-

Posts

15,151 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

I do think that lending is going to get tighter because many banks will consider their liquidity buffers.

-

Banks Are fun - just have a look at $FRC. Bought more $USB $ESB and $CATY myself. I always wondered what Fintwit experts are seeing in that one. Not any more.

-

@dipod - what is your take at $ZION. they also got a bunch of AFS securities and moved a large bunch to HTM ( yellow flag). They also have seen a huge bump in deposits in 2020 and have seen some of them disspear. the bank is very cheap, if they can hold on to their security portfolio and they seem to have very low cost deposits, but there are definitely reasons why some investors are concerned, based on a preliminary look. Edit - i just saw that they also drawn ~$10B from federal funds already, so they are definitly liquidity constraint. those Federal funds loans are quite expensive and might lead to negative carry relative to their securities.

-

Regarding SIVB: https://seekingalpha.com/article/4585904-svb-financial-selloff-overdone-well-positioned-long-term#comment-94677294

-

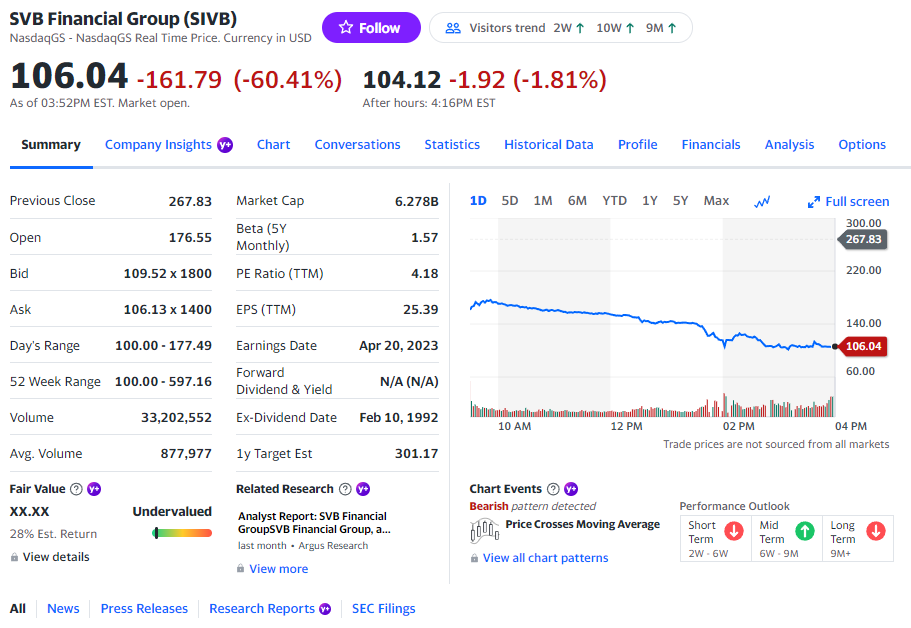

It's not lending that did them in, it's liability management. These guys take deposits from the SillyCon valley VC bubble economy which have been fleeting, I think. They put those into treasuries that are deeply under water and then decided that they need to sell part of the treasury holding and realize losses. These idiots managed to own $120B in fixed income securities with an $16B equity base.

-

-

I think the idea of the USA making good with China was that the bigger headache was Russia at this point and the enemy of my enemy may be my friend. Russia had a rift with China at that time and Nixon/Kissinger was trying to exploit. Also, economically speaking, China has beaten itself into submission with Maoist policies, so wasn't really a threat beyond the nuclear weapons.

-

The US forgave Germany and Japan after they were beaten into submission and totally destroyed. If we can beat Russia into submission, then we will forgive them. I am not sure what you mean by forgiven in China's case. China was an ally in WW2. @Xerxes said it first. LOL

-

The history of sanction and red flag enemies of the US would suggest that things take a long time to go back to "normal". Just look at Cuba and Iran? those are in the doghouse for decades (Cuba since the 50's, Iran since the late 70's). It doesn't matter who is president in the US either, these things transcendent party lines. In the case of Cuba, the reason for the sanctions (affiliation with Soviet Union, nuclear missile installation) is gone since the mid 90's. Yet here we are... I think Russia is in the doghouse with the US and the west for decades even after Putin is gone. The US is almost a #neverforget country as far as foreign policy enemies are concerned.

-

Bought some regional bank stocks $EBC and $CATY. I also added to $CABO

-

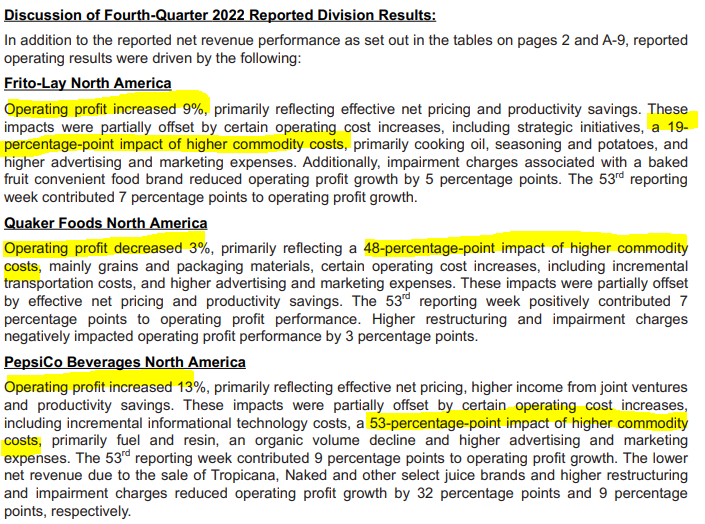

I actually agree that Pepsi for example is not price gauging. you can read their earnings releases. They just managed to pass on the cost increases (give or take) and their profit grew with inflation basically (9%).

-

I think this article is a bit misleading. There is more than meets the eye. $1.3B was a "deferred EPL charge" (what ever that is, but it looks like non-cash). Harbour had quite a bit of FCF. Taxes actually paid were a fraction of the nominal tax indicated.

-

If you grab a handful of ketchup single packs from your local McDonald (of course without dining there), then there is no inflation When times are really tough, I go there for inspiration: http://www.bumwine.com/compare.html The Fed can also deflate stonks so we can buy more of them. That also helps with inflation.

-

I also think the Fed is in the "business" to impact peoples and by extension the business behavior to transmit their monetary policies. That's why Powell and the other Fed governors do these talks and the Fed publishes their notes and all those things. If the Fed truly believed that behavioral aspects don't matter or they can't influence them, then they would do nothing of this sort and just raise or cut interest rates or change monetary policies without comments or pre- announcements. That's clearly not what they are doing.

-

Moral philosophy transplanted from Disney thread

Spekulatius replied to nafregnum's topic in General Discussion

I think if you believe in God, you may as well believe in Santa Claus. You don't need god for anything - how life started out, to explain the Universe, or the foundation of ethics. Santa Claus is a convenient and comfortable belief for 4 year old and god or religion is convenient and comforting belief for adults. I also think ethics are developed evolutionary both on a biological as well as on a societal level. For example it is human (or mamal) instinct to care for our young, because it makes evolutionary sense to do so. If we would be a species that is programmed (by evolution) to eat the weak younglings to let the strong survive, the ethics of a society that this species develops, would likely indeed condone and reward this practice. -

Oops: https://finance.yahoo.com/news/windfall-tax-wipes-north-sea-120711857.html

-

Great podcast episode recommendation thread

Spekulatius replied to Liberty's topic in General Discussion

Great podpast here from odd lots regarding pricing power: https://www.bloomberg.com/news/articles/2023-03-09/corporate-earnings-calls-provide-clues-on-inflation-odd-lots-podcast?srnd=oddlots-podcast#xj4y7vzkg "Price over volume" seems to be the new corporate mantra. -

As to why Cheetoh's went up in price - listen to this oddlot's podcast. The new corporate mantra is "Price over volume". It means that companies started to rise prices even if they lose some volume. There are a lot of examples cited: Pepsi (double digit price increases), Wingstop (raised prices when chicken wings wholesale price went up and didn't lower them when they went down), Hotels (occupancy down compared to 2019, prices up), Cruises (same) . You can also look at energy (crude) or automobile (less supplies, higher prices). The list goes on and on. It's not just limited to consumer goods, it happens in industrial markets or services as well. This will end when the consumer / customers start to push back presumable. So far that has not happened yet. Another thing to note - people and business are now already conditioned to see price increase and don't push back as much any more. This shows that inflation has a strong behavioral aspect. in other words we have already sticky inflation that creeps up in many, if not most goods and services. https://www.bloomberg.com/news/articles/2023-03-09/corporate-earnings-calls-provide-clues-on-inflation-odd-lots-podcast?srnd=oddlots-podcast#xj4y7vzkg

-

@changegonnacome Yes, that’s correct. Inflation is a flat tax on everyone and we know where tax checks go. Inflation is the government way to silently reduce liabilities and obtain more taxes at the same time.

-

@longterminvestor Thx for the comment. I wasn’t really following this story closely, but it was clear Berkshire had the inside track in this deal. let’s also not forget that this happened in a choppy market, some of Allegheny’s equity holding were affected, so with a fair bid from Berkshire at hand that sure is going to close, it was hard for an outside to make much more compelling bid.

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

LOL, it's like playing Jumanji when you get your renewal letter: -

I take the opposite side on this. I think it will take a long time until Russian stocks trade again in western markets.

-

I think it's too early to draw conclusion from the investigation. My guess is that if the Ukrainian pro government organization was indeed involved, it wasn't done with the Ukrainian authorization. The reason is simple - the truth on these type of things do come out and pot. down side too highvs the pot gain (as we see now). The pipeline wasn't really all that important - it was idle and was supposed to remain so. I thought it was a russian psy operation with the intend to create fear in the west , but that does not seem that likely now. We do not even know if the leak is true, but it does come from sources that have been credible in the past (major German TV station). If it turns out that the Ukrainian government was involved, then Ukraine will lose a lot of support in the Germany and likely the rest of Europe as well.

-

Interesting results from Nordstream leak investigating from credible sources: Seems like a pro Ukrainian group was involved.

-

In every war in the last 100+ years, nations went into it unprepared and vastly underestimated what they needed to produce and move to keep the front lines supplied. I think every war is entered with the assumption (spoken out or not) that it only last a few weeks or at most month and that just isn’t the case any more. Wars tend to last longer nowadays and they are typically won by those who can outproduce and get their material to the front lines (logistics) in time. I think it was a General Bradley who said that the war in Europe was won by Victory cargo ships , Jeeps and Mack trucks. Germany had none of these, stuff was moved often by railroad and horses, believe it or not in WW2.