Viking

-

Posts

4,694 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

19 minutes ago, changegonnacome said:

I think the thing that they cant believe and either can I is that in a full employment/output economy with sleepy productivity growth perhaps sub-1% (BLS data out tomorrow on productivity) that wage increases annualized in the 4%+ range would NOT result in over 2% inflation.....math would say you land or get stuck at least 3-4%+ for 2023.....and its only a softening of labor market conditions out into 2024 that temper wage growth enough.

Chart below IMO is the key - you just don't get stable prices on domestically produced goods and services writing yourself these types of wages increases in a highly developed low productivity growth economy.

The problem is 8% inflation. That causes all sorts of economic and societal problems. 3% inflation is needed… over many years that solves our too much debt problem. The pivot today signals the Fed is OK with some inflation… They also don’t want to return to disinflation and potential deflation.

Bottom line, great place to be for stock investors. Bond investors are also going to make out like bandits as rates across the curve normalize (fall). Volatility. Active management. Are we back to normal financial markets for the first time in a long time?

-

33 minutes ago, Spekulatius said:

Regardless of what Powel is saying, they still raised Rates by 0.25% and they pretty much said, they will raise rates again at the next meeting in March. This still does not sound that great to me.

The two keys are labour market and services inflation (labour). IF we get a weak labour report the Fed is likely done. Regardless, if the current trends continue, the Fed is done after the next increase in March. The important point is the Fed is largely done with rate increases. The economy needs certainty. People/businesses can then plan and get on with their lives. We now have certainty (give or take a month or so… close enough).

Housing stocks (builders and lumber producers) are popping. Metal stocks are popping. Much of the economy has been slowly digesting higher interest rates. And they now know they are peaking on the short end of the curve. The 2 year treasury could be in the low 3% range later this year. Lower rates are a big deal… and further out on the curve they are already down big.

The chances that the Fed will get a soft landing just went way up today. Pretty good set up for risk assets. And my guess is most people continue to be under-invested (in stocks). So people got hammered last year and likely sold down their stock positions in December (that stop the pain thing). And they are waiting for markets to crash again so they can get back in. Perhaps stocks slowly keep going higher from here (climbing that wall of worry). Fear will be replaced by FOMO. Sell low and buy high… ouch! Making money in stocks is a pretty tough thing!

—————-

All the fear mongers / Fed haters are screwed. The world (probably) isn’t going to end.

-

Well… sounds to me like the Fed is close to a pivot. Regardless, they are no longer hawks. Stock market ripping? Not a problem. Falling bond yields (further out on the curve)? Not a problem. Weakening US$? Not a problem.

Any crack in the labour market and the Fed is done. Rate cuts later this year?Today, the Fed moved to where the bond market currently is. Super interesting. Sounds like risk on to me.

-

At the end of the day, people need to find an investment strategy that works for them. Their intellect, their emotional make-up and their life situation. Not that complicated (in theory

If following macro (just one of many examples) doesn’t help you then don’t do it. But if it doesn’t work for you, does that mean it doesn’t work for other people? Other people shouldn’t use it because it doesn’t work for you? Or you don’t understand it so they are stupid for using it?

When it comes to investing my view is there is no ‘one way’ that works for everyone. That is what makes the game so interesting and fun. Be inquisitive. And open minded (to quote that dummy Druckenmiller).

—————

Please note, the picture below is NOT directed at older board members… rather it is directed at the mind set…

-

4 hours ago, nwoodman said:

For the moment

. Eurobank is on a tear, +17% for the month or looking at it another way, +$400m to FFH.

. Eurobank is on a tear, +17% for the month or looking at it another way, +$400m to FFH.

Fitch recently upgraded them saying

"The upgrades reflect the structural improvements to Eurobank's profitability as a result of its successful de-risking and restructuring, supported by rising interest rates and economic growth in Greece. Buffers over regulatory capital requirement have strengthened and we expect internal capital generation to continue supporting metrics. The upgrade also reflects that Eurobank's funding stability and diversification have improved following consistent deposit growth and recent wholesale debt issuances. The expected resilience of the Greek economy in 2023, even in light of prevailing uncertainty, further underpin the upgrade."

Fitch Upgrades Eurobank to 'BB-'; Outlook Stable (fitchratings.com)

@nwoodman Yes, Eurobank certainly has been on the move. They were dealt a pretty shitty hand for many years... The management team there certainly has been executing well for years. The bank sure looks well positioned. If the Atlas go-private is rejected (and the stock sells off) then Eurobank could well pass Atlas and become Fairfax's largest equity holding. The FFH total return swaps have also been spiking higher the past 4 months. Those three holdings are much larger than any other single equities that Fairfax owns.

US$ Market Value of FFH stake

Jan 31 change from Dec 31, 2022

1.) Atlas $1.94 billion -$69

2.) Eurobank $1.57 billion +$264

3.) FFH TRS $1.31 billion +$141

Of interest, these three positions represent about 30% of Fairfax's total equity exposure. And about 9.5% of Fairfax's total investment portfolio.

----------

Another tailwind for Fairfax is currency (US$ weakness). Fairfax has significant international holdings.

-

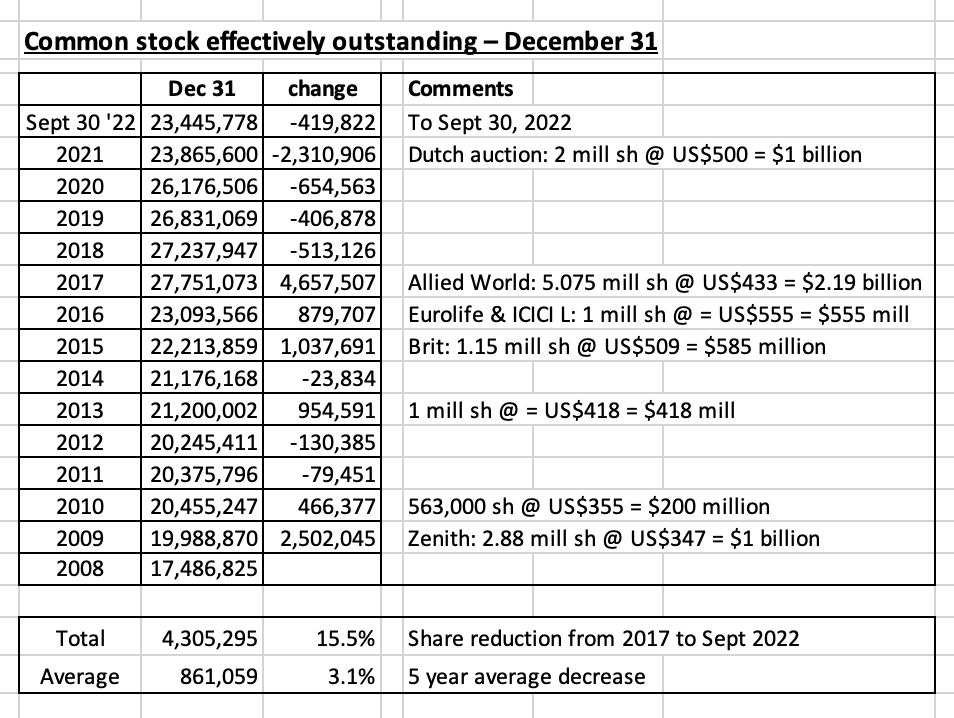

Share buybacks, done in a responsible manner (purchased at attractive prices) and sustained over many years, can be very beneficial for shareholders.

Fairfax’s 'common stock effectively outstanding' peaked in 2017 at 27.75 million shares. At September 30, 2022, share count had fallen to 23.45 million shares. Over the last 5 years, Fairfax has reduced its share count by approximately 4.3 million shares or 15.5% = 3.1% per year (or 860,000 shares per year). See table at the bottom of this post for details.

The big share repurchase came in December 2021, when Fairfax executed a substantial issuer bid and purchased 2 million shares at US$500/share at a total cost of $1 billion. With Fairfax shares trading at US$670 today, this repurchase is already looking like a great decision for shareholders.

Fairfax has been doing a solid job on the buyback front the past 5 years: share count has come down nicely and shares have been repurchased at attractive prices.

What could we see in 2023? The good news is Fairfax’s free cash flow should be very high in 2023, driven by record underwriting income, record interest and dividend income and solid realized investment gains. The bad news is Fairfax’s share price is trading today at new all time highs (US$670) so Fairfax will have to ‘pay up’ a little.

It looks pretty likely that we should see Fairfax continue to buy back stock in 2023. My guess is a repurchase of 2% of shares outstanding is a pretty safe minimum amount (470,000 shares @ $670/share = cost of $315 million). A much larger repurchase is also very possible. Much will depend on how cheap Fairfax feels their shares are. My guess is Fairfax feels US$670 is dirt cheap. So it would not surprise me to see Fairfax execute another large buyback while shares are still cheap. Perhaps something in the range of 1 million shares (cost @ $670 million at todays share price). They could easily do this as part of their approved NCIB.

Much will depend on opportunity cost: Fairfax has lots of good options of what to do with their growing free cash flow:

1.) we are still in a hard market: supporting growth at insurance subs will likely be the top priority

2.) we are in a bear market for equities: lots of companies are cheap

3.) continue to buy out minority shareholders (Allied, Odyssey, Brit): while not technically a buyback, taking out minority shareholders does increase the amount of earnings that flows to Fairfax shareholders. Some on this board have likened this activity to a stock buyback.

We will know much more when Fairfax reports Q4 results. It will be interesting to see what they have been up to on the capital allocation front. And to learn how they are thinking as we begin 2023.

—————

Below is Prem’s quote from 2018 that suggests Fairfax will continue to be aggressive with share buybacks in the coming years. It is interesting that Prem discusses share buybacks and buying out minority partners in the same paragraph (viewed as being similar activities?).

2018AR Prem’s letter to shareholders: “I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years. We began that process by buying back 1.1 million shares since we began in the fourth quarter of 2017 up until early 2019 – about half for cancellation and half for various long term incentive plans we have across our company. This was after we increased our ownership of Brit to 89% from 73% while having the funds ready to increase our ownership of Eurolife from 50% to 80% in August 2019.”

—————

Fairfax’s total return swaps on 1.96 million Fairfax shares: some on this board consider this investment to represent a buyback of sorts. Here is an update on this holding. It is turning into one of Fairfax’s best investments ever.

Cost at Inception = $733 million ($372.96) - initiated late ‘20 & early ‘21

Value Sept 30, 2022 = $913 million ($464.80 share price)

Value Dec 31, 2022 = $1.167 billion ($594.12 share price)

Value Jan 31, 2023 = $1.305 billion ($665.74 share price)

Increase in value of position from inception = $574 million = + 79% over 26 month holding period (not including any costs to maintain TRS position).

From Q3 2022 Report: Long equity total return swaps

During the first nine months of 2022 the company entered into $217.4 notional amount of long equity total return swaps for investment purposes. At September 30, 2022 the company held long equity total return swaps on individual equities for investment purposes with an original notional amount of $1,012.6 (December 31, 2021 - $866.2), which included long equity total return swaps on 1,964,155 Fairfax subordinate voting shares with an original notional amount of $732.5 (Cdn$935.0) or approximately $372.96 (Cdn $476.03) per share that produced net losses of $82.3 and net gains of $7.1 during the third quarter and first nine months of 2022 (2021 - net losses of $50.4 and net gains of $51.1).

—————

-

7 hours ago, SafetyinNumbers said:

BMO upgrades to outperform C$1050 price target.

What we are seeing is more analysts looking out the front windshield. Analysts have no choice… regardless of what they think of Fairfax as a company, they have to update their models. Lots of good things were happening under the hood at Fairfax in 2022 but they were masked by market to market losses, mostly in their bond portfolio (equities as well). Now that the losses in the bond portfolio are over (and likely reversing) we will see the earnings power of the company shine through. Who knew???The BMO note also illustrates beautifully ALL ANALYSTS CARE ABOUT: ‘operating earnings’. They hate ‘investment gains’ - likely because of their volatility quarter to quarter.

Analysts are awakening to the fact that operating earnings at Fairfax are exploding and the higher amounts are sustainable. Underwriting income and interest and dividend income are no brainers. I was pleased to see BMO also giving Fairfax credit for ‘share of profit of associates’. I wasn’t sure how analysts would treat that line item.

My guess is Fairfax could deliver about $3.5 billion in ‘operating earnings’ in 2023 = about $150/share (underwriting profit + interest & dividend income + share of profit of associates). If analysts include share of profit of associates in their estimate of operating earnings (the ‘predictable’ items) then we could be off to the races in terms of upgrades/investor interest. Analysts use operating earnings as their ‘north star’ to value P&C insurance companies.

Bottom line, analysts are finally getting their analysis of Fairfax correct when it comes to underwriting income, interest and dividend income and share of profit of associates. But where are analysts still messing up? Investment gains.

BMO clearly has no idea how to model investment gains. So they assume they mostly do not exist. That is easy. And safe. But way underestimates what Fairfax will likely deliver.

BMO is estimating Fairfax will deliver an average of US$280 million per year in investment gains in 2023 and 2024. The Ambridge sale already announced should deliver a big gain in 2023 (we should know more when Fairfax reports Q4 results). We also know a $100 move in FFH share price = US$200 million in gains (thank you TRS). Fairfax has a large mark-to-market equity portfolio. They likely will monetize more assets over the next 2 years (for sizeable gains). The $280 million estimate looks comically low to me… but we will see.

The good news is only very modest ‘investment gains’ are built into BMO’s updated estimates. So future investment gains should provide further upside to BMO’s estimates.

The bottom line is Fairfax has two engines of growth: insurance AND investments. And both engines are performing exceptionally well right now. Nice to see analysts starting to figure out at least one engine.

-

The price of oil is driven by demand and supply factors. On the supply side, it appears US SPR releases have effectively ended. That is a significant amount of oil supply that will need to come from somewhere else moving forward.

And of course, if the US hopes to re-fill the SPR (the goal eventually), that will become a significant new source of demand for oil.

Good thing we are not getting any large increases to demand in the coming months (something like China reopening). Oh, wait…

Bottom line, a tight oil market is getting tighter.

-

Atlas is Fairfax's largest equity holding. It appears Fairfax has exercised the remaining 6 million warrants it held in Atlas around Jan 12 (see note 2 below). After exercise, my math says Fairfax holds 130.9 million shares (excluding those held directly by Prem and the charity controlled by Fairfax) = 45.8% of total shares outstanding (287.565 million - including 6 million FFH warrants). The value of Fairfax's holding in Atlas = $2.0 billion.

-

6 hours ago, gfp said:

It's funny, for me today was the day the dividend actually cleared the accounts. If you were inclined to reinvest the dividend at least there was a dip. The "Viking" dip!

Looks to me like Mr Market likely did not like WRB’s outlook for the hard market. A few insurers traded lower today. Chubb’s commentary when they report after market on Tuesday should provide more good insight.—————

As others have pointed out, if we get clear signs the hard market is ending we will likely get multiple contraction across all P&C insurance stocks. Something to monitor.

—————

WRB - 2.94%TRV - 1.74%

CB. - 1.64%

FFH. - 2.61%

-

36 minutes ago, jfan said:

However if the following happens, I would trim or sell out:

1) more insurance company purchases with FFH shares

2) large macro bets

3) position sizing hard on too many turnarounds or deep value plays with too many macro externalities

I agree. If Fairfax wants to attract new long term shareholders they need to be very careful not to pick old scabs. My watch out is arrogance. Do they have some success with Mr Market in 2023 (shares rip higher), get cocky and then mess up with a big purchase/macro bet/empire building. Not my base case... but definitely something to monitor.

-

Lots of great information on the current state of the P&C insurance market from WR Berkley's release today (with a listen if you have time). WRB posted great Q4 results. But I wonder if the decelerating top line growth spooks markets tomorrow.

Of note, Fairfax has an average yield of 1.6 years on their fixed income portfolio at the end of Q3, the shortest by far of any P&C insurer. WRB is next, with a duration of 2.6 years. WRB saw the yield on their fixed income portfolio increase from 3% in Q3 to 3.6% in Q4. We know the yield on Fairfax's fixed income portfolio increased in Q4... perhaps the increase in WRB's yield of 0.6% gives us a clue.

----------

1.) top line growth: net premiums written: growth slowed to 6.6% in Q4 compared to 13% for the full year.

Elyse Greenspan: And then you made a lot of good market commentary on different business lines. You've in the past spoken about, right, 15-plus premium growth, that's obviously come down reflective, right, of some of the trends in the comp and in liability lines. How do you think when you put everything together, and I know that's hard, where do you think the top line growth could trend over the coming year?

Robert Berkley: As far as your question about growth, we'll have to see how it unfolds. I would tell you that based on the limited data I have on January so far, early returns are encouraging. But my ability to speak at a detailed level beyond that, I just wouldn't want to mislead you. But we see a lot of opportunity, and we're watching the opportunity shift from over time from one product line to another. So I think we have good balance to the shift, but we also are very nimble amongst the different parts of the business.

----------

Rob Berkley: As far as rate goes, as you would have seen from the release we got just shy of 7 points of rate and we think that that comfortably helps us keep up with trend and more likely than not perhaps we are exceeding trend.

----------

Rob Berkley: Another comment that I did want to make is on renewal retention ratio. Obviously, different product lines, different parts of the business, we target different levels of renewal retention. When we look at our portfolio overall, we look through the renewal retention to sort of float somewhere between 77 and 80, maybe 81 depending on the mix.

When we see that renewal retention ratio ticking up above that, from our perspective, it is an invitation to be pushing rate harder. We want to be in the market at a granular level, testing it every day to be getting as much rate as we can to ensure that we are at a minimum at rate adequacy. That's a very important thing that is a priority for us as an organization.

2.) investment income

Richard Biao EVP & CFO: Our book yield on the fixed maturity portfolio increased from 3% for the third quarter to 3.6% for the fourth quarter, which compares very favorably to 2.2% in the year ago quarter. Our new money rate exceeds the roll-off of our invested assets and we expect net investment income to continue to grow. The investment funds performed well, with a book yield of 5.6%, despite the deterioration in the broader equity markets in the third quarter. And as you may remember, we report investment funds on a one quarter lag.

The credit quality of the portfolio remains very strong at a double A minus with the duration on our fixed maturity portfolio, including cash and cash equivalents of 2.4 years.

----------

The unrealized loss position on fixed maturity securities improved in the quarter.

----------

Rob Berkley: And I think as Rich flagged and I will flag again, the new money rate these days is north of 4.5%, we're flirting with 5%. So I will leave it to others to fill in the blanks as to what this means for our economic model. But obviously, when you think about the spread between the book yield and the new money rate and what we're able to achieve and you extrapolate that for what it means for our economic model, I think it is very encouraging.

One last quick comment on the investment front. While we are not in a rush and we are going to do it in a very thoughtful way, we certainly are considering beginning to push that duration out towards to 2.6, maybe more towards 2.8 over time. But again, we are not in a rush. We're going to do that in an opportunistic way as windows open and close.

-

59 minutes ago, Spekulatius said:

CVX dilutes shareholders when shares are cheap and buys back shares when they are expensive. This is the way.

I think CVX has been better than most on this front. A quick google search says CVX had 2.001 billion shares in 2011 and the current share count is 1.93 billion. Clearly, their business has increased significantly since 2011. -

I wonder how Buffett feels about Chevron’s $75 billion buyback announcement? BRK probably bought more shares. Regardless, BRK shareholders will see their ownership in Chevron increase materially in the coming years. Buffett will be going to sleep tonight with a big smile on his face.

-

Well it appears this time it is different. Oil companies have been told for years by the government, environmentalists, institutional investors, banks, insurance companies etc… that they are evil and that they are no longer wanted or needed by society. Climate change is real and oil is the problem. Tell people/companies the same thing over and over… and they just might start to believe you…

So in such an environment, what is an oil company to do? Governments hate you. Banks can’t lend to you. Institutional investors don’t want your equity. Insurance companies don’t want to do business with you. Young people don’t want to work for you.

Chevron provided an answer today. You put yourself in run-off. You make as much money as you can and you return it to shareholders as fast as you can. Chevron just announced a historically large $75 billion stock buyback. Chevron’s market cap is $360 billion. The buyback is for +20% of its market cap.

What surprises me is the audacity of Chevron’s move. Their management team is smart. They have to understand announcing this is going to cause their many haters to freak out. So what’s up? It looks to me like Chevron’s management team is reading the writing on the wall. They are listening to their haters. And deciding the appropriate thing to do is to return cash to shareholders. Lots of it. And quickly.

All oil stocks screamed higher today on the news. Investors are (ever so slowly) beginning to understand a few things:

1.) ‘drill baby drill’ is dead

2.) ‘high prices are the solution for high prices’ is dead

Energy markets have entered a new paradigm - one driven by ESG and climate change and government policy that is driven by fantasy. Chevron announced today that rational, well managed energy companies (and Chevron is one of the best) will return large amounts of cash to shareholders. Expect more announcements from other oil companies like the one we got from Chevron today.

Oil companies will no longer be known for gushing oil… rather, they will be known in the coming years for gushing cash and returning it to shareholders.

—————

Capex is increasing but it is not spiking higher (the increases we are seeing is largely driven by inflation). That means oil supply growth will remain muted. That means prices will remain high.

Because we know world oil demand will continue to grow every year by 1-2 million barrels per year moving forward.

And that is a delicious set up for a forward looking investor (its dinner time where i live).

—————

- https://finance.yahoo.com/news/chevron-buyback-boosts-stock-rebuke-180906354.html

-

WR Berkley just reported an exceptional quarter. Will be interesting to hear their commentary on the current state of the hard market on the conference call at 2pm.

Fourth quarter highlights included:

- Return on equity of 23.0%.

- Book value per share grew 8.1%, before dividends and share repurchases.

- Net investment income grew 40.2% to a record $231.3 million.

- Record quarterly pre-tax underwriting income of $291.9 million.

- The current accident year combined ratio before catastrophe losses of 1.2 loss ratio points was 87.2%.

- The reported combined ratio was 88.4%, including catastrophe losses of $30.8 million.

- Average rate increases excluding workers' compensation were approximately 6.9%.

-

Well i lightened up on my Fairfax position today. Why?

1.) i was way, way overweight. Especially given the recent run-up. My strategy with Fairfax is to have a core position i hold as long as the story remains intact (the Fairfax story is actually getting better). I trade around that core holding - buy more when the stock sells of (like last Sept/Oct) and lighten up when the stock pops (like now). This strategy has worked exceptionally well since Fairfax hit its pandemic lows in Oct 2020.

2.) tax reasons. My wife and i do not have day jobs. Selling Fairfax in our taxable accounts realizes some pretty big capital gains (we were up 35% on those positions) that we will pay minimal tax on (given it will be our only income for the year). In Canada capital gains receive very favourable tax treatment.

Fairfax remains a little over 30% of my total portfolio - so i am still way overweight. Oil is about 30% (mostly SU). Cash is up to 35%. Misc is 5% (US financials and Fairfax India). I recently sold my big tech and dividend stocks for 6-8% gains (over 6 weeks). My total portfolio is up about 8% to start the year so i am happy to lock in gains and raise some cash (that will earn +3%) while i wait for the next fat pitch.

-

2 hours ago, Xerxes said:

Folks, I hate to break it to you, but Fairfax's performance in 2023 probably has a lot to do with how S&P500 performs in 2023.

A 15-20% (Grantham style) drop on S&P500 by year-end, would probably have Fairfax rally to a healthy premuim to BV.

A major bounce back at the indices level, would probably be a flat/modest gain for Fairfax.

So what is your bet on S&P500 for 2023 ....

@Xerxes i am not following your logic… -

1 hour ago, StubbleJumper said:

Not dirt cheap. Maybe BV will be more or less US$700 on Dec 31, 2023? So, choose your likely multiple of book that the stock will trade at: 0.8x, 0.9x, 1x, 1.1x, 1.2x? As you noted, currently it's trading roughly at 1x, and if it continues to do so, then we'd be looking at an end-year price of roughly US$700, which is 10% from where we currently sit. If we get lucky and have some multiple expansion, maybe we'll see it trade at 1.1x, which would be ~20% from where we currently sit? Those are good, healthy double-digit returns, AND they are not just plausible but rather probable. But, dirt cheap? Not quite.

The interesting thing that nobody really addressed was @gfp's post from last week noting that Bradstreet has been buying preferreds, particularly the F and H series. Now, for the record, Bradstreet's forgotten more about investing than I'll ever know. He surely can see the same things that we can see, and probably more because he's an insider. Instead of doing the "obvious" and piling into the common shares, he's bought the floating preferreds. Curious, that.

As you noted, it's a bizarre set up. But, let's try not to get ahead of ourselves.

SJ

@StubbleJumper, i agree it is important to keep a level head. Point taken.i think the challenge when trying to value Fairfax is the numbers from the past 3 years really don’t help us much when trying to determine what an appropriate price for the stock should be today. So we are kind of in uncharted territory. I will not be surprised if the stock continues to move higher. I also will not be surprised if the stock goes back to US$500. This will make it difficult for current shareholders who are not in the stock for the long term (or who are way overweight like me).

—————

My guess is BV Dec 31, 2022 will come in at about $635-$640/share. Pet insurance will deliver $40/share after tax all by itself. Another $30/share seems reasonable for underwriting profit, interest and div income, share of profit of associates and investment gains (market to market equities were up +$300 million in Q4). So looks to me like stock is currently trading at about 1xBV.

My guess is Fairfax will earn about $105/share in 2023. That would put BV at $740 Dec 31, 2023. My $105 is already looking low. Why?

1.) Ambridge was sold for $400 million and will likely involved a sizable gain ($10/share after tax?).

2.) Equity markets are starting the year strong (

- example: 1.95 million Fairfax shares x $150/share gain over 2023 = $300 million pre-tax gain).

- example: earnings at Eurobank are really starting to move. The stock is popping (i realize it is not mark to market). Perhaps they are allowed to start a dividend in 2023.

3.) Bond yields have really come down a little further out on the curve (3 years and further out) so we likely will see decent gains on the bond portfolio in 2023.

4.) Fairfax has been supporting/cultivating a large number of private holdings that it could chose to monetize: Exco, AGT, Bauer, etc. it has a large number of ‘hidden’ assets. My guess is we get a couple of more monetizations in 2023.

5.) Digit IPO: this will be a big deal when it happens. We know Digit has the approvals. We just don’t know the timing. Lots of buzz about India right now…6.) share buybacks: do they go big again? I think its pretty safe to assume share count is coming down minimum of 2% but it could easily be higher.

So based on what i know today, i think Fairfax should earn about $105/share in 2023. That is my conservative number. If a few of the things i note above happen, earnings will likely be higher. If we get the Digit IPO, earnings could easily be much higher (+$130/share).

—————

Earnings are very important. Equally important for an undervalued stock like Fairfax is what happens to the multiple. Why is 1x BV the appropriate number? That is comically low for a company like Fairfax - as it exists today. Fairfax should be able to deliver ROE of over 15% for at least the next few years. Does a 1.3 or even a 1.4 multiple not make sense? Over time Mr Market does get valuation right.

If BV is US$635 (at Dec 31) x multiple of 1.3 = $825/share. If Fairfax earns $105/share in 2023, it the stock was trading at $825 = forward PE of 8x. Hardly expensive.

So to me, the stock today trading at $640 looks crazy cheap. When will Mr Market agree with me? No idea. But it does look to me like the Fairfax pendulum is slowly swinging from fear to neutral. If Fairfax can deliver the good in 2023 and 2024 (like they have the last couple of years) i think there is a good chance the pendulum swings to greed - and we see the multiple go to the higher end of the band.

-

Sanjeev, can you please add the rocket emoji to the toolbar?

Fairfax closed today at $640. $10 dividend is being deposited tomorrow (=$650)

Stock was trading at $450 in early October = 45% return in 3 months. Time to sell? Stock is trading at 1x BV. And about 6x 2023 earnings. That hardly looks expensive. It actually looks dirt cheap. What a bizarre set up.

-

The property cat market and reinsurance is something to watch moving forward. Fairfax has a significant reinsurance business so it will be interesting to learn what sort of rate increases they have been getting.

—————Here is what Brown and Brown Insurance had to say on their Q4 call this morning:

“From an insurance standpoint, certain markets have been and remain in significant turmoil. Pricing for CAT property both commercial and residential was under pressure through the third quarter. Then Ian slammed into Florida. This caused 1/1 reinsurance treaties to be bound at higher attachment points and materially higher rates. As a result, we saw incremental price increases and lower limits being offered for placements in late Q4 of last year and early this year.

The placement of CAT property in Q4 last year and January of this year with some of the most difficult placements we've experienced in decades with rates increasing 20% to 40% or more. However, properties of lesser construction quality or that have experienced losses could be much higher and I mean much higher than this range.

As a result, we had customers unable to buy or afford full limits and therefore ended up increasing their deductibles or purchasing loss limit in order to manage our cost of insurance. In certain cases, this was not possible as lending institutions or condo associations would not allow lower limits or significantly higher deductibles. Admitted market rate increases were similar to prior quarters and were up 3% to 7% across most lines with the outlier being workers' compensation rates which remained down 1% to 3%.The placement of professional liability and excess liability remain competitive with rates down 5% to up 5%, with public company D&O rates down 5% to down 20% or more. Regarding cyber, the story is similar to the last few quarters with rates and deductibles continuing to increase but we did see some slight moderation during the quarter.”

—————

Question: Greg Peters

…So, when I think about '23, …how will those variables -- like the June first renewals on property CAT…, how will that affect your organic results for this year -- this upcoming year?

Answer: Powell Brown

…As it relates to the CAT property pricing, the variable there, Greg, as you know is not as much our -- I mean, it is there are certain limitations on ability to present limits in some instances. But it's more of -- in my opinion, it's more of an affordability issue. And so, if you think about if you've been giving rate increases, let's just say to yourself on your own personal lines homeowners, if you've got an increase of let's say 10% a year for four or five years in a row and then all of a sudden we came on the fifth year and gave you a 25% increase, there is a -- the buyers are tiring of that.

And so, having said that, availability of capacity in this market is unlike anything I've ever seen, I've only been in the insurance industry for 33 years now. So, there's a lot more to go, but I've not ever seen anything like this and we will continue to provide solutions to our customers. But sometimes the example I think we used last time and I would use it again is, if you have an entity, and they're paying $800,000 for their property and the renewal is a $1.8 million, and they say, what can we buy for $1 million, which can't buy anymore insurance, we can't afford it.

So, we're seeing that more and more, Greg. So, the CAT pricing that is going to -- is it more of a wildcard. The other thing that we're seeing is in the CAT capacity and accessing it in some instances, there is commission pressure downward on some of those placements now. So, a lot of people just think, well, as the rate goes up X, then you're going to -- your commission goes up X if you're on commission as opposed to a fee and that is true sometimes, but in this case, they might cut your commission one or two points, and so we're seeing that as well. So that's a harder one to answer, Greg.

-

38 minutes ago, Parsad said:

Viking, there is only one thing more amazing than Fairfax and their management. You! And the other great posters on FFH.

But clearly...YOU are the one that continues to provide exceptional detail day after day.

Are you going to the AGM this year?

Cheers!

Sanjeev, i am happy to throw my thoughts about Fairfax against the wall to see what sticks. Other posters add a great deal of value (most of which i steal for my next update). We are all slowly learning just how1.) undervalued Fairfax got back in 2020.

2.) well positioned the company is for the current environment (extended hard market, rising interest rates and outperformance of value/cyclical equites).

3.) well the management team at Fairfax is executing.

We are in that Peter Lynch stage today where the story is continually getting materially better. So even though the stock has been going up a lot it remains cheap.

—————Regarding attending the Fairfax AGM, yes, i plan on attending this year (no overlap with family vacation this year). I look forward to meeting other board members who are able to make it.

-

P&C insurance earnings started today with Travelers. Sounds like the hard market in insurance is continuing into 2023 with no signs of a slowdown. WR Berkley reports after close on Thursday; we should have a good handle on trends after they report.

What does this mean for Fairfax? We should see strong top line growth again in Q4 (20%?). And with an exceptionally hard market in reinsurance, perhaps Fairfax can deliver another year of 20% top line growth in 2023. If they can do this, that would put net written premiums at around $26.5 billion in 2023, which would be double what they were in 2019 ($13.3 billion). That would be amazing. The Fairfax story just keeps getting better…

—————Alan Schnitzer - Travelers Chairman and Chief Executive Officer on Q4 conference call:

“And let me spend just a second on the pricing environment because that seemed like it was part of your question, and I’ve seen a number of you write about it this morning. So I think it’s hard to characterize this pricing environment as anything other than very strong. At 10.1% that RPC is spot on an eight-quarter average. So incredibly stable and near record levels. Small movements between pure rate and exposure, but I would emphasize small movements between rate and exposure. The breadth of the pricing gains across our book is very strong and very consistent. I don’t think you can assess the pricing environment without looking at retention and given where that is literally record levels and given the profitability very strong. The pricing gains that we achieved were broad-based, led by property, auto, umbrella and CMP. And then you take all that against the margins that we printed and we just – we feel fantastic about the pricing and the overall execution this year. And again, we’re going to go out and do it again in ‘23. -

On 12/30/2022 at 10:43 PM, Viking said:

I have updated my equity spreadsheet for Fairfax to Dec 30. The equity portfolio that I track is up about $1 billion in Q4. Of the total, about $380 million is mark to market (about $17/share pre-tax).

Bottom line, Fairfax's equity portfolio has held up much better in the bear market of 2022 compared to what happened in the bear market of 2020.

Big movers:

1.) FFH TRS +$250 million

2.) Eurobank +$331 million

3.) Atlas +$181 million

4.) Fairfax India +$150 million

5.) Quess - $130 million

-----------

For board members who might not know... my spreadsheet attached below has a number of tabs you might find useful:

Tab 1: 2022 = where I track Fairfax's various equity holdings

Tab 2: Moves = various purchases Fairfax has made going back to 2010

Tab 3: 2022 Estimated Earnings = with history back to 2016

Tab 4: Premiums = net premiums written going back to 2014

- also includes losses from equity hedges and CPI positions (2010 to 2020)

Tab 5: Interest = interest and dividends going back to 2010

Tab 6: Associates = Associate holdings going back to 2017

Tab 8: Fairfax India holdings - my contain errors

Fairfax Equity Holdings Dec 30 2022.xlsx 218.84 kB · 28 downloads

I estimated Fairfax's equity portfolio increased about $1 billion in Q4. Of the total, about $380 million was mark to market (about $17/share pre-tax). My numbers are usually decent directional guides.

Given the hot start in equity markets in January, I thought it would be interesting to see how Fairfax's portfolio is doing YTD in Q1. My spreadsheet estimates Fairfax's portfolio is up about $640 million so far in Q1. About $225 million is mark to market ($10/share). Not too shabby.

Big movers:

1.) Eurobank +$212 million

2.) Fairfax India +$134

3.) Stelco +$75

4.) Blackberry +$47

5.) FFH TRS +$43

6.) Micron +$41

Is The Bottom Almost Here?

in General Discussion

Posted

This update from Morgan Stanley was an eye-opener for me. Their forecasts have been pretty good over the past year.

“Given these developments, we have revised lower our Treasury yield forecasts. We see the 10 year Treasury yield ending the year near 3%, and the 2 year yield ending the year near 3.25%. That would represent a fairly dramatic steepening of the Treasury yield curve in 2023.”

https://podcasts.apple.com/ca/podcast/thoughts-on-the-market/id1466686717?i=1000597464912