-

Posts

3,485 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

At the same point in time, US largecaps are priced at all time highs and multiples while the rest of the world, except for a small elite of companies in europe (LVMH, ASML and what not, NOTE: ASML bows down to US orders too, and what is left of chinese tech), is priced low. Inflows definitely have something to do with it. Geopolitically, China is in a bad place. Everything will need AI, Software/Games, Commodities, consumer staples and what not. Mcdonalds will have a cool AI in China but their local chinese players will not have that. Their players will significantly suffer in competition. I dont know if china is able to replicate the chip technology but its really not a nice place to be in.

-

It doesn't matter what "horrific" things China is doing. They may as well stop the labor camps, but they still won't get the chips. They won't get them even if they start appeasing the US. They are just not allowed to develop and become a counterweight to the US led world order. The US now controls more than 60% of global cashflows with their multinational companies, the SP 500 is THE most important index and totally overweight in a total world. Maybe the sanctions will be lifted if they have elections that can be influenced by western media and the elected leader becomes a servant to the US/Nato.

-

Whats bothering me the most right now is chinas inability to get the latest high end chips and the continuing pressure on ASML to stop support china with older machines. What impact will that have on their economies and competitiveness? What if Tesla is allowed to use latest Nvidia chips but BYD cant, making their product inferior? Essentially, that ban is a complete blockade on chinas development and will effect them literally everywhere. They wont grow as much as the west since they cant have the level of automatization, their tech companies will lag behind, tech products will lag behind compared to the west. Amazing for the west and US economies, terrible for china...

-

We wanted to try an estimate, we can never be sure of the numbers. This was not an attempt at an audit proof number, but rather to estimate how much the board could own. If we take the active member numbers for granted and speculate about the volume that comes into existence by guests and outside readers that have full access to the fairfax threads, i think its likely that the board owns quite the significant amount of the stock by now.

-

I wanted to say that the board might have influenced hundreds of millions of buying power onto fairfax due to many guests that read the fairfax posts but do not take part in the poll.

-

Almost 50% in FFH for me at the moment. 0 Plans to sell.

-

Is the guest to member ratio like that? Guests are 5% of the boards active users?

-

And why is tesla "for profit" if he always claims his goal is to help humanity and bring us to mars?

-

I thought free market capitalism serves all of humanity and that musk as a libertarian is all for that?

-

Btw is Musk now a CCP member? OpenAi received capital to "serve humanity"? LOL!

-

We also need to include the lurkers who are here via guest visit!

-

Thing is, i can not find anything looking as good as FFH right now that i dont already fully own, which makes "rebalancing" redundant at the moment.

-

Money market: Xtrackers II EUR Overnight Rate Swap UCITS ETF 1C Plain and simple.

-

This overconsumption argument is harmful IMO, we really should want more growth. Overconsumption arguments mostly comes from well off upper middle class people, many still would like to own an appartment/house, have a second car, higher quality of food etc. Yeah, the more for less is just a weird cognitive dissonance for some. Yes and exactly those people need more growth, if you'd stop the system now it will be those people who will vote for more radical types of politicians because they see how other people live and their standard of living isn't growing anymore. Then you will have fights for distribution of resources because general wealth isn't growing. That exactly will cause instability, which we really don't want: Little anecdote... Yes, people will always be jealous, but they also see they are getting better off over the years. If that stops then they will start rioting, stealing in stores etc. The promise of everybody benefitting in capitalism was great for stability, until the growth stops... Yeah, housing is difficult.

-

The problem I pointed out is that we will have too many people who do not have the disposable income to buy the surplus production created by automatization and AI. And that this needs government policies, which I assume will happen by then

-

-

Of course it depends on what your definition of wealth is, if you look at asset ownership many people can not afford homes and lifestyles their parents were able to afford.

-

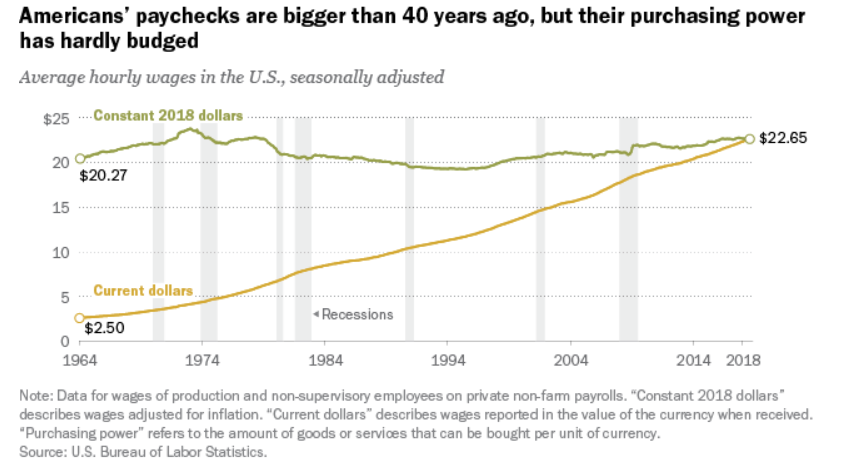

Bottom 50% percentile wages have not risen at all for 15 years+, not "everyone" is getting richer. Considering inflation its more like more than half is not seeing more wealth but less, hence the political instability worldwide.

-

Id go so far and say that the average service worker joe is not better off today in terms of wealth than a factory worker 60 years ago, yes he will live longer, can use more technology etc but uber drivers are broke and dont make any money. On top comes that these companies try everything to pay them as little as they can, part of the business model. Wealth increases for qualified earners but those will become fewer with automatization, many more will drop into services and we can all see that the delivery drivers, nail salon polishers whatnot are not getting wealthier. Unemployment will increase if even service sector can use automatization (automated delivery drivers etc), i dont think its plausible to argue that increase of automatization and AI will NOT lead to less jobs in total.

-

What does this mean? Where does the grandma who buys bitcoin now have an increase in energy and higher productivity? So you think bitcoin is worth more as long as it has not been completely adopted? Getting a bad feeling if answers about crypto become more and more cryptic

-

I wouldnt want to underestimate businesses that look like high margin businesses today could easily become low margin commodity businesses 15 years down in the future due to AI Real estate like ST.JOE could turn out super well in that case, luxury goods...

-

If Ai results in a productivity miracle and a significant increase in automatization, the economy will need consumers who are able to buy the surplus of produced goods and services funneled by that growth. If the consumer is jobless and without money, nobody will buy the surplus and AI will not be implemented as much as the market hopes. So its a key question of how we can increase the consumers wealth while he is losing his job, higher taxation as @mattee2264 pointed out is the only way i see out of this scenario. In the end everybody would win in that case, we will have way more time, work less, have more products than we could imagine etc. But what are good assets to own in that case? With that turbocharge of growth we will likely also see a huge increase in competition in markets because monopolies wont help with growth, id not like to own the fabless chip producers for a 10 year period, i really cant say if the game will be the same as it is today. I think things like micron, tsmc, asml, railroads, amazon/ high capex infrastructure businesses will do very well in that case. Commodities might also do surprisingly well, who knows how less the cycles will there be if AI gets really implemented in business planning...especially considering the underinvestment and the following increase in demand...maybe with automatization and AI the economy will start to grow a lot more predictable with automatization. In any case, one would want to be an owner of high quality wide moat businesses most likely at reasonable prices, nothing changes here IMO

-

At which price would you say is bitcoin a bubble? 100k? 1m? Or would you repeat the same arguments when it hits 1m, 10m etc And why would it be a bubble at 200k and not at 50k? Also, your next door grandma losing -50% of her money to bitcoiners after many start to sell and buy real assets, is that productive? Or is it something you then would call a "productive wealth transfer"? Why is it more productive for you to have her money than her having her money? Thanks!

-

Why would only the FANG stocks be a fing life raft? Why should only "technology" thrive in a world of increased automatization? The technology has to be built with matter, steel etc. If the robots hypercharge GDP worldwide then 4x earnings miners will do well and probably even better than 35x technology companies.

-

I worked in the industry and can only point out how RIDICULOUS the prices increased in that sector, everything became more expensive, wood, labor, shipping. I want to buy a Bechstein piano but i am not buying now because prices are 30-40% higher than pre covid and i simply do not see it, waiting to buy something used.