-

Posts

15,151 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Is Concentration a better strategy than Buy and Hold?

Spekulatius replied to Viking's topic in General Discussion

Munger has a way way higher risk tolerance than Buffett. Buffett also took some chances early on, but never to the same extend than Munger did. Buffett also was actively involved as a control investor when he bet big. He left up as little as possible to chance and other people. I don’t think Munger ever did that either. -

Phenomenal businesses that don't require any capital

Spekulatius replied to LearningMachine's topic in General Discussion

META and Google each spent more than $30B in Capex last year. That’s hardly asset lite. -

Is Concentration a better strategy than Buy and Hold?

Spekulatius replied to Viking's topic in General Discussion

@ValueArb I try to answer this. I consider myself a value investor too and buy often things that are out of favor so to speak. There are a couple of reasons why I like to keep more positions around. 1) Some positions are legacy positions and they are holds to me. I wouldn’t buy them at current prices , it I still think they are decent values. Furthermore, they have proven themselves and performed well, So I would like to keep them - maybe trim them but I like to keep a position. An example would be $ORI. I bought it in summer Fall 2020. I felt it was an OK business with some tailwinds to its title business. The execution surprised me to the upside and managment has done better that’s I thought and thry distributed way more cash than I thought. It have trimmed the position a bit, but kept most of my shares. I am very reluctant to sell shares. 2) Some bets are “theme” plays where I believe a sector may be undervalued. Let’s take a concrete example and look at the issues in the banking sector. But what’s the best play? there clearly is some tail risk here. I guess I could just bet on one and cross my fingers. Or I could buy an index and call it a day. My preferred approach would be to buy a few banks that I think are money good and hey some diversification. 3) I think you don’t know the stock really well before you own them. There are a couple of reasons for this. One of them is that having money at stake sharpens your sense. But there is a more profound reason: If you buy a stock your research is Post fact um so to speak. Everything seem to make sense as to how things has evolved in the past, at least if you decided to make a buy decision. But when you buy this stock and things start to evolve and new issues come up, Management decisions can flabbergast you. I often find that I don’t know the business as well as I thought and I think buying a new stock is inner Italy much riskier than holding one, from my POV. This even more so if you make contrarian bets as you often do as a value investor. So even if your research a stock , you know less than you think and also let’s not forget, that luck plays a role here too. For me, it lead to tossing out a lotmof position after a relatively period of time (and often losses). The situation is sort of like reading about the GFC and living through it as an investor. When you read about it now, of course you know the outcome and the outcome makes perfect sense. You were fine , if you held your stocks a couple of years (unless they were in a permanently impaired group like banks). but that’s all post factor. It did not feel that way when living through it, it probably felt more than the people who loved through the depression in the 30’s which of course had a much worse outcome. That's how it is with researching a stock and owning it as well, I think. 4) Sometimes when I research stocks, I come across one that I really like (management, business quality) but they are not particular cheap but neither egregiously expensive. I think they are great companies, I like to buy a small position in the with the intent of perhaps buying more later. That also goes along with 3) where I think I know the stocks better that I own, even in small size. Recent examples of above are $BRO ( inspired by @dealraker and $PAYC which is an unusual tech company I found through Motley Fool ) 5) I believe luck plays a bigger role than most investors give it credit for. -

Is Concentration a better strategy than Buy and Hold?

Spekulatius replied to Viking's topic in General Discussion

The survivorship bias with concentrated investors is something we all need to keep in mind. How many Dealbrakers are there for any @dealraker. How many Buffons (or Biglaris etc) for every Buffett? I know quite a few people who blew up their retirement account in the tech stock bubble in 2000. Lots of great performing growth stock investor blew up in 2022 and destroyed their track record. It’s a super hard game and many underestimate the impact of luck and path dependency on the ultimate outcome. I would posit that if you intend to play this game long term, surviving need to be the first and second bullet point on your checklist. Diversification does that- other take losses quickly. Thats not to say that you shouldn’t sometimes swing big or perhaps try the coffee can approach, but if you roll the dices too many times, 2 sixes will come up eventually. -

How do you guys deal with false answers? I find errors in a lot of answers that come back - probably 30% of the answer are partly wrong , if not more. For example, I asked about the spec for my air conditioner unit , based on. Y model number, because I need to replace this spring. In the answer below, ChatGPT was correct about the capacity, but incorrect about the SEER rating (The SEER rating of my unit is 10) x and yes, it is very old. This is just one example. Some of the math answers that I asked it were incorrect. Sometimes, you can find out directly by asking the question in a different way and you get a conflicting answer. Sometime, ChatGPT just makes facts up. I think it’s like a teenage who thinks it knows everything and makes reckless predictions instead of just saying “I don’t know”. How do you use something like this for work? I am flabbergasted. maybe with coding and very binary stuff, you just test it out, but for the rest of the application, it’s a mixed bag. I did find it working well to create outlines and sometimes generates storylines (like essays). Those are easy to correct though, but in other cases the half truth it spits out can lead to very damaging results.

-

I forgot who brought it up - but I did like MBB.DE (German Holding co) good enough to buy a few shares: https://www.mbb.com/ir/praesentationen.html I think it's pretty cheap as well. Added to a few positions in LUV, NTDOY etc.

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

Spekulatius replied to thepupil's topic in General Discussion

Reits are not bonds. Some like NNN are very much like bonds or even office Reits with long duration leases often are, but others like MF reits that reprice yearly clearly are not. For example since the 1990's, I believe commercial property as a group traded at higher Cap rate than the 10year risk free treasury. However, in the 70's, commercial property actually traded a lower cap rate than the 10 year treasury. Why - because commercial property owners could generally raise rent with increasing inflation, so there was an inherent inflation protection build in which of course was appreciated by property owners. Reits as an asset class did not exist yet in the 70's as far as i know, so we can't look at that part of the stock market history. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

Spekulatius replied to thepupil's topic in General Discussion

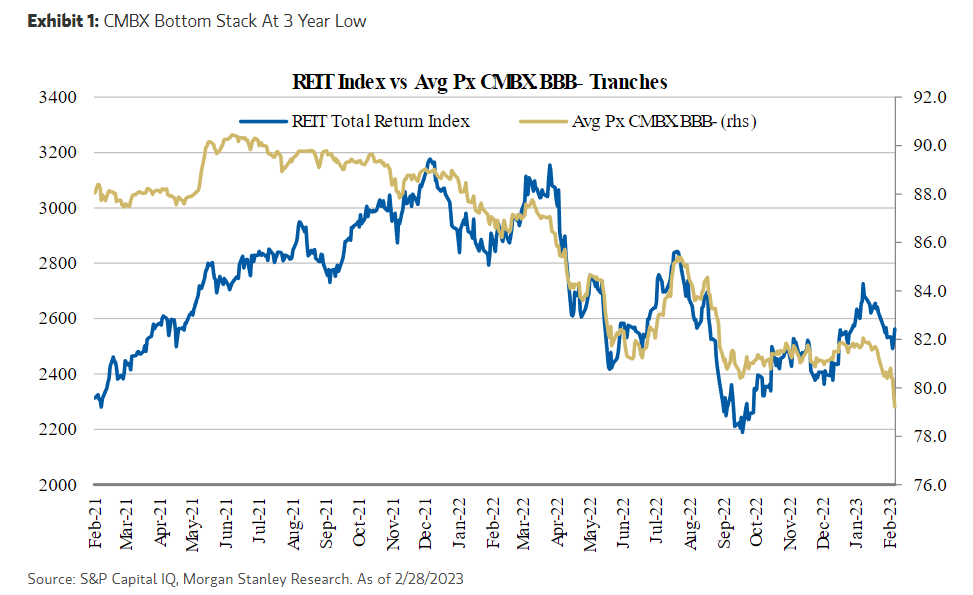

Yep, found a similar chart from MS. Shows the BBB- (lowest investment grade) CMBX price which apparently correlates with Reit prices. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

Spekulatius replied to thepupil's topic in General Discussion

The economy might break, but it's not clear to me that MF Reits will break. 10% interest rates do not occur in a vacuum - they are likely are caused by high inflation. My guess is that 10% interest rates mean ~ 10% inflation which also likely means 10% (likely higher) rent increases. So, depending on the rate / inflation trajectory, it might not hurt then Reits as much as you would think. -

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

Haha - swingtrader Warren: -

You run out of bankers pretty quick that way.

-

All you need to know about the last 2 weeks worth of financial news from El risitas:

-

-

Added some $CASH and $CPT today.

-

Is Concentration a better strategy than Buy and Hold?

Spekulatius replied to Viking's topic in General Discussion

it is interesting to see that seemingly detrimentally different approaches of Buy and hold (coffee can) or concentrated swing trading can work well. I have heard about people who did well using momentum strategies as well. I think the important insight is to find what works for you - where is your edge in terms of knowledge and temperament. I am more of a diversification /sleep well kind of kind of guy. Quite frankly, you can do pretty well owning just index funds (at least in the US0) as long as you don't do stupid trades. Different people, different strokes. -

What stealth QE? A banking crisis is pretty much equivalent to quantitative tightening. The Fed does not lend to business or individuals , banks do. If they hold back on credit, "main street" will feel it. There is some fuzzy logic being repeated by many that a banking crisis will lead to money printing. This is false, imo and we only need to look at the GFC and it's aftermath to check that the "money printing" went nowhere. It's quite simple actually - what do you care of the fed opens the discount window and lends to banks to improve their liquidity or similar measures. You can't use any of this and as long as the banks don't lend to you, this will do nada other than preventing a crash in the financial system. This is very different than the checks sent to most people in the pandemic.

-

The Fed does not give the banks par value for their securities, it lets them borrow in exchange for par value for the securities, but they still need to pay the current 4.5% ST interest rates. So this may solve some liquidity issues, but it becomes a negative carry trade and the banks will lose money doing so.

-

Banking or any to get financial has a high degree of reflexivity attached to it. That means that perception can very well become reality. Or in other words, as long as people believe banks are stable, then they are stable - if people don’t trust the banks, they will become very fragile. There simply isn’t a bank that can withstand a 50% drawdown of deposits. I think almost no bank is designed to withstand such a drawdown. As for inflation - any crisis of banking system is deeply recessionary and deflationary. Bank now will have to increase their liquify buffer to withstand bank runs better which means less lending. I don’t really see anything remotely inflationary in the current development, unless LT interest rates go down so much, that the ~$4.4T in securities held by banks that are currently underwater go to par again and everyone continues as if nothing has happened.