-

Posts

12,971 -

Joined

-

Last visited

-

Days Won

42

Content Type

Profiles

Forums

Events

Everything posted by Parsad

-

Well, it was 25 years ago as the handover was about to happen, but then they thought things would be ok and business was great. Now they are fleeing again after a significantly more dangerous crackdown on rights, etc. Problem is, Beijing has gotten smarter on how to prevent capital outflows, so many stay in HK, etc to access their Chinese bank accounts. PDH has a couple hundred thousand USD stuck in China for 6 years now from the MRI joint venture we had that was arbitrarily shut down by the CCP. We've tried numerous ways to get it out, but can't! Cheers!

-

It's like an Einhorn slide deck (like 150 slides) but with almost no information! Must have been put together for those with a short attention span! Cheers!

-

If China doesn't respect property rights or intellectual property, how does India ever trust them? Not possible. India is a burgeoning empire of intellectual property...they aren't going to give it away for free. Partnership with China...sure. Deep alliance...I think you are right...not going to happen. India really wants access to the BRICS through any China alliance...but their bread and butter will come from the West and Europe. They know that. Cheers!

-

LOL! Don't worry...I eat my own cooking! Just remember to keep averaging down slowly if it goes down further. That's what keeps losses to a minimum and improves the upside if the thesis is correct. People who just bought META when I started buying obviously didn't do nearly as well as those that kept averaging down with me. It was the difference between a 20% return and a 120% return! In the mean time, just enjoy the fat 5.4% dividend that they've paid out for the last 20 years! Cheers!

-

Generally as a rule of thumb...Fairfax takes a 1-3% hit of any large catastrophe and Berkshire takes a 5-8% hit. Idalia is easily manageable by both. Cheers!

-

Kyle is a fund manager and member of the COBF. Cheers!

-

Yup, I have one sent to me and autographed by Prem! Thanks PW! I keep it with the original Markel and Fairfax annual reports I have...given to me by an analyst friend at Fairfax...his own personal collection over the years. Thanks PI! Two of the nicest gifts I've ever gotten! Cheers!

-

Happy 93rd birthday to Warren Buffett on August 30!

Parsad replied to Buffett_Groupie's topic in Berkshire Hathaway

There were three Yellow BRK'ers hats originally...my friend John Zemanovich (Lotsofcoke) had one...John Gartmann had one...and the third belonged to someone else...maybe Farmer Lyle, Sherrie Gregorie or Marlin. Cheers! -

Happy 93rd birthday to Warren Buffett on August 30!

Parsad replied to Buffett_Groupie's topic in Berkshire Hathaway

Yes...happy birthday to the GOAT! Cheers! -

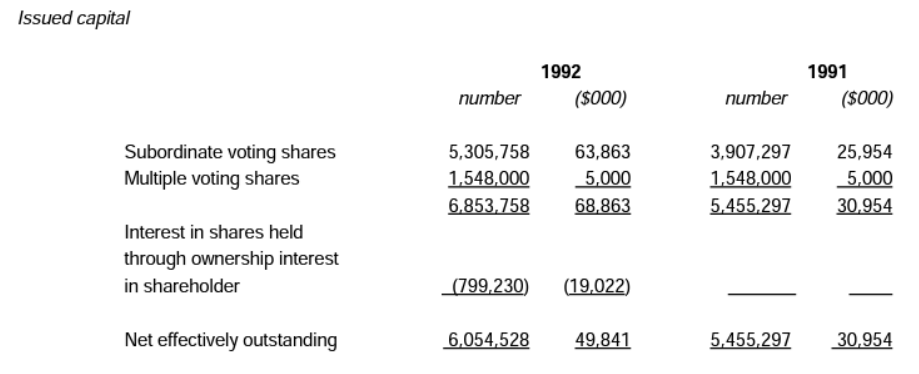

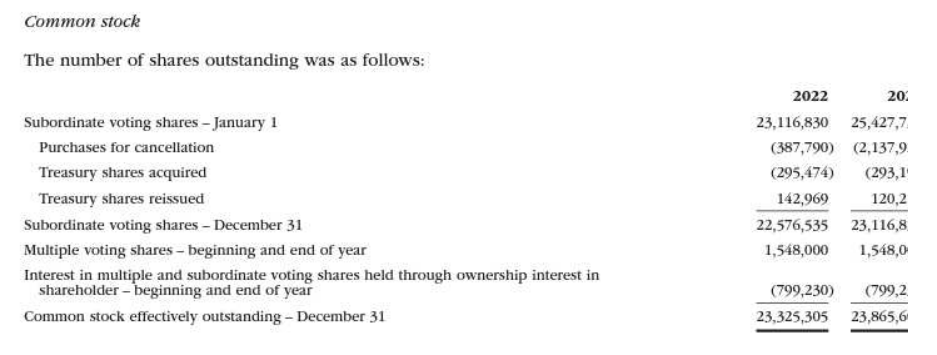

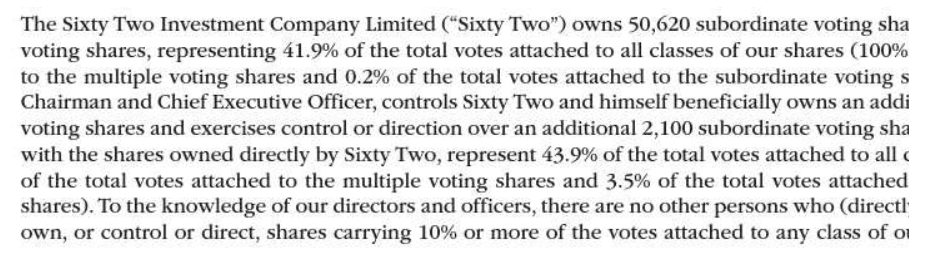

Actually, here is the information Kyle put together from the 1992 Letter...it actually seems that the minority interest was bought by Fairfax in 1992 from the minority investors...not sure if the ownership is the same today...but Prem certainly has control of Sixty-Two. Maybe others know. Cheers! Sanjeev, I was reading the message board this morning so I figured I would pass the below/attached from an old annual letter over to you related to one of the threads for what it was worth: In 1992 we simplified our corporate relationships significantly by the purchase of Hamblin Watsa Investment Counsel Ltd. (HWIC) as well as a 49.9% interest in The Sixty Two Investment Company Limited (Sixty Two), the controlling shareholder of Fairfax. As I was a shareholder in both these companies and recognized the potential conflict of interest was very high, I want to make sure you understand how and why we did these transactions and why they were fair (I hope you agree!). --- The purchase of the 49.9% interest in Sixty Two was basically to provide liquidity to the original investors who backed me seven years ago, on terms attractive to Fairfax. Sixty Two’s only asset is shares of Fairfax and it has no liabilities. The shares of Sixty Two were valued on the basis of the market price of the Fairfax shares owned by it, less a liquidity discount of 15%. As disclosed in Note 9, in essence Fairfax issued approximately 680,000 shares to acquire indirect ownership of about 800,000 of its shares. The net result was that Fairfax effectively repurchased approximately 120,000 of its shares (with a market value of over $3.3 million at $28 per share) for no cost. Book value and earnings per share will be about 2% higher because of this purchase. Sixty Two will continue to be controlled by me as it has been in the past. This purchase also was approved by our Board of Directors, the majority of our minority shareholders and all the investors in Sixty Two. With the completion of these two transactions, Fairfax is much simplified in its relationships and perhaps more focused. Also, the purchase of the Sixty Two shares brings to an end (at least formally) the original partnership that refinanced Fairfax (then known as Markel Financial) in those early days in 1985. Looking back, these investors must have been special to have financed an almost bankrupt insurance holding company led by a chairman with no corporate experience at all. There may, after all, be some truth in the definition of an entrepreneur–‘‘Unreasonable conviction based on inadequate evidence’’! Even though this group will continue to be shareholders for some time, I want to take this opportunity to thank them for their invaluable support, without which Fairfax would not have existed. To further add some more colour to the below, as I understand it, Fairfax still owns 49.995% of Sixty Two while Prem still owns the other 50.005% so on an economic basis Prem effectively owns 799,389 shares via his interest in Sixty Two (he also owns another 744,085 shares to take his total to 1,543,474 shares) but of course due to his control of Sixty Two and then in turn Fairfax he controls 100% of the votes related to these shares… additionally, he does not need to worry about any issues related to minority partners in Sixty Two as Fairfax is his minority partner which he obviously controls so it provides for a lot of certainty related to Prem’s protection of the culture/etc at Fairfax longer term as you well know! Note 9 from the 1992 Annual Report On November 5, 1992 the company issued 433,773 subordinate voting shares at $28 per share as partial consideration for the purchase of Hamblin Watsa Investment Counsel Ltd. Also on November 5, 1992, the company issued 679,352 subordinate voting shares at $28 per share to indirectly purchase 49.995% of The Sixty Two Investment Company Limited which owns 1,548,000 multiple voting and 50,620 subordinate voting shares of Fairfax. The company's indirect ownership of its own shares constitutes an effective reduction of shares outstanding by 799,230 and this effective reduction has been reflected in the fully diluted earnings per share calculation and the book value per share calculation. From Fairfax’s 2023 MIC Mr. Prem Watsa controls Sixty Two, which owns 50,620 of our subordinate voting shares and 1,548,000 of our multiple voting shares, and himself beneficially owns an additional 741,985, and exercises control or direction over an additional 2,100, of our subordinate voting shares.

-

Thanks to Kyle Holmes for confirming from the 1992 FFH Letter that Prem owns 100% of Sixty-Two since buying out the minority shareholders in 1992. For some reason, I thought he increased his stake to 70%+, but he bought control of the whole entity. Cheers!

-

Movies and TV shows (general recommendation thread)

Parsad replied to Liberty's topic in General Discussion

Plus it's directed by David Fincher...should be awesome! Cheers! -

Movies and TV shows (general recommendation thread)

Parsad replied to Liberty's topic in General Discussion

Fassbender is one of the best actors of his generation. Like Denzel or Neeson, he can make the most mundane things interesting...so I imagine it will be pretty good. Cheers! -

https://finance.yahoo.com/news/china-evergrande-shares-plunge-more-013647508.html Cheers!

-

Movies and TV shows (general recommendation thread)

Parsad replied to Liberty's topic in General Discussion

Yeah, I was able to understand some of it as well. I thought the movie was excellent. Cheers! -

Yes, Hamblin-Watsa is completely owned by Fairfax and their investment advisory arm for Fairfax's portfolio. I believe Prem and his wife Nalini control almost 70% of Sixty-Two...maybe more now. The Watsa Family will retain control over Sixty-Two and Fairfax long-term. Prem and Nalini aren't big on passing on large amounts of inherited wealth. I imagine, not unlike Buffett and his ownership of Berkshire, Nalini will probably pass most of the ownership of Fairfax to their foundation...The Sixty-Three Foundation through which they do their family donations. The Watsa children and probably Prem & Nalini's grand-children, alongside their advisory board, will be long-term stewards of The Sixty-Three Foundation and indirectly Fairfax. So the family culture will remain with Fairfax for many, many decades! Cheers!

-

Movies and TV shows (general recommendation thread)

Parsad replied to Liberty's topic in General Discussion

Dune2 will not be released until April 2024 due to the writer's strike. Damn! Cheers! -

Yes, Sixty-Two Corporation was the holding company that Prem started with a few very close investors...not sure if Robbert Hartog (Prem's mentor) was part of Sixty-Two...but there were a handful of early investors that joined him. He controls it though. Robbert did put a considerable sum in...not sure if it was through Hamblin-Watsa...or through Sixty-Two...or directly when Prem acquired Markel (now Northbridge). I believe the story is in the 25th Anniversary Book. So the bulk of his ownership is through Sixty-Two, and the $150M worth of stock he personally bought in the midst of the pandemic makes up about half the subordinate shares he owns outside of Sixty-Two. His family members also own some shares...some relatives...a lot of the employees and managers at Fairfax...Francis Chou still owns all the stock he bought at $3...etc. Cheers!

-

What are you listening to ? (Music thread)

Parsad replied to Spekulatius's topic in General Discussion

https://www.yahoo.com/entertainment/rich-men-north-richmond-singer-215707251.html I stand corrected about his intentions! Cheers! -

Macy's could experience a recessionary environment, but so will the entire retail industry. The question is why is Macy's priced at a lower valuation to its peers...not dissimilarly to why FFH is priced lower to its peers? For some reason, the market thinks both Macy's and FFH will disproportionately be impacted by any industry losses, so Macy's is dumped in with lower tier retailers and FFH is dumped in partly with general reinsurers. Yet neither business deserves to belong there. Like FFH is currently doing, Macy's has generated steady free cash for years, unlike many retail competitors. Macy's also owns a quality real estate portfolio. Again like Fairfax, Macy's has been through many different types of environments and continues to generate cash. So even in the best case scenario, you've both assumed that Macy's isn't priced any more cheaply than Fairfax...yet we would all agree that as Macy's goes down and Fairfax goes up, the margin of safety moves in favor of Macy's. Like I said, I own a ton of Fairfax, and I like its long-term prospects. But I find Macy's more and more attractive as the price falls further. The one thing I promised myself years ago, is never fall in love with a stock...fall in love with the fundamentals and the margin of safety it provides. If something is cheap and something is stupid cheap...I'm going to always fall into that stupid cheap category! Cheers!

-

At today's prices, if I liquidate FFH, even with higher fair value prices for the insurance subs, I might get 1-1.2 times book after paying off the debt...at best! If I liquidated Macy's today, just the store in Herald Square alone is worth more than the entire company. So forget the retail brick and mortar business, forget the online Macy's business, forget Bloomingdales, forget BlueMercury. Just selling the real estate will pay off the debt and get me what the market value of the company is. Then if you look at it from a P/E basis...at current prices, I would get my money back from FFH in 8-10 years...whereas even with the lower earnings for this quarter as they liquidated 10% of their inventory, Macy's would give me my money back in 4-5 years. I don't need Macy's to hit it out of the park. I just need Macy's to keep up with its peer group. If it can do that over the next couple of years, the market at some point will revalue it back up to around 10-12 times earnings. And if they manage to get a double, then it might get valued at 13-15 times earnings. And what's the worst that could happen to Macy's in the next few years? Another pandemic? Tougher competition? Reduced consumption? They've plowed through all of that before. I'm by no means saying people should sell Fairfax and buy Macy's. 25% of my portfolio is still Fairfax. But I'm certainly comfortable buying a chunk of Macy's based on P/E and liquidation value. I think it will return to fair value just like META did at some point. Cheers!

-

Is Warren Buffett or Charlie Munger Smarter?

Parsad replied to nickenumbers's topic in Berkshire Hathaway

My friend, Dr. Ryan D'Arcy, one of the premier neuroscientists in the world and arguably one of the smartest people in Canada would argue otherwise. The actual depth of understanding we have of neurology, cognitive functioning, etc is still relatively young. I think if you ask 50 different psychologists, scientists, doctors, engineers, etc what "intelligence" is, you will get a variety of definitions or descriptions. It's why AI is so difficult to create...the nuances of the human brain and what we consider "intelligence" is far more complicated than perception might have us believe. As a teenager I scored 145 on an IQ test. But I've never felt particularly smart or intelligent. I've seen people from all walks of life at times do extraordinary things that certainly made me feel ordinary. I just don't think intelligence is as definable as some may think, and the box for intelligence isn't as structured as one may imagine. Cheers! -

+1! Just no need to list on there. If markets don't narrow the value gap because they are TSX listed and not NYSE listed, who gives a damn. It will just give FFH a reason to keep buying back stock and enrich their loyal investor base. Why would you want to bring on board investors who would sell out as fast as they got in by listing on the NYSE. Just take excess cash and keep reducing the shares outstanding! And then you also limit your exposure to short attacks or unnecessary scrutiny/regulation. Cheers!