thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

He’s not, $215mm is the incremental interest expense at his 10% refi rate (which I think is absurd, but likes of MAA/CPT could handle) -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

So I kind of loaded up today and ended up with 7% each in MAA/CPT. Sold my 29 year TIP at 1.6% real, CLO AAA at 6 and change yield to buy these pups at 6.5% CR and like a 6% AFFO yield, in conjunction with my ESS/NEN/CLPR/parts of JBGSFRPH got like low 20’s in multi family which seems reasonable to me. Lots of supply but starting with well below pvt mkt basis and leverage will (hopefully) help. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

I'd think that dramatic of a move in rates zombie-fies the whole banking system given that the move to date basically killed 80-90% of capital. now the system collectively doesn't have to "mark to market", but I don't think i'd love being invested in banks if they went to like 4x their equity into theoretical insolvency, nor do i think capital return would be happening. I'm not a bank doomer; in fact I don't think there's evidence we are in a "crisis" that is widespread or important.. But I'd be a bank doomer if I thought rates went to 7-10% quickly. as for energy, I don't know. I own some. no idea where prices going. Sort of in line with what @Gregmal was saying, being so concerned w/ rise in cost of capital does push you into lower multiple sectors that have other different risks. Time will tell. But for the record, I think a 2 handle 10 year is more likely than a 7 handle . And a 1 handle more likely than a 9. given we're at 3.5%, I think most would agree. doesn't make it right of course. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

It's not clear to me that there are securities that wouldn't be drastically lower in price under LMPTRHCOC. So if you use LMPTRHCOC as a base/reasonably probably downside case, I'm not sure what you could own. If there are some, I'm very interested. I think maybe my royalty trusts (unlevered and hydrocarbon cost linked) may do okay, but who knows. their success will depend on hydrocarbon px and volume of production on their land. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

I don't know. that's a lot of rhetoricals and not a lot of tickers. what companies under what I'll term the Learning Machine Pet Theory Radically Higher Cost of Capital (LMPTRHCOC) scenario do you like at today's prices? what's the LMPTRHCOC Portfolio look like? -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

well sure, I'd like a stock like that, but that doesn't exist. If you think it does, I'm all ears. What stocks do you think fit that criteria? Of course, stocks collapsing would increase the return on redeployment, but I can assure you if risk free rates go to 7-10% and PE's go to 7x, I and everyone else is going to lose a shit ton of money and not be happy. CPT has been around since 1993. According to bloomberg, In 1994 it had 9.1mm shares. Today it has 106mm. In 2013 it had 84mm. Despite all that share issuance and "dilution", after a 44% drawdown from peak, CPT has returned 9.4%/yr over the last 10 yrs (behind S&P 500's 11.9%/yr and ahead of broad RE 6.3%/yr) and 11.4%/yr for the last 30 or so years (ahead of S&P500's 9.8%/yr and REIS 9.5%/yr. What you call "dilution", I would describe as "value accretive issuance" -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

this scenario contemplates high quality apartments trading to 9-11% cap rates and $150K / unit - $190K / unit on today's NOI. I can only find data to 1986, but the absolute peak CR on multifamily was in early 90's at around 9% according to what i can find. and that's before the institutionalization of the asset class. Said differently, this scenario contemplates apartments trading to 1.5-2.0x it's tenants' income and like 1/2 replacement costs (which would theoretically be increasing at inflation as well). In such a scenario, no apartment will get build (few are being approved now at current prohibitive short term financing rates). ALL risk assets will decline significantly if the risk free rate goes up by 350 - 650 bps. it's kind of like saying "what if stocks PE goes to 7x?". It's like "yea, then I'll lose a lot of money". -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

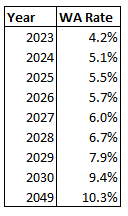

The 1% / year comment is in reference to incremental interest expense if they have to refi their 3.9% get average debt at 6%. It increases interest expense by cumulative $75mm over 10 years which was about 10.5% cumulatively, which was about 1%. it’s higher at 10%. The 30% of AFFO comment. there are 2 tables in the post which show how the wgt average rate changes at 10% and 6%. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

I added MAA and CPT to my existing ESS today. I was a touch aggressive in buying 5.0% ers in each given the low leverage of these bad boys. For learning machine's sake CPT has $1B of 2023E NOI. and $3.6B of debt paying 4.0%. Here's how the WA rate changes with no paydown if they had to refi everything at 10%. It would add about $215mm of interest and decrease AFFO by 30% over the next decade or so. In the real world, CPT's debt yields 4.8-6.0%. If they renew at 6% over next decade about 10% of today's AFFO goes away over a decade (so a 1% / yr each headwind, assuming no offsetting increase). Note that if they have to renew at 6%, you're still at 5.1% wgt average rate in 2029. the flip side of this is the returns on these bad boys (absent m&a which MAA is too big for) can't be all that great because there's just so little leverage relative to private market, but think they're good r/r down here and very average down-able in the event of an extended downturn (which we may be entering). if they renew at 6% -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

The whole world breaks at those govvy rates. it’s a pet theory of yours that’s probably my priced at a sub 1% probability. You should just roll options on futures because you’ll make like bajillion dollars if that comes to pass. and l these REITs are 30-40% LTV and 4-6x ND/EVITDa when the private market is 1.5-2.0x more levered and sometimes with floaters -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

the high quality multifamily REITs access 2 markets for financing. The corporate unsecured investment grade market and the agency multifamily market. These are both typically in the government + 100-200 bps area. Implied in @LearningMachine tail risk financing market is a 5-8% 10 yr yield. the world / banking sector started breaking at 4%. I personally view the probability of a 7% 10 yr as EXTREMELY low. but if it did happen, most of these MF REITs could trash their divvies and pay off their debt while the entirety of the RE market would effectively blow up. If we applied tail scenarios to most investments, we would not get comfortable with much. -

Is Concentration a better strategy than Buy and Hold?

thepupil replied to Viking's topic in General Discussion

I don't really understand your point though because theoretically as one gets wealthier, the less and less one needs to risk as a % to make a "reasonable amount of money". Like let's say you find an options situation that's a 0x or a 10x. If you have $100K and are saving a good bit and you're young, maybe it's not crazy to risk 10% of your capital on that. Can make it back easily and in the upside case you double your capital base. If that person ahs $1mm, I don't think you risk $100K on it. I'd probably risk the same $10K. No right answer of course. -

Banking vs Brokerage Question for Deposits or Stock Holdings

thepupil replied to Saluki's topic in General Discussion

I keep money at Vanguard, Fidelity, Interactive Brokers, Treasury Direct, and Bank of America. I have a HELOC at Third Federal. I think each one is individually safe, but have selected those based on combo of convenience and perception of safety. an additional precaution worth taking is to not have a margin account if you don’t need one (I believe more clearly segregated). I assume at least once in my life, I won’t be able to access one or several of these. My biggest fear of this nature is a cyber attack (I’ve contemplated direct registration but have procrastinated and it’s not compatible with employer required reporting of all my holdings / trades). these types of risk are very low probability but extreme severity. I always want to be liquid and never want my liquidity to be dependent on one corporation. -

i don't know man, i think he thinks he's the steward of the almighty dollar tasked with keeping our dollar hegemony intact ("price stability") which allows for our gloriously profligate standard of living....and also charged with wrecking the shit out of the speculative froth in all kinds of unproductive assets (including, probably, some i own). I kinda dig it. on the other hand, no idea how the whole government budget thing works at 5% rates and don't relaly think this last for a long time...but macro's obviously not my strong suit. and it's nice to have real return on savings. i sort of see it as a cleansing. cleansing of the most speculative behaviors (crypto, short term floating rate funded financial stuff (PE, RE flipping), and a check on non productive or marginal projects. we all got a little carried away. hell i put $100K in a groundup mixed use development in an opportunity zone that i won't see a dime for for like 10+ years if ever. we just had a crypto bank blow up. good to see some bodies start falling no?

-

well KHC and KO's margins are down (GP and EBITDA) from pre-covid, so maybe they have to reinvest all that into advertising. I don't really think it's important in the end or precisely understand your point. Everyone's complaining about egg prices. Cal Maine's margins are high, but they go thorugh boom/bust cycles all the time. nothing new. i just don't see any evidence of "price gouging" or whatever. if anything, inflation is wreaking havoc on profitability (as one would expect)

-

then you'd have a different view because no one is predicting that. I frankly don't find any validity to this "corporate greed" as cause of inflation reasoning. Like Kroger's margins are very barely up to flat from 2019. many companies' margins are declining and earnings power is declining in real terms. The simpler explanation is that inflation is has been real.

-

you can see PEP's wild and crazy (and by that, i mean completely non existent) margin expansion from all those price hikes here:

-

I'd agree here. Brent is $82 relative to $71 10 year average WTI is $77 relative to $65 10 year average Natty G is $2.60 relative to $3.40 10 year average Rotterdam Coal is $118 relative to $100 10 year average Dutch Natty is 44 relative to 34 10 year average All of these have declined substantially over the past year or so, are above pre-covid prices, but not crazily so, and not really at all in real USD terms. There's some strong dollar at work here though. For example, Brent is $78 euros, relative to $60 Euros 10 year average (so 30% above, whereas Brent is only 15% above 10 yr average.

-

Following a significant inflow (yay!!!) I bought 10% OTM calls on $ZROZ and $VT because I don’t have many high conviction ideas at this time and just want to cover myself in case of a big stock/duration rally. I am posting this in case anyone else is feeling dumb or out of ideas or timid. Maybe just park in t-bills like everyone and their brother is talking about, but also maybe consider that you may be wrong and consider capping your opportunity cost. This will obviously cost $.

-

My dad retired in 2007. He got "rich" (depending on your definition) through extreme concentration. He was an exec at a company that went public and put a lot in the stock at IPO. Company got LBO'd so he crystallized his gains, company later went bankrupt after he left. He stayed rich via bonds. Being 60% muni's w/ a typical Merrill lynch guy into the GFC saved my family's financial health as they weren't forced to make withdrawals at steeply discounted stock prices and didn't panic.. they owned a valuable unlevered home and by no means would have been destitute but a real life "sequence of returns risk" case study; if they went in 100% stocks, I'd imagine their standard of living would be lower than it is today. Now in 2013, I took over and it was stil like 50/50 and thought that was too conservative and switched things up to more like 70-80% stocks / 20-25% cash and it's the best and most impactful financial decision i've ever made (we're now more like 70/30 with the 30 being in bonds not cash built up the bond position over last year or so. Bonds are indeed a wealth preservation tool. and for many that's the goal.

-

An increasingly great time to be a saver. Starting to be able to lock in decent returns with duration. Short stuff 1 yr bill: 5.0% CLO AAA 6.3% Longer Stuff 10 yr: 4.07% 30 yr 4.01% MBS Index Yield to Worst: 4.8% 20 yr BBB Corps 6% TIPS 5 yr: 1.7% 10 yr: 1.6% 30 yr: 1.6%

-

I’m not saying bonds will beat Coke. Coke very likely wins vs 30 year 4% tsy. on the other hand this bond apologist thought Buffett’s comparison of KO vs the bond to be a bit lacking given that long term bonds actually did pretty damn well over that time frame and provided like 70% of the return and (1-2% less CAGR than KO). I didn’t run the analysis myself but the other dude on Twitter said constant maturity 30 years was beating KO for majority of time frame until big duration sell off last year. alas thought 30 yr tsy’s don’t yield >7% like they did then, then I’d own 50% instead of like 5

-

Most of you anti-bonders (asset classist or equity supremacists) will take heart in reading Buffett shilling Coca Cola vs a 30 year bond and what a resounding success his purchase of Coca Cola was vs a bond. You will sit back with your 100%+ equity allocation and smugly say “what kind of idiot would own bonds?” what you will not do is what two brave keyboard warriors of fintwit have already done, which is point out that since August 1994, KO has annualized at 8.5% per annum with divvies reinvested. A 30 year zero coupon bond returned 7.5% per annum. mr Buffett’s so called “trouncing” is more like a slight victory. #bondlivesmatter

-

since 2010, BNSF has paid out about $46 billion of dividends to Berkshire. total Liabilities grew from $33B to $45B, so about $11B. This was mostly increase of Debt from about $12B to $25B. The deferred tax liability was pretty constant at $14-$15B. Revenue went from $17B to $26B, EBITDA from ~$6B to $12B (so ND/EBITDA went from about 1.8x to 2.0x). Sales / Employee from $443K to $662K, Personnel Expenses from $4B to $5.2B, OM from 26% to 35%. BNSF's gross property wentr from $46B to $82B 2010- and equity from $35B to $46B. BNSF has certainly enjoyed very nice margin expansion, returned lots of capital to Berkshire and been a very successful investment.

-

selling INDT which at this point was only in non-taxable accounts to buy more more CLO AAA via JAAA. Index yields all in at about 6.03%, SOFR/LIBOR +150. Hiding spot while figure out the next move.