-

Posts

15,138 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

USB has the infamous toilet flush chart formation - down ~8.5% today. Iwonder what's up. I don't think that they are worse than PNC or BAC in terms of what they did with their security portfolio. They do have a lower CET1 ratio of 8.4% due to paying partly cash for the MUFG acquisition. Bought a few more shares today, but won't add more. Maybe it's this (shelf registration): https://www.sec.gov/Archives/edgar/data/36104/000110465923031197/tm238798-1_s3asr.htm

-

@tnathanCould you elaborate on $MTB. MTB has been a value investors favorite from what i can remember. the CEO writes very well written shareholder letters and the bank is sensibly run. I did notice relatively high commercial real estate exposure (~$43B vs ~$23b in equity) as well as high non performing loans - ~1.85% of the total. That's a very high number in the current economic framework. They do not have egregiously large holdings of long duration securities though. FWIW, i bought a few shares as part of my regional bank stock basket.

-

You can do that on your own. I took many classes beyond my main subject (easy to do and didn't cost anything but the time effort). I took classes in biology, economy, operations research, marketing, public talk/presentation . I particular loved the classes in Marketing as it really opened my eyes in terms of how companies work, which lead me to investing. The most important school and University will teach you is to study and research a topic on your own. Almost everything else is actually pretty fleeting.

-

I studied Physics in Germany and never had to take a liberal art class at the University. I was supposed to know how to read and write when I started at the a University, that’s what the Abitur is for.

-

I guess it’s like with TARP, not taking the medicine wasn’t an option. Now this time, the bankers self insure and not kicking in wasn’t an option either. Feels like March 2008 when Bear Stearns failed, I am afraid. This fellows says, the near term banking crisis is over, but I don’t think so: https://finance.yahoo.com/video/first-republic-receive-30b-deposits-223938171.html

-

I posted this elsewhere, but deposits moving to MM is also a concern. Could be that savers are sleeping at the wheel and the whole debacle have woken them up and now they start to move funds. https://finance.yahoo.com/news/deposits-started-moving-money-market-145355809.html

-

Not that great (deposits moving to MM funds) if true. https://finance.yahoo.com/news/deposits-started-moving-money-market-145355809.html I always think that headlines that we are having wakes up people wo tend to do nothing and often get them to do something. When you have access cash that is sitting there, then the question is why not move this to XXX where it's safe and I earn interest? Again, stuff can be sticky until it isn't.

-

Bought a bit of $FNF this AM. New position. I think refinance activity is going to pick up after the recent treasury declines and title insurers benefit from this. I am not too exited about their annuity business $FG but it is what it is. Maybe I can even get my $JXN back around $30. These stocks really trade all over the place.

-

Basket of Large Cap US Financials - No Brainer Buy Today?

Spekulatius replied to Viking's topic in General Discussion

Looks at what's in XLF - a huge chunk of BRK (~14%) and JPM (~10%) which are up. A lot of constituents are financial service cos as well that are up. The rest has been pummeled very hard - take a look at IAT or KRE. -

XOP is an index where many small E&P from 2016 went bankrupt. XLE is more large cap and higher quality, so there are way less bankruptcies and impairment in XLE. Thats why XLE has outperformed XOP. The stocks that went to zero remain a zero, there is no recovery. The ones that diluted at the bottom get a partial recovery. The companies that did not dilute and made it through are business like CVX or XOM trade at higher prices than in 2016.

-

The issues is political. Lula became President after the controversial Bolsonaro and he has a leftist bias. He has been President before and Brazil hasn’t done too badly, albeit this was more of a function of economic tailwinds than of his own making. However, I think Lula is way more pragmatic than most give him credit for.

-

That is probably the case, i don’t think it was a diversity issue, the issue was that this was a train wreck by mid 2022. The only thing that could have saved them was a massive Capital raise and that is a decision that management could have done with a CRO or not, but they decided not too.

-

@Cigarbutt The deposit to cash ratio is meaningless. In the past, banks have used MBS and treasuries as cash substitute, but that‘s not valid any more because the MTM on debt securities make them essentially an asset that the banks can’t touch (until they are close to par again). So in my opinion, you need to look at loans plus longer dated securities and if you do that, the liquidity is far less impressive. Pretty much all the longer term security on the bank balance sheet are now immobilized : Deposits made a Huge jump in 2020 but are now shrinking https://fred.stlouisfed.org/series/DPSACBW027SBOG Looks like there are $4.4T of treasuries and MBS on the banks balance sheet, which are mostly “under water”, so they are basically immobilized and can’t be sold , since it would lead to loss of regulatory capital. Those $4.4T represent basically quantitative tightening. I guess some of it is shorter dated paper, but I think most of it is longer dated. https://fred.stlouisfed.org/series/USGSECNSA

-

For cash return junkies, PBR-A is hard to beat. Nothing comes even close.

-

@KJP Signature bank had a liquidity issue, not a solvency issue. Their deposits were fleeting and they had $31B in MM accounts and others in short term savings. there was relatively little in transactional account. Ad for 12/31/2022 they had already drawn ~$12B from FHLB, but they have not borrowed from the discount window (I think they can do so by using MBS or treasures as collateral.) At 12/31/2022, their liquidity didn’t look that great, but not that bad either. They had ~$6B in cash and I think a total of $12B in cash and ST securities. My guess is that the situation must have deteriorated from 12/31/2022 and Barney Frank said, that they were OK until the last hours of Friday. the withdrawals must have been huge , I guess in excess of $30B so they exhausted cash, FHLB capacity and discount t window capacity. Either that or the treasury / FHLB don’t let them draw down their credit line. Ny concern is that similar things can repeat. Maybe we get Meme inspired deposit runs on instructions started on Reddit. the Fed and regulators should take the potential for those serious because a few failures will cause a banking meltdown. I think extension of deposit insurance (higher limits or no limits at all) may be necessary. I think you are also correct that there is less friction. Social media was around in 2008, but we have seen the herding being much more pronounced as is evident by the GameStop /Meme crowd, Then there is easer transfer capability which formerly needed to do in the branch. Now I can do it Friday afternoon at 3Pm to get my money back the same day. Again, removing friction is great for the customer , but it also can get things moving much faster and pot. destabilize a bank. I would love to see a post mortem of a Signature bank case much more so than the Silicon Valley bank, because the former was mich more like a plain vanilla Bank than the latter. anyways, the risk as different than what the regulators have considered so far, which were mostly due to economic distress, loan losses, counter party failure. I don’t recall seeing losses on securities due to higher interest rates and sudden bank runs accounted for in stress tests.

-

If you take Book, you should at least tangible book. FWIW, I took a look at Signature bank. The bank was rated BBB+ / A- when it was seized. The banks want insolvent either - they had $7.2B in equity, ~$700M in preferred and the bond losses were about $3.2B total. So there was quite a bit of equity left. There are many banks still standing that look worse. What SBNY didn’t have was a stable deposit base. They also had the crypto connection against them. So there was a bank run and instead of saving them, the bank was seized, despite reasonably solvency. I think the point can be made, that it was probably the crypto connection , that did them in. I think the regulator were probably out to get them. It’s interesting and somewhat alarming because I don’t think I have ever seen a bank with those metrics that SBNY had fail. At the end of the day, while numbers matter, it’s really only two things that matter - the trust of the regulators and the trust or the banking customers. If one of these is lost, your tangible book value will not save you. I think balance sheet and earnings wise, FRC is in a way worse condition, yet is still limping around. Although, I think they may become part of JP Morgan wealth management soon. It can’t really be that great to cater to HNW clients when your stock trades like a penny stock on steroids.

-

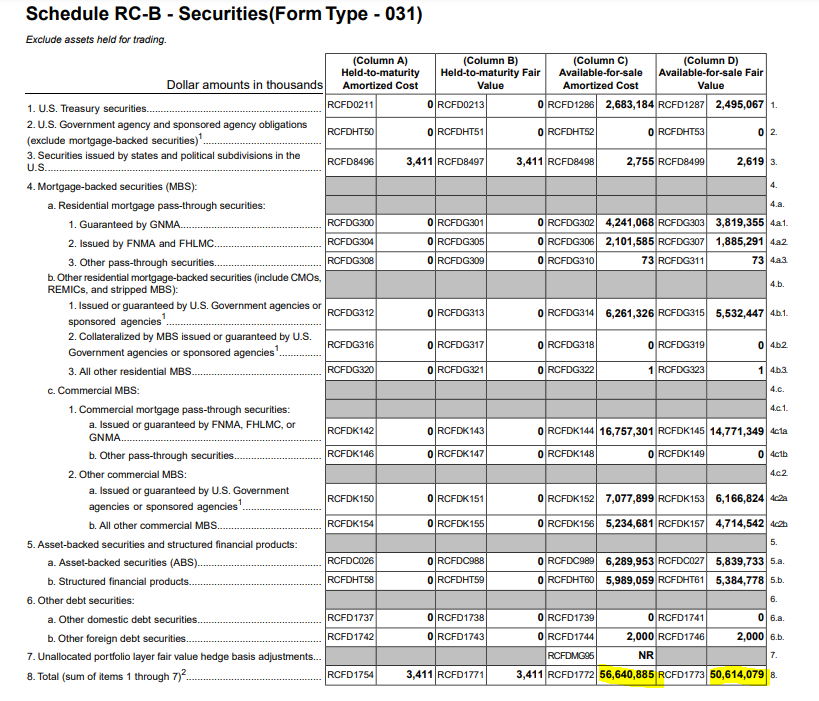

I actually think that banks can elect if they do let AOCI affect regulatory levels or not, but I am not sure. here is one Example. FFIEC report from Exchange bank in Santa Rosa. They hold a huge bucket of securities (~$1.5B) in AFS. MTM loss ~$150M Hence the fair value losses run to GAAP equity and reduce it from ~$350M to ~$200. However , despite th MTM losses reducing in GAAP book value, and the securities held AFS regulatory capital stills stands at $350M Second page below shows that Exchange bank has elected to opt out of AOCI. So I think the GAAP equity is $202M here and the regulatory capital is $355M. As far as I know any bank that I have looked at ops out of AOCI adjustments affective regulatory capital. I may have misinterpreted something Example ZOIN Bank - same form: I always imagine that if the CFO or his assistant one day makes a mistake and checks the box with a "0" instead of a "1" and sent this to the FDIC the bank could instantaneously implode with the Fed standing at the door on a Friday afternoon to shut the place down. Oops.

-

I think there are mistakes in this table or it's meaningless. Banks can elect if they put debt securities in the AFS or HTM bucket. If they put them in the AFS bucket, then they are taking a hit to book value (if the security loses value), in the HTM bucket, they do not. For regulatory capital purposes, both AFS and HTM get treated the same though and they do not take a hit to regulatory capital if they put it in either AFS or the HTM bucket (as long as it's not impaired or sold) . Regulatory capital is what should matter here. For example, BAC has $173B in tangible book value. Most of their securities are in the HTM bucket, so they have not taken a hit to book value on their HTM losses which are ~$115B. So tangible book would really be $173B -$115B = $58B which looks pretty bad in above table.