-

Posts

15,138 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

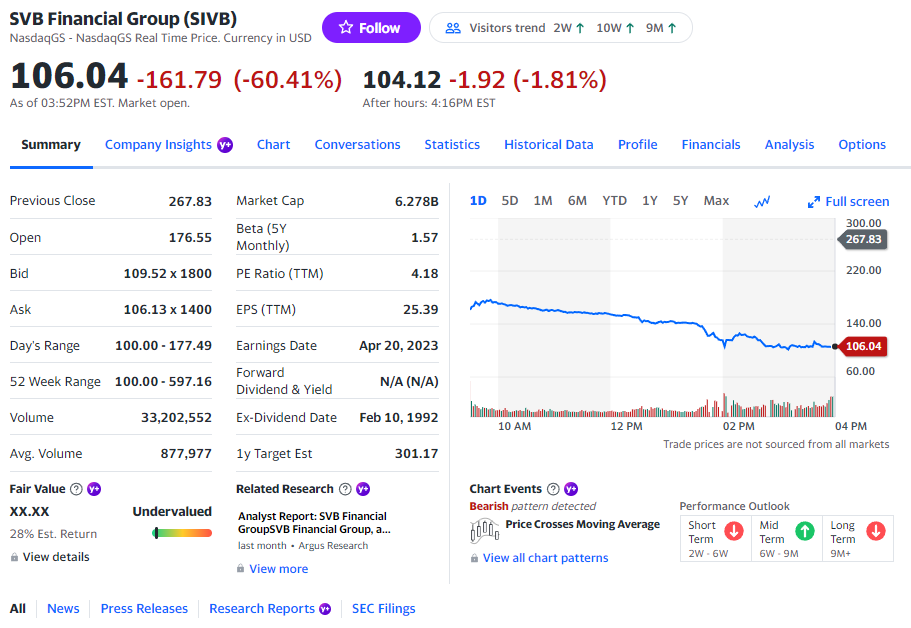

I think the bailout for depositors was done to prevent sudden deposit flight like the one who did SIVB in. There were likely many request from depositors the last few days to move fund away from banks that looked like they are having issues. With financials, perceived issues can very quickly become real issues due to reflexivity. Things can become much viral much faster than even 14 years ago during the GFC and it’s also a bit easier to move funds out. These frictionless systems can move very quickly in a herd like fashion even with many small participants as the GME short squeeze and similar events have shown.

-

I am a bit surprised that Signature bank is shut down. They clearly were on the ropes, but that was awfully quick. Maybe we should tax crypto to pay for this mess.

-

This is not Joe Sixpacks bank. Joe is protected anyways up to $250k and not many average people have more than that in a single bank account. These are corporation and VC firms who have CFO’s who made decisions. It was also Peter Thiel who literally cried fire and instigated a bank run here. are is well known as a libertarian. So, I am not sure sob stories “we couldn’t have known better “ are appropriate here. Feels a bit like trying to buy insurance after you had a car crash. In any case, the depositors will probably lose 20% or thereabouts above 250k. Everything below 250k is insured and can be paid out, so it’s not like Mondays payroll for a small form is in jeopardy here. Since liquid assets (even after haircuts ) are a bit more than 50% of the balance sheet, about 50% of deposits should be available very quickly (next week) with probably the other 30ish percent being paid out in weeks or so, all without rescue package. It’s not quite as catastrophic as it’s made out to be. The FDIC is government sponsernd but works like a Mutual insurance cos that banks need to pay in. If coverage is increased, then the contributions need to increase too, there is no free lunch.

-

I don’t think Berkshire is going to touch SIVB (too messy, he needs to replace management etc) but I think he might get some phone calls from other bank CEO’s that want to raise capital quickly. I am sure he is open to preferred deals with equity kickers with the right bank. SCHW might be a good bet. Berkshire not just get money quickly without fuzz, but also the seal of approval from Omaha, which is equally valuable.

-

Why would companies tap their revolvers? They only do this if they themselves are in a liquidity crunch. The bigger risk is deposit runs, Imo. I think those are unlikely, but there are few banks with strained liquidity and narrow focus like PACW that may have to do something.

-

This gal wasn’t the head of risk management. Looks like she was head of risk management for the UK sub which had little to do with the blowup. Head of risk management was Laura Izurieta, which came from Capital One and apparently had a carrier in banking.

-

Long list of filing on 3/10/2023 regarding SIVB. companies that held cash are RBLX, RKLB, ROKU, SGMO https://www.sec.gov/edgar/search/#/q=Silicon%20Valley%20Bank&dateRange=custom&startdt=2023-03-09&enddt=2023-03-11 Also, crypto of course involved with a stable coin failure: https://www.wsj.com/articles/crypto-investors-cash-out-2-billion-in-usd-coin-after-bank-collapse-1338a80f?mod=hp_lead_pos1

-

LOL, how many people actually read 10-K’s? I bet less than 1% of the people investing or even less than 10% of the people claiming to do a lot of reading when investing. To be fair to the banks, you need to look at both the asset as well as the liability side to get the full picture.

-

During the last financial crisis, E*Trade got into trouble, because they also started a banking sub and made it easy to get home equity loans. They had some toxic looking assets on the balance sheet that they could work out over time, but it does not take much for the customers to get running, especially since brokerage is very commoditized product with low switching costs. I guess these things repeat. Schwab is probably fine here, but what I don’t get is why even take a chance? Why not just create a short treasury ladder instead of going for long duration bonds for an extra 1% or so yield.

-

Nope. Banks can get liquidity by various sources, but for example overnite FHLB advances cost ~4.5% interest rates right now. That hurts if a large part of your balance sheet is parked in underwater MBS with a now 10 yearn+ duration and 2.2% interest rates (was probably 1.8% when they bought them) https://www.fhlbdm.com/products-services/advances/

-

BAC and a lot of other banks did:

-

What bank is most likely acquirer of SIVB?

Spekulatius replied to ratiman's topic in General Discussion

SIVB is a $200B bank. Only a major National bank can swallow this one whole. Think JPM, WFC, BAC. It’s too large for a bank like USB, especially since they are currently involved in the Union bank acquisition and have some rebuilding on the capital ratios to do. -

I am fairly sure the yield curve inversion will at some point revert whether we get a recession or not. Even if we don’t get a recession over time, the higher interest rates will reduce inflation and that will likely revert the yield curve into a more normal shape. The current shape is the result of the Fed tightening very quickly. I also think that current event in banking will reduce lending, simply because banks are going to be more concerned about the liquidity buffer. When you look at bank balance sheet, the liquidity has been drained because deposits have been mostly flat and lending has continued to increase at healthy rate, probably caused by inflation. As we know , the current holdings of under water MBS and treasury also has sterilized part of the banks balance sheet, as selling them would cause losses denting regulatory capital and banks don’t want that.

-

iPhone 11 Updated to iOS 16 and Now Refuses to Charge

Spekulatius replied to DooDiligence's topic in General Discussion

Charging has nothing to do with the operating system update. Since you swapped the cable, it’s probably an issue with your phone plug having problems to make the electrical contact. I would bring it to the Apple Store. I have an iPhone XR on iOS 16 and my son has an 8+ that still works as well. -

Yes, I recall I looked at them when you mentioned the stock a while ago. having lived near the Bay area, I was somewhat familiar with them and I think my inlaws have an account with them. They have pretty good metrics profitability (mid thirties efficiency ratio) due to having somewhat of a moat with Chinese people preferring to bank with them. it was simply something that I knew and have checked for pitfalls when the hell broke loose. Same thing with USB where I added to my position. Given more time, i would possibly pick up some spicier stuff like $ZION but I simply did not have enough time to double check the FFIEC filings, 10-K's transcript to get confidence here. I'd rather play it safe then getting into some gotcha's because I venture into something that I haven't fully checked out.

-

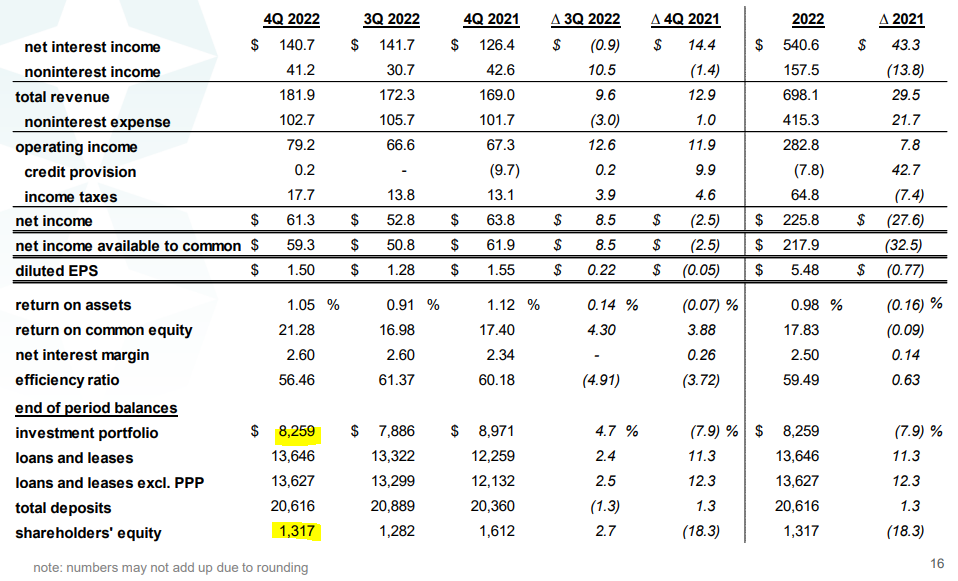

To me BOH looks pretty safe. They do have a large security portfolio as well - ~$8.3B with ~$1.3B in equity. this looks scary, but BOH has a very stable deposit base because there is very limited competition in Hawaii. I think they will be fine. They have traded at premium valuation because the lack of competition has enabled above average ROE with very low risk lending.

-

-

I do think that lending is going to get tighter because many banks will consider their liquidity buffers.

-

Banks Are fun - just have a look at $FRC. Bought more $USB $ESB and $CATY myself. I always wondered what Fintwit experts are seeing in that one. Not any more.

-

@dipod - what is your take at $ZION. they also got a bunch of AFS securities and moved a large bunch to HTM ( yellow flag). They also have seen a huge bump in deposits in 2020 and have seen some of them disspear. the bank is very cheap, if they can hold on to their security portfolio and they seem to have very low cost deposits, but there are definitely reasons why some investors are concerned, based on a preliminary look. Edit - i just saw that they also drawn ~$10B from federal funds already, so they are definitly liquidity constraint. those Federal funds loans are quite expensive and might lead to negative carry relative to their securities.

-

Regarding SIVB: https://seekingalpha.com/article/4585904-svb-financial-selloff-overdone-well-positioned-long-term#comment-94677294

-

It's not lending that did them in, it's liability management. These guys take deposits from the SillyCon valley VC bubble economy which have been fleeting, I think. They put those into treasuries that are deeply under water and then decided that they need to sell part of the treasury holding and realize losses. These idiots managed to own $120B in fixed income securities with an $16B equity base.

-

-

I think the idea of the USA making good with China was that the bigger headache was Russia at this point and the enemy of my enemy may be my friend. Russia had a rift with China at that time and Nixon/Kissinger was trying to exploit. Also, economically speaking, China has beaten itself into submission with Maoist policies, so wasn't really a threat beyond the nuclear weapons.

-

The US forgave Germany and Japan after they were beaten into submission and totally destroyed. If we can beat Russia into submission, then we will forgive them. I am not sure what you mean by forgiven in China's case. China was an ally in WW2. @Xerxes said it first. LOL