thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

as someone who started this thread in 4/2022, I've obviously been way too early...but the nature of bonds is such that we're at levels where (absent wild debasement/currency collapse), it's very difficult to lose money. If you bought at the absolute peak (8/6/2020), you're now down 16% with coupons reinvested. bought at beginning of thread, down 5.6% in the agg index and that's with the yield on the index going up 2% in less than 2 years. just keep buying and reinvesting coup, extending duration a little. I daresay it's very hard to lose money in bonds. if we do, then you're talking major collapse of currency/fiscal state. could happen, but wouldn't be my base case. honestly, I'm just trying to keep my greed in check. want to keep buying more...

-

Well today I bought some bonds maturing in 2112, so my approach is slightly different . specifically, I’ve spent the past month or so accumulating the illiquid Bowdoin 4.69%’s of 2112 at $76 / 6.2% yield. delicious perpetual yield.

-

I own both. I bought the equity first @ like 6 cap and bought this thing at 6.4%. One has long term inflation protection / growth, the other has more bounded return profile (absent extreme increase in rates). I don’t think either are “high conviction” or super special, but just part of a portfolio that will hopefully preserve/grow purchasing power.I like todays environment of 6%+ caps and 6% + IG yields instead of 4 caps and 3 yields. bonds are cool and all but I still always want to have bull of assets in stuff that isn’t nominal obligations.

-

Here's kind of a cool illustration of the nice (IMO) risk profile of bonds right now. the ESS 2048's yield 6.5% right now. they won't default unless the value of apartments in california declines by like 70%, so let's ignore the whole credit risk thing. On a 5 yr basis, they'll return between 2%/yr and 13%/yr depending where yields end up at +-300 bps. So you can buy a bond that's maturing in 25 years, rates could go up over the next 5 year ssuch that that bond will be yielding 9.5% and you won't lose money. you may lose purchasing power for sure, but you won't lose nominal $$$. now I'd probably dismiss the extreme upper end (the 12%/yr) and the extreme lower (the 2% / yr). I also think it's a nice illustration of why it makes sense to potentially take a little corporate spread/liquidity risk (they have the 30 yr treasury return next to it) the ESS bond does better in all scenarios except the extreme -300 bp change in yields.

-

In the US, eggs' protective coating is, by law, washed off. therefore eggs must be refrigerated in the US (and shouldn't be refrigerated in Europe).

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

not sure I understand this math. if FFO is going to grow by inflation +2-3%/yr, then wouldn't total return be 8-9% inclusive of inflation? Let's say inflaiton = 3%. So FFO growth = 6%. So at a constant FFO payout ratio, wouldn't dividend growth be 6%? Ergo wouldn't total return be current yield of 3% + 6% growth = 9% (just simplified DDM, assuming no kind of re-rating). how do you get to 8-9% + inflation? -

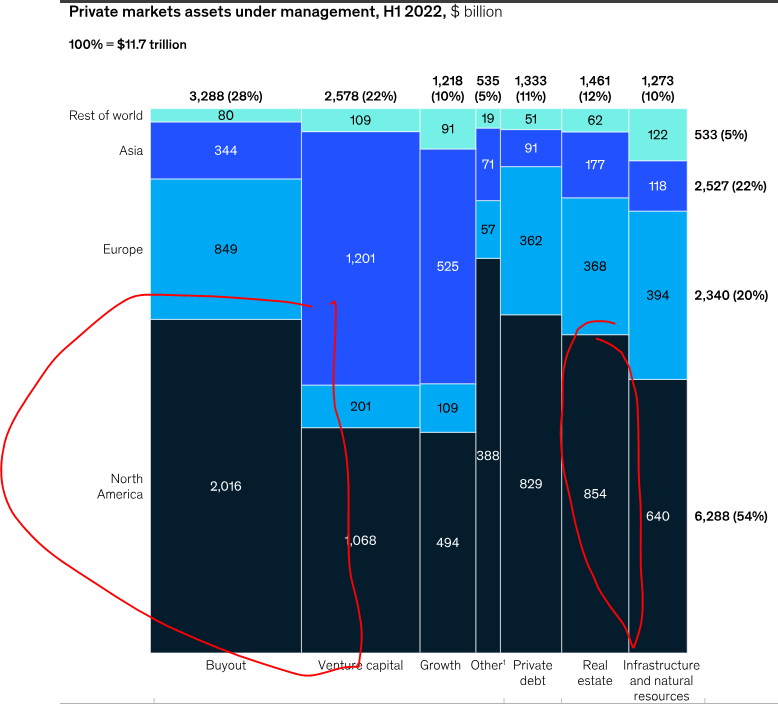

the bodies are in here. you can't see them yet;. higher for longer will really hurt a few buyout/private RE vintages. publicly traded mostly IG corporate america and the locked in debt at fized rates consumer are fine. privately held, levered to the tits with floater, private equity is not. there's big equity cushion and tons of uncalled commitments and private credit to extend / can kick / distract, but if we stay here for a while, you're gonna start seeing problems. the real world impact is not clear to me. institutional investors won't be able to make 15%/yr buyouts anymore. they'll take some writedowns and continue to invest with the same folks after a few shitty vintages. the question to me is it a big enough issue to cause banking problems or problems in the REAL economy. for now, I'm at a "not yet"...and most of the risk on credit/loan side is likewise w/ instititions/not in the banking system.

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

perhaps to illustrate better, on 12/31/2021 the trailing 5 year return for CPT was 20%/yr. the trailing 5 yr return now is 5.7%/yr. changes in valuation have HUGE impacts on 3,5,10 year track records. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

SUI has been a serial issuer of equity (EV from $2.6B 10 or so years ago to $23B today). That's not necessarily a bad thing. But what it means is that it's an ever growing and complex portfolio. Every time I've looked into it, I've had to stop and divert my attention elsewhere. Just never a company I've been able to fully grasp. happy to hear your thoughts on it. haven't done any works since wrote this on your thread -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

I think valuation has a significant impact on returns with a time horizon of even 10 years. for example, if you looked at MAA at the peak, the trailing 10 yr was 18%/yr (12/2011 to 12/2021). Today it's 12.8%/yr. Are they a worse management team because the stock is down 36% from 12/2021? Generally, I think the large high quality guys (MAA/CPT/ESS/EQR/UDR/AVB) etc should be expected to be run like they always have, which generally provide decent returns to shareholders w/ low risk (but not wild and crazy super high @gregmal returns. For something like ELME. ELME hasn't existed in its current form until like today. Until 2021 it was a multi-asset regional REIT. Now it's a single property type REIT of decent scale. but the mediocre mgt remains same, but it's probably a slightly easier target. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

i thought we were talking "pre-covid". Of course everything is going to look bad bringing to today. We've had cap rate expansion of 200-350 bps and drawdowns of 40%+. that's the appeal right? a nice reset of expectations and pricing which works at low rates of rental growth. the way we lose substantial money from here is if we get MANY years of negative rents/big declines in occupancy. the 10 yr return on bloomberg apartment REIT index is 7.8%/yr, 5 yr is 3.4%, 2 yr is -10.5%/yr -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

from 1993 to 2021 apartment REIS returned 12%/yr / 23x w/ divvies reinvested. if you end at 8/2023 it goes to 10%/yr and 17x. I don't really know which start date to pick, but 1/2014 to 12/2019 is 14-16%/yr for apartment REITS, 16%/yr for ESS, 16% / yr for CPT, 14%/yr for EQR. it's 11-12%/yr if I start on 12/2016, 9-14%/yt if i start 12/2011. it's weird to me you think apartment REITs didn't do well pre-covid. They did spectacularly in the 2010's. I wouldn't expect that going forward. I think right now, they are (without re-rating) HSD IRR's which offers a premium to bonds and TIPS for very low levered properties. Good stay rich stocks. They're not gonna be get rich stocks unless something changes with financial conditions. most NAV's / green street stuff at peak was like 4% cap rate, 6% unlevered IRR assumption. No we're like 6-7%+ cap rate and 8%+ unlevered IRR assumption. that's a meaningful change. but the ability to flip to BREIT at some stupid price is no longer there. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

I disagree with this. It's not a given that there is a public market discount. It's cyclical and the LT average is actually a slight premium (of 2%) according to Green Street. REITs do not have an incentive to go private. I'll concede that, but most studies suggest public core RE outperforms similarly levered private core real estate. The idea that a) public REITS "always" trade at a discount and "always" underperform is not supported by data. So in terms of optionality, I'd say there's scenarios where in 1,3,5,10 years thinks look different and you trade at NAV for whatever reason. obviosuly a 1x big move up on a take private has its appeal, but you could just have something more mundane happen (like record outflows stop happening) or whatever. I think there's plenty of ways for the HSD IRR to become a LDD IRR (but only one way for them to become short term 50%+ whcih is take private which can't happen at current financing) -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

I don't think outright take privates will occur, without a change in the cost of financing. I think most of these are likely to return high single digit IRR's with relative safety, with a degree of optionality. I think they offer a return profile that is higher than say 10 yr TIPS. You're buying <40% (in some cases <30%) levered diverse portfolios. I don't think one should expect to get paid anymore absent panic in the market causing lower prices. I think that's attractive. As an illustration of the type of things that can occur, UDR sold in JV a portion of its older properties at low 5's to cash institutional buyer. REITS can slowly JV/sell assets, buy back stock (or one can buy back w/ divvies), provide capital to overlevered owners, etc). they're cheaper / better capitalized than anyone. but that doesn't mean they're going to provide crazy high returns. the math isn't there and leverage not high enough. https://www.businesswire.com/news/home/20230629089950/en/UDR-Announces-Formation-of-510-Million-Joint-Venture -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

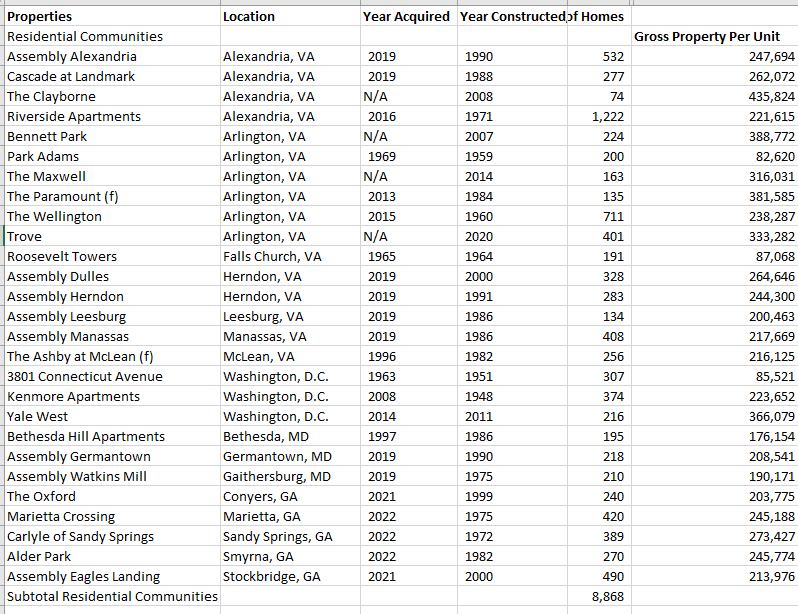

I think this is a great point and to be clear, I have positions in CPT, ESS, MAA, etc that are more in line with this thinking. In steady state, I'd probably expect them to grow in value at greater rates than ELME. But I think at this price, recognizing it could and probably will get cheaper, one should also mix in some ELME. the low leverage is such that you'll start to get pretty wild headline per units/cap rates with another 10/20% down. Like these folks may not be super wealthy yuppies, but new renters in their washington metro area apartments make $92K/year...the per unit value ($170K/unit to $200K depending on watergate) seems pretty darn low in that respect, right?. also with rates are, people who make $92K have to save a hell of a lot of money to be able to buy a home. renting is much more affordable than buying. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

ELME used to be called "Washington REIT". It was (is) a perennial underperformer and was previously a multi-asset, regional focused REIT, an oddball in world where REIT mafia wants large liquid single asset, but multi-geography REITS. In the 10 years before covid (12/31/2009-12/31/2019) Washington REIT returned 5.5% whereas REIT index returned 12.5%. 1999-2009 it atually slightly OP'd (12.3%.yr vs 10.9%). Washington REIT became "ELME" after they fire saled all but one of their remaining office buildings to Brookfield in '21. At the time it looked like WRE was optimizing optics by selling to BAM fro an 8.5%+ cap rate. BAM then put like 80% leverage on half the portfolio and decreased their equity consideration considerable. I assume BAM will lose every single one of those buildings given the floating rate high LTV debt they put on it. WRE took the proceeds from that and paid off debt and bought two or three multifamily properties in atlanta at steep prices. with hindsight, the office sales were probably good. So WRE basically did what all the cool kids were doing, bought sunbelt multifamily at peak values. they changed their name to ELME and are trying to improve their margins/operating platform. I think what matters more than the past is that you have a low leverage portfolio of 8,900 units. The question I'm trying to answer is "wreckability". Can an activist get involved and what roadblocks can ELME put up. I can't find if they've elected MUTA in their bylaws and need to understand the board a little better. But even absent any kind of event, I think there's a case to be made for just owning it in its current mediocre state. Just buy it and make a 5.2% divvy + growth of a few percent. 8% / yr with optionality on much more w/ some kind of positive change. It's only a $1.2 billion company, easy to be swallowed up or fought. DC is an unglamourous investment destination and people will say none of the public guys want this portfolio (true) and that PE guys don't want to add to their DC weighting. I don't have evidence to refute that, but there's a price at which I just hold my nose and buy and <$200K / unit for units that rent for $1,900/month...that just feels too afforable to me. housing shouldn't be that cheap. -

Well that’s a hell of a lot cooler than a bond!!! Congrats!

-

I think @TwoCitiesCapital was talking about constant maturity long durations, which would have done very well over the time frame. I have tried to find a benchmark/performance for this in the past with no success. I think this would be competitive (not sure more) with equities for much of the past few decades. If he's talking about bond index vs stock index, obviously stock index done much better than bonds. no idea why he'd say bonds done better.

-

I bought the ROIC 6.75% of 2028 at $98.78 / 7% yield. These are a little low in duration for my taste with a duration of 4 ish. Just a low risk 7% return. nothing more, nothing less. zzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzz

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

I think it might finally be time to buy ELME. Don’t love the mgt, don’t love the assets, but we’re closing in on a low leverage 8% cap rate… -

yes, in reality, I probably wouldn’t go 50/50, but faced with the binary choice b/w 100/0 and 50/50, I’d probably choose 50/50 given the above statistics. I mean i’m 35 and approaching >20% bonds right now. Right now my self imposed limit is I’m not going to allow myself to have more bonds than my mortgage lol.

-

Doesn’t the above chart show 75/25 as having highest chance of success at 3-5% wr’s? (Though 100% stocks looks grea too) and even looking at 100/0 vs 50/50 for 30 years is 96% vs 98%; if that’s actually the case, I’d take the MUCH lower vol of 50/50 in exchange for 2% lower actual statistical chance given the huge behavioral advantages of 50/50. To me that chart makes the case for like 20-40% bonds (perhaps not coincidentally kind of the standard boring retirement portfolio hawked by folks everywhere) am I misreading it?

-

He claimed that it’s easier to tell which bonds are riskiest than to tell which stocks are riskiest. A claim with which I wholeheartedly agree. you can pick where on the maturity/credit risk spectrum you invest and that will lead to a generally predictable payoff profile and low risk of nominal losses over the duration you pick. Many stocks aren’t like that and are all long duration quasi perpetuals (they are all 30 years). “ And unlike equities, there places you can be guaranteed to "hide-out" in bonds regardless of what other bonds are doing.” he also made some comments about the relative level of “bonds” which typically means the agg, which has duration of 6 (was like 7.5) and has experienced like a 15%-20% peak to trough total return drawdown in the worst Ben bear market ever, which id say is consistent with a much lower than equity risk profile.

-

well I'm not building any bunkers, but our childcare / future education / lifestyle expenditures are probably equivalent to a bunker....the life we choose to lead is expensive which I think constitutes much of our difference in outlook. could move to the hinterlands/make different choices in a pinch, but for now, I'll be moderately drawdown sensitive and keep "preparing". I'm definitely one of those people. assuming it'd be available in bad times where everyone wants such a job. being a UPS drivers seems MUCH MUCH more stressful than our current jobs for signficantly less pay. if you google around, it seems quite common for UPS drivers to work 12 hours / day.