thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

there are already regulations against using false or misleading information to manipulate the price of a stock. activist do the same thing on long side w/ calls in monetizing bumps. risk of selling / buying something because of what someone else said is borne by those acting on that information. there is nothing wrong with short (or long) reports if they use true information. if people want to sell or buy the stock as a result of their assessment of the information, that is the market functioning. everyone's accountable under the current system. if you bring to light interesting enough info that causes longs to sell, you get rewarded if you lie, you (should) get prosecuted/punished. if your schtick has no impact or even further heartens bulls / the company is well capitalized, you get run over. seems pretty fair / well functioning to me.

-

well I'm just glad the board's (at time irrational) hatred of short sellers will be reinforced for decades to come. Guarantees my role as resident short seller apologist for a long time. this one seems pretty myeh...

-

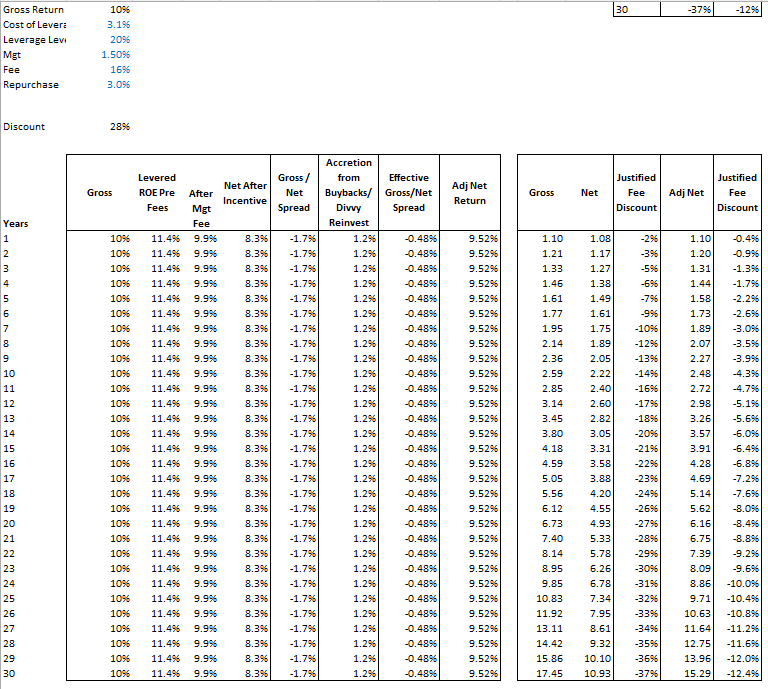

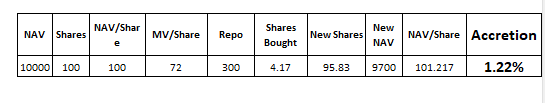

this is similar to how I view things, with a little help from low cost leverage and discount, a buyback/divvy reinvestment of 3% of NAV more or less cancels out the fees such that gross return should be quite close to the net return. this is why a consistent divvy/buyback is so important with discounted NAV vehicles. it acts as a self-correcting mechanism by which the discount allows for accretion to offset other factors which weigh on NAV growth. It does not guarantee a closing of the discount but does help with per share value growth.

-

can you point to any data that backs this impression? it goes against my anecdata (which is that immigrants are, for the most part, working their asses off to make the next generation better)

-

From henceforth, 80-90% of you all won’t pay income taxes…lol

-

It's interesting in that I remember distinctly in the early 2010's working at a place that was benchmarking managers against equal weighted indices because equal weighted had done so much better than cap weighted (particularly abroad where indices concentrated, often in banks) over the past decade. I'd also note that the longest term data I have does indeed show that cap weighted beats equal weighted, but it's not by as much as you'd think, and the two approaches were tied at 9.4%/yr for the entire period 1990-2016. I think it's impressive that the equal weighted basket of 500 US stocks (rebalanced quarterly i believe) has done as well as it has. Makes a good case for RSP. SPY has about 29% in Mag7. RSP has about 1.75%. 1990-1999 Cap weighted: +18.2%/yr , Equal Weighted: +12.5%/yr 2000-2009: -1%/yr vs +3.4%/yr (equal weighted wins) 2010-2019- +13.5% vs +13.55% (cap weighted edges by .05%/yr) 2020-Present: +12.5% vs +9.9% (equal weighted wins) Whole Period Cap Weighted: +10.26% , 2693% Equal Weighted: +9.72%, 2262%

-

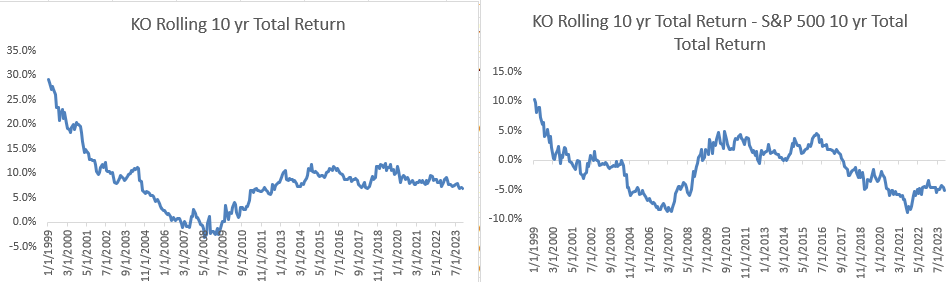

From it's absolute cherry picked 1998 peak, KO has returned 4%/yr, roughly what the bond index has returned. from same date SPX did 3.5% / yr better and 3.4x cumulatively what the KO returned. KO lagged significantly and substantially following its glorious rating upwards and generated a poor absolute return. Less cherrypicked data below. Let's be clear, the stock made 30% a freaking year in the 10 years ended 1999 in a market that did a steamy 18%/yr. It's been an absolutely fantastic pick, and I'd argue buffett did monetize it (issuing stock) and never reinvested dividends. He doesn't monetize via selling stock. On balance that's been a very good way of managing berkshire's portfolio and made him and his shareholders rich. doesn't mean there aren't potential drawbacks to #neversell

-

not sure I get your point. LT TIPS destroyed KO from when it was expensive, as did normal bonds and other types of stocks. from 01/1999 - 12/31/2007 (so not including the GFC), LT TIPS made 110% / 8.6%/yr and KO made 10% / 1% / yr. (I'd love to provide a less cherrypicked atart point but am constrained by the index for which i have data) KO has been a spectacular investment for Berkshire. It was a shitty investment in 1999. Buffett sold it via issuance of Berkshire stock toward the top, hasreaped lots of divvies and probably, with benefit of hindsight, should have sold the stock too. I don; when does my apple stock mature?

-

I don't really think it's anything to be disappointed about, but rather a risk people can decide they want or don't want and people can bear the consequences because at the very least Berkshire's stand on the matter is pretty clear. Even indexers have to watch their concentration these days...

-

I don't think he's short. I wouldn't mind if Berkshire indexed a portion or some other form of diversified equity ownership. I mostly agree w/ the authors points. Berkshire trades for 1.6x book. AAPL stake net of DTL is about 28% of the book value. So for that 28% of the book value, one is paying like 45x earnings. Of course some of the subs aren't worth book (rathe rfar more) and the liabilities are favorable (DTL / insurance / etc) so this is the least favorable way to look at it, but it is nevertheless quite richly valued at 30x and via Berkshire one is payinga big premium to that. I've sold a fair bit of Berkshire over last year for both my and family's account. been an issue in particular for family. Have ~4% in AAPL that's up 15x and 18% in Berkshire up 2.5x, and some QQQ as well...have to watch the look through aapl becoming too big at a seemingly stupid valuation and less painful to trim the berkshire..plus the aapl's been trimmed enough...we also use the the AAPL for donations as another way to trim. In the past when, I've done more detailed work on Berkshire, have always thought it should trade 1.8x-2.0x times (this was a combo of DTL/insurance franchise/writeup of Berkshire Energy/BNSF etc); and I've owned it for 12/14 years because it was always pretty reasonably priced. But the AAPL makes me think the multiple should be lower.

-

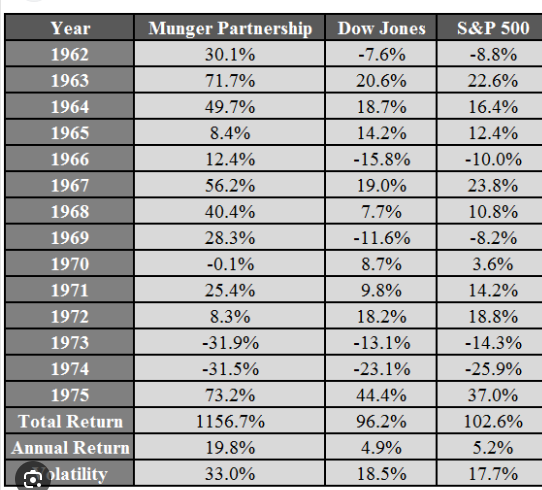

he had a 55% drawdown 73/74. might be bigger peak to trough. I wouldn't consider it a "blow up", particularly in the context of the returns in the years leading up to it/overallrecord.. note: as an illustration of sequence of returns risk, if you put those two bad years in the earlier part of his TR, a high withdrawal rate (say 8%) bankrupts the strategy despite it making 20%/yr. I think this is an unfair hypothetical and do not at all mean to discredit the record. but just a good illustration (ie you can be a spectacular investor and make 20%/yr and far exceed the market but if you start at a bad time and have a big drawdown, a too high WR kill you).

-

this is case by case. illiquid assets could be well covered 1st lien loans / mortgages that just don't have an established market...or they could be worthless venture capital assets...or they could be land held at 1920's prices or they could be well anything..."illiquid assets" is simply too broad a category for any one method to be able to approach anything useful.

-

Fair enough t, thought you were trying to argue it’s not expensive to raise a family in NYC metro, and i was…confused.

-

w/ 30% down, PITI is $7,500/month, so you should make like at least $20k/ month take home / like $400k gross to afford that. id describe that as pretty expensive

-

maybe fortescue?

-

@ValueArb damn...I'm really very boring.

-

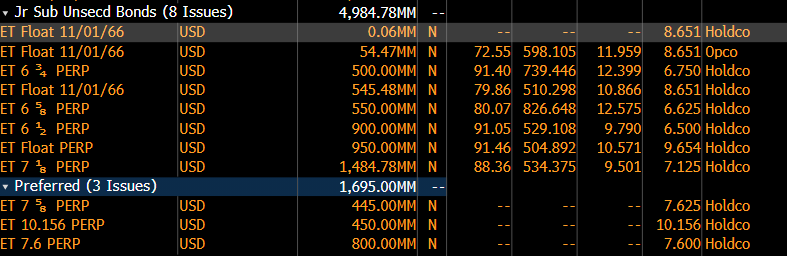

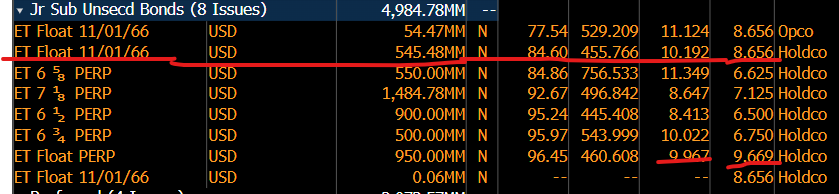

ET is out today with a 3 part bond offering. They are issuing a 10 year and 30 year unsecured BBB notes (at or below 10Y + 190, probably sub 6%, and 30y + 212, which looks like should be 6.3% ish). They're also issuing junior subordinated notes whose rate resets on some interval at ~8.5%. Use of proceeds is to redeem preferreds with high coupons. these prefs were trading above par and this was priced in the market. I believe gets rid of almost all debt which has a higher coupon and is junior to the bonds discussed in this thread. It also shows ET flexing its new investment grade rating to lower its cost of capital. After this, they'll have ~$45B of unsecured IG rated debt yielding 5-6.5% and then ~$5.5B of junior yielding 8.5 -10%+. Of the junior debt there will be a $950mm issue w/ a 9.7% coupon (which they should takeout before the bonds i like) and then after that is our $550mm of bonds with an 8.6% coupon (at current rates). The bonds are now $85 / $86. I still think they're attractive. you'll make ~16% cumulative from the call, plus you get SOFR + 330 (currently 8.6%) until call, so still a 10% current yield + the call potential. So still think a low to potentially high teens IRR on a 2-5 year time horizon with a call, with potential for sooner as they continued to clean up the capital structure. I also value these from a portfolio perspective as they will pay more coupon if the fed doesn't cut. if the fed doesn't cut, my longer term bonds will (probably) not do well.

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

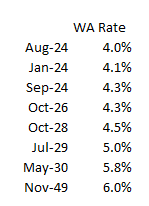

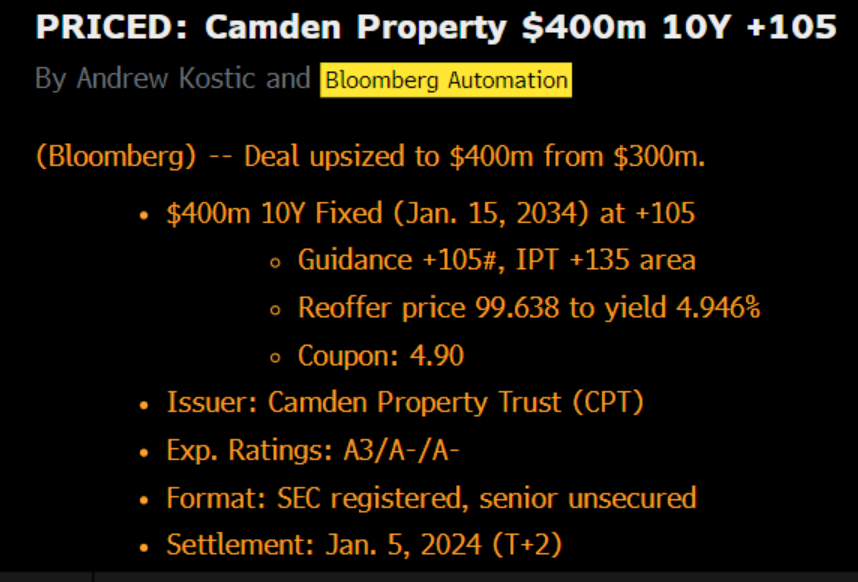

CPT with a CPT just raised $400mm of 10 year money at t+105, 4.9%. I assume they'll use this to pay off floating debt at >6% coupon which will keep weighted average rate at around 4% ish and significantly extend their weighted average term. This significantly decreases the already low rate/refi risk for CPT and demonstrates the access to debt advantage. S&D Fundamentals, not financing, will be main driver, given low leverage at low rate. -

who is "they"?

-

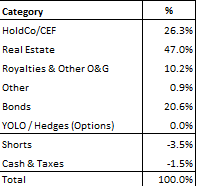

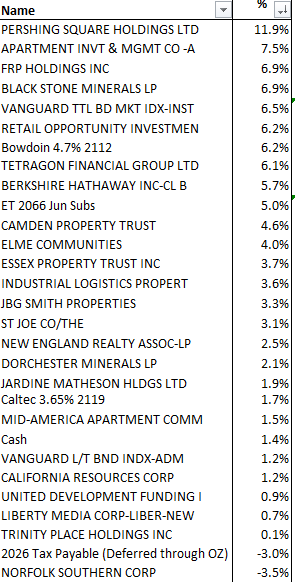

More comprehensive writeup: So this was a year in which I had little conviction, decreased equity exposure significantly as bonds became more relatively attractive IMO (got as low as 70% long stocks, 30%-40% long bonds) and was generally not inclined to to aggressively average down or hold things on their way up. This means I impaired some capital in things like JBGS (swapped for ELME at the bottom, ELME rebounded less), aggressively took profits in JOE (began year at 9%, ended year at 3% despite outperforming holdings), sold a significant amount of Berkshire Hathaway given my belief its largest holding (AAPL) is overvalued and that its absolute / relative value is less clear than in past. I more or less feel the same about my portfolio as i did throughout 2023. I don't have super strong conviction in much of anything and am about 80% long stocks / 20% long bonds. I own a bit too much real estate and am way too invested in the US, but this has been the story of my entire investing journey. My consolidated IBKR accounts have returned: +319% from May 24th 2013 to December 29th 2023. SPY is about 249%. REITS +81%....Account = 14.5% / yr. SPY = 12.5% / yr. My consolidated Fidelity accounts have returned: +141% from August 12th 2016 to December 29th 2023. SPY is +148%. REITs +38%. Account =12.6%/yr, SPY =13.1%/yr. My 401K (not included in the above and a low % of NAV) returned 6.7% as it was mostly invested in the bond index. My wife's 401k (a very small % of NAV) is invested in stock indices. Good year professionally. Substantial savings/growth in NW, remodeled house, paid for expensive ass life. I've modestly outperformed over time. About half of my accounts is tax deferred which blunts the blow of decreased tax efficiency relative to index. I view my performance as okay. I could paint it as really good ( outperforming despite almost no direct tech, 50% ish on average in RE and destroying RE benchmark). Or I could paint it in a very negative light (higher effort and tax inefficiency relative to indx to no risk adjusted value add). Overall, since tracking consolidated all account performance (+14.9%/yr vs SPY +13.3%/yr) 2023: +18% 2022: +4.5% 2021: +55% 2020: +2% 2019: +20% 2018: -2% 2017: +15% Ending Portfolio (I'll get rid of the stupid Norfolk short soon)

-

About +18% will post more fulsome thoughts later. I feel fine about it. Think the significant underperformance was very much deserved. Didn’t have much conviction in anything this year.

-

What Is the Best Investment That You've Ever Made?

thepupil replied to Blake Hampton's topic in General Discussion

from a pure MOIC perspective, I think the below call option on APTS, $774 to $38,500 or 50x. I think that significantly overstates the profitability because I lost a few grand on the prior month's expirations, but it's still a cool line item. I made more in the common, but the options juiced it really well and also prevented me from risking more money in APTS which had a more levered balance sheet than other REITs. In an alternative world where BX didn't buy them out, these would have been a good trade in terms of keeping loss minimized. I think LAACZ and Berkshire are biggest $$$ contributors over time...(though my primary residence probably eclipses them if you count that). I think my first investment (a speculative company that went to zero) which inspired me down path of value investing was probably the best in terms' of the more indirect wayh of answering the question. -

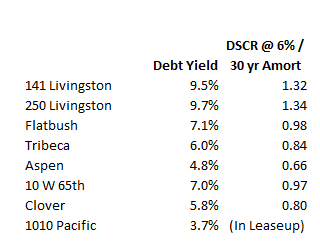

4% 10 yr 2% spread + some amortization and CLPR can't service its debt on most of its buildings. we'll have a few years to see how it plays out at maturity, but it's pretty dicey. a full 25% of NOI is office which trades like utter dogshit in public markets (for obvious reasons). On an asset basis alone, if you assume a 500 bp spread at 5%/10% between office and MF, this is worth a 20% discount to pure play peers. on a levered basis, materially more than 20%. this will decline of course as 1010 leases up/the other one comes online. I don't understand the appeal relative to NEN/AIV/FRPH/VRE & blue chip MF's...beyond "YOLO".