-

Posts

15,074 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Sudan is an interesting case, a war that has been going on for a decade (lost count) and probably killed hundred of thousand. however, what is the what is the west supposed to do here? What about the African neighbors Egypt, South Africa ( a bit away but still closer than we are). I think it’s their job to do something here and maybe the west can help? Is the US supposed to go with an army there while neighbors do nothing? I don’t even think we know whom to back here? None of the parties in this civil war are aligned with the US really. On Jemen, I agree. Backing the Saudis should be so over. Its less of a high spheres thing, it’s more that you got to pick your fight.

-

I Need a Laugh. Tell me a Joke. Keep em PC.

Spekulatius replied to doughishere's topic in General Discussion

This guys is pretty good: -

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

Lifted from the Massimo account from X: -

The more I think about it the more I believe that the CCP putting money in banks is more of a salvage operation than stimulus. For stimulus the CCP needs to give money to consumers who hopefully spend it, but that’s not what we are seeing here This seem tells us that the CCP is afraid of their financial system falls apart, just like when Congress decided on TARP in 2008. Not exactly bullish.

-

It’s cyclical, always has been.

-

If only ignoring problems (moving on) would solve them. Doesn’t work in engineering that’s for sure. Ignoring a problem has never worked for me there and likely grows into a larger problem. I guess I should have studied sociology and politics instead. So simple. Also, Russia will run out of sons too. Demographics are terrible and not in Russias favor. Russia can’t keep this up forever. They recruit 30,000 mean/ month for the war. Thats gives you an idea about the consumption rate this war has for the Russians. Also, the Rubel is back to trash levels of about 93 Rubel for he $ on grey market. Roughly 2 x Pre war. that means imports cost 2x too. The price economic data on the surface does not look to bad with ~3% GDP growth but that’s because the Russian economy has to switch to a war economy, this growth does not go into consumer goods and services. Interest rates were raised to 18%. An interesting stat from another war - German production of goods was rising until 1944 - with pretty much everything going into war efforts directly and indirectly. In 1944 much of Germany was already destroyed and the war was lost. I am just putting this out there k because some people claim the the economic data proves that Russia is doing well economically.

-

This is a classical case where you need an activist. On the topic of FI I f management a bit of keep away, I would agree with this, but I think they really have proven that they have no cause what they are doing in the US. Current management bought this, so I don’t buy excuses here. Now it’s the time to do a change because post season is pretty much done, so if management is booted now, the new management can put some things in motion for next season over winter. Otherwise there a risk that we get that we get another tardy trading update late ins print that ahem things yet didn’t not work out again, excuses of this and that and the stock is dead for another year. Also, I want to point out that the people who create a mess are rarely the best people to fix it. I still have a very small starter position in this because of above concerns but I think this is a fixable situation- it’s not like we are trying to send humans to Mars here.

-

Up 5% today. Should have waited a little longer…

-

A first grader with a map can figure out that there is not going to be a war between an Israel and Iran. How do you make war with a county ~600 miles away? Sending a couple of drones won’t so much and and sending troops though 600miles through hostile counties isn’t really possible. Iran does not have the air power, they just get 5x what they sent over in return. Hezbollah is on its own, the Iranians pretty much signaled such. There will be some symbolic acts of retaliation and that will be pretty much it.

-

Sold most of my $BABA. Worked well enough. While a I don’t mind smaller portfolio position , that particular one does require more ongoing research to keep current than it’s worth for me.

-

I am not sure either. I think the chance that a Democratic Revolution swipes away Putin isn’t large, but surprising things have happened - Ceaucescu was one of those. I think there is a much higher likelihood that a coup sipes away Putin and somebody close to his inner circle eff’s him off, but that’s not something we can predict , much less count on. Andy Grove famously said “Only the paranoid survive” and that’s true even more so for dictators & autocrats than for business.

-

Putins idea how this works is you play by my rules but none apply to me. <<insert nuclear saber rattling sound here>> Obvious play on gullibility. There are some nice mushroom clouds from Russian ammo depots in YT. Imagine what Ukraine could do with a few hundred cruise missiles.

-

Pretty good summary how Russia tries to reroute trade flows. Easier for some goods than for others: https://www.wsj.com/world/russia/putin-russia-trade-routes-charts-maps-921aa78b?mod=finance_lead_pos3

-

Looks like the UAE is the hub and the Indians are well knows to buy Russian oil too. Saudis aria is is greenwashing the discounted Russian oil too, they use it domestically so they can export more of their own. How to prevent his from continuing is a challenge because you would need to effectively sanction UAE, Saudi Arabia and India as well. I also want to point out that both Biden and a Trump have avoided a direct confrontation with an Iran Trump did not respond when Iran shot down an US drone over international waters. So I doubt he would deal much more aggressive with Iran than the current administration. All these conflict do not seem to change the demand and supply solution for energy in the longer run. In the short run, they leads to disruptions until the flows get rejigged but at the end, the volumes always seem to get to market.

-

@LC I do much more work when I start a position then I do later after I own a stock for a while. I really only pay attention when the stock moves a lot and take a second look. LW is one where I averaged down but not to a large position. After looking at the new info that caused a drop, I am just staying put since I do now know yet, if the issue is more temporary in nature (meaning it takes less than 1-2 years to play out) or if the business is worse than I assumed.

-

The Iran has more money because crude prices are higher than 4 years ago. The US and Europe does not buy Iranian crude but others do (Chinese, Oman, Bangladesh and who knows who else). The rest of the world does not follow, they sell a commodity and for a discount you can sell almost any commodity on size , somebody will buy it. Russian crude finds buyers too despite being sanctioned by western world, they just have to sell it at a discount. India is a big buyer. The nuclear treaty does seem to not work out. I agree on that but that’s a different issue from above.

-

@LC Does it reduce your returns significantly, if you don’t keep up with everything? I have some smaller holdings where I never managed to establish a full position. I review them a bit maybe every 6 month. I had a few with negative surprises but also a few that performed better than I thought. Just keeping up every 6 month (because it’s in my portfolio) I sometimes find good opportunities to add when I think the fundamentals are better than the stock price performance suggests.

-

This is also an opportunity for Chinese stocks and a risk for Indian ones. The valuation for Indian stocks are sky high and could easily come down a lot. In the meantime here are very cheap Chinese stocks if you can get past the political risk. but then again, Russian stocks were cheap too in early 2022. As far as the money going out part is concerned, Chinese companies have been increasing capital returns. Alibaba is a prime example with dividends and buybacks but there are many others. I think the best companies to own are those that focus Chinese domestic consumption and have a shareholder friendly management and are somewhat aligned with the goals of the CCP. Anta and other sports good manufacturers seem to check some boxes here.

-

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

@nwoodman I have their Esentials track on my phone but when you watch their live acts it’s on another level. Pure energy. Reminds me off me of Iggy Pop in his day: It’s on my bucket list to see them live one day. -

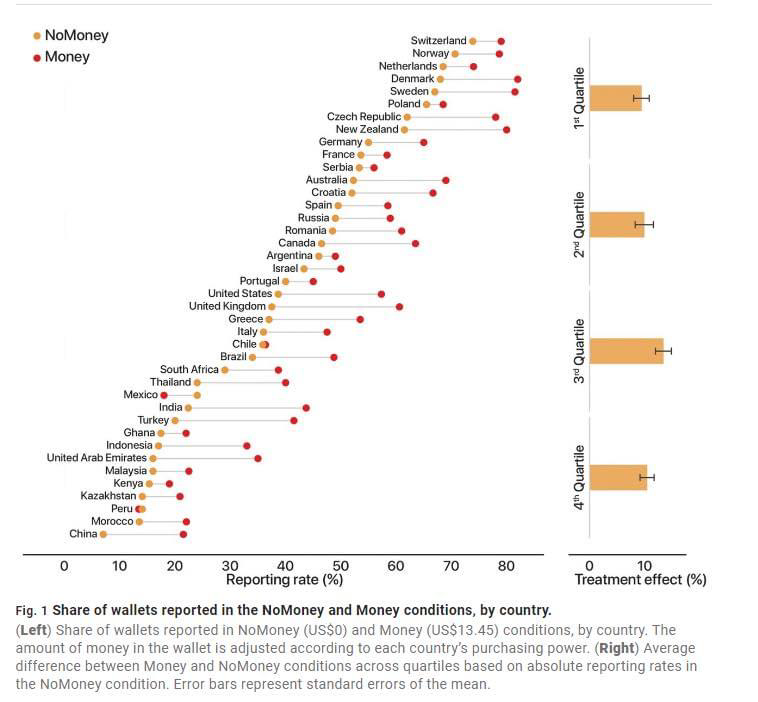

I posted this before, just a reminder how China’s works - chance to get your lost wallet back, broken down by country. My take is you do need a high premium to invest in China; the default risk for government bonds is probably not a good measure.

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

Uhg. Now like sounds like Berkshire is a target day retirement fund. -

Iran isn’t exactly thriving but how do you prevent them from selling their oil. They have plenty of it and there are plenty of buyers for a small discount.

-

Funny how this can work out. 10x in revenue and zero appreciation. But but stock price always follows us ones performance…. IF you buy at a reasonable price.