thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

-

How often do you use DCF (or something like it)?

thepupil replied to Sweet's topic in General Discussion

All investments are a DCF of some kind. Whether or not one builds detailed models called DCFs will vary. -

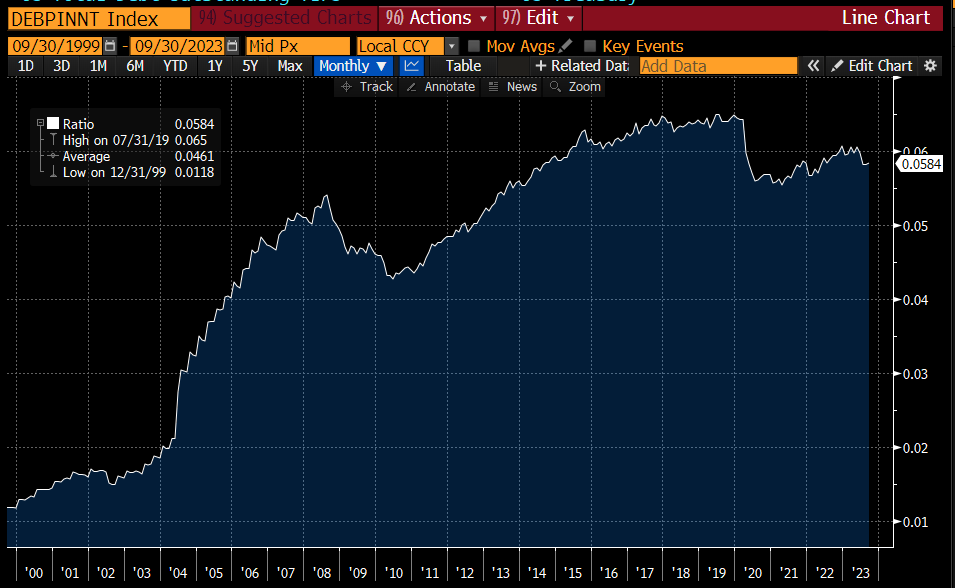

I don't think we'll see that kind of relative performance out of LT tips. At peak equity valuations in 1/2000 TIPs offered 1% more than SPX's earnings yield. stocks were more expensive then then they were today. then stocks collapesed in GFC and bonds went to negative real yields. I think today is much less extreme. but 2.5% risk free real in context of a highly highly indebted society, is attractive and unsustainable IMO.

-

TIPS were a very new asset class in the late 90's and were, with hindsight, a spectacular buy. In 2000 there were only like $75 billion of TIPS. There are now $2T. They were about 1% of tsy market then. Now they're 6%. For these, and a host of other reasons, I don' think we'll see 4% real on TIPS again. I may be wrong. in the early 90's TIPS were <2% of a much smaller treasury market. They are now 6%. from when they were 4% real TIPS OP'd stocks for the next 20 years.

-

yes, I'm not a big "follow the CPI" guy but this one seems particularly dumb.

-

I'm not wealthy enough for PPLI. I think these guys are the leader, but I'm way out of my depth. This is for $100mm+ types, not little old me.https://www.lombardinternational.com/en-US Owned by a Blackstone fund...of course. I've just heard that's the way wealthy individuals invest in tax inefficient strategies (but you obviously pay fees and give up fulla ccess to your $$$ it's for people who are ensuring their grandchildren's grandchildren will be wealthy). I agree. I'm all IG/tsy/MBS for now. I don't think risky credit spreads are that interesting. CDX HY spreads are about 90 bps wide of avg since 2012. I don't think that compensates one enough for what will likely be higher default/low recovery environment than last 10 years. I'm comfy adding a little spread via IG/MBS/etc just to make the returns more "equity like", at the risk of underperformance to tsy's ina big drawdown.

-

2011. real and nominal yields are drastically higher and ERP's much lower today than in any time of my career (which is short and does not at all comprise the numerous scenarios both backward looking and forward which might occur). from my college graduation to present the 10 yr TIP has yielded 500 bps less (on average) in real yield than SPX, for the first few years that number was 800 bps. That's now 238 bps (2.3% real 10 yr TIP, 4.66% nominal earnings yield, SPX) Using nominal 10 yr tsy's, the average has been -300 bps, with the first few years** (2011/2012) being -600 bps. Now its 5 bps (10 yr yield and SPX earnings yields are the same). I'd therefore say that on a simplistic yield comparison using broad liquid indices, that bonds are more attractive than they have been over last 12 or so years (post GFC era). of course there are individual securities of both types that will be better/worse than anything over this time frame (your greek bonds being a nice example). ** I remember lots of Jim Grant (and Jeremy Grantham)** articles from the 2011/2012 time frame talking about buying blue chip high quality widow and orphan stocks for like 11-14x earnings (think WMT, JNJ, LMT, GOOG even, MSFT even, UNH, etc). Back then it was very clear to me as a 20 something to be all stocks. and you got paid handsomely for it. I use those folks because they are often painted as permabears. even with there bearish value oriented bias, they couls see risk/reward much better in stocks. I think the picture is far more murky today.

-

I don’t think he’s marketing to wealthy individuals, but rather (mostly) non tax paying institutions. non wealthy to moderately wealthy people have 401ks/IRAs/annuities etc. very wealthy people have private placement life insurance that remove the tax friction. regarding defaults, agree completely the common practice of quoting gross yields in risky credit is somewhat misleading, but I’m not sure of a good alternative because everyone will have dofferent default rates/LGD. I agree that 6-8% pre-tax is more or less what’s on offer at this time, most safe stuff I’ve seen being closer to 6 on the long end and 7 on the short end. Extreme safety being ~1% lower then going up from there with credit risk. pre-tax seems pretty competitive with stocks, when get at computer, I’ll run what % of 5 year rolling periods >7% for stocks, my guess would be like 60%-80% or so but not sure. If you’re starting from “with no knowledge, strictly backward looking, this has 30% chance to beat stocks” and overlaying a little bit of bearishness/caution/relative value judgement, think it’d make sense to own some bonds (and would be dumb to own all bonds /no stocks). it at least makes more sense now than any time in my short time as an investor.

-

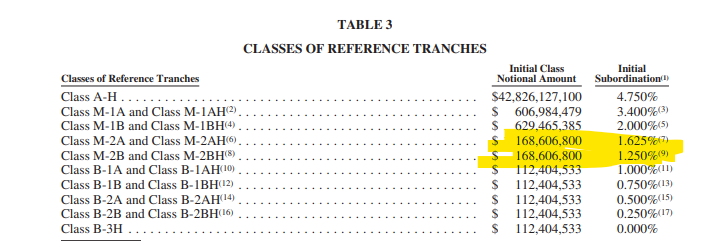

rabbit hole #2 of the evening, so the largest security held by this fund is FNMA STACR 2022 DNA2 M2RB (quite a mouthful!). I don't begin to fully understand them. Because I don't have a PhD in financial engineering. From a high level, they are interest only, pay a floating rate and you really don't want Fannie Mae experiencing >125 bps of losses on their mortgage portfolio, >200 bps over the 5 yrs from issuance and you lose all your principal. I kind of love it, put 1% in it, get paid 10% just to bet on disaster not happening. but you're writing a put on the american household. biggest risk would seem to be short term rates decline along with spike in defaults (deep recession).

-

this is a fun chart. 80-145 bps thick tranches. HUGE structural leverage (but you got burn through everyone's substantial home equity before dime of losses) https://capitalmarkets.fanniemae.com/media/22751/display

-

I don't know too much about CRT's, my relatively uninformed impression is they are a very levered bet on housing prices and health of consumer and not really in line w/ your cautious macro view. .you're basically betting there won't be any defaults on agency MBS. check out the coupons on the largest holdings. very high. https://capitalmarkets.freddiemac.com/crt/securities https://capitalmarkets.fanniemae.com/credit-risk-transfer/single-family-credit-risk-transfer/connecticut-avenue-securities

-

howard marks mostly selling credit and private credit that will have relatively short duration or in case of private credit, direct lending, leveraged loans, etc, all that’s floating rate. but even if we’re talking fixed rate credit, duration of the High yield index is quite low at about 4. Most HY bonds mature in 5-7 years and at 9%+ YTM on index not very rate sensitive. Credit bonds/loans etc have far less duration than equities. You can obviously get more duration in tsy’s/IG/mtg’s etc I don’t think credit spreads for risky stuff are all that great; IG spreads are pretty average/myeh (but I think all in yields on IG/MBS meet my hurdle).

-

ZROZ options are pretty illiquid. I recommend just buying 30 year futures options CBOT via IBKR, pretty easy once you get hang.

-

kind of my point. if the aggregates (real and nominal) have seen very good trailing 3-5 year growth and the top 20% of companies and people who drive the income, asset ownership and spending all have inflated NW's from ZIRP era can now invest their NW's (just a hair off peak values) at positive REAL interest rates, it feel to me that rising rates doesn't do much until it really really breaks something. feels like stimmy as much as highly negative rates felt like stimmy, just with a different course of action.. and the to date damage is just kind of myeh little flesh wounds or niches blwoing up (like a bank with 10 venture firms as its entire deposit base, or some value add sunbelt multifamily floating rate folks or whatever). the bottom 50% were and are poor. no change. until the tax man or social upheaval man ruins the party,

-

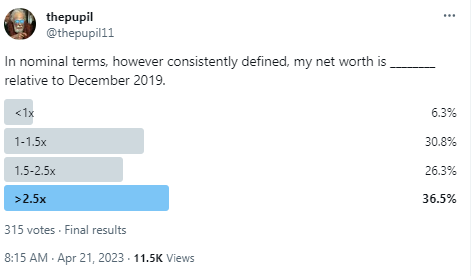

I don't think its about impressive friends so much as where folks are in life. Mostly friends with HENRY's who bought their homes in 2018-2020. I mean my own home equity has gone from $30K ish to $600K ish ($200K starting if I asusme 20% equity instead of 2%). If I only had that and not much savings/stocks (like lots of americans), it'd be 3x, and i live in a lagging housing market, a covid loser. If I look at one of the first results for "household nw adjusted for inflation" I get this September 2023 article that shows the metric to be pretty much at all time high, just a hair off peak and above trend. like if housholds have 98% of peak NW but can now earn 2.5% real risk free, I struggle to conclude that they are worse off, collectively, on income side unemployment is 3.8%, about best its ever been... https://www.advisorperspectives.com/dshort/updates/2023/09/08/household-net-worth-q2-2023 again, I expect things to get worse, but it seems like everything is prety awesome right now and virtually no damage has occurred. along with just seeing much better than previously relative value in fixed income, it's why i'm more defensively positioned than in past, because it's just been so damn good. feels like housing prices should come down, maybe stocks should go down, but they haven't really overall (as measured by cap weighted indices).

-

Yea, obviously out much greater weight on the FRED data than my own poll, just saying that’s what it feels like.

-

I struggle to think of one example in my admittedly small circle of folks of this being the case. Honestly, don't know anyone who would describe what's occured thus far as damage. maybe that's my bubble talking, but to me it's like we have much higher risk free returns (real and nominal) with almost no damage, whchi feels like a free lunch. There is no free lunch of course. people lie on social media, but this graph is closer to my personal experience and those around me than your characterization of "very few" being better off today than a few years ago. To me it's going to take years of malaise to unwind the glorious and ongoing boom in household wealth that's occured over last few years.

-

the 10% losses if you bought the entirety of your nut on the tippy top DAY of markets make you conclude this? I think you need to distinguish between a prediction (which may become true) and what is true today. I think it's quite debateable. I think the majority of mass affluent people who already own their home (like the top 25% of americans who drive a huge portion of spending) have never felt wealthier and investment incomes (divvies and interest) at all time highs and balances within 5-10% of nominal peak. this is both borne out in the aggregate FRED type data and my own personal anecdata. more middle class folks who own home are feeling okay until they have to buy their next car at 9%. I like bonds just like you, but I don't understand some of the statements you are making. incomes at ATH, Net worth very close to ATH's. shit may get worse (in fact I think it will) but looking at the data, I struggle to see what you're seeing. I think US households in aggregate are gorging on interest income with locked in borrowings from yesteryear. Until you need to buy a finance a new house/car, it's a bit of a gravy train, no?

-

The Vanguard Balanced Index (60 / 40) is down 11% from its peak. The total stock market is -10%. total world stock market is -11%. on a 3 yr basis balanced portfolio is up 3.5% /yr, 5 yr 5.7%/yr, 10 yr, 7.3%/yr. what losses are you talking about? there's a whole lot of deposits,cash, US govvy securities, etc in the $112 trillion of financial assets owned by US housholds.

-

where is the data to support this? total household net worth wrt stocks mirrors the indices. there's in aggregate huge net worth and cash balances in those measures. my own anecdotal evidence of mass affluent people is they just own indices/cash/bonds/primary residence. i'd wager the people "severely punished" by peloton/rivian/gamestop/crypto is a very small minority of people.

-

Wilshire 5000 market cap / GDP exceeds dot-com peak

thepupil replied to RuleNumberOne's topic in General Discussion

my point for resurrecting thread was we had a debate about the credit health of S&P 500 a while back. Rates have skyrocketed since then and for now at least, the credit health (as defined by net interest expense in that chart, assuming its right) has potentially improved. my view then ( and now) is that anyone who actually looks at the data for large cap corporate america will have close to zero worries about the DIRECT effect of increased rates on the companies. there are far reaching and important INDIRECT effects, but in terms of credit risk, I think it's almost entirely confined to the private market (which is actually consistent with history, the S&P 500 is and has been mostly IG which has a very low historical default rate). @wabuffo also has been a consistent pointer-outer of US households on the whole being cash rich and how rising rates improves their income...so if households in aggregate are seeing incomes go up, large cap corporate seeing them go up because of rising rates, it feels like rising rates is actually stimulative. But we have to balance that with car / house / durable goods payments for new purchases being terrible and you should start seeing companies and buildings with floating rate debt getting hurt.... that's a bit of a ramble... -

I'm not. It will take 3 bad fund cycles (15 years ish) to kill PE. Right now we only know 2020-2021 PE vintages will be bad. same guys all have more uncalled capital and private credit funds to sweep up their own mess. LPs impairing their capital or making really bad returns on 1-2 vintages won't kill (most) PE / alts.

-

for me the biggest questions is how will the economy handle a (inevitable/already happening ?) slowdown in everything that's financed (cars, housing, appliances) by the bottom 80%-99% (in case of housing) of people and the jobs that are connected to those and will we start to see actual real bankruptcies which affect employment of the 12 million people in the U.S employed by private equity backed companies. these companies can't handle the current cost of financing. if there was a stock index of these companies and they were treated like the public market, they'd be down 60%. Leveraged loans have gone from costing 5% to 10% and that's the index. worse off than index borrowers will be more. for me the biggest quesiton is will those companies change significanlty in operations (fewer people / job losses / closures of locations) or will they just have new capital structures. I don't know answer to that.

-

Wilshire 5000 market cap / GDP exceeds dot-com peak

thepupil replied to RuleNumberOne's topic in General Discussion

Rates are up a lot non-financial corporate america is seeing its net interest payments decline steeply as it earns high rates on its cash and pays low rates on its debt. the S&P 500's debt has a wgt average maturity of 10.5 years so this dynamic will likely persist. wealthy consumers with locked up mortgages are the same way. -

agreed here, and I mostly think/invest pre-tax for bonds, but have bought bonds in taxable recently (mostly w/ duration so there will be significant capital appreciation/loss component). taxation definitely messes w/ the math on bonds (or dividend paying stocks) I used 8/2020 as the worst example to the day and yes, realized inflation since then is bad. I'm not sure what realized inflation has been since 4/2022 (the point at which I thought bonds were becoming attractive and the point at which bonds have lost 5% cumulatively / underperformed bills by ~9% cumulatively). 5 yr TIPS yield 2.5% if you want to use that instead as the "very hard to lose money in tax free account" thing. my broad point is that I think bonds are very attractive and am struggling to fight the urge to invest more in them. I think over very long time frames, stocks will beat bonds, so I have to constantly remind myself of that before I end up with much less in stocks than I have now. you can buy 1 median HHI for $1.3 million of 20 yr IG bonds. 2 for $2.6mm 3 for $3.9mm. That just seems cheap to me. like it only takes a few million to have a couple households of nominal income. that's a world in which I have never lived. if inflaition persists, then the HHI will probably go up faster than the income from bonds and it won't be all that great for bondholders, but for now, I think it's pretty awesome.