-

Posts

15,137 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

Spekulatius replied to thepupil's topic in General Discussion

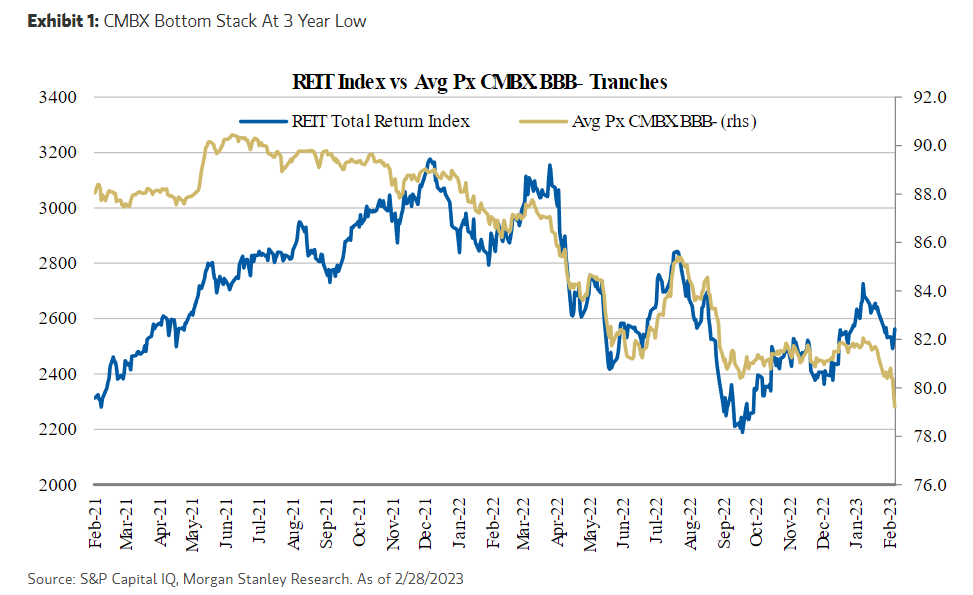

Yep, found a similar chart from MS. Shows the BBB- (lowest investment grade) CMBX price which apparently correlates with Reit prices. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

Spekulatius replied to thepupil's topic in General Discussion

The economy might break, but it's not clear to me that MF Reits will break. 10% interest rates do not occur in a vacuum - they are likely are caused by high inflation. My guess is that 10% interest rates mean ~ 10% inflation which also likely means 10% (likely higher) rent increases. So, depending on the rate / inflation trajectory, it might not hurt then Reits as much as you would think. -

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

Haha - swingtrader Warren: -

You run out of bankers pretty quick that way.

-

All you need to know about the last 2 weeks worth of financial news from El risitas:

-

-

Added some $CASH and $CPT today.

-

Is Concentration a better strategy than Buy and Hold?

Spekulatius replied to Viking's topic in General Discussion

it is interesting to see that seemingly detrimentally different approaches of Buy and hold (coffee can) or concentrated swing trading can work well. I have heard about people who did well using momentum strategies as well. I think the important insight is to find what works for you - where is your edge in terms of knowledge and temperament. I am more of a diversification /sleep well kind of kind of guy. Quite frankly, you can do pretty well owning just index funds (at least in the US0) as long as you don't do stupid trades. Different people, different strokes. -

What stealth QE? A banking crisis is pretty much equivalent to quantitative tightening. The Fed does not lend to business or individuals , banks do. If they hold back on credit, "main street" will feel it. There is some fuzzy logic being repeated by many that a banking crisis will lead to money printing. This is false, imo and we only need to look at the GFC and it's aftermath to check that the "money printing" went nowhere. It's quite simple actually - what do you care of the fed opens the discount window and lends to banks to improve their liquidity or similar measures. You can't use any of this and as long as the banks don't lend to you, this will do nada other than preventing a crash in the financial system. This is very different than the checks sent to most people in the pandemic.

-

The Fed does not give the banks par value for their securities, it lets them borrow in exchange for par value for the securities, but they still need to pay the current 4.5% ST interest rates. So this may solve some liquidity issues, but it becomes a negative carry trade and the banks will lose money doing so.

-

Banking or any to get financial has a high degree of reflexivity attached to it. That means that perception can very well become reality. Or in other words, as long as people believe banks are stable, then they are stable - if people don’t trust the banks, they will become very fragile. There simply isn’t a bank that can withstand a 50% drawdown of deposits. I think almost no bank is designed to withstand such a drawdown. As for inflation - any crisis of banking system is deeply recessionary and deflationary. Bank now will have to increase their liquify buffer to withstand bank runs better which means less lending. I don’t really see anything remotely inflationary in the current development, unless LT interest rates go down so much, that the ~$4.4T in securities held by banks that are currently underwater go to par again and everyone continues as if nothing has happened.

-

It seems to me that finance will be one of the worst hit sectors, since everything is already digitized or at least digitizable.

-

Well what is a recession proof business though? It is easy to find out the exposure to real estate lending. The breakdown for loans would in the 10–k or the FDIC filings. Many banks also give out the percentage of problem loans as well. Below is a paper that I found through a link in a Fox business news article. Looks at MTM loses (including on loans) vs bank size. In these distribution charts , the mega bank don’t look any better than the smaller ones and indeed have a lower percentage of insured deposits (since they bank large institutions). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4387676 What does it mean ?

-

I do not know anyone either, but I do not know anyone who has more than $250k in deposits either and those are the ones that are likely to do something. Shoot first and ask questions later is a totally rational way of thinking of downside is significant and upside is non existent. the problem for regional banks is that most people would be better off moving some of their deposits and earn more and be probably safer, I think a lot of these banks have been hoping for inertia but fear of losing may be a motivator to get them to do something like moving to a MM market cash management account or similar.

-

Yes, that is definitely a possibility, but I think he would need to stay below 10%. On FRC - if they are not forced to realize losses, well JPM is not in the business to give them money for nothing. They could get a credit line from FHLB, but that would cost them 5% interest . So then they lend money at 2-3% and have to borrow it at 5% which is going to wreck their income statement. I think it’s game over for FRC, the deposit injection just bought them some time, because even JPM is a bit concerned that things go out of hand. I would not be surprised to see a deal regarding FRC soon. They are not viable stand-alone any more, imo.

-

I think FRC gets sold for one $. They are deeply insolvent if you account for the fair value of their mortgages and taking into account for losses on securities. The mortgage are the far larger problem. My guess is that “equity” is probably around -$10B. I think equity preferred will be wiped out and bonds get a haircut or get wiped out as well. The deposit insurance likely need to bear some pain. WEB won’t do anything with FRC - if he does something at all he will buy more BAC or possible get involved in some preferred deal with another bank.

-

It not really that useful of a chart. FRC and I believe PACW have tons of fixed rate mortgages on their books. FRC has ~$100B in fixed rate mortgage and continues to write them aa interest rate rise. crazy. I think they are worth less than 85c on the $ and that in addition to losses on securities. None is accounted for on the chart. Both BAC and TFC look pretty bad on unrealized losses on securities as well, but have very stable deposit basis. It’s not easy to determine which one is going to skate buy and which one is going to have issues. Factors are Tier 1 capital levels, stability of deposits (% uninsured is just one factor here), unrealized losses as a percentage of capital, profitability,% of loan with variable vs fixed interest rates, business diversity , interest rate hedges, management. Ultimately everything boils down to keeping the deposit base stable, but of course that outcome is a function of above. FWIW, MTB looks pretty solid here and indeed has little unrealized losses, but they have high NPA and excessive (imo) commercial real estate exposure (3x equity).