-

Posts

3,485 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

It's highly likely that one can get peace with Putin taking his regions of interests and Ukraine promising to stay a neutral country. We won't get peace with "Ukraine is independent and can decide to join NATO" and "Ukraine gets everything back".

-

Highly recommended

-

I have recently watched the navalny documentary and also his 1.5 hours video about putins abuse of his political power, stealing taxes etc. Yes, russia became an authoritarian regime with a few people with lots of power, with putin at the top. But he is also very paranoid and he hates having missiles close to his border that could bomb him away because of "missing democracy in russia" or whatever reason the US might make up. He is not interested in conquering the world but rather preserving a wide margin of safety around his country so he can live in peace and play his emperor game. That's for the Russian people to solve and not for us, we try to be diplomatic and take the resources necessary and maintain peaceful relations and focus on our own...

-

Trump is terrible for us and you have to counter him with his own medicine. America great again? Sure! Germany great again too No more "common interests", sure! Then we all look out for our own and i think thats best. Germany is in a great position, lots of industry, lots of neighbors and potential. We need missile defenses for germany but most of all we need good relationships with russia I am very sure putin is not interested in attacking germany, he actually rather looks at the US with pessimism if you read his speeches so i think he will be quite happy if we get back to diplomacy and the US chills on their own island.

-

So yes, leaving nato, stopping being a US puppet and looking out for our own interests will make a lot of sense. But hey, perhaps the US will start sanctions if we miss behave? Maybe stop sending the AI chips to germany too? lol! Imagine what could be possible in eurasia and how much wealth we could create? Short SP 500, long Eurasia 500?

-

About time we get independent from the US, especially considering what kind of presidents are voted for...is Trumpe a reliable nato partner? Absolutely not. Germany upsizes military spending, either gets control of french nuclear weapons in an alliance between the two countries, or asks for their own (lol). As you can see by my illustration, your nato partners already provide enough buffer space for us were you have to protect these countries before russia or china reaches us: Win Win. The rocket defense domes are produced in germany too, we shall up the spending! With better russian relations we can built/reuse our pipelines again, start a large industrial stimulus and germany will be great again! On top comes that we dont get drawn between the US and China, can keep china as an ally/market/ressource partner!

-

Leaving nato ultimately would be a good thing for germany honestly, we can finally stop the non sense in ukraine, get our cheap energy back and drive up our industrial machine, not be involved in military conflicts all over the world and time to focus on our economy...getting to a position like switzerland, neutral...one can dream.

-

Why are we getting booted out?

-

Also find it quite funny that western countries focus SO much on "DEMOCRACY" (the process) while OUTCOMES apparently seem to matter less. I have to say, I care more for the outcome of a society than for the process and id say that is true for a large swatch of chinese people. Sure we have some rebellious journalists or students etc, the west has greta thunberg etc, doesnt mean that these people are necessarily correct with what they want although they make good headlines. What will matter to the chinese joe is growth per capita, feelable development of their environment, wealth increase for everyone. Not if he can vote black or white and nothing changes.

-

+ Its also not very democratic setup either, US+Europe is 1b people. China alone is more than that, then you have the Brics nations which historically didn't have much say either... I mean, putin cant go into countries that accept the power of these courts so they are working in someway dont they?

-

-

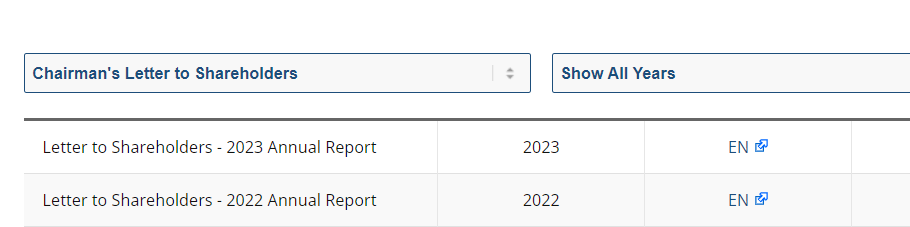

Its uploaded in the Fairfax Letter 2023 thread!

-

Holy S*** this is a great read, especially considering that sleezy MW shorter...Watsa seriously can be proud of what he built

-

Yeah even when i did it it just went blank but started to work now

-

Its live: FFH_Fairfax-Financial-Shareholders-Letter-2023.pdf

-

-

To reframe: What help are high-end AI chip sanctions for Uyghurs? Which other countries have sanctions for NVIDIA chips? The sanctions are just there to get the upper hand on China, economically and militarily. China could stop the labor camps now and it wouldn't change anything. And yeah, if china allows LGBTQ folks they will surely get the chips too Why is the US allowed to have AI chips with Assange releasing war crimes to the internet and then faces 175 in a torture cell somewhere in the US? Prisoners were hidden from the red cross...collateral murder by US Apache helicopters, spying on normal citizens without probable cause... But more fundamentally, i seriously hope for chinese investments that they can develop their own chips because i dont think they will get em anytime soon and i think there is a reasonable chance the US can really amplify the control of these for their own benefit.

-

I strongly disagree. The only thing that matters is that China is a significant competitor of the US on all fronts. Are there sanctions against other countries with human rights abuses? Its one sided against china only.

-

Something that really shocks me: I have an account at a german broker called "trade republic". Its the robin hood equivalent for northern europe. If i simply go to "search", the function to search for stocks etc, I have DIRECTLY on the front page the option for derivates with THREE underlying stocks: NVIDIA NASDAQ SUPERMICRO Its probably based on the most traded derivatives but still, the app is inviting people into buying derivatives on the companies which obviously then also pushes up the prices of the underlying securities... Talking about a bubble... EDIT: They are managing 35b in assets.

-

If China is blocked from global semiconductor trade, bombing TSMC will hurt a bit, but a lot less than if they are included in the supply chains. What it will hurt is the US at that point. So very strategic business for global power and way closer to china to destroy...

-

China looks towards Taiwan with the fingers on their missile buttons. IF the US continues to harm China and their economy continues to deteriorate, i think it can make sense for china to take taiwan has a hostage and cut off the chip supply. Do a full blockade of the island, bombard it with heavy missiles from the mainland...taiwan isnt investing nearly enough into their military, US still far away...

-

I hope that they are able to circumvent the sanctions with shell companies in other countries etc. But the supervision for NVIDIA AI server chips seems to be tougher, and can't say how easy it is to dodge controls here. Maybe we really end up with similar work arounds with russian gas. Just order it through multiple companies and countries at a higher price. Perhaps AI chips will then only be sold to US largecaps and your company needs to be at a certain size to buy them? What will that do to Nvidias supply chains? Perhaps this will become a more tightly controlled business on par with military shipments at some point in the future. AI regulation also seems to be an open question. But i think China is also able to get quite some manpower together with the global south and rejected countries with lots of ressources, LOTs of potential for conflict and the more the gap in development continues, the more people on the other side will have nothing to lose and a war becomes more likely (hello Bin Laden).

-

I guess US small caps is still a good place to be in.

-

And lets say AI really drives GDP growth north of 3% and we see 4%+ for a couple of years in the US. Thats the dream for US wallstreet and china will look: