Viking

-

Posts

4,695 -

Joined

-

Last visited

-

Days Won

35

Content Type

Profiles

Forums

Events

Posts posted by Viking

-

-

7 hours ago, StubbleJumper said:

Valuations have expanded, but that doesn't mean that will be permanent or enduring. Price to book has oscillated in a very wide range over the life of FFH. There will be periods of gross over-valuation when it might trade at 1.4x and, as we've seen in the past couple of years, where are also periods when it trades at ridiculous multiples of 0.6x or 0.7x. But, as a baseline assumption, I'd say 0.9x to 1.1x is a reasonably likely range for the end year price.

Don't get me wrong here! I'd be happy to see 2023 earnings come in at $150/sh, and I'd be happy to see a 1.5x multiple, but I certainly don't count on either occurring. But, overall, if the stock price came in at 1.0x the conservative book estimate of US$693, that would be a good return for 2023.

SJ

I agree, using a 0.9-1.1 x BV multiple makes sense. Here some additional catalysts:

1.) buybacks and how aggressive Fairfax is moving forward. Fairfax could take out 150,000 shares a month = US$90 million. If they did this for an extended period the stock would likely pop and likely trade north of the 1.1 x BV range.2.) the investment community. Fairfax was a hated stock. As the investment community comes to understand the size, consistency and durability of future earnings, Fairfax could exit the penalty box and once again be viewed as an ok stock. This would push the multiple higher.

3.) real and growing earnings. In today's world near term cash type earnings are becoming more highly valued given their scarcity. Earnings at Fairfax will be primarily driven by underwriting profit and interest and dividend income, which is highly prized.

—————

With Fairfax today we have the perfect set up for a stock:

1.) cheap valuation

2.) much higher and growing earnings

3.) growing PE multiple

4.) meaningfully lower share count

We will see what actually happens in 2023.

-

1

1

-

-

SU, CNQ, TRP, GOOG, AMZN, PYPL, DIS. Continued to lighten up on FFH (now below a 30% position).

-

2 hours ago, allycat18 said:

Seasons greetings Viking I always admire and value your analysis. With buy backs where would you see the market price December 2023

@allycat18 welcome to the board. Obviously trying to predict a price on any stock 12 months out is pretty much impossible to do with any sort of certainty, especially given the current environment. Having said that, here is how i look at Fairfax. i break things into what Fairfax controls and what Fairfax doesn’t control.

What Fairfax’s controls: I think they will earn +$100/year on a normalized basis in 2023 (and 2024). The rub, of course, is ‘normalized’. Because we are not in a normal environment right now (middle of a bear market). We also have no idea how big catastrophe’s will be in 2023… maybe we get ‘the big one’. Assuming the market multiple stays the same, $100 seems like a reasonable increase in the stock price looking out 12 months - on a normalized basis. Now Fairfax’s multiple is low; if we get multiple expansion then that would drive the stock price higher. Three wild cards are:

1.) more large asset monetizations (i.e. something like EXCO, their net gas producer)

2.) successful IPO of Digit

3.) meaningful share buybacks - something close to 8-10% of shares outstanding

These would also drive the stock higher.

What Fairfax doesn’t control:

1.) the biggest risk that is see is a global recession. All central banks are now tightening (ECB becoming very hawkish). If equities sell off 20% from current levels (as Morgan Stanley expects… and they have been pretty accurate so far this year) my guess is Fairfax’s stock price will also get hit hard.

2.) the risk of a year of even higher catastrophe losses (even higher than record levels of recent years) is real as well. This would hit all insurance stocks hard.

3.) if the hard market in insurance comes to a quick stop in 2023 this might hit market multiples hard and cause a sell off in all insurance stocks.If any of these events happen then Fairfax’s stock price will likely get hit. If they all happen (as anything is possible), well…, look out below.

My strategy is two-fold: i have a core position of Fairfax that i plan on holding. And i have an opportunistic position in Fairfax that i will sell down on strength (i have been selling some Fairfax given its 30% move over the last 6 weeks and the renewed sell off we are seeing in the overall market - pretty everything else is getting much cheaper).

Bottom line, Fairfax is very well positioned today. It has had an exceptional 2022 and the set up for 2023 looks even better.

In the 2020 bear market Fairfax got killed. In the current bear market Fairfax is thriving. Crazy times!

-

China is a communist country. ALL THE MATTERS IS THAT THE COMMUNIST PARTY STAYS IN POWER. There is no rule of law. There are no property rights. There are no individual rights/freedoms. There is no freedom of the press. There is no capitalism. Everything that exists in China is a mirage. Everything (and everyone) exists to serve the Chinese Communist Party. It is not that complicated to understand.

The economic model will change to whatever the CCP feels serves its needs the best. Parts of it might look like a capitalist model today. But that means little. It is built on a foundation of sand. And a storm has been raging for a few years… and as the sands shift it is getting hard to make the old model out…

-

ING’s latest (Europe focus): Energy Outlook 2023: Oil, gas and power markets to remain tight

“…However, the impact of the EU ban on Russian crude oil is still playing out, and we will have to wait until early February for the ban on Russian refined products. The ability of India and China to absorb a still more significant amount of Russian oil is likely limited. As a result, we expect Russian supply to fall in the region of 1.6-1.8MMbbls/d Year-on-Year in the first quarter of 2023.”

-

Good 1 hour discussion on oil and refining from someone knowledgable (Rory Johnston) who is not trying to sell you anything.

Lead-Lag Live: Is Oil Set To Collapse With Rory Johnston

-

It is highly likely that Fairfax will buy back a significant number of shares over the next couple of years. Why?

1.) capital allocation priorities:

- The hard market in insurance is drawing to a close. Funding growth of subs will be less of a priority.

- While debt levels are elevated, the company is not over leveraged. I also expect earnings to be significant in Q4 and 2023 so this will help. So debt reduction is not necessary.

- That leaves share buybacks as the obvious choice. I expect NCIB purchases to be meaningful in Q4. I think Fairfax could take out a million shares quite easily over the next year. It could be much higher.

- We could also see Fairfax continue to take out minority shareholders in 2023. Perhaps they buy another slug of Allied. Or perhaps Brit. Or a slug of Odyssey.

2.) cash flow should be robust. Fairfax will be earning record amounts from underwriting and interest and dividend income. An average of $600 million per quarter moving forward (pre-tax and before minority interests).

3.) future asset monetizations - more are likely coming in 2023.Trading at under US$600, stock is still crazy cheap. My guess is Fairfax will utilize the NCIB in 2023. If so, this could just keep powering the shares higher for an extended period.

-

1 hour ago, Dinar said:

Yes, but what about Venezuela? Can its production recover? Could it go back from 400K barrels a day to 2MM?

The world is not short oil reserves. The issue is oil is the devil. The capital is simply not available to develop the reserves. Banks can’t lend to oil. Institutional money can’t own oil equities. ESG is growing as a movement so this will only increase as a constraint.

Western governments are also getting increasingly hostile to big oil. This will only get worse over time as climate change becomes more apparent… we will need to blame someone for $150 and likely $200 oil (not to mention the more frequent and more destructive natural catastrophes). Big oil has a bulls eye painted on their backs. Oil executives also know growing production will not get the bulls eye off their back (if anything it will only make the bulls eye bigger).

So what isa rational oil executive to do? They will prioritize returning cash to shareholders. As much as possible as fast as possible. Except for shareholders, pretty much everyone else is trying to put you out of business.

Does Venezuela have a shit ton of oil? Yup. But who is going to pony up the $ to get it? Especially in a country with maximum political risk?

Big oil is desperate to exit operations in countries like Canada. We really are in a brave new world when it comes to not just oil but most commodities. It will really become apparent when we get to the next global expansion (2024?). My read is supply will simply not be able to keep up with demand… at any price. With ESG/government demonizing energy/mining etc, supply will not increase much moving forward. But demand will and by a lot.

And guess what spiking commodity prices will do to inflation… Like i said earlier… brave new world.

-

30 minutes ago, mattee2264 said:

What are people's view on 2023 outlook for oil?

Obviously most people are expecting a recession which is bearish.

But on the other hand if suppliers are expecting a recession they aren't going to go crazy increasing production so supply will stay tight and another bullish factor is that the US is surely running out of SPR reserves to release and China will eventually abandon zero COVID which will add to demand and OPEC ever since COVID has been pretty good at coordinating to offset weak demand with production cuts.

A few commentators are saying $80 is going to be a floor and oil could go above $100 next year.

The key to pricing for any commodity will be demand and supply. Looking out 12-24 months i am quite optimistic oil prices will be higher and probably much higher. Over the next year, absent a severe global recession, i expect oil to do ok ($75) to very good (+$100). So lots of volatility just like 2022.Demand:

- China ending zero covid should add +1 million barrels per day, but likely with a delay into Q2

- slowing global economies is a big unknown. Hard landing is only scenario where global demand actually goes down and i don’t think that is in the cards.

- US. will need to re-filling SPR at some point.

Supply

- capex across the globe remains muted so supply will increase but modestly.

- US will be ending releases of SPR at some point in 2023 = reduction of 800,000 to 1 million barrels per day.

- Russia: given sanctions and much lower capex spend (lower in 2023 than during covid in 2020) i would expect supply from Russia to decline over time. No idea of cadence (how much how fast).

- OPEC: appears to want oil in $80-90 range. Given how tight oil market currently is OPEC might get their wish.

Ukraine war is a wild card. Weather in Europe is a wild card.

-

I think China is an important player in the war. China’s support of Russia is already accelerating the West’s move away from China. I am not sure China wants the West to accelerate its pivot even further as it would have more severe economic consequences for China. The chip sanctions were a shot across the bow.

If Russia escalates the war into other European/NATO states then China will likely experience collateral damage. US and European hawks will have a field day. And it could be severe for China. 2023 is shaping up to be another very crazy/interesting year. The geopolitical world is shifting. And in a big way.

The iron curtain coming down in 1989 was a big deal for global economies and financial markets. China joining the WTO in 2001 was also a big deal. Both developments ushered in decades of global prosperity. As 2022 draws to a close we now know BEYOND A REASONABLE DOUBT that those days are gone for good. A thing of the past.

Russia and China have decided it is time for a new global regime. They have decided the global world order needs to be disrupted and at its very core (taking a page from Clayton Christensen’s book The Innovator’s Dilemma). Russia and China feel they have leverage over the West and the time is right to exercise that leverage. Long live authoritarianism. The split of the world into two blocks (authoritarian vs Western democracies) will be equally as impactful and will play out over decades.

-

1

1

-

-

17 hours ago, dealraker said:

A neighborhool lady posted video of a fox, called it a coyote (which we have tons of), and proceeded to awfulize that her sometimes outdoor pets had been eaten. We'd been on that neighborhood FB page suggesting she indoor the little creatures, but she had not seen a coyote and had to live it to believe it. There's not a single outdoor pet here now in a neighborhood where we once had probably 50.

In any event she eventually penned on the Watership Downs neighborhood FB page, "Charlie, I don't need your lecture." We laughed; yes she was correct, I had given her a speech! So I'll lecture this a.m. maybe...given I tend to do that.

Prices...oh yea it is simply this, we don't like to see the quotes go down. So along the way back in the early 2000's I bought the trading houses, CME, NDAQ, and ICE. I generally, when in quite the "oh my...this is one heck of a good business" mode, put a whopping "should-have-done-more-in-hindsight" $30,000 or so into something like this. And then ole dealraker just goes plum hibernate mode.

And I have well into 7 figures of these businesses and basically never hear anyone ever mention them. But they are there, still independent, and my limited brainpower says, "How do you ever find a better business than this?" Others of course will disagree.

And I didn't sell a couple of years ago- the taxable account thingy- when it looked as if the stocks may have gotten as we say "ahead of themselves" and whatnot. But the question I ask is simply this? Did those stocks get overpriced? Now overpriced to me is truly long term, I tend to be the type to make fun of the cyrpto go-go gang's of today and the "Tesla's run by a mad genius and he'll dominate the world soon" types. My view is, as was posted by someone else on the crypto forum in a positive mode, that crypto is priced by "myth" and by the current "narrative"...both the cyrpto poster considered good and permanant, yes my view is of certainty myth/narrative to change violently at some point. But I'm old, and my great nieces were obsessed with dodgecoin and prancing about (the price had gone blisteringly up)...now only to be saddled with a house in the Triangle of NC, one they paid a lot for and the value is below that---and it has endless problems that need a-fixin...and nearly complete cryto losses. Thus my biased lecture to them--- I had, back in the downturn of Covid suggested they buy some stocks instead of dodgecoin. Based on the request of my sister/bro-in-law and their parents (I have no biological children and am quite close to them)- I sent them a 20 year summary of my investments. They yawned and said, "You're cute and old and so-so-so old fashioned and out of it."

But I'm off topic as ususal, not too serious (as usual), but forums are placed to vent and opine. My view is that any time you can grab hold of a good business and "Rip" (that's Van Winkle) you are best served by doing just that.

Prices will vary. What's ole dealrakers view? It is precisly the same as 13 years ago or so when that asshole Warren Buffett stole my Burlington Northern stock. I had bought several hundred thousands of that puppy, even got my investment club to buy it. They were off-the-charts delighted when Berkshire, a stock the club also owned, bought Burlington. They licked their chops, brought out the wine, and celebrated.

My view? Well some of the guys in the club I eyeballed regularly for my life's direction (I grew up without parents and looked all around for models to go by)---- felt the same way as I did, that we got the shaft when the whiz kid came a knocking and literally stole our prize possession. Yep, I knew the guys who thought the same as me because I was the spring chicken in the club still after years and years being the youngest. And I listened and watched...even probed these guys endlessly because I wanted investment results like them! I suspected they were well-off, most have died now and let's just say the proof was in their donations. Buy and hold good businesses?

Prices vary often and intensely, but good businesses...maybe well-above average businesses exist and tend to stay that way for some time. Most think Microsoft, Meta, Google, Apple, Tesla, Amazon and such. But there are tons of others with relatively small market caps- market caps that won't bump up against historical limits that suggest bigger market cap may be the first time in history such exists, that cloud/tech/media may have to take a time break?

Growth and stock prices won't be linear but to me the prices of both ICE and CME today aren't absurd, and there are tons more. The Buffett types come around and steal them when they can, if it is appropriate to the system and such.

They weren't cheap either in the early 2000's when I bought them. Value investing ain't just 10 pe's and such. I'd messed around with England/London's Jardine Lloyd Thompson through the years, yet another toll booth (ole dealraker loves toll booth businesses, those brokers, trading houses, railroads that Train quoted Buffett on near 50 years ago) things over there in my ancestry land. Jardine too got stolen from me, literally stolen, by Marsh.

So now I look at the London Stock Exchange often, Microsoft somehow's got involved. A long period of not such good results? My best guess is that will change.

Lots of variants in the value investing world. Making money is what we care about and it takes being willing to exist for long periods under other people's pricing, not yours or mine. Life is great if you can stand it.

Ranting, rambling or maybe lecturing?. Good morning world.

Please keep the posts coming… lots to think about.

-

Bought SU, BAC, GOOG, AMZN, PYPL. Lightened up a little on FFH (still way overweight).

-

Making money (what we all really care about) for the past 10 years was really all about following the Fed. That was even more true as we began 2022. At the beginning of 2022, the Fed told everyone it was raising interest rates… and what did we get? Worst results in bonds since American independence in 1776 and a bear market in stocks. Ouch! But we all were given fair warning.

So what did we learn from the Fed today? They are going to raise the Fed Funds rate to +5% and keep it there for a long time. What did financial markets do? They yawned. Really?

So as we close off 2022 we have a really interesting set up for investors. Now i could go off on a tangent and talk about conspiracy theories and UFO sightings and secret meetings… but hey… what is an investor supposed to do with that?

Lets get back to reality… So as we close off 2022 we have a really interesting set up for investors. Someone is wrong: the Fed or financial markets.

If the Fed increases the Fed Funds rate to over 5% and keeps it there for most of 2023 then stock averages are going to get torched (hello S&P500 at 3,300). Bonds? I’m not sure where yields go across the curve… short term yields rise and perhaps long term stay kind of where they are?

Or maybe the bond market is right… inflation comes down aggressively and by mid-2023 the US is in a mild recession (bringing inflation down even faster - perhaps close to 2%)… and the Fed actually cuts rates in 2H 2023. Bonds rock and stocks do ok (setting the table for stocks to rock later in 2023 and 2024).

I am wondering in 2023 if we do not get a slowing economy/perhaps even a mild recession with the job market remaining relatively resilient.

So what is an investor to do? Short answer: i’m not sure. We still have a few weeks to figure it out… early January is when we usually post our top ideas/themes for 2023

-

Understanding supply and demand is key to understanding the price of a commodity like oil. What have we learned the past month?

1.) China is officially abandoning its zero covid policy. Which of course will stimulate demand for oil in the coming months.

2.) Russia… i am not sure anyone understands what is going on in Russia today from a supply perspective (other than they appear to be hanging in there). What is clear is upstream investment will be down about 30% in 2023 (below covid levels). This suggests to me Russian production will struggle to remain flat moving forward and will likely fall.3.) US SPR release: this is set to end any month.

4.) does the US enter a recession in 2023 as predicted by many?Bottom line, driven by China’s reopening, looks to me like oil markets will remain tight.

—————Russian upstream investments set to plunge by $15 billion this year as sanctions obscure production outlook

The financial impact of Western sanctions and the widescale exodus of foreign partners from the Russian oil and gas sector are beginning to materialize, with upstream investments set to sink to $35 billion in 2022, according to Rystad Energy research. Before Russia’s invasion of Ukraine in late February this year, upstream investments in Russia were expected to approach $50 billion in 2022.

-

@StubbleJumper thanks for taking a stab at the math. What a crazy (good) year for Fairfax. I hope Fairfax continued to add to the duration of the bond portfolio in Q4. Duration increased from 1.2 years in Q2 to 1.6 years in Q3.

-

4 hours ago, StubbleJumper said:

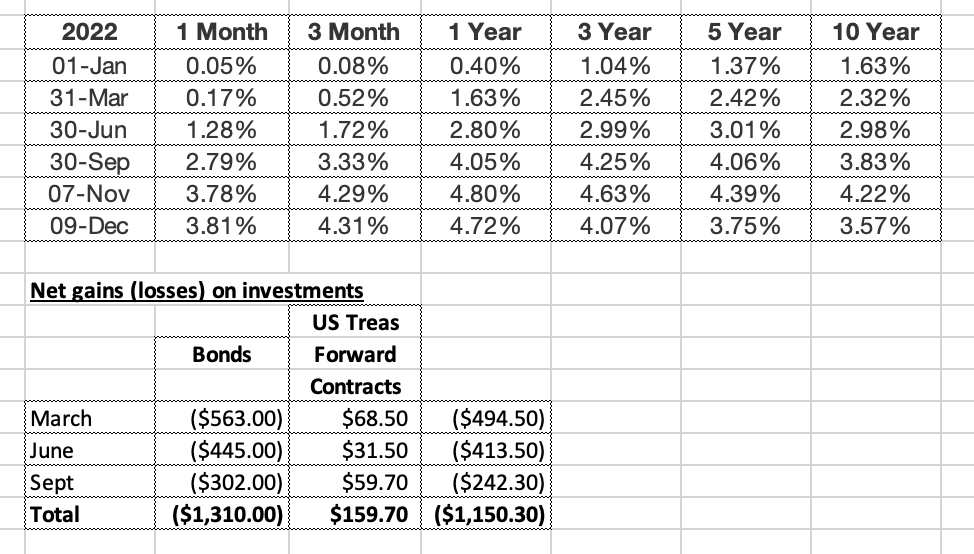

What is your methodology for estimating the M2M bond gains of $250m? Treasury rates for 5-yr and 10-yr treasuries are definitely lower since Sept 30, but the shorter term rates such as the 1-yr and 2-yr have edged up a shade. I haven't attempted any arithmetic on the fixed income port, but my mental model was that from Q3 to Q4 it would be roughly a wash. My logic for that was the basic notion that dV/dy would likely be slightly negative because shorter treasury rates have edged higher, but that would likely be more or less offset by dV/dt being slightly positive.

In any case, the M2M change for the fixed income port is pretty irrelevant when the bonds are intended to be held to maturity, but as you noted, it could make a bit of a difference for the EPS number that gets reported, and sometimes the market reacts favourably to a higher headline number (even if the earnings quality is dubious).

SJ

@StubbleJumper great question. When Fairfax reported Q3 I was surprised the net loss from bonds was only $240 million (after hedge). It was $150 million lower than Q2 - even though the absolute interest rate moves in Q3 were larger than Q2 across the curve. So I wonder if we are not now seeing - as bonds held shrink in duration and get closer to maturity - a small unwind each quarter in the unrealized loss bucket. Which is what Fairfax told us would happen (the unrealized $1 billion loss in bonds would reverse as they are held to maturity).

After doing more of a deep dive this morning I think my $250 million number for bond gains in Q4 is too high. I was overestimating the gains (further out on the curve) versus the losses (on the shorter end). My new guess is something closer to zero.

Fairfax will see gains in Q4 from their longer term bond holdings. In Q3 they were very aggressive adding $4.1 billion with a 3-5 year duration. Their total bond exposure of 3 years and longer went from $2.5 billion to $6.9 billion = + $4.4 billion. My guess is Fairfax likely continued to add bonds of 3 year or more duration in Oct and Nov. Yields on longer term treasuries peaked around Nov 7. If Fairfax continued to be aggressive adding to duration in Q4 then the gains from falling bond yields will be even larger in Q4.

Offsetting the gains on longer term bonds will be unrealized losses on shorter duration bonds as short term rates continue to march higher.

The bottom line, Fairfax's bond portfolio is in very good shape and they are positioned very well for the current environment (lots of unknowns). My guess is big unrealized bond losses are a thing of the past. And now Fairfax shareholders will enjoy much higher interest and dividend income.

So it was 9 months of pain (and $1.1 billion net loss on their bond portfolio). Moving forward, Fairfax shareholders will now reap the gain of higher interest rates.

-

As of today, it looks to me like Fairfax is set to report Net Gains on Investments of around $2 billion in Q4 = $450 (equities) + $1,300 (pet insurance) + $250 (bonds). Over the first 9 months of 2022, Fairfax had booked a $2.3 billion loss in the 'Net gains (losses) on investments' line item. If Fairfax comes in around $2 billion in Q4 they would reverse most of the YTD loss. That would be amazing, given we have just had bear markets in both bond and stock markets. Importantly, the investment portfolio at Fairfax looks well positioned and should deliver better than average returns moving forward.

----------

As of Dec 9, Fairfax is sitting on about $1.14 billion in gains on its equity holdings (that I track... I attached my Excel spreadsheet below).

Here is the split by 'bucket':

1.) mark to market = +$450 million (incudes TRS, warrants etc)

2.) associates = +$500 million

3.) consolidated = +$190 million

Big movers?

- Eurobank = +$299

- FFH TRS = +$226

- Fairfax India = +$181

- Atlas = +$180

- Quess = - $109

- Stelco = +$105

-

My guess is one of the reasons for the divergence is the significant stock buybacks that are happening. They will be increasing as more debt targets are getting achieved.

—————In the near term, i have no idea where the price of oil will trade. I continue to love the set up for oil looking out a couple of years. Constrained supply. And increasing demand. With more and more cash flow being returned to shareholders.

-

At the end of the day what we learn is an investor has to find a strategy that works (beats the averages) and fits with how they are wired: intellectually and emotionally. There is no one right way. Very interesting to think about all the different intellectual models that work.

When looking at an investment I never think 20-25 years into the future. I usually focus my efforts on understanding 1-3 years out and that is pretty much it. Good short term decisions = good long term outcome. That has been my experience. (By short term I mean 1 to 3 years.)

In my personal life I KNOW what I am doing the next 12 months. I have a pretty good idea looking out 12-24 months. 36 months out the view is starting to get a little blurry. That's as far as I get (right now). But I love change. Our youngest will be done university in 3 years. After that no need for a 4 bedroom house. Also no need to live full time in Vancouver. Lots of great options. (I should note that when my 3 kids were in elementary & especially high school we were locked and loaded in our house and neighbourhood - not going anywhere.)

-

Does this not kind of suggest an index fund / ETF (i.e. S&P500) approach is indeed a solid strategy for most people. They will be invested in most of the right (surviving) companies looking out 25 or even 50 years. And over time the companies that disappear (bought out, merged, broken up or gone bankrupt) from the index/ETF are replaced by the best of the rest. Over time you end up with the best companies and you pay virtually no fees for that expertise.

-

What a crazy year it has been; not just for energy but for all asset classes.

Regarding energy, i follow the large Canadian producers the closest. Cash flow in 2022 has been amazing. Most of the cash flow has gone to debt repayment. Net debt levels in the Canadian oil patch have got to be at historically low levels. Balance sheets have largely been de-levered over the past 2 years which is a significant achievement. The interest expense savings for all companies will also be material moving forward (lowering their per barrel break even cost).

As we end 2022, we are seeing more and more producers shift more and more of their free cash flow to investors. In Q4 MEG moved to 50% to share buybacks (was 100% debt reduction). In January 2023, CVE will be 100% to dividends, special dividends and share buybacks (with net debt at their $4 billion mark). Every company is materially increasing the % of free cash flow that is being returned to investors. All Canadian oil patch companies will likely hit their final net debt targets in 2023. The amount of money that will be returned to investors will be massive.

My guess is the amount of stock buybacks that will be done moving forward will start to provide a floor for share prices of energy companies. If share prices get too high… energy companies will shift to special dividends.

So how does and investor value a company that has little debt, solid free cash flow and is committed to returning an increasing % of free cash flow to investors?

i ask because it is pretty clear no one is actually doing the math on Canadian oil companies. We learn that a stock is worth the discounted value of future cash flows. This does not apply to the Canadian oils (perhaps the US too… i just don’t follow them).

So what is an investor to do? Wait. Give it time. Mr Market will eventually get it right. And patient shareholders will make out like bandits.

—————Even if oil sticks at US$70, the Canadian producers will still be gushing cash. And it their shares get pummelled (likely), with debt targets largely hit, they will be able to buy back meaningful amounts of shares a rock bottom prices.

It really is a crazy set up. Regardless of where oil prices go in the short term, oil investors should do very well looking out a couple of years.

I wonder if we do not see the next wave of consolidation happen in the Canadian oil patch over the next year. European and Chinese producers desperately want out. Canadian producers may get their ‘buy low’ opportunity.

-

On 12/3/2022 at 11:41 AM, KFS said:

Congrats Viking and thank you for the excellent analysis on this company over the past few years. I seriously can thank you and others enough (glider, petec, etc.) for all the work you guys have done and shared on this board. I had been a quiet reader of this board for several years, and made a huge purchase of FFH during covid, shortly after Prem's large personal purchase of the stock, and made an additional large investment earlier this year. At this stage, Fairfax has had a meaningful impact on my personal financial situation and has probably shaved several years off my expected retirement plans... (I do not have an ultra-high income -- a 36 year old chemical engineer working in operations at a nuclear power plant.) Fairfax has "accidentally" grown to about 66% of my overall portfolio. Normally, I would rebalance to reduce the risk of being so far overweight in one security, and I may still do that only as a matter of principle, but given the future prospects and intrinsic value of the company relative to the (still low) stock price, I could just as easily stick with the full position for now... I think we are just getting warmed up, and I'm very much looking forward to what the next few years will bring.

@KFS nice to hear FFH has worked out well for you. Individual stock weighting is an interesting topic. I like to flex positions of stocks i have high conviction in. Add (sometimes aggressively) when they sell off for no apparent reason. And also lighten up when they pop aggressively and lock in some nice short term gains. I am lucky because most of my holdings are in tax free accounts (so i am not taxed on gains when i sell).

Regarding Fairfax specifically, aggressively flexing my position has been a very good strategy the past 2 years. The stock just keeps selling off +20% - even as the story continues to get better each quarter. Eventually Mr Market figures it out and the stock hits higher highs. That will continue to be my strategy moving forward. I do expect Fairfax to be very aggressive on the share buyback front moving forward and this could mean the stock just keeps powering higher over the next year (with less downside volatility). Given how good to story currently is my plan today is to keep a large core position.

Another factor for me is what the overall market is doing. My guess is investors will get another wonderful opportunity to buy great companies at wicked low prices at some point in the next 3 months. So i have been slowly building my cash position. It has been a great year and i am happy to lock in some of my gains. And sit in the weeds and patiently wait for Mr Market to serve up some more fat pitches.

-

1 hour ago, whatstheofficerproblem said:

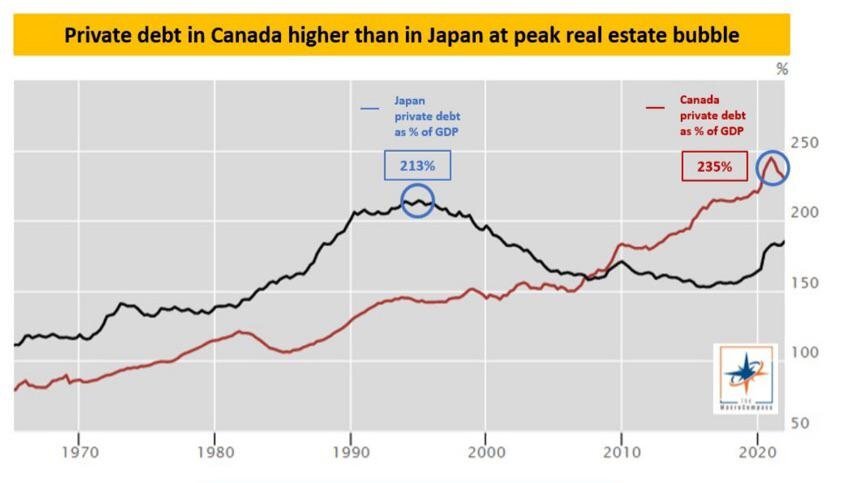

@whatstheofficerproblem when you get your answer please let me know. I continue to think that interest rates are one of the keys. If the Bank of Canada keeps raising rates then i think more pain is ahead. The spring market (gets going in Feb) will be key - and it is not far away.

If the economy also slows in 2023 that will probably be a hit to housing.

—————Prices are coming down pretty hard in the areas that were most frothy. I looked at my old neighbourhood (Langley) and house prices look to be back (perhaps even lower) to where they were back in March of 2021.

-

Well time to get the bubbly out this weekend for Fairfax shareholders. Why? Christmas has come early. Fairfax’s stock price has hit a new all time high today in Canadian dollar terms of $791.93 (markets haven’t closed). The previous all time high had been C788.88 on June 15, 2018. Congratulations to shareholders… it is always nice when a plan comes together! A few of us backed up the truck late in Oct/Nov of 2020 at under C$400 which has been a double in a little over 2 years. Not too shabby.

But the story gets even better. Trading today around C$790, Fairfax is still wicked cheap. My guess is ‘normalized’ earnings for Fairfax is north of US$100/share, or C$135/share. So the stock is trading at PE multiple of less than 6. Moving forward i think Fairfax should be able to deliver 20% to 25% returns per year for at least the next couple of years driven primarily by earnings growth and also a little multiple expansion. (I also expect the stock to continue to have lots of volatility… as per usual.)

The quality of my estimated C$135/share in earnings is very high: primarily coming from Interest and dividend income and underwriting profit. I also expect Fairfax to be very aggressive on the stock buyback front over the next year, taking out at least 1 million shares (perhaps 2 million) and this is NOT built into my earnings estimate. Other catalysts would be a Digit IPO or more asset monetizations like we saw in 2022 with pet insurance and Resolute Forest Products.

We can be very hard on Fairfax and their management team. Today i tip my hat to them. They appear to have learned from past mistakes. Largely corrected past mistakes. And have been executing well for the past 5 years. As a result of all their hard work, today both the insurance and investment operations at Fairfax are positioned exceptionally well at the same time. That is a big deal for Fairfax investors.

Bottom line, Fairfax’s future has never looked brighter. So my guess is the shares will power even higher in the coming years. Prem and company have got their mojo back! Well done!

—————I am not a big technical guy. But i do think Fairfax stock hitting new all time highs is a big deal. We can officially call an end to the 8 year bear market in Fairfax’s stock. It is also impressive to see Fairfax starting to dramatically outperform the market averages (one year and two year).

—————

In US$ terms it looks like the all time high was US$593.99 in Oct 3, 2016. Shares hit US$588.50 today so we are within striking distance of this mark as well.

Energy Sector

in General Discussion

Posted · Edited by Viking

Oil/energy: what a delicious set up for investors. Tight markets. Major producers, Russia and Saudi Arabia, want higher prices. US needing to re-fill SPR. China reopening.

Oil stocks look to be the gift that keeps on giving for investors in 2023.

—————

Oil Prices Jump After Russia Says It May Cut Production

- https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Jump-After-Russia-Says-It-May-Cut-Production.html

After two weeks of silence in detailing how it would react to the G7 oil price cap, overnight the Kremlin raised the stakes for the west when state-run Tass news service quoted Deputy Prime Minister Alexander Novak as saying that Russia may reduce output by 500,000 to 700,000 barrels a day in response to the cap.