thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

@Gregmal , don’t you live off your investments? Or so you have a job? How is your money, “money you don’t need”? it you’re living off your nut, then volatility and drawdowns have deleterious effect on your wealth and impair capital. I know I’ve said this before, but you often say things like volatility doesn’t matter, it’s just an opportunity, but then also say “you don’t need that much to retire” or “the 4% rule is bullshit”. In my view it’s completely contradictory. you either aren’t living off your investments and have other sources of income in which case volatility is a feature not a bug, or you are living off investment in which case volatility and sustained drawdowns impair your capital. I have a job that pays for the household expenses, but still don’t want to impair capital. I lost about 40% in a month during covid. For me the traumatic part was not the volatility/drawdown itself, but rather how quickly the fundamental outlook of that which I owned changed. What I thought were good investment with a margin of safety were not. I was very poorly positioned. I made some changes and survived and had my best 3 years after it, both relative and absolute, but it absolutely shook my confidence, and am much more diversified now (my Nw is also about 4x as much in nominal terms so that also impacts my thinking). I feel like there are alternative histories where if the fed acted differently, I would have lost a huge amount of my money and been severely underwater on my (at the time) 98% levered house. Instead it all worked out swimmingly.

-

I again think that the discussion on stocks vs bonds is overly binary. For me it's choice of 100% stocks 0% bonds or 60-80% stocks, 20-40% bonds. In my opinion no sane person is going to go 100% bonds/cash as that is clearly destructive to long term wealth and introduces a debasement tail risk. I'd really struggle to sleep at night having all my assets in nominal instruments. bonds have historically generated positive real returns (and will going forward), but you still don't want to have everything in them if "the big one" (in terms of currency) ever happens. Rather than run a bunch of monte carlos or look at 1000's of historical scenarios, I prefer a more simplistic exercise. Over the last 10 years, US stocks (defined as VTSAX) have returned 12.2%/yr. (215% cumulative) Over the last 10 years, US bonds (defined as VBTLX) have returned 1.5% / yr. (15.6% cumulative) Over the last 10 years, a 60/40 portfolio (defined as VBIAX) has returned 8.0%/yr (116% cumulative) Notice how the 60/40 returned about what you'd expect. (12.2%*0.6=7.3%)+(1.5%*0.4=0.6%) = 7.3%+0.6% = 7.9%. the 60/40 portfolio did a little better in practice but there wasn't a lot of rebalancing benefit (like 0.1%/yr). the cost of decreasing volatility by investing in the balanced index has been pretty freaking huge. About 100% of starting value. Starting with $1mm, the 60/40 guy has $2.15mm and the 100% stocks guy has $3.15mm What will that number be for the next 10 years? Well we know that absent defaults (the agg isn't going to have many defaults and neither are IG bonds), bonds will make their yield to maturity if held to the duration of the index. So the duration/maturity of the bond index isn't quite 10 years, but let's just say it is (one can buy 10 yr fixed income if one wants to). The barclays aggregate has a yield to maturity of 5.1%. So going forward, rather than make 1.5%/yr, bonds will make 5.1%/yr, if held for long enough. Let's say stocks defeat the naysayers and repeat the last decade's amazing returns, tey make 12.2%. So a 60/40 portfolio will make about 9.3%/yr vs 100% stocks at 12.2% (assuming no rebalancing benefit). This is $2.4mm vs $3.15mm for a $1mm starting nut. There's still a big difference and a high cost of "safety" of bonds, but it's 28% less than the prior decade. ($715K of wealth difference instead of $1mm). IF you think stocks do 8%/yr instead of 12% and assume no rebalancing benefit, then the wealth difference is $220K in favor of 100% stock portfolio. The cost of lower volatility of the balanced portfolio is 78% lower than the prior decade. Of course as you get closer to or even lower than the bond yield on forward equity returns, then there is no cost to having a substantial portion in bonds.. Portfolios with bonds will end up with better returns. So I'd frame it as something like this, If stocks make 12%/yr (repeat wondrous bull market), the cost of incremental safety from carrying bonds will be 30% less than the prior decade, but still substantial. If stocks make 8%/yr, then the cost of safety will be 78% less than the prior decade. If stocks make less, there will likely be little to no cost of safety. I can't really predict the market's next 10 years of returns. I don't know, but I think the above supports that holding bonds will have significantly less opportunity costs than it has in the past. In my view, the above logic supports a weighting to bonds significantly greater than the prior decade (which for me was basically 0). For now that's something like 20-25%, and going higher. Also, anyone who's been investing and saving for the prior decade should be many multiples richer in 2023 than in 2013. As you get richer, keeping the money instead of optimizing for absolute highest NW makes sense for many, but not all people. There are some people who are inclined to take more risk as they get wealthier. I am not one of those. My goal is to reduce dependence on my labor via accumulation of capital. my goal is not to have the highest possible net worth in 50 years. If someone who invest in all stocks ends up 10,20,30% wealthier than i do over the next decade because stocks do really well, I'm not going to care. If it's 50-100%+, I will care. But either way if stocks do very well for next decade, then I'll be just fine. I'd also posit the rebalancing benefit will probably be higher in the next decade than in the last. This tilts the math in favor of including some bonds. Also we haven't taken into account portfolio withdrawals and sequence of returns, which will tilt things further to the less volatile portfolio that has bonds. I don't really think the inclusion of bonds in a portfolio is about market timing or predicting doom and gloom. I think it's about bond yields (nominal AND real) being substantially higher than they have been and equity yields do not appear to be any higher today than they have been; owning more bonds today than in the past 10+ years seems like a rational response to changes in relative pricing. It's fundamental investing. The inclusion of bonds will probably have lower opportunity cost than it has and may even lead to better outcomes than all stock portfolio. the era of financial repression is over (at least for now). we have positive real rates. we aren't forced to invest in just risk assets anymore. the entirety of this ignores any potential value add from active management. it also ignores the more extreme upside/downside of longer term bonds, which I invest in to be a little more grey. A 20 yr IG bond at 6.2-6.5% is more competitive w/ equities, but also far less predictable in return over an intermediate horizon so the math isn't quite as clean as the above. It's also very US centric. Prospective US bond returns look MUCH better if you think stocks outside the US repeat the prior decade's shittiness. tat wouldn't be my prediction, but just saying that US stock market participants have been incredibly spoiled of late relative to ex US. EM index has made 3.5%/yr for 10 years and developed international 5.1%. US bonds yields are higher today than either of those. I'd wager the ex US indices will do better going forward, but strictly backward looking.

-

5,10,20,30 year yields all now > October 2022 highs.

-

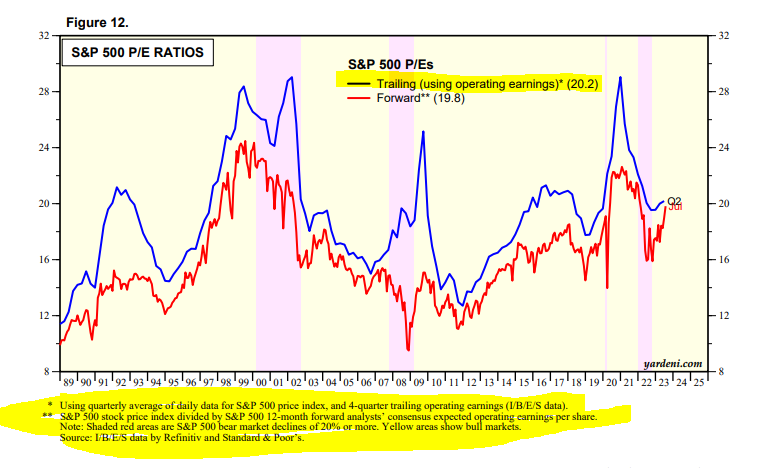

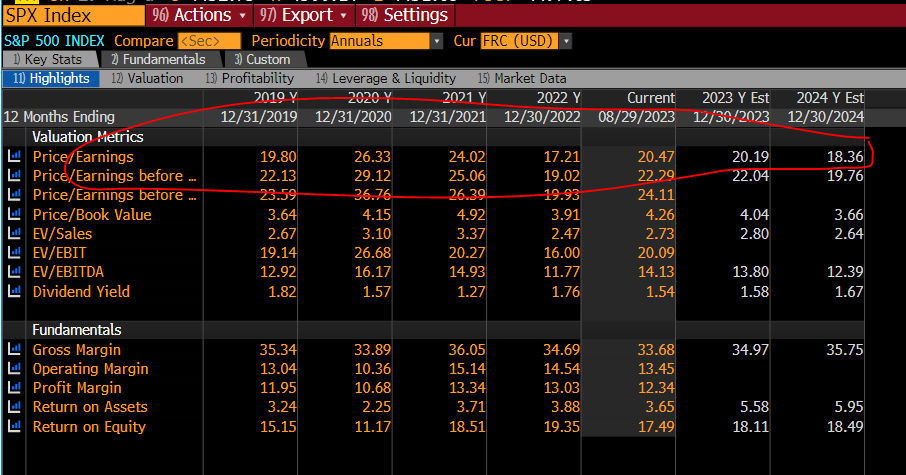

not trying to get into some kind of index multiple tit for tat here, but Yardeni is at 20x trailing operating earnings for S&P 500, Ibbotson as source. there's like 40 PE's in this YArdeni PDF. Let's just agree that it's somewhere between 20 and 30x trailing lol (which is a huge delta) https://www.yardeni.com/pub/stockmktperatio.pdf

-

in fairness, there's a gap b/w "as reported" and "operating earnings" that gets you to more like 24.5x

-

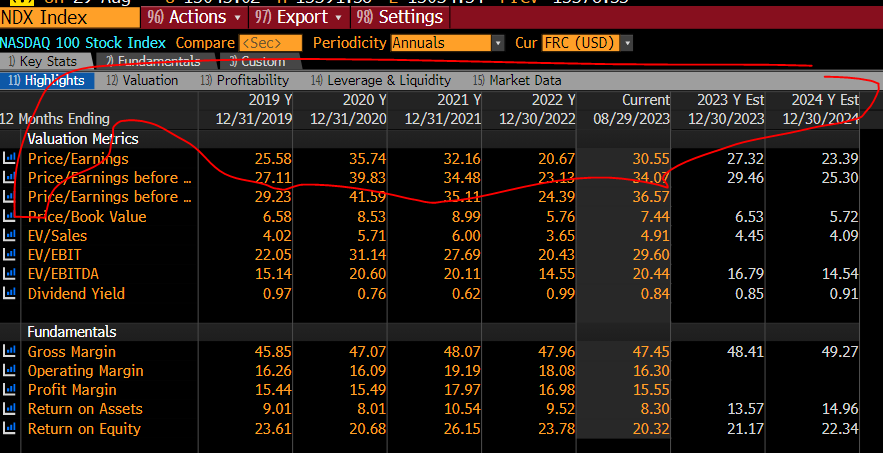

that's only for the nasdaq 100, which isn't the market. I just downloaded the entirety of the S&P 500 (which is most, but not all of the broad market / a selected portion of the profitable US market). Median PE is 20.5x Median Fwd PE is 18x. Summing up all forward year estimates and market cap (the right way to do index PE) you get 18x fwd. Now you can take issue w/ next year's earnings or some of the top guys, but I simply don't see the broad US mkt at the kinds of current multiple you do. Here is the Wall Street Journal. S&P 500= 20x Nasdaq =30x. "PE Data is based on as-reported earnings" S&P provides a comprehensive excel of S&P 00 earnings. They have S&P at 19.5x 2022 EPS 20x 2023 EPS 18x 2024 EPS https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

-

I see you're referring to earnings yield not total return. That makes more sense now, but what's all this 30x talk?

-

LTPZ, this is the only ETF (that i could find) that owns long term TIPS, trades $7mm / day, $635mm market cap It charges 20 bps/year for the privilege, but I'm willing to pay that given I'm buying these with dividends/interest coming in and sometimes buying only a few k at a time which is quite cumbersome/impossible if you're buying such small pieces of actual direct treasuries. 20-30 year TIPS yield about 2% real. If you bought this ETF in 11/2021 when real rates were -0.5%, you've lost about 30% in total return since then, which is roughly in line with the 32% one would have lost buying TLT. Effectively the long duration of long term TIPS offset any gains in par value coming from inflation increasing your principle. Long term TIPS are a terrible short term inflation hedge if real rates rise by 2.5% as they did. I don't think they'll continue to rise, and if they do, Ill buy much more. A move to 4% real would cause another 38% decline for these things. I'd be tempted to put a huge portion of my money at that price. ~20% in bonds of varying kinds, 2.5% in LTPZ. long term TIPS can only be bought in an IRA. paying tax today on accretion of principle that you won't get until 2053 would be a crazy thing to do. very unnatractive for taxable account.

-

disagree. If earnings grow 10%/yr w/o interruption then stocks will make ~11%/yr over next 7 yrs. If exit @ 15x vs current 20x then ~7.2%/yr. In both cases that beats bonds (if we assume one earns the YTM over the 7 ish years of duration. I like bonds but this math doesn't make any sense to me.

-

you can do this by looking up managers Form ADV’s on the SEC website. This will get most RIA’s and funds in a given geographic area. search by firm rather than individual. Then read up on the ones that look promising. https://adviserinfo.sec.gov/search/genericsearch/grid goes without saying the vast majority of firms don’t hire people from “non traditional” backgrounds and this will be a long slog / low hit rate exercise. But there are many people who started out doing what you’re doing. You can email me at thefinancepupil@gmail.com. I can’t promise that I’ll be helpful but can try

-

Is this a China ETF?

-

So if you had to pick a number for the delta between 100% VTSAX and 70% VTSAX / 30% VBTLX , over the next ten years, what would it be? Is it greater than say 1-2%/yr? If so why? I suspect you will say "who cares?" to which I would respond, "anyone w/ a 401k". I care about index returns for about $70K/yr. It's material to me. It may not be material to you. But I also care about it for the portion of my portfolio I control. I don't have a high degree of confidence in generating HUGE outperformance/high absolute returns. A certain 5-6-7% / yr with consistent carry and low risk of nominal capital impairment is a nice tool to have. It's not THE tool, but it's A tool.

-

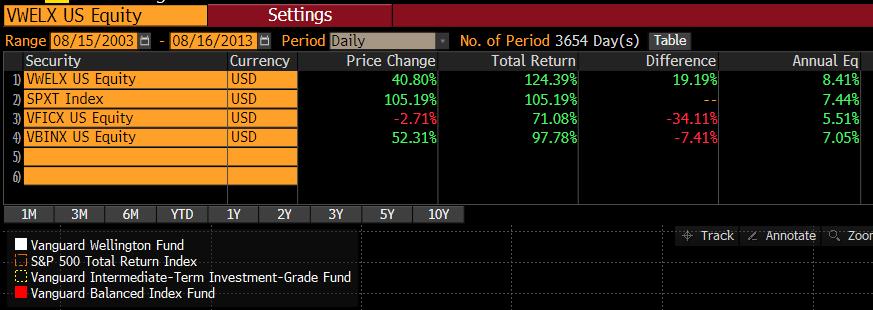

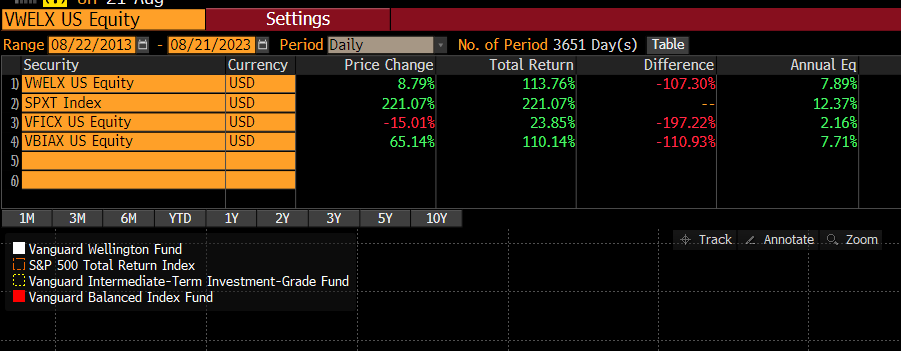

yes, agreed with @Spekulatius. I don't think anyone is saying that "bonds will absolutely and definitively beat stocks over the next 10 years". What I'm saying is that "having 10-20-30% in bonds will potentially have lower opportunity cost [maybe none or negative cost] vs a portfolio of 100% stocks over the next 10 years when comparing portfolios comprised of broad market indices". To phrase a bit less clumsily, I expect the go-forward return on a portfolio of 70% stocks / 30% bonds to be "competitive" with a portfolio of 100% stocks. I expect the path to more closely resemble 2003-2013* than 2013 to 2023 2003-2013, balanced index lagged all stocks by 0.5% / yr. 2013-2023 that number was close to 5.0%/yr. That's a huge difference. I'm not looking to lag passive indices by 5%/yr, that's destructive to my wealth / purchasing power. If I lag by 0.5% and have a smoother ride, that's a tradeoff I'm willing to take. All the better if I can outperform in my stocks and not lag at all. The reasoning is that we are at a 5 handle on agg (mostly tsy's and MBS) and a 6 handle on IG corps. Bond returns, if held for their duration are pretty predictable; if you lose initially, you make it back on the reinvestment of coupon. I expect them over the duration of the index (7-8 years) to return their current YTM's. I also expect some rebalancing benefit. I don't expect stocks to repeat the 12%/yr of the prior decade. I'm not crazily bearish, just when i look at the ingredients of earnings growth, yield, multiple change, etc, I don't get to 12%. Therefore, for many of us who can only invest in indices for a substantial portion of our ongoing and existing savings, I think it makes more sense to own bonds, than it has in the last decade. I also find myself surprised that the bond market has become MUCH more attractive and we've entered a much higher return on savings environment without me having experienced any personal wealth destruction. It seems like I (and a lot of otgher folks) have a ZIRP NAV and now get to ivnest at a PIRP RoA / RoE. Feels like a free lunch for savers. To some extent, I don't think that is sustainable/will last and am therefore adding a chunk of duration, which introduces more price risk, but also more upside if things change. *i just picked these as arbitrary 0-10, and 11-20 lookback so as to not be accused of cherrypicking and just for ease, not trying to pick top of market to bottom of market, or only have "the lost decade" etc.

-

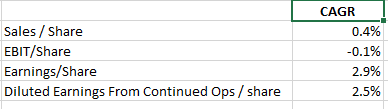

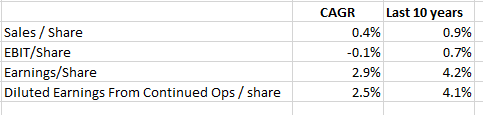

agree completely. If we think of Utilities as a perpetual TIP, then we've seen the competing 10-30 yr TIPS go from negative yields to 2%+ with little corresponding de-rating from utilities and that's just from rates alone. When you add in the asymmetry regarding these liabilities, it really seems unattractive. Why pay 200% of book value for a 8-9% ROE (4% earnings yield with a slow inflaiton increase) when you can get 2% real from TIPS or 6-7% nominal from bonds. Here's the 2006-2022 and 2012-2022 Per share growth in fundamental metrics. Maybe go forward's a bit better if we have higher inflation, but certainly a shitty starting point. This argument is probably stronger than the staples discussed in the KVUE thread because utilities have just as weak long term growth w/ far greater capital intensity. Another way to think about it is the utilities index returned about 9% / yr w/ divvies reinvested over the last 10 years. over that time frame the index re-rated from 1.5x book to 2.0x book, so you had a nice ~3% / yr from re-rating. If you think that's goes from a positive to negative, then the total return prospects for utility stocks are quite low.

-

so as y’all know I keep an eye on long duration high quality fixed income. If you look at Fidelity’s offerings (which tend to feature lots of adverse selection l) the highest yield for the rating is in utilities, clearly people trying to decrease their weight to “low risk” utility bonds, including Berkshire related ones. on the margin, I’m a buyer, but at very small size, stuff like BRKHEC 2054 at $85 / 6.6%. Not recourse to the mothership, but it’s still be a pretty momentous decision for Berkshire to give up an important subsidiary. For a small portion of capital, I’d bet that won’t happen. I think taking advantage of peoe ligjtening up in related securities may be the better option than running to the literal fire.

-

I looked at shorting the short maturities, but couldn’t get borrow….no view here

-

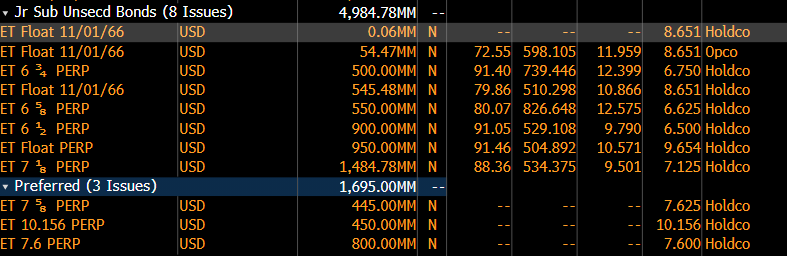

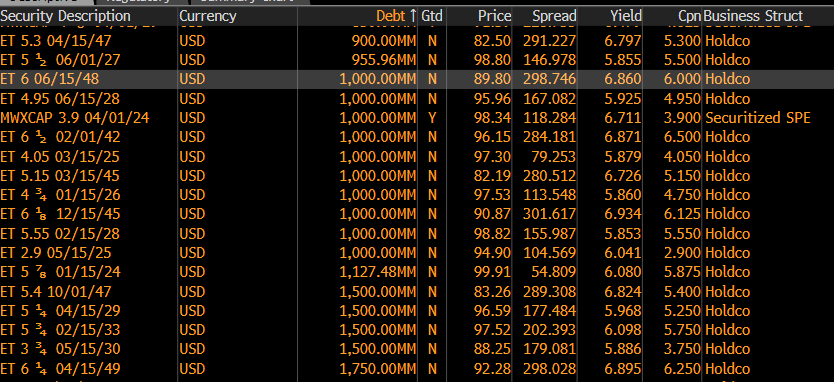

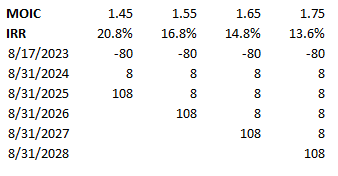

I own a decent (~5%) position in the Energy Transfer Floaters which mature in 2066. I bought around $79/$80 and they're offered at $81. CREDIT: the bonds are pretty much subordinate to all other bonds of ET, but above the prefs / common. ET has $48B of debt and trades for $100B enterprise value. 2024 EBITDA is $13.5B before a recent acquisition announce. So EV is about 7.5x EBITDA (which seems fairly reasonable, assuming no shenanigans, which I worry about w/ a roll-up) and the debt is about 1/2 that. I think these bonds will do very poorly if ET experiences a credit event. they are junior. But I don't foresee a credit event happening. More on that later... Some VIC writeups https://valueinvestorsclub.com/idea/ENERGY_TRANSFER_LP/1401237966#description https://valueinvestorsclub.com/idea/ENERGY_TRANSFER_LP/7981359147 https://valueinvestorsclub.com/idea/ENERGY_TRANSFER_LP/2125697553 RATES: the bonds pay SOFR + 328 and the most recent coupon was set at 8.65%. This provides >10% of floating rate yield to the bonds at $80. The bonds are callable at par. The vast vast majority of ET's debt is fixed rate and features both coupons and yields below these bonds. I would expect that if short term rates persist or go even higher, then ET would have incentive to call the bonds using cheaper capital. They have a fair bit of near term maturities to work through but generally have been de-leveraging. Most recent acquisition announcement is all equity so leverage neutral. You can make a decent IRR here if the bonds are called. If the bonds aren't called, you'll earn the coupon / price paid over time. HEre's a simplified IRR / MOIC if called at 2,3,4,5 years (assuming an 8% coupon) So what am i missing? I've done enough work to be somewhat comfortable with this bond. I'm willing to wager 5% of my nut on the idea that ET is worth > $50B (vs current $100B EV) and don't mind getting paid 10% in carry or making 25% upside if they decide to call the bonds. If rates fall, these will be less interesting in terms of coupon, but I make money elsewhere. I'm skeptical of roll-ups, but this seems like one that actually makes sense... Any thoughts appreciated. Here are ET's Junior Securities Here is a sampling of ET's unsecureds

-

Well, I capitulated today and bought a fair bit of corporate bonds where I had liquidity (in my taxable account). 2% in the Bowdoins and Essex (the safest IMO) and about 1% in each of the others. ~10% collectively. After tax these only yield about 3.5% but they service my mortgage and have duration upside. Along w/ a slug of ET floaters I have, my corporate bond basket yields 7.7% pre-tax / 4.4% after tax. I own about 32% of my mortgage amount in this basket. Pre-tax is pays about 88% of my pre-tax mortgage interest. Admittedly that's heavily subsidized by the 10% yielding ET notes whihc have a much worse credit risk profile than the others. Every time I've done this, rates go back down and prevent me from deploying real money in bonds. Maybe this time is different and I'll start getting 7% on safe long duration stuff...I like having lots of line items / credits and would just add names like 5-10 at a time. this increases t-costs though. Would re-iterate the better approach may be treasuries or a fund. Bowdoin 4.69% of 2112 @ $78 / 6% / +163 to the 30 yr. ESS 4.5% of 2048 $76.7 / 6.37% / +188 to the int tsy META 5.75% of 2063 / $96.8 / 5.96% / +157 BNSF 5.15% of 2043 / $94/2 / 5.6% MO 5.95% of 2049 / $90 / 6.75% SHW 4% of 2042 / $77 / 5.9% KIM 4.25% of 2045 @ $75 / 6.4%

-

So i was into this stuff late last year when it started getting to these type of levels. Stuff like SHW 4's of 2042. Sherwin Williams isn't going anywhere and you're buying at the highest yielding (20 yr) part of the 10-30 yr curve with some credit/liquidity spread and you get to 5.9% YTM / $78. It doesn't seem terrible, my. The problem is when you go to buy and to sell, the t-costs aren't great, so you have to be prepared to lose a few points on the way in / out, this doesn't matter if you're actually intending to hold long term, but I found that when duration/spreads rallied, I made 8 points instead of 12 points and found myself wondering if I'd have just been better off buying more liquid things like tsy futures or calls thereon. I'm looking to extend duration of my parents bonds portfolio and probably will be picking up some stuff like this, but they use Fidelity which is absolutely terrible at bonds...a simpler solution may just to be to buy the Vanguard fund VWETX w/ an SEC yield of 5.2% as of 8/10 and probably a little higher now. also think LT TIPS are interesting. Why should the government give investors 2% real risk free, and the ability to lock that in for 30 years? it just doesn't seem to make sense to me. 30 yr TIPS yeields are highest they've been since 2010. while they debuted at 4% REAL in the late 90's (an amazing opportunity to jus tlock in all one needed in hindsight), still think 2% real is pretty good for a portion of a retiree's capital. All this is said in the context of a tax deferred accounts, not taxable.

-

Beginning of the End of Car Ownership as We Know It

thepupil replied to Parsad's topic in General Discussion

I read @rkbabang's rant in the voice of Daniel Plainview -

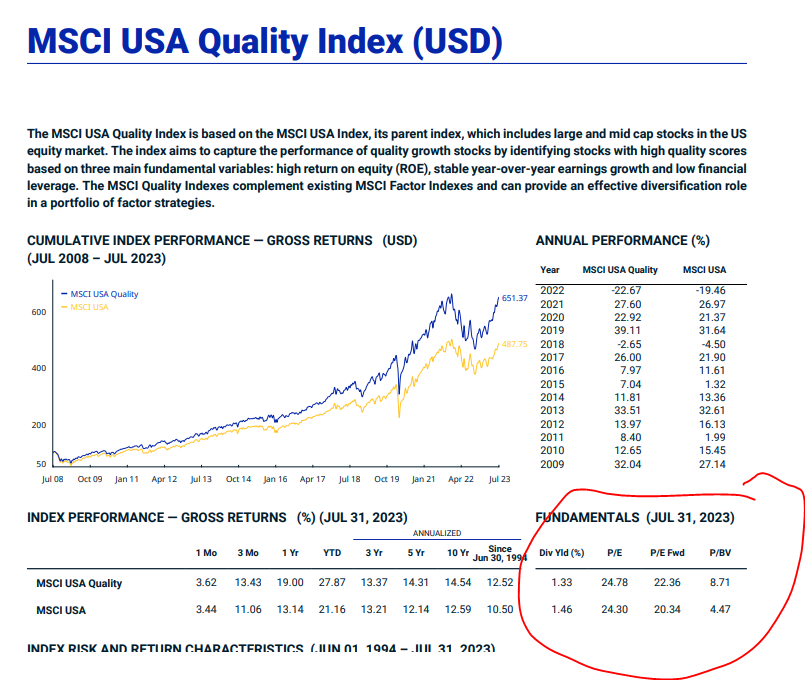

My overall view is similar to that which I wrote 2 and change years ago. High quality US stocks (ie the best of companies in the most expensive and highest returning major market) trade for 24x trailing and 22x forward. Is this a "bubble"? In my view it is not. Is it "cheap" "compelling"? No. Does it offer a mrgin of safety over near term investment horizons? No. What has changed since I wrote that is the 10 yr inflation linked treasury wentr from -1% to +1.7%, CLO AAA yield went from 1.5% to 6.2%, 30 yr went from 1.5% to 4%, HY went from 4.5% to 8.7%, etc. So bonds, cash, low risk floating rate paper, risky bonds etc, all beefed up as as competitors to stocks by ~2-3% REAL and 3-4% nominal, which is meaningful. but the trade off is still not so so clear. it was hard to picture oneself owning any bonds/cash/etc 2 years ago. Now things are better for those. In some ways (as I mentioned earlier), it's been the best of all possible worlds for asset owners as one can take the stock gains and invest in the lower risk stuff at much higher returns without having lost any money. it's a good time to re-assess asset allocation, lock in some gains. maybe do some heding for the more frisky of us... Still struggle to call it a bubble.

-

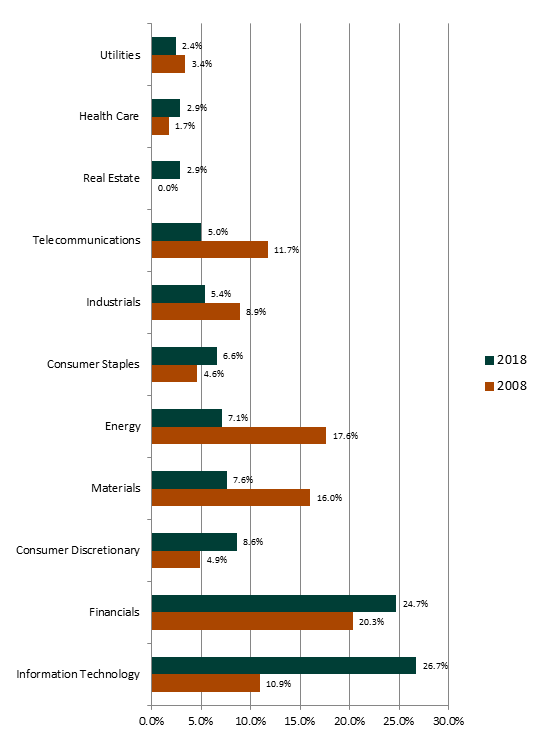

yea i hear you. for my 401k its just the indices available, not active funds, so i go with those. I think the quality of the EM index has improved over time (if one is okay owning chinese tech). it's no longer just a bunch of telco's and miners and energy (and the energy is amking lots of money)

-

this is a fair point, though many of us have a lot of $$$ that can only be invested in indices (of the cap weighted variety) so some degree of view on the overall market's valuation may be warranted. I invest my index only stuff in foreign stock indices these days..I vacillate b/w bonds and foreign stocks and have recently (perhaps stupidly and procyclically) gone with foreign stocks. a recent trip to Europe where verything jsut felt oo freaking cheap relative to my strong dollars tipped the scale for me..Generally the foreign indices are of lower quality and in in lower multiple sectors, so the 13x offered by foreign markets isn't comparable to the 21x of the US. But I think b/w the valuation discount and currency diversification, a reasonable addition to a portfolio....the EM index is mostly just china though...

-

yea. it's a breath of fresh air. parents portfolio feels so much safer with all this yield...been locking in w/ some duration. they also just turned 70 and both worked long and paid a lot into SS, deferred til 70, they have ~$100K/yr of inflation linked SS income turning on. While that's obviously not typical, lots of boomer savers out there benefitting from the (seemingly unsustainable) simultaneous rise in real and nominal rates and the stock market...while getting fat CPI adjustments to their checks...and the real estate market still humming...just a crazy time

-

some quick thoughts. - agree manufactured housing / RV parkst are great. Clearly there's institutional bid for marinas right now and these guys have very strong position there. - I've never really looked at SUI other than its bonds (they trade a little wide in sell-offs) ). Reason being whenever I look at equity, I always conclude I'd rather own ELS. - it appears to be at widest discount to ELS in last 10 years on a simple P/FFO basis. (5 second analysis) - It's hard to call a company that's done 13%/yr for 10 yrs AND 13%/yr since 1994 mismanaged. and that's after a 38% drawdown - BUT, I'd also note that SUI has historically been much more dependent on accretive issuance to grow value. They'v increased share count from 36mm to 124mm over last 10 years to roughly double ish AFFO/share. ELS has done similar per share growth in per share metrics with 12% cumulative share count growth. So I'd observe that SUI is potentially more dependent on its stock price to create value where with ELS you can take comfort that the actual portfolio created the value. With such a rapidly growing (EV has 8x'd over last 10 years) company, there's also the potential for any bad stuff to be hidden. - What I find confusing is the company claims 7%/yr SSNOI growth. which with leverage should lead to > 7% organic equity metric growth, which with accretive issuance should lead to even greater growth, but when I eyeball per share fundamental metrics, I only see about a double over 10 years, which implies either the SSNOI record is not real, they've issued dilutively, or....something else. I don't know. - they have nice debt, 10 yr wgt avg maturity for the mortgage portion, seemingly mostly fixed. probably nothing new to you if you looked at in depth already, but just took a gander at it for a bit.