thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

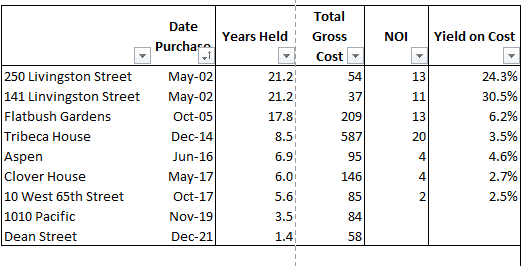

Debt yield = NOI / debt. the cap rate on a building at which equity is a zero. So if Flatbush has $13mm of NOI on $300mm of debt, debt yield = 4% = equity in building worthless unless NOI increases. google “debt yield CMBS” very common CRE lending term/metric. I’m calculating the debt yield at building level and they all just kind of suck. Now maturities are well staggered so there’s still time for NOI to go up (which I think it will but am surprised at how long it’s taking) so yea I feel like Covid was obviously a problem just kind of surprised we’re still not seeing “the recovery” in the 4Q 2022 results

-

like what's up with Clover House? Non rent control, 95% occupied and putting up <$1mm/quarter...on $146mm of 2017 cost....how does that happen? typing all that out made me question my 1% position....like it just looks terrible. Debt Yields look pretty bad.... 4% at Flatbush, 5.6% at Tribeca House, 7.0% at Aspen, 4.7% at Clover, 6.6% at 10 W 65.

-

Cool, I hope 1010 comes in at a 7% yield. that would, in my view, be the first example of a purchase that created value in CLPR's time as a public company. I feel like each of these has a story, but collectively a simple LQA NOI / gross book test displays very little evidence of any kind of value creation (in contrast to say FRPH or any development arm of a multifamily blue chip REIT w/ like 1/10 the risk profile in terms of liqudiity/leverage/etc). I think the stock is cheap though.

-

"Aligned" can mean and not mean so many things. I own CLPR in my IRA. I have no tax considerations. The Bistricers are NY residents. That's a misalignment and difference in incentives. I have 1% of my wealth and none of my reputation/status in society/etc on the line with respect to CLPR. They have a much larger % of their money and rep. That's misalignment. I am a passive shareholder. for them it's the family biz for several generations and many decades. I don't think anyone is truly "aligned" with a management team. Do they care that the stock is at $5.50? Probably. they' would probaby rather it be $15 than $5.50. Does that mean they're perfectly aligned? Nope. they are low basis taxable multigenerational owners of RE with substantial wealth and assets outside of the CLPR entity. they're not well aligned. To me there's a spectrum of alignment. they don't seem like crooks actively working against shareholders, but also don't jump off the page as being spectacular value creators who really care about the stock. @BG2008 thinks they're better than they appear. I struggle to see that. but he does more in depth work (to a very big degree)

-

A buyback is the absolute last thing CLPR needs. CLPR is a subscale highly leveraged, illiquid and inconsequential company relegated to the small crap value backwater of the securities market. there is 1 institutional holder (13f filer) who has gained enough conviction to invest >1% of its portfolio in CLPR. a buyback would, in my opinion, solve absolutely nothing and would not act as some sort of long lost catalyst. My view on CLPR remains unchanged. It’s cheap, own a little, let it sit there, don’t stress too much about it or really expect much of anything from them It’ll probably work out over a long time. I’m down to 1% from its underperformance and my own neglect of it. Maybe I’ll bring her to 2% since we’re in the 5’s.

-

JOE trades for $2.7B EV. the market clearly ascribes "real value" to it. the stock is up 33%/yr for last 3 years and 18%/yr for last 5, besting the real estate index by 28%/yr over the last 3 and 17%/yr last 5. I'll continue to not understand why you think the market is not assigning "real" value to the company. We can argue it's worth more, but there's no need to continually strawman the thing. you're a greedy mf'er expecting the market to give us more than that lol.

-

see below. saying nothing of the go forward (not a company i know well), CSU has quintupled to sextupled most per share fundamental benchmarks over the last decade while almost entirely self funding its growth and without issuing a single share. truly magical. credit due to those who identified early and held. I on the other hand prefer to invest in far lower quality much more capital intensive businesses at lower returns.

-

I think there's plenty to worry about. the biggest question brought about by GEICO/BNSF, is "are companies more valuable within Berkshire or outside it?" There's worries about reinsurance/Jain/etc. the stock picking record, pre-apple was pretty dogshit for a while and i'd expect zero alpha on a $300B+ equity portfolio over the long term. You can find plenty to worry about.

-

I think the buyback has been helpful. a) nicely executed at good prices, mostly in '20/'21 b) has limited the growth of excess capital both in absolute terms and as a percentage of book. 2019 was $108B of cash/ST bills against $348B equity (31%), 2022 is $124B/$472B or 26%. Without the ~$60B of buybacks, ceteris paribus, Berkshire would have just piled up more excess capital. It's a good tool to have , particularly when the old man dies. Should it have come sooner? In my opinion, yes. Should they just pay out all earnings via buyback and not be so stingy and price sensitive? Also yes. But Buff dog's the goat and you should trust his decisions over mine!

-

this is mostly true. P/B has not really expanded. BUT, book value does include stock portfolio valued at market and some of those have enjoyed multiple expansion.

-

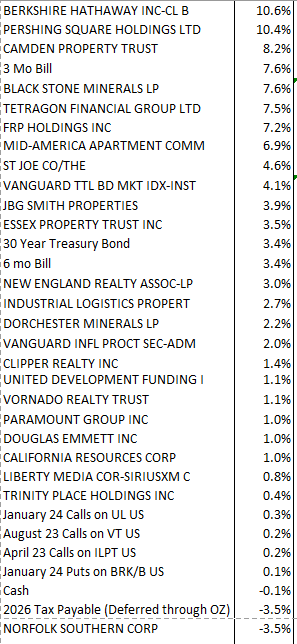

my berkshire's in my taxable account. I'd pay about a 9% of MV to the tax man if i sold. Berkshire trades at 1.4x book, so my realized proceeds would be about 1.25X book. 1.25x book for a diversified, well run, conglomerate seems more than reasonable to me.. I know the company well, it's very diversified, it should probably do okay over time and has low risk of permanent impairment of capital. It's not clear to me that I should sell it even if there are higher returning opportunities. I don't really manage my portfolio to maximize return. My portfolio has enough stuff with lower quality than Berkshire;. I haven't added to it in a while and may dilute its ~10% sizing over time with additions to other stuff. It's not perfect (PCP, GEICO issues, etc), but 10 yr BVPS CAGR is 11%/yr, not terrible by any means. Berkshire is one of the few stocks that I'm actually truly long term about. Other stocks I've had have got taken out, have seen my conviction waiver for whatever reason, etc. It's a lightly and favorably leveraged portfolio of high quality businesses and a decent tool to preserve and grow one's purchasing power. I haven't done the work to prove this, but I think my IRR > TWR with Berkshire given some sizing up/down on the margin. Probably low teens IRR over my ownership, which would techniclally have been a drag on performance, but in my view a very high return per unit of risk and per unit of stress. I don't think anyone should have too lofty expectations of Berkshire (or the market generally).

-

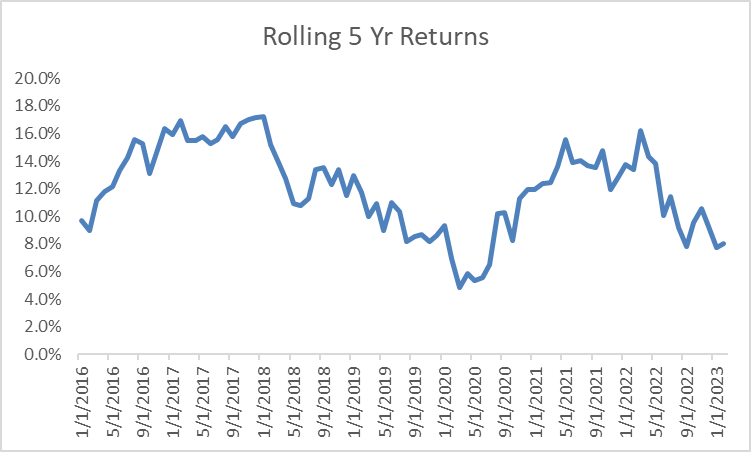

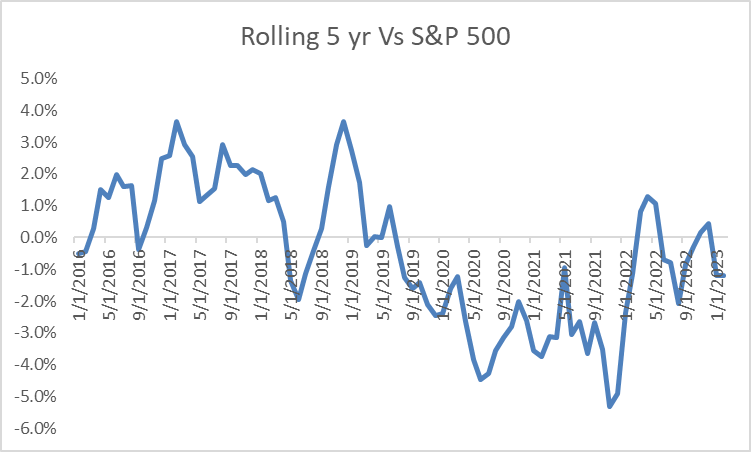

Interesting perspective. I've owned Berkshire since 2010/11 and been quite pleased. Here are the rolling 5 yr CAGRs for 5 yr periods ending in 2016 and later. Average is 12% with several 5 yr periods in the mid teens. What is true is that it hasn't consistently OP'd S&P500 given very very strong market returns. I'd be happy if it did 8-10% for next 10 years. surprised if <6% or >12% I agree with you on Geico. I'm not quite sure about BNSF. I think BNSF may just be structurally less profitable than UNP and BNSF has been slower to adopt PSR. I am unsure if that's a good or bad thing.

-

just preparing myself to lose tons of money as the apartment glut becomes ever clearer....

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

so having consulted the twitter hive mind, it's fair to say that CPT is not exactly at a 6.8% cap rate. It is cheaper than private market value, but the 6.8% number overstates that. You can see thread here. So what I was doing was $1000/$14,700. Some corrections. CPT owns 93% of OP so effective SO is more like 117mm, so market cap is more like $11.7B, not $10.6B. Unadjusted for developments in progress EV is $15.3 billion,. People can decide what to do with the $500mm ish of devs in progress. You then have headline NOI of $1B or so (4Q annualized and 2023E for the sell side). CPT adds back $30mm of porperty mgt expense in calc of NOI. I think that's dumb because someone has to manage them. So $970mm. There's then a number of expenses where people can choose/not choose to deduct them. $60mm of G&A (Matt/owner of 26K units deducts this, though I'm not aware of any other private market operator doing so) . Some amount of "operating capital" and if you want to really compare it to private market you potentially adjust for increase in property taxes upon sale. I frankly don't know precisely how to do this but some PE RE guys insist it's the right way to do for comparability to reported private market cap rates. The bottom line is that CPT is somewhere between 5.6% cap rate and 6.5% cap rate. And the private market is definitely lower. Same guy who said my 6.8% was totally wrong and it was more like 5.6% threw out $300K/unit as reasonable (which is $122/share). Green Street/sell side seems closer to $140. But the point is it's not like $160 or $200 and not high 6's (which was a bit too good to be true). As i said there, he is CEO of a company that owns/manages 26K units. so his view has MUCH more weight than mine. What I can't really reconcile with all this (which is effectively that REIT reported NOI is materially different from private market) is that when REITs do interact with private market they report buys/sales at cap rates consistent with my more dummy/simplified way of looking at things. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

1% months of purchase price per month in rent. It’s used by Bigger Pockets types as rule of thumb. $CPT is like 0.85% using last Q. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

to steal from @realassetsvalue who just posted a comp sheet on twitter (pasted below), I'm liking CPT because it's approaching a 7 cap making it one of the highest cap rate with the lowest leverage. I like basically all of these. 7 cap for blue chip multifamily in my opinion prices in a lot going wrong. NOI disappointing or cap rates expanding substantially. You have to pick your poison. You can invest in california (ESS, EQR/AVB to lesser extent, but also 7% of CPT too) and have no supply growth but deal with stormclouds of tech layoffs and blue state outmigration and all that stuff...but no supply growth...Or you can invest in "sunbelt" and have a rosier economic/demographic picture but with more supply growth. don't really have a SUPER strong view and am open to all of them, I started w/ ESS in 4Q2022 because it fell a lot for obvious reasons and am now adding sunbelt. I'll add urban coastal (EQR/AVB) too if things keep going down. the problem w/ EQR / AVB is if you already have ESS, it just becomes a big california bet. I have NEN (Boston workforce), FRPH (DC riverfront / developer), the MF side of JBGS (DC). I'm an all you can eat apartment buyer at the right price. If you want to wait for 10 caps, you are welcome to do so. I'm buying right now. I may be early, I may be wrong. But I prefer to buy things in the real world and not some apocalyptic fantasy scenario. I'm a permabull at heart. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

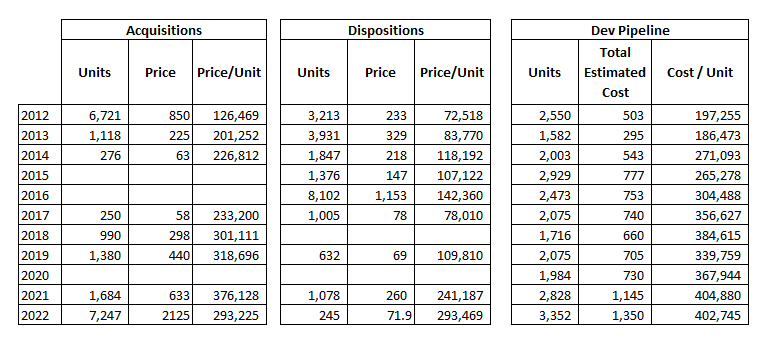

Just to continue on the CPT train. You can currently buy CPT for what looks to me to be a $240-$250K / unit (depending on how you count the development pipeline. CPT has been consistently upgrading portfolio over last decade and has been buying apartments in >$200K / unit since 2013 (and shedding lower value properties) and has been delivering new units to the market at >$250K for a decade. The going rate for shiny CPT units that they are developing is $400K/unit. this is why when you look at a chart like this below and see that the EV/unit has come down from $350K to $245K but also note that it was $110K/unit in 2012, you have to be careful because they've been consistently upgrading the quality of the portfolio. if you look at their acquisitions and dispositions by year, generally they've been selling old stuff and buying new stuff and obviously any development they've been doing is new stuff. In 2012, the typical CPT apartment was renting for $1000/month, now its $2,200/month. that's a combo of same stor growth, but also the massive amount of change the portfolio has undergone over that time frame. they do the work for you and note that since 2011 they sold $3.4B of assets w/ average oge of 20+ years, developed $4B of assets w/ average age of 6 years and bvought $2.7B w/ avg age of 4 years. CPT almost meets the "1% rule" which I associate w/ low quality, subscale non institutional real estate and has not been available for this type of asset in a long time. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

yep, i've found some at what I'd call borderline attractive levels after a 17 year de-rating (plot some of the older building DC condo prices against the median american home over time and you'll see that on average a tired condo on Connecticut used to trade for MORE than typical home and now trades for less, in some cases much less). But I just don't want to deal with that and would rather just buy the stocks on this thread. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

my zip has an interesting bifurcation going on. the moribund condo market seems pretty bad (because of folks like JBGS who constantly build nice new buildings which hurts the 1960's / 1970's buildings the most. still have a few more years of working through this, high short term rates and decreasing return on development will allay the supply. single family on the other hand. you'll pry the good inventory from everyone's cold dead hands. Transactions down 43% LOL. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

he is saying the market is much tighter than posted. he is a credible person who owns 26K units (or runs a company that has investors which own 26K units more accurately). I'm not sure who you are referring to. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

Anyways back to MF. for those who didn’t see this, large landlord (CEO of 26K unit owner) tweeted this today and said the posted cap rates were not representative of the market and were unrealistically HIGH. while we sit here and wonder if 6.5% is going to 8%, private market still in the 4’s and 5’s, with maybe even high 3 handle here and there. that’s basically the opportunity/disconnect. https://twitter.com/MRossG199/status/1640338388459876352?s=20 -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

everyone has their own way of doing things. I look at numerous ways of valuing something like CPT. 1) what would a sovereign, Blackstone, MAA, EQR pay? NAV today. how fast is NAV growing, how does that NAV and NAV discount change in numerous environments. 2) Perpetual constant multiple going concern metrics (dividend + growth, AFFO yield) etc there are numerous folks who calculate NAV. Consensus NAV is $140 ish at a low 5's cap. stock is at $100. so that's a good start. Now how reasonable is the low 5's? How levered is the NAV? has this mgt team historically created value? what if cap rates go to 4%? what if they go to 7%? what does that all look like. What if NOI is 20% lower in 3 years because of recession / too much supply? etc. I won't claim to have modelled everything out precisely. I kind of think of something like CPT as having a mid to HSD perpetual return (call it 7-9% / yr, 4% divvy +3-5% growth) which for 25% levered RE seems pretty damn good to me. Or you could say "at some point in 10 years, someone will pay me NAV, I think NAV is $140 because I agree with the consensus assumptions and I think NAV will grow 3% / yr), so if I get paid NAV in 10 years, I'll make a little more than 10.5%/yr ($188 NAV 4% divvy) or if I get paid NAV in 5 years, I'll make 15%/yr ($162 NAV + divvy)...or If NAV doesn't grow for 10 years because of some combo of bad stuff and it still trades at same discount I'll clip the divvy (4%/yr) or any number of permutations. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

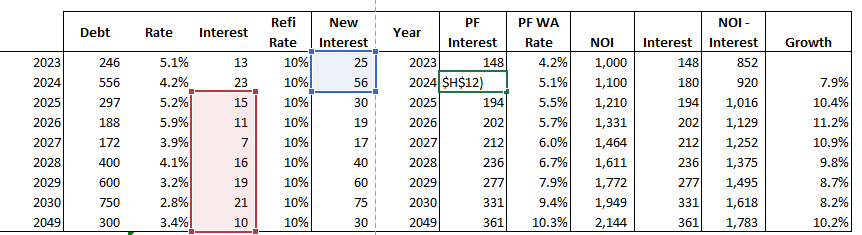

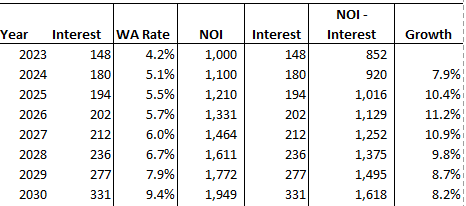

I built it using their capital structure. I assumed that at maturity debt gets refi'd at x% (in this case 10%) and then that calculates a pro-forma total interest expense. Just a very simple excel exercise. NOI and FFO and CFO, EBITDA, etc. are not at all the same thing. NOI is Revenue - Property operating expenses. It does not include G&A, interest, mcapex, etc. FFO subtracts g&a and interest, but does not include maintenance capex, CFO is cash from operating activities and may include many different other things. there are many different metrics or ways of looking at things. For example for 2023, using JPM estimates, CPT's estimated NOI is $1B its, its FFO $6.9 / share ($760mm) and AFFO $6 / share ($660mm). the delta between NOI and FFO is $60mm ish of g&A and $135mm ish of of interest and some "other expense plug that I honestly don'd know what that is. then there's an implied $100mm of mcapex ($1,600/unit/yr). However you want to look at things, the general principle is that if rent and whatever expense line item is growing at same rate, then whatever you're looking at will grow a that rate. If something is growing faster (and it's on the expense side) that's a problem. If CPT had to refi at 10%, all else equal their interest expense would grow about 12%/yr over the next 7 years. if you want to make a case that all expenses and capex will rise more quickly than rents (causing NOI/FFO/AFFO growth to lag inflation), AND we'll see cap rate expansion then you can make that case, but rising interest rates alone are unlikely to be a problem for a REIT with such low leverage and well staggered maturities. CPT's maturity profile is very typical for blue chip REITs (7.5 years appears to be the market average). Some REITs are longer like PLD and KIM IIRC. Some are shorter. you can read more about it here https://www.reit.com/news/blog/market-commentary/solid-balance-sheets-prepare-reits-rising-interest-rates -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

if rent and expenses grew by 10%/yr, NOI would grow by 10%/yr. (NOI - Interest) would grow at roughly the same rate. Under this scenario, the additional rent would by no means be eaten up by additional interest. there is $1B of additional NOI and $183mm of additional interest. Under this scenario Interest goes from 15% of NOI to 17% of NOI over 7 years. Does that surprise you? What matters is the relative growth between rent and operating expenses (or interest or maint capex etc). For example, if rents grew 7% but all other expenses grew 10%, then NOI would only grow 4%/yr over a 10 year period and margins would be declining (and your mcapex as % of NOI is probably increasing too). if the opposite (10% rents, 7% expense growth, then you get 12% NOI growth. What will happen will probably be like 4 and 3 or 3 and 4. (2-5%) but just entertaining the crazy high numbers for your benefit.