thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

How is the Fed going to cut rates with inflation over 3%?

thepupil replied to ratiman's topic in General Discussion

@Gregmalbecoming a long duration buyoooooor. if you really want to do this, just buy 30yr futures options....you'll get section 1256 tax treatment on the losses/gains -

Re teachers think part of this is a red state blue state thing as well. My MIL worked 20 years as a teacher in a red state, topped out at $60kw/ a PhD, $12K/ year pension. Naturally, her state is in spectacular fiscal condition. if your reference point is Illinois or NJ, and those numbers are >$100k pension, you feel differently

-

Wait We’re talking about elite MD/PhD’s? And it’s a grift for them to make < a PCP after like 8-12+ years of paying for school or making less than a living wage? (And the lowest form of hourly comp for elite professions) I just don’t get it. Honestly I think it’s a strength of the American system that our smartest people can go into research and make just okay money. but even then, I was not aware of $200K+ research positions; my only exposure to this is discussions with biotech funds who employee loads of PhD’s cheaply, because according to them research pays so poorly. Even $200k in 30’s would be well below market for someone of that caliber in any other elite profession.

-

Yes, honestly if I wanted to kneecap a smart, hardworking person’s earning potential, I’d tell them to get a PhD and try to go into academia. Almost guarantees underemployment and little net worth growth for many years.

-

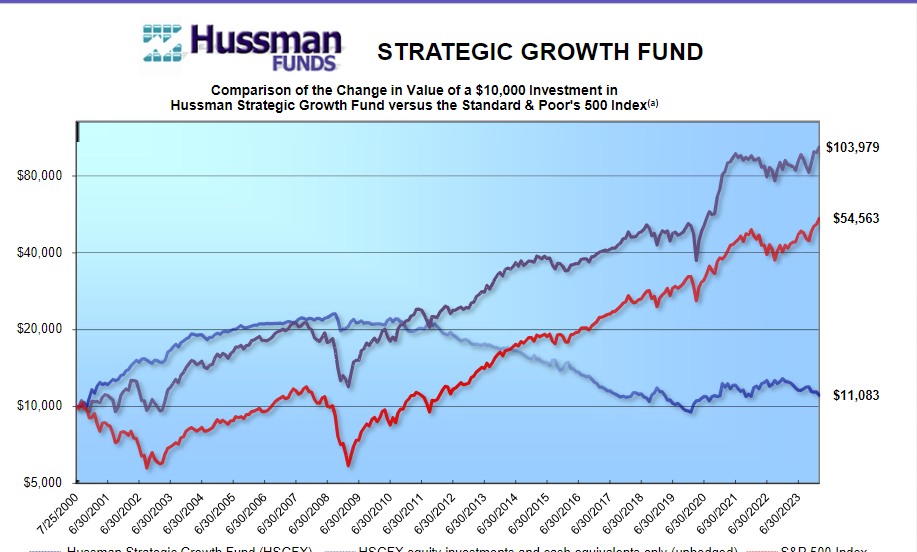

Yes, another way to frame his performance is he always hedged to beta so when he made $$$ he was generating lots of alpha; once alpha went away, no more $$$ and you just bear brunt of being short market. again just looking at the lines and not doing any analysis beyond that.

-

He said non taxable, so I’d recommend against EPD to avoid UBTI DMLP does not generate UBTI. BSM has in past but did not for me this year.

-

there it is...I don't have the underlying data, but crazy to me that he'd be a good mutual fund manager if he ran unhedged...given the unhinged overly intellectualized perma-bearism...typically those folks aren't good business analysts/stock pickers, but he, at least on an inception to date basis, appears to be.

-

He’s a strangely good stock picker. I theorize he’s super smart, knows his niche as permabear and just owns it. He can pick stocks that outperform and then hedges it all away. If he can maintain okay AUM…so be it. this is based on old stuff that he used to put out that his actual stocks OP’d the index, but based on recent results don’t think that can be true. So you have poor stock picking compounded by shorting a bull market…rough. can’t find the updated chart….I wouldn’t be surprised if lawyers made him take it down or if he didn’t update because it got less flattering

-

Again, I’ll just repeat that your data points seem far more cushy than the data or my anecdata suggests. almost every PhD I know also did 2-3+ years of some research or other low paying job b/w undergrad and grad to have a chance of getting into a competitive funded program. Combine with a couple years of post doc and your looking at 10-12 years before you get a job with real benefits and a salary >$60k…most people in my wife’s cohorts ended up in debt despite no tuition/stipend because making $25k in major metro isn’t cutting it. the idea of a 20 hour workweek is laughable to me. Another family member is a professor at a small podunk rural liberal arts college. She’s constantly grading papers and doing emails /admin work, honestly seems like she works 50 hours/week. She make $50k/year. It’s a labor of love for her. Perhaps your datapoints are people with PhD’s wher the private sector is more competitive like comp sci. even then,. They seem world’s away from my experience.

-

my reference points are people i went to undergrad w/ who graduated in 2009 and 2011 2009 Guy Magna Cum Laude, Engineering, Top 10 University 2013 PhD Civil Engineering, top 10 school 2014 - Present Associate Professor @ Large midwest university the average associate professor at this school, with his years of experience makes $90K. I made more than that in my first year after college. I have no idea in what world this dude is "grifting". 2011 girl, liberal arts top 10 university 2011-2013 teach for america 2014 - 2020 PhD, top 10 university 2020- 2023 postdoc same school 2023- present visiting assistant professor in rural new england at liberal arts college google tells me a "visting assistant professor" at this school makes $70K these are my direct touch points. people who graduated 13-15 years ago from a top 10 undergrad, who i doubt have hit $100K yet. my wife is in field w/ PhD's, she has one. the academic route pays far less and works harder than the non-academic route. she made like $20-$25K as a funded PhD for 5-6 years, $40K as postdoc (another 2 years). that's 7-8 years of post undergrad indentured servitude. if she went academic route she'd be making $90K in an expensive metro....like where's the grift? it's a grift by the institutions. they utilize like 10 eyars of free labor from the PhD's/ I

-

you must know more successful aspiring academics than i do. to me it seems like an almost reward-less grind pursued out of passion / desire for prestige rather than $$$ or work/life balance.

-

I completely disagree. I regard the academic career path as brutal. It's low pay, unstable (until it becomes gloriously so for the minority who make tenure track), political, and just generally shitty. To become one of those people getting paid an okay amount takes 7,10,15,20 years of PhD, adjunct, assistant, etc. I don't envy people in academia at all and do not regard it to be a grift. if anything, people chasing the dream of becoming a professor are the ones being grifted....The people I know who are trying to / have gotten there work harder for far less pay than people in corporate / tech / finance / medicine. do you know anyone in their 20's / 30's that's tried/is trying to become a professor?

-

as someone whose parents IRA owns a slug of $EQC bought w/i last year at a total loss of ~2% when the position was bought at nice discount to NAV and some of which bought for less than t-bills on b/s, I don't entirely mind his presence. I think $EQC is quite reasonable risk/reward here. https://x.com/thepupil11/status/1757430588745650685?s=20

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

ESS just raised 10 yr money at 5.5%, 145 bps > 10 yr, very reasonable cost of debt for the high quality REITs -

Why did so many smart investors miss making a killing on BRK stock?

thepupil replied to Viking's topic in Berkshire Hathaway

- it's been a great time to own Berkshire - it's been an almost just as great time to own US stocks (and at various points in the last decade, even better than berkshire) - Berkshire's outperformance has been positive but very small in the post GFC era - if one has a 5-10+ year time horizon it's hard to lose money owning Berkshire, I think moreso than it is w/ US stocks, but that's subjective. - I'd note the "barely OP'd for 20 years" commentary is a bit unfair to Berkshire considering its HUGE outperformance in the years leading up to that time frame, in early 2004, Berkshire had just done 17-19%/yr for decade and 5-8%/yr better than market. - below is rolling performance vs S&P, to avoid focusing on any single data point. -

Why did so many smart investors miss making a killing on BRK stock?

thepupil replied to Viking's topic in Berkshire Hathaway

I've owned some berkshire for the entirety of my investing life. I'm not THAT much wealthier for it relative to S&P, and I'm definitely poorer for it relative to QQQ or FAANG/MAG7or friends who just bought apple / MSFT / google and held (who knew nothing about stocks, but said "google/apple go up"). more generally, if my dad/grandparent are representative of mass affluent, people who have been investing since 1950's in case of my late grandpa and 1980's in case of my dad. most normal investor people wither just buy hold household name divvy stocks (at least that's what my grandpa did) or just invest in what their broker put them in (american funds which earned marked +-1% - 1% ish fee) Buffett was pretty niche stuff for a long time. I think investment in berkshire is a very reasonable way to preserve and grow purchasing power. I'm at my lowest Berkshire weighting of the last 13 or so years save a brief moment where I owned none. My IRR on berkshire (while I've not explicitly calculated) likely exceeds 15% and I've generally been able to buy / sell at good times having come to know it decently well. With that said, the rewards for picking the absolute best companies of the last decade or two have far exceeded investment in Berkshire. I don't really consider myself capable of doing that, so I'll likely continue to hold, at least some Berkshire for a while. -

@Salukii will agree with you on those @Gmthebeau I'm not saying he's a saint, just that your characterization (which fits the popular narrative of that interview) does not, in my opinion, have any consistency with the facts. He's done like 20% gross/year for 20 years. It may not be luck. Guess that's what makes a market.

-

curious way to drive the stocks down...by saying he's buying in that very same interview. I don't know man...Isn't the alternative explanation (that he actually believed what he was saying) the simplest and most consistent. - he thought lots of people would die (lots of people died) - he thought we should shut down for 30 days (we ended up shutting down for longer, probably a big mistake, but idk if 30 day shutdown was a mistake for society, was reasonable view to take at time w/ facts known). - he thought the turmoil he foresaw in february 2020 was not priced into credit markets, put on a huge position in them, and made money when it got priced into credit markets. - he thought his highs quality restaurant and hotel stocks would see it through and recover. they recovered. - within reason, all of this was communicated in commercially reasonable real time to his limited partners for whom he tonned it. I have zero ethical concerns with this fact pattern; everything seems quite rational and in the interest of both society and his LP's. Is he a drama queen? sure. but I still don't understand why people give him shit for this call. he was pretty much right on everything. I'm not saying he's infallible, but just don't see anything wrong with this episode. I mean we've all got better things to do than debate what Bill ackman said 4 years ago, but for whatver reason, this is a "perception becomes a reality" thing that just seems completely inconsistent with he facts and where people extrapolate one one sound byte to draw sweeping conclusions. March 18th 2020 https://www.cnbc.com/2020/03/18/bill-ackman-pleads-to-trump-to-increase-closures-to-save-the-economy-shut-it-down-now.html

-

the timeline of this incident is inaccurate. the narrative around the "hell is coming" interview is false. Ackman was aggressively getting longer of stocks in March and monetizing his hedge (half of which already had been sold by the time of the CNBC interview). as someone who was buying his fund monitoring the net exposure, I was a little taken aback at how quickly and aggressively long of restaurants and hotels he had gotten in March and April. The 28 minute interview , where he talks about buying stocks can be found here https://www.cnbc.com/2020/03/18/watch-the-full-interview-with-bill-ackman-on-the-coranvirus-threat-to-economy-shut-it-down-now.html?__source=twitter|main The details regarding the hedge monetization here. At March 31st 2020, PSH was long and strong Bill's story that he didn't make much more money after his interview. This is corroborated in the data by the spread on CDX IG which widened from 40-60 bps in February to 140 on the 18th. It peaked at 152. on 3/20/2020 and ended the month at 113. He made the bulk of his money on the move from 40 to 140 (and had already taken off over half of it) before the interview, not from 140 to 155, even if you think he widened out CDX with that interview. .

-

lol, BND is at $71.80. It peaked recently at $73.5, after which it paid $0.2. so it's down about 2% in terms of total return from recent peak. $TLT is 7% off peak, less a little coupon. For something with a little more duration I have some Caltech 2119 bonds that I bought at $58 in October, think they got to $72, and are now at $68. In what world is that blowing up? a bit dramatic

-

Sold 1/2 for $90.1, some lots purchased in May 2023 @ $75, others in August 2023 closer to $80, all in cost of $78. decent returnfor risk taken (think like 20% ish total return since August, 30% ish from may, higher IRR's, beat SPY, JNK, BND, etc). Think the bonds are perfectly fine at today's price, but looking to add to other stuff/maybe some new ideas/longer term stuff. the callability means it's very easy to calculate your max upside. EDIT: I ended up selling the rest a few days later. just think I'll have better opps.

-

as an interesting data point, my parents church had an annual budget shortfall of $100K as donations did not come in as expected. they dropped their windstorm coverage ($100K of $120K / yr total insurance premium) in order to meet the budget and plan to forego coverage indefinitely. I'm sure there's a relevant bible verse to share here, but I guess I didn't pay enough attention growing up...

-

I mean marginal tax rates on short term gains are like 50% with NII and state and federal

-

I didn't see any new info in this article regarding my understanding of how the industry works / what the incentives are. I believe we simply disagree on interpretation of the same facts.

-

how so? who's getting paid by whom? from my understanding activist short sellers have several models. they either take LP's in an SPV or fund structure and use that capital to put on positions. they can do the research themselves, or can collaborate with other hedge funds/freelancers who wish to stay off the radar from a regulatory/LP/company/general reputation standpoint. so from my understanding activist short sellers are paid fees by other HF (either success or cash based) and get paid on their performance from trading their ideas. the prime brokers get paid through trading flow, through the arranging of securities lending which results from demand from HF's and from fully paid stock from retail / LO's. longs get paid by being right, have heard several longs with very successful stock purcahses whcih resulted from dislocations from an ultimately inaccurate activist short report the twisted incentives to do work, share information and make money in the markets thereon for the benefit of LP's or personal capital. what would you correct / add?