaps oil companies should lever back up and throw gobs of cash at shareholders... The dividend yields would astronomical. There is my crazy thought of the day (I am only allowed one of these each day).

-

I think the key variable affecting PE multiple for any company is narrative. Narrative is closely tied to type of investor. I remember when Apple traded at a PE under 10 (2013?). Everyone hated Apple. Steve Jobs had passed. Tim Cook was no visionary. Samsung was going to rule the world. I think the PE for Apple was over 30 last year. Everyone loved Apple last year. No price was too high for the stock. Set and forget. But at its core, Apple was essentially the same company in 2022 that it was in 2013.

The big US banks in 2016 were still hated… investors could not get the great financial crisis narrative out of their heads. Even though the big US banks were completely different animals by 2016 and operating in a very different regulatory regime.

My view is Fairfax is a turnaround play that had has turned around. But most investors do not understand it or believe it. I think the turnaround really got going in 2018. More good things happened in 2019. In 2020 covid hit and their equity portfolio got crushed. This is when sentiment in Fairfax (and the stock price) hit a multi-year low. Performance (BV growth, stock price) over the previous decade had been terrible. Trust in management was gone. The last of the long term investors in the company capitulated and sold their shares. The narrative in Q2/Q3 2020 was that Fairfax was a broken company. How did the management team actually perform in 2020? Pretty well.

2021 was one of the best years in Fairfax’s history. 2022 was a very good year (although you wouldn’t know it by just looking at earnings or growth in BV). Looking at the 5 year span from 2018-2022, the management team at Fairfax has done an outstanding job with both insurance and investment businesses. i think the narrative for Fairfax has slowly started to shift over over the past year. The negativity on this board towards Fairfax is largely gone. Most now grudgingly think it might do ‘ok’ moving forward.

2023 is looking like it will be another very good year for Fairfax. If Fairfax executes well, my guess is the narrative will continue to shift and start to reflect the current earnings power of the business. But narratives take years to change - it is a very slow process. So i am not expecting the PE multiple to expand a great deal in 2023. I hope it does - that could provide rocket fuel to the stock price.

-

1 hour ago, MMM20 said:

@MMM20 great chart. BV was US$570/share at end of Q3. My guess is earnings in Q4 will come in around $70/share (the pet insurance sale by itself is +$40). If my estimate is accurate then BV at Dec 31, 2022 is about $640. Shares are trading today at $597, so P/BV = 0.93.

One on my questions for Fairfax for 2023 is what multiple will the shares trade at? As your chart outlines very well, pre-pandemic (2014-2019), Fairfax shares generally traded in a band between 1.1 and 1.3 x BV. Post pandemic, Fairfax shares have generally traded between 0.8 and 0.9 x BV. As i outlined above, as of today they are trading at about 0.93 X BV.

My guess is Fairfax will earn about US$100/share in 2023. This would put 2023 year end BV at about $730 (adjusting for the $10 dividend). Here is where Fairfax shares would trade Q1 2023 based on various P/BV assumptions:

1.) 0.9 = $660 = +10% from stock price today of $597

2.) 1.0 = $730 = +22%

3.) 1.1 = $800 = +33%

4.) 1.2 = $870 = +45%

My guess is Fairfax could start to trade back at a 1.1 x multiple in 2023. The primary reason is the $100 in earnings i am modelling are very high quality… coming primarily from underwriting profit, interest and dividend income and share of profit of associates. Only a modest amount is coming from investment gains. (Large investment gains will push my $100/share earnings estimate higher).

So it will be very interesting to see if Fairfax starts to trade closer to its pre-pandemic P/BV multiple in 2023. Growing earnings AND multiple expansion = very good returns for shareholders.

-

As we think about investing ideas for 2023, i thought it would be interesting to bring forward the same thread from the start of 2022. Lots to learn. Druckenmiller’s advice is especially useful at this time of the year: be inquisitive… and open minded.

-

So what are board members best investment ideas to make $ in 2023? So what can a board member buy on Tuesday and expect to earn a reasonable return in 2023 (which i define as +10%)? It can be a specific stock. Or a sector. Please include a couple of bullet points as to why you like the idea.

To get things started my highest conviction ideas today are:

1.) Fairfax. Stock was up 20% in 2022; value of business increased much more over the year. So the stock, closing at US$594, is cheaper today than it was Dec 31, 2021 when it closed at US$492. I think Fairfax will earn US$100 in 2023 (and this is my conservative estimate). Misunderstood stocks trading at a normalized PE of 6 times earnings are a layup. Fairfax is the gift that keeps on giving.

2.) oil. Not as cheap as it was Dec 31, 2021. But still cheap. Especially if the world does not go into a big recession in 2023 (and I don't think it will). Growing demand + constrained supply = higher prices for any commodity. Throw in terrible government policy, the religion of ESG, war in Ukraine, China emerging from covid, US ending SPR releases...

- what stocks to own? I tend to stick to large cap Canadian players: CNQ, CVE and SU. My largest holding today is SU. They have had some issues and the stock looks cheaper today than CNQ and CVE. Lots of good options in oil in both Canada and the US.

- for me oil is a trade. Buy low and sell high. Rinse and repeat. This strategy worked great in 2022.

3.) US big tech looks cheap (GOOG, AMZN, META). Down 50% from highs is good enough for me. I have a 1/2 position in each today. I hope they keep selling off… so i can continue buy and get to a full position.

- i have also started to add smaller positions in PYPL, QCOM, CIBR. Nvidea is on my watch list (i might just buy SOXX).4.) US financials look cheap. If they go much lower from here on recession fears I will likely get aggressive. Small holding today…

There is lots of other stuff that is cheap. Definitely a stock pickers market.

-

+28% Lucky. What I liked/understood did very well this year. It usually does not work that way (in 2018 I was down 4% on the year). Fairfax, oil and cash drove all of my returns this year. Cash? Not losing a bunch of money sometimes feels like making money.

1.) in Dec of 2021 I started to load up on oil. It was my number one pick to start the year. I got lucky as it worked way better than I thought it would.

2.) when the Fed got aggressive with raising interest rates I got conservative and moved a big chunk of my portfolio to cash. Lucky? I don't think so. Following the Fed has been the best single strategy for the past 10 years... and it continued to work in 2022.

3.) extreme volatility in oil and Fairfax allowed me to but low and sell high a couple of times. This was simply being opportunistic. Fairfax went to US$450 twice in 2022... I messed up a little the first time in March but nailed the second time in Oct (that concentration thing that Druckenmiller talks about).

Looking ahead to 2023 my favourite picks:

1.) Fairfax. Stock was up 20% in 2022; value of business increased much more over the year. So the stock, closing at US$594, is cheaper today than it was Dec 31, 2021 when it closed at US$492. I think Fairfax will earn US$100 in 2023 (and this is my conservative estimate). Misunderstood stocks trading at a normalized PE of 6 times earnings are a layup. Fairfax is the gift that keeps on giving.

2.) oil. Not as cheap as it was Dec 31, 2021. But still cheap. Especially if the world does not go into a big recession in 2023 (and I don't think it will). Growing demand + constrained supply = higher prices for any commodity. Throw in terrible government policy, the religion of ESG, war in Ukraine, China emerging from covid, US ending SPR releases...

3.) US big tech looks cheap (GOOG, AMZN, META). Down 50% from highs is good enough for me.

4.) US financials look cheap. If they go much lower from here on recession fears I will likely get aggressive.

There is lots of other stuff that is cheap. Definitely a stock pickers market.

What about the Fed? Not sure. Nothing obvious comes to mind right now.

-

I have updated my equity spreadsheet for Fairfax to Dec 30. The equity portfolio that I track is up about $1 billion in Q4. Of the total, about $380 million is mark to market (about $17/share pre-tax).

Bottom line, Fairfax's equity portfolio has held up much better in the bear market of 2022 compared to what happened in the bear market of 2020.

Big movers:

1.) FFH TRS +$250 million

2.) Eurobank +$331 million

3.) Atlas +$181 million

4.) Fairfax India +$150 million

5.) Quess - $130 million

-----------

For board members who might not know... my spreadsheet attached below has a number of tabs you might find useful:

Tab 1: 2022 = where I track Fairfax's various equity holdings

Tab 2: Moves = various purchases Fairfax has made going back to 2010

Tab 3: 2022 Estimated Earnings = with history back to 2016

Tab 4: Premiums = net premiums written going back to 2014

- also includes losses from equity hedges and CPI positions (2010 to 2020)

Tab 5: Interest = interest and dividends going back to 2010

Tab 6: Associates = Associate holdings going back to 2017

Tab 8: Fairfax India holdings - my contain errors

-

@glider3834 thanks for all your help over the past year. As you likely see, I am good at stealing other posters good ideas

Putting together the Top 10 List helped me a lot. I had a pretty good handle on:

1.) top line growth and underwriting profit

2.) the bond portfolio and interest and dividend income

3.) share of profit of associates

What I missed this year was the size of the equity investments, with a spend of about $2 billion. For reference, equity purchases most years have been under $1 billion.

The other big takeaway is Fairfax is buying much higher quality equities compared to 2017 and prior years. From 2018-2022 they have had very few misses with their equity purchases. I attached my Excel spreadsheet (see 'moves' tab) that tracks most of Fairfax's purchases by year all the way back to 2010 - board members can scroll through and see the style evolution.

-

2022 Top 10 List: Part 2

I started the list yesterday… here are the remaining items driving shareholder value at Fairfax. What am i missing (good and bad)? Look forward to discussing what other people are thinking.

5.) asset monetization: sale of Resolute Forest Products to Domtar for cash of $626 million + $183 million contingent value right (tied to duties collected). The timing of this sale was perfect. Resolute was sold at a high price ($20.50/share). When it closes proceeds can be rolled into other investment opportunities at bear market lows. Regulatory approval for the deal was just given (late Dec). As much as I like the lumber part of the business over the next 5 years or so... the newsprint/paper part of the business looks pretty ugly. Very happy with this transaction.

—————

With (likely) record underwriting profit and interest and dividend income and significant asset sales, Fairfax generated a significant amount of cash in 2022. We should see more of the same in 2023. This is a significant development for Fairfax. Cash is a very good thing, especially when you are in a bear market and both bonds and equities are on sale (that buy low thing).

So what did we see Fairfax do with all that cash in 2022? Record equity investments of around $2 billion. Surprised?

6.) take private of 2 businesses: Fairfax spent $537 million as follows: July - Grivalia Hospitality ($195 million), August - Recipe ($342 million). These are two businesses Fairfax understands very well as they had already owned significant stakes in both for years. Both purchases were highly opportunistic given they were made as we were just emerging from covid and the price paid likely reflected depressed earnings (at least in the case of Recipe).

7.) increase ownership stakes in businesses already owned: Fairfax spent $506 million as follows: February - Fairfax India ($65 million), March - exercise of Atlas warrants ($201 million), April - exercise of Altius warrants ($78 million) and Ensign Energy debenture conversion ($9), June - John Keels debentures ($75 million), Oct - exercise Foran Mining warrants ($25 million), Dec - Mytilineos ($53 million).

8.) increase partnership: Fairfax spent $300 million on preferred equity in Kennedy Wilson. Fairfax has a long history with Kennedy Wilson, going back to 2010. Kennedy Wilson has been Fairfax’s real estate partner for over a decade.

When you put 6.) + 7.) + 8.) together… Fairfax spent $1.343 billion, a significant chunk of money, increasing its ownership in businesses that it was already invested in. These are businesses and management teams that Fairfax understands well.

9.) US large cap purchases: over the first 9 months of 2022, Fairfax spent about $350 million: Micron Technologies ($152 million), Bank of America ($96 million), Occidental Petroleum ($54 million) and Chevron ($45 million).

- of interest, coming out of the Great Financial Crisis, Fairfax spent over $1 billion on a bunch of large cap US stocks: Wells Fargo, J&J, US Bancorp, and USG. It would not surprise me to see Fairfax continue to build out their holdings of large cap US stocks in Q4 and into 2023.

10.) increase private equity holdings/partnerships: as part of the pet insurance sale, Fairfax invested $450 million in two separate deals with JAB Holdings. JAB is a privately held German conglomerate. The two transactions: $250 million in debentures + $200 million in JAB - JCP V investment funds. Fairfax already had significant investments/partnerships with other private equity shops like BDT Capital Partners and ShawKwei. The investment in JAB expands and diversifies Fairfax’s significant portfolio of private equity type holdings.

When you put 6.) + 7.) + 8.) + 9.) + 10.) together… Fairfax spent around $2 billion on a collection of businesses that look like solid additions to Fairfax’s existing portfolio of equity holdings. Nothing flashy. Boring. Low risk. Good value / opportunistic purchases. Sold upside. Just what many Fairfax shareholders have been asking for…

Fairfax is once again planting lots of seeds. Over time, these investments will all grow and compound in value to the benefit of Fairfax shareholders. A larger equity portfolio will drive higher future earnings. And this will drive the stock price higher. This is just another of many catalysts in place at Fairfax. Fairfax is once again playing offence with its investment portfolio.

—————

11.) continue to take out minority shareholders of insurance businesses: On Sept 27, 2022 Fairfax increased its ownership interest in Allied World to 82.9% from 70.9% for total consideration of $733.5 million ($228 million hit to retained earnings) funded via $750 million debt offering. Fairfax buying out minority partners is a solid use of cash. Low risk. Solid return.

12.) Fred VanVleet - bet on yourself update: FFH total return swap (TRS) investment continues to perform exceptionally well, up $200 million in 2022. FFH share price: Dec 30, 2022 = $594. Dec 31, 2021 = $492. TRS = 1.96 million FFH shares. ($594 x 1.96 million shares = $1.164 billion market value.). Given Fairfax shares remain crazy cheap, my guess is Fairfax continues to hold this position.

13.) share buybacks: to Sept 30, 2022 Fairfax had repurchased 419,000 shares = 1.8%. Common stock effectively outstanding was 23.445 million at Sept 30,2022 and 23.865 million at Dec 31, 2021. My guess is Fairfax continued to buy back shares in Q4, especially after the pet insurance deal closed the end of October. It will be interesting to see how aggressive Fairfax gets with share buybacks in 2023.

14.) share buybacks at Fairfax equity holdings: both Fairfax India and Stelco bought back shares in 2022 and this boosted Fairfax’s ownership stake in each company.

- Fairfax owns/controls 58.4 million shares of Fairfax India (as of Feb 2022). Total share count at Fairfax has fallen: Dec 31, 2020 = 149.4 million; Dec 31, 2021 = 142.2 million; Sept 30, 2022 = 138.7 million. Fairfax's ownership at Fairfax India increased from 37.3% to 42.1%.

- Fairfax owns 13 million shares of Stelco. Total share count at Stelco has fallen significantly: Dec 31, 2020 = 88.7 million; Dec 31, 2021 = 77.3 million; Nov 1, 2022 = 55.1 million. Fairfax's ownership at Stelco increased in 2022 from 16.8% to 23.6% (significant).

15.) Proposed privatization of Atlas: a group (lead by D. Sokol) has proposed to take Atlas private at $15.50/share. Fairfax (with 45% stake) is supportive of the deal. Fairfax is not obligated to purchase any additional shares. The deal is expected to close in 1H 2023. This is a massive deal and involves Fairfax’s largest equity holdings. I don’t have a strong opinion on the proposed deal right now. All things being equal, I think being a private company is better for Atlas. However, I do not like the lack of financial details available on Fairfax’s private holdings.

Negatives

1.) increase in net debt of $1.3 billion: Sept 30 = $7.6 billion. Dec 31, 2021 = $6.3 billion. The pet insurance sale closed the end of October so the net debt number of $1.3 billion will come down when Q4 is reported. It will be interesting to see if Fairfax decides to bump the minimum $1 billion cash at hold co to a higher number moving forward.

2.) impairment charge: non-cash impairment charge on goodwill of Farmers Edge of $109.2 recognized in the second quarter of 2022. Like all large companies, Fairfax has a few warts.

3.) continued losses from what is left of runoff; what will average loss be moving forward? -$25 million/quarter?

-

Over the past week: SU, GOOG, AMZN, META, QCOM, DIS

I also rebuilt my dividend portfolio (mostly Canadian stuff): TRP, ENB, T, BCE, VZ, BNS, CM, CWB, WFC, C, SLF, GWO, DXT

-

2022 Top 10 List: Part 1

I am going to do this post in 2 parts. Part 1 will summarize the top 4 items driving shareholder value. Part 2 will summarize the remaining items.

Fairfax has had an outstanding 2022. I characterized 2021 as the year the ‘new Fairfax’ finally started emerging for all to see. We got more of this in 2022. Fairfax has been making important changes under the hood for the past 4-5 years and 2021 and 2022 were the years in which all the hard work is now being reflected in the reported financial results. The Fairfax 'super tanker' finally appears to be headed in the right direction and is building value at a solid rate for shareholders again.

FFH stock price increased 20% in 2022 (to Dec 29)

- Dec 29, 2022 = US$591.73; Dec 31, 2021 = $492.13

- S&P500 is down 19% so FFH outperformance of close to 40% has been significant in 2022.

BV decreased 9.5% in the 9 months to Sept 30 (BV will be much higher when Q4 is reported).

- Sept 30, 2022 BV = US$569.97; Dec 31, 2021 BV = US$630.60

Dividend of US$10 dividend will likely be paid Jan 2022 (it is usually announced in early January).

How can i say Fairfax had a great year in 2022 if BV is down 9.5% Sept YTD? The hit to BV is coming primarily from the spike in bond yields. We just had the worst year for bonds in something like 200 years! To Sept 30, 2022, net losses on investments was $2.3 billion (@$100/share) = $1.4 billion in bonds + $500 million in stocks + $400 million in currency. Counter intuitively, the spike in bond yields is actually the best thing that could have happened to Fairfax in 2022. Importantly for Fairfax, most of the ‘losses’ in the bond portfolio will likely reverse over the next year or two as bonds are held to maturity. And moving forward, Fairfax will be generating record amounts of interest income…. see below for the details. I also expect Fairfax to earn +$60/ share in Q4, which if it happens, will push BV for the full year into slightly positive territory. So even though BV will finish 2022 up slightly, as we will learn below, the future earnings power of Fairfax has never looked better.

—————

2022 Top 10 List: Part 1 (Top 4)

1.) increase in interest income: I estimate interest income will increase to a record $830 million in 2022 from $568 million in 2021 = increase of about US$260 million (+45%). In 2023 my guess is interest income will increase further to a staggering $1.37 billion, a $540 million increase (+65%) over 2022, and a 140% increase over 2021. For reference, $1.37 billion = $58/share and FFH shares are trading today under US$600. Fairfax is trading today at about 10X interest income (pre-tax). Nuts. The significant increase in interest income will be the gift to Fairfax shareholders that will keep on giving for years into the future.

Fairfax has an investment portfolio of about $51 billion. Of this total, about $36 billion is fixed income. Over 2021 Fairfax reduced the duration of their fixed income portfolio to 1.2 years. Most P&C insurers have an average duration closer to 4 years. With such a low duration portfolio, Fairfax has been able to benefit from spiking interest rates by rolling over most of their fixed income portfolio into much higher rates. In Q3 they also started extending the average duration of their fixed income portfolio to 1.6 years by buying longer dated US treasuries (with 3-5 year duration). Increasing duration will lock in high yields for years into the future.

2.) increase in underwriting income: net premiums written will increase to a record $22 billion in 2022 from $17.8 billion in 2021 (+20% growth) and $14.7 billion in 2020 (+50% growth over the last 2 years). In turn, this is spiking underwriting profit which I estimate will come in at a record $970 million in 2022 (95CR est), compared to $801 million in 2021 (95CR) and $308 million in 2020 (97.8CR). In 2023 my guess is net premiums written will increase 15% to $25.4 billion and underwriting profit will increase to $1.1 billion (assuming a 95CR). For reference, $1.1 billion = $47/share. The significant increase in net premiums and underwriting profit will be the gift to Fairfax shareholders that will keep on giving for years into the future.

What is driving the substantial increase in net premiums written? We are in a hard market for P&C insurance. It started in 2019 and looks like it will continue well into 2023. Re-insurance rates are set to spike higher in 2023 and this will benefit Fairfax as they have a large re-insurance business.

3.) increase in share of profit of associates: this source of earnings had a break-out year in 2022. I estimate share of profit of associates will finish 2022 at a record of around $1 billion = $43/share. Over the 5 year period, from 2017-2021, ‘share of profit of associates’ averaged about $200 million per year for Fairfax. My guess is ‘share of profits of associates’ should be able to deliver around $1 billion again in 2023 and this number could compound at +10% each year moving forward.

That is a staggering increase in a very short period of time. What happened? Put simply, the earnings power of the equity holdings captured in the ‘associates-equity accounted’ bucket are beginning to shine through. The turnarounds have (finally) turned around (Eurobank). The fast growers are executing well (like Atlas). The commodity bull is running (Resolute, Stelco, EXCO Resources).

What is ‘share of profits of associates’? Fairfax has an equity portfolio of about $15 billion. Of this total, about $5.6 billion (38%) are accounted for as ‘Associates’ and fall into this bucket. ‘Associates’ are holdings where Fairfax has an economic interest of 20% or more but no control. Investments in associates are accounted for using the equity method.

4.) significant asset monetization: Fairfax pulled a rabbit out of its hat in 2022. On October 31, 2022, Fairfax closed on the sale of C&F Pet Insurance Group and Pethealth to Independence Pet Group (majority owned by JAB Holding Company) for proceeds of $1.4 billion in the form of $1.15 billion in cash and $250 million in seller debentures. In Q4 Fairfax expects to record a pre-tax gain of approximately $1,278 million and an after-tax gain of approximately $992 million ($42/share).

Bottom line, Fairfax sold a business no one knew they owned for $992 million after tax ($42/share). For a little background, Fairfax purchased Hartville Group for $34 million in 2013 and Pet Health for $89 million in 2014 and in 2022 sold the combined entity for $1.4 billion. That is nuts. Fairfax has a long history of buying small insurance businesses and patiently growing them over a decade or more and then selling them for very large gains: First Capital, ICICI Lombard, Riverstone UK and now C&F pet insurance. Very impressive. Makes one wonder what else Fairfax has in the cupboard that is under-appreciated by investors?

—————

2022 Top 10 List: Part 2 will follow in the next day or two.

-

1

1

-

-

2021 Top 10 List: originally posted Jan 31, 2022

- link to actual post: https://thecobf.com/forum/topic/19272-fairfax-2022/page/2/#comment-466701

Fairfax has had an outstanding 2021. In fact it was one of the best years in Fairfax’s history. Below is a Top 10 list of what drove value for shareholders of Fairfax in 2021. What is missing?

I would characterize 2021 as the year the ‘new Fairfax’ finally started emerging for all to see. Fairfax had been making important changes under the hood for the past 4-5 years and 2021 was the year all the hard work finally started to be reflected in the reported financial results. The Fairfax 'super tanker' finally appears to be headed in the right direction and building value at a solid rate for shareholders again.

FFH stock price increased 45% in 2021

- Dec 31, 2021 = $492.13; Dec 31, 2020 = US$340

BV increased 18% in the 9 months to Sept 30 (BV will be higher when Q4 is reported)

- Sept 30, 2021 = US$561.88; Dec 31, 2020 = US$478.33

Dividend of US$10 dividend was paid Jan 2021

1.) net gains on investments of $2.5 billion (to Sept 30) = $96/share

- equities, Digit revaluation and FFH TRS

- does NOT include pending gain on Digit of $1.1 billion (Digit should be on its own but i decided to include it here).

- FFH TRS: 1.96 million shares at cost of US$396/share. Classic Fairfax move: creative, unconventional, opportunistic, smart, well timed, profitable

2.) increase in fair value of Investments in associates of US$1,372 million (to Sept 30) = $53/share

- this gain is in addition to ‘gains on investments’ summarized above.

- this gain is NOT captured in BV.

3.) significant increase in net premiums written of US$2.3 billion (to Sept 30) = growth of 20.5%

- hard market that began in Q4 2019 is continuing as we begin 2022

4.) US$1 billion share buy back Dec: 2 million shares purchased (7% of shares outstanding) at US$500/share

- financed through sale of 10% interest in Odyssey for US$900 million

- share buybacks done below intrinsic value are very accretive for long term shareholders.

- second classic Fairfax move of 2021: creative, opportunistic, smart, well timed

5.) debt reduction: total debt was paid down. Combined with significant earnings in 2021, debt ratios have improved considerably.

- largely paid with proceeds from sale of the remainder of Riverstone for US$700 million and 14% interest in Brit for US$375 million.

6.) underwriting profit increased $182 million (to Sept 30)

- YTD Sept 30, 2021 = $330; YTD Sept 30, 2020 = $142 million

- given hard market we should see continued improvement in underwriting profit in 2022 (as written premiums become earned)

7.) Fairfax’s two largest equity holdings look exceptionally well positioned as we begin 2022 and the shares are very cheap:

- Atlas: executed and completed financing on very aggressive new build strategy in 2021. Should drive 15-20% EPS growth per year next 3 years.

- Eurobank: completed multi-year fix of balance sheet in 2021 and is now poised to grow business and earnings and leverage improving Greek economy

8.) Gulf Insurance Group: completed acquisition of AXA Gulf, increasing size by about 40%

9.) a number of Fairfax equity holdings completed significant stock buy backs in 2021, significantly increasing Fairfax’s ownership percent: Fairfax India, Stelco, Resolute Forest Products

10.) changes at private holdings:

- Eurolife stake was increased to 80%

- Pethealth was folded into Crum (Jan 1, 2021)

- Toy ‘R Us retail operations were sold (kept real estate)

- Boat Rocker IPO - raised C$170 million - very opportunistic

- Farmers Edge IPO - raised C$125 million -very opportunistic (even though the business continues to struggle)

The bad

1.) drop in interest and dividend income of $109 million (to Sept 30)

- Sept 30 2021 = $496 million from Sept 30, 2020 = $605 million

- decline is due to Fairfax reducing duration on bond portfolio

- this strategy (low duration) carries a short term cost

- however, should bond yields move higher (as is currently happening as we begin 2022) Fairfax is well positioned to benefit

2.) continued losses from what is left of runoff; what will average loss be moving forward? -$25 million/quarter?

-

2020 Top 10 List: originally posted Dec 28, 2020

- link to actual post: https://thecobf.com/forum/topic/17401-fairfax-2020/page/34/#comment-430239

Fairfax has had a very eventful 2020. Below is a Top 15 list of events driving value for shareholders this year. What is missing?

Some events were driven by Fairfax (corporate/subs) and some were driven by management teams in the stock/equities held. I would characterize 2020 as a ‘holding pattern’ kind of year given all the disruption caused by covid and its impact on Fairfax, insurance subs and equity investments. Looking at both 2019 and 2020 there is lots going on under the hood at Fairfax. I continue to believe the Fairfax 'super tanker' is slowly turning to the benefit of shareholders.

————————————

FFH stock price: Dec 31, 2019 US $469; Dec 28, 2020 = $336; -28%

BV: Dec 31, 2019 = US $486; Sept 30, 2020 = $442

Dividend = $10 (Jan 2020).

1.) Covid

- hit to BV of $54/share in Q1 - primarily due to unrealized losses in investment portfolio (lots of cyclical companies)

- resulted in losses at insurance subs, lead by Brit, of $535.6 million through Q3

2.) Insurance - hard market confirmed

- net premiums written up 12.7% in Q3, 2020

- expected to continue strong growth in 2021

3.) Sale of Riverstone UK

- sale providing much needed cash in 2 transactions

- 40% sold - closed March 31; proceeds of US$599.5

- remaining 60% - to CVC Strategic Opportunities Fund II (will close early 2021) for approximately US$750 million at closing + up to US$235.7 million post-closing under a contingent value instrument.

4.) Common Stock and Equity Index Short Positions

- Q3 net realized loss = $168 million

- First 9 months realized loss = $391 million

- Biggest negative for the year (under Fairfax control)

5.) Increase in total debt

- April 24: additional $650 million at 4.625%

6.) Fixing Mistakes

- APR sale to Atlas closed Feb 2020 - Atlas issued approximately 29.9 million ATCO shares to APR sellers as equity consideration, at a deemed value of $11.10 per share.

- Fairfax Africa / Helios - Helios will acquire a 45.9% voting and equity interest in Fairfax Africa in exchange for contributing its entitlement to cash flows from certain fee streams and being appointed sole investment advisor to Fairfax Africa. Fairfax recorded a non-cash net loss on investments of $164 million in consolidated statement of earnings.

7.) opportunistic Bond Purchases during pandemic

- from Q1 report: US corporate bonds - $2.9 billion; avg maturity of 4 years; int rate of 4.25%; avg maturity of 4 years; interest income of $123 million/yr

8.) Blackberry - new convertible debentures - September

- Fairfax redeemed $500 million 3.75%

- Fairfax subscribed $330 million 1.75%; $6 conversion (55 million shares)

9.) Digit (India) continues strong growth (30% versus flat for overall insurance market) and expects to reach break even by end of year

10.) Buying out minority partners

- Brit - 9.4% - Aug for $220 million - now owned 100% by Fairfax

11.) Positioning Non Insurance Companies to Succeed

- Dexterra - reverse acquisition of Horizon North Logistics - closed in March https://www.newswire.ca/news-releases/horizon-north-and-dexterra-sign-definitive-agreement-to-create-leading-canadian-support-services-company-898386935.html

- Easton Baseball sold to Rawlings (Seidler Equity Partners) - Existing shareholders of Peak Achievement Athletics Inc., the parent of Easton, will continue to participate as minority owners in the combined organization. https://www.prnewswire.com/news-releases/rawlings-enters-into-definitive-agreement-to-acquire-easton-diamond-sports-301156058.html

12.) Monetizations

- Davos Brands - Sept 30 - for cash proceeds of $58.6 and recorded a net realized gain of $19.3

- Vault insurance - announced Nov - close Q1, 2021 - Allied World sells controlling position; retains 10% ownership https://www.insurancejournal.com/news/national/2020/11/18/591092.htm

13.) Seeding New Insurance Ventures

- Ki Insurance (Brit) - announced in May 2020; open for business Jan 1, 2021. Ki will aim to significantly reduce the amount of time taken for brokers to place their follow capacity. Ki’s algorithm, developed with support from University College London, will evaluate Lloyd’s policies and automatically quote for business through an always available digital platform, built by Google Cloud and accessed directly by brokers. Ki has raised US$500m of committed capital from two backers: Blackstone and Fairfax. https://www.britinsurance.com/news/ki-platform-goes-live-with-partner-brokers

14.) Insider Stock Purchases

- Prem: $149 million in June at $310/share. https://www.fairfax.ca/news/press-releases/press-release-details/2020/Prem-Watsa-Acquires-Additional-Shares-of-Fairfax/default.aspx

- Others at Fairfax: https://www.canadianinsider.com/company?ticker=ffh

15.) Stelco (Fairfax owns 13 million shares; cost CAN$20.27)

- Amazing year; stock price: jan 1 was CAN$10.91. In March the stock went to $3.24 per share. Dec 28 the stock closed at $22.11 per share.

- Most importantly the company is positioned very well looking ahead to 2021 and what looks like a bull market for steel pricing; investment phase in the business is ending and Stelco is focussed on maximizing free cash flow generation and rewarding shareholders.

Personnel Changes

- Feb: Paul Rivett (President of Fairfax) retires

- Nov: Scott Carmilani (former CEO of Allied) resigns to run Vault

- Q2 former CEO of APR left (under Atlas umbrella). June Brian Rich appointed as new President and COO.

-

2019 Top 10 List: originally posted Dec 28, 2019

- link to actual post: https://thecobf.com/forum/topic/16444-fairfax2019/page/5/#comment-378570

Fairfax has had a very active 2019. For fun, i decided to try and come up with a 2019 Top 10 list of events driving value for shareholders. Some events were driven by Fairfax (corporate/subs) and some were driven by management teams in the stock/equities held. The breadth of the items below is very interesting and informative. On balance, it is clear to me that Fairfax, on balance, has done many things to build a more valuable company for shareholders over the past year. Please feel free to comment; what items are missing? One obvious bucket is ‘Share of profits of associates’ and how fast it is growing.

Here is a summary of the types of items impacting shareholder value:

- being positioned to capitalize at subs on hard market in insurance

- solid growth in interest and dividend income

- seeding new/newer investments: Seaspan (tranche 2)

- monetizing mature investments: ICICI Lombard sale and sale of 40% of Riverstone UK.

- merging investments to make the whole stronger: Eurobank/Grivalia

- selling investment to put it in a better position to thrive: APR Energy

- simplifying corporate structure to better enable companies to succeed: Thomas Cook demerger of Quess and IIFL split into Finance, Securities and Wealth

Top 10 Events Driving Shareholder Value During 2019

1.) Ongoing: emergence of hard market for pricing in certain insurance lines: leading to double digit growth in net premiums written at many of the subs. Looks like double digit growth should continue in 2020.

2.) Ongoing: Solid increase in interest and dividend income: while short of FFH goal of $1 billion, looks to be close to $900 million for 2019, versus $784 in 2018 and $559 in 2017.

- January: Seaspan: tranche 2 of $250 million at 5.5% = $14 million in interest income/year

3.) January: Seaspan: Fairfax’s additional $250 million investment = 37 million shares purchased at cost of $6.75; with shares currently trading at $14.25 paper gain = $278 million.

- 25 million additional warrants exercisable at $8.10 = paper gain of $154 million

4.) Eurobank: stock closed at $0.54 Euro on Dec 31, 2018. Today the stock is at 0.92 Euro; paper gain = US $400 million. Eurobank looks well positioned.

a.) April: merger with Grivalia improved balance sheet

b.) April: Cairo Securitization - plan to hive off 7.5 billion euro chunk of underperforming assets is now almost complete (target Q1 2020).

c.) July: election of pro business government in Greece with clear majority in parliament. Lowered corporate tax rate; approved Hercules (vehicle for banks to reduce non-performing assets. - see b).

5.) Sept/Oct: ICICI Lombard sales: of remaining 10% position for proceeds of US $729 million; recorded a net gain on investments of $240 million in 2019 (there was more in previous years).

6.) December: OMERS paid US$560 million for 40% of Riverstone UK, which gives it a total value of $1.4 billion. Will increase BV by $10/share.

7.) Fairfax India: book value is up significantly in 2019 (+$3/share). BIAL looks like a jewel of an investment that will grow double digits for years to come.

a.) Dec 16: Bangalore International Airport (BIAL): Fairfax India to sell an 11.5% interest in Anchorage Infrastructure (holds airport investments) for gross proceeds of 9.5 billion Indian rupees ($134-million at current exchange rates). Fairfax India’s ownership of BIAL will fall from 54% to 49%. As a result of the transaction, Fairfax India will record investment gains of approximately $506 million, an increase in book value per share of $3.30 per share. The investment gains are supported by positive operational developments at BIAL. For the 12-month period ending October 2019, total traffic at BIAL was approximately 33.7 million passengers. The second runway commenced operations in December 2019. The expansion project for a second terminal at BIAL is expected to be completed in 2021.

b.) Dec 23: Sanmar Chemicals Group: completed its previously announced transaction with Fairfax India. During the period since announcing the transaction in the third quarter of 2018 through September 30, 2019, Fairfax India recorded investment gains from the Sanmar common shares and bonds of approximately $210 million and $100 million, respectively.

8.) November: Sale of APR Energy to Seaspan: moved an underperforming unit into a better situation; obtained Seaspan shares is return.

- APR Energy: US $300 mill / $11.10 per share = 27 million shares

- $14 (share price today) - $11.10 (cost) = $2.90 x 27 million shares = $78 million paper gain

Under-performers:

9.) Recipe. Shares fell from CAN $26.19 to about $19.50 = $180 million paper loss. Hard to see this turning any time soon. Restaurant stocks in Canada have been crushed this year. Most provinces are increasing minimum wages aggressively and will be doing so in the coming years as well, which is a severe negative for the hospitality industry. It appears all the home delivery options available are negatively impacting revenue. The good news is the assets are quality and have value; at $19.50 they look cheap.

10.) Blackberry: shares fell from US $11.17 to about $6.50 = $220 million paper loss (double if you include convertible shares they own). The purchase of Cylance has not resulted in the growth expected. Most recent quarter results were ok. If they can get the Cylance unit growing the shares will do very well. 2020 will be very interesting to watch.

11.) Resolute Forest Products: shares fell from US $7.93 to about $4 = $120 million loss of papar. Dec: purchased 3 sawmills in US South for $150 million; should new home construction in US pick up in 2020 this could become a solid aquisition for RFP.

Not sure what to think

12.) AGT take private

More work needed (by me to understand the businesses):

13.) Indian Investment: Quess, Thomas Cook, IIFL Finance - Securities - Wealth

- there was a lot of noise with these investments in 2019. Thomas Cook demerged its Quest stake and IIFL split into 3. This made it difficult to follow. The good news is these 5 firms are now independent with easy to understand share structures; we know how much Fairfax owns of each. And it will be much easier to monitor and understand what is happening moving forward.

Quess: Amazon investment suggests Quess is undervalued. Quess also looks like a real jewel of an investment set to grow at double digits for many years to come.

a.) July Amazon invested US$ 7.43 million for a 0.51% stake in Quess ($ went to fund growth of Qdigit unit); they paid INR 676/share and market price at the time was INR 430 (they paid a 50% premium).

b.) December: Thomas Cook India demerged their 50% holding in Quess Corp in order to simplify the corporate structure.

—————

@bluedevil on Dec 29, 2019, highlighted an big miss on my part…

One other item I would add to the list is the progress at Digit Insurance. A recent start-up, but quickly becoming material.

Digit is the fastest growing general insurer in India, and will write 250m-280m in premiums this year.

According to this press report, Digit is currently looking to raise capital from domestic PE firms at a valuation between $800-900m. According to the report, Fairfax has invested about $140m since 2017 in Digit, and I believe they own about half of it. So a significant appreciation in Fairfax's investment already.

-

Each year i like to do a ‘Top 10’ for Fairfax. What do i think are the top 10 events driving shareholder value for the past year? I list the items in rank order of importance. I find it is useful at the end of each year to sit back and reflect on the year. This exercise is especially useful looking back a couple of years. Ultimately, it is the cumulative effect over many years that really matters to shareholders.

Before sending out the list for 2022, i thought it would be fun to re-post the unedited prior year ‘Top 10’ lists. So over the next few minutes i will dig out and re-post the past few years. And over the next day or two i will also post my 2022 list. I look forward to everyone’s comments.

-

5 hours ago, Crip1 said:

Though others disagree with this, I still see the price/BV metric being the best way to value FFH. Buffet said years ago that intrinsic value of BRK roughly follows book value over time and it seems to fit with FFH as well. The good news is that intrinsic value has been growing in a few areas which are not reflected in Book Value, the pet insurance business and Digit being prime examples. The P/E graph suggests that FFH would be worth 2-3x what it is currently selling for assuming a reversion to a P/E of 20, and I don’t think that’s accurate. I do think that it’s worth a 25% premium to BV, which is about 20% higher than it is right now, more or less. Furthermore, as has been pointed out multiple times on this board, there are several catalysts for further improvement in BV so, yeah, I’m holding it.

-Crip

@Crip1 I agree that BV is generally a pretty good way to value insurance companies. But I think there has been so much happening at Fairfax over the past decade that today BV is not a very good way to value the future earnings power of Fairfax. I continue to think that Fairfax should be able to earn US$100/share (after tax and minority interest) in 2023 and 2024 = 6PE (with shares trading around US$600) and that is wicked cheap.

----------

Does anyone seriously think Fairfax has grown intrinsic value (as measured by BV) by a total of US$218/share = 58% over the past 13 years? Fairfax of 2009 is nothing like Fairfax of 2022.

2009 Sept 30, 2022 Increase

Book value/share US$370 US$588 $218 +58%

Over the past 13 years (from 2009 to 2022) Fairfax has increased net premiums written by 414%. It has also increased investments by 140%.

2009 2022

Net premiums written $4.3B $22.1B (9 mo ann) +414%

Investments $21.2B $51B (Q3) +140%

Net debt $1.1B $7B (my est) +540%

Share count 20M 23.4M +17%

Fairfax's earnings power has increased significantly from 2009 to 2022. Much more than the 58% increase in BV. Yes, the increase in debt has helped. As has the increase in share count.

underwriting investments total shares outstanding

2009 $215M $1.3M = $1.515 billion / 20M = $76/share

2022 Est $1,105M $3,060M = $4.165 billion / 23.4M = $178/share = +134%

Underwriting = 95%CR

Investments = 6% total return (interest & dividends + realized and unrealized gains)

-

I wondered why Resolute shares were up 5% today. Great news. The sooner Fairfax gets the cash from this deal the better. With stocks aggressively selling off again there are lots of other great opportunities for Fairfax to redeploy the proceeds into other solid equity opportunities that should compound nicely for shareholders in the coming years.

-

1 hour ago, glider3834 said:

fun fact - the new 'Glass Onion' release in Netflix was filmed at Amanzoe resort owned by Grivalia

https://www.aman.com/resorts/amanzoe/accommodation/villas/villa-20

Rooms starting from 1,500 euro per night… pretty spectacular place. Definitely a trophy property. It would be interesting to understand the economics of catering to the ultra-rich. -

Happy holidays to all board members. Sanjeev, thank you for starting this board 20? years ago. The insight and advice received over the years has been life changing for me and my family. This board really has been the gift that keeps on giving. Thanks also to all board members for sharing their thoughts, perspectives and knowledge. Thanks also to those who posted in the past… i especially remember bsilly for helping get us through the especially dark days (back in 2003 when Fairfax traded under C$100)… All the best in 2023! Crazy that another year is almost over.

-

1

1

-

-

Michael Pettis is one of my favourite China watchers. He has a great perspective of how China has developed the past 40 years and where it is at today. Bottom line, they might be where Japan was in the late 1980’s - in a heap of trouble.

China’s fundamental problem is the institutions that drove its growth the past 40 years need to change. And doing so is exceptionally hard to pull off. Local government and a property bubble bigger than the one Japan experienced. This is not to say China will not muddle their way through it. Pettis’ comments are pretty wonky… so you have been warned.

—————

Lead-Lag Live: the China shock is coming with Micheal Pettishttps://www.youtube.com/live/mX8vyRXHCP8?feature=share

-

19 minutes ago, Sweet said:

There has been a bullish story in oi all year but it’s been a year of up first half and down second half.

Perma bulls saying throughout the year, wait until the SPR is done, when China comes back, when Russian price cap comes into force etc… oil didn’t care.

The key here for investors is still US shale discipline. They can’t be growing production more than global consumption growth. If they stay disciplined oil prices will sit at a level where energy equity investors should make some money. Shale is not the marginal barrel.

@Sweet i subscribe to @SharperDingaan’s strategy of renting, not owning, oil. The volatility of oil in 2022 has been pretty wicked. I buy on weakness and sell on strength. If we get a nice 10% pop from current levels i will be happy to sell. And i also really like the long term set up for oil so i also do not mind simply holding. Meanwhile, i get paid 5% while i wait. This is my 4th time owning oil this year. Rinse and repeat. After Fairfax, oil has been my second best performer. And i expect this to continue into 2023. It also helps that my oil is in tax free accounts (TFSA, RRSP, LIRA, RESP - Canadians really do have a wonderful suite of vehicles that can grow significantly in size with 20-30 years of tax free compounding). -

Oil/energy: what a delicious set up for investors. Tight markets. Major producers, Russia and Saudi Arabia, want higher prices. US needing to re-fill SPR. China reopening.

Oil stocks look to be the gift that keeps on giving for investors in 2023.

—————Oil Prices Jump After Russia Says It May Cut Production

After two weeks of silence in detailing how it would react to the G7 oil price cap, overnight the Kremlin raised the stakes for the west when state-run Tass news service quoted Deputy Prime Minister Alexander Novak as saying that Russia may reduce output by 500,000 to 700,000 barrels a day in response to the cap.

Fairfax 2023

in Fairfax Financial

Posted · Edited by Viking

Below is an update of my net earnings estimates for Fairfax for full year 2022 and 2023.

My guess is Fairfax will finish full-year 2022 with net earnings of about US$35/share. To Sept 30, 2022, Fairfax had a net loss of $35/share so my guess is they will earn about US$70/share in Q4. The closing of the pet insurance deal will be the big driver. We should also see solid results from underwriting, interest and dividend income, share of profit of associates and investment gains (driven by equities).

My guess is Fairfax can earn a ‘normalized’ US$100/share in 2023. This is not an aggressive number. My estimate assumes:

1.) underwriting achieves a 95 combined ratio

2.) the fixed income portfolio delivers an average yield of 3.7%

3.) share of profits of associates delivers similar results to 2022

4.) investment gains rebound modestly from 2022 levels

The 2 big wild cards for 2023 are:

1.) level of catastrophes

2.) financial market volatility (stocks and bonds)

Fairfax’s stock is trading today at about US$600. If Fairfax earns $100/share in 2023 that would put the forward PE multiple at 6 times earnings. Crazy cheap. Fairfax stock is like a coiled spring.

Notes:

—————

Below are more detailed updates to the first three buckets:

1.) underwriting profit

2.) interest and dividend income

3.) share of profit of associates